Abstract

To ensure the realization of carbon neutrality and emission peak, the Chinese government promulgated the pilot policy for an emissions trading scheme (ETS) in 2011 and gradually expanded the range of the pilot program. However, it has not been systematically studied whether this policy can achieve double dividend and its transmission mechanism. Based on the Porter hypothesis, this paper explores the impacts of an ETS on macro emission reduction and microeconomic performance, verifies the influence of an ETS on double dividend, and analyzes its transmission mechanism using a difference in difference (DID) model and mediation model. The results indicate that an ETS can reduce CO2 emissions and remarkably improve the economic performance of the enterprises in the areas it is enacted. A double dividend has been realized, which verifies Porter’s hypothesis. The mechanism test shows that from the macro perspective, the emission reduction effect of an ETS is mainly achieved by adjusting the energy structure and through local government regulations. In contrast, the mediation effect on the industrial structure is not apparent. From a micro perspective, an ETS mainly affects the economic situation of enterprises through cash flow and technological innovation. Moreover, the transmission effect of enterprises’ low-carbon behavior is not apparent. Heterogeneity analysis shows that compared with Midwestern China, an ETS could reduce emissions by adjusting the energy structure in Eastern China. Also, compared with state-owned or large enterprises, an ETS helps improve the economic performance of small or non-state-owned enterprises through technological innovation. This paper provides empirical evidence from macro- and microperspective for evaluating an ETS, conducive to improving the top-level framework of China’s future carbon market operation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

With the increasing threats of global warming, greenhouse gas emission reduction has drawn an increasing amount of attention (Ren et al. 2021a, 2022). Especially with the negative influence of COVID-19 spreading throughout the world, societies across the globe have begun to reflect on the relationship between man and nature and climate governance (Liu et al. 2020a; Mirabelli et al. 2020). According to the Global Energy Review 2021 report, with the economic recovery in the post epidemic era, global energy demand will increase by 4.6% in 2021 compared with 2020, and global energy-related CO2 emissions will increase by 4.8% (IEA 2021). To reduce greenhouse gas emissions, in the ninth session of the Financial and Economic Commission held in March 2021, President Xi stated that emission peak and carbon neutrality should be brought into the overall planning of ecological civilization construction. The aim of hitting emission peaks and carbon neutrality before 2030 and 2060, respectively, should be achieved (Shi et al. 2021). In the meantime, the fourteenth 5-year plan stresses that it is necessary for China to promote a comprehensive green transformation process in the economic and societal fields. Therefore, facing pressure from international commitments to reach a carbon peak and eventual neutrality, the Chinese government’s environmental policies to seek both environmental and economic dividends have become a major issue needing to be addressed by Chinese political and academic circles.

According to the double dividend theory proposed by Pearce (1991), when environmental policy is beneficial to environmental improvement, this is called an environmental dividend. When environmental policy is beneficial to economic development, this is called an economic dividend. When the above two dividends are both met, it is called a double dividend. For a long time, countries have been exploring a kind of flexible environmental regulation tool to balance the development of the environment and economy.

In 1997, the Kyoto Protocol proposed that CO2 emission rights could be transferred and traded between countries or regions as a sort of commodity, thus forming a kind of carbon rights trading market (Kahn and Franceschi 2006; Lau et al. 2012; Aichele and Felbermayr 2013). Since then, the carbon trading market has been widely recognized and implemented worldwide. In 2005, the EU took the lead in launching an ETS, followed by New Zealand, the USA, and other countries, all of which also successively adopted the carbon trading model to achieve emission reduction targets (Zhang and Wei 2010; Streimikiene and Roos 2009; Veith et al. 2009). In October 2011, the NDRC of China promulgated the Notice on Launching Pilot Work of ETS, which officially approved several pilot provinces, such as Beijing and Tianjin. Theoretically, the Porter hypothesis holds that flexible and moderate environmental regulation can realize a double dividend from environmental protection and economic increases through technological innovation (Rassier and Earnhart 2015; Murty and Kumar 2003). In reality, ETS, as one of the economic and environmental control tools formulated by the Chinese government, can effectively coordinate the balanced economic development and emission reduction? If double dividend can be realized, through what transmission mechanism does an ETS affect emission reductions and enterprise economic performance? When an ETS is implemented, what are the different response and transmission mechanisms of the emission reduction effect and economic performance in different pilot regions and enterprises? All of these problems need to be further studied.

Currently, the related ETS research focuses on carbon quota allocation(Zhu et al. 2018; Jiang et al. 2018), carbon price control (Bayer and Aklin 2020), and the operational efficiency of carbon markets (Hu et al. 2020a; Chen et al. 2020; Zhang and Zhang 2020; Yu et al. 2021a). Among these studies, the literature on whether the operation of a carbon market can realize double dividends mainly concentrates on three categories. The first concerns the effects of an ETS on emission reduction, including total emission reduction (Hu et al. 2020a; Xuan et al. 2020) and regional carbon equality (Zhang et al. 2021). The second category focuses on observing the effects of an ETS on economic development, including macroeconomic growth level (Dong et al. 2019), enterprise value enhancement (Zhang and Wang 2021), and public employment expansion (Yu and Li 2021). The third determines an ETS’s comprehensive impacts on economic and emission reduction, mainly including the effects of carbon trading on carbon productivities (Wang et al. 2019; Zhou et al. 2020) and carbon intensity (Zhou et al. 2019) at the provincial level with the effects of carbon trading on environmental benefits and economics at the industry level (Yu et al. 2018; Zhang et al. 2019a) and the influence of carbon trading on the corporate innovation (Lv and Bai 2021; Qi et al. 2021).

The current paper belongs to the third research paradigm. However, in this third category, the research perspective is relatively single, and the conclusions are inconsistent (Dong et al. 2019; Zhou et al. 2019; Zhang et al. 2019a). More importantly, there is a lack of systematic studies on the transmission mechanism and heterogeneous effects of double dividend. Given this, the current paper provides three contributions. First, combining macroprovincial data with microfirm data, we discuss the effects of an ETS on emission reductions and economic performance from a dual perspective. Second, based on Porter’s hypothesis, we make a comprehensive and systematic explanation of double dividend of China’s ETS. Finally, we analyze the heterogeneity for the transmission mechanism of an ETS in the different regions and enterprises, enriching theory for the construction mechanism of China’s ETS from macro- and microperspectives while providing more policy recommendations and data support for the operation of carbon markets in developing countries.

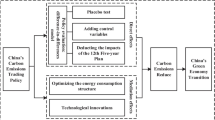

The rest of the present paper is arranged as follows: The literature review and hypothesis proposal are presented in “Literature review and research hypothesis” section, which mainly reviews how an ETS can affect emission reductions and firms’ economic performance, here from macro- and microperspectives; this section also gives the theoretical mechanism framework. “Materials and methods” section analyzes the main models, variables, and data sources. “Empirical analysis” section introduces the baseline regression results and robustness test. “Mechanism tests and heterogeneity analysis” section presents the heterogeneity analysis and the effects of the mechanism test. “Conclusion and policy implications” section provides the conclusion and policy recommendations.

Literature review and research hypothesis

Impact of an ETS on macro emission reductions

Based on the Coase theorem, the carbon trading model can obtain resource allocation efficiency by clarifying carbon emission property rights. The total emission reduction target can be accomplished with minimal social abatement costs. However, the effectiveness of an ETS in reducing emissions is not stable because of differences in national systems and production efficiency. A handful of studies have found that environmental policy has no evident effect on reducing emissions. For example, Streimikiene and Roos (2009) showed that an ETS implemented in some European countries could not effectively inhibit carbon emissions. Similarly, Shin (2013) found that China’s sulfur dioxide emissions trading policy failed to reduce pollutant emissions. However, most scholars have still indicated that China’s ETS can fulfill its emission reduction potential and lower CO2 emissions (Dong et al. 2019; Hu et al. 2020a; Chen et al. 2020).

