Abstract

There is a great linkage between environmental mitigation and economic growth. Several studies stretch this linkage as an environmental Kuznets curve (ECK) association. This practice revisits the linkage between environmental degradation and remittance inflow for the circumstance of the top ten remittance-receiving economies by embracing a fresh process of panel quantile regression (PQR) method to achieve the country-specific anatomy over the period between 1980 and 2018. Our research affords a more respectful seeing of the heterogeneous effects of the technological effects and remittance inflow on environmental pollution in the top ten remittance-receiving economies. Precisely, our analysis of PQR findings affords the obviousness of an inverted N-shaped EKC hypothesis of the technological effects of financial development on environmental quality from the 10th to 60th quantile. As regards the technical effects of remittance inflow, an N-shaped EKC has been spotted across from the 40th to 60th quantile. Finally, the interaction effects of financial development and remittance inflow pursue negative and significant effects on carbon dioxide emissions across all quantiles. Some injunctions that were most built-in in this introduced survey are the top ten remittance-receiving economies that ought to line programs that inhibit investors to involve remittance inflows to perform sustainability surrounding.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Nowadays, worldwide money transfer is regarded as an important avenue of financing small projects in several developing countries that seem to be significantly reliant on remittance inflows owing to its considerable contribution to relaxing the suffering of many households and to raising the domestic investment level through providing complementary funding not only to relatives and individuals but also to small firms and start-ups. Das et al. (2019) argued that this financial mainstream contributed essentially in accelerating economic growth and also considered as a key factor of income source for any economy. Accordingly, it may induce an increase growth in the country’s recipient economic and especially the boosting of their financial development.

Researchers such as Ahmad et al. (2019) and Sarkodie and Ozturk (2020) emphasized on the nexus between remittance inflows that enhance buying power and mitigating bad effects of poverty and environmental degradation in the host countries. Obviously, when the GDP is getting higher, it brings various technological changes having an impact in turn on more environmentally friendly techniques of production (Ssozi and Asongu 2016a, b). Nevertheless, it is not rational to deny that remittances have many effects on environmental quality which depends on the fact how it is implemented throughout each economy. The rising trend of remittance inflows and how to make efficient this significant and exceptional financial avenue that could help establish such a new path of economic growth.

As a source of liquidity, remittance inflows can improve domestic entrepreneurship and investment in private and small projects. Similarly, Syed and Miyazako (2013) recognized that this financial engine is regarded to be an important source of investment in agriculture specifically when shifting from such a subsistence agriculture toward a market-oriented production. Moreover, Wang et al. (2021), Yang et al. (2021), and Ssozi and Asongu (2016a) reported that it is very important to investigate the impact of remittance inflows on both economic development and the quality of the environment. Thus, they recommend consequently suitable policy implications.

In this study, we intend to bring some response elements for such important inquiries relatively to not only the extent that can boost remittances to alleviate economic distress but also how it can help induce efficient environmentally friendly production techniques. The remainder of the paper is structured as the following: the second section deals with the literature review that introduces remittances and how they induced not only GDP betterment but also environmental quality. The third section concerns the empirical investigation that tries to test the PQR of the interaction effects between technology and remittance inflow in one step, the interaction effects between financial development and remittance inflow in the second step, and the interaction effects between technology and remittance inflow. The fourth section is shaped by the results, interpretations, conclusions, and summary.

Remittance inflows and environmental quality

A few decades ago, a lot of interest has been attributed by either academicians or policymakers to remittance inflows considered a significant contributor to the global economy and an effective avenue of income throughout the world.

As a transitory source of income, remittances (abroad transfer) help boost domestic investment by providing complementary funding and supporting new start-ups. Moreover, the remittance inflow trend has increasingly grown faster and faster globally to become such a huge source and often exceedingly somewhat the foreign direct investment value (Sarkodie and Ozturk (2020), Ahmad et al. (2019), Syed and Miyazako (2013)).

Remittance inflows could affect the whole human capital components such as investment, health, investment, consumption, and household. Accordingly, such a relationship was shaped between the new potential source of funding and the various features of human being betterment that may converge into increasing avenues of higher levels of investment or consumption. Besides, Ahmad et al. (2019) emphasized that through its contribution to the amelioration of the living standard of households, remittance inflows seem unfortunately to put further pressure on energy use and induce carbon dioxide emissions. In this sense, this kind of abroad transfer should stimulate domestic consumption and make investment increase significantly in the receiver countries. Consequently, the improvement of some macroeconomic determinants such as aggregate demand, investment, consumption, and saving may result in higher demand for energy more probably considered to affect the environment quality via such a direct impact on CO2 emissions (Dzansi (2013), Asongu et al. (2016), Toumi and Toumi (2019)).

Many scholars highlight that it is true that remittance inflows are viewed as an important source of income which may affect positively human welfare and financial development (Meyer and Shera (2017)), whereas it may contribute seriously to causing environmental degradation through the expansion in both of households’ consumption and financing businesses. Others argued that remittance inflows can boost household per capita income stimulating consequently their consumers who could consume even more. This fact may trigger an escalation in both aggregate demand and bank deposits which leads eventually to such significant industrial production (Ahmad et al. (2019)). In other words, the consequent increase in economic growth is regarded to be linked to an increase in carbon dioxide emissions and thus to environmental degradation.

In contrast, Das et al. (2019) showed that remittance inflows could directly attenuate carbon dioxide emissions specifically when these transitory incomes are effectively spent on friendly or cleaner energy. In addition, remittance inflows may directly affect the environmental quality via financial development and economic growth.

Technological innovations and environmental quality

Many studies have highlighted the close relationship tying financial development to remittances and consequently to environmental quality. Anyway, remittance inflows, regarded as migration financial counterparts, remain increasingly shaping such a social insurance role. Remittances could improve purchasing power (commodities such as electric machines, cars, lands, houses, computers, and voyages). Moreover, these household transfers could help to get high the domestic investment level, especially when producing true state investment (Das et al. (2019), Ahmad et al. (2019), Sarkodie and Ozturk (2020), Syed and Miyazako (2013)).

