Abstract

Green credit is one of the most important financial instruments to promote sustainable development. Taking the provincial panel dataset of China as the research sample, this paper investigates the spatial impacts of green credit on the green economy. The super slack-based measure (Sup-SBM) model with undesirable outputs is employed to calculate the level of green economy within China. On this basis, we establish spatial Durbin models to study the impact of green credit on green economy and its transmission mechanisms. The results show that green credit exhibits a local-neighborhood effect on green economy; that is, the green credit can not only improve the local green economy but also generate spatial spillover effect to promote the development of green economy in surrounding areas. The above conclusion still holds after the robustness test by replacing spatial weight matrices and alternative measurement for the explained variable. Furthermore, enhancing innovation efficiency and optimizing energy structure are important ways for green credit to promote green economy. The findings of this study not only provide a new perspective for understanding the economic consequences of green credit policy but also provide empirical evidence for the important role of green finance in achieving the win-win goals of economic growth and environmental protection.

Similar content being viewed by others

Introduction

The novel coronavirus disease (COVID-19) has caused the tragic loss of life and threatened the sustainable economic growth. To build a greener, more sustainable, and inclusive post-pandemic world, countries all over the world should put in place policies and practices for green recovery (United Nations Environment Programme 2021). To this end, China has promoted the development of green finance to cope with eco-environmental challenges (Pan et al. 2021). In 2021, the State Council of China (SCC) issued the Guidance on Accelerating the Establishment and Improvement of Green, Low-carbon and Circular System for Economic Development and proposed to develop green finance to promote green transformation, emphasizing the important role of green finance in modern environmental governance system (SCC 2021).

According to the G20 Green Finance Study Group (2016), green finance refers to investment and financing activities that can produce environmental benefits. The ultimate goal of green finance is to promote sustainable development (An et al. 2021). The green credit is one of the most important green financial instruments in China (Yang et al. 2020). It incorporates environment-related risks into credit management and allocates more funds to low-carbon and environmentally friendly industries (China Banking Regulatory Commission 2012). The green credit in China has developed rapidly. By the end of June 2020, the balance of green credit has exceeded 11 trillion yuan, which is one of the highest in the world (People’s Bank of China 2020). The existing literature has contributed to the discussion on the effects of green credit policy, but the results are mixed. On the one hand, there are two opposite opinions on the implementation efficiency of green lending. Some scholars argued that financial institutions, as the main body of green credit, strived to maximize profits and did not fully implement green credit due to the lack of economic incentives (Biswas 2011). However, several studies demonstrated that financial institutions actively followed the principle of green credit because of capital security (Zhang et al. 2011), compliance cost, and differentiated competition (Hu and Cao 2011; Gao and Gao 2018). Moreover, financial supervision (Lu and Fang 2018), peer pressure (Contreras et al. 2019), and financial innovation such as order financing (Wang et al. 2021a) can solve the problem of insufficient incentives. On the other hand, the prior literature has mixed views on the impacts of green credit policy. One strand of literature believed that green credit policy promoted industrial upgrading (Hu et al. 2020) and improved environmental quality (Cai et al. 2019; Sun et al. 2019); instead, other strands argued that green credit was not conducive to economic performance and the positive effect on environment was not significant (Liu et al. 2017).

Taken together, the existing studies are insufficient to shed light on the effects and influencing mechanisms of green credit policy. First, most of the literature examines the impacts of green credit policy from a single perspective, without considering the dual goals of green credit on environment and economy, and thus lacks comprehensive evaluation systems for green credit policy. Second, most of the mainstream literature ignores the spatial effect of green credit policy. According to the first law of geography proposed by Tobler (1970), near things are more related to each other. Therefore, the spatial distance is an important factor affecting the relationship between variables. Previous studies have also found that there exists interaction and correlation between environmental behaviors and economic activities within different regions (see Shao et al. 2020; Yuan et al. 2020; Zhang et al. 2020). It is therefore necessary to incorporate spatial factors into the research framework of green credit policy. What is more, the influencing mechanisms of green credit policy on economy and environmental still need further in-depth analysis.

To fill aforementioned research gaps, this study establishes spatial econometric models to explore the local-neighborhood effect of green credit policy. With China’s provincial panel dataset as the research sample, we apply the Sup-SBM data envelopment analysis (DEA) model considering undesirable outputs to calculate the green economy, which is used as the proxy to comprehensively measure the dual objectives of green credit policy on economy and environment. Furthermore, we construct the spatial Durbin model to investigate the local-neighborhood effect of green credit policy, which not only studies the impacts of green credit on local region’s green economy but also explores the spatial effect on surrounding areas’ green development. In addition, in order to clarify the influencing mechanisms of green credit policy, we discuss how green credit policy can promote green economy through improving innovation efficiency and reducing the share of fossil energy consumption.

The marginal contributions of this study are threefold. First, this paper illustrates the effects of green credit policy from both economic and environmental perspectives. The results show that green credit policy helps promote the development of green economy, which not only enriches the literature on green credit policy but also provides empirical evidence for achieving the win-win situation between economic development and environmental protection. Second, most of the existing literature on green credit focuses on the local effect and ignores the spatial correlation. This paper extends the application of spatial econometrics to green financial research and finds that green credit policy has positive effects on the green economy in the surrounding areas, verifying the existence of spatial spillover effects of green credit. Third, based on the green lending principles, this paper clarifies the transmission mechanisms of green credit on green development. Our study emphasizes the importance of innovation efficiency and energy structure optimization in the practice of green credit policy, which not only deepens the understanding of green credit but also enriches the research on its transmission mechanisms.

