Abstract

This research article examines the impact of stock market capitalization on carbon emissions using forty high carbon-emitting countries from 1996 to 2018. This study adopts the Driscoll-Kraay method that simultaneously tackles heteroscedasticity, autocorrelation, and contemporaneous correlation issues. We find an inverted U relationship between stock market capitalization (SMC) and environmental degradation. We propose an extended environmental Kuznets curve based on SMC while energy intensity, industrialization, and urbanization increase emissions in sample countries. The quadratic method, SLM test, and derivative graphing detect the consensus of the inverted U relationship. The weak-negative SMC2 coefficient reveals that the dangerous impact of capitalization declines gradually and finally curbs the environmental degradation challenges. The relationship is strong in highly polluted countries with overvalued stock markets. The study catches no policy synergies between the growing stock market and increased carbon emissions. Stock market capitalization should be integrated into climate change adaptation strategies at national and regional levels, primarily to address the dark effect of environmental degradation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The financial environment is a game-changer that links investors, firms, and financial markets and proves a blessing for the environment. Stock markets connect all parties to pooling resources and increase economic activities. Undoubtedly, the stock market’s role is crucial; Bai et al. (2021) categorize it as a leading indicator and economy’s barometer, while Altan et al. (2021) argues that the financial markets channel resources through the stock market capitalizations.Footnote 1 It is considered the best proxy for equity market valuation that boosts investor trust.

Stock market capitalization (SMC) primarily provides firms with access to resources and affordable borrowing to invest in green and environmentally friendly technologies. It gives firms opportunities to shift toward greener technologies and renewable energy options. Initially, stock market capitalization increases emissions due to higher economic activities with conventional or less efficient technology. However, as investor confidence increases, firms get more affordable capital, positively impacting the environment by adopting green technology. Consequently, investor confidence and affordable capital will reduce costs and emissions. As the firm’s financial constraint is a barrier to adopting green technology; therefore, stock market capitalization can play a significant role in curbing the issue of carbon emission through green resources. Hence, firms can get affordable green capital to acquire environmentally friendly technology, which reduces CO2 emissions.

The literature on the relationship between capitalization and environmental deterioration yields varied conclusions. Paramati et al. (2018) find that stock market capitalization reduces emissions in developed economies. In contrast, Zakaria and Bibi (2019) conclude that stock market capitalization increases emission while efficiency decreases the magnitude. In theory, the SMC impact on CO2 emission is subject to diversity, which largely depends upon the efficiency of the financial environment. We devise a proxy of efficiency if direct financing is more than 100% of the GDP in the economy (Anton and Nucu 2020). The recent literature supports stock market boosts clean energy (Alam et al. 2021). In this context, Raza et al. (2020) find that stock market capitalization increases renewable energy consumption, while (Alam et al. 2021) pinpoint the stock market increase clean energy consumption in thirty OECD countries. In contrast, Le et al. (2020) discover that financial inclusion reduces carbon emission and Mhadhbi et al. (2021) catch asymmetric effects of stock markets on environmental degradation. These studies agree that the stock market plays a positive role in environmental well-being but adopts linear philosophy, but exponential growth after 1980 required a critical lensFootnote 2 (Kuvshinov and Zimmermann 2022).

Going beyond existing literature, this article examines the influence of the financial environment through a stock market capitalization lens on environmental degradation. The research provides contributions in theoretical and empirical domains; the foremost is stock market capitalization inverted U-shape relationship propose a capitalization based extended environmental Kuznets curve and threshold provides the exact point of reversal. The new lens will open a further theoretical discussion on the environment and capitalization nexus. For empirical contribution, we tested the inverted U relationship at aggregate and country-level data for the authenticity of the proposed relationship, which is rare in existing literature accompanying testing the relationship by semi-parametric and parametric approaches with extensive post estimation. There are no policy synergies between rising stock market capitalization and CO2 emissions. Developing a friendly secondary markets policy is especially helpful to countries that rely on conventional fuels like coal.

