Abstract

Very few studies exist in rationalizing comprehensively the relationship between market integration and green economic growth in China. This paper tries to answer the question whether and how market integration influences regional green economic growth in China. Based on the panel data of 285 city-level regions from year 2004 to 2018 in China, this paper develops explanatory mechanism and discusses the influence theoretically and empirically. To advance the analysis, we construct market integration indicator through relative price variance method based on commodity retail price index and employ the Malmquist–Luenberger (ML) productivity index and DEA-SBM (data envelopment analysis–slacks-based measure) model to evaluate green total factor productivity (GTFP) as indicator for green economic growth. Our empirical findings are: (1) Apparent regional imbalance exists in both the development of market integration and green growth and gaps are expanding from year 2004 to 2018. (2) Market integration promotes regional green growth significantly. (3) Mechanism analysis illustrates that market integration fosters green growth through economies of scale effect, composition effect and spillover effect, respectively. (4) Heterogeneous analysis suggests that the influence from market integration on green growth varies depending on region’s difference in traffic situation and in overall development level.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Although China’s economy is developing rapidly and its share in global trade continues to rise, China’s export trade may face an increasingly complex and severe international environment in consideration of current COVID-19 epidemic and anti-globalization trend. Nowadays China has to rely more on demand from domestic market, and the domestic market integration is becoming vital. Market integration means that goods, services and production factors can be circulated freely across different regions and thus prices of goods and capital are equalized (Poncet 2003; O'Hara & Ye 2011). Various studies on market integration have shown that an increase in market integration level affects economic development positively (Evans 2003; Ke 2015). The concept of “market integration” is used also as the anonym of “market segmentation” which restricts free flow of economic activities and is a barrier to free trade in regions.

While market integration in China has made progress, local protectionism still exists to varying degrees (Lai et al. 2021). Some scholars even believe that China’s domestic market is far less integrated (Ke 2015; Sun et al. 2020) and is still in a relatively fragmented state due to its decentralization systems and long-term excessive competition among local government (Poncet 2005). As a result, market segmentation hinders domestic trade, increases homogeneous competition among regional industries, distorts resources allocation and reduces production efficiency of enterprises (Young 2000). Taking the severe regional imbalance into account, removing local protectionism barrier and promoting regional market integration have become national strategy for the sustainable and green growth of local economiesFootnote 1 (Li & Lin 2017; You & Chen 2021).

Meanwhile, studies have criticized that current economic growth of China is achieved through the consumption of large amount of energy resources (Yang et al. 2018). Waste gas and wastewater generated in the production process pollute the environment and cause ecological damage. Obviously, the traditional extensive economy with high energy consumption and pollution emission is unsustainable. China today faces the challenge of green growth in social, economic and ecological aspects. Earlier in 2020, China announced its commitment to peak carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060. How to achieve green economic growth has become an important topic for the whole society. The concept “green economy” is first introduced by Pearce et al. (1989) in book “Blueprint for a Green Economy” and defined as “an economic situation that can achieve sustainable development.” Since then, the concept has been identified variously in different disciplines including environmental economics and ecological economics, etc. Green economy is defined by the United Nations Environment Program (UNEP) as one that improving “well-being and social equity, while significantly reducing environmental risks and ecological scarcities” (UNEP 2011). The aim for a transition to an economy with green growth is simply being low carbon, resource efficient and socially inclusive (UNEP 2011). Green economic growth means both environmental efficiency and production efficiency (Sun, et al. 2020). And it can be achieved through proper industry restructure, reduced production costs and environment-friendly firm strategy. Related literature usually applies the concept of green total factor productivity (GTFP) to represent green economic growth. Basing on traditional total factor productivity framework, GTFP considers additionally the undesirable or unintended output such as pollution emissions. Therefore, GTFP is a good indicator for green growth and measures the productivity growth more comprehensively (Watanabe & Tanaka 2007).

Scholars from the field of economics and environmental science are trying to explain China’s green economic growth in terms of industrial structure (Lai et al. 2021), resource market distortion (Lin & Chen 2018), environmental regulation (Zhao et al. 2018), fiscal decentralization and spending such as energy conservation and emission reduction policies (Song et al. 2018; Lin & Zhu 2019), financial development (He et al. 2019) and market openness (Ke 2015; Bian et al. 2019). However, these analyses are based on the premise that all market participants carry out their economic activities in a relatively complete and effective environment. If there exist serious regional protection or market barriers impeding market integration, the analysis result becomes biased. As a result, the influence from these factors on green growth is not robust statistically (Ding & Niu 2019).

Moreover, while green economic growth incorporates both production resource and environmental factors in the standard economic growth framework, previous studies have shown that market integration can improve both production efficiency and environmental efficiency. On the one hand, market integration refers to the elimination of market segmentation and resources flow freely in the market. The resulted larger market enables enterprises to realize large-scale production, which is an effective way for productivity growth. (Hermosilla & Wu 2018; He et al. 2018). In addition, unified economic policies and measures are implemented in integrated market, which leads to a reduction in transaction and trade costs (Lim & Breuer 2019). Also, in the process of market integration, firms gain more opportunity to choose its partners along supply chain with relative lower opportunity costs (He et al. 2018). Eventually, production efficiency and economic performance is realized with increased market integration (Lim & Breuer 2019). On the other hand, fluent flow of resources and frequent trade accompanied with the market integration facilitates enterprises’ R&D investments induces technology diffusion and technological progress and results in less pollution emission and energy consumption (He, et al. 2018; Sun et al. 2020). The new trade and new growth theories believe that market integration promotes countries and regions to achieve economies of scale, gain comparative advantages and absorb new technologies (Ke 2015). As a result, environmental or ecological efficiency is improved when more economic output achieved with less environmental cost (Ma et al. 2018).

Therefore, it is necessary to include the concept of market integration in the study of green economic growth, especially when taking into account China’s ongoing integrated development strategy. In recent years, the Chinese government has paid attention to the issue of regional market integration. The government tries to break regional barriers and to promote integrated development of domestic markets through infrastructure investment and policy guidance. Regional economic integration has become a national strategy for China’s economic development (Li & Lin 2017; You & Chen 2021). To fulfill the strategy’s implementation, a series of planning outlines have been issued, such as the Outline of the Regional Integration Development Plan of the Yangtze River Delta, Outline of the Pearl River Delta Region Reform and Development Plan (2008–2020), Outline of Beijing–Tianjin–Hebei Coordinated Development Plan and Chengdu–Chongqing City Cluster Development Plan. The nation’s four big urban agglomerations including the Yangtze River Delta, Pearl River Delta, Beijing–Tianjin–Hebei and Chengdu–Chongqing economic zones have become main engines for the general economic growth (You & Chen 2021). With their development, the degree of Chinese market integration has been improved.

This paper contributes to existing literature in the following ways. Firstly, although both market integration and green economic growth have attracted considerable attention from researchers and policy makers, academic research on green economic growth from the perspective of market integration is relatively scarce. Moreover, consensus has yet not to be achieved. By focusing the research question that whether and how market integration influences regional green growth in China, this paper tries to fill the research gap. To the best of our knowledge, very few studies directly discuss these two concepts into one explanatory framework. Secondly, most researchers have explained the environmental change as indicator of green economy from the influence of environmental regulations, fiscal policies, market segmentation, etc. However, green economy means not only environmental efficiency but also production efficiency. This study chooses GTFP to represent green economic growth, which provides more comprehensive complementary to the literature about green economic growth. Thirdly, this paper elaborates theoretically three mechanisms through which market integration influences on green growth. Different from previous studies usually studying the relationship from one specific aspect, we place all relevant factors in a comprehensive explanatory framework. In addition, as far as we know, this paper is the first that carries out empirical analysis on the city scale within the whole nation. Empirical researchers have advocated for geographic unit as small as possible (Mukim 2012). In this paper, we choose 285 citiesFootnote 2 in China as the unit of analysis, which advances most studies where province is used as spatial scale. Although data collection at city level is difficult, our analysis can more accurately reflect regional heterogeneity, which is decisive for reliable empirical results. Furthermore, this study constructs market integration indicator through relative price variance method based on commodity retail price index and employs the Malmquist–Luenberger (ML) productivity index and DEA-SBM (data envelopment analysis–slacks-based measure) model to evaluate green economic growth. The econometric construction and measurement methods here are relatively new and make our results more reliable and robust.