Remittances help to stimulate macroeconomic variables by boosting savings and aggregate demand inducing consequently multiplier effects on domestic growth which in turn may affect thoroughly the environment. They have been viewed as an effective contributor to financial development and then economic growth. Enormous scholars put stress on the fact that remittances could stimulate financial development by draining funds to domestic entrepreneurship facing financial distress and facilitating the start-up creation by doping its need for capital credit and then getting rid of the exorbitant interest rate of financial institutions. Moreover, remittances could provide a genuine source of immediate liquidity, namely, when mitigating several barriers that cut down business development. It has been argued that remittance inflows could drive significant industrialization throughout the financial development mechanism, basically because of the best reliability of the new potential source of funding, compared to the other sources of foreign capital flow.

Das et al. (2019) considered that a one percent increase in remittances tends to increase GDP by nearly 0.06 percent in the long run. Moreover, this new shape of financing seems to improve household consumption, intermediate goods demand, and even finance projects of start-ups and distressed small firms. Undoubtedly, during the huge outbreak of the COVID-19 virus, several domains had found their resort only on remittances to mitigate the hard effects of the pandemic throughout the world. Some recent studies put stress on the fact of the remittances’ relevance to many economies wherein there is such a positive long-run effect on entrepreneurship and domestic investment. Moreover, Syed and Miyazako (2013) argued that remittances could also positively boost agriculture investment, especially when shifting from subsistence agriculture towards market-oriented production or to value addition.

Ssozi and Asongu (2016a) did postulate that remittance inflows have been recently documented to contribute to the output per worker. Otherwise, this new financial drainer may affect countries’ exchange rates, and consequently, it may influence the performance of the whole manufacturing sector (via real exchange rate changes). In addition, Dzansi (2013) showed that remittance inflows could promote the relative growth of traded sectors in recipient countries. Others argued that a massive inflow of foreign currency could be associated with real exchange rate appreciation and subsequently a loss of international competitiveness which in turn could lead to a decline in the production of manufactured and other commercial goods.

Recent studies postulated the more GDP is higher, the more energy consumption is needed. Accordingly, for the sake to mitigate CO2 emissions (environmental degradation), policymakers devote significant efforts to proceed towards renewal of energy reliance instead of carbon emission procedure. Because of its increased use and demand, Sarkodie and Ozturk (2020) highlighted the significant importance of renewable energy and that could be considered as a genuine shift from an industrial economy to another one more secure, pure, and friendly. It is a service-reliant economy shutting basically for the betterment of environmental quality.

Financial development and environmental quality

New studies have been carried out recently to investigate the linkage between some important macroeconomic variables mainly household income, consumption, savings, aggregate consumption, aggregate demand, and financial development, within a framework of remittance inflows, looking for such an eventual causing of environment degradation. Ahmad et al. (2019) stipulate that remittance inflows generate household income which positively contributes to an increase of both consumption and bank deposits leading consequently to magnifying the aggregate consumption and then the aggregate demand that does accordingly improve the financial sector.

Other scholars put stress the fact that this new financial support may negatively affect the quality of the environment. Their findings showed both negative and positive effect of financial development on carbon dioxide emissions. Moreover, remittance inflows are viewed as the main determinants of industrial production and financial development. Thus, to produce goods, several sources of energy are used mainly natural gas, oil, and coal. Unfortunately, these sources are considered significant sources of carbon dioxide emissions (Jamel and Maktouf (2017), Meyer and Shera (2017)).

Evidently, such a higher demand for energy generated by the receiving countries’ economic growth could urge them to devote significant and prominent efforts to afford new tools and means in the industrial sector helping carbon dioxide emission mitigation and in turn better environmental quality. Sarkodie and Ozturk (2020) put stress the fact that technological changes were subsequent to one country’s economic growth which may induce efficient environmentally friendly production techniques with high income and consumer demand. These technological changes may aid to increase the feeling of reliance on renewable energy.

Methodological framework and data

Methodology

This study has principally analyzed the panel quantile regression PQR method, developed by Koenker and Bassett (1978), of remittance inflows as the determinant of carbon dioxide emissions in the top ten receiving remittance inflow countries by introducing financial development, technology, real GDP, the interaction effects between financial development and remittance inflows, the technological effects of financial development, and the technical effects of remittance inflows. Before stepping into the methodological framing, it is very necessary to spotlight the dynamic interactive effects of environmental quality and financial development in the top ten remittance-receiving countries among the technological effects in the short and long-run association in the presence of the N-shaped environmental Kuznets curve. Therefore, remittance inflows are one of the substantial factors affecting large-scale production setup (Song, et al. (2021)). In addition, remittance inflows less the existing gap between investment savings of the economy in the world, especially the top ten remittance-receiving countries by relaxing the financial handcuffs that blocked real GDP (Su et al. (2021)).

Furthermore, the influx of remittance inflow participates to accumulate foreign reserves lack and ameliorates the economy’s success and minimizes the account balance deficit. However, this research has been introduced in determining the interactive effects of environmental quality and financial development in the top ten remittance-receiving countries and used real GDP as a factor that has a dual linkage between the technology effects of remittance inflows and carbon dioxide emissions. Many literature reviews have acknowledged the impact of remittance inflow on change in domestic credit to the private sector and the economic growth in the presence of carbon dioxide emissions (Wang et al. 2021), but this study is the first to introduce the technology effects of remittance inflows (composite effects of technology and remittance inflows) in environmental sustainability program in top ten receiving countries. It reveals that the inflow of funds in remittance-receiving countries increases households’ purchasing capacity, increasing the energy mix demand. As a result, demand for nonrenewable energy consumption is more than renewable energy consumption which defines the level of carbon dioxide emissions. This concept exerts a theoretically inverse literature review between carbon dioxide emissions and remittance inflows (Kibria (2022)).

