Abstract

The paper examines how environmental, social, and governance (ESG), including management incentives, influence a firm’s financial performance. The study method is based on an empirical analysis of data describing firm-level information about corporate financial performance and corporate sustainability performance between 2001 and 2020, summing up 6291 observations related to 422 analyzed firms from the European Union (EU). The study findings emphasize that firm size is highly influenced by sustainable economic development and significantly conditioned by a CSR strategy and a capable management team. We also prove a long-term relationship between the measures of corporate financial performance and the scores reflecting corporate ESG performance. Our results show a co-integration relationship between corporate financial performance metrics and corporate sustainability performance scores. ESG corporate performance is highly conditioned by the level of resources affected for this purpose, directly impacting firms’ cash flow.

Similar content being viewed by others

Introduction

Non-financial reporting represents a fundamental concept through which companies reveal their attitude toward the community, environment, and governance, often referred to as environmental, social, and governance (ESG) or corporate social responsibility (CSR) actions. Over time, sustainability reports have become increasingly important, completing financial statements in substantiating investment decisions and long-term sustainable development goals. However, they were first seen as an obligation to comply with legal requirements (PwC 2021), with ESG compliance being more pronounced in European companies than in other parts of the world (Shaikh 2022).

Sustainability is a broad and complex concept. It seems that CSR tends to add value only under certain conditions. Researchers reveal that there may also be an indirect relation between CSR and firm performance (Servaes and Tamayo 2013) rather than a direct relation in which CSR improvements are positively related to companies’ future profitability (Shah et al. 2019; Sarfraz et al. 2020a; Maury 2022). In this context, managers play a crucial role as more and more companies start to include indicators on meeting environmental, social, and corporate governance objectives in their directors’ remuneration packages.

Managers are responsible for directing resources to implement effective monitoring processes and controls that aim to achieve firms’ targets in terms of ESG actions (Ajaz et al. 2020; Velte 2021). The effectiveness of those processes is crucial for firms. Through CSR/ESG strategies, managers search for solutions to develop and consolidate firms’ dynamic capabilities, increasing their resilience in the current context of extremely high economic uncertainty. Those capabilities reflect firms’ capacities to redesign, adapt, and change processes and direct resources in volatile economic, social, and environmental circumstances. Therefore, firms can gain a significant competitive advantage on the market through more agile processes, creative and innovative solutions addressing ESG problems, or the facilitation of human capital development (Babasanya et al. 2018).

Furthermore, a top-down approach to ESG strategy implementation is essential. The moderating effect of CSR on corporate financial performance is conditioned by the CEO’s power (Velte 2021) or the board characteristics (Rossi et al. 2021). Top management decides on a CSR strategy that has to consider several mechanisms that significantly influence the relationship between CSR and corporate financial performance (Vishwanathan et al. 2020; Naseem et al. 2021). Therefore, managers should build a relationship with both shareholders and stakeholders, based on trust and long-term cooperation, in line with the legitimacy theory and stakeholder theory.

Managers must also have enough experience and expertise to cope with industry-specific challenges (Zaiane and Ellouze 2022) or county regulatory framework and enforcement mechanisms (Christensen et al. 2021), especially in the case of mandatory adoption, to avoid the deterioration of CSR’s positive long-term moderating effect on corporate financial performance. Industries such as the energy or manufacturing sector are more sensitive to environmental concerns, so managers should integrate economic and environmental dimensions into the day-to-day decision-making process. Otherwise, the compliance costs will be significantly high and drastically affect corporate financial performance. Nonetheless, we emphasize the moderating role of the national regulation and the monitoring and control mechanisms that look for compliance with environmental, social, and economic regulations. Additionally, the transition to sustainable growth models on a macroeconomic level creates distinct paths, even when common understanding is achieved. For example, European Union economies have subscribed to the Green Deal but plan to reach the targets in different ways, through relatively customized public policies aimed to cope with the local characteristics of their economies.

This paper aims to offer some insights into the relationship between ESG/CSR practices and financial performance. The literature emphasizes a positive but small impact of corporate ESG practice on corporate financial performance (Grewatsch and Kleindienst 2017; Shehzad et al. 2020). The link between ESG performance and corporate financial performance has been generalized among people involved in ESG practices, whether they be researchers, ESG implementation experts, or non-practitioners responsible for the processes scoped to become green (Bergmann 2016; Sarfraz et al. 2020b). In this context, the focus of our paper is an empirical analysis of data describing firm-level information about corporate financial performance and corporate sustainability performance between 2001 and 2020, summing up 6291 observations related to 422 analyzed firms, covering most of the European Union members. The study is oriented on a firm-level analysis as the sample analyzed consists of firms that are more or less subject to similar country regulation in terms of sustainability, as they are originated from European Union members.

Our paper attempts to fill the gap in the literature, including in the sample analyzed companies from developing countries as well, such as Poland, the Czech Republic, and Hungary (Goyal et al. 2013; Alshehhi et al. 2018). We proceed to a long-term analysis, as the literature highlights that a link between corporate sustainability performance and corporate financial performance is more likely to be visible over a longer period (Lu and Taylor 2016; Alshehhi et al. 2018). The research is oriented toward accounting-based metrics of corporate financial performance, rather than market-based performance, as long-term behavior can be better reflected by accounting-based financial measures, while market-based proxies better reflect short-term causality with ESG performance (Lu and Taylor 2016; Atz et al. 2021).

Additionally, our study addresses the role of ESG strategies, rather than ESG practice on corporate financial performance, providing insights on the essential place of the top-down ESG approach. Management contributes to the efficient use of organizational resources and thus these resources are efficiently allocated to ESG activities. ESG activities contribute to sustainable development and increase the level of competitiveness (Grewatsch and Kleindienst 2017; Atz et al. 2021).

This paper is structured as follows: the “Literature review” section presents the literature review and the hypothesis development, testing how ESG/CSR and management efficiency on implementing firms’ strategy influence financial performance; the “Research methodology” section presents the research methodology; the “Results and discussion” section discusses the results obtained; and the “Conclusion” section summarizes the main findings, conclusions, and avenues for future research directions.

Literature review

Non-financial reporting, defined as the disclosure of a company’s ESG information. Today, ESG reporting has become a topic of real interest, with environmental, sustainability, and governance policies alongside CSR practices being the real drivers of business development and among the main factors that promote green innovation and environmental management (Pan and Fan 2021).