The paper is organized as follows. The next section reviews prior studies on market integration and on green economy. Section 3 proposes three mechanisms through which market integration influences green economic growth. They are economies of scale effect, industrial composition effect and spillover effect, respectively. Section 4 constructs econometric model and describes dataset. More specifically, econometric methods are documented for main explanatory and explained variables. Section 5 presents empirical analysis and results interpretation. In addition, robustness test, endogeneity test, quantile regression and heterogeneity analysis are carried out here. Section 6 concludes with policy implications.

Literature review

This study is based on two main branches of literature. One is about the market integration including sources, measurement method and its influence on economic and social development. And the other is in the research field about the way and method to achieve green economic growth, especially its relationship with market integration.

Discussion about market integration has been continued for a long time. Some study its causes and believe that many factors hinder market integration and lead to market segmentation, including natural conditions such as spatial distance (Daumal & Zignago 2010), poor infrastructure (Shepherd & Wilson 2007), cultural or ethnic diversity (Pendakur & Pendakur 2002), degree of openness (Poncet 2003), interest game between local governments (Li & Zhou 2005) and regional protectionism especially the fiscal decentralization system (Poncet 2005). Some of the literature focuses on the measurement for market integration. Methods are various due to the differences in the analysis perspective, empirical data and selected sample intervals. Methods can be classified into dynamic and static level measurement methods. Dynamic level measurement includes mainly trade flow method (Naughton 2003; Poncet 2003), questionnaire survey method (Wang et al. 2019) and social network analysis method (Hou, et al. 2009), while the static level measurements are price method (Parsley & Wei 2001a; Lu & Chen 2009), production method (Young 2000) and business cycle method (Tang 1998).

The economic and social influence from market integration or market segmentation, which is normally regarded as an antonym of market integration, is still an important research topic. Most relevant research focuses on their relationship with national or regional economic growth, corporate productivity, resource misallocation and enterprises’ exports (Johansson & Ljungwall 2009; Ezcurra & Rodríguez-Pose 2013; Ke 2015). In recent years, discussion about the environmental effects from market integration has begun to attract scholars’ interests. Study from Li and Lin (2017) uses a price approach to measure the magnitude of regional integration and finds that regional integration has significant and robust positive effects on energy and CO2 emissions. Empirical result from Zhang and School (2018) shows that regional integration significantly promotes the convergence of emission intensity and reduces emission, with a more apparent role in reducing emission in recent years in China. Similarly, research from He and others (2018) testified empirically that regional market integration can reduce carbon dioxide (CO2) marginal abatement costs through affecting energy consumption, productivity growth and technical progress. By using the concept of market segmentation instead of market integration, study from Bian et al. (2019) applies dynamic panel econometric model to analyze the impact of market segmentation on environmental pollution from the perspective of resource misallocation. Their research finds that market segmentation has significantly aggravated the misallocation of labor and capital resources and has a significant deteriorating effect on environmental pollution. Although the literature mentioned above does not directly discuss the impact of market integration on green economic growth, they are regarded as studies that indirectly discuss the relationship between the two, because the economic meaning of green growth is namely the increase of GTFP which taking the pollution emissions into account.

Similarly, as stated above, the key to realize China’s economic transformation and upgrading is to develop green economy which requires both efficient and effective environmental protection. More and more scholars have paid attention on the way and method to increase the GTFP and achieve green economic growth. Most of related studies focus on the influence from environmental regulations (Yang et al. 2014; Wu et al. 2020), industrial structure (Lu, et al. 2020; Wei et al. 2020), foreign investment (Pan et al. 2020) and others. For example, study from Lin and Chen (2018) measures GTFP to discuss that factor market distortion hinders the green development of China’s economy.

There are some researches discussing green growth problem from the perspective of market integration. For example, studies from environmental governance perspective find that market integration leads to transboundary pollution and affect green economic development in some regions (Lapan & Sikdar 2011; Chen & Huang 2016). Several scholars have adopted in their researches the concept of market segmentation. For example, study from Sun et al. (2018) evaluates the loss of green growth efficiency caused by market segmentation. Their finding shows that the commodity, labor and capital market segmentations have inverted “U”-shaped nonlinear relationship with green economic growth. After eliminating these three kinds of market segmentations, the loss of green growth efficiency will be reduced largely. Treating ecological efficiency as an important indicator reflecting green growth, study from Sun et al. (2020) uses the relative price method to measure market segmentation and concludes that the market segmentation has negative impact on ecological efficiency with a panel data of 29 provinces in China during the period year 2000 to year 2015. Similarly, econometric analysis from Nie and Zhang (2019) indicates that market segmentation is negative to China’s energy efficiency significantly.

Study from Hou and Song (2021) is one of the very scarce researches directly focusing on the relationship between GTFP and market integration. Based on the panel data of 30 provinces in China from 2008 to 2017, the paper finds that market integration can promote the improvement of regional GTFP through efficiency improvement and technological progress. Considering the imbalanced development among provinces in China, even in different regions inside a province, the conclusion based on panel data on the provincial level might suffer robustness. In addition, study from You and Chen (2021) constructs a single-city regional integration index based on commodity retail price index and examines the effect of the regional market integration on green growth with GTFP as indicator in the Yangtze River Delta in China. However, they select the Yangtze River Delta which is the largest economy in China as a sample while neglect most Chinese areas with smaller economy. Their empirical result is not representative for overall situation in China.

Altogether, considering the insufficient research in related field, this paper tries to observe more comprehensively relationship between market integration and regional green economy. Benefiting from some preliminary studies, existing database and improved econometric methods, the finding of this paper provides new insight for both academy and policy makers.

Mechanism analysis

Literature review shows that market integration affects green economic growth in three ways. They are resource reallocation resulted by economies of scale effect, industry restructure and upgrading by composition effect, and technology and knowledge transfer by spillover effect, respectively.

Economies of scale effect

Market integration means the mobility of labor and capital, investment and trade. On the one hand, the free flow of resources among sectors pursuing higher returns increases the efficient use of production factors and thus the overall productivity (Hou & Song 2021), which contributes to productivity efficiency. On the other hand, the achievement of scale in an economy reduces the amount of energy consumption and also the CO2 emissions (He et al. 2018), which directly affects environmental protection. In addition, the process of market integration is also a process of resource re-allocation caused by market scale effect and agglomeration effects. Market scale effect leads to the flow of production factors from traditional labor-intensive sectors to knowledge-intensive sectors which are usually less environmental pollution (Lin & Chen 2018). As a result, economies of scale effect improve efficiency of resource consumption and also reduce environmental pollution to a certain extent. Eventually, this process leads to achieving green economic growth. Similarly, previous researches have shown that factor market distortions due to market segmentation also reduce energy efficiency, leading to excessive energy input. For example, study from Lin and Chen (2018) argues that factor market distortion has negative influence on the green development of China’s economy.

