Abstract

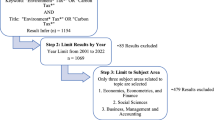

This study aims to provide a systematic literature review based on bibliometric analysis for scientific articles published between 1999 and 2019 extracted from Clarivate Analytics’ Web of Science (WOS) database. The current research project provides an overview of scientific publications, influential authors, and research journals. Our analysis reveals that the USA leads the academic research contribution, whereas China has provided the most research publications in recent years. Environmental and Resource Economics, University of London, and Barcena-Ruiz are the most productive journal, academic institution, and author in the field of environmental taxes, respectively. The degree of research contribution among researchers, institutional and national level, has an upward trend in recent years; however, the research contribution at the author level is higher than the institutional and national level. Furthermore, cocitation analysis suggests that research articles in the dataset are closely related. Pigou’s “The economics of welfare” published in 1920, is considered as the basic literature, and the “In defence of degrowth” authored by Giorgis Kallis is the most cited article. Our analysis of abstracts and keywords indicates that climate change, environmental taxes, double dividend, carbon tax, and environmental pollution are the hotspots within academic literature. We suggest that research collaboration between developed and developing nations and further coordination among environmental agencies such as IEA and IPCC will enhance the effectiveness of environmental reforms.

Similar content being viewed by others

Data availability

Research data can be obtained from the corresponding author through email.

References

Aimin Z (2008) The cluster analysis of co-occurrence strength in the field of knowledge management in 2006. Modern Information 28(5):30–33

Allan G, Lecca P, McGregor P, Swales K (2014) The economic and environmental impact of a carbon tax for Scotland: a computable general equilibrium analysis. Ecol Econ 100:40–50

Arbolino R, Romano O (2014) A methodological approach for assessing policies: the case of the environmental tax reform at European level. Procedia Economics and Finance 17:202–210

Aria M, Cuccurullo C (2017) Bibliometrix: an R-tool for comprehensive science mapping analysis. Journal of Informetrics 11(4):959–975

Armington PS (1969) A theory of demand for products distinguished by place of production. Staff Papers 16(1):159–178

Asafu-Adjaye J, Mahadevan R (2013) Implications of CO2 reduction policies for a high carbon emitting economy. Energy Econ 38:32–41

Bachus K, Van Ootegem L, Verhofstadt E (2019) 'No taxation without hypothecation': towards an improved understanding of the acceptability of an environmental tax reform. J Environ Policy Plan 21(4):321–332

Bashir MF, Shahzad U, Latif S, Bashir M (2015) The nexus between economic indicators and economic growth in Brazil. Nexus 13(1)

Bashir MF, Ma B, Shahbaz M, Jiao Z (2020a) The nexus between environmental tax and carbon emissions with the roles of environmental technology and financial development. PLoS One 15(11):e0242412. https://doi.org/10.1371/journal.pone.0242412

Bashir MF, MA B, Shahzad L, Liu B, Ruan Q (2020b) China’s quest for economic dominance and energy consumption: can Asian economies provide natural resources for the success of one belt one road? Manag Decis Econ. https://doi.org/10.1002/mde.3255

Bento AM, Jacobsen M (2007) Ricardian rents, environmental policy and the 'double-dividend'hypothesis. J Environ Econ Manag 53(1):17–31

Bobicki ER, Liu Q, Xu Z, Zeng H (2012) Carbon capture and storage using alkaline industrial wastes. Prog Energy Combust Sci 38(2):302–320

Bor YJ, Huang Y (2010) Energy taxation and the double dividend effect in Taiwan's energy conservation policy—an empirical study using a computable general equilibrium model. Energy Policy 38(5):2086–2100

Bosquet BT (2000) Environmental tax reform: does it work? A survey of the empirical evidence. Ecol Econ 34(1):19–32

Bovenberg AL, Goulder LH (2002) Environmental taxation and regulation handbook of public economics, vol 3. Elsevier, pp 1471–1545

Bowen A, Cochrane S, Fankhauser S (2012) Climate change, adaptation and economic growth. Clim Chang 113(2):95–106