In addition, relevant studies have come to different conclusions regarding whether an ETS can effectively reduce carbon intensity in China. Zhou et al. (2019) empirically showed that using an ETS led to a decline of carbon intensity in the pilot provinces. However, Zhang et al. (2019a) believed that after launching an ETS, total CO2 emissions in the pilot provinces decreased significantly, but carbon intensity did not. In view of the differences in the above studies, it is essential to further explore the influence of an ETS on macro-level emission reduction and detect the transmission mechanism of environmental dividends as a way to provide more robust evidence for evaluations of the CO2 reduction potential of China’s ETS.

ETS mainly plays a restraining role on carbon emission behavior by setting the number of allowances lower than the actual carbon emission demand. From the principle of mechanism design, carbon market sends emission reduction signal by setting total quota, urges enterprises with low emission reduction cost to achieve excess emission reduction, and sells the remaining quota in the carbon market. At the same time, enterprises with higher abatement costs will purchase carbon allowances to meet their emission reduction targets. This type of trading can benefit both buyers and sellers, and ultimately contribute to the energy saving and emission reduction of the whole society.

ETS is essentially a government-guided and market-driven environmental regulation tool, and its implementation process is inevitably influenced by the industrial structure, energy efficiency, and technology level (Chen 2011; Cao and Karplus 2014; Yu et al. 2015; Wang et al. 2018, 2021). Among them, industrial structure, energy structure, and local government regulation seem to be the three fundamental mechanisms affecting the macro emission reduction effect of an ETS (Wang et al. 2019; Zhou et al. 2019; Zhang et al. 2020a). The theoretical analysis is given below.

-

1)

Industrial structure. The government can adjust the industrial structure through macropolicies (Wang et al. 2019); indeed, a change in the industrial structure has an essential impact on reducing carbon emissions (Zhou et al. 2019). Specifically, different industries have different demands for energy, and upgrading the industrial structure means that industries with a high energy demand will be gradually transformed into industries with a small demand for energy. That is, new industries such as new energy will gradually replace traditional industries with high emissions and high pollution and form a cleaner green industry system.

-

2)

Energy structure. In the context of the studied ETS, the pilot provinces were encouraged to use more clean energy such as hydropower and wind power, while lowering their share of high-carbon energy sources (Wang et al. 2021). For example, the power sector in the implementation of the ETS achieved the lowest abatement cost by replacing coal with natural gas and has contributed more than 50% of the abatement rate in the overall carbon trading system (Ren and Fu 2019).

-

3)

Local government control. Since China’s reform and opening, fiscal decentralization has given local governments greater autonomy in resource allocation. Driven by GDP tournaments, local government officials are more willing to focus on resource advantages in the short term and vigorously develop the economy rather than protect the environment, and carbon emissions have grown year by year under this short and fast economic model (Li et al. 2018; Zhang et al. 2019b). Adversely, the ETS is operated more by market supervision (Liu et al. 2020b), and it can effectively avoid excessive intervention by local governments and promote a market mechanism.

Based on the above analysis, the main hypotheses are as follows:

-

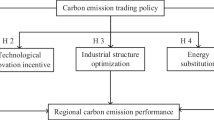

H1: An ETS can effectively lower CO2 emissions and realize environmental dividends.

-

H2: An ETS may affect the emission reduction effect via the channels of industrial structure, energy structure, and local government control.

Impact of ETS on the microeconomy

As far as the impacts of an ETS on microeconomics are concerned, the literature has mainly focused on the EU carbon market, and the conclusions have been conflicting. Some studies have argued that the frequent buying, selling, and financing patterns involved in the carbon trading field are conducive to improving the financial situation of firms and have an enhancing effect on their economic performance (Yu et al. 2021b; Chan et al. 2013; Oestreich and Tsiakas 2015). Other studies have argued that carbon trading mechanisms invariably increase the environmental costs of firms, including pollution control inputs, disclosure costs, and environmental fines, which are detrimental to firm production and development in the short term (Oberndorfer 2009; Chapple et al. 2013).

Studies on the economic dividends of China’s ETS are mostly macrostudies. For example, Dong et al. (2019) found that the ETS failed to effectively increase the GDP of the pilot provinces in the short term. On the contrary, Wang et al. (2019) argued that China’s ETS could promote macroeconomic transformation and contribute to an economic dividend. In addition, the few microstudies focusing on China’s ETS used a scenario simulation (Zhou et al. 2013; Tang et al. 2015, 2016), game analysis (Wang et al. 2012; Ma et al. 2018; Hao and Li 2020), and empirical tests involving the economic effects of the listed companies. For this reason, we investigate the economic dividend of the ETS in the hope of incorporating microfirm data to add empirical evidence to the microeconomic mechanism of China’s ETS.

In the initial stage of the operation of China’s ETS market, except for some enterprises in Guangdong Province, all carbon quotas were issued for free, which had the potential to bring more profits to enterprises (Shen and Huang 2019). At the same time, the Chinese government has usually provided environmental protection subsidies for pilot enterprises to finish emission reduction targets, which is beneficial to improving the welfare of relevant enterprises (Ren et al. 2021b). Hence, it is possible that an ETS can bring more profits to enterprises. In addition, in the discussion on the mechanism of an ETS affecting the microeconomy, low-carbon behavior, corporate cash flow, and technological innovation are also considered important mechanisms for improving the operation of the carbon trading field economy system (Shen and Huang 2019; Qi et al. 2021; Hu et al. 2021b). A detailed analysis of this is give below.

-

1)

Low-carbon behavior. Implementing an ETS forces more companies to adopt low-carbon behaviors, which have an unstable impact on corporate profits. On the one hand, as a vital part of corporate social responsibility, low-carbon behavior can attract external financing through signal transmission, thus raising a company’s stock price (Plumlee et al. 2015). On the contrary, low-carbon behavior will also restrict the traditional production mode of enterprises, making enterprises increase emission reduction compliance costs, thus reducing profits (Brouwers et al. 2016).

-

2)

Corporate cash flow. Because carbon credits are part of a firm’s assets (Cook 2009), when allowances are granted for free, firms can sell the remaining credits to obtain more cash flow, thus increasing their corporate earnings (Oestreich and Tsiakas 2015). At the same time, environmental subsidies motivated by the maintenance of policy goals can also generate large cash flows for firms (Cui et al. 2021), thus producing excess profits.

-

3)

Technological innovation. A reasonable environmental regulation will induce firms to increase their R&D investments. Additionally, new energy-saving and emission-reducing technologies will alleviate the pollution problem in general (Qi et al. 2021). The spillover effect of innovation investment will offset the compliance cost of environmental protection, thus strengthening the competitiveness of firms (Hu et al. 2020b) (Fig. 1).

Based on the above analysis, the following two hypotheses are proposed:

-

H3: An ETS can enhance enterprises’ economic performance and realize economic dividends.

-

H4: An ETS may influence enterprises’ economic performance through low-carbon behaviors, cash flow, and technological innovation.

Materials and methods

Econometric model

Difference in difference (DID) model

For the sake of testing the macroreduction effect of an ETS, the current paper takes advantage of the DID model for causal identification to analyze whether an ETS can cut CO2 emissions in the pilot regions. Different from traditional policy evaluation methods, the DID model takes carbon trading pilot provinces as the experimental group and non-pilot provinces as the control group, and the fixed effects are estimated by setting the interaction dummy variables of policy occurrence or non-occurrence. In this way, the bias of missing variables can be alleviated to some extent, and the endogeneity problem caused by reverse causality can be effectively avoided, to estimate the net effect of policy intervention more accurately. The model is set as follows:

\({C}_{it}\), the explained variable, indicates the carbon emissions in the ith province in year t; \({didc}_{it}\), is the explanatory variable (\({didc}_{it}={T}_{it}\times {Y}_{it}\), where \({T}_{it}\) is used to determine whether a province is affected by the policy. If the province is a pilot region, then \({T}_{it}\)=1, otherwise \({T}_{it}\)=0. \({Y}_{it}\) differentiates the policy implementation period, where the year ≥ 2012, \({Y}_{it}\)=1 and vice versa \({Y}_{it}=0\)); \({Control}_{it}\) denotes other control variables affecting carbon emissions; \({\mu }_{i}\) and \({\delta }_{t}\) denote the province and year fixed effects, respectively, and \({\varepsilon }_{it}\) is a random factor.