Moreover, market integration reduces market barriers and induces more competition in regional market while competition encourages enterprises to adopt green technology which leads to the improvement of production and ecological efficiency (Hou & Song 2021). If regional market is not merged but segmented, the input of large number of low-cost factors inhibits enterprises’ enthusiasm to reduce the investment of technology and carry out indigenous innovation while underdevelopment of enterprises’ innovation activities is detrimental to the growth of green economy (Ljungwall & Tingvall 2015).

Previous studies have shown that large markets resulting from market integration have advantages in the implementation of environmental regulations (Zhang et al. 2020). Benefiting from scale effect, not only the cost is reduced but also the effect of the green policies is improved. The scale effect also contributes to the centralized processing of pollutants. It is another way through which market integration improves ecological efficiency and promotes green economic growth indirectly.

Industrial composition effect

The continuous development of market integration is also the process of forming a large market. According to Schumpeter (Schumpeter 1934), large market results in resources’ flowing to innovative firms, accompanied by the upgrading of the industrial structure. That is to say, industrial composition changes with enlarged market. It is also called “composition effect” by some scholars (Lin & Zhu 2019). Market integration and agglomeration have the ability to bring capital and other production factors into innovative enterprises, and thus increase their R&D (Research & Development) investment. Therefore, through composition effect market integration contributes to the continuous industry transformation and upgrading.

Industrial composition effect induces the process where industrial structure evolves continuously from a low-form to a high-form. It can be the evolution from the primary or secondary industry to the tertiary industry, or from labor-intensive industries to technology-intensive industries; or from low-value-added products to high-value-added products (Yu 2017). As a result, industrial transformation leads to the dominance of tertiary industry with the characteristics of low carbon, green and environment friendly. As stated above, industrial transformation improves also the productivity accompanied by the reduction of energy consumption and of environment pollution. Therefore, industrial transformation and upgrading by composition effect has become an important method to arrive environmental protection and green economic growth (Li and Lin 2017; Lai, et al. 2021). Previous researches have confirmed the role of industrial transformation and upgrading in promoting sustainable economic growth empirically and theoretically, e.g. (Gan et al. 2011; Yu 2015). In particular, there exist excessive discussion about the influence from the structural optimization of the primary, secondary and tertiary industries on green total factor productivity (Liu et al. 2018).

Spillover effect

Literature believes that market integration causes significant knowledge spillover effects, thereby promoting green innovation (Johansson and Ljungwall 2009) while market segmentation inhibits these effects.

Industry size has been recognized as an important influential factor of innovation since Schumpeter (Schumpeter 1934). On the one hand, greater market size resulting from market integration implies greater profitability and thus induces more new entry. Increased market competition or industry dynamism such as threat of entry, threat of substitute products and rivalry among existing firms requires firm’s higher organizational learning capabilities and innovation strategy and thus results in more rapid technological change (Utterback and Suarez 1993; Pecotich et al. 1999; Weerawardenaa et al. 2006). On the other hand, greater market size indicates immense industry networks and business associations promoting firms’ interaction and cooperation which are usually accompanied by knowledge spillovers (Bessonova and Linton 2019; Hu et al. 2020).

Moreover, in the process of market integration, related enterprises or industries have to respond to the changes in the prices and output of commodities along the supply chain. They need to maximize revenue or utility, and to maintain the balance of supply and demand through technological innovation activities. Previous studies have shown that the input–output relationship between products and industries, namely the supply–demand relationship of the product itself, contains technology and knowledge transfer. That is, products are essentially the continuous integration of technologies and the technology or knowledge spillover effect between industries is realized along supply chain by using products as the knowledge carrier (Jaffe 1998). As early as the 1960s, study from Schmukler (Schmookler 1966) has pointed out that one of the best ways to promote innovation in an industry is to “improve its purchased from other industries.”

In addition, in the process of market integration, many other knowledge-spillover channels have emerged (Varga 2000). One is the information diffusion via personal networks or employment activities. The second one is the technology transfer between academic institutes and industries. The third one is spillover promoted by physical research facilities such as liabilities and scientific laboratories. The innovation process induced by market integration prompted enterprises and even whole society to adopt technologies which are environment friendly and beneficial to economy’s sustainability and green growth (Sandberg et al. 2019).

Methods & data

Econometric model

To examine the influence from market integration on green economic growth, this paper adopts an econometric model by controlling other factors that may affect green growth as well. As stated above, this paper adopts the concept of GTFP representing green economic growth because GTFP considers both productivity and environmental efficiency (Huang, et al. 2014). The variables are logarithmically processed and the econometric model is as follows:

Among them, \({lngtfp}_{it}\) represents the logarithm of GTFP of city \(i\) in year \(t\); \(ln{integ}_{it}\) represents the logarithm of the market integration degree in city \(i\) in year \(t\); \({X}_{it}\) is control variables include environmental regulations, R&D investment, regional openness, resource abundance and educational level, etc. \({\varepsilon }_{i,t}\) is random disturbance.

To examine the economies of scale effect, industrial composition effect and spillover effect discussed in above mechanism analysis, this paper constructs a mediating effect model

where \({M}_{it}\) represents the mechanism variables for the three effects, respectively.

Variables construction

Explained variable

GTFP is usually employed as the indicator for green economic growth. However, different from traditional TFP method, the measurement of GTFP requires not only productivity, resource efficiency but also environmental efficiency and circularity (Huang, et al. 2014). It means that the measurement model needs to consider both good output and undesirable factors, such as environmental pollutants. Although there is no consensus on the measurement method for GTFP, lots of research from various discipline have been conducted (Tone 2001; Färe et al. 2007; Emrouznejad & Yang 2016).

This paper refers to the production possibility set constructed by Färe et al. (2007), which include both good output and undesirable output. Also, some scholars recommend the Malmquist-Luenberger (ML) index that can handle undesirable factors within data envelopment analysis (DEA) (Emrouznejad & Yang 2016). In addition, study from Tone (2001) provides slacks-based measure (SBM) to account for undesirable outputs, which can evaluate the environmental efficiency more comprehensively. Therefore, to obtain accurate empirical results, this paper adopts the SBM (Tone 2001), with ML-index based on a non-radial directional distance function (DDF) for measuring dynamic changes in GTFP over time (Zhang et al. 2015).

Among them, \({D}_{0}^{t}({x}^{t},{y}^{t},{b}^{t},{g}^{t})\) is the distance function in t period, indicating the distance between each production decision-making unit (DMU) and the effective production frontier. x, y, d and g are, respectively, production input, good output, undesirable output and directional variables. If \({GTFP}_{t}^{t+1}>1,\) GTFP increases from t period to \(t+1\) period, and if \({GTFP}_{t}^{t+1}<1\), vice versa.

The detailed calculation of green total factor productivity includes both input and output indicators. The input indicators are: (1) labor input, captured d by the number of employees in each region; (2) capital input, we refer to the “perpetual inventory method” by Zhang et al. (2004). The formula is \({k}_{it}={k}_{it-1}\left(1-{\delta }_{it}\right)+{I}_{it}/{p}_{it}\), where \(k, I, \delta\) are, respectively, capital stock, investment amount and depreciation rate. Year 2000 is the base period for deflation; (3) energy consumption, measured by the region’s annual electricity consumption. The output indicators include: (1) good (desirable) output, expressed by gross regional products (GRP) and take year 2000 as the base period for reduction. (2) Bad (undesirable) output includes discharge amount in wastewater, SO2 emission and soot emission.

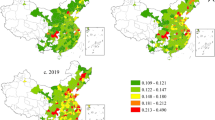

To reflect the change in green growth from both dynamic and spatial perspective, we use ARCGIS10.2 to get following figure (Fig. 1). We take year 2004 and 2018 as examples. A comparison between them shows that, firstly, the growth rate has shown an upward trend in general. Secondly, there exist apparent regional differences in the GTFP with relatively high rate in the Eastern region while relatively low rate in Western region.

