Abstract

While many studies have examined the influence of urbanization on income inequality, the study on the moderating effect of governance on the relationship between urbanization and income inequality remains quite inexistent. To fill this gap in the literature, the study examines the moderation of governance quality on the influence of urbanization on income inequality in 46 African economies from 1996 to 2020. A two stage system GMM estimation approach has been used to achieve this goal. The results unveil that the impact of urbanization on income inequality is positive and significant, meaning that increase in urbanization exacerbates income inequality in Africa. However, the results show that the improvement of governance quality could contribute to improve income distribution in urban areas. Interestingly, the results show that improving governance quality in Africa could contribute to spurring a positive urbanization which could contribute to promote urban economic growth and reduce income inequality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, income inequality has been widely debated among policymakers and researchers both in developed and developing countries, as it has increased dramatically (Dossou et al., 2021). According to Shi et al., (2020) and Dossou et al., (2023), rising income inequality could hamper economic growth. Similarly, a high level of income inequality could induce political instability, which by extension, could retard economic growth. In the same sense, Ajide and Alim (2021) opined that increasing income inequality could negatively affect investment in education, which, in turn, could contribute to the exacerbation of terrorism and thereby hampering economic growth. Very recently, Folarin and Adeniyi (2019) argued that poverty and income inequality are highly interrelated in Africa. Similarly, Castells-Quintana and Royuela (2015) argued that the increase of income inequality could reduce private investment physical capital and human capital, which by extension could negatively affect future production capacities. In the same account, Zhao and Xia (2020), Zhao (2020), and Dossou et al., (2021) have empirically shown that income inequality contributes to the exacerbation of the level of poverty in China and Latin America, respectively.

Recently, urbanization has been seen an important driver of economic growth. As argued by Sulemana et al., (2019), no country can achieve sustainable economic growth and economic development without concrete urbanization. According to the World Bank’s report, urban population account for 55% world population and it is expected to increase by 2050.Footnote 1 similarly, World Bank (2017) report showed that increased in urbanization contributes to boosting economic growth through increasing demand among urban businesses and individual consumers for more agricultural products. Underlying these arguments, several studies have assessed the relationship between urbanization and economic growth and unveiled a positive relationship between urbanization and economic growth (Turok & McGranahan, 2013). Further, recent studies have translated the positive contribution of urbanization to economic growth into socio-economic development. Therefore, many studies have investigated the influence of urbanization on income inequality (Ha et al., 2020; Sulemana et al., 2019). However, two opposite findings have been found in these studies (Sulemana et al., 2019). On the one hand, some studies concluded that urbanization exacerbates income inequality. As argued by Ekeocha (2021), urbanization could contribute to income inequality due to high unskilled labour in urban areas. According to Nguyen et al. (2020), urbanization is an important tool for income distribution, unless good policy towards education has accompanied it. On the other hand, some studies revealed that urbanization could contribute to reducing income inequality. As urbanization can contribute to promoting structural change, Sulemana et al., (2019) postulated that it could reduce income inequality by providing job opportunities. Similarly, Turok and McGranahan (2013) documented that urbanization could contribute to promoting industrialization, which by extension, could contribute to lessening income inequality through improving employment opportunities. This has been corroborated by the World Bank’s report, which argued that the concentration of economic activity could contribute to improve living standard, reducing income inequality and poverty.Footnote 2 Recently, Sulemana et al. (2019) argued that lack of consensus among previous could be attributed to their sample period, estimation technique, the choice of a variable.

We also argued that the lack of consensus among previous studies could be ascribed to using the Gini index as a proxy of income inequality. According to Asongu and Odhiambo (2019) and Ofori et al., (2022), the Gini index is subjected to criticism as it has failed to account for all extremities of the income distribution. For example, ) documented that the Gini index has failed to account for educational inequality. Likewise, Njangang et al., (2021) opined that the Gini index does not account for wealth inequality. Similarly, Liu and Long (2021) argued that the Gini index has failed to account for regional disparities. In the same context, the Gini index has failed to racial discrimination. To overcome this challenge, new income inequality indicators, namely the Palma ratio, Theil index, and Atkinson index, have been considered to account for all extremities to income distribution. While the Palma ratio accounts for the bottom and top income,Footnote 3 the Atkinson index determines which end of the distribution contributed most to the observed inequality.Moreover, the Theil index is used to measure racial segregation.Footnote 4 However, to our knowledge, no study has looked at the relationship between urbanization and income inequality using these new income inequality indicators. Consistent with these arguments, it compels us to consider a further investigation, which has been highly recommended by previous studies (Liu & Long, 2021; Sulemana et al., 2019).