Model (1) only assesses the average effect of China’s ETS on macro emission reduction. Then, its dynamic effect is as in Eq. (2):

where \({didc}_{it}^{k}\) represents the annual dummy variable for the kth year (k = 1,…,6) of the ETS in the pilot provinces. For example, if the ETS impact point is 2012, then 2012 is the first year for the ETS, the variable is \({didc}_{it}^{1}\)=1, the rest of the years are assigned to 0, and so on. \({\beta }_{k}\) reflects the persistent impacts of the ETS on macro-CO2 reduction after the kth year of implementation.

The above analysis is only limited to the macroperspective. Undoubtedly, a more comprehensive and systematic assessment of the ETS also needs a microperspective, which refers to the impact of the ETS on the pilot enterprises’ economic performance. The model for this is as follows:

where \({E}_{ijt}\) represents the economic performance of enterprise j in province i in year t; \({dide}_{ijt}\) indicates whether an enterprise was a pilot enterprise of the ETS intervention in 2012 and after, where if it is a pilot enterprise, the value is 1, otherwise 0; \({Control}_{jt}\) represents the control variable that affects the economic performance of the enterprise; \({\mu }_{j}\) and \({\delta }_{t}\) represent firm and year fixed effects, respectively. \({\varepsilon }_{ijt}\) is a random factor.

Mediation effect model

The realization of double dividend requires exploring the inherent mechanism of the ETS. The current paper constructs mediating effect models (4) and (5) based on Xu et al. (2021). The direct effect and causal mediating effect of the ETS affecting macro emission reduction and the microeconomy through the mediating mechanism are analyzed (Imai et al. 2010; Sun and Li 2021). The model is given below.

First, the significance of the explanatory variable (did) on the mediating variable (M) is observed.

Second, the core explanatory variable (did) is included in the same equation as the mediating variable (M), and its significance on the explanatory variable (Y) is observed.

where \({Y}_{it}\) denotes the explained variable; \({did}_{it}\) represents the ETS; \({M}_{it}\) is the mediation variable; and \({Control}_{it}\) denotes various control variables. The above model requires \({\rho }_{1}\) and \({\theta }_{2}\) to be significant, while \({\theta }_{1}\) can be significant or not. If \({\theta }_{1}\) is significant and its absolute value is lower than that of \({\alpha }_{1}\) in the model (1) or \({\varphi }_{1}\) in the model (3), it is an incomplete mediation effect. Otherwise, there is a complete mediation effect.

Variable and data

Explained variable

Macroperspective: \({C}_{it}\) represents the macro emission reduction effect and is measured by the logarithmic value of CO2 emissions (Dong et al. 2019; Zhang et al. 2020a; Jia et al. 2021). Because CO2 emission data are not publicly available, with the help of the CO2 estimation method in the IPCC Guidelines for National Greenhouse Gas Inventory, CO2 emissions are calculated from the physical consumption of nine energy sources: coal, coke, crude oil, gasoline, fuel oil, kerosene, diesel, natural gas, and electricity. To ensure the robustness of the macro emission reduction effect, CO2 emissions per capita (Cp) and the logarithmic value of CO2 released from noncarbon combustion materials, such as cement (lnCeme), are selected as the alternative explanatory variables for verification. The physical consumption data of various kinds of energy are obtained from the China Energy Statistical Yearbook, and data on total cement production comes from the CSMAR database.

Microperspective: \({E}_{ijt}\) represents the microeconomic effect, and it is measured by the return on total assets (Zhou et al. 2021). In addition, the logarithm of the net profit of enterprises (lnEco) and return on equity (Roe) are also selected as alternative explanatory variables to ensure the robustness of the microeconomic effects of the ETS. The relevant data are obtained from the CSMAR database.

Core explanatory variables

Considering that the behavioral decision of pilot enterprises has a certain forward-looking aspect, we integrated realistic factors and set 2012 as the policy shock point (Zhang et al. 2020b), and \({didc}_{it}\) or \({dide}_{it}\) takes the value of 1 if a province or enterprise is affected by the policy in 2012 and later and 0 if the opposite is true.

Mediating variables

Macro perspective: The proportion of tertiary industry’s added value to added value of industry is used to measure the industrial structure (isthi); the proportion of coal consumption in total energy represents the energy structure (es); the proportion of local fiscal expenditure in GDP represents local government control (admin) (Ren and Fu, 2019; Liu et al., 2020a, b; Bai et al., 2020; Peng et al., 2020). Among them, the data of tertiary industry added value, industrial added value, and local fiscal expenditure stems from the China Statistical Yearbook. Similarly, the data of coal consumption and total energy are taken from the China Energy Statistical Yearbook.

Micro perspective: Low-carbon behavior (lc) is based on whether the enterprise follows the Sustainable Development Report Guidelines of GRI to set dummy variables. If so, it is 1; otherwise it is 0. The proportion of operating cash flow in total assets is used to measure corporate cash flow (cash). Technological innovation (rd) is measured by using the logarithm of R&D investment (Shen and Huang, 2019; Lv and Bai, 2021; Sun et al., 2021; Li et al., 2021). Among them, the low-carbon behavior data and enterprise cash flow data are supplied by the CSMAR database, and the technological innovation data are taken from the Wind database.

Control variables

Considering the regression bias caused by missing variables, the control variables are as follows:

Macroperspective: Economic development level (edl); population size (ps); industrial structure (issec); technology import level (til); environmental governance intensity (egi); and international trade level (itl) (Wang et al. 2019; Zhang et al. 2020a; Peng et al. 2020). Among these, the permanent population data at the beginning and end of the year are taken from the annual data of the National Bureau of Statistics; GDP, value-added of secondary industry, the amount of energy conservation and environmental protection expenditure, and other data are all from the China Statistical Yearbook in past years; the amount of foreign direct investment in fixed asset investment and total imports and exports are taken from the CSMAR database.

Microperspective: Enterprise asset scale (es); capital structure (cs); ownership concentration (oc); firm social wealth creativity (tbq); and enterprise nature (ep) (Brav et al. 2018; Zhang et al. 2020b; Hu et al. 2020b; Qi et al. 2021). Most of the enterprise data are from the CSMAR database, and some of the missing data are from the annual reports of each enterprise (see Table 1).

Sample selection

For the macroperspective, except for Tibet, Hong Kong, Macau, and Taiwan, the panel data from 2005 to 2017 of 30 provinces of China give the research sample a capacity of 390; from the microperspective, all A-share listed companies in China from 2010 to 2018 are used as the initial sample. According to the Notice on Starting the Key Work of the National Carbon Emission Trading Market, eight pilot industries (petrochemical, chemical, building materials, iron and steel, nonferrous, paper, power, and aviation) work in different groups. Specifically, the treatment group comprises the enterprises’ data in eight industries of the pilot provinces. Similarly, the control group refers to the data of the enterprises in the eight industries of nonpilot provinces. By excluding enterprises marked with ST, ∗ ST, and so forth, enterprises with extensive missing data, and enterprises listed after 2010, the data of 246 enterprises are finally obtained, 89 for the treatment group, 157 for the control group, and 2214 for total capacity.

Empirical analysis

The present paper studies the double dividend of the ETS from macro- and microperspectives. On the one hand, given the difficulty of obtaining relevant data on carbon emissions at the enterprise level, we use provincial data to study the CO2 reduction effect of the ETS and identify the emission reduction mechanism of the ETS, which favors controlling the macrostrategic layout of future environmental policy design. On the other hand, the ETS mainly targets specific pilot enterprises for environmental regulation, and the profitability of the enterprises has a crucial role in regional economic growth. Therefore, we use enterprise data to link environmental regulation with economic growth to facilitate a more detailed observation of the economic effects of the ETS and their micromechanisms.