Explanatory variable

This paper adopts the market integration index (\(lninteg\)) to measure the degree of market integration in a city. Existing studies have proposed a variety of measurement methods to assess market integration, including traditional gravity model, trade flow method based on gravity model (Poncet 2003), price-based approach (Parsley and Wei (2001a), etc. However, the gravity method is criticized for not considering region-specific characteristics which have influence on trade (Ke 2015). The trade flow method attracts criticism of its non-consistent in logic (Shao et al. 2019). Therefore, this study chooses the price-based approach to measure market integration. The price-based approach relies on the law of one price and the idea is that commodity prices by location converge to the same level if there are no barriers to trade and market integration. This approach has been widely used in many empirical studies to measure market integration or segmentation in China (He et al. 2018; Nie & Zhang 2019; Hong et al. 2019; Lai et al. 2021). More specifically, this study refers to the relative prices method by Parsley and Wei (2001a) and the method by Gui et al. (2006), and adopts relative price variance method. The variance of relative prices (VRP) is used as an indicator of price convergence. The iceberg cost model is the fundamental theory of the VRP method.

Take the price ratio of the two cities as \({P}_{it}^{k}/{P}_{jt}^{k}\), and take its natural logarithm as \({Q}_{ijt}^{k}=ln({P}_{it}^{k}/{P}_{jt}^{k})\). Taking the logarithmic form is to make sure that the coefficient of the independent variable will not be affected by the change in the unit of dependent variable and to alleviate the estimated heteroscedasticity and skewness. We then use the first-order difference form as follows:

We assume the market segmentation as “iceberg cost.” Under special circumstances, \({Q}_{ijt}^{k}\) shows a convergence trend, and finally, \(\Delta {Q}_{ijt}^{k}\) shows a convergence trend as well. In addition, this paper uses the chained consumer price index. The differential form allows us to construct the following equation to reflect the degree of market integration.

After direct conversion, the chained consumer price index \({P}_{it}^{k}/{P}_{it-1}^{k}\) and \({P}_{jt}^{k}/{P}_{jt-1}^{k}\) can directly express \(\Delta {Q}_{ijt}^{k}\).

In order to avoid the change in variance of relative price caused by the exchange of the numerator and denominator position after the logarithm, this paper takes the absolute value of \(\Delta {Q}_{ijt}^{k}\) as follows:

Considering the non-additive characteristics of various types of commodities, this paper refers the method (mean method) by Gui et al. (2006).

Assuming that \(\left|\Delta {Q}_{ijt}^{k}\right|\) is composed of \({a}^{k}\) and \({\varepsilon }_{ijt}^{k}\), where \({a}^{k}\) is the systematic bias caused by the fixed effect related to commodity \(k\), and \({\varepsilon }_{ijt}^{k}\) is closely related to the market environment in region \(i\) and \(j\).

Reasons for price changes are various. It can be the characteristics of the commodity itself. For example, the price change of agricultural products might due to natural conditions. In addition, it might be because of local market environment or other random factors. If not taking into account the influence from certain characteristics of the commodity on \(\left|\Delta {Q}_{ijt}^{k}\right|\), the variance in relative price may be overestimated. Therefore, we use the De-mean method proposed by Parsley and Wei (2001a, b) to remove fixed effects relating to commodity characteristics. Then, we obtain following equation:

where \({q}_{ijt}^{k}={\varepsilon }_{ijt}^{k}-\overline{{\varepsilon }_{ijt}^{k}}=\left|\Delta {Q}_{ijt}^{k}\right|-\left|\Delta {Q}_{t}^{k}\right|\), \({q}_{ijt}^{k}\) is related to both segmentation elements among regions and some random elements. Finally, the residual of the price difference (\(var({q}_{ijt}^{k})\)) is calculated as the change part of the relative price variance.

To carry out the empirical analysis, we construct three-dimensional dataset of “city \(i\)—commodity \(k\)—time \(t\).” Considering the estimation accuracy, the consistency and diversity of commodity and the residents’ consumption preferences, we choose the price index of 16 categories of commodities from year 2004 to 2016. They are food, beverages tobacco and alcohol, textiles, clothing and footwear, home appliances, stationery, daily necessities, sporting goods, furniture, cosmetics, transportation and communications, gold and silver jewelry, books and electronic publications, construction and hardware, etc. Altogether 8,417,760 (= 285 × 284/2 × 13 × 16) \(\left|\Delta {Q}_{ijt}^{k}\right|\) as the absolute value of relative prices and its variance \(var({q}_{ijt}^{k})\) are computed based on 40,470 (= 285 × 284/2) pairwise city, 16 types of commodities and 13 years (2004–2016).

Then, we calculate the market segmentation index of city \(i\) in year \(t\) as \({\sum }_{i=1}^{n}var({q}_{ij,k,t})/n\), where \(n\) is the number of cities. Therefore, the market integration index of commodity \(k\) in city \(i\) in year \(t\) is counted as the reciprocal of the market segmentation index, namely:

Using ARCGIS 10.2 software, we get the spatial distribution map of market integration situation in China for each year. We take year 2004 and 2018 as example (Fig. 2). We find that difference in the magnitude of market integration among regions is gradually increasing although the degree of market integration in each region itself increases from 2004 to 2018.

Control variables

In order to describe accurately the relationship between market integration and green economic growth and to avoid endogenous problems caused by omitted variables, we select environmental regulation, R&D input, regional openness, educational level and resource abundance as control variables in analysis.

-

1.

Environmental Regulation (\(regu\)). According to the Porter Hypothesis (Porter 1991), well-designed and stringent environmental regulation can stimulate enterprises to transform and upgrade technology and to be innovative, eventually achieving a win–win situation of economic growth and energy conservation or emission reduction. Due to lack of adequate data on environmental regulation and policies, we refer to method by Lin and Zhu (2019) and employ urban green coverage rate as the indicator for variable “environmental regulation.”

-

2.

R&D Input (\(rd\)). Endogenous economic growth theory believes that technology innovation is the source of economic growth, while R&D activities are the core of technology innovation. Accompanied by today’s continuous national resources reduction and ecological environment deterioration, increasing investment in R&D and improving technological innovation capability have become the primary choice to promote overall economic transformation. In this paper, we choose the sum of science and technology (S&T) expenditure and education expenditure as a percentage of the fiscal expenditure of each region to indicate R&D input.

-

3.

Regional Openness (\(open\)).

Studies have shown that existence of FIEs (foreign invested enterprise) and FDI (foreign direct investment) contributes to regional capital and innovation capacity through knowledge spillover effect, demonstration effect and competition effect. In addition, both multinational R&D activities and the entry of foreign capital increase local innovation output directly. Moreover, FIEs possess advanced firm-specific assets and competitive advantage in management and their know-how in practice can be transferred to local partners. Here, we use the ratio of actual utilized amount of foreign capital to GDP (gross domestic products) as indicator for variable “regional openness.”

-

4.

Educational Level (\(edu\)).

Resource-based view (RBV) (Barney 1991) suggests that highly qualified people is an important human resource in generating successful new products or process, particularly in knowledge-intensive industry. It is empirically verified that highly educated and technically qualified workforce is positively related to higher level of a region’s innovation performance (Vega-Jurado et al. 2008). Moreover, these people have relatively high environmental awareness. In this paper, the number of teachers in higher education is used to represent educational level in the region.

-

5.

Resource Abundance (\(reso\)).