We find an inverted U-shape relationship between stock market capitalization and CO2 emission (Fig. 1). Improving stock market capitalization enhances industrial activities in the economy, which increases CO2 emissions and results in global warming. At the initial phase of higher SMC, some businesses focus only on profitability motives and ignore the business impact on the environment. This profitability motive produces energy-intensive products that create high energy demand and CO2 emissions. However, it happens only in the short term, but after a threshold point, the relationship reverts. The empirical finding suggests a threshold of stock market capitalization (97–110%, full sample results) where the relationship reversed. We find that the efficiency of stock market capitalization is negatively related to emissions. The argument of an inverted U-shape relationship somehow straight as a high level of capitalization shows investor trust, so firms have more affordable resources for green innovation, which reduces environmental degradation. Investors prefer investment in more environmentally friendly firms, even ready to pay premiums (Ji et al. 2021), as higher environmental performer firms have more sustainability and prospects (Velte et al. 2020).

Literature review and hypothesis development

Finance-led-growth argument reveals financial development causes economic growth that requires energy, which is a potential culprit of environmental degradation (Piñeiro Chousa et al. 2017). In this regard, Stock markets are considered barometers of the economy and engines for financial growth that work through stock market capitalization for pooling resources for venture capitalists and entrepreneurs. It is one of the significant parameters that can provide capital, competitive advantage and resources for booming and innovative businesses. Besides the finance-led growth argument, recent research focuses on the environmental Kuznets curve (EKC), favoring economic growth, decreasing CO2 emission, and reducing environmental degradation. However, literature has short empirical iterations of the Stock market’s role in Environmental EKC. The prevailing literature categorizes financial development through indirect and direct financing (Paramati et al. 2017). Banking credit is an indirect financing source and has been extensively researched in the context of EKC. However, in environmental literature, direct financing through stock markets is still under-researched, especially stock market capitalization (SMC).

Stock market capitalization provides many different benefits to the firms who engage in business which ultimately translates at the economic level. Stock market capitalization helps pool resources and lowers financing costs by optimizing capital structure, funding for mega projects, easy direct and indirect financing, risk sharing, and provides advanced technology. The most crucial benefit of stock market capitalization is advanced low carbon emission technologies that reduce environmental degradation. So, SMC equips developed and developing countries with advanced & environment-friendly technologies that may increase energy efficiency and help them with sustainable and environmentally friendly production to reduce CO2 emissions (Claessens and Feijen 2007; Piñeiro Chousa et al. 2017).

Stock market gains indicate future economic growth that attracts entrepreneurs and builds economic confidence at the macro level through high stock market capitalization (SMC). It allows entrepreneurs to expand their businesses, get affordable financing (Sadorsky 2010), and smooth the business through risk diversification. As a result, the stock market gain boosts economic activity and raises demand. Dauda et al. (2021) reveal that conventional or old technology is the culprit of environmental degradation, and advanced technology is needed due to the severity of environmental challenges. These arguments provide a foundation to investigate the relationship between stock market capitalization and CO2 emissions (Ozturk and Acaravci 2013; Sadorsky 2010; Zhang 2011).

These arguments shed light on the theoretical linkage among economic activities, energy demand and stock market capitalization. But few studies have been conducted on the link between stock market development and CO2 emissions. Piñeiro Chousa et al. (2017) found market’s growth is connected to lower CO2 emissions per capita. Further, they found that strong financial markets help technical advancements and reduce business risk in the long run. Sadorsky (2010) examined how financial development affects energy usage in 22 developing nations in the globalization phenomenon. He found the development of the stock market has a statistically significant and beneficial effect on the energy sector. Later on, Sadorsky (2011) studied the impact of financial development on energy consumption in 9 frontier economies in Eastern and Central Europe using the panel GMM regression technique. The study found that only stock market turnover had a positive and statistically significant effect on energy use.