The remainder of this paper is organized as follows. The “Institutional background and literature review” section presents the institutional background and literature review. The “Research method and data” section describes the method and data. The empirical results and discussion follow in the “Results and discussion” section, and the “Conclusion and policy implications” section concludes and makes policy implications.

Institutional background and literature review

Institutional background of China’s green finance

The term green finance originated from the Equator Principles (EPs)Footnote 1 proposed by the International Finance Corporation (IFC) in 2003, which called for financial institutions to consider environmental and social factors in their investment and financing activities (Scholtens and Dam 2007). Looking back on the development of green finance in China, it is typical of Chinese characteristics. Different from the voluntary characteristics of EPs, China’s green financial system combines the stringent government supervision and flexible market incentives. The government plays a significant role in guiding and supervising the promotion of green finance. Table 1 shows some important green finance policies of China, and it can be seen that China’s emphasis on green finance is increasing and gradually moving from advocacy recommendations to specific provisions. At present, China’s green financial system is under continuous improvement, with green standards, environmental information disclosure, incentive mechanisms, product innovation, and international cooperation as its five core pillars.Footnote 2 China’s green financial market has developed rapidly, and the function of optimizing resource allocation has been continuously strengthened. The scales of green credit and green bonds have continued to expand. By the end of 2020, their stocks are among the highest in the world.Footnote 3 Besides, the construction of emission trading market has accelerated (Zhang and Zhang 2020), and other innovative products such as green funds, green insurance, green trust, green public-private partnership (PPP), and green leasing have been emerging. In particular, China has proposed the goal of carbon neutrality, which provides an opportunity for green finance to take a new step forward. As one of the major advocates and practitioners of green finance, China has played great roles in the green recovery of the world economy. However, China’s green finance is still in its infancy (Dong et al. 2021), and there are many theoretical and practical issues to be explored. The studies of green finance from the perspective of China can help provide Chinese solutions and contribute to the global sustainable development.

Green credit policy, economic development, and environmental pollution

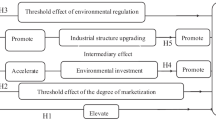

Green credit is the earliest and fastest growing green financial product in China. In 2007, China formally introduced the green credit policy. However, it was not until the promulgation of the Green Credit Guidelines in 2012 that comprehensive and specific requirements for the implementation of green credit were put in place. As a financial innovation, green credit has dual objectives. It emphasizes not only environmental benefits but also economic benefits, aiming to improve the ability to serve the real economy. Therefore, the green credit has a profound impact on green development. However, the real effect of green credit is highly uncertain. In practice, the implementation of green credit can be influenced by many factors (Huang et al. 2021b; Yin et al. 2021). Therefore, in-depth and extensive studies are particularly necessary to accurately evaluate the true effects of green credit. This has motivated a large number of scholars to investigate the effects of green credit policy on the economy and environment (see Fig.1).

On the one hand, some studies have found that green credit policy is highly correlated with the economic performance of firms. Green credit policy can directly influence the innovation activities of enterprises. Hu et al. (2021) revealed that the Green Credit Guidelines (GCG) of China stimulated green innovation in highly polluting firms, leading to a green transition. Furthermore, the environment-related innovation induced by green credit policy can promote green total factor productivity (Zhang 2021). However, Wen et al. (2021a) found the opposite results within energy-intensive industries; that is, the GCG reduced allocation efficiency of bank credit and negatively affected the total factor productivity of firms, while Zhang and Vigne (2021) argued that the negative effects of green credit policy on firm performance were weakened in a dynamic process. In addition, the green credit can be an important factor in moderating the relationship between different activities of enterprises. For example, Zhou et al. (2021) found that green credit mitigated the negative impact of social responsibility on banks’ financial performance.

On the other hand, many scholars have discussed the impacts of green credit policy on environmental pollution. Andersen (2017) argued through theoretical derivation and empirical analysis that capital distortion caused by credit constraints increased pollution emissions. Therefore, it is necessary to rationally reallocate credit resources through green credit policy in the process of environmental abatement. Sun et al. (2019) found that China’s green credit policy effectively encouraged enterprises to reduce water pollution. Zhang and Vigne (2021) found similar results that green credit significantly reduced pollution emissions in China. Dong et al. (2020a) took China’s provincial panel data as research sample, finding that green lending helped developing countries address environmental pollution problems. Considering the environmental constraints, Song et al. (2021) found that green credit improved the efficiency of energy utilization, which was important for promoting green development.