We are thus moving toward the moment when a company’s non-financial performance can compete with its financial performance, greatly influencing investment decisions (PwC 2021). This is because managers and stakeholder believe that significant ESG disclosures yield better operating performance, higher returns, and lower firm-specific risk (Shaikh 2022).

In this context, the identification of the impact of non-financial reporting expressed by ESG and CSR strategies on financial performance, particularly the correlation of KPI indicators with financial performance factors, is of particular importance. This is true from the perspective of, on the one hand, long-term development and value creation, with studies highlighting that social and governance performance significantly affects economic performance (Cek and Eyupoglu 2020; Naseem et al. 2021). On the other hand, new non-financial reporting regulations require companies to have responsible and transparent business models. Hence, investors can evaluate the financial results of various ESG factors from the perspective of changes in cash flows, the impact on earnings, or the cost of capital and asset values.

Authors agreed that sustainability strategies play a crucial role in business development (Amel-Zadeh and Serafeim 2018). However, there is significant gap in the literature regarding a ground theory concerning the causality between corporate ESG performance and corporate financial performance (Grewatsch and Kleindienst 2017). Hence, in this sense, it is interesting to examine how ESG influences firms’ financial performance, CSR strategies, and managers’ ability to incur expenses on social responsibility projects and maintain, at the same time, positive financial results.

Overall, the literature reflects that firms that integrate CSR strategies into their business model perform better (Bocquet et al. 2017). Maury (2022) stated that CSR improvements are shown to be positively related to higher profits, and Cheng et al. (2014) emphasize that firms with higher CSR ratings have better access to finance and gain competitive advantages (Ruokonen and Temmes 2019). Nevertheless, Masulis and Reza (2014) stated that the stock market can react negatively to the announcement of corporate philanthropic contributions, suggesting that these kinds of CSR activities are not valued by investors mainly because they interfere with the goal of firm value maximization. However, companies are under increasing pressure to “do good” (Huang 2021). Therefore, we believe that CSR practices are key elements of the business model and risk management framework, promoting the image and values with which the company identifies. As such, the first hypothesis that will be tested is:

-

H1: CSR strategies determine significant changes in a firm’s performance.

However, corporate sustainability today implies much more, namely a process that implements a business strategy that focuses on environmental, social, and governance dimensions to improve traditional financial analysis by identifying potential risks and opportunities beyond economic aspects. Kumar (2020) highlighted that ESG compliant firms have better governance, care more for sustainable development and the environment, record less earnings volatility, and have lower-cost funds. Also, high ESG scores have a significant positive impact on firm value (Duque-Grisales and Aguilera-Caracuel 2021). Performance indicators like ROA, ROE, and Tobin’s Q generate economic benefits to shareholders (Buallay et al. 2020).

Hence, long-term value creation is not a goal only for investors and management, but also for regulatory bodies, like the United Nations. The latter’s involvement can be seen through their recommendation that firms disclose their ESG practices by 2030 to address how severe environmental threats due to climate change can be counteracted in ways that do not affect the financial performance of companies. In addition, studies reveal that when firms undertake strategic actions to improve their ESG performance, they also enhance the firm’s reputation in the eyes of its various stakeholders (Kim and Lyon 2015; Abdullah et al. 2018). Therefore, we believe that a firm’s ESG score influences its performance and as such the second hypothesis that will be tested is:

-

H2: A firm’s ESG score determines significant changes in its financial performance in the context of environmental change concerns.

Another aspect highlighting the great importance of this topic is whether ESG or CSR performance is the outcome of well-governed managerial decisions, or if they arise when managers are acting in their interests (Gillan et al. 2021). This implies that CSR projects may represent, on the one hand, opulent expenditure made by managers motivated by personal interests, decreasing shareholder value, and worsening financial performance. Managers may be motivated by the remuneration packages received for fulfilling the ESG objectives; evidently, the largest listed companies set the tone on stock exchanges (PwC 2021). On the other hand, in the case of sensitive industries, managers tend to set higher ESG performance targets and to disclose more corporate social information than other sectors through non-financial reports. This is done out of a desire to mitigate the negative impact of the activity carried out by posing a good image into the market (Garcia et al. 2017). Therefore, we believe that management efficiency in implementing firms’ strategy and how shareholders offer incentives to managers to motivate them to obtain an optimal level of corporate performance, are important factors in how CSR/ESG projects influence performance. As such, the third hypothesis that will be tested is:

-

H3: Managers’ ability to cope with environmental, social, and governance issues determines significant changes in a firm’s financial performance.

Overall, ESG activities are perceived as a source of explicit costs for firms, with low awareness of the implicit potential positive effects on their performance from a long-term perspective. Incentives in favor of sustainable growth seem too low, discouraging companies from taking the next step toward a green economy. In those circumstances, additional pressure is required, such as more regulation on ESG activities, as the scenario of voluntary adoption of a green business model does not generate sufficient benefits. Also, the widespread practice within countries, industries, and even firms operating in the same field of activity, or at least the information disclosed by them, creates this status quo. The lack of standardization on ESG reporting, despite the common efforts of international standard-setters in the area of ESG practice, may affect the measures of ESG scoring. Therefore, aiming for standardization in disseminating ESG information is a first step to obtain a clearer image of the link between the constructs explored in this paper, as underlined by Christensen et al. (2021). Otherwise, corporate sustainability reports will become highly complex, addressing numerous subjects in a general rather than a relevant and clear manner (Székely and Vom Brocke 2017), leading to higher cost for preparation, higher risk of litigation costs, or just negative reactions on the markets because of insufficient information disclosed on essential topics.

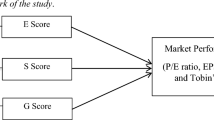

Research methodology

Data and variable definition

Our study represents an empirical analysis of data describing firm-level information about corporate financial performance and corporate sustainability performance. Information analyzed is limited to 2001–2020, summing up 6291 observations related to 422 firms.

The study focuses only on firms with a country of origin as EU members, as they are subject to a common approach in terms of regulation, structural reforms, and financing of projects in sustainable development. The European Union’s Green Deal looks at environmental, social issues, innovation, and circular economy and is designed to lead to sustainable development. Countries are supported to provide firms’ incentives to achieve targets on SGDs set up by UN members. These targets are transposed into firm sustainability practices related to transformations concerning vision, mission, objectives, policies, and processes that lead to sustainable economic development and create an organizational culture promoting continuous transformation toward sustainability (Khaled et al. 2021).