Bye T, Bruvoll A (2008) Multiple instruments to change energy behaviour: the emperor’s new clothes? Energy Efficiency 1(4):373–386

Callon M, Courtial JP, Laville F (1991) Co-word analysis as a tool for describing the network of interactions between basic and technological research: the case of polymer chemsitry. Scientometrics 22(1):155–205

Carbone JC, Morgenstern RD, Williams III RC, Burtraw D (2013) Deficit reduction and carbon taxes: budgetary, economic, and distributional impacts. Resources for the Future

Carraro C, Galeotti M, Gallo M (1996) Environmental taxation and unemployment: some evidence on the ‘double dividend hypothesis’ in Europe. J Public Econ 62(1–2):141–181

Chaabane A, Ramudhin A, Paquet M (2012) Design of sustainable supply chains under the emission trading scheme. Int J Prod Econ 135(1):37–49

Chen L, Zhao X, Tang O, Price L, Zhang S, Zhu W (2017) Supply chain collaboration for sustainability: a literature review and future research agenda. Int J Prod Econ 194:73–87

Ciaschini M, Pretaroli R, Severini F, Socci C (2012) Regional double dividend from environmental tax reform: an application for the Italian economy. Res Econ 66(3):273–283

De Bakker FG, Groenewegen P, Den Hond F (2005) A bibliometric analysis of 30 years of research and theory on corporate social responsibility and corporate social performance. Bus Soc 44(3):283–317

Deng J, Zhang Y, Qin B, Yao X, Deng Y (2017) Trends of publications related to climate change and lake research from 1991 to 2015. J Limnol 76(3)

Dresner S, Jackson T, Gilbert N (2006) History and social responses to environmental tax reform in the United Kingdom. Energy Policy 34(8):930–939

Ekins P (1999) European environmental taxes and charges: recent experience, issues and trends. Ecol Econ 31(1):39–62

Ellerman AD, Buchner BK (2007) The European Union emissions trading scheme: origins, allocation, and early results. Rev Environ Econ Policy 1(1):66–87

Europea C, Fifth E (1992) Environmental action program (towards sustainability: COM (92) 23). Commissione Europea, Bruxelles

Fernández E, Pérez R, Ruiz J (2011) Optimal green tax reforms yielding double dividend. Energy Policy 39(7):4253–4263

Fraser I, Waschik R (2013) The double dividend hypothesis in a CGE model: specific factors and the carbon base. Energy Econ 39:283–295

Freire-González J, Ho M (2018) Environmental fiscal reform and the double dividend: evidence from a dynamic general equilibrium model. Sustainability 10(2):501

Fullerton D, Heutel G (2007) The general equilibrium incidence of environmental taxes. J Public Econ 91(3–4):571–591

Glomm G, Kawaguchi D, Sepulveda F (2008) Green taxes and double dividends in a dynamic economy. J Policy Model 30(1):19–32

Goulder LH (2013) Climate change policy's interactions with the tax system. Energy Econ 40:S3–S11

Haunschild R, Bornmann L, Marx W (2016) Climate change research in view of bibliometrics. PLoS One 11(7):e0160393

He Q (1999) Knowledge discovery through co-word analysis

He P, Sun Y, Shen H, Jian J, Yu Z (2019) Does environmental tax affect energy efficiency? An empirical study of energy efficiency in OECD countries based on DEA and logit model. Sustainability 11(14):3792

Hirsch JE (2005) An index to quantify an individual's scientific research output. Proc Natl Acad Sci 102(46):16569–16572

Hu X, Sun Y, Liu J, Meng J, Wang X, Yang H, Cu J, Yi K, Xiang S, Li Y (2019) The impact of environmental protection tax on sectoral and spatial distribution of air pollution emissions in China. Environ Res Lett 14(5):054013

Kallbekken S, Saelen H (2011) Public acceptance for environmental taxes: self-interest, environmental and distributional concerns. Energy Policy 39(5):2966–2973

Kallis G (2011) In defence of degrowth. Ecol Econ 70(5):873–880

Kim W, Chattopadhyay D, Park JB (2010) Impact of carbon cost on wholesale electricity price: a note on price pass-through issues. Energy 35(8):3441–3448