Panel quantile regression (PQR)

This recent study highlights the empirical dynamics of remittance inflows as a proxy of environmental sustainability, besides the existence of some control determinants mainly financial development, technology, and economic growth on carbon dioxide emissions (Koenker and Bassett 1978; Yang et al. 2021; Khan et al. 2020). Via the adoption of a panel quantile regression, this study attempts to examine the eventual relationship tying remittances to the enhancement of householders’ living standards and consequently the environmental quality (Le and Ozturk (2020)).

The current study implements such a strongly normal distribution of the panel quantile regression (PQR) developed by (Koenker and Bassett 1978) where this process warrants measuring the reaction of the dependent variable of other independent variables with the classical regression method process. Therefore, the PQR method is used to find the contingent dealing as regards the survey variable’s affiliation. Therefore, the use of the traditional empirical method can be a wrong result issued from these methods focusing on mean evaluation (Lamarche 2010).

Indeed, various panel quantile regression methods combined the individual effects of both tracking and ladder of a dependent variable (\(Y\)) Koenker (2004) and Canay (2011). Therefore, this process denotes acquaintances on how the contingent heterogeneous covariance effects of the determinants of environmental degradations are examined by \(X\) factors of independent variables with conditional distribution on a \(K\)-vector, where the nonlinear conditional panel quantile regression estimation is followed by

where \({Q}_{\mathrm{x}}\) is the conditional model, \({\mathrm{Y}}_{\mathrm{it}}\) are the endogenous variables, \({\mathrm{K}}_{\mathrm{it}}\) is the conditional \(K\)-vector containing the \({\mathrm{X}}_{\mathrm{it}}\) independent variables, \({\beta }_{\mathrm{0, }\zeta }\) is the “residual function,” and \(0\leq\zeta <1\) is the “quantile index.” The conditional nonlinear modulization in model (1) can be represented by the estimator \(E\):

where \(\zeta\left\{\eta\left(Y_{\mathrm{it}},X_{\mathrm{it}},\beta_{0,\zeta}\right)\leq0\right\}\) is the “indicator function.”

To estimate the “residual function” \(\left({\beta }_{\mathrm{0,}\zeta }\right)\) the “unconditional moment” method is followed by

With a specific case developed by Kaplan and Sun (2017) within \(\eta \left({\mathrm{Y}}_{\mathrm{it}}{{\mathrm{,}{\mathrm{X}}}_{\mathrm{it}},\beta }_{\mathrm{0,}\zeta \, }\right)=\left({\mathrm{Y}}_{\mathrm{i1}}{-{\mathrm{Y}}_{-i1}^{T}\beta }_{1 }{-{\mathrm{X}}_{-i1}^{T}\beta }_{2}{-{\mathrm{X}}_{-i2}^{T}\beta }_{31 }\dots \dots {-{\mathrm{X}}_{-in-1}^{T}\beta }_{{\mathrm{n}}-\mathrm{1 }}\right)\), where \({\mathrm{Y}}_{\mathrm{i1}}\) is the outlet and \({\mathrm{Y}}_{-{\mathrm{i}}{1}}={\mathrm{Y}}_{\mathrm{i2}},{\mathrm{Y}}_{\mathrm{i3}},\dots \dots ..{\mathrm{Y}}_{{\mathrm{in}}-{1}}\) are “endogenous regressors” of generalized method moment quantile regression.

Therefore, the general form of the median of panel quantile regression (Hübler 2017) can be represented in Eq. (4) as follows:

where \({Q}_{\mathrm{yit}}\left({\eta }_{k}/{X}_{\mathrm{it}}\right)\) means the \(\eta\) th conditional quantile model for dependent variable, \({\mathrm{Y}}_{\mathrm{it}}\) are the endogenous variables (carbon dioxide emissions), \({\mathrm{X}}_{\mathrm{it}}\) represent the \({\eta }_{k}\) vector of independent variables (GDP, GDP2, GDP3, FD, RM, (FD*RM), (FD*T) and (RM*T)) for each \(i\) country at \(t\) time, and \(\beta {\eta }_{k}\) point the slopes of the explicative variables for quantile \({\eta }_{k}\) (Zhu et al. 2016). Therefore, the equality test of the elasticity coefficients of independent variables must be affected to see the existence of a significative dissimilarity between these slopes of different quantiles. For example, the PQR method can be appointed, when the respect to the interquartile method is between \({\eta }_{k}= 0.10\) and \({\eta }_{k}=0.5\) is established.

To identify the linkage between the environmental mitigation and remittance inflows, the technological effects of financial development and the technological effects of remittance inflows. The aim of our research is to test the validity of the N-shaped environmental Kuznets curve hypothesis. Based on the following structure of Grossman and Krueger (1995), the first model with the interaction effects of Rm and FD is as follows:

where \({Q}_{{\mathrm{CE}}_{it}}\left({\eta }_{k}/{X}_{\mathrm{it}}\right)\) is the \(\eta \mathrm{th}\) conditional quantile model for dependent variable, \({\mathrm{Y}}_{\mathrm{it}}\) are the endogenous variables, \({\mathrm{X}}_{\mathrm{it}}\) represent the \(\eta\) vector of independent variables for each \(i\) country at \(t\) time, and \({\eta }_{k}\) represent the quantile. In addition, \({\alpha }_{1}\), \({\alpha }_{2}\), and \({\alpha }_{3}\) explain the elasticity of environmental degradation with fulfill to real GDP, and \({\alpha }_{4}\) assess the environmental strain of financial development, \({\alpha }_{5}\) assess the environmental strain of remittance, \({\alpha }_{6}\) assess the environmental strain of technology, and \({\alpha }_{7}\) assess the environmental strain of interaction between remittance inflow and financial development, and \({\varepsilon }_{it}\) is the error term. The validity of the environmental Kuznets curve hypothesis is validated when the sign and the significance of (\({\alpha }_{1},{\alpha }_{2}, {\alpha }_{3}\)) variables are served (Allard et al. 2018; Alvarez and Balsalobre 2016).