Although previous studies have contributed significantly to the research and discussion of green credit policy, there are still some gaps that need to be filled. First, to the best knowledge of us, few studies have included both environmental and economic factors in the research framework of green credit policy (Liu and He 2021). Therefore, this paper adopts the concept of green economy to measure the dual goals of green credit for economy and environment in a more integrated manner. The green economy is defined as one that is low-carbon, resource-efficient, and socially inclusive (UNEP 2011). How to promote green economy has drawn attention of researchers and policy-makers. Many studies have explored the factors influencing the green economy (Zhao et al. 2020). For example, Zhuo and Deng (2020) used synthetic control method to find that China’s Western Development Strategy (WDS) positively affected the green economy. Yuan et al. (2020) investigated the nonlinear impacts of manufacturing agglomeration (MA) on the green economy in China and found a significant positive U-shaped relationship between MA and the green economy. Based on a dataset from the member countries of the Belt and Road Initiative (BRI), Zhang et al. (2021) showed that public spending contributed to the green economy. However, few studies have explored the impact of green credit policy on the green economy.

Second, most of the studies ignore the spatial spillover effects of green credit policy. Generally, there are strong spatial correlations between economic and environmental activities in different regions (see Shao et al. 2020; Yuan et al. 2020; Zhang et al. 2020). Dong et al. (2020b) showed that environmental regulation not only affected the green technology progress in the local regions but also changed the innovation of green technology in the neighboring regions. From the perspective of green finance, Li and Gan (2021) showed that the development of green finance improved the ecological environment in the surrounding areas. However, few literatures explore the spatial effects of green credit policy. As an important environmental policy, it is necessary to study the local-neighborhood impacts of green credit policy, and the present study is based on this consideration.

Research method and data

Model specification

Benchmark model

First, without considering spatial factors, we establish the following econometric model to study the impact of green credit policy on the green economy.

where i is province, t is time, and GEit represents the green economy. GCit represents the green credit, and \( {Controls}_{it}^1 \) denotes control variables in Equation (1). \( {\mu}_i^1 \) and \( {\nu}_t^1 \) represent the fixed effects. \( {\varepsilon}_{it}^1 \) is the random error term, with \( {\varepsilon}_{it}^1\sim iid\left(0,{\sigma}^2\right) \).

Spatial econometric model

Furthermore, the spatial econometric model is established to test the local-neighborhood effect of green credit policy. It is recognized that the Durbin model (SDM) is a more general form of spatial models (Elhorst 2014), which can be degenerated into the spatial autoregression model (SAR) and spatial error model (SEM). We refer to Shao et al. (2020) and thus set the SDM as follows:

where i(j) is the space unit and \( {Controls}_{it}^2 \) refers to control variables in Equation (2). Wij is the spatial weight matrix, reflecting the interdependence and correlation among different spatial units. \( {\sum}_{j=1}^N{W}_{ij}{GE}_{jt} \) denotes the spatial lag term of the explained variable, \( {\sum}_{j=1}^N{W}_{ij}{GC}_{jt}^2 \) denotes the spatial lag term of the explanatory variable, and \( {\sum}_{j=1}^N{W}_{ij}{Controls}_{jt}^2 \) represents the spatial lag terms of control variables.

It is worth noting that the coefficients of spatial econometric models by point estimation method can lead to bias. With reference to the existing studies, we decompose the impacts of green credit policy into direct and indirect effects. The direct effect reflects the impact of green credit on the local green economy; the indirect effect shows the impact of green credit on the surrounding areas’ green economy, which is known as the spatial spillover effect. The sum of these two effects measures the total effects of green credit policy.

Spatial weight matrix

The spatial weight matrix is critical to the spatial economic analysis, which is an important tool to quantify the spatial dependence among observations. There is no unified standard for the selection of spatial weight matrix, and most of the existing studies set weight matrices based on geographical distance (dij). Referring to Huang et al. (2021a), we set the following geographical distance spatial weight matrix.

Considering that different settings of matrix may have impacts on the estimation results, we also set alternative weight matrices for robustness test. First, we use the discrete matrix, which is the simplest binary 0-1 spatial weight matrix (\( {W}_{ij}^{0-1} \)) and often be used in previous studies of spatial economics (Radmehr et al. 2021).

Second, with the development of spatial econometrics, the economic factors are gradually incorporated into the spatial weight matrix, which is widely used in the field of environmental economics. Referring to Shao et al. (2020), this paper embeds the gross domestic production (GDP) into the geographical distance matrix to establish the following asymmetric spatial weight matrix (\( {W}_{ij}^{geo- eco} \)).

Definition of variables

Explained variable

In previous literature, the stochastic frontier analysis (SFA) method (Chen et al. 2021) and DEA technique (Ma et al. 2019; Wu et al. 2020) are mainly used to measure the level of green economy. The latter does not need to set specific function forms to determine the efficiency frontier, nor does it require subjectively giving the weight of the index, and thus has stronger objectivity. Referring to the ideas of Zhao et al. (2020), we measure the green economy of each province in China, and the definitions of input-output factors are shown in Table 2.

Explanatory variable

The core explanatory variable is the scale of green credit. There are two widely used methods to measure green credit in previous literature: dummy variable (Su and Lian 2018) and the amount of loan for energy saving and environmental protection (Wen et al. 2021b). Referring to Wen et al. (2021b), the proportion of loans obtained by energy-efficient and environmental protection enterprises to total loans in each province is taken as the proxy variable for green credit.