Krass D, Nedorezov T, Ovchinnikov A (2013) Environmental taxes and the choice of green technology. Prod Oper Manag 22(5):1035–1055

Li A, Lin B (2013) Comparing climate policies to reduce carbon emissions in China. Energy Policy 60:667–674

Li L, Zhu QH (2008) An empirical study of Coauthorship analysis using social network analysis [J]. Inf Sci 4(200)

Li Y, Yang P, Wang H (2018) Collecting coal fired power environmental tax to promote wind power development and environmental improvement. Acta Sci Malays 2:05–08

Lijia ZW (2008) The research of co-word analysis (1)—the process and methods of co-word analysis [J]. Journal of Information 5

Lu C, Tong Q, Liu X (2010) The impacts of carbon tax and complementary policies on Chinese economy. Energy Policy 38(11):7278–7285

Mao G, Liu X, Du H, Zuo J, Wang L (2015) Way forward for alternative energy research: a bibliometric analysis during 1994–2013. Renew Sust Energ Rev 48:276–286

Metcalf GE (1999) A distributional analysis of green tax reforms. Natl Tax J:655–681

Molinari JF, Molinari A (2008) A new methodology for ranking scientific institutions. Scientometrics 75(1):163–174

Nyborg K, Howarth RB, Brekke KA (2006) Green consumers and public policy: on socially contingent moral motivation. Resour Energy Econ 28(4):351–366

Oates WE (1995) Green taxes: can we protect the environment and improve the tax system at the same time? South Econ J 61:915–922

Orlov A, Grethe H, McDonald S (2013) Carbon taxation in Russia: prospects for a double dividend and improved energy efficiency. Energy Econ 37:128–140

Ouyang X, Mao X, Sun C, Du K (2019) Industrial energy efficiency and driving forces behind efficiency improvement: evidence from the Pearl River Delta urban agglomeration in China. J Clean Prod 220:899–909

Pachauri RK, Allen MR, Barros VR, Broome J, Cramer W, Christ R, Church JA, Clarke L, Dahe Q, Dasgupta P (2014) Climate change 2014: synthesis report. Contribution of working groups I II and III to the fifth assessment report of the Intergovernmental Panel on Climate Change, 151

Parry IW, Bento AM (2000) Tax deductions, environmental policy, and the “double dividend” hypothesis. J Environ Econ Manag 39(1):29

Patuelli R, Nijkamp P, Pels E (2005) Environmental tax reform and the double dividend: a meta-analytical performance assessment. Ecol Econ 55(4):564–583

Pereira AM, Pereira RM, Rodrigues PG (2016) A new carbon tax in Portugal: a missed opportunity to achieve the triple dividend? Energy Policy 93:110–118

Pigou AC (1920) The economics of welfare: London

Price DJ (1963) Little science, big science. Columbia University Press, New York

Radulescu M, Sinisi C, Popescu C, Iacob S, Popescu L (2017) Environmental tax policy in Romania in the context of the EU: double dividend theory. Sustainability 9(11):1986

Renlei YSZJ (2011) Research hotspots analysis of digital library based on keywords co-occurrence analysis and social network analysis [J]. Journal of Academic Libraries 4

Rodríguez M, Robaina M, Teotónio C (2019) Sectoral effects of a green tax reform in Portugal. Renew Sust Energ Rev 104:408–418

Saveyn B, Van Regemorter D, Ciscar JC (2011) Economic analysis of the climate pledges of the Copenhagen Accord for the EU and other major countries. Energy Econ 33:S34–S40

Shahzad U (2020) Environmental taxes, energy consumption, and environmental quality: theoretical survey with policy implications. Environ Sci Pollut Res Int 27:24848–24862

Shinwell M, Cohen G (2020) Measuring countries’ progress on the sustainable development goals: methodology and challenges. Evolutionary and Institutional Economics Review 17(1):167–182

Speck S (2017) Environmental tax reform and the potential implications of tax base erosions in the context of emission reduction targets and demographic change. Econ Polit 34(3):407–423