-

The N-shaped EKC is required when \({\alpha }_{1}> 0\), \({\alpha }_{2}< 0\), and \({\alpha }_{3} >0.\)

-

An inverted N-shaped EKC is required when \({\alpha }_{1}< 0\), \({\alpha }_{2} > 0\), and \({\alpha }_{3} <0.\)

-

An inverted U-shaped is produced when \({\alpha }_{3}\) is not substantial.

The second model with the technology effects of financial development is as follows:

\({Q}_{{\mathrm{CE}}_{it}}\left({\eta }_{k}/{X}_{\mathrm{it}}\right)\) is the \(\eta \mathrm{th}\) conditional quantile model for dependent variable, \({\mathrm{Y}}_{\mathrm{it}}\) are the endogenous variables, \({\mathrm{X}}_{\mathrm{it}}\) represent the \(\eta\) vector of independent variables for each \(i\) country at \(t\) time, and \({\eta }_{k}\) represent the quantile. In addition, \({\upbeta }_{1}{,\upbeta }_{2}\mathrm{,}\mathrm{ and }{\upbeta }_{3}\) explain the elasticity of environmental degradation with fulfill to real GDP, and \({\upbeta }_{4}\) assess the environmental strain of financial development, \({\upbeta }_{5}\) assess the environmental strain of remittance, \({\upbeta }_{6}\) assess the environmental strain of technology, and \({\upbeta }_{7}\) assess the environmental strain of the technology effects of financial development, and \({\varepsilon }_{it}\) is the error term. The validity of the environmental Kuznets curve hypothesis is validated when the sign and the significance of (\({\upbeta }_{1},{\upbeta }_{2}, {\upbeta }_{3}\)) variables are served (Allard et al. 2018; Alvarez and Balsalobre 2016).

-

The N-shaped EKC is required when \({\upbeta }_{1}>\) 0, \({\upbeta }_{2}\)˂ 0, and \({\upbeta }_{3} >0.\)

-

An inverted N-shaped EKC is required when \({\upbeta }_{1}<\) 0, \({\upbeta }_{2} >\) 0, and \({\upbeta }_{3} <0.\)

-

An inverted U-shaped is produced when \({\upbeta }_{3}\) is not substantial.

The third model with the technology effects of remittance inflow is as follows:

\({{Q}_{{\mathrm{CE}}_{i\mathrm{t}}}({\eta }_{k}\mathrm{/}{\mathrm{X}}}_{\mathrm{it}})\) is the \(\eta \mathrm{th}\) conditional quantile model for dependent variable, \({\mathrm{Y}}_{\mathrm{it}}\) are the endogenous variables, \({\mathrm{X}}_{\mathrm{it}}\) represent the \(\eta\) vector of independent variables for each \(i\) country at \(t\) time, and \({\eta }_{k}\) represent the quantile. In addition, \({\zeta }_{1}{,\zeta }_{2}\mathrm{,}\mathrm{ and }{\zeta }_{3}\) explain the elasticity of environmental degradation with fulfill to real GDP, and \({\zeta }_{4}\) assess the environmental strain of financial development, \({\zeta }_{5}\) assess the environmental strain of remittance, \({\zeta }_{6}\) assess the environmental strain of technology, and \({\zeta }_{7}\) assess the environmental strain of the interaction between FD and RM, and \({\upbeta }_{8}\) assess the environmental strain of the technology effects of RM, and \({\varepsilon }_{it}\) is the error term. The validity of the environmental Kuznets curve hypothesis is validated when the sign and the significance of (\({\zeta }_{1},{\zeta }_{2}, {\mathrm{and }\zeta }_{3}\)) variables are served (Allard et al. 2018; Alvarez and Balsalobre 2016).

-

The N-shaped EKC is required when \({\zeta }_{1}>\) 0, \({\zeta }_{2}\)˂ 0, and \({\zeta }_{3} >0.\)

-

An inverted N-shaped EKC is required when \({\zeta }_{1}<\) 0, \({\zeta }_{2} >\) 0, and \({\zeta }_{3}<0.\)

-

An inverted U-shaped is produced when \({\zeta }_{3}\) is not substantial.

Data

This examination treated the dynamic panel quantile regression between environmental degradation and remittance inflows, gross domestic product, financial development, technology, the technological effect of financial development, and the technological effects of remittance inflows in the top ten remittance-receiving inflow economies (Indonesia, Bangladesh, Vietnam, Pakistan, Egypt, Arab Rep, Nigeria, Mexico, Philippines, China, and India) over the period between 1980 and 2018, where GDP variables are defined by real GDP per capita (constant 2015 US$), environmental degradation (CE) is clarified in metric tons per capita, remittance inflow is the personal remittances, received (% of GDP), financial development (FD) measured by domestic credit to the private sector by banks (% of GDP), the technology effects (\(T\)) is the contribution of the industry sector (including construction), value added (% of GDP) (Martínez-Zarzoso and Maruotti (2011)), the technological effects of financial development (TEFCTF) are the interaction effects of technology and financial development, the technological effects of remittance inflows (TEFCTR) are the interaction effects of technology and remittance, and the composite effect of remittance and financial development (FD*REM) is the interaction between both these variables. All were selected variables from the database of the World Bank (WDI 2021).

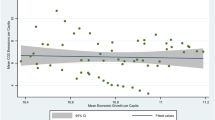

A logarithmic settlement has been applied for all data (Table 1, Fig. 1).