In Fig. 1, we observe that the number of observations is balanced related to the distribution along the analyzed years. Instead, our sample of observations is mainly related to manufacturing firms originating from the UK, France, and Germany, based on data available on the Refinitiv database. Industry 4.0 has represented an interest in manufacturing firms over the last decade, especially in the case of firms originating from well-developed countries (Czvetkó et al. 2021). We expect that our results show that ESG activities significantly influence firms’ corporate financial performance. However, Industry 4.0 leads to SDG achievements, such as SDG 9 related to the industry, innovation, and infrastructure, and SDG 12 concerning responsible consumption and production (Mabkhot et al. 2021). Instead, firms’ transformation in achieving those SDGs determines indirect positive effects on human capital-related SDGs, such as SDG1, which leads to poverty elimination through better productivity rates and premises for increases in employees’ wages, or SDG 3, which generate improvements in employees’ health and well-being. Still, getting benefits from ESG efforts is often referred to as trade-offs made, especially on the objectives of SDG 12, which means that cultural factors influencing people’s behavior become even more critical.

In Table 1, we define the variables considered in our model. All data are collected from the Refinitiv database. ESG score, CSR strategy, and management score are calculated based on a percentile rank scoring methodology that generates a score between 0 and 100. Overall, the Refinitiv ESG score focuses more on the social pillar. The weights considered for aggregate score calculation for the environmental pillar is 34%, for the social pillar is 42%, and for the governance pillar, only 24% (Refinitiv 2021). However, we do not analyze separate pillars of the ESG score in our analysis, just the overall ESG score. This way, our results are not affected by the choice of a specific database of ESG information, as Lopez et al. (2020) emphasized that generally, aggregate ESG scores are not influenced by the field of activity or ESG score provider’ methodology but rather by market capitalization.

We look as well for CSR impact on corporate financial performance, as an individual component of the sustainable development framework, as it focuses on human capital and social relations within an organization, representing the premises to get benefits from an optimal approach of the knowledge management system and firms’ innovation capabilities (Mabkhot et al. 2021).

Management score is included in our analysis to understand the role of management incentives in ensuring firms’ sustainable economic development, as motivated managers are more likely to obtain better sustainable economic growth through environmental and social performance (Rezaee 2017).

We consider two measures for corporate financial performance to ensure robustness for our results, as accrual-based firms’ profitability differs many times from firms’ cash flows. While ROA is considered a critical key performance indicator, firms’ free cash flow may be perceived as indicating a realistic self-financing capacity for firms. Additionally, free cash flows represent an essential parameter in the contemporaneous firm valuation models (Damodaran 2007).

Time series analysis and model specification

Earnings sustainable growth represents a current dilemma in the literature, especially from the lens of methodological issues. Those issues have been doubled by the negative effects of earnings management, leading to the deterioration of the value relevance of financial statements over the last decades (Hail 2013; Lev 2018). Monahan (2018) noted that dynamic analysis of corporate financial performance is opportune, bringing insights into the quality of earnings reported. Therefore, we look for a dynamic perspective of earnings evolution by time series analysis considering a panel data approach, where each panel is the firm analyzed.

Panel stationarity testing

Testing for stationarity of time series is performed by running a set of panel unit root tests: Levin-Lin-Chu t-test, Im-Pesaran-Shin test, ADF-Fisher chi-square test, and PP-Fisher chi-square test. All the methods have a similar principle, representing extensions of the traditional augmented Dickey-Fuller (ADF) unit root test for univariate time series modeling, which was restricted to the assumption of individual cross-sectional independence. Levin-Lin-Chu tested the assumption that all countries in the panel share the same autoregressive coefficient \({\alpha }_{i}=\rho -1\), estimating models below:

where \(\Delta\) is the first difference operator of the two measures of corporate financial performance (CFP), \(i=1,\dots ,N\) indicates each firm analyzed, t = 1,…, T indicates the period, \({p}_{i}\) is the number of lags, \({\mu }_{i}\) is the unit-specific fixed effect, while \({\theta }_{t}\) denotes the time fixed effect and \({e}_{it}\) is the error terms that follow a stationary invertible autoregressive moving-average process for each unit in the panel but are independently distributed across the panels. If \(\rho <1\), the test confirms that the time series is stationary. Otherwise, the null hypothesis \(\rho =1\) is accepted, showing that each panel has a unit root.

Panel co-integration testing

Compared with panel stationarity tests that look for unit root on single time series, co-integration reviews the relationship among a group of variables, each having a unit root (Gujarati 2011). The co-integration test starts from the econometric equation.

where, by \(CSP\), we express the three measures (\(k=\stackrel{-}{\mathrm{1,3}}\)) concerning sustainability firms’ performance, respectively the ESG score, the CSR strategy, and the management score, that follow a stochastic process \({CSP}_{k,i,t}={CSP}_{k,i,t-1}+{u}_{it}\). Co-integration evaluation involves testing the stationarity of the error term (\({e}_{it}\)), which translates into the following parametric equation:

If the error term \({\widehat{e}}_{i,t}\) is stationary, endogenous variables analyzed are co-integrated, which means a VAR model is better for our estimation purpose (Pesaran 2015). Instead, suppose the error term is not stationary. In that case, a higher level of co-integration between the analyzed group of endogenous variables asks for unrestricted econometrics models, such as the VECM model in case of endogenous variables with the same order of integration higher than 1 or the ADRL model in case of endogenous variables with different orders of integration.

After all, interpretation of the results supports us in deciding if the model specification has to consider the separation between short-term and long-term variation impact on our corporate financial performance measures. For this purpose, we run the Pedroni panel co-integration battery of tests.

Granger causality test consists of estimating the bivariate regressions of the form below for each possible pair of variables considered in the analysis, testing for the hypothesis that \({\beta }_{1}={\beta }_{2}={\beta }_{3}=\dots ={\beta }_{l}=0\), for each equation.

The null hypothesis is that x does not Granger-cause y in the first regression and that y does not Granger-cause x in the second regression. We can reject the null hypothesis if the F statistic is statistically significant, concluding that there is a causality relationship between the two variables but with a clear direction of causality.

This test is essential for our study to provide insights into the direction of causality between the endogenous variables we include in the VAR model to be estimated. There can be bi-directional causality relations or unidirectional causality relations. However, the focus of our paper is on the causality relation between endogenous variables included in the VAR model that shows a significant impact on the CFP measures.