Macro emission reduction effect of the ETS

According to models (1) and (2), the average and dynamic effects of the ETS on provincial CO2 emissions are estimated, respectively (Table 2). Columns (1)–(2) show the results of the average effect of the ETS on carbon emissions reduction. The ETS (didc) coefficient of column (2) is significantly negative. To ensure the robustness of the results, the explained variables were replaced by per capita CO2 emissions and CO2 emissions generated by cement. The results in columns (4) and (6) show that the ETS (didc) coefficient is consistently and significantly negative. This means that the ETS reduces carbon emissions at the macro level and achieves an environmental dividend; that is, hypothesis H1 is validated.

In terms of the dynamic effect of the ETS on macro emission reduction (Table 3), the absolute value of the ETS (didc) coefficient shows a significant upward trend with increasing years, indicating that the ETS has gradually enhanced its macro emission reduction effect in recent years.

In addition, the estimated results of the control variables fundamentally meet expectations. Among them, technology import level (til) inhibits the increase of carbon emissions, while economic development level (edl), population size (ps), industrial structure (issec), and the international trade level (itl) significantly enhance carbon emissions. However, one result is that environmental governance intensity (egi) is extremely positive, which indicates that the government’s investment in more environmental governance funds has increased carbon emissions, which seems to be inconsistent with reality. One possible reason is that the government will invest more environmental governance funds in high-polluting industries. The original high-carbon production mode of high-polluting industries can hardly to change in the short term, resulting in the illusion that the higher the intensity of environmental governance, the more carbon emissions there are.

Note: t statistic in parentheses, *p < 0.1, ***p < 0.01. All regressions control province and year fixed effects.

Note: t statistic in parentheses, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for province and year fixed effects.

Microeconomic effects of ETS

Evaluating the influence of the ETS on the economic performance of microenterprises is also a crucial part. Therefore, we use a two-way fixed effects model to perform a regression on model (3), and the results are listed in Table 4. As we can see from columns (1)–(2), the ETS (dide) coefficient is statistically significantly positive, with or without the control variables being included. The dependent variables are replaced with corporate net profit and net return on assets, respectively, to decrease the estimation bias caused by the difference in the choice of proxies. The coefficients of the ETS (dide) in columns (3)–(6) are all significantly positive with robust results, indicating that the ETS has a large contribution to microeconomic performance. Hence, H3 is verified.

Column (2) shows that enterprise asset scale (es), a firm’s social wealth creativity (tbq), and ownership concentration (oc) all contribute to a firm’s economic performance. In contrast, firms with higher capital structure (cs) inhibit a firm’s economic performance. These results are consistent with traditional economic theory. In addition, based on the results of columns (1)–(6), there is no significant robust relationship between ownership nature (ep) and the economic performance of enterprises, which requires further subgroup discussion.

Note: t statistic in parentheses, *p < 0.1, ***p < 0.01. All regressions control firm and year fixed effects.

Robustness tests

Robustness tests under a macroperspective

The above results imply that the ETS inhibits macro-CO2 emissions. To further verify the robustness of hypothesis H1, in addition to replacing the explained variables, a parallel trend test, counterfactual analysis, and other methods are adopted to cross-verify H1.

Parallel trend test. The use of the DID model is inseparable from the vital premise of the parallel trend assumption. The carbon emissions growth trends of the treatment and control groups should be roughly parallel before the ETS shock. As shown in Fig. 2, before 2012, the trend of total CO2 emissions of the treatment and control groups steadily increased and were roughly parallel. However, in the treatment group, the trend of CO2 emissions decreases significantly, while that in the control group still increases steadily after 2012. Added to this, the different trends are the net effect caused by the ETS shock, thus verifying the effectiveness of the ETS in reducing emissions.

Counterfactual analysis: The counterfactual analysis could be divided into regional counterfactual analysis and time counterfactual analysis. For the regional counterfactuals, the counterfactual experiment is constructed by randomly selecting six provinces as pilot regions and other provinces as nonpilot regions. The core explanatory variable after constructing the virtual samples is “didcv”. Referring to model (1), if the coefficient of “didcv” is insignificant, the reverse clarifies that the conclusion of H1 holds. We construct three different groups of pilot areas randomly and then perform a DID estimation successively; the results are listed in columns (1)–(3). The “didcv” coefficients are not statistically significant (Table 5), which inversely supports that H1 holds.

The time for a counterfactual experiment is constructed by setting virtual policy shock years, here assuming that the implementation years of the ETS are 2007, 2008, and 2009, respectively, excluding the data of 2012 and later years. If the coefficients of “didcv” are insignificant, then H1 holds. The three sets of DID estimations are performed sequentially according to the set years, and the results are shown in columns (4)–(6). The “didcv” coefficients are all insignificant (Table 5). In other words, the decrease in macro-CO2 emissions is indeed caused by the ETS in 2012 and is not disturbed by other policy variables in other years; that is, the conclusion of H1 is robust.

Note: t statistic in parentheses, ***p < 0.01. All regressions added control variables, while controlling for province and year fixed effects.

Robustness tests from a microperspective

The results from the baseline regression mean that the ETS can enhance the enterprises’ economic performance and realize economic dividends. In addition to replacing the explanatory variables, the reliability of H3 should pass the below robustness tests.

Parallel trend test.

We can test the parallel trend hypothesis through dynamic effects and uncover the dynamic impact of the ETS on the economic performance of enterprises. As shown in Table 6, the ETS had no significant effect on enterprise economic performance before 2012; that is, there is hardly any difference in economic performance between the treatment and control groups, which satisfies the parallel trend hypothesis. In terms of dynamic effects, over time, the ETS stimulates the improvement of enterprise economic performance. The policy effect is effective.

Note: t statistic in parentheses, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for firm and year fixed effects.

Adding control variables. Besides the control variables selected above, intrafirm factors such as the firm size, characteristics of the board, degree of firm incentive, and competition in the market all affect the economic performance of the firm, at least to some extent. Therefore, the current paper chooses the number of employees of the firm (staff), the board size (board), the percentage of independent directors (indep), the logarithm of the sum of the top three executive salaries (pay), and the ratio of operating profit to revenue from main business (compe) to measure the above indicators, controlling for them in the model. We focus on column (1) of Table 7, where the positive coefficients of the ETS (dide) indicate that H3 is robust.

Replacing the time window. To identify whether the effect of ETS on firms’ economic performance changes with the time of the sample, a robustness test can be conducted by changing the study period of the sample. The time windows are replaced with three sets of periods, 2010–2012, 2010–2014, and 2010–2016, respectively, and a double fixed effects regression is conducted according to model (3). The results of columns (2)–(4) are in Table 7. With the change in sample time, ETS has a consistent and positive effect on enterprise economic performance, indicating that the empirical results above do not change with the selection of sample time, and the conclusion of H3 is robust.

Note: t statistic in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for firm and year fixed effects.

Mechanism tests and heterogeneity analysis

Mechanism tests

Macromechanism test

To test H2, we regard industrial structure (isthi), energy structure (es), and local government regulation (admin) as mediating variables, total carbon emission (C) as the explained variable, and ETS (didc) as the core explanatory variable. In terms of macro emission reduction, models (4)–(5) contribute to analyzing the mechanism of the ETS. We report the estimated results in Table 8.