Cross-sectional dependence tests

For the majority of panel studies, panel data slightly the problem of the cross section can be obtained by biased estimations results. Following the cross-sectional dependence (CD) of Yang et al. (2021), many various tests of CD are used in our studies such as the LM test of Breusch and Pagan (1980) and the test of CD by Pesaran (2004).

Table 2 denotes the results of the cross-sectional dependence test of Breusch and Pagan (1980) and Pesaran (2004), which denotes the null hypothesis; there is no CD for all variables. Therefore, the being of CD-used variables denotes that policymakers’ environmental decisions of the top ten remittance inflow economies are feigned one by one.

Panel unit root tests

To check the long-run parameters’ slopes in panel quantile regression, the study applied various panel unit root tests introduced in Table 3 such as Fisher-ADF statistics (Dickey and Fuller (1979)), Fisher-PP statistics (Maddala and Wu 1999), and Kwiatkowski-Phillips-Schmidt-Shin statistic (Kwiatkowski et al. (1992)).

Before exploring fundamentally, the panel quantile regression approach, it is significant to test whether all variables are stationary at levels and in the first difference, via mainly the Fisher augmented Dickey-Fuller (Dickey and Fuller (1979)) and Im et al. (2003) unit root test. As shown in Table 3, the panel unit root tests reveal that all variables fail to reject the null hypothesis at a level; nevertheless, the whole variables are stationary at first lag.

Westerlund cointegration test

Once all unit root test outcomes reveal that all variables are stationary, it is rather significant to test long-run association among variables via two famous methods, namely, Pedroni (2004) and Kao et al. (1999) panel cointegration test. In addition, the Pedroni test reveals how most of the statistical values reject the null hypothesis of cointegration. So, Kao’s result confirms the presence of cointegration since the null hypothesis. Therefore, both hypothesis tests of cointegration ignored the cross-sectional dependence between all variables. So, if we have a cross-sectional dependence for all PQR methodology for all used variables, standard long-term cointegration tests such as making biased results. Therefore, Westerlund (2007) developed four mean tests of normality distribution because of the cross-sectional unit of cointegration and homogeneous of panel quantile regression. So, in both normality distributions between groups (Gt) and among groups (Ga), the alternative hypothesis is the existence of cointegration of slopes at least one cross-sectional unit. In addition, both homogeneous tests of the cross-sectional units between and among panels are, respectively, Pt and Pa; the alternative hypothesis is the existence of a long-term relationship at the whole of the panel. Table 4 denotes the results of the cross-sectional dependence test of Westerlund (2007), which denotes the null hypothesis; there is no CD for all variables, so the cross-sectional independence of environmental quality, FD, RM, \(T\), and the gross domestic product is returned and the dependence of these variables is applied. In addition, there is a long-run association between all variables in the panel quantile method across the top ten remittance-receiving countries’ economies.

Result and discussions

The results of conditional panel quantile regression (PQR) are exposed in Table 5. Firstly, the effect of economic growth on carbon dioxide emissions is confirmed, so real GDP rises in the 10th quantile from 1.406365 to 2.146834 for the 80th quantile. Secondly, economic growth in the top ten remittance-receiving countries revolts a heavy incidence in the first stage of quantile and becomes speedy in the delayed stages of quantile moment regressions. Thirdly, economic growth in the top ten remittance-receiving countries has a positive and significant effect on carbon dioxide emissions. Therefore, the square of real GDP is negative and statistically negative for all quantiles. In addition, the cubic of income in the first model is positively affecting the carbon dioxide emissions and the turning point has almost a 5% value for all quantiles. So, the N-shaped environmental Kuznets curve hypothesis is validated for all quantiles in the first model for remittances, specifying that remittance-receiving countries have been affected positively by environmental degradation (Islam 2022).

Our results are confirmed by the research of Zafar et al. (2022), enhancing that, in 22 top remittance-receiving countries, and Allard et al. (2018), Alvarez and Balsalobre (2016), that is notified, in the top ten remittance-receiving countries, the N-shaped EKC is inspected only in all quantiles. Therefore, in line with the view results, the decoupling between carbon dioxide emissions and economic growth outflow assumes that the majority of treated countries have managed the required minimum level of income at the improvement point, which means the energy powers economy is either better harnessed or produced by traditional methods, for example, in China and India, the production function is alimented by fossil fuel energies. In addition, the decoupling analysis between carbon dioxide emissions and economic growth especially in the Asian region has happened in the region (Zhang et al. (2020)), where the real GDP is the major driving power behind the rise of environmental degradation.

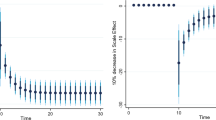

In addition, Rem and FD variables have an exceptional effect on environmental mitigation; both variables are significant and have a positive effect on carbon dioxide emissions in all quantiles from Rem and for 60th to 95th quantile from FD, pointing that environmental mitigation of Rem supported all quantile and the environmental degradation sustained in the last quantiles for financial development. The substantial effects of Rm on carbon dioxide emissions could be clarified by the occurrence that, the significant effects of remittances (Wang et al. 2021), gifted the feebleness of real GDP, remittance inflows as a principal factor of income in top ten remittance-receiving countries, for example, in Bangladesh, Vietnam, Egypt, China, and India, is used in manufacturing industries that depend on fossil energy, productive in turning point considerable of carbon dioxide emissions. The same, the substantial effects of FD on carbon dioxide emissions could be clarified by the occurrence that the significant effects of financial development on environmental degradation in this case are the same results on many researchers, which peaked financial development aggravate environmental quality in BICS countries (Yang et al. (2021)) and in sub-Saharan Africa by Mensah and Abdul-Mumuni (2022), suggesting that bank credits in top ten remittance-receiving countries are used in energy efficacity emitter of environmental degradation. In addition, the technology variable is significant and has a positive effect on environmental quality in the 10th to 60th quantiles at 10% in the long term, which denotes that the technology effect is not eco-friendly with environmental sustainability in top receiving remittance inflows. Finally, we can restart the contradiction results between the positive and significance of financial and remittance inflows separated and the negative and significance of the composite effects of both FD and Rm on the environmental quality regrouped. It unfolds that an expansion in remittance inflows with the interference of financial development rise financial sectors and proved more investment for the technical effect of technology for the ecological environment. Therefore, when the financial sector in the top ten remittance inflows economies is supported by a suitable waterway, then the remittance inflows will be respected in the recompense gap of environmental degradation. Therefore, the interference of financial development and remittance inflows shows the negative and significant effects on environmental quality in our study between the 40th and 90th quantiles. Our results are confirmed by the research of Yang et al. (2021) in BICS economies over the period from 1990 to 2016. In addition, the results of PQR found in model 1 are heavy in Table 5 and Fig. 2 and confirmed by the graphic of the composite variable FD and Rm, which the interference of financial development and remittance inflows shows the negative and significant effects on environmental quality in our study between the 40th and 90th quantiles.