In contrast, Zhang (2011) looked into the impact of financial growth on CO2. According to him, China’s stock market disproportionately influences carbon emissions, yet its efficacy is minimal. Some rare studies used SMC as a function of environmental well-being and tried to reveal the non-linearity assumption of SMC with energy consumption instead of environmental degradation (Ouyang and Li 2018; Zhang 2011).

An extensive literature search reveals that SMC as a function of environmental degradation was dealt with the linear assumption (Alam et al. 2021; Ouyang and Li 2018; Paramati et al. 2018, 2017; Sharma et al. 2021; Zhang, 2011) but these studies have a few shortcomings that require a critical lens. Their findings show that the relationship is linear with CO2 emission, but it is not linear due to exponential growth yearly. To support the claim of non-linearity in this study, Kuvshinov and Zimmermann (2022) study are critical for the capitalization-led pollution-halo hypothesis. They collected SMC data from 1870-to 2018 from 17 advanced countries. They reveal a striking new formation like a “hockey stick” that indicates a deviation from the monotonic relationship between SMC and CO2. Over the last 50 years, the growth rate in capitalization has been enormous, so the hook shape curve of capitalization is prominent but current studies focus only on linear aspects, which require a critical lens. The findings of both researchers compel us to adopt the nonlinear approach to provide unbiased and factual findings. The two most recent studies also support the negative relationship between CO2 and SMC; Nguyen et al. (2021) reveal a negative but insignificant relationship, while Paramati et al. (2021) reveal that stock market growth reduces CO2 in developed economies based on linear assumption. One of its interpretations is that in developed countries, the trend of SMC is exponential, requiring a nonlinear approach to provide unbiased results. These studies provide us justification for developing our hypothesis by adopting a non-conventional approach as:

-

H1: Stock market capitalization has an inverted U-shaped relationship with environmental degradation. As the stock market capitalization increases, environmental degradation will decrease, or the positive relationship will revert to a negative.

Data and methodology

We follow the basic STIRPAT model of Dietz and Rosa (1997), which provides a theoretical and analytical foundation to check the impact of population, technology, and affluence on environmental degradation. The leading variable is SMC, and the quadratic term of SMC. The STIRPAT variables are control variables in the equations; we convert the GDPPC variables into log form to provide unbiased results.

Apart from SMC, we extended the STIRPAT model by using other controlling factors like urbanization, energy intensity, and industrialization. In Eq. 2, this study takes the per capita form by dividing both sides of the equation by the total population (Le et al. 2020). The dependent variable is environmental degradation, proxy by the log of CO2 emissions. Without rapid reductions in CO2 emissions, climate change will cause irreversible devastating effects. The independent variables are stock market capitalization, quadratic terms of SMC, GDPPC, energy intensity, industrialization, and stock market efficiency (DF)Footnote 3 (Table 1). In our conceptual framework, SMC has an inverted U relationship like income in environmental Kuznets curve (EKC). Our leading contribution is extended EKC based on stock market capitalization, threshold findings, and the efficiency hypothesis.

Results and discussion

This study tests critical assumptions of error-term in long-panel like heteroscedasticity, contemporaneous correlation, and autocorrelation. Table 2 reveals the value of Contemporaneous correlation measure by CD test and variance inflated factors. If we ignore these critical post-estimation issues untackled, the result will be biased. We choose Driscoll and Kraay’s methodology for unbiased estimation of standard error, which tackles the crucial assumptions and provides robust results. Hoechle (2007) devised a Stata package for efficient estimation in the presence of the issues. The XTSCC program is compatible with balanced and unbalanced panels and handles missing values.