Control variables

Referring to Yuan et al. (2020), we include the following control variables in the model to mitigate the bias caused by missing variables: (1) economic development (ECO), expressed by the real GDP per capita; (2) infrastructure (INF), expressed by the road area per capita; (3) opening degree (OPE), expressed by the ratio of real foreign direct investment to GDP; (4) population density (PEO), expressed by the logarithm of the total number of people per square kilometer; (5) employment rate (EMP), expressed by the percentage of urban employment in the total number of people; (6) industrial structure (IND), expressed by the proportion of the secondary industry; and (7) the intensity of environmental regulation (REG), calculated by the proportion of investment related to environment protection in GDP.

Sample and data source

The research sample of this paper is Chinese provincial panel dataset from 2007 to 2017, including 30 provinces (municipalities) in China. Considering the availability and completeness of the dataset, Tibet, Hong Kong, Macao, and Taiwan are excluded. The data of innovation inputs and patent are from the China Science and Technology Yearbook, the data of energy consumption are from the China Energy Statistical Yearbook, the data of pollution emission and environmental investment are from the China Environmental Statistical Yearbook, the financial data of enterprises are from the China Stock Market and Accounting Research database, and other data are from the China Statistical Yearbook. With regard to missing data, the linear interpolation is employed to supplement. In order to avoid the adverse effect of extreme values, all continuous variables are subjected to 1% winsorization process. Moreover, with 2007 as the base year, the price-related indicators are converted to the real price levels to enhance the comparability. Table 3 shows the descriptive statistics of variables.

Results and discussion

Benchmark regression

Table 4 shows the benchmark regression results of green credit on green economy without considering spatial factors. The estimated coefficient of green credit (GC) in column (1) is 0.149, which is positive at the 1% significance level. To avoid missing important variables and multicollinearity problems, this paper adds control variables stepwise in columns (2)–(8). The regression results show that the estimated coefficients of green credit (GC) are all positive at the 1% significance level, indicating that green credit policy can significantly contribute to the development of green economy within China. In column (8), the regression coefficient of green credit (GC) is 0.168, and it means that as the size of green credit increases 1 unit, the level of green economy can increase by approximately 0.168 units. The findings are consistent with prior studies by scholars (Wang et al. 2019; Wang et al. 2021b), suggesting that green credit plays important roles in the win-win situation between environmental protection and economic development.

The local-neighborhood effect of green credit policy

Next, we turn to the spatial econometric analysis. First, the global Moran’s index is calculated to test the spatial correlation with the following equations:

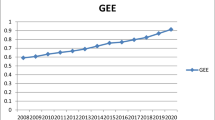

where I is the global Moran’s index, n is the number of space units, and Wij is the spatial weight matrix. GEi and GEj refer to the green economy of regions i and j, respectively. \( \overline{GE} \) measures the average level of the green economy. S2is the sample variance, with\( {S}^2=\sum \limits_{i=1}^n{\left({GE}_i-\overline{GE}\right)}^2/n \)). I∗ is the standardized Moran’s index, E(I) is the mean value of I, and Var(I) represents the variance. Table 5 shows the results of Moran’s index from 2007 to 2017. It can be seen that values of Moran’s index are significantly positive for all years, indicating that the green economy within China presents a significant and positive spatial correlation.

The results of Moran’s index test described above support the rationality of using the spatial models. On this basis, Table 6 reports the regression results of the spatial Durbin model (SDM). The results of LR test show that the SDM is reasonable. In column (8), which contains all the control variables, the spatial lag term of the explained variable is negative and significant at the 1% level (W ∗ GE = 0.418, z = 6.044), indicating that the positive spatial correlation within China’s green economy exists. The spatial lag term of green credit is significantly positive at the level of 1% (W ∗ GC = 0.564, z = 3.052), which indicates that green credit has a positive impact on the green economy in the surrounding areas. The direct effect of green credit is 0.176, which indicates the positive and significant impact of green credit on local green economy; the indirect effect is 1.039, reflecting that green credit has positive impact on the green economy in surrounding areas. The above regression results show that, the green credit has a local-neighborhood effect on the green economy. Green credit not only promotes the development of green economy in the local but also plays a positive demonstration role in effectively driving the development of green economy in the surrounding areas.

Robustness test

In order to enhance the robustness of the above results, we repeat above regression using different spatial weight matrices. In addition, we also examine whether the local-neighborhood effect of green credit still holds when the explained variable is replaced.

Replacing the spatial weight matrix

The selection of spatial weight matrix has important impacts on the studies, and different settings may lead to large differences in the results or even reversal of the conclusions. In this subsection, we take \( {W}_{ij}^{0-1} \) and \( {W}_{ij}^{geo- eco} \)as the spatial weight matrices into Equation (2) for estimation; the results are shown in Tables 7 and 8, respectively. The statistics of LR spatial lag (LR _ lag) and LR spatial error (LR _ error) are all significant, which once again validate the reasonableness of spatial Durbin model. The spatial lag terms W ∗ GE and W ∗ GC are both positive and statistically significant, supporting the spatial correlation of green economy and the spatial spillover effect of green credit. The direct, indirect, and total effects of green credit are all significantly positive, which suggest the local-neighborhood effect of green credit on green economy.