When the result of panel quantile regressions (PQR) is exposed in Table 6 of the technical effect of financial development model. Firstly, the effect of real GDP on environmental quality is established, so GDP variables decrease in the 10th quantile from 18.14354 to 1.350265 for the 90th quantile. Secondly, economic growth in the top ten remittance-receiving countries has a negative and significant effect on carbon dioxide emissions in all quantiles. Therefore, the square of real GDP is positive and statistically significant between the 10th and 60th quantiles. In addition, the cubic of income in the second model is negatively affecting the carbon dioxide emissions and the turning point has almost a 10% value for the 30th and 40th quantiles. So, the inverted N-shaped environmental Kuznets curve hypothesis is validated for the turning point for the 30th and 40th quantiles in the second model for technology effects of financial development. Therefore, the waning of environmental quality is the result of the transfer of technology for the top ten remittance-receiving economies and by the underplaying of the energy intensity (Sarkodie and Strezov (2019)).

In addition, Rem and FD variables have an exceptional effect on environmental mitigation; both variables are significant and have a positive effect on carbon dioxide emissions between 10 to 70th quantiles from Rem and for 10th to 60th quantiles from FD, pointing that environmental mitigation of Rem supported all quantile and the environmental degradation sustained in the first quantiles for financial development. The substantial effects of Rm on carbon dioxide emissions could be clarified by the occurrence that the significant effects of remittances (Wang et al. (2021)) gifted the feebleness of real GDP, remittance inflows as a principal factor of income in top ten remittance-receiving countries, for example, in Bangladesh, Vietnam, Egypt, China, and India, used in manufacturing industries that depend on fossil energy, productive in turning point considerable of carbon dioxide emissions. The same, the substantial effects of FD on carbon dioxide emissions could be clarified by the occurrence that the significant effects of financial development on environmental degradation in this case are the same results on many researchers that peaked financial development aggravate environmental quality in BICS countries (Yang et al. (2021)).

In addition, the technology variable is significant and has a positive effect on environmental quality in the 10th to 60th quantiles at 10% in the long term, which denotes that the technology is not eco-friendly with environmental sustainability in top receiving remittance inflows. So, we can restart the contradiction results between the positive and significance of financial and technology segregated and the negative and significance of technology effects on the environmental quality assembled. It unfolds that an expansion in technology with the interference of financial development rise financial sectors and proved more investment for the technical effect of technology for the ecological environment. Therefore, when the financial sector in the top ten remittance inflows economies is supported by a suitable waterway, then the technology will be respected in the recompense gap of environmental degradation. Therefore, the technology effect of financial development shows the negative and significant effects on environmental quality in our study between the 10th and 60th quantiles. Our results are the opposite results found by the research of Aluko and Obalade (2020) in sub-Saharan African SSA economies over the period from 1985 to 2014. In addition, the results of PQR found in model 2 are heavy in Table 6 and Fig. 3 and confirmed by the graphic of the technology effects of financial development variable (TEFCTF) that the interference of financial development and technology shows the negative and significant effects on environmental quality in our study between the 10th and 60th quantiles.

When the result of the PQR is exposed in Table 7 of the technical effect of remittance inflow model (composite effect between the technology and remittance inflows), at first, the effect of real GDP on environmental quality is established, so GDP variables increase in a maximum value 2.074315 in the 40th quantile. Secondly, the coefficient value of economic growth in the technical effect of remittance inflow model has a positive effect on environmental quality in all quantiles. Therefore, the square of real GDP is negative and statistically significant between the 40th and 60th quantiles. In addition, the cubic of income in the second model is positively affecting the carbon dioxide emissions and the turning point has almost a 5% value for the 40th, 50th, and 60th quantiles. So, the N-shaped environmental Kuznets curve hypothesis is validated for the turning point between the 40th and 60th quantiles in the third model for technology effects of remittance inflow. This outcome is the same with the results found by Allard et al. (2018) underlining that in 74 lower middle income between the period 1994 and 2012, the N-shaped environmental Kuznets curve is validated.

In addition, Rem and FD variables have an exceptional effect on environmental mitigation; both variables are significant and have a positive effect on carbon dioxide emissions between the 80th to 90th quantiles from Rem and for the 70th to 90th quantile from FD, pointing that environmental mitigation of Rem and FD supported the latest quantiles. The substantial effects of Rm on carbon dioxide emissions could be clarified by the occurrence that the significant effects of remittances (Wang et al. (2021)) gifted the feebleness of real GDP, remittances inflow as a principal factor of income in top ten remittance-receiving countries, for example, in Bangladesh, Vietnam, Egypt, China, and India, used in manufacturing industries that depend on fossil energy, productive in turning point considerable of carbon dioxide emissions. The same, the substantial effects of FD on carbon dioxide emissions could be clarified by the occurrence that the significant effects of financial development on environmental degradation, in this case, are the same results on many researchers that peaked financial development aggravates environmental quality in BICS countries (Yang et al. (2021)).