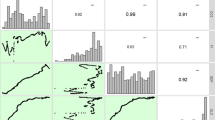

Hoechle (2007) methodology is the central one of the study. Other estimations pooled, XTPCSE, SML, semiparametric (Fig. 2), partial derivatives, and the existence of quartic term method are used for the robustness of findings (Table 3). For robustness of the threshold, we devised a dummy variable of DF that has a negative relationship with CO2 emissions. The results show that energy consumption, industry, and urbanization positively impact CO2 emissions. At the same time, we find an inverted U-shape relationship between SMC and CO2 emission, which indicates that SMC enhances emission. Still, after the 97 percent relationship marginally decreases and reverts to negative, stock market capitalization contributes to environmental well-being and proves a climate-friendly solution. The threshold varies by methodology, but diverse methods have the consensus of a threshold where the relationship revers.

Figure 1 shows an inverted U relationship in 40 sampleFootnote 4 countries that incorporate SMC’s second-order derivatives at different levels of environmental degradation. This study finds justification by a semi-parametric approach; Fig. 2 reveals the SMC nonlinear relationship with CO2 (same procedure applied on aggregate regional data and Panel B and Panel C countries and available in the Appendix). Panel A consists of all countries in Appendix Table 5, whereas Panel B and C are taken from this sample. Panel B consists of the top 10 CO2 emitter counties like China, USA, India, Russia, Japan, Germany, South Korea, Iran, Saudi Arabia, and Canada, per Forbe listing 2018. Panel C consists of the top 10 counties with a high stock market to capitalization ratio as per Global economic ranking 2018. These countries are Singapore, South Africa, Switzerland, Saudi Arabia, USA, Canada, Malaysia, Japan, Thailand, and Australia.

The positive association between energy intensity and CO2 emission across countries reveals the worse impact of energy intensity on environmental well-being and similar results found in industry and urbanization. These indicators cause environmental degradation, and our results are consistent with (Le et al. 2020; Renzhi and Baek, 2020). However, these indicators’ improvement enhances income but cannot tackle mega challenges like environmental quality and sustainable growth, while eco-friendly technologies are seemingly ignored during growth initiatives. We test the quadratic income term for robustness which indicates an inverted U-shape and is consistent with the EKC philosophy (missing from the table). The high energy demand is aligned with high industrialization and economic growth. Industrialization brings higher urbanization, creating a high demand for energy consumption that worsens the cosmos due to improvement in income. The top energy-consuming counties like China, the U.S.A., India, Japan, and Russia use more than 60% of their energy with an increasing trend. Overall, this data confirms the pollution haven hypothesis: dirtier sectors have been migrating from the developed to the developing world to avoid stricter environmental regulations (Le et al. 2020).

The study’s leading variable’s stock market capitalization has an inverted U-shape relationship with CO2 emission in the sample countries. The same findings are witnessed in Panel B and C countries and aggregate-data levels. We find non-linearity of aggregate data and SMC2 is justification, so the inverted U relationship is also prominent at aggregate level data of regions except European Union (detail of result is given in the Appendix). So we have somehow consensus that stock market capitalization and environmental degradation quantified by CO2 emission has inverted U shape in aggregate regional data, high financial developed countries and high emitting countries. It indicates higher stock market capitalization mitigates environmental degradation in countries and regions. The emission reduction can occur at two levels; at the individual level, improved access to finance, and high-income people can afford to buy eco-friendly technology (Le et al. 2020); the arguments are pretty convincing at the firm level. High stock market capitalization enhances investor confidence, provides firm opportunities to invest in modern technology, equips t firms with desired resources, and creates an efficient financial environment. We claim financial environment is essential for reducing environmental degradation (Paramati et al. 2018). Our findings indicate an asymmetric relationship of SMC and CO2 has the potential for a synergy effect, and SMC efficiency further reduces environmental degradation.