Alternative explained variable

The ratio of economic output to environmental pollution emission is used as an alternative index for the explained variable, with \( {GE}_{it}^{\ast }= Ln\left({RGDP}_{it}/{EPI}_{it}\right) \), where \( {GE}_{it}^{\ast } \) is a proxy variable for the green economy and RGDPit denotes the real GDP. EPIit is the environmental pollution index, which is calculated by the entropy method following to Zhou and Wu (2018), and the calculation process is shown in the Appendix. The regression results with \( {GE}_{it}^{\ast } \) as the explained variable are shown in Table 9. From the results in columns (1)–(8), the local-neighborhood effect of green credit on green economy is verified once again, which enhances the robustness of the aforementioned findings.

Analysis of transmission mechanisms

In order to clarify the transmission channels of the local-neighborhood effect of green credit, this paper establishes the following model to explore the ways of green credit affecting green economy:

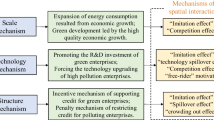

where Mit is the variable representing transmission mechanism and the superscript k is used to distinguish different equations (k = 3, 4, …). On the basis of the principles and practice of green credit in China, we consider the following two influencing ways (see Fig.2).

The driving effect of green credit on innovation

Considering that innovation is an important engine for the green and low-carbon development, we first explore the innovation-driven effect of green credit. In 2012, China issued the Green Credit Guidelines (GCG), stating that financial institutions should implement differentiate and dynamic credit policies to promote the transformation and restructuring of economy. Under the guidance of green principles, it requires all industries to increase technological innovation, update and renovate traditional and backward production equipment, eliminate the previous heavily polluting and energy-intensive production modes, and design environmentally friendly production processes to achieve the green development. The Porter effect points out that reasonable environmental policies can enable enterprises to increase their innovation efforts, thereby increasing economic performance and compensating for the increased production costs (Porter and Linde 1995). China’s green credit policy combines the dual advantages of economic incentives and government supervision, making it easier to achieve the innovation compensation effect described above. Therefore, green credit may stimulate the technological innovation to promote the development of green economy within China. On this basis, this paper adopts innovation efficiency to test the innovation-driven effect of green credit. According to the study of Battese and Coelli (1992), the stochastic frontier analysis method (SFA) is used to calculate the innovation efficiency. Accordingly, the trans-log function is defined as follows:

where Yit is the output factor, expressed by the number of patent applications in current year (Jin et al. 2019). Kit and Lit represent the scale of capital for research and development (R&D) and the number of R&D personnel, respectively. νit and μit represent the random error and inefficiency terms, respectively. The innovation efficiency can be measured by the following equation:

Then, take innovation efficiency into Equation (8) to get the following equation:

where \( {Controls}_{it}^3 \) represents control variables, including the level of economic development (ECOit), infrastructure construction (INFit), the degree of opening(OPEit), the population density (PEOit) and the level of education (EDUit).

Table 10 reports the regression results of green credit on innovation efficiency. According to the results in column (6), the spatial lag terms of innovation efficiency and green credit are statistically significant and positive (W ∗ TE = 0.277, z = 3.650; W ∗ GC = 0.008, z = 2.340). Regarding the effect of green credit on innovation efficiency, the direct effect is 0.009, which indicates that green credit has a positive role in promoting the local innovation efficiency; and the indirect effect is 0.014, indicating that green credit has a positive spillover effect on the innovation efficiency in the surrounding areas. Considering the local-neighborhood effect of green credit on innovation efficiency, an increase of one unit of green credit can promote the overall innovation efficiency by 0.024 units. The above findings support the innovation-driven effect of green credit. Through this mechanism, green credit can contribute to the development of China’s green economy.

The optimization effect of green credit on energy structure

In addition, another question of concern is the impact of green credit on energy structure. China is one of the world’s major carbon emission countries (International Energy Agency 2019); promoting clean energy and eliminating backward capacity is one of the most important measures for China to realize green and low-carbon transformation. Since China issued the Energy Efficiency Credit Guidelines in 2015, financial institutions have been required to provide credit support for reducing energy consumption and improving energy efficiency. To a certain extent, it can encourage enterprises to improve energy efficiency, reduce fossil energy consumption, and increase the use of clean energy. Therefore, the green credit may have positive impact on energy structure optimization. Through credit reallocation, it reduces fossil energy consumption and the resulting pollution emissions on the basis of meeting the energy demand necessary for economic development, which is beneficial to the green economy in China.

Referring to Yang et al. (2018), the share of fossil energy consumption is used to measure the energy structure, which is brought into Equation (8) to get the following equation:

where\( {Controls}_{it}^4 \) represents control variables, including the level of economic development (ECOit), infrastructure construction (INFit), the degree of opening(OPEit), the structure of industry (INDit), and the intensity of environmental regulation (REGit).

Table 11 shows the optimization effect of green credit on energy structure. According to the results in column (6), the spatial lag term of energy structure (W ∗ ES) is 0.217, which is statistically significant and positive at the 5% level, indicating a positive spatial correlation of energy structure within China. The spatial lag term of green credit (W ∗ GC) is − 0.221, indicating a significant and negative spatial spillover effect of green credit on fossil energy consumption in the surrounding areas. Furthermore, the direct effect of green credit on energy structure is − 0.217, which indicates that green credit can optimize the local energy structure; and the indirect effect is − 0.331, which indicates that green credit has spillover effect on energy structure in the surrounding areas. According to the total effect of green credit on energy structure, the increase of green credit can reduce the share of the fossil energy consumption and thus promote the green economy through the energy structure optimization effect.