Extensive studies have focused on the impact of natural resources on environmental pollution and economic growth (e.g., Sachs & Warner 1995; Sun & Wang 2021). Most studies have arrived the conclusion that the development of natural resources has a significant negative effect on the environment and thus on economic growth, confirming the existence of China’s “resource curse” effect (e.g., Cheng et al. 2020). On the one hand, natural resource abundance leads to the resource industry dependency which makes the city emphasizing largely on secondary industry and force out input variables including high-educated human capital and R&D investment for innovative purpose. On the other hand, the development of resource-dependent industry accelerates energy consumption and pollutant emissions, which finally inhibit the development of green economy. Referring to study from Lin and Zhu (2019), this paper uses the share of number of employees in the extractive industry in all employed persons in urban units to measure the effect.

Mechanism variables

-

1.

Economies of Scale Effect (\(scale\))

As stated above, market integration influences regional green economic growth through resource reallocation and changes in ecological efficiency by economies of scale effect. Here, we use averaged DMSP/OLS nighttime light image data to represent the magnitude of this effect.

-

2.

Industrial Composition Effect (\(comp\))

As we have argued, composition effect accompanied by market integration process encourages industry structure transformation and upgrading while industrial restructure can reduce effectively energy consumption and pollutant emission from the first and secondary industry, which is conducive to the green growth of regional economy. Therefore, the indicator “the ratio of the added value from the secondary industry to that from the tertiary industry” is suitable to reflect the composition effect.

-

3.

Spillover Effect (\(spillover\))

Literature shows that market integration affects regional green growth through various knowledge spillovers such as geographical knowledge spillover, competition spillover and technological spillover. Similar to previous research, this paper chooses number of applied green patents from a region as the indicator.

Data description

This paper uses three major data sets. The first is the China City Statistical Yearbook coedited by NBS. It comprehensively reflects the annual social and economic development of 285 Chinese cities. The second is the city-level statistical yearbook coedited by local statistics bureau. The third is the yearly statistical materials and bulletins that have been publicized by governmental agencies at different administrative level. The dataset presented here is a panel data. It spans a period of 13 years from 2004 to 2018 and covers 285 prefecture-level cities. Due to the large difference in the magnitude of various variables, the heteroscedasticity has impact on estimation results. To avoid it, we take natural logarithms for some variables. Table 1 presents the descriptive statistics after data processing.

Figure 3 is the scatter diagram describing the relationship between market integration and green growth. Obviously, there exists a positive relationship between them.

Empirical analysis & results

Baseline regression

Table 2 reports the regression results based on econometric model in Eq. (1). Columns (1) and (2) are the results of ordinary least squares (OLS) regression. The positive and statistically significant coefficient in Columns (1) shows that market integration promotes GTFP in general. After including five control variables in Columns (2), the coefficient of market integration index is 0.0749, which passed the test at the 1% level. It means that market integration has a positive and significant effect on the improvement of regional GTFP. That is, the higher the degree of market integration is, the higher the level of regional GTFP becomes. It is exactly what we speculate that market integration can promote regional green economic growth remarkably. This result is consistent with the empirical study from Hou and Song (2021). However, their results are based on panel data of 30 provinces in China while our empirical test uses city, a relatively narrow geographical range to account the effect, which makes our results more accurate and reliable.

In addition, three control variables (\(regu\), \(rd\), \(edu\)) have significantly positive effect on GTFP, which indicate that environmental regulations, regional R&D input and educational level benefit green economy growth. It means that environmental policies are effective for sustainable development in China and it confirms again the Porter Hypothesis (Porter 1991). Moreover, previous researches have shown that both R&D input and human resource contribute to regional innovation capacity and high education helps to improve people’s awareness to be environment friendly (Raspe & Van Oort 2008). Studies in the field of market integration and green growth usually include R&D and education variables in analysis, e.g., You and Chen (2021).

Expectedly, the coefficient of the resource abundance variable (\(reso\)) has a significantly negative influence on GTFP at the 5% level. It is fully in line with our previous analysis and the existence of China's “resource curse” effect (e.g., Cheng et al. 2020). However, regional openness variable (\(open\)) has no effect on GTFP. Many related studies have adopted regional openness as a control variable into their empirical tests. Due to the different indicators used, the results are not exactly the same. For example, study from Hou and Song (2021) applies the total investment of foreign-invested enterprises in each province to indicate the level of openness and find that it increases regional GTFP.

Furthermore, considering that panel data may suffer heteroscedasticity and autocorrelation due to the mutual influence from economic activities among cities, we apply feasible generalized least squares (FGLS), which allows different individuals to have heteroscedasticity and correlation in the same period. Columns (3) and (4) report the results of the FGLS estimation. Results from the two econometric methods (OLS and FGLS) are consistent, indicating that the individual characteristics are basically the same as the overall characteristics in the model.

Robustness test

This paper uses three methods for robustness test. The first one is to change the econometric method. Similar to Nie and Zhang (2019), we also use generalized moment estimation (GMM) method for the sake of robustness. Results in Column (1) Table 3 show that the estimated coefficient of the explanatory variable is significantly positive at the 1% level. The signs and significance of the control variables (except variable “regional openness”) are basically consistent with those of above regression. The second is to use smoothing outliers. We remove outlier observations by smoothing the top and bottom 5% of samples. Results in column (2) show that the signs and significance of both explanatory and control variables are consistent with the baseline regression. Taking into account the particularities of four main municipalities (Peking, Shanghai, Tianjin, Chongqing) in China, such as economy, population, culture and transportation, we exclude the four cities and get results in Column (3) with OLS and (4) with FGLS, respectively. This method has been frequently used in researches about China. All the robustness tests show that the coefficient signs and significance of main variables are consistent with the baseline regression, implying that the estimation are robust (Table 3).

Endogeneity test

Various possibilities have been developed to resolve the endogeneity issues. The existence of some unobservable factors might result in the problem of missing variables. We adopt the instrumental variable (IV) approach to tackle this problem. An ideal instrument should satisfy two conditions: (1) it must be (highly) correlated to the endogeneity variable; (2) it is uncorrelated to the disturbance term. In this paper, we choose relief degree of land surface of each city (altitude) as instrument. The average altitude comprehensively reflects terrain changes in the city. Generally speaking, communication and cooperation in lower altitude region are more frequent than that in higher altitudes regions. As a result, the degree of market integration in regions with lower altitude is higher. Moreover, altitude is a natural condition and has no direct relationship with the current green growth. Therefore, altitude can meet both relevance and exogenous requirements and is a suitable instrument in our analysis.

The Hausman test result of chi2(6) = 11.64 (P = 0.0000) rejects the null hypothesis that “all explanatory variables are exogenous.” Therefore, we can use IV to deal with endogeneity problem. The over-identification test of chi2(6) = 1.28 (P = 0.9725) exhibits that the IV has nothing to do with the disturbance term.

We further test the correlation between the chose IV and endogenous variable. Results of first stage regression in Column (1) Table 4 show that the IV is significantly negatively correlated with market integration, meaning that the higher the average altitude is, the lower the level of regional market integration becomes. Results of the second stage regression (two-stage least squares method (2SLS)) in Column (2) Table 4 show that IV is positively correlated with GTFP, which is consistent with the benchmark regression results.

We then adopt the limited-information maximum likelihood method (LIML), which is relatively insensitive to weak IV. The coefficients in Column (3) Table 4 are very close to that in 2SLS. Therefore, no weak IV exists and we can conclude that market integration has a significant positive influence on GTFP.

Mechanism test

Previous research shows that market integration has generally promoted regional green economic growth. Does market integration affect the green development of the region through the three channels of scale effect, composition effect and spillover effect? In this regard, this paper carries out mechanism test.