Conclusion

This study is based on forty countries’ samples from 1996 to 2018. Different methodologies reveal that industry, energy intensity, and urbanization increase CO2 emission while GDPPC and stock market capitalization have an inverted U-shape relationship with CO2 emissions. The inverted U-shape relationship between SMC and CO2 justifies that a higher level of stock market capitalization proves environmentally friendly. We find an inverted U-shape relationship between SMC and environmental degradation and propose an extended EKC based on the SMC philosophy. The quartic term of SMC is negative, revealing that policymakers should devise policies to uplift the SMC by better regulation for the mutual benefit of investors and firms. The stock market efficiency proves environmentally friendly.

Stock market-rated policies, irrespective of jurisdictional confinement, are urgently needed by today’s industrialized society to address the environmental degradation crisis, and aggregate data shows Europe is on the right track. Despite substantial political and ideological conflicts, the European Emission Trading Scheme, carbon taxation, and green finance facilities simultaneously enhance investor confidence and business sustainability. In this regard, Sachs et al. (2019) emphasize the significance of massive public and private investment to transition to a low-carbon, green economy. Policymakers need to set a policy to incentivize firms pursuing renewable energy options, adopt green energy initiatives, and provide emission disclosure for investors. The policy should be based on ratings, and green initiative firms must be given high ratings.

We faced two types of limitations in our study. The first is the sample size; our sample is purposive based on forty high carbon-emitting countries from 1996 to 2018. The balance panel data was unavailable before 1998, so the sample size is limited to < 1000 observations. We restrict the data before 2019 because COVID-19 impacts all countries’ GDP, which ultimately impacts emissions, so the inclusion of recent data may provide misleading results. We recommend increasing the sample size for better generalizability. This study can be extended in the future by using different control variables that can impact relationships and applying different long-run methodologies. Future research applies moderator variables like Hofstede’s cultural dimension, globalization effect, economic uncertainty, and nation aptitude at the macro-level for a thorough understanding of the relationship.

Data availability

Not applicable.

Notes

Stock market capitalization to GDP ratio also refers capitalization in the article.

“Stock market capitalization grew in line with GDP. But over subsequent decades, an unprecedented expansion saw market cap to GDP ratios triple and remain persistently high.”.

According to the Buffet indicator, we code DF 1 if the stock market is overvalued otherwise 0. The stock market of any country is called overvalued if the capitalization of stock markets reaches more than 100% of GDP. The overvalue is a sign of efficiency and investor inclination for equity investment in those countries, so it is also a Stock market efficiency proxy.

This article focuses on high emission and better financial environment countries “Top 10 Emitters countries contribute over two-thirds of global emissions while top forty almost more than 80%.” The purposive sample consists of 40 countries and analyzes data at country levels and the aggregate level. So sample countries irrespective of jurisdiction provide dynamic findings.

References

Alam MS, Apergis N, Paramati SR, Fang J (2021) The impacts of R&D investment and stock markets on clean-energy consumption and CO2 emissions in OECD economies. Int J Financ Econ 26(4):4979–4992

Altan İM, Alvan A, Aslan L, Aydin Ü, Berk C, Bilik M et al (2021) Financial systems, central banking and monetary policy during COVID-19 pandemic and after. Rowman & Littlefield

Anton SG, Nucu AEA (2020) The effect of financial development on renewable energy consumption A Panel Data Approach. Renew Energy 147:330–338

Bai L, Wei Y, Wei G, Li X, Zhang S (2021) Infectious disease pandemic and permanent volatility of international stock markets: a long-term perspective. Financ Res Lett 40:101709

Claessens S, Feijen E (2007) Financial sector development and the millennium development goals (No. 89). World Bank Publications

Dauda L, Long X, Mensah CN, Salman M, Boamah KB, Ampon-Wireko S, Dogbe CSK (2021) Innovation, trade openness and CO2 emissions in selected countries in Africa. J Clean Prod 281:125143

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proc Natl Acad Sci U S A 94(1):175–179. https://doi.org/10.1073/pnas.94.1.175

Hoechle D (2007) Robust standard errors for panel regressions with cross-sectional dependence. Stand Genomic Sci 7(3):281–312