Conclusions and policy implications

Taking the provincial panel dataset of China from 2007 to 2017 as the research sample, this study applies the Sup-SBM data envelopment analysis (DEA) with undesirable outputs to calculate the level of green economy within China. On this basis, the spatial panel Durbin models are established to study the local-neighborhood effect of green credit on green economy and its influencing mechanisms. The results show that there exists significant spatial correlation of green economy in different regions. The green credit has local-neighborhood effect on green economy; that is, the green credit can not only improve the local green economy but also generate spatial spillover effect to promote the green development in the surrounding areas. The above conclusion still holds after the robustness test by replacing spatial weight matrix and alternative explained variables. Furthermore, innovation efficiency and energy structure are important channels for green credit to improve the green economy. The green credit matters in the green transformation of economy through innovation-driven effect and energy structure optimization effect. The research of this study not only provides a new perspective for understanding the economic consequences of green credit but also provides empirical evidence for the important role of green finance in achieving the win-win situation between economic growth and environmental protection.

The above findings have significant policy implications for promoting green finance and sustainable development. First, we should pay more attention to the important role of financial policies (Zhang et al. 2019) such as green credit in economic development and environmental protection and promote green development by constructing a sound green financial market. Specifically, the government departments, as the supervisor and promoter of green finance, should increase government subsidies to build green financial infrastructure and design a reasonable and effective green incentive mechanism. What is more, it is necessary to guide and urge banks and enterprises to practice green principles. Financial institutions, as the main implementers of green finance, should advocate the Equator Principles (EPs), fully consider environmental risks in their financial activities, cultivate a green financial culture, and cooperate with relevant official departments to support the development of green and low-carbon industries. Enterprises are the main force of green development and should actively change their business philosophy, raise their awareness of environmental risks, and actively fulfill social responsibilities.

Second, we should consider the spatial spillover effect of green credit policy, strengthen inter-regional exchanges and cooperation, and enhance the driving effect of green credit on local green development and the demonstration effect on neighboring areas through joint implementation of green credit principles. Ultimately, the overall improvement of the green economy within China can be achieved. Third, it is necessary to clarify the transmission mechanisms of green credit on the environment and economy and thus adjust the policy according to the actual situation in a timely manner. This paper finds that green credit policy contributes to the development of green economy by improving innovation efficiency and optimizing energy structure, which contributes to the development of green economy. Therefore, it is important to increase support for green innovation and encourage enterprises to actively participate in greening production and operation. In addition, we should continue to promote clean energy, increase credit support for the clean energy sectors, and provide stable and sustainable energy security for economic and social development through optimizing the energy structure and thus contribute to the green economy.

Notes

Available at the official website of Equator Principles Association. https://equator-principles.com

Available at the official website of the People’s Bank of China. http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4201524/index.html

References

An S, Li B, Song D, Chen X (2021) Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur J Oper Res 292(1):125–142. https://doi.org/10.1016/j.ejor.2020.10.025

Andersen DC (2017) Do credit constraints favor dirty production? Theory and plant-level evidence. J Environ Econ Manag 84:189–208. https://doi.org/10.1016/j.jeem.2017.04.002

Battese GE, Coelli TJ (1992) Frontier production functions, technical efficiency and panel data: with application to paddy farmers in India. J Prod Anal 3(1):153–169. https://doi.org/10.1007/BF00158774

Biswas N (2011) Sustainable Green banking approach: the need of the hour. Bus Spectr 1(1):32–38

Cai H, Wang X, Tan C (2019) Green credit policy, incremental bank loans and environmental protection effect. Account Res 3:88–95

China Banking Regulatory Commission (2012) Notice of the China Banking Regulatory Commission on Issuing the Green Credit Guidelines. http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=9636&itemId=928&generaltype=0. Accessed 24 Feb 2012

Chen X, Li H, Qin Q, Peng Y (2021) Market-oriented reforms and China’s green economic development: an empirical study based on stochastic frontier analysis. Emerg Mark Financ Trade 57(4):949–971. https://doi.org/10.1080/1540496X.2019.1694885

Contreras G, Bos JWB, Kleimeier S (2019) Self-regulation in sustainable finance: the adoption of the Equator Principles. World Dev 122:306–324. https://doi.org/10.1016/j.worlddev.2019.05.030

Dong Q, Wen S, Liu X (2020a) Credit allocation, pollution, and sustainable growth: theory and evidence from China. Emerg Mark Financ Trade 56(12):2793–2811. https://doi.org/10.1080/1540496X.2018.1528869

Dong Z, He Y, Wang H, Wang H, Wang L (2020b) Is there a ripple effect in environmental regulation in China? Evidence from the local-neighborhood green technology innovation perspective. Ecol Indic 118:106773. https://doi.org/10.1016/j.ecolind.2020.106773

Dong G, Ge Y, Zhu W, Qu Y, Zhang W (2021) Coupling coordination and spatiotemporal dynamic evolution between green urbanization and green finance: a case study in China. Front Environ Sci 8(272):621846. https://doi.org/10.3389/fenvs.2020.621846

Elhorst JP (2014) Spatial econometrics: from cross-sectional data to spatial panels. Springer, New York

Gao X, Gao G (2018) A study on the relation between the scale of green credit and the competitiveness of commercial banks. Econ Probl 7:15–21. https://doi.org/10.16011/j.cnki.jjwt.2018.07.003

