Abstract

The paper considers a dynamic two-firm model of intra-industry trade in which the firms compete for the same market on the basis of product reliability. By assumption, the home firm always has the reliability cost advantage but it may or may not have the manufacturing cost advantage. The results suggest that reliability improvement always helps customers in that they pay a lower full quality price. Comparing the home firm with the foreign firm, metrics such as price, sales, profit margins, and variable profits depend on the relative costs, with the low cost firm performing better. Finally, although this is not the common outcome, the paper suggests that it is possible for the reliability cost advantages gained by R&D expenditures to overcome manufacturing cost disadvantages.

Similar content being viewed by others

References

Colombo, L., Lambertini, L., & Mantovani, A. (2009). Endogenous transportation technology in a Cournot differential game with intraindustry trade. Japan and the World Economy, 21(2), 133–139.

Confessore, G., & Mancuso, P. (2002). A dynamic model of R&D competition. Research in Economics, 56(4), 365–380.

DeCourcy, J. (2005). Cooperative R&D and strategic trade policy. Canadian Journal of Economics, 38(2), 546–573.

Dockner, E. J., Feichtinger, G., & Mehlmann, A. (1993). Dynamic R&D competition with memory. Journal of Evolutionary Economics, 3(2), 145–152.

Herguera, I., & Lutz, S. H. (2003). The effect of subsidies to product innovation on international competition. Economics of Innovation and New Technology, 12(5), 465–480.

Herguera, I., Kujal, P., & Petrakis, E. (2000). Quantity restrictions and endogenous quality choice. International Journal of Industrial Organization, 18(8), 1259–1277.

Highfill, J. & McAsey, M. (2010). Dynamic product reliability management for a firm with a complacent competitor vs. a lockstep competitor. Journal of Economics, forthcoming.

Joshi, S., & Vonortas, N. S. (2001). Convergence to symmetry in dynamic strategic models of R&D: the undiscounted case. Journal of Economic Dynamics and Control, 25(12), 1881–1897.

Lenhart, S., & Workman, J. T. (2007). Optimal control applied to biological models. Boca Raton: Chapman & Hall/CRC.

Petit, M. L., & Tolwinski, B. (1999). R&D cooperation or competition? European Economic Review, 43(1), 185–208.

Petit, M. L., Sanna-Randaccio, F., & Tolwinski, B. (2000). Innovation and foreign investment in a dynamic oligopoly. International Game Theory Review, 2(1), 1–28.

Petit, M. L., Sanna-Randaccio, F., & Sestini, R. (2009). Asymmetric knowledge flows and localization with endogenous R&D: a dynamic analysis. Economic Modelling, 26(2), 536–547.

Suetens, S. (2008). Does R&D cooperation facilitate price collusion? An experiment. Journal of Economic Behavior and Organization, 66(3–4), 822–836.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The parameters for the main example are W 0 = 100, V 0 = 200, N 0 = 60, \( m{c_{10}} = m{c_{20}} = 72 \), K 0 = 140, k = 0.03, \( r = s = \rho = 0.025 \), ξ = 0.5, \( {X_{10}} = {X_{20}} = 0.68 \), and T = 3.

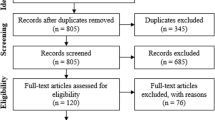

For the Monte Carlo simulation, the parameters were chosen independently and randomly from a 60%-interval (±30%) around their value in the example. The parameter k, as suggested by Highfill and McAsey (2010), must be orders of magnitude smaller than the other parameters and is the same for all observations.

The selection of 60%-intervals was determined by two factors. First, increasing the width of the randomization interval resulted in significant decreases in the number of data sets with positive prices and quantities. Using the 60% intervals there were 310 observations that generated such solutions out of 700 randomly generated parameter sets. Second, with significantly longer randomization intervals, the number of data sets that failed to produce convergent solutions increased significantly.

Rights and permissions

About this article

Cite this article

Highfill, J., McAsey, M. Firm Metrics with Continuous R&D, Quality Improvement, and Cournot Quantities. Int Adv Econ Res 16, 243–256 (2010). https://doi.org/10.1007/s11294-010-9269-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-010-9269-9