Columns (1), (3), and (5) reflect the estimated results of the first step, in which the ETS restrains the coal-dominated energy structure and excessive local government regulation but nearly does not promote upgrading the industrial structure, indicating that the ETS is likely to reduce CO2 emissions through adjusting the energy structure and local government regulation. Columns (2), (4), and (6) reflect the regression results of the second step. The ETS (didc) coefficients of the three mechanisms are all significantly negative, and the absolute value of the coefficients decreases compared with \({\alpha }_{1}\) (\({\alpha }_{1}\)= − 0.248). From this, it is deduced that the ETS could promote CO2 emissions reduction through energy structure and local government regulation. Some mediation effects are apparent, so H2 is only partially valid. However, although industrial structure upgrading can reduce CO2 emissions, it is not a transmission mechanism for the ETS to achieve macro emission reduction, probably because the pilot enterprises included in the ETS are mostly high-emission and high-pollution industries, and it is difficult to achieve industrial upgrading and optimization in the short term. Although the upgrading of industrial structure can reduce emission in theory, it is not the transmission mechanism for ETS to achieve macro emission reduction. This may be because the pilot enterprises included in ETS are mostly high-emission and high-pollution industries, and it is difficult to achieve industrial upgrading and optimization in a short period of time.

Note: t statistic in parentheses, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for province and year fixed effects.

Micromechanism test

To test the validity of H4, low-carbon behavior (lc), corporate cash flow (cash), and technological innovation (rd) are used as the mediating variables, corporate economic performance (E) as the explained variables, and ETS (dide) as the core explanatory variables. The above mediation effect model is used to explore the micromechanism of the ETS on enterprise economic performance, as shown in Table 9.

Columns (1)–(2) identify the influence of the ETS on enterprise economic performance from the perspective of low-carbon behavior. It is found that the ETS promotes enterprise low-carbon behavior, but enterprise low-carbon behavior nearly does not affect enterprise economic performance. The coefficient of the ETS (dide) does not decrease compared with \({\varphi }_{1}\) (\({\varphi }_{1}\)=1.911), indicating that the ETS cannot enhance economic performance through corporate low-carbon behavior, so a mediation effect does not exist (column 2). Columns (3)–(4) show the influence of the ETS on corporate economic performance through corporate cash flow, in which the ETS significantly increases corporate working capital and sufficient capital significantly increases corporate profits. The coefficient of the ETS (dide) is less than \({\varphi }_{1}\) (column 4), and the partial mediation effect is obvious. This shows that corporate cash flow is the transmission mechanism of the ETS to realize microeconomic dividends. Columns (5)–(6) show the results of technological innovation as the mediation effect. The ETS promotes enterprises to increase R&D investments, which significantly improves enterprise economic performance. The coefficient of the ETS (dide) is less than \({\varphi }_{1}\) (column 6), indicating that pilot enterprises actively responded to policy requirements after the introduction of the ETS. Significant progress has been made in technological innovation, and the economic benefits of enterprises will eventually be improved. H4 partially holds.

To sum up, the ETS improves enterprise economic performance mainly by increasing the cash flow and improving technological innovation levels. Both mechanisms have significant effects. However, the mediating effect of corporate low-carbon behavior is not established, which may be because of enterprises being forced to passively implement low-carbon behavior under media pressure, and low-carbon behavior leads to more emissions reduction costs, which cannot generate profits. Therefore, corporate economic performance cannot be improved through this mechanism.

Note: t statistic in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for firm and year fixed effects.

Heterogeneity analysis

Macroheterogeneity

Due to the heterogeneity of resource endowment in different regions of China, the implementation of the ETS will have significant differences in different regions (Zhou et al. 2020; Zhang et al. 2021). We divide provinces into eastern, central, and western regions, namely Eastern and Midwestern China, to discuss macroregional heterogeneity (Chen et al. 2020).

Columns (1)–(3) in Table 10 represent the effect of ETS on CO2 emissions in the different regions. The ETS significantly lowers CO2 emissions of the eastern region but has no significant impact on the central and western regions. The possible reason for this is that the pilot provinces of the ETS are not evenly distributed in China, with four provinces in the east and one each in the midwestern regions. The main force of emissions reduction is the pilot provinces of the ETS, so the effect of emissions reduction is significant in the eastern region, which ranks the highest. However, the motivation and sensitivity of the midwestern region to the ETS is not enough, probably because the economic infrastructure in the central and western regions needs to be perfected and the process of seeking development is accompanied by the westward migration of highly polluting heavy industries. The solidified development model accelerates carbon migration and carbon locking, and the operation of the ETS at this stage is not yet able to reverse the high-carbon pattern in the central and western regions, so it cannot achieve effective emissions reduction.

From the theoretical side, based on Baron and Kenny (1986) definition of the mediation effect, the discussion of the mediation effect presupposes that the total effect is significant (MacKinnon and Fairchild 2009). Therefore, we do not conduct further mechanism tests for the Midwest region.

The previous section has shown that the energy structure and local government regulations are essential mechanisms for achieving macro-CO2 emissions reduction. Do these two mechanisms still exist in Eastern China? Table 10 shows the empirical results of these two mechanisms through the mediation effect model. In columns (4)–(5), it can be seen that the ETS can reduce CO2 emissions by cutting the ratio of coal consumption, so the transmission mechanism of energy structure still exists. Columns (6)–(7) show that the ETS has no significant influence on local government regulations, indicating that the mediating effect of local government regulations does not exist. This is probably because of the active market in Eastern China and the perfect operation of the CO2 trading mechanism, so the emission reduction effect can be achieved without the intervention of local government regulations.

Note: t statistic in parentheses, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for province and year fixed effects.

Microheterogeneity

The microeconomic dividends of the ETS have been verified, but it is not clear whether different types of pilot enterprises respond differently to the impact of the ETS. A discussion on this issue is helpful in making sense of the micromechanism and boundary conditions of the ETS. Therefore, the heterogeneity of the effect of the ETS on enterprise economic performance can be discussed from two perspectives: enterprise ownership and enterprise size.

Heterogeneity of enterprise ownership. Based on the different types of ownership, enterprises can be divided into state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs) (Qi et al. 2021; Li et al. 2021). To verify the Porter hypothesis, the current paper focuses on enterprises’ technological innovation mechanisms with different ownership types. Columns (1) and (4) of Table 11 demonstrate that the ETS can positively stimulate the economic performance of enterprises. However, the ETS (dide) coefficients of SOEs are smaller than non-SOEs, indicating that the ETS more obviously improves the economic performance of non-SOEs. The possible reason for this is that the government possesses or controls the capital of SOEs. However, compared with non-SOEs, SOEs gain more financial support. Hence, their business activities are more influenced by the government and are not sensitive to market-like environmental policies. On the contrary, non-SOEs are responsible for their own profits and losses. They survive and make profits more from the supply-and-demand relationship in the market. Hence, they are greatly affected by market regulation policies, so they show better economic performance from policy effects.

Note: t statistic in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for firm and year fixed effects.

Furthermore, columns (2)–(3) show that SOEs will significantly improve the level of technological innovation during policy implementation. However, between technological innovation and economic performance, there is a negative correlation. This indicates that the technological innovation implemented by SOEs may still be at the left end of the “U-shaped curve.” The ETS (dide) coefficient of column (3) does not decrease compared with column (1). In other words, the mediating effect of technological innovation does not exist, indicating that SOEs do not achieve economic dividends through technological innovation. For non-SOEs, columns (5)–(6) reflect that the ETS improves technological innovation and promotes enterprise economic performance through technological innovation. The mediating effect is obvious. That is, non-SOEs realize the Porter hypothesis under the influence of the ETS. There are a few possible reasons for this. First, non-SOEs have greater flexibility to integrate resources in response to compliance pressure and are more sensitive to high-quality information provided by the market than SOEs. Consequently, they can stimulate the forcing effect of technological innovation mechanisms, thus leading to long-term economic benefits for enterprises; on the contrary, SOEs are not sensitive to external market information, and it is difficult to adjust and reform the internal system of SOEs. Therefore, the Porter hypothesis does not work here.