As long as variables included in our analysis are I(0) co-integrated, we estimate a VAR model to review the marginal effect generated by CSP measures on considered CFP measures, looking if there is a positive or negative association. By estimating the VAR model, we overcome the issue of endogeneity in the model specification (Gujarati 2011; Brooks 2019). The \(VAR(p)\) process used in our analysis, with a lag of \(p\), can be expressed by the system of relations below:

where εi,t, \({{\varepsilon }^{^{\prime}}}_{i,t}\), ε’’i,t, and ε’’’i,t denote the stochastic error terms, called innovations. Those innovations are used later for an impulse function analysis to show the effect of changes in the standard deviation of endogenous variables on the other remaining endogenous variables included in the estimated VAR model.

The error terms have to follow a white noise process, known in terms of VAR models as an innovation process, and no autocorrelation between different panel unit residuals, ensuring (i) no dynamic interdependencies, (ii) no static interdependencies, and (iii) no cross-sectional heterogeneities (Schnücker 2016). Therefore, we assess model validation by performing several tests, the autocorrelation LM test and the White heteroscedasticity test, to check for panel errors in autocorrelation and model heteroscedasticity.

Results and discussion

Descriptive statistics

In Table 2, we provide exploratory statistics for the variables used in our study. Looking at the standard deviation, we observed significant heterogeneity in our sample related mainly to ROA and cash cycle, which suggest specific firms’ business model particularities. Instead, score-based variables used in the study are more homogenous, most probably because dimensionality reduction purpose of those scores.

Overall, our sample consists of firms with relevant experience in their field of activity (17.14 years) and similar size (22.50). Instead, the cash cycle varies significantly within the sample, with a variation coefficient of approximately 72.59%, highly conditioned by firms’ power of negotiation and competitive advantage, with direct implications on firms’ cash flow. The return on assets is relatively small, with a mean of 4.70%. However, firms’ profitability differs significantly from our sample, with a standard deviation of 13.38%, suggesting significant differences in firms’ operation efficiency. Operation efficiency from the perspective of firms’ potential to generate cash flows shows a slight variation in our sample, with a coefficient of variation over 41%, which suggests that the variation in ROA is explained by other factors, such as the managerial ability.

Additionally, we observe from Fig. 2 that heterogeneity in our sample related to ROA increases, especially in the period 2014–2018, and reduces slightly during the COVID-19 pandemic, but with an insignificant impact on the overall mean of ROA of our sample. Instead, the evolution is relatively stable in the case of free cash flows, and our sample’s heterogeneity is persistent in time. These results indicate that earnings management’s measure of profitability is more influenced by cash flow measures, especially through accrual manipulation, as real activity-based earnings management would have affected FCF, not only ROA.

The managerial ability we use in this study shows firms’ management teams’ modest competencies and abilities to draw up and implement firms’ strategies. The mean of 54.2 scores represents only approximately 54.2% of the maximum theoretical value of 100. Similar moderate values are valid for the measures of CSR strategy (47.50) and ESG score (52.39). Instead, those values suggest that firms have understood how important it is to follow the approach of a sustainable economic growth approach. Even there is a small difference between the mean score of CSR strategy and ESG score, corroborated with a higher coefficient of variation in the case of CSR strategy \(\left({CSR}_{var. coef.}=\frac{32.55}{47.5}\approx 68.53\%{>ESG}_{var. coef}=\frac{20.38}{52.39}\approx 38.90\%\right)\) and 1st quartile of those variables \(\left({CSR}_{25th perc.}=16.67{<ESG}_{25th perc.}=36.84\right)\), we appreciate that firms run ESG activities without a mature approach based on a robust CSR strategy which may translate into less cost-effective ESG operations and lower net benefits of ESG efforts for the firms. Overall, ESG activities are perceived as a source of explicit costs for the firms, with low awareness of the implicit potential positive effects on firms’ performance long-term.

The representation in Fig. 2 of variables included in the study shows that they evolve slightly similar, suggesting a relation of long-term co-integration. In Table 2, we provided results of collinearity tests as well. The results show there is no collinearity issue, as the VIF does not exceed the threshold of 10 (Gujarati 2011).

Correlation analysis

Table 3 provides the associations between variables included in our study. The results show significant correlations only between firm size, ESG score, CSR strategy score, and managerial ability score. Instead, financial performance measures of profitability and FCF are less associated with CSR and ESG measures. Additionally, we observe a small association between ROA and FCF, which confirms that the cash flow measure is less affected by earnings management. At the same time, ROA is highly conditioned by the discretionary decisions of management concerning firms’ accounting and financial reporting policies.

Results indicate that sustainable economic development is highly influenced by firm size (0.575) and significantly conditioned by the existence of a CSR strategy (0.739) and a capable management team (0.510). Sustainable economic development does not resume only to isolated ESG projects, or compliance with minimum legal requirements, as it has to be understood beyond those boundaries, such as the design of innovative vision, objectives, and strategies, the creation of concise, clearly defined, and coherent policies, or proper monitoring and control tools. Otherwise, the efforts will translate just in period expenses, negatively impacting firms’ future financial performance (− 0.40) or even corporate sustainability performance. This approach is influenced by firms’ business model (− 0.025), firms’ experience (0.247), and firms’ potential to finance such ESG projects (0.575), the reason why higher focus on ESG activities is confirmed in the case of firms of larger size (Christensen et al. 2021).

Stationarity of time series

In Table 4, we provide panel stationarity test results. As shown in Fig. 2, there is not a significant trend component in the evolution of our endogenous variables, the reason why we consider not looking for individual intercept only. Based on the results, all tests performed are statistically significant, indicating our endogenous variables are stationary on their levels. Therefore, relevant for our regression analysis are the levels of our endogenous variables.

Panel co-integration testing

The choice of VAR or VECM model to assess the link between corporate financial performance and corporate sustainability performance depends on the co-integration between our endogenous variables. Therefore, the next step for our analysis consists of testing for co-integration. Results are provided in Table 5 for both measures of corporate financial performance, respectively, the ROA and FCF variables.

As the results obtained show most of the tests are statistically significant, we conclude that there is a long-term relationship between the measures of corporate financial performance and the scores reflecting corporate ESG performance (Aljandali and Tatahi 2018). In the case of firms’ profitability, seven of the eleven tests performed are statistically significant for a significance level of 5%. In comparison, in the case of firms’ potential to generate cash flow for self-financing (FCF), eight tests performed are statistically significant.

Therefore, there is a co-integration relationship between corporate financial performance metrics and corporate sustainability performance scores. However, variables considered in our analysis are of I(0) order of integration, with no significant trend component emphasis, the reason why we consider proper a VAR model estimation (Pesaran 2015), a model which looks only for long-term effects, without incorporation of short-term effects as well.