In addition, the technology variable is significant and has a positive effect on environmental quality in the 80th and 90th quantiles at 10% in the long term, which denotes that the technology is not eco-friendly with environmental sustainability in top receiving remittance inflows. Therefore, when the financial sector in the top ten remittance inflow economies is supported by a suitable waterway, then the technology effect of remittance inflow will be respected in the recompense gap of environmental degradation. Therefore, the technology effect of remittance inflow shows the negative and significant effects on environmental quality in our study between the 80th and 90th quantiles. In addition, the results of conditional PQR found in model 3 are heavy in Table 7 and Fig. 4 and confirmed by the graphic of the technology effects of remittance inflow variable that the interference of remittance inflow and technology shows the negative and significant effects on environmental quality in our study between the 80th and 90th quantiles. In line with our results, the clipping between economic growth and environmental quality issued in the top ten remittances receiving inflow supposing that these economies have not reached the required level of income, but have a minimum of adoption of technologies transferred by the remittance inflow to the minimization of the energy intensity in terms of gains in energy efficiency.

Conclusion and policy implications

The main aims of this research involved PQR that captured unobservable individual effects and homogeneous cross-sectional units to inquire about the nexus between environmental sustainability, technological effects of financial development, and the technical effects of remittance inflow in the panel of top ten remittance-receiving economies during the period between 1980 and 2018. Furthermore, this research appointed the dissimilarity of the slopes between all quantiles of used models across the varying panel carbon dioxide emissions. In the first step, looking at the linkage between remittance inflow and environmental quality has recognized the carefulness of many researchers and what percentage of remittance inflow has been used in the technology concerned to minimize the environmental degradation in the top ten remittance-receiving countries. In stripe with feature research, this analysis requests to rectify the soundness of the N-shaped environmental Kuznets curve hypothesis for the technology effects of remittance inflow and the technical effects of financial development in the top ten remittance-receiving economies between 1980 and 2018.

In line with our results, this research looks to examine the ratification of the N-shaped environmental Kuznets curve hypothesis for remittance inflow in the top ten remittance-receiving economies over the period 1970 to 2018, with the interaction between remittance inflow and financial development in the first order, the interaction between financial development and the technology variable (technical effects of financial development) in the second order, and the interaction between remittance inflow and technology (technology effects of remittance inflow). We have used the conditional PQR developed by Hübler (2017) to analyze the interactive effects of financial development and remittance inflow in the first step and the interactive effects of remittance inflow and technology in the second step.

According to our results, the conditional quantile model shows that Rem, FD, and technology have an exceptional effect on environmental mitigation; these three variables are significant and have a positive effect on environmental mitigation in all quantiles in the top ten remittance-receiving economies in all used models. Moreover, the interaction effects between Rm and FD in the first model unfold the negative and significant effects on environmental degradation. Furthermore, the empirical results show the validity of the N-shaped environmental Kuznets curve hypothesis for all quantiles in the first model. So, in line with the view results, the decoupling between carbon dioxide emissions and economic growth outflow assumes that the majority of treated countries have managed the required minimum level of income at the improvement point, which means the energy power economy is either better harnessed or produced by traditional methods, for example, in China and India, the production function is alimented by fossil fuel energies.

Additionally, when considering the technology effects of the financial development model, the interaction effects between technology and FD in the second model show a negative and significant effect on environmental quality in our study between the 10th and 60th quantiles. Furthermore, the empirical results show the validity of the inverted N-shaped environmental Kuznets curve hypothesis between the lower quantiles in the second model. So, if the financial sector in the top ten remittance inflow economies is supported by a suitable waterway, then the technology will be respected in the recompense gap of environmental degradation.

Based on our results, for the technology effects of the remittance inflow model, the interaction effects between technology and Rm in the third model show a negative and significant effect on environmental degradation for the higher quantiles. Besides, the empirical results with the PQR show the validity of the N-shaped environmental Kuznets curve hypothesis between the 80th and 90th quantiles in the third model, denoting that technology transferred by the remittance inflow, for top ten remittance-receiving economies, serves to minimize the energy intensity in terms of gains in energy efficiency.

Referring to the aforementioned results, this survey examines the subsequent conclusions and policy implications of the policymakers, in accurately the top ten remittance-receiving economies for environmental mitigation. At first, remittance inflow has a positive effect on environmental quality in the top ten remittance-receiving economies, but the interaction between Rm and FD, Rm and technology, has adverse effects on carbon dioxide emissions. Therefore, our findings denote that remittance inflow and technology are a supplement to financial development in these economies to underplay the energy intensity and increase the gains of energy efficiency. Therefore, the guidance of the top ten remittance-receiving countries ought cleverness in the warring potency of remittance inflows on the environmental quality by imposing supplement taxes on extremely polluted sectors via tight financial settlement and technology innovation and ought to line programs that inhibit investors to involve remittance inflows to perform sustainability surrounding.

Data availability

All data are available upon request.

References

Ahmad M, UlHaq Z, Khan Z, Khattak SI, Ur Rahman Z, Khan S (2019) Does the inflow of remittances cause environmental degradation? Empirical evidence from China. Econ Res-Ekonomska Istraživanja 32(1):2099–2121

Allard A et al (2018) The N-shaped environmental Kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ Sci Pollut Res 25(6):5848–5861

Aluko OA, Obalade AO (2020) Financial development and environmental quality in sub-Saharan Africa: is there a technology effect? Sci Total Environ 747:141515

Alvarez HA, Balsalobre LD (2016) Economic growth and energy regulation in the environmental Kuznets curve. Environ Sci Pollut Res 23(16):16478–16494

Asongu S, El Montasser G, Toumi H (2016) Testing the relationships between energy consumption, CO 2 emissions, and economic growth in 24 African countries: a panel ARDL approach. Environ Sci Pollut Res 23:6563–6573