Heterogeneity of enterprise scale. Taking the average total assets of the sample enterprises as the standard, those larger than the standard are classified as large-scale enterprises, while those smaller than the standard are classified as small-scale enterprises. A group regression was conducted to discuss the transmission mechanism of the technological innovation of enterprises of different scales when it comes to the influence of the ETS on microeconomic dividends. Table 12 (1)–(3) illustrates that the ETS has an obvious influence on the technological innovation of large-scale enterprises. However, this policy barely has any obvious effect on the economic performance of large-scale enterprises. Technological innovation does not promote the economic dividends of large-scale enterprises. Therefore, the technological innovation mechanism is invalid. The possible explanations are as follows: For one thing, large-scale enterprises with abundant capital and talent advantages are more inclined to choose large-scale investments and long-term research and development models. Consequently, their economic performance has not shown up in the experimental period of the present study. For another, large-scale enterprises have a strict and high hierarchical decision-making structure. The communication between decision makers and R&D personnel is weakened, leading to the decline of innovation function and coordination ability. Consequently, this reduces the technological innovation efficiency of large-scale enterprises. Therefore, R&D investment has no significant influence on the economic performances of large-scale enterprises.

On the other hand, columns (4)–(6) indicate that under the background of the ETS, the economic performance and R&D investment of small-scale enterprises are significantly improved. The transmission effect of the technological innovation mechanism of such enterprises is obvious. That is, small-scale enterprises have fully achieved Porter’s hypothesis. The possible reasons are as follows: First, small-scale enterprises are sensitive and flexible to the market and can seize the opportunity to find innovative projects and implement innovative activities from the gap of large-scale enterprises. Second, small enterprises have fewer decision-making processes and can quickly implement innovation decisions and carry out technological innovation one step ahead of others. Third, the innovation benefits of small-scale enterprises are directly owned by the decision makers because of the low degree of separation of two rights, which encourages leadership’s innovation enthusiasm.

Note: t statistic in parentheses, **p < 0.05, ***p < 0.01. All regressions added control variables, while controlling for firm and year fixed effects.

Conclusion and policy implications

The ETS is a vital and meaningful policy for China’s green and sustainable development. An accurate and comprehensive evaluation of its policy effect is crucial for China to better carry out energy conservation and emission reduction work. Using the Porter hypothesis, the current paper has comprehensively evaluated whether China’s ETS can achieve double dividend under the macro- and microperspectives. The results indicate that the Porter hypothesis for China’s ETS does exist. Specifically, (1) The ETS not only restrains the total CO2 emissions of pilot provinces, but it also promotes the economic performance of high-polluting enterprises in pilot areas, realizing double dividend. (2) The main transmission mechanism of the ETS to achieve macro emission reduction is the energy structure and local government regulation. In contrast, the industrial structure played no role in the present research period. (3) The ETS promotes microeconomic performance mainly through the mechanism of corporate cash flow and technological innovation, while low-carbon behavior barely has any significant impact on corporate economic performance. (4) In terms of regional difference, the ETS has had the most significant macro emission reduction effect on the eastern region and much less on the midwestern region. Among them, energy structure is the most critical mechanism for the eastern region’s emissions reduction effect. (5) From the perspective of the differences in ownership and size of enterprises, the microeconomic effects of the ETS are better for non-SOEs than SOEs and likewise better for small enterprises than large enterprises. Meanwhile, small-scale enterprises and non-SOEs are more likely to implement the Porter hypothesis under an ETS environment.

The current paper attempts to put forward the following policy suggestions in view of the above conclusion:

First, the industrial structure optimization mechanism has hardly played any role in the CO2 reduction effect of the ETS. Therefore, future policy design should focus on cultivating a bench-marking environmental protection industry, encourage the development of a high-tech service industry with energy conservation and emissions reduction technologies, and combine environmental protection subsidies, tax incentives, and other related environmental protection policies. Consequently, the ETS can drive the transformation and upgrading of the entire industrial system.

Second, the low-carbon behavior of enterprises has brought more compliance costs, resulting in the failure to generate the economic dividend within this channel. Therefore, the government should focus on expanding green financing channels for enterprises, flexibly combine the ETS with green credit, green bonds, and other green financial mechanisms, and provide diversified financing methods for enterprises to carry out low-carbon behaviors, solving their development difficulties.

Third, the government should consider the overall situation and pay attention to the differences in policy effects caused by different regions when formulating environmental policies. For the eastern region, when the effect of CO2 emissions reduction is significant, the government should encourage it to maintain and implement the other mechanisms. The emission reduction effect is not obvious in Central China; the government should strengthen environmental regulations and provide subsidies. When the western region fails to effectively reduce emissions, indicators such as resource consumption, environmental damage, and ecological benefits should be included in the performance assessment of officials to eliminate “GDP-only theory” and promote carbon equality among different regions.

Fourth, to achieve the accurate classification and implementation of policies, the formulation of the ETS should fully consider the needs and differences of different types of enterprises. For enterprises of different ownership, on the one hand, we should urge a flexible reform of the internal system and mechanism of SOEs so that they can fully adapt to the regulation and control of market-oriented environment policy. On the other hand, the entry threshold of carbon pilots for non-SOEs should be lowered to stimulate the enthusiasm of non-SOEs to participate in the ETS, hence improving the efficiency of technological innovation in a wide range. For enterprises of different scales, we should create a generous and fair competitive environment for small-scale enterprises. At the same time, quota supervision for large-scale enterprises would impose compliance pressure, urging them to improve innovation efficiency and, thereby, promoting profits for enterprises.

Finally, although our research has provided useful implications for the future planning of China’s ETS, there are still some limitations. On the one hand, microdata need to be improved in terms of sample size and research duration. In the future, more industrial data can be expanded to observe the different economic performance of pilot enterprises in different industries under the ETS. On the other hand, the design of carbon quotas is one of the core elements of the ETS and an important factor affecting the effectiveness of the policy implementation. Future research can consider the mechanism of the role of quota design in developing more effective and better environmental policies. In addition, the multiple impacts on the macroenvironment and microeconomy when multiple environmental policies coexist can be considered, such as green credit and new energy promotion policies.

Data availability

Most of the basic data are publicly available, mainly from the National Bureau of Statistics of China, the official website, http://www.stats.gov.cn/, and the Wind and IFind financial databases. Other data are calculated by authors, and the calculation method is shown in the text of this paper.Declarations.

Not applicable.Consent for publicationNot applicable.Competing interestsThe authors declare no competing interests.

References

Aichele R Felbermayr G (2013) The effect of the Kyoto Protocol on carbon emissions. J Policy Anal Manage 32(4):731–757. https://doi.org/10.1002/pam.21720

Bai C Feng C Yan H Yi X Chen Z Wei W (2020) Will income inequality influence the abatement effect of renewable energy technological innovation on carbon dioxide emissions? J Environ Manage 264:110482. https://doi.org/10.1016/j.jenvman.2020.110482

Baron R M Kenny D A (1986) The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173. https://psycnet.apa.org/buy/1987-13085-001

Bayer P Aklin M (2020) The European Union emissions trading system reduced CO2 emissions despite low prices. Proc Natl Acad Sci 117(16):8804–8812. https://doi.org/10.1073/pnas.1918128117

Brav A Jiang W Ma S Tian X (2018) How does hedge fund activism reshape corporate innovation? J Financ Econ 130(2):237–264. https://doi.org/10.1016/j.jfineco.2018.06.012

Brouwers R Schoubben F Van Hulle C Van Uytbergen S (2016) The initial impact of EU ETS verification events on stock prices. Energy Policy 94:138–149. https://doi.org/10.1016/j.enpol.2016.04.006

Cao J Karplus V (2014) Firm-level determinants of energy and carbon intensity in China. Energy Policy 75:167–178. https://doi.org/10.1016/j.enpol.2014.08.012

Chan HSR Li S Zhang F (2013) Firm competitiveness and the European Union emissions trading scheme. Energy Policy 63:1056–1064. https://doi.org/10.1016/j.enpol.2013.09.032