VAR model estimation

Table 6 provides a battery of tests performed to validate estimated VAR models. The Lagrange multiplier test indicates there is no autocorrelation of residuals on the models, as the p value of each model estimates exceeds the significance level of 5%, which rejects the null hypothesis autocorrelation of residuals (Aljandali and Tatahi 2018).

The results also show joint normality Jarque–Bera test results that are statistically significant, which indicates that the variables are not multivariate normally distributed. Similar results are obtained for assessing model heteroscedasticity, as White test statistics are statistically significant with a significance level of 1%. Regression coefficients are not affected in the presence of heteroscedasticity. We estimate the model using the White-Huber standard error regression procedure to correct this estimation bias to ensure efficient regression coefficient estimates concerning standard errors. Additionally, we highlight that estimated VAR models are stable, as there is not any root of the related polynomial that exceeds the absolute value (Aljandali and Tatahi 2018). Model stability emphasizes that estimated coefficients are relevant from the long-term analysis perspective and shows that estimated VAR models can also be used for forecasting purposes.

In Table 6, we summarize the results of the VAR estimated model, resuming the information provided only to the OLS equations describing the effect on corporate financial performance if the other endogenous variables are considered in model estimation.

The optimal lag of the VAR model was chosen based on the Schwartz criterion as it was lower than the Akaike information criterion (Aljandali and Tatahi 2018). Based on the Schwartz criterion, we have considered a lag of two for all VAR models estimated and presented in Table 6.

Models incorporated on the VAR estimated model are statistically significant. The p value of each F test performed for the OLS estimated models does not exceed the significance level of 1%. Also, the individual estimated OLS models we have presented in Table 6 have the adjusted \({R}^{2}\) varying between 22.7%, in model 4, and 60.2% in model 2.

Adjusted \({R}^{2}\) illustrates higher value relevance of ESG- and CSR-related scores for free cash flow forecasting, compared with the ROA, as \({R}_{model 1}^{2}=43.5\%\) is significantly lower than \({R}_{model 3}^{2}=57.6\%\). Those results show the negative perspective on the efforts firms make for sustainable economic development, as ESG activities are mainly seen as expenses without immediate benefits for the firms, with a direct impact on firms’ cash flow and lower effect moderated by earnings management on ROA.

Instead, the situation changes when controlling the results for firms’ characteristics, as \({R}_{model 2}^{2}=60.2\%\) is significantly higher than \({R}_{model 4}^{2}=22.7\%\); the results suggest that firms’ operation efficiency, business model complexity, or experience in the industry are more relevant. This statement is also confirmed by the higher absolute value of estimated coefficients related to control variables than the coefficients corresponding to corporate sustainability performance measures.

Results presented in Table 7 emphasize the persistence (predictability) of ROA when controlling for one lag (\(Coef.=0.427, Sig.<0.01\)) and two lags (\(Coef.=0.341, Sig.<0.01\)) as well. Those results indicate significant effects of earnings management, showing managers smooth reported earnings. Similar results are identified in the case of FCF when controlling for one lag (\(Coef.=0.401, Sig.<0.01\)) and two lags (\(Coef.=0.389, Sig.<0.01\)) as well. As the correlation between ROA and FCF is only 0.292, those results indicate managers prefer accrual-based earnings management, as cash flow persistence is less related to structural concerns about firms’ operations and more related to reported profitability.

All four models incorporated into the estimated VAR model present a significant marginal effect of ESG score on ROA and FCF. However, the effect differs based on the lag considered in the model. The ESG score reported for the prior year negatively affects both corporate financial performance measures considered in our study. In contrast, the ESG score reported 2 years prior generates positive effects on firms’ financial performance. In the case of model 1 and model 2, the ESG factor effect is compensated for 2 years, showing a cumulative neutral effect on firms’ profitability. Our results are similar to Chen et al. (2021), who have again underlined that in the short run, the costs of ESG activities are to be compensated by the future benefits. From a long-term perspective, it is expected that net positive effects are generated by higher firms’ corporate ESG responsibility (Friede et al. 2015; Lu and Taylor 2016; Vishwanathan et al. 2020).

Instead, the situation is slightly different based on results from model 3 and model 4 estimation, as the cumulated effect of the ESG factor over a period of 2 years leads to a slight positive impact. Therefore, FCF is significantly positively affected by ESG score both in the case of model 3 (\({Coef}_{lag 1}=-0.0768, Sig.<0.01\), lower in absolute value than \({Coef}_{lag 2}=0.1071, Sig.<0.01\)) and model 4 (\({Coef}_{lag 1}=-0.0613, Sig.<0.01\), lower in absolute value than \({Coef}_{lag 2}=0.1016, Sig.<0.01\)). Chen et al. (2021) suggested that the impact of ESG-related project costs is observed on the next year’s level of firm reported free cash flow, while positive effects of those costs are observed only 2 years later, as the value creation generated through lean managements, cost improvements initiatives, productivity increase, employees’ motivation, or even reputational benefits are potential on short term. Those latent gains can be valorized from a longer perspective, and once they are confirmed, they affect firms’ cash flow. The state has an essential role in this equation, as regulatory and legal interventions configure the basis of assumptions managers work with concerning possible non-compliance costs. Investors also have an essential place in this framework, as they negatively perceive any potential non-compliance costs and increase the pressure on managers raising awareness on managers’ side about possible future litigation costs generated by commitments on ESG objectives not met. Therefore, based on those results, we can confirm our second hypothesis H2: ESG score determines significant changes in firms’ financial performance in the context of environmental change concerns.