Ji X, Chen X, Mirza N, Umar M (2021) Sustainable energy goals and investment premium: evidence from renewable and conventional equity mutual funds in the Euro zone. Resour Policy 74:102387

Kuvshinov D, Zimmermann K (2022) The big bang: stock market capitalization in the long run. J Financ Econ 145(2):527–552. https://doi.org/10.1016/j.jfineco.2021.09.008

Le T-H, Le H-C, Taghizadeh-Hesary F (2020) Does financial inclusion impact CO2 emissions? Evidence from Asia. Financ Res Lett 34:101451

Mhadhbi M, Gallali MI, Goutte S, Guesmi K (2021) On the asymmetric relationship between stock market development, energy efficiency and environmental quality: a nonlinear analysis. Int Rev Financ Anal 77:101840

Nguyen DK, Huynh TLD, Nasir MA (2021) Carbon emissions determinants and forecasting: evidence from G6 countries. J Environ Manage 285:111988. https://doi.org/10.1016/j.jenvman.2021.111988

Ouyang Y, Li P (2018) On the nexus of financial development, economic growth, and energy consumption in China: new perspective from a GMM panel VAR approach. Energy Econ 71:238–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Paramati SR, Alam MS, Apergis N (2018) The role of stock markets on environmental degradation: a comparative study of developed and emerging market economies across the globe. Emerg Mark Rev 35:19–30

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371

Paramati SR, Mo D, Huang R (2021) The role of financial deepening and green technology on carbon emissions: evidence from major OECD economies. Financ Res Lett 41:101794

PiñeiroChousa J, Tamazian A, Vadlamannati KC (2017) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):2009

Raza SA, Shah N, Qureshi MA, Qaiser S, Ali R, Ahmed F (2020) Nonlinear threshold effect of financial development on renewable energy consumption: evidence from panel smooth transition regression approach. Environ Sci Pollut Res Int 27(25):32034–32047. https://doi.org/10.1007/s11356-020-09520-7

Renzhi N, Baek YJ (2020) Can financial inclusion be an effective mitigation measure? evidence from panel data analysis of the environmental Kuznets curve. Financ Res Lett 37:101725

Sachs JD, Schmidt-Traub G, Mazzucato M, Messner D, Nakicenovic N, Rockström J (2019) Six transformations to achieve the sustainable development goals. Nat Sustain 2(9):805–814

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39(2):999–1006

Sharma GD, Tiwari AK, Erkut B, Mundi HS (2021) Exploring the nexus between non-renewable and renewable energy consumptions and economic development: Evidence from panel estimations. Renew Sustain Energy Rev 146:111152

Velte P, Stawinoga M, Lueg R (2020) Carbon performance and disclosure: a systematic review of governance-related determinants and financial consequences. J Clean Prod 254:120063

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res Int 26(8):7926–7937. https://doi.org/10.1007/s11356-019-04284-1

Zhang Y-J (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Author information

Authors and Affiliations

Contributions

Aamir Azeem: writing — initial draft, analysis, visualization and validation. Muhammad Akram Naseem: review, editing, and supervision. Shahid Ali: writing literature review, editing, and methodology. Naveed Ul Hassan: writing a literature review, editing. Muhammad Toseef Aslam: writing literature review, editing. Ijaz Butt: writing literature review, editing. Atif Khan Jadoon: writing literature review, editing.

Corresponding author

Ethics declarations

Ethical approval

The authors acknowledge that the current research has been conducted ethically. We declare that this manuscript does not involve research about humans or animals.

Consent to participate

The authors consented to participate in this research study.

Consent for publication

The authors consent to publish the current research in the Environmental Science and Pollution Research journal.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Azeem, A., Naseem, M.A., Hassan, N.U. et al. A novel lens of stock market capitalization and environmental degradation. Environ Sci Pollut Res 30, 11431–11442 (2023). https://doi.org/10.1007/s11356-022-22885-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22885-1