Chapple L Clarkson PM Gold DL (2013) The cost of carbon: capital market effects of the proposed emission trading scheme (ETS). Abacus 49(1):1–33. https://doi.org/10.1111/abac.12006

Chen S (2011) The abatement of carbon dioxide intensity in China: factors decomposition and policy implications. World Econ 34(7):1148–1167. https://doi.org/10.1111/j.1467-9701.2011.01370.x

Chen S Shi A Wang X (2020) Carbon emission curbing effects and influencing mechanisms of China’s emission trading scheme: the mediating roles of technique effect, composition effect and allocation effect. J Clean Prod 264:121700. https://doi.org/10.1016/j.jclepro.2020.121700

Cook A (2009) Emission rights: from costless activity to market operations. Account Organ Soc 34(3–4):456–468. https://doi.org/10.1016/j.aos.2007.12.001

Cui Y Khan SU Li Z Zhao M (2021) Environmental effect, price subsidy and financial performance: evidence from Chinese new energy enterprises. Energy Policy 149:112050. https://doi.org/10.1016/j.enpol.2020.112050

Dong F, Dai Y, Zhang S, Zhang X, Long R (2019) Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci Total Environ 653:565–577. https://doi.org/10.1016/j.scitotenv.2018.10.395

Hao X, Li B (2020) Research on collaborative innovation among enterprises in green supply chain based on carbon emission trading. Sci Prog 103(2):0036850420916329. https://doi.org/10.1177/0036850420916329

Hu Y, Ren S, Wang Y, Chen X (2020) Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ 85:104590. https://doi.org/10.1016/j.eneco.2019.104590

Hu J, Pan X, Huang Q (2020) Quantity or quality? The impacts of environmental regulation on firms’ innovation-Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol Forecast Soc Change 158:120122. https://doi.org/10.1016/j.techfore.2020.120122

Imai K, Keele L, Yamamoto T (2010) Identification, inference and sensitivity analysis for causal mediation effects. Stat Sci 25(1):51–71. https://doi.org/10.1214/10-STS321

International Energy Agency (IEA), Global Energy Review (2021) International Energy Agency, China, 2021. https://www.ieaorg/reports/global-energy-review-2021

Jia R, Shao S, Yang L (2021) High-speed rail and CO2 emissions in urban China: a spatial difference-in-differences approach. Energy Econ 99:105271. https://doi.org/10.1016/j.eneco.2021.105271

Jiang M, Zhu B, Wei YM, Chevallier J, He K (2018) An intertemporal carbon emissions trading system with cap adjustment and path control. Energy Policy 122:152–161. https://doi.org/10.1016/j.enpol.2018.07.025

Kahn JR, Franceschi D (2006) Beyond Kyoto: a tax-based system for the global reduction of greenhouse gas emissions. Ecol Econ 58(4):778–787. https://doi.org/10.1016/j.ecolecon.2005.09.004

Lau LC, Lee KT, Mohamed AR (2012) Global warming mitigation and renewable energy policy development from the Kyoto Protocol to the Copenhagen Accord—a comment. Renew Sustain Energy Rev 16(7):5280–5284. https://doi.org/10.1016/j.rser.2012.04.006

Li G, He Q, Shao S, Cao J (2018) Environmental non-governmental organizations and urban environmental governance: evidence from China. J Environ Manage 206:1296–1307. https://doi.org/10.1016/j.jenvman.2017.09.076

Li K, Guo Z, Chen Q (2021) The effect of economic policy uncertainty on enterprise total factor productivity based on financial mismatch: evidence from China. Pac Basin Finance J 68:101613. https://doi.org/10.1016/j.pacfin.2021.101613

Liu M, Ren X, Cheng C, Wang Z (2020) The role of globalization in CO2 emissions: a semi-parametric panel data analysis for G7. Sci Total Environ 718:137379. https://doi.org/10.1016/j.scitotenv.2020.137379

Liu C, Ma C, Xie R (2020) Structural, innovation and efficiency effects of environmental regulation: evidence from China’s carbon emissions trading pilot. Environ Resour Econ 75(4):741–768. https://doi.org/10.1007/s10640-020-00406-3

Lv M, Bai M (2021) Evaluation of China’s carbon emission trading policy from corporate innovation. Finance Res Lett 39:101565. https://doi.org/10.1016/j.frl.2020.101565

Ma X, Ho W, Ji P, Talluri S (2018) Contract design with information asymmetry in a supply chain under an emissions trading mechanism. Decis Sci 49(1):121–153. https://doi.org/10.1111/deci.12265

MacKinnon DP, Fairchild AJ (2009) Current directions in mediation analysis. Curr Dir Psychol Sci 18(1):16–20. https://doi.org/10.1111/j.1467-8721.2009.01598.x

Mirabelli MC, Ebelt S, Damon SA (2020) Air Quality Index and air quality awareness among adults in the United States. Environ Res 183:109185. https://doi.org/10.1016/j.envres.2020.109185

Murty MN, Kumar S (2003) Win–win opportunities and environmental regulation: testing of porter hypothesis for Indian manufacturing industries. J Environ Manage 67(2):139–144. https://doi.org/10.1016/S0301-4797(02)00203-7

Oberndorfer U (2009) EU emission allowances and the stock market: evidence from the electricity industry. Ecol Econ 68(4):1116–1126. https://doi.org/10.1016/j.ecolecon.2008.07.026

Oestreich AM, Tsiakas I (2015) Carbon emissions and stock returns: evidence from the EU emissions trading scheme. J Bank Financ 58:294–308. https://doi.org/10.1016/j.jbankfin.2015.05.005

Pearce D (1991) The role of carbon taxes in adjusting to global warming. Econ J 101(407):938–948. https://doi.org/10.2307/2233865

Peng Y, Chen Z, Xu J, Lee J (2020) Analysis of green total factor productivity trend and its determinants for the countries along silk roads. Growth Change 51(4):1711–1726. https://doi.org/10.1111/grow.12435

Plumlee M, Brown D, Hayes RM, Marshall RS (2015) Voluntary environmental disclosure quality and firm value: further evidence. J Account Public Policy 34(4):336–361. https://doi.org/10.1016/j.jaccpubpol.2015.04.004

Qi SZ, Zhou CB, Li K, Tang SY (2021) Influence of a pilot carbon trading policy on enterprises’ low-carbon innovation in China. Clim Policy 21(3):318–33610.1080/14693062.2020.1864268

Rassier DG, Earnhart D (2015) Effects of environmental regulation on actual and expected profitability. Ecol Econ 112:129–140. https://doi.org/10.1016/j.ecolecon.2015.02.011

Ren YY, Fu JY (2019) Research on the effect of carbon emissions trading on emission reduction and green development. China Popul Resour Environ 29(5):11–20 ((in Chinese))

Ren X, Cheng C, Wang Z, Yan C (2021) Spillover and dynamic effects of energy transition and economic growth on carbon dioxide emissions for the European Union: a dynamic spatial panel model. Sustain Dev 29(1):228–242. https://doi.org/10.1002/sd.2144

Ren S, Sun H, Zhang T (2021) Do environmental subsidies spur environmental innovation? Empirical evidence from Chinese listed firms. Technol Forecast Soc Change 173:121123. https://doi.org/10.1016/j.techfore.2021.121123

Ren X, Li Y, Shahbaz M, Dong K, Lu Z (2022) Climate risk and corporate environmental performance: empirical evidence from China. Sustainable Production and Consumption 2022(30):467–477

Shen HT, Huang N (2019) Will the carbon emission trading scheme improve firm value? Finance Trade Econ 40(1):144–161 ((in Chinese))

Shi X, Zheng Y, Lei Y, Xue W, Yan G, Liu X, Cai B, Tong D, Wang J (2021) Air quality benefits of achieving carbon neutrality in China. Sci Total Environ 795:148784. https://doi.org/10.1016/j.scitotenv.2021.148784