G20 Green Finance Study Group (2016) G20 Green Finance Synthesis Report 2016. http://unepinquiry.org/g20greenfinancerepositoryeng. Accessed 5 Sep 2016

Hu N, Cao D (2011) Green credit policy and environmental risk management of commercial banks. Econ Probl 3:103–107. https://doi.org/10.16011/j.cnki.jjwt.2011.03.027

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27:10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Hu G, Wang X, Wang Y (2021) Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ 98:105134. https://doi.org/10.1016/J.ENECO.2021.105134

Huang J, Chen X, Cai X, Zou H (2021a) Assessing the impact of energy-saving R&D on China’s energy consumption: Evidence from dynamic spatial panel model. Energy 218:119443. https://doi.org/10.1016/j.energy.2020.119443

Huang S, Fan ZP, Wang X (2021b) Optimal financing and operational decisions of capital-constrained manufacturer under green credit and subsidy. J Ind Manag Optim 17(1):261–277. https://doi.org/10.3934/jimo.2019110

International Energy Agency (2019) Global Energy & CO2 Status Report 2019. https://www.iea.org/reports/global-energy-co2-status-report-2019. Accessed 26 Mar 2019

Jin PZ, Peng C, Song ML (2019) Macroeconomic uncertainty, high-level innovation, and urban green development performance in China. China Econ Rev 55:1–18. https://doi.org/10.1016/j.chieco.2019.02.008

Li C, Gan Y (2021) The spatial spillover effects of green finance on ecological environment—empirical research based on spatial econometric model. Environ Sci Pollut Res 28:5651–5665. https://doi.org/10.1007/s11356-020-10961-3

Liu L, He L (2021) Output and welfare effect of green credit in China: evidence from an estimated DSGE model. J Clean Prod 294:126326. https://doi.org/10.1016/j.jclepro.2021.126326

Liu JY, Xia Y, Fan Y, Lin SM, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Lu Z, Fang Q (2018) Financial regulation and green finance development: practice and research review. Financ Regul Res 11:1–13. https://doi.org/10.13490/j.cnki.frr.2018.11.001

Ma L, Long H, Chen K, Tu S, Zhang Y, Liao L (2019) Green growth efficiency of Chinese cities and its spatio-temporal pattern. Resour Conserv Recycl 146:441–451. https://doi.org/10.1016/j.resconrec.2019.03.049

Pan D, Chen C, Grubb M, Wang Y (2021) Financial policy, green transition and recovery after the COVID-19. https://ssrn.com/abstract=3719695. Accessed 22 Feb 2021

People’s Bank of China (2020) Supporting low carbon development with green finance video speech at the Singapore FinTech Festival (SFF) 2020. http://www.pbc.gov.cn/en/3688110/3688175/4141703/index.html. Accessed 9 Dec 2020

Porter ME, Linde CVD (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118. https://doi.org/10.1257/jep.9.4.97

Radmehr R, Henneberry SR, Shayanmehr S (2021) Renewable energy consumption, CO2 emissions, and economic growth nexus: a simultaneity spatial modeling analysis of EU countries. Struct Change and Econ D 57:13–27. https://doi.org/10.1016/j.strueco.2021.01.006

State Council of China (2021) Calls for green, low-carbon and circular development. http://english.www.gov.cn/policies/latestreleases/202102/22/content_WS6033af98c6d0719374af946b.html. Accessed 22 Feb 2021

Scholtens B, Dam L (2007) Banking on the equator. Are banks that adopted the Equator Principles different from non-adopters? World Dev 35(8):1307–1328. https://doi.org/10.1016/j.worlddev.2006.10.013

Shao S, Zhang Y, Tian Z, Li D, Yang L (2020) The regional Dutch disease effect within China: A spatial econometric investigation. Energy Econ 88:104766. https://doi.org/10.1016/j.eneco.2020.104766

Song M, Xie Q, Shen Z (2021) Impact of green credit on high-efficiency utilization of energy in China considering environmental constraints. Energy Policy 153:112267. https://doi.org/10.1016/j.enpol.2021.112267

Su D, Lian L (2018) Does green credit policy affect corporate financing and investment? Evidence from publicly listed firms in pollution-intensive industries. J Financ Res 12:123–137

Sun J, Wang F, Yin H, Zhang B (2019) Money talks: the environmental impact of China’s green credit policy. J Policy Anal Manage 38(3):653–680. https://doi.org/10.1002/pam.22137

Tobler WR (1970) A computer movie simulating urban growth in the Detroit region. Econ Geogr 46:234–240. https://doi.org/10.2307/143141

United Nations Environment Programme (2011) Towards a green economy: pathways to sustainable development and poverty eradication. https://www.unep.org/resources/report/towards-green-economy-pathways-sustainable-development-and-poverty-eradication-10. Accessed 11 Feb 2011

United Nations Environment Programme (2021) UN Environment Assembly sets stage for green recovery. https://www.unep.org/news-and-stories/story/un-environment-assembly-sets-stage-green-recovery. Accessed 15 Feb 2021

Wang Y, Pan D, Yu P, Liang X (2019) China’s incentive policies for green loans: A DSGE approach. J Financ Res 11:1–18