Economies of scale effect

Here, we use averaged DMSP/OLS nighttime light image data (\(scale\)) to represent the magnitude of this effect. Table 5 shows the test results with inclusion of scale effect variable. Column (1) is the baseline regression and the amount of the total effect of market integration on GTFP is 0.0749. The coefficient of market integration affecting scale effect variable (\(scale\)) in column (2) is 1.0847, which is significantly positive at the 1% level, indicating that the improvement of market integration has significantly increased region’s nighttime light amount. After scale variable added to the model in column (3), the significance remains unchanged and the coefficient of the market integration variable becomes from 0.0749 to 0.0744. The amount of the direct effect of market integration on GTFP is 0.0744 and that of its indirect effect, namely the mediation effect, is 0.0114 (= 0.0105*1.0847), which occupies 15.21% (= 0.0105*1.0847/0.0749) of the total effect. It shows that market integration can generate scale effects and agglomeration, induce resource allocation and realize resource efficiency and environmental protection, which ultimately improve GTFP. Study from Hou and Song (2021) also testifies the existence of market scale effect although it does not analyze this effect explicitly. Therefore, as analyzed above, market integration can influence the green economic growth through scale effect.

Industrial composition effect

Table 6 shows the result with inclusion of composition effect variable (\(comp\)). The coefficient of market integration affecting composition effect variable (\(structure\)) in column (2) is -0.1166, which is significant at the level of 1%, indicating that the degree of market integration can significantly reduce the ratio of the secondary industry to the tertiary industry, which is more environmentally friendly. After composition variable added to the model in column (3), the significance remains unchanged and the coefficient of the market integration variable reduces from 0.0749 to 0.0746. The amount of the indirect effect of market integration on GTFP, namely the mediation effect, is 0.0015 (= (-0.0128)*(-0.1166)), which occupies 1.99% (= (-0.0128)*(-0.1166)/0.0749) of the total effect. This means that market integration has also promoted the composition effect, which is conducive to industrial transformation and upgrading in achieving green growth. Study from He et al. (2018) includes the effect from economic structure into their analysis. However, it discusses the influence only on the CO2 emissions, not on the green growth as a whole. Our mechanism analysis shows that regional integration promotes green economic growth through composition effect.

Spillover effect

Table 7 shows the test results with inclusion of spillover effect variable (\(spillover\)). The coefficient of market integration in column (2) is 2.1880, which is significantly positive at 1%, indicating that the improvement of market integration has significantly promoted regional green patent applications. After spillover variable added in column (3), the significance remains unchanged. However, the coefficient decreases from 0.0749 to 0.0678. It means that the mediation effect is 0.0070 (= 0.0032*2.1880), which occupies 9.35% (= 0.0032*2.1880/0.0749) of the total effect. Although many related studies have mentioned the existence of spillover effect as influence mechanism from market integration to GTFP, most of them lacks empirical analysis. Mechanism test here shows that, besides scale effect and composition effect, market integration also promotes green economic growth through spillover effect.

Quantile regression

In order to describe the influence from market integration on green economic growth more precisely, this paper further uses quantile regression method. Quantile regression can capture the tail characteristics of the distribution and describe the difference in magnitude of the influence more exactly. Regression results in Table 8 show that market integration exerts different influence for regions with various levels of GTFP, namely when the quantiles at q = 0.25, 0.50, 0.75, 0.90, respectively. We find that, the observed coefficient gradually decreases with q, and all significantly positive at 1% level. At the 90% quintile, the coefficient of market integration is negative, but not significant. That means, market integration contributes less on GTFP with the increased quantile. In other words, market integration has more influence on regions with lower GTFP, and vice versa.

Heterogeneity analysis

To facilitate heterogeneous analysis here, we employ two indicators to categorize regions. One is the direct distance to the coastline indicating the location of regions. The other is GDP per capita indicating the economic development level of different region.

Heterogeneity analysis by traffic situation

Considering traffic situation is an important characteristic of a city today, we split the whole sample by measuring its road density. Specifically, the top 50% of cities and the last 50% are in the low and high road density group, respectively. Columns (1) and (2) in Table 9 show the existence of significantly positive effect in both groups. In addition, the high road-density group shows higher coefficient of market integration than the lower group does. This result is logical because the most developed area in China is usually the city with more road density. The results confirm again the validity of our estimates.

Heterogeneity analysis by development level

Generally, well-developed area possesses high-level infrastructure and institutional environment, such as public research institutes, financial institutes and labor market. Citizens in developed regions have higher requirements for green development, and have a better awareness of environmental protection than those in less-developed regions.

Therefore, we split the whole sample by measuring this variable with GDP per capita of a region, and take top 50% cities as resource-rich group and the other as resource-scarce group. Similar to baseline regression, Columns (3) and (4) in Table 9 show the existence of significantly positive effect in both groups. Furthermore, less-developed group experiences smaller influence from market integration on green growth than more-developed group does. It is consistent with our expectation.

Conclusions

China has experienced high rate of economic growth over these decades. Nevertheless, China today faces the challenge of sustainable growth in social, economic and ecological aspects. Regarding the importance of sustainable and balanced growth in future, Chinese government has launched a series of policies and regulations in the field of market integration and green growth. Although the two themes of market integration and green growth have gained widespread attention in research and practice, they are usually investigated separately. Even though there exist very few studies discussing their relationship directly, most of them suffer limitations due to data availability or empirical settings.

To fill the research gap, this study elaborates the influence from market integration on regional green growth in China, which contributes to explain green economic growth to some degree. We rationalize this evidence in an explanatory framework and develop mechanisms to verify our estimation both theoretically and empirically. Basing on a large amount of literature review, we formulate three mechanisms to show how the different paths change the magnitude of green economic growth. To realize it, this paper constructs two indicators, namely market integration index and GTFP to measure degree of market integration and regional green economic growth, respectively. To ensure reliable empirical results, we employ a city-level panel data which cover 285 cities or regions from year 2004 to 2018 in China. No prior analysis is carried out on the city scale within the whole nation. And data in this study suffer less from unreliable observations and are of higher quality.

The econometric analysis highlights the importance of market integration for green growth purpose. The results in general are in line with our expectation. Effects from economies of scale, industry composition and knowledge spillover are also underscored here. It is one of the newest insights of our analysis. To achieve a robust and reliable empirical result, robustness test and endogeneity test are carried out. Both results show the consistence in baseline regression model. In addition, we adopt quantile regression to examine the effect from different level of explained variables. Different from traditional heterogeneous analysis which is prone to categorize Chinese cities into eastern, western and middle part, this paper applies two indicators to differentiate them. One is the road density inside a city reflecting its traffic situation and openness to outside. The other is the region’s development level in economy. Heterogeneous analysis shows the existence of regional diversification.

The finding of this study could provide several important implications for regional and national policy makers, especially in China. First, because market integration has a significant positive effect on regional green economic growth, policies to promote market integration should be intensified. That is to say, local protection and barriers need to be eliminated. Because economies of scale, industrial composition and knowledge spillover effect are the three main channel through which market integration influences green economic growth positively, it is meaningful to encourage cross-regional and -enterprise cooperation and communication activity, to realize industrial upgrading and transformation and to improve overall innovation enthusiasm. As the newest development pattern China requires, to establish both domestic and international dual circulations. Among them, the domestic market is key to the new development paradigm. As a whole, various policies relating to environment protection, industrial transformation and urban planning and sector need to be coordinated in a long-term perspective.

Meanwhile, as we describe above, apparent regional imbalance exists in both the development of market integration and green growth and gaps among them are expanding. Therefore, governments need to pay much attention on city’s heterogeneity and avoid the “one size fits all” policies and regulations. Government at different administrative levels might adjust measures in order to achieve an optimal result.

