Abstract

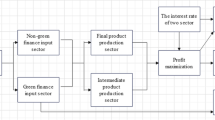

This article discusses the influence and mechanism of green finance on carbon emission efficiency. Based on the panel data of 27 provinces and municipality in China from 2008 to 2017, the slack-based model of unexpected output is used to measure the efficiency of carbon emissions. On this basis, the Tobit model is used to empirically study the impact and mechanism of green finance on the efficiency of carbon emissions. The consequences exhibit that (1) China’s carbon emission efficiency is not high and generally presents a gradient decreasing characteristic of east, middle, and west. (2) Overall, green finance plays a considerable role in improving carbon emission efficiency; by region and group, there are significant differences in the influence of green finance on carbon emission efficiency. (3) The study found that green finance promotes the efficiency of carbon emission through technological progress and industrial structure upgrading. This study provides empirical evidence and policy enlightenment for the realization of carbon peaking and carbon neutrality goals and the evolution of green finance.

Similar content being viewed by others

Data availability

All data generated or analyzed during this study are included in this article. What’s more, the data and materials used in this paper are available from the corresponding author on reasonable request.

Notes

Project comprehensive report preparation team (2020). Comprehensive report on China’s long-term low-carbon development strategy and transformation path. China Population, Resources and Environment. 30:1–25.

The data comes from CSMAR database.

Writing Group of China Green Finance Progress Report (2021). Analysis of green loan business in China. China finance. pp:48–50.

The data comes from EPS database.

References

Chen X, Shi Y, Song X (2019) Green credit constraints, commercial credit and corporate environmental governance. Studies of International Finance (12):13–22

Ding J (2019) Green credit policy, credit resource allocation and enterprise strategic response. Econ Rev (04):62–75

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103

Gu B, Chen F, Zhang K (2021) The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: analysis from the perspective of government regulation and public environmental demands. Environ Sci Pollut Res Int 28:47474–47491

Hao W, Rasul F, Bhatti Z et al (2021) A technological innovation and economic progress enhancement: an assessment of sustainable economic and environmental management. Environ Sci Pollut Res 28:1–13

He A, Xue Q, Zhao R et al (2021) Renewable energy technological innovation, market forces, and carbon emission efficiency. Sci Total Environ 796:148908

Hu G, Wang X, Wang Y (2021a) Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Economics 98:105134

Hu J, Yan S, Han J (2021b) Research on implied carbon emission efficiency of China’s industrial sector – an empirical analysis based on three-stage DEA model and non competitive I-O model. Statistical Research 38:30–43

Jiang H, Wang W, Wang L et al (2020) Research on carbon emission reduction effect of China’s Green Financial Development – taking green credit and green venture capital as an example. Finance Forum. 25:39-48+80

Li D, Xu H, Zhang S (2018) Financial development, technological innovation and carbon emission efficiency: theoretical and empirical research. Inquiry into Economic Issues (02):169–174

Li L, Dong B (2018) Research on the development level and influencing factors of regional carbon finance. Econ Manag 32:60–65

Liu Q, Wang W, Chen H (2020) Research on the impact of the implementation of green credit guidelines on the innovation performance of heavily polluting enterprises. Sci Res Manag 41:100–112

Meng F, Su B, Thomson E et al (2016) Measuring China’s regional energy and carbon emission efficiency with DEA models: a survey. Appl Energy 183:1–21

Ning L, Zheng W, Zeng L (2021) Evaluation of China’s provincial carbon emission efficiency and analysis of influencing factors from 2007 to 2016 – two-stage analysis based on super efficiency SBM Tobit model. Acta Scientiarum Naturalium Universitatis Pekinensis 57:181–188

Ren X, Shao Q, Zhong R (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J Clean Prod 277

Sun W, Huang C (2020) How does urbanization affect carbon emission efficiency? Evidence from China. J Clean Prod 272:122828

Tone K (2002) A slacks-based measure of super-efficiency in data envelopment analysis[J]. Eur J Oper Res 143:32–41

Wang G, Deng X, Wang J et al (2019a) Carbon emission efficiency in China: a spatial panel data analysis. China Econ Rev 56:101313

Wang K, Wu M, Sun Y et al (2019b) Resource abundance, industrial structure, and regional carbon emissions efficiency in China. Resour Policy 60:203–214

Wang X, Cheng Yu (2020) Research on the impact mechanism of urbanization on carbon emission efficiency – an empirical analysis based on the panel data of 118 countries around the world. World Regional Studies 29:503–511

Wang X, Wang Q (2021a) Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resources Policy, 74

Wang X, Wang Y (2021b) Research on green credit policy promoting green innovation. Manage World 37:173–188+11

Writing Group of China Green Finance Progress Report (2021) Analysis of green loan business in China. China finance, pp 48–50

Wu L, Sun L, Qi P, et al. (2021) Energy endowment, industrial structure upgrading, and CO2 emissions in China: revisiting resource curse in the context of carbon emissions. Resources Policy, 74

Xie Z, Wu R, Wang S (2021) How technological progress affects the carbon emission efficiency? Evidence from national panel quantile regression. J Clean Prod 307:127133

Xing Y (2015) Research on the dynamic relationship between economic growth, energy consumption and credit extension -- an empirical analysis of provincial panel based on carbon emission intensity grouping. J Financ Res (12):17–31

Yu CH, Wu X, Zhang D et al (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Yu D, Zhang X, Liu W (2015) Carbon emission efficiency analysis based on stochastic frontier analysis. China Popul Resour Environ 25:21–24

Yu Y, Zhang N (2021) Low-carbon city pilot and carbon emission efficiency: quasi-experimental evidence from China. Energy Economics 96:105125

Zhang C, Chen H (2017) Product market competition, property right nature and internal control quality. Accounting Research (05):75–82 + 97

Zhang J, Jiang H, Liu G et al (2018) A study on the contribution of industrial restructuring to reduction of carbon emissions in China during the five Five-Year Plan periods. J Clean Prod 176:629–635

Zhang J, Wu G, Zhang J (2004) Estimation of China’s inter provincial physical capital stock: 1952–2000. Econ Res J (10):35–44

Zhang W, Hong M, Li J et al (2021) An examination of green credit promoting carbon dioxide emissions reduction: a provincial panel analysis of China. Sustainability 13:7148–7148

Zhang X (2016) Current situation, problems and countermeasures of financing for low-carbon economic construction in China. J Graduate School Chinese Acad Soc Sci (06):58–63

Zhang Y, Hao J, Song J (2016) The CO2 emission efficiency, reduction potential and spatial clustering in China’s industry: evidence from the regional level. Appl Energy 174:213–223

Zhu B, Zhang T (2021) The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: a case of the Yangtze River Delta. Sci Total Environ 778:146089–146089

Zhu X, Huang Y, Zhu S, Huang H (2021) Technological innovation and spatial differences of China’s polluting industries under the influence of green finance. Scientia Geographica Sinica 41:777–787

Funding

This research was supported by the key project of the National Social Science Foundation of China—“Research on policy framework and innovation path of green finance to promote the realization of carbon neutrality goal” (Grant No. 21AZD113).

Author information

Authors and Affiliations

Contributions

Wei Zhang: conceptualization and validation; Zhangrong Zhu: methodology, visualization, and writing—original draft; Xuemeng Liu: software, data curation, formal analysis; Jing Cheng: formal analysis.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, W., Zhu, Z., Liu, X. et al. Can green finance improve carbon emission efficiency?. Environ Sci Pollut Res 29, 68976–68989 (2022). https://doi.org/10.1007/s11356-022-20670-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-20670-8