Results also show a significant effect of CSR strategy score on corporate financial performance along the models incorporated into the estimated VAR model. However, marginal effects generated by CSR strategy score are statistically significant only for 1-year lag, with a lower impact on ROA (\({Coef}_{lag 1}=-0.0001, Sig.<0.01\)), compared with the marginal effect on the free cash flow reported (\({Coef}_{lag 1}=-0.025, Sig.<0.01\)). The marginal effect is lower than the one generated by the ESG score. Therefore, sustainable strategies determine a short-term negative effect on firms’ financial performance. A clear corporate social responsibility strategy disclosed by sustainability reports gives shareholders and stakeholders an indication of what efforts the firm should make to enhance its reputation, improve communication with its stakeholders, improve risk management, or strengthen firms’ innovation capabilities (Vishwanathan et al. 2020). The negative results show that investment in human capital, process improvements, and innovation capabilities significantly affect corporate financial performance, especially the free cash flow component of investments in operations. The transition to a sustainable economic growth model represents an essential objective nowadays for firms. However, it asks for significant costs instead, especially because of the need to integrate economic, social, and environmental dimensions of the business operations, leading to synergy effects in time. These costs affect corporate financial performance in the short run, especially in the case of firms starting this transition recently. Instead, this effect is insignificant in the medium and long term because of the heterogeneity in practice related to strategic business behavior. Wang et al. (2016) and Boukattaya et al. (2021) stated that the impact of ESG activities on corporate financial performance plays a moderating role. It is highly affected by industry-specific regulatory frameworks and stakeholders’ demands concerning firms’ social responsibility. If some firms perform ESG activities only based on legal or industry-specific requirements, the costs of implementing sustainability projects will represent short-term costs. Instead, suppose firms adjust their strategies to target long-term benefits from ESG projects by adjusting processes, training people, and implementing supporting systems and controls to monitor clear KPIs addressing ESG strategic objectives. In that case, the outcome is expected to be positive (Friede et al. 2015). Therefore, based on those results, we can confirm that our first hypothesis H1: CSR strategies determine significant changes in a firm’s performance is partially confirmed.

Robustness analysis

While firm size is used as a proxy for business model complexity, firm age is used as a proxy for a firm’s experience accumulated over time in the area of activity. In model 2 and model 3, we observe a significant negative effect on corporate financial performance metrics generated by the firm size and age. Additionally, we observe that the score of firms’ operation efficiency impacts positively corporate financial performance. Those results indicate that the learning curve has already reached the phase of unconscious competence, described by mastery competence, but unconscious awareness of the competencies assimilated. In those circumstances, there is a small room for improvements on firms’ processes as firms and employees as well are not able to adjust to the dynamic complexity in the organization because of the lack of a system thinking practices which promote initiative among the employees and generate opportunities for process improvements (Zgrzywa-Ziemak and Walecka-Jankowska 2020). Another explanation could be the higher compensation of experienced employees but lower financial performance improvements than the increase in employees’ compensations.

Causality analysis

Results in Table 7 show the association between corporate financial performance metrics and corporate sustainability performance measures. However, those results do not indicate the direction of those associations if the associations are unidirectional or bidirectional. According to the results in Table 7, we observe that the only bidirectional associations appear between ROA and ESG score, respectively between FCF and CSR strategy score, considering a lag of two. We estimate Granger causality models considering different lag scenarios to properly control the effect of lags considered on the causality models (see Table 8).

Figure 3 represents Granger causality relations through a causality loop diagram to better understand the results obtained. As noted, in representation in Fig. 3, we observe only unidirectional significant causality between corporate financial performance and management score. Those results indicate that higher managerial ability is not a moderating factor for higher firms’ profitability. Based on those results, we appreciate that managers may decide on approving ESG and CSR activities, mainly driven by minimum legal requirements and guidance provided on the industry level by professional associations. However, the results show a unidirectional causality between managerial ability and firms’ cash flow. Considering a lag of 3 periods in the analysis, the results (\(Coef.=-0.0303, F stat.=2.679, Sig.<1\%\)) show that higher managerial ability leads to lower free cash flow, which is expected considering the impact of costs related to ESG activities. After all, the ESG activities are expected to positively impact the firm’s value only in the long term, as investors and stakeholders’ perceptions (trust) are essential to understanding firms’ behavior and real intentions related to its sustainability vision (Wang et al. 2016). Therefore, based on those results, we can confirm our first hypothesis H3: Managers’ ability to cope with environmental, social and governance issues determines significant changes in firms’ financial performance. The managers are the ones that decide on firms’ strategy, objectives, and how they are to be controlled and monitored. As long there are not robust and mature corporate governance mechanisms in place, serious difficulties can appear in the execution and monitoring stages of the implementation process. Also, managers without motivation are not expected to commit to the efforts of transition to a sustainable economic growth model agreed by shareholders and stakeholders. This is why both managers’ abilities and governance supporting processes are essential, which leads to costs of managers’ incentivization and costs of compliance with the regulatory framework and internal corporate governance mechanisms.

Causal loop diagram. Legend: blue (lag = 1), green (lag = 2), orange (lag = 3). Note: coefficient from the figure represents the regression coefficient from Table 7. Source: author’s projection

Instead, the results in Table 8 emphasize how vital are the positive effects determined by ESG efforts for management to decide to increase their attention and allocate additional resources for better results on sustainable corporate performance. An increase in ESG score determines a decrease in the firm’s profitability due to costs incurred for implementing mentation of planned ESG projects (\(Coef.=-0.0006, F stat.=4.135, Sig.<1\%\)). Instead, higher profitability determines an increase in the ESG score, which might be caused by a higher awareness of the potential benefits of firms’ sustainable economic growth (\(Coef.=2.159, F stat.=6.537, Sig.<1\%\)).

Moreover, these results indirectly show the increasing role of the human factor in the equation of firms’ sustainable economic development. Higher commitment to social and environmental concerns in society increases stakeholders’ trust. It leads to higher employee motivation, directly affecting business operations profitability and indirectly affecting firms’ innovation capabilities, including digitalization and business process improvements. Therefore, the moderating effect of ESG strategic thinking is highly conditioned by firms’ capacity to finance ESG activities, as long as business operation efficiency is positive (Wang et al. 2016; Vishwanathan et al. 2020). ESG strategy and project initiatives are the basis for higher productivity, technological progress and innovation, continuous improvements and processes redesign, or simply optimal knowledge management (Kordab et al. 2020). The impact is higher on the cash flow measure, as employees’ motivation and costs with innovation impact directly firms’ cash flow. Firms’ profitability is not statistically influenced by this component, as a measurement of the return on human capital investments encountered along the time numerous controversies. There is no separate account on the financial statements that report the costs and benefits of CSR projects and current CSR activities.

Between FCF and ESG scores, there is only a unidirectional Granger causality relation, which shows that ESG corporate performance is highly conditioned by the level of resources affected for this purpose, directly impacting firms’ cash flow (\(Coef.=2.159, F stat.=6.537, Sig.<1\%\)). ESG does not Granger-cause FCF, as benefits from ESG project implementation do not translate into cash inflows but better operation efficiency and improved cost structure, with only an indirect effect on firms’ cash flows.

Related to the bidirectional relation between FCF and CSR strategy score, we appreciate that the cause of the negative causality reciprocal relation is determined by management preferences to motivate firms’ employees rather with non-cash compensation packages. Also, a productivity improvement can be generated through process improvement and redesign, reducing employee workload or higher satisfaction on the job.