Wang C, Li X, Wen H, Nie P (2021a) Order financing for promoting green transition. J Clean Prod 283:125415. https://doi.org/10.1016/j.jclepro.2020.125415

Wang Y, Lei X, Zhao D, Long R, Wu M (2021b) The dual impacts of green credit on economy and environment: evidence from China. Sustainability 13(8):4574. https://doi.org/10.3390/su13084574

Wen H, Lee CC, Zhou F (2021a) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94:105099. https://doi.org/10.1016/j.eneco.2021.105099

Wen S, Lin Z, Liu X (2021b) Green finance and economic growth quality: construction of general equilibrium model with resource constraints and empirical test. https://doi.org/10.16381/j.cnki.issn1003-207x.2020.2173. Accessed 20 Feb 2021

Wu J, Lu W, Li M (2020) A DEA-based improvement of China’s green development from the perspective of resource reallocation. Sci Total Environ 717:137106. https://doi.org/10.1016/j.scitotenv.2020.137106

Yang Z, Shao S, Yang L, Miao Z (2018) Improvement pathway of energy consumption structure in China’s industrial sector: from the perspective of directed technical change. Energy Econ 72:166–176. https://doi.org/10.1016/j.eneco.2018.04.003

Yang X, He L, Zhong Z, Wang D (2020) How does China’s green institutional environment affect renewable energy investments? The nonlinear perspective. Sci Total Environ 727:138689. https://doi.org/10.1016/j.scitotenv.2020.138689

Yin W, Zhu Z, Kirkulak-Uludag B, Zhu Y (2021) The determinants of green credit and its impact on the performance of Chinese banks. J Clean Prod 286:124991. https://doi.org/10.1016/j.jclepro.2020.124991

Yuan H, Feng Y, Lee CC, Cen Y (2020) How does manufacturing agglomeration affect green economic efficiency? Energy Econ 92:104944. https://doi.org/10.1016/j.eneco.2020.104944

Zhang D (2021) Green credit regulation, induced R&D and green productivity: revisiting the Porter Hypothesis. Int Rev Financ Anal 75:101723. https://doi.org/10.1016/j.irfa.2021.101723

Zhang D, Vigne SA (2021) The causal effect on firm performance of China’s financing–pollution emission reduction policy: Firm-level evidence. J Environ Manag 279:111609. https://doi.org/10.1016/j.jenvman.2020.111609

Zhang G, Zhang N (2020) The effect of China's pilot carbon emissions trading schemes on poverty alleviation: a quasi-natural experiment approach. J Environ Manag 271:110973. https://doi.org/10.1016/j.jenvman.2020.110973

Zhang B, Yang Y, Bi J (2011) Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J Environ Manag 92:1321–1327. https://doi.org/10.1016/j.jenvman.2010.12.019

Zhang DY, Zhang ZW, Managi S (2019) A bibliometric analysis on green finance: current status, development, and future directions. Financ Res Lett 29:425–430. https://doi.org/10.1016/j.frl.2019.02.003

Zhang J, Zhang K, Zhao F (2020) Research on the regional spatial effects of green development and environmental governance in China based on a spatial autocorrelation model. Struct Change Econ D 55:1–11. https://doi.org/10.1016/j.strueco.2020.06.001

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 153:112256. https://doi.org/10.1016/j.enpol.2021.112256

Zhao P, Zeng L, Lu H, Zhou Y, Hu H, Wei X (2020) Green economic efficiency and its influencing factors in China from 2008 to 2017: based on the super-SBM model with undesirable outputs and spatial Dubin model. Sci Total Environ 741:140026. https://doi.org/10.1016/j.scitotenv.2020.140026

Zhou G, Sun Y, Luo S, Liao J (2021) Corporate social responsibility and bank financial performance in China: the moderating role of green credit. Energy Econ 97:105190. https://doi.org/10.1016/j.eneco.2021.105190

Zhou X, Wu W (2018) The measurement and analysis of the inclusive green growth in China. J Quant Tech Econ 35(8):3–20. https://doi.org/10.13653/j.cnki.jqte.2018.08.001

Zhuo C, Deng F (2020) How does China’s Western development strategy affect regional green economic efficiency? Sci Total Environ 707:135939. https://doi.org/10.1016/j.scitotenv.2019.135939

Availability of data and materials

The datasets used and analyzed during the current study are available from the corresponding author on reasonable request.

Funding

This work was supported by the Project of National Social Science Foundation of China (No. 20BJY079) and the project of Humanity and Social Science of Ministry of Education of China (No. 19YJA790086).

Author information

Authors and Affiliations

Contributions

Conceptualization: Xiaodong Lei, Yanli Wang. Methodology: Xiaodong Lei. Formal analysis and investigation: Xiaodong Lei, Qi Chen. Writing, original draft preparation: Xiaodong Lei. Writing, review and editing: Yanli Wang, Dongxiao Zhao. Funding acquisition: Yanli Wang. Supervision: Yanli Wang. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

ESM 1

(DOCX 14 kb)

Rights and permissions

About this article

Cite this article

Lei, ., Wang, Y., Zhao, D. et al. The local-neighborhood effect of green credit on green economy: a spatial econometric investigation. Environ Sci Pollut Res 28, 65776–65790 (2021). https://doi.org/10.1007/s11356-021-15419-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15419-8