Abstract

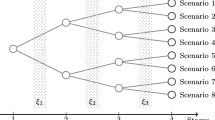

The progressive hedging algorithm for stochastic programming problems in single or multiple stages is a decomposition method which, in each iteration, solves a separate subproblem with modified costs for each scenario. The decomposition exploits the separability of objective functions formulated in terms of expected costs, but nowadays expected costs are not the only objectives of interest. Minimization of risk measures for cost, such as conditional value-at-risk, can be important as well, but their lack of separability presents a hurdle. Here it is shown how the progressive hedging algorithm can nonetheless be applied to solve many such problems through the introduction of additional variables which, like the given decision variables, get updated through aggregation of the independent computations for the various scenarios.

Similar content being viewed by others

References

Rockafellar, R.T., Uryasev, S.: Optimization of conditional value-at-risk. J. Risk 2, 21–43 (2000)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Fin. 26, 1443–1471 (2002)

Rockafellar, R.T., Uryasev, S.: The fundamental risk quadrangle in risk management, optimization and statistical esimation. Surv. Oper. Res. Manag. Sci. 18, 33–53 (2013)

Rockafellar, R.T., Wets, R.: Scenarios and policy aggregation in optimization under uncertainty. Math. Oper. Res. 16, 119–147 (1991)

Watson, J.-P., Woodruff, D.L.: Progressive hedging innovations for a class of stochastic mixed-integer resource allocation problems. Comput. Manag. Sci. 8, 355–370 (2010)

Acknowledgments

This research was sponsored by DARPA EQUiPS grant SNL 014150709.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rockafellar, R.T. Solving Stochastic Programming Problems with Risk Measures by Progressive Hedging. Set-Valued Var. Anal 26, 759–768 (2018). https://doi.org/10.1007/s11228-017-0437-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11228-017-0437-4

Keywords

- Stochastic programming progressive hedging algorithm

- Problem decomposition

- Risk measures

- Conditional value-at-risk