Impulse analysis

Figure 4 represents the impact of shocks on corporate financial performance metrics, expressed through the VAR models’ residuals determined. Overall, we observe that impact of earnings management is visible, especially within 4 years, which generally coincide with a full mandate for the CEO and the board of directors.

Instead, shocks of ESG score impact both firms’ profitability and free cash flow which are visible in a later period with a lag of 1–2 years, while shocks on CSR strategy score impact the same measures in a later period with a lag of 2–3 years. Generally, social projects and governance improvement initiatives do not take that long time; the reason why we appreciate either firm focus less on environmental projects or they allocate resources for projects that mainly look for compliance with minimum regulatory requirements or investors’ expectations and which are estimated with low financial impact for the firms.

Conclusion

This paper discussed the impact of ESG/CSR practices on the financial performance of 422 analyzed firms from the EU, looking for long-term causality. Overall, our study shows that ESG corporate performance is highly conditioned by the level of resources allocated for this purpose, directly impacting firms’ cash flow and characteristics, such as industry-specific, managerial ability, investment, and financing strategy. Through empirical analysis, our paper reveals that firms run ESG activities without a mature approach based on a robust CSR strategy, which may translate into less cost-effective ESG operations and lower net benefits of ESG efforts for the firms.

Further research on this topic is planned for the future. First, it would be useful to identify differences in the link between corporate ESG performance and corporate financial performance for developing countries and highly developed ones to see if regulatory and economic externalities act as mediators or moderators between the two constructs. Additionally, an investigation of the evolution of the link between the two constructs along the business model lifecycle would be revealing, as additional expenses accrued by ESG activities are expected to be less likely in the premature stages of a business. Overall, there is a need for a better analysis on the impact of industry-specific aspects on the link between the constructs explored in this paper, especially on the areas that are highly exposed to environmental and social controversies. The focus should be on the redesign of the existing balanced-scorecard solution, by integrating relevant key performance indicators that better reflect the link between financial performance and firms’ sustainable development.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Abdullah MI, Sarfraz M, Qun W, Javaid N (2018) Drivers of green supply chain management. LogForum 14:437–447

Ajaz A, Shenbei Z, Sarfraz M (2020) Delineating the influence of boardroom gender diversity on corporate social responsibility, financial performance, and reputation. Logforum 16:61–74

Aljandali A, Tatahi M (2018) Economic and financial modelling with Eviews. Springer Int Publ, Berlin. https://doi.org/10.1007/978-3-319-92985-9

Alshehhi A, Nobanee H, Khare N (2018) The impact of sustainability practices on corporate financial performance: literature trends and future research potential. Sustainability 10:494

Amel-Zadeh A, Serafeim G (2018) Why and how investors use ESG information: evidence from a global survey. Financ Anal J 74:87–103

Atz U, Liu ZZ, Bruno C, Van Holt T (2021) Atz, Ulrich and Liu, Zongyuan Zoe and Bruno, Christopher and Van Holt, Tracy, Online Appendix: Does Sustainability Generate Better Financial Performance? Review, Meta-analysis, and Propositions (August 31, 2021). Available at SSRN, https://doi.org/10.2139/ssrn.3919652

Babasanya AO, Oseni IO, Awode SS (2018) Human capital development: A catalyst for achieving SDGs in Nigeria. Acta Universitatis Danubius. Oeconomica 14:25–41

Bergmann A (2016) The link between corporate environmental and corporate financial performance—viewpoints from practice and research. Sustainability 8:1219

Bocquet R, Le Bas C, Mothe C, Poussing N (2017) CSR, innovation, and firm performance in sluggish growth contexts: a firm-level empirical analysis. J Bus Ethics 146:241–254

Boukattaya S, Achour Z, Hlioui Z (2021) Corporate social responsibility and corporate financial performance: an empirical literature review. Int J Innov Res Publ 35:291–311

Brooks C (2019) STATA guide for introductory econometrics for finance. Cambridge University Press

Buallay A, Fadel SM, Alajmi J, Saudagaran S (2020) Sustainability reporting and bank performance after financial crisis: evidence from developed and developing countries. Compet Rev An Int Bus J 31:747–770

Cek K, Eyupoglu S (2020) Does environmental, social and governance performance influence economic performance? J Bus Econ Manag 21:1165–1184

Chen L, Yuan T, Cebula RJ et al (2021) Fulfillment of ESG responsibilities and firm performance: a zero-sum game or mutually beneficial. Sustainability 13:10954

Cheng B, Ioannou I, Serafeim G (2014) Corporate social responsibility and access to finance. Strateg Manag J 35:1–23

Christensen HB, Hail L, Leuz C (2021) Mandatory CSR and sustainability reporting: economic analysis and literature review. Rev Account Stud 26:1176–1248

Czvetkó T, Honti G, Abonyi J (2021) Regional development potentials of Industry 4.0: open data indicators of the Industry 4.0+ model. PLoS One 16:e0250247

Damodaran A (2007) Valuation approaches and metrics: a survey of the theory and evidence. Foundations and Trends in Finance 1:693–784

Dickinson V (2011) Cash flow patterns as a proxy for firm life cycle. The accounting review, Chicago 86(6):1969–1994

Duque-Grisales E, Aguilera-Caracuel J (2021) Environmental, social and governance (ESG) scores and financial performance of multilatinas: moderating effects of geographic international diversification and financial slack. J Bus Ethics 168:315–334

Friede G, Busch T, Bassen A (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J Sustain Financ Invest 5:210–233

Garcia AS, Mendes-Da-Silva W, Orsato RJ (2017) Sensitive industries produce better ESG performance: evidence from emerging markets. J Clean Prod 150:135–147

Gillan SL, Koch A, Starks LT (2021) Firms and social responsibility: a review of ESG and CSR research in corporate finance. J Corp Financ 66:101889

Goyal P, Rahman Z, Kazmi AA (2013) Corporate sustainability performance and firm performance research: literature review and future research agenda. Manag Decis 51:361–379

Grewatsch S, Kleindienst I (2017) When does it pay to be good? Moderators and mediators in the corporate sustainability–corporate financial performance relationship: a critical review. J Bus Ethics 145:383–416

Gujarati DN (2011) Econometrics by example. Palgrave Macmillan New York USA

Hail L (2013) Financial reporting and firm valuation: relevance lost or relevance regained? Account Bus Res 43:329–358

Huang DZX (2021) Environmental, social and governance (ESG) activity and firm performance: a review and consolidation. Account Financ 61:335–360