Shin S (2013) China’s failure of policy innovation: the case of sulphur dioxide emission trading. Env Polit 22(6):918–93410.1080/09644016.2012.712792

Streimikiene D, Roos I (2009) GHG emission trading implications on energy sector in Baltic States. Renew Sustain Energy Rev 13(4):854–862. https://doi.org/10.1016/j.rser.2008.02.005

Sun L, Li W (2021) Has the opening of high-speed rail reduced urban carbon emissions? Empirical analysis based on panel data of cities in China. J Clean Prod 321:128958. https://doi.org/10.1016/j.jclepro.2021.128958

Sun Z, Wang X, Liang C, Cao F, Wang L (2021) The impact of heterogeneous environmental regulation on innovation of high-tech enterprises in China: mediating and interaction effect. Environ Sci Pollut Res 28(7):8323–8336. https://doi.org/10.1007/s11356-020-11225-w

Tang L, Wu J, Yu L, Bao Q (2015) Carbon emissions trading scheme exploration in China: a multi-agent-based model. Energy Policy 81:152–169. https://doi.org/10.1016/j.enpol.2015.02.032

Tang L, Shi J, Bao Q (2016) Designing an emissions trading scheme for China with a dynamic computable general equilibrium model. Energy Policy 97:507–520. https://doi.org/10.1016/j.enpol.2016.07.039

Veith S, Werner JR, Zimmermann J (2009) Capital market response to emission rights returns: evidence from the European power sector. Energy Econ 31(4):605–613. https://doi.org/10.1016/j.eneco.2009.01.004

Wang M, Wang M, Wang S (2012) Optimal investment and uncertainty on China’s carbon emission abatement. Energy Policy 41:871–877. https://doi.org/10.1016/j.enpol.2011.11.077

Wang Q, Hang Y, Su B (2018) Contributions to sector-level carbon intensity change: an integrated decomposition analysis. Energy Econ 70:12–25. https://doi.org/10.1016/j.eneco.2017.12.014

Wang H, Chen Z, Wu X, Nie X (2019) Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis?—Empirical analysis based on the PSM-DID method. Energy Policy 129:930–938. https://doi.org/10.1016/j.enpol.2019.03.007

Wang Y, Liao M, Xu L, Malik A (2021) The impact of foreign direct investment on China’s carbon emissions through energy intensity and emissions trading system. Energy Econ 97:105212. https://doi.org/10.1016/j.eneco.2021.105212

Xu L, Fan M, Yang L, Shao S (2021) Heterogeneous green innovations and carbon emission performance: evidence at China’s city level. Energy Econ 99:105269. https://doi.org/10.1016/j.eneco.2021.105269

Xuan D, Ma X, Shang Y (2020) Can China’s policy of carbon emission trading promote carbon emission reduction? J Clean Prod 270:122383. https://doi.org/10.1016/j.jclepro.2020.122383

Yu DJ, Li J (2021) Evaluating the employment effect of China’s carbon emission trading policy: based on the perspective of spatial spillover. J Clean Prod 292:126052. https://doi.org/10.1016/j.jclepro.2021.126052

Yu S, Zhang J, Zheng S (2015) Provincial carbon intensity abatement potential estimation in China: a PSO-GA-optimized multi-factor environmental learning curve method. Energy Policy 77:46–55. https://doi.org/10.1016/j.enpol.2014.11.035

Yu Y, Zhang W, Zhang N (2018) The potential gains from carbon emissions trading in China’s industrial sectors. Comput Econ 52(4):1175–1194. https://doi.org/10.1007/s10614-017-9724-2

Yu P, Cai Z, Sun Y (2021a) Does the emissions trading system in developing countries accelerate carbon leakage through OFDI? Evidence from China. Energy Econ:10539710.1016/j.eneco.2021a.105397

Yu P, Hao R, Cai Z, Sun Y, Zhang X (2021b) Does emission trading system achieve the win-win of carbon emission reduction and financial performance improvement?—Evidence from Chinese A-share listed firms in industrial sector. J Clean Prod 13012110.1016/j.jclepro.2021b.130121

Zhang YJ, Wang W (2021) How does China’s carbon emissions trading (CET) policy affect the investment of CET-covered enterprises? Energy Econ 98:105224. https://doi.org/10.1016/j.eneco.2021.105224

Zhang YJ, Wei YM (2010) An overview of current research on EU ETS: evidence from its operating mechanism and economic effect. Appl Energy 87(6):1804–1814. https://doi.org/10.1016/j.apenergy.2009.12.019

Zhang G, Zhang N (2020) The effect of China’s pilot carbon emissions trading schemes on poverty alleviation: a quasi-natural experiment approach. J Environ Manage 271:110973. https://doi.org/10.1016/j.jenvman.2020.110973

Zhang H, Duan M, Zhang P (2019) Analysis of the impact of China’s emissions trading scheme on reducing carbon emissions. Energy Procedia 158:3596–3601. https://doi.org/10.1016/j.egypro.2019.01.905

Zhang J, Qu Y, Zhang Y, Li X, Miao X (2019) Effects of FDI on the efficiency of government expenditure on environmental protection under fiscal decentralization: a spatial econometric analysis for China. Int J Environ Res Public Health 16(14):2496. https://doi.org/10.3390/ijerph16142496

Zhang Y, Li S, Luo T, Gao J (2020) The effect of emission trading policy on carbon emission reduction: evidence from an integrated study of pilot regions in China. J Clean Prod 265:121843. https://doi.org/10.1016/j.jclepro.2020.121843

Zhang YJ, Shi W, Jiang L (2020) Does China’s carbon emissions trading policy improve the technology innovation of relevant enterprises? Bus Strategy Environ 29(3):872–885. https://doi.org/10.1002/bse.2404

Zhang S, Wang Y, Hao Y, Liu Z (2021) Shooting two hawks with one arrow: could China’s emission trading scheme promote green development efficiency and regional carbon equality? Energy Econ 101:105412. https://doi.org/10.1016/j.eneco.2021.105412

Zhou P, Zhang L, Zhou DQ, Xia WJ (2013) Modeling economic performance of interprovincial CO2 emission reduction quota trading in China. Appl Energy 112:1518–1528. https://doi.org/10.1016/j.apenergy.2013.04.013

Zhou B, Zhang C, Song H, Wang Q (2019) How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci Total Environ 676:514–523. https://doi.org/10.1016/j.scitotenv.2019.04.303

Zhou D, Liang X, Zhou Y, Tang K (2020) Does emission trading boost carbon productivity? Evidence from China’s pilot emission trading scheme. Int J Environ Res Public Health 17(15):5522. https://doi.org/10.3390/ijerph17155522

Zhou D, Qiu Y, Wang M (2021) Does environmental regulation promote enterprise profitability? Evidence from the implementation of China’s newly revised Environmental Protection Law. Econ Model 102:105585. https://doi.org/10.1016/j.econmod.2021.105585

Zhu B, Jiang M, He K, Chevallier J, Xie R (2018) Allocating CO2 allowances to emitters in China: a multi-objective decision approach. Energy Policy 121:441–451. https://doi.org/10.1016/j.enpol.2018.07.002

Funding

This study is financially supported by Shanxi University Philosophy and Social Science Research Project (2021W055), and Shanxi University of Finance and Economics Graduate Education Innovation Project in 2021 (21cxxj025).

Author information

Authors and Affiliations

Contributions

Qian Ma: data preparation, methodology, writing—original draftGuang Yan: writing—editingXiaohang Ren: supervision, analysis, and writing—reviewing and editingXiaosong Ren: conceptualization, software, writing—reviewing.

Corresponding author

Additional information

Communicated by Roula Inglesi-Lotz.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ma, Q., Yan, G., Ren, X. et al. Can China’s carbon emissions trading scheme achieve a double dividend?. Environ Sci Pollut Res 29, 50238–50255 (2022). https://doi.org/10.1007/s11356-022-19453-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19453-y