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Canay IA (2011) A simple approach to quantile regression for panel data. Economet J 14(3):368–386

Das A, McFarlane A, Jung YC (2019) Remittances and GDP in Jamaica: an ARDL bounds testing approach to cointegration. Int Econ J 33(2):365–381

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Dzansi J (2013) Do remittance inflows promote manufacturing growth? Ann Reg Sci 51(1):89–111

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Hübler M (2017) The inequality-emissions nexus in the context of trade and development: a quantile regression approach. Ecol Econ 134:174–185

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. Journal of Econometrics 115(1):53–74

Islam M (2022) Do personal remittances cause environmental pollution? Evidence from the top eight remittance-receiving countries. Environ Sci Pollut Res 29(24):35768–35779

Jamel L, Maktouf S (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cognet Econ Fin 5(1):1341456

Kaplan DM, Sun Y (2017) Smoothed estimating equations for instrumental variables quantile regression. Econometric Theory 33(1):105–157

Kao C, Chiang MH, Chen B (1999) International R&D spillovers: an application of estimation and inference in panel cointegration. Oxford Bull Econ Stat 61(S1):691–709

Khan ZU, Ahmad M, Khan A (2020) On the remittances-environment led hypothesis: empirical evidence from BRICS economies. Environ Sci Pollut Res 27(14):16460–16471

Kibria Md (2022) Environmental downfall in Bangladesh: revealing the asymmetric effectiveness of remittance inflow in the presence of foreign aid. Environ Sci Pollut Res 29(1):731–741

Koenker R (2004) Quantile regression for longitudinal data. J Multivar Anal 91(1):74–89

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46(1):33–50. https://doi.org/10.2307/1913643

Kwiatkowski D, Phillips PC, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? J Econ 54(1–3):159–178

Lamarche C (2010) Robust penalized quantile regression estimation for panel data. J Econ 157(2):396–408

Le HP, Ozturk I (2020) The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27(18):22680–22697

Lorente DB, Álvarez-Herranz A (2016) Economic growth and energy regulation in the environmental Kuznets curve. Environ Sci Pollut Res 23(16):16478–16494

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxford Bull Econ Stat 61(S1):631–652

Martínez-Zarzoso I, Maruotti A (2011) The impact of urbanization on CO2 emissions: evidence from developing countries. Ecol Econ 70(7):1344–1353

Mensah BD, Abdul-Mumuni A (2022) Asymmetric effect of remittances and financial development on carbon emissions in sub-Saharan Africa: an application of panel NARDL approach. Int J Energy Sect Manag (ahead-of-print)

Meyer D, Shera A (2017) The impact of remittances on economic growth: an econometric model. Economia 18(2):147–155. https://doi.org/10.1016/j.econ.2016.06.001

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet Theor 20(3):597–625

Pesaran MH (2004) Cambridge working papers in economics. Fac Econ Univ Cambridge

Sarkodie SA, Ozturk I (2020) Investigating the environmental Kuznets curve hypothesis in Kenya: a multivariate analysis. Renew Sustain Energy Rev 117:109481

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Song Y, Paramati SR, Ummalla M, Zakari A, Kummitha HR (2021) The effect of remittances and FDI inflows on income distribution in developing economies. Econ Anal Policy 72:255–267

Ssozi J, Asongu SA (2016a) The comparative economics of catch-up in output per worker, total factor productivity and technological gain in sub-Saharan Africa. Afr Dev Rev 28(2):215–228

Ssozi J, Asongu SA (2016b) The Effects of remittances on output per worker in sub-Saharan Africa: a production function approach. South Afr J Econ 84(3):400–421

Su CW, Sun T, Ahmad S, Mirza N (2021) Does institutional quality and remittances inflow crowd-in private investment to avoid Dutch Disease? A case for emerging seven (E7) economies. Resour Policy 72:102111

Syed S, Miyazako M (eds) (2013) Promoting investment in agriculture for increased production and productivity. Italy: CAB Int Food and Agric Organ. https://doi.org/10.1079/9781780643885.0001

Toumi S, Toumi H (2019) Asymmetric causality among renewable energy consumption, CO 2 emissions, and economic growth in KSA: evidence from a non-linear ARDL model. Environ Sci Pollut Res 26:16145–16156

Wang Z, Zaman S, Rasool SF (2021) Impact of remittances on carbon emission: fresh evidence from a panel of five remittance-receiving countries. Environ Sci Pollut Res 28(37):52418–52430

World Development Indicators (WDI, 2021) https://databank.worldbank.org/source/world-development-indicators. Accessed 16 Dec 2021

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748

Westerlund J, Edgerton DL (2007) A panel bootstrap cointegration test. Econ Lett 97(3):185–190

Yang Bo, Jahanger A, Ali M (2021) Remittance inflows affect the ecological footprint in BICS countries: do technological innovation and financial development matter? Environ Sci Pollut Res 28(18):23482–23500

Zafar MW et al (2022) The dynamic linkage between remittances, export diversification, education, renewable energy consumption, economic growth, and CO2 emissions in top remittance-receiving countries. Sustain Dev 30.1:165–175

Zhang J, Fan Z, Chen Y, Gao J, Liu W (2020) Decomposition and decoupling analysis of carbon dioxide emissions from economic growth in the context of China and the ASEAN countries. Sci Total Environ 714:136649

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Author information

Authors and Affiliations

Contributions

Abdussalam Aljadani: conceptualization. Hassen Toumi: design, dealing with data collection, and calculation so as to write the manuscript. Mosbah Hsini: writing of the introduction and literature review.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Aljadani, A., Toumi, H. & Hsini, M. Exploring the interactive effects of environmental quality and financial development in top ten remittance-receiving countries: do technological effect matter?. Environ Sci Pollut Res 30, 56930–56945 (2023). https://doi.org/10.1007/s11356-023-26256-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-26256-2