Khaled R, Ali H, Mohamed EKA (2021) The Sustainable Development Goals and corporate sustainability performance: mapping, extent and determinants. J Clean Prod 311:127599

Kim E-H, Lyon TP (2015) Greenwash vs. brownwash: exaggeration and undue modesty in corporate sustainability disclosure. Organ Sci 26:705–723

Kordab M, Raudeliūnienė J, Meidutė-Kavaliauskienė I (2020) Mediating role of knowledge management in the relationship between organizational learning and sustainable organizational performance. Sustainability 12:10061

Kumar PC (2020). ESG compliant companies provide superior returns. https://www.thestar.com.my/business/business-news/2020/02/29/esg-compliant-companies-provide-superior-returns. Accessed 20 Nov 2021

Lev B (2018) The deteriorating usefulness of financial report information and how to reverse it. Account Bus Res 48:465–493

Lopez C, Contreras O, Bendix J (2020) ESG Ratings: The Road Ahead (October 6, 2020). Available at SSRN. https://doi.org/10.2139/ssrn.3706440

Lu W, Taylor ME (2016) Which factors moderate the relationship between sustainability performance and financial performance? A meta-analysis study. J Int Account Res 15:1–15

Mabkhot MM, Ferreira P, Maffei A et al (2021) Mapping industry 4.0 enabling technologies into united nations sustainability development goals. Sustainability 13:2560

Masulis RW, Reza SW (2014) Agency problems of corporate philanthropy. Rev Financ Stud 28:592–636

Maury B (2022) Strategic CSR and firm performance: the role of prospector and growth strategies. J Econ Bus 118:106031

Monahan SJ (2018) Financial statement analysis and earnings forecasting. Found Trends® Account 12:105–215

Naseem S, Mohsin M, Zia-UR-Rehman M et al (2021) The influence of energy consumption and economic growth on environmental degradation in BRICS countries: an application of the ARDL model and decoupling index. Environ Sci Pollut Res 29:13042–13055

Pan D, Fan W (2021) Benefits of environmental information disclosure in managing water pollution: evidence from a quasi-natural experiment in China. Environ Sci Pollut Res 28:14764–14781

Pesaran MH (2015) Time series and panel data econometrics. Oxford University Press

PwC (2021) Paying well by paying for good. https://www.pwc.co.uk/services/human-resource-services/insights/environmental-social-governance-exec-pay-report.html. Accessed 25 Nov 2021

Refinitiv (2021) Environmental, social and governance scores from Refinitiv. https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/refinitiv-esg-scores-methodology.pdf. Accessed 10 Jan 2022

Rezaee Z (2017) Corporate sustainability: Theoretical and integrated strategic imperative and pragmatic approach. J Bus Inq 16:1–28

Rossi M, Chouaibi J, Chouaibi S et al (2021) Does a board characteristic moderate the relationship between CSR practices and financial performance? Evidence from European ESG firms. J Risk Financ Manag 14:354

Ruokonen E, Temmes A (2019) The approaches of strategic environmental management used by mining companies in Finland. J Clean Prod 210:466–476

Sarfraz M, Shah SGM, Ivascu L, Qureshi MAA (2020b) Explicating the impact of hierarchical CEO succession on small-medium enterprises’ performance and cash holdings. Int J Financ Econ. https://doi.org/10.1002/ijfe.2289

Sarfraz M, Ozturk I, Shah SGM, Maqbool A (2020a) Contemplating the impact of the moderators agency cost and number of supervisors on corporate sustainability under the aegis of a cognitive CEO. Front Psychol 11:1

Schnücker A (2016) Restrictions search for panel VARs . DIW Berlin Discussion Paper No. 1612, Available at SSRN. https://doi.org/10.2139/ssrn.2865627

Servaes H, Tamayo A (2013) The impact of corporate social responsibility on firm value: The role of customer awareness. Manage Sci 59:1045–1061

Shah SGM, Sarfraz M, Fareed Z, et al (2019) Whether CEO succession via hierarchical jumps is detrimental or blessing in disguise? Evidence from Chinese listed firms. Zagreb Int Rev Econ Bus. https://doi.org/10.2478/zireb-2019-0018

Shaikh I (2022) Environmental, social, and governance (ESG) practice and firm performance: an international evidence. J Bus Econ Manag 23:218–237

Shehzad K, Xiaoxing L, Sarfraz M, Zulfiqar M (2020) Signifying the imperative nexus between climate change and information and communication technology development: a case from Pakistan. Environ Sci Pollut Res 27:30502–30517

Székely N, Vom Brocke J (2017) What can we learn from corporate sustainability reporting? Deriving propositions for research and practice from over 9,500 corporate sustainability reports published between 1999 and 2015 using topic modelling technique. PLoS ONE 12:e0174807

Velte P (2021) Meta-analyses on corporate social responsibility (CSR): a literature review. Manag Rev Q 1–49

Vishwanathan P, van Oosterhout H, Heugens PP et al (2020) Strategic CSR: a concept building meta-analysis. J Manag Stud 57:314–350

Wang Q, Dou J, Jia S (2016) A meta-analytic review of corporate social responsibility and corporate financial performance: the moderating effect of contextual factors. Bus Soc 55:1083–1121

Zaiane S, Ellouze D (2022) Corporate social responsibility and firm financial performance: the moderating effects of size and industry sensitivity. J Manag Gov 1–41. https://doi.org/10.1007/s10997-022-09636-7

Zgrzywa-Ziemak A, Walecka-Jankowska K (2020) The relationship between organizational learning and sustainable performance: an empirical examination. J Work Learn

Author information

Authors and Affiliations

Contributions

Conceptualization: Larisa Ivascu, Aura Domil, and Muddassar Sarfraz; methodology: Oana Bogdan, Valentin Burca; formal analysis and investigation: Muddassar Sarfraz and Valentin Burca; writing—original draft preparation: Codruta Pavel, Larisa Ivascu; writing—review and editing: Aura Domil and Muddassar Sarfraz; funding acquisition: Muddassar Sarfraz; resources: Oana Bogdan; supervision: Larisa Ivascu and Aura Domil. All authors approved the current study.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

All procedures performed were in accordance with the ethical standards as laid down in the 1964 Declaration of Helsinki and its later amendments or comparable ethical standard.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ivascu, L., Domil, A., Sarfraz, M. et al. New insights into corporate sustainability, environmental management and corporate financial performance in European Union: an application of VAR and Granger causality approach. Environ Sci Pollut Res 29, 82827–82843 (2022). https://doi.org/10.1007/s11356-022-21642-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21642-8