Moreover, our study also shows that environmental regulations as institutional factors contribute to local green growth. As study from Lin et al. (2011) emphasizes, China is characterized with remarkable regional imbalance which underlines a regional institutional environment rather than production networks or others. However, the market in China is not adequate to solve most allocation problems and institutional components are expected to play bigger role (Boeing & Sandner 2011). Therefore, it is worth noting institutional components such as legal and extralegal formal institutions such as patent and tax laws that regulate and coordinate interactions, government policy and specific institutions such as industrial policies, environmental and safety regulations that direct the innovation process, norms and routines that influence the nature and extent of innovative efforts (Buckow 2013).

Nevertheless, this study has its limitations. One can argue that enterprise is the main player in the process of market integration. It might be more practical to apply corporate perspective rather than regional perspective in future analysis (Zhang et al. 2020). Moreover, due to limited data availability, institutional variables are not emphasized particularly in our study. According to Lundvall et al. (2002), institutions have more importance in developing economies, especially in transition economy like China, rather than in developed economies. We suggest that future research can look into these aspects and may yield more relevant implications.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Green growth, green economic growth and green economy are used interchangeably throughout this paper.

China City Statistical Yearbook coedited by the National Bureau of Statistics of China (NBS) include altogether 285 prefecture-level administrative city. Among them, 4 municipalities (Peking, Tianjin, Shanghai and Chongqing) are directly under the control of national central government. This paper refers to these 285 cities. Region and city are used interchangeably throughout this paper.

References

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17:99–120

Bessonova E, Linton J (2019) How the innovation-competition link is shaped by technology distance in a high-barrier catch-up economy. Technovation 86–87:15–32

Bian Y, Song K, Bai J (2019) Market segmentation, resource misallocation and environmental pollution. J Clean Prod 228:376–387

Boeing P, Sandner P (2011) The innovative performance of China's national innovation system

Buckow J (2013) The transnational dimension of innovation in China. China Analysis n 104. Discussion Paper 1–40

Chen X, Huang B (2016) Club membership and transboundary pollution: Evidence from the European Union enlargement. Energy Econ 53:230–237

Cheng Z, Li L, Liu J (2020) Natural resource abundance, resource industry dependence and economic green growth in China. Resour Polic 68:101734

Daumal M, Zignago S (2010) Measure and determinants of border effects of Brazilian states. Pap Reg Sci 89(4):735–758

Ding C, Niu Y (2019) Market size, competition, and firm productivity for manufacturing in China. Reg Sci Urban Econ 74:81–98

Emrouznejad A, Yang GL (2016) A framework for measuring global Malmquist-Luenberger productivity index with CO2 emissions on Chinese manufacturing industries. Energy 115:840–856

Evans CL (2003) The economic significance of national border effects. Am Econ Rev 93(4):1291–1312

Ezcurra R, Rodríguez-Pose A (2013) Does economic globalization affect regional inequality? A cross-country analysis. World Dev 52:92–103

Färe R, Grosskopf S, Pasurka CA Jr (2007) Environmental production functions and environmental directional distance functions. Energy 32(7):1055–1066

Gan C, Zheng R, Yu D (2011) An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ Res J 5:4–16 (in Chinese)

Gui Q, Chen M, Lu M, Chen Z (2006) Does China’s domestic commodity market tend to be segmented or integrated: an analysis based on the relative price method. Econ Res J 10:35–44 (in Chinese)

He W, Wang B, Wang Z (2018) Will regional economic integration influence carbon dioxide marginal abatement costs? Evidence from Chinese panel data. Energy Economics 74:263–274

He L, Zhang L, Zhong Z, Wang D, Wang P (2019) Green Credit, Renewable Energy Investment and Green Economy Development: Empirical Analysis Based on 150 Listed Companies of China. J Clean Prod 208(20):363–372

Hermosilla M, Wu Y (2018) Market size and innovation: The intermediary role of technology licensing. Res Policy 47(5):980–991

Hong T, Yu N, Storm S, Gao B (2019) How much does regional integration contribute to growth? An analysis of the impact of domestic market integration on regional economic performance in China (1997–2011). Econ Res Ekon Istraživanja 32(1):3189–3210

Hou S, Song L (2021) Market Integration and Regional Green Total Factor Productivity: Evidence from China’s Province-Level Data. Sustainability 13(2):472

Hou Y, Liu Z, Yue Z (2009) Social network analysis over the process of economic integration in the Yangtze River Delta. China Soft Science 12:90–101 (in Chinese)

Hu Y, Fisher-Vanden K, Su B (2020) Technological spillover through industrial and regional linkages: Firm-level evidence from China. Econ Model 89:523–545

Huang J, Yang X, Cheng G, Wang S (2014) A comprehensive eco-efficiency model and dynamics of regional eco-efficiency in China. J Clean Prod 67:228–238

Jaffe AB (1998) The importance of “spillovers” in the policy mission of the advanced technology program. J Technol Transf 23(2):11–19

Johansson AC, Ljungwall C (2009) Spillover effects among the Greater China stock markets. World Dev 37(4):839–851

Ke S (2015) Domestic market integration and regional economic growth—China’s recent experience from 1995–2011. World Dev 66:588–597

Lai A, Yang Z, Cui L (2021) Market segmentation impact on industrial transformation: Evidence for environmental protection in China. J Clean Prod 297:126607

Lapan HE, Sikdar S (2011) Strategic environmental policy under free trade with transboundary pollution. Rev Dev Econ 15(1):1–18

Li J, Lin B (2017) Does energy and CO 2 emissions performance of China benefit from regional integration? Energy Polic 101:366–378

Li H, Zhou LA (2005) Political turnover and economic performance: the incentive role of personnel control in China. J Public Econ 89(9–10):1743–1762

Lim ES, Breuer JB (2019) Free trade agreements and market integration: Evidence from South Korea. J Int Money Financ 90:241–256

Lin B, Chen Z (2018) Does factor market distortion inhibit the green total factor productivity in China? J Clean Prod 197:25–33

Lin B, Zhu J (2019) Fiscal spending and green economic growth: Evidence from China. Energy Econ 83:264–271

Lin GC, Wang CC, Zhou Y, Sun Y, Wei YD (2011) Placing technological innovation in globalising China: production linkage, knowledge exchange and innovative performance of the ICT industry in a developing economy. Urban Stud 48(14):2999–3018

Liu Y, Tian Y, Luo Y (2018) Upgrading of industrial structure, energy efficiency, green total factor productivity. Theor Pract Financ Econ 39(001):118–126 (in Chinese)

Ljungwall C, Tingvall PG (2015) Is China Different? A Meta-Analysis of the Growth-Enhancing Effect from R&D Spending in China. China Econ Rev 36:272–278

Lu M, Chen Z (2009) Fragmented growth: Why economic opening may worsen domestic market segmentation? Econ Res J 44:42–52 (in Chinese)

Lu X-H, Jiang X, Gong M-Q (2020) How land transfer marketization influence on green total factor productivity from the approach of industrial structure? Evidence from China. Land Use Polic 95:104610

Lundvall BÅ, Johnson B, Andersen ES, Dalum B (2002) National systems of production, innovation and competence building. Res Polic 31(2):213–231

Ma X, Wang C, Yu Y, Li Y, Dong B, Zhang X, Gu Y (2018) Ecological efficiency in China and its influencing factors—a super-efficient SBM metafrontier-Malmquist-Tobit model study. Environ Sci Pollut Res 25(21):20880–20898

Mukim M (2012) Does agglomeration boost innovation? An Econometric Evaluation. Spat Econ Anal 7(3):357–380

Naughton B (2003) How much can regional integration do to unify China’s markets? How far across the river. pp 204–232

Nie L, Zhang Z (2019) ‘Neighbors as Competitors’ or ‘Neighbors as Partners’: How Does Market Segmentation Affect Regional Energy Efficiency in China?