Meanwhile, good governance is the fulcrum in which urbanization can affect income distribution. According to Acemoglu et al., (2004) and North and Douglass (1989), the quality of institutions matters for economic growth. In the same vein, Dossou et al., (2021) documented that no country can achieve sustainable economic growth without good institutions. For example, good quality of institutions could spur urban infrastructural development, which by extension, could contribute to promoting income distribution (World Bank, 2011). Similarly, Di Clemente et al., (2021) opined that good quality of institutions could positively affect investment in education, which remains important to close the regional gap. In the same spirit, Le et al., (2020) argued that good quality of institutions is needed to boost agglomeration economies, which could significantly reduce income inequality. It has also been indicated that good quality of institutions could play a significant role in boosting productivity and competition, which could contribute to promoting urbanization and promoting income distribution through improving job opportunities, wage and social welfare (Wall, 2018). Good institution can help to increase investment in infrastructure, which by extension, can promote urbanization and lessen income inequality (Ha et al., 2020). In the same context, good institution is associated with sustainable economic growth due to its capacity to promote connective infrastructure, reducing regional disparities (World Bank, 2011). Despite these arguments, the study on the moderating effect of governance quality on the relationship between urbanization and income inequality is quite scarce.

Africa has been selected for this study for at least three reasons. First, in recent years, Africa has recorded good economic performance (Ofori et al., 2021a, 2021b, 2022a, 2022b, 2022c). Despite such performance, income inequality still persists. According to Meniago and Asongu (2018), Africa remains the most unequal continent globally. For example, among the 19 most unequal countries in the world, ten are in Africa (Ujunwa et al., 2021). Consistent with this argument, (Ofori et al., (2022a, 2022b, 2022c) argued that African growth is not inclusive and call for include growth. Recently, inequality has been exacerbated globally, especially in Africa due the havoc COVID-19 pandemic on the world economy ( Ofori & Asongu, 2021; (Ofori et al., 2021a). For example, according to the World Bank report, the COVID-19 pandemic has pushed up 40 million people into extreme poverty.Footnote 5 Similarly, African growth has been expected to decline by 3% in 2020 (Ofori & Asongu, 2021). Likewise, the COVID-19 pandemic has contributed to increasing unemployment rate in Africa.Footnote 6 Consistent with these arguments, ) pointed out the negative effect of COVID-19 pandemic on the achievement of Sustainable Development Goals by 2030. As posited by Xu et al., (2021), there is a high correlation between income inequality, political instability and crime. A high income inequality is associated with high crime which by extension, could hinder economic growth. Second, according to Sulemana et al., (2019), urbanization rate in Africa has increased from 38% in 2010 to 50% in 2015. Unfortunately, a bourgeoning urbanization in Africa has been associated with unskilled labour which lead to the increase of income inequality. Third, while good institutions remain important to promote economic growth, Africa still continues to deal with poor institutions (see Fig. 1). Recently, Ogbonna et al., (2022) have termed African institutions as an extractive institution. As shown in Fig. 1, corruption still remain high in Africa. As argued by Xu et al., (2021), a rise in corruption could lead to political instability, which by extension could hamper economic growth and increase income inequality. This has been corroborated by Kazeem Bello Ajide and Alimi (2021a, 2021b), who argued that increased in income inequality could contribute to the exacerbation of terrorism, which retard economic growth in the continent. Consistent with these reasons, it is an imperative to investigate the moderating effect of governance quality on the influence of urbanization on income inequality.

The contributions of this study are two-fold. First, although the linkage between urbanization and income inequality using the Gini index has been extensively examined, the relationship between urbanization and income inequality using new measurements such as the Palma ratio, Atkinson index and Theil index is quite inexistent. As discussed earlier, previous studies have used the Gini index as a proxy of income inequality which has failed to account for all extremities of the income distribution (Sulemana et al., 2019). For example, the Gini index has failed to account for education inequality which contribute to increasing urban disparities. Likewise, the Gini index has failed to account for infrastructure disparities which contribute to the exacerbation of regional disparities. Consistent with these argument, this study tries to complement to the existing literature by investigating the relationship between urbanization and income inequality using the Palma ratio, Atkinson index and Theil index. This study covers 46 African countries over the period 1996–2020. Second, this study contributes to the literature by examining the moderating effect of governance quality on the relationship between urbanization and income inequality. According to the United Nations, no country can achieve sustainable development without good institutions