Sun C, Ouyang X (2016) Price and expenditure elasticities of residential energy demand during urbanization: an empirical analysis based on the household-level survey data in China. Energy Policy 88:56–63

Sun R, Wan W (2019) Government strategy for environmental pollution prevention and control based on evolutionary game theory. Nat Environ Pollut Technol 18(2):563–567

Talbi B, Jebli MB, Bashir MF, Shahzad U (2020) Does economic progress and electricity price induce electricity demand: a new appraisal in context of Tunisia. J Public Aff:e2379

Tracey S, Anne B (2008) OECD insights sustainable development linking economy, society, environment: linking economy, society, environment. OECD Publishing

Wei Y, Mi Z, Zhang H (2013) Progress of integrated assessment models for climate policy. Syst Eng Theory Pract 33(8):1905–1915

Wei Y, Yuan X, Wu G, Yang L (2014) Climate change risk assessment: a bibliometric analysis based on web of science. Bulletin of National Natural Science Foundation of China 28(5):347–356

Wesseh PK Jr, Lin B (2016) Modeling environmental policy with and without abatement substitution: a tradeoff between economics and environment? Appl Energy 167:34–43

Wesseh PK Jr, Lin B (2020) Does improved environmental quality prevent a growing economy? J Clean Prod 246:118996

West SE, Williams III RC (2012) Estimates from a consumer demand system: implications for the incidence of environmental taxes fuel taxes and the poor (pp. 98-125): RFF Press

Yu H, Wei YM, Tang BJ, Mi Z, Pan SY (2016) Assessment on the research trend of low-carbon energy technology investment: a bibliometric analysis. Appl Energy 184:960–970

Zhang K, Wang Q, Liang QM, Chen H (2016a) A bibliometric analysis of research on carbon tax from 1989 to 2014. Renew Sust Energ Rev 58:297–310

Zhang X, Guo Z, Zheng Y, Zhu J, Yang J (2016b) A CGE analysis of the impacts of a carbon tax on provincial economy in China. Emerg Mark Financ Trade 52(6):1372–1384

Zhou W (2020) In defence of the WTO: why do we need a multilateral trading system? Legal Issues of Economic Integration 47(1):9–42

Funding

We acknowledge the financial support by the Ministry of Education-China Mobile Joint Laboratory Grant Number: 2020MHL02005.

Author information

Authors and Affiliations

Contributions

Authors’ contributions are the following.

Muhammad Farhan Bashir—writing—review and editing, data curation.

Benjiang MA—supervision, project administration.

Bilal—methodology.

Bushra Komal—resources.

Muhammad Adnan Bashir—investigation, formal analysis.

Corresponding author

Ethics declarations

Ethical approval

We certify that the manuscript titled. “Analysis of Environmental taxes publications: A bibliometric and systematic literature review” (hereinafter referred to as “the Paper”) has been entirely our original work except otherwise indicated, and it does not infringe the copyright of any third party. The submission of the Paper to Environmental Science and Pollution Research implies that the paper has not been published previously (except in the form of an abstract or as a part of a published lecture or academic thesis), that it is not under consideration for publication elsewhere, that its publication is approved by all authors and that, if accepted, will not be published elsewhere in the same form, in English or any other language, without the written consent of the Publisher.

Copyrights for articles published in Environmental Science and Pollution Research are retained by the author(s), with first publication rights granted to Environmental Science and Pollution Research.

Consent to participate

We affirm that all authors have participated in the research work and are fully aware of ethical responsibilities.

Consent to publish

We affirm that all authors have agreed for submission of the Paper to ESPR and are fully aware of ethical responsibilities.

Competing interests

The authors declare that they have no conflict of interest.

Additional information

Responsible Editor: Baojing Gu

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bashir, M., MA, B., Bilal et al. Analysis of environmental taxes publications: a bibliometric and systematic literature review. Environ Sci Pollut Res 28, 20700–20716 (2021). https://doi.org/10.1007/s11356-020-12123-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-12123-x

Keywords

- Environmental tax

- Bibliometric analysis

- Massive literature data

- Frequency and cooccurrence analysis

- Research trends