O’Hara M, Ye M (2011) Is market fragmentation harming market quality? J Financ Econ 100(3):459–474

Pan X, Li M, Wang M, Chu J, Bo H (2020) The effects of outward foreign direct investment and reverse technology spillover on China’s carbon productivity. Energy Polic 145:111730

Parsley D, Wei S (2001a) Limiting Currency volatility to stimulate goods market integration: A price-based approach. NBER working paper No. W8468

Parsley D, Wei SJ (2001b) Explaining the border effect: the role of exchange rate variability, shipping costs, and geography. J Int Econ 55(1):87–105

Pearce D, Markandya A, Barbier E (1989) Blueprint for a Green Economy. Earthscan, London

Pecotich A, Hattie J, Low LP (1999) Development of industruct: A Scale for the measurement of perceptions of industry structure. Mark Lett 10(4):409–422

Pendakur K, Pendakur R (2002) Language as both human capital and ethnicity. Int Migr Rev 36(1):147–177

Poncet S (2003) Measuring Chinese domestic and international integration. China Econ Rev 14(1):1–21

Poncet S (2005) A fragmented China: Measure and determinants of Chinese domestic market disintegration. Rev Int Econ 13(3):409–430

Porter M (1991) America’s green strategy. Sci Am 264:168

Raspe O, Van Oort F (2008) Localized Knowledge Externalities in Regional Economic Development and Firm Growth. J Reg Anal Polic 38(2):100–116

Sachs JD, Warner A (1995) Natural resource abundance and economic growth

Sandberg M, Klockars K, Wilén K (2019) Green growth or degrowth? Assessing the normative justifications for environmental sustainability and economic growth through critical social theory. J Clean Prod 206:133–141

Schmookler J (1966) Invention and economic growth. Harvard University Press, Cambridge.

Schumpeter JA (1934) The theory of economic development. An inquiry into profits, capital, credit, interest, and the business cycle. Harvard University Press, Cambridge (Reprint 1983: Transaction Publishers (first published in 1911 in German))

Shao S, Chen Y, Li K, Yang L (2019) Market segmentation and urban CO2 emissions in China: Evidence from the Yangtze River Delta region. J Environ Manag 248:109324

Shepherd B, Wilson JS (2007) Trade, infrastructure, and roadways in Europe and Central Asia: New empirical evidence. J Econ Integr 22:723–747

Song ML, Du J, Tan KH (2018) Tan. Impact of Fiscal Decentralization on Green Total Factor Productivity. Int J Prod Econ 205:359–367

Sun Z, Wang Q (2021) The asymmetric effect of natural resource abundance on economic growth and environmental pollution: Evidence from resource-rich economy. Resour Polic 72:102085

Sun B, Chen L, Li H (2018) Assessment of green growth efficiency losses from market segmentation. China Popul Resour Environ 28(7):147–157 (in Chinese)

Sun X, Loh L, Chen Z (2020) Effect of market fragmentation on ecological efficiency: evidence from environmental pollution in China. Environ Sci Pollut Res 27(5):4944–4957

Tang KK (1998) Economic integration of the Chinese provinces: a business cycle approach. J Econ Integr 13:549–570

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Euro J Oper Res 130:498–509

UNEP (2011) Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication

Utterback JM, Suarez FF (1993) Innovation, competition, and industry structure. Res Policy 22(1):1–21

Varga A (2000) Local academic knowledge transfers and the concentration of economic activity. J Reg Sci 40(2):289–309

Vega-Jurado J, Gutiérrez-Gracia A, Fernández-de-Lucio I (2008) Analyzing the determinants of firm’s absorptive capacity: Beyond R&D. R&D Manag 38(4):392–405

Wang X, Fan G, Hu L (2019) Marketization index of China’s Provinces: NERI report 2018. Social Sciences Academic Press, Beijing (in Chinese)

Watanabe M, Tanaka K (2007) Efficiency analysis of Chinese industry: a directional distance function approach. Energy Polic 35(12):6323–6331

Weerawardenaa J, O’Cassb A, Julianc C (2006) Does industry matter? Examining the role of industry structure and organizational learning in innovation and brand performance. J Bus Res 59:37–45

Wei W, Zhang W, Wen J, Wang J (2020) TFP growth in Chinese cities: The role of factor-intensity and industrial agglomeration. Econ Model 91:534–549

Wu H, Hao Y, Ren S (2020) How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ 91:104880

Yang C, Tseng Y, Chen C (2014) Environmental regulations, induced r&d and productivity: Evidence from taiwan’s manufacturing industries. Resour Energy Econ 34:514–532

Yang M, Yang F, Sun C (2018) Factor market distortion correction, re- source reallocation and potential productivity gains: an empirical study on China’s heavy industry sector. Energy Econ 69:270–279

You S, Chen X (2021) Regional integration degree and its effect on a city’s green growth in the Yangtze River Delta: Research based on a single-city regional integration index. Clean Technol Environ Polic 23:1837–1849

Young A (2000) The razor’s edge: Distortions and incremental reform in the People’s Republic of China. Q J Econ 115(4):1091–1135

Yu B (2015) Economic growth effects of industrial restructuring and productivity improvement – analysis of dynamic spatial panel model with Chinese city data. Chin Industr Econ 12:83–98 (in Chinese)

Yu B (2017) Does financial agglomeration promote the industrial structure upgrading: from spatial spillover - based on dynamic spatial panel model in China. Financ Theor Polic 2:12–23 (in Chinese)

Zhang K, School B (2018) Is regional integration beneficial to emission reduction? J Financ Res 61:67–83

Zhang J, Wu G, Zhang J (2004) The Estimation of China’ s provincial capital stock :1952–2000. Econ Res J 10:35–44 (in Chinese)

Zhang N, Zhou P, Kung C-C (2015) Total-factor carbon emission performance of the Chinese transportation industry: a bootstrapped non-radial Malmquist index analysis. Renew Sustain Energy Rev 41:584–593

Zhang K, Shao S, Fan S (2020) Market integration and environmental quality: Evidence from the Yangtze River delta region of China. J Environ Manag 261:110208

Zhao XM, Liu CJ, Yang M (2018) The Effects of Environmental Regulation on China’s Total Factor Productivity: An Empirical Study of Carbon-intensive Industries. J Clean Prod 179(1):325–334

Acknowledgements

We would like to extend our sincere gratitude to our supervisor, Professor Shanlang Lin, for his instructive advice and useful suggestions on our thesis. We are deeply grateful for his help in the completion of this paper.

Funding

This work was supported by the < National Natural Science Foundation of China #1 > under Grant [number 72003141]; < Shanghai Philosophy and Social Science Planning Project #2 > under Grant [number 2019BJB012].

Author information

Authors and Affiliations

Contributions

Jieping Chen and Xiaoli Hu conceived the study and were responsible for the design and development of the data analysis. Xiaoli Hu was responsible for data collection and analysis. Junpei Huang and Ruofei Lin were responsible for data interpretation. Jieping Chen wrote the first draft of the article. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chen, J., Hu, X., Huang, J. et al. Market integration and green economic growth—recent evidence of China’s city-level data from 2004–2018. Environ Sci Pollut Res 29, 44461–44478 (2022). https://doi.org/10.1007/s11356-022-19070-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19070-9

Keywords

- Market Integration

- Green Growth

- Green Total Factor Productivity

- Economies of Scale Effect

- Composition Effect

- Spillover Effect

- Industry Upgrading and Transformation

- Transmission Mechanism

- China

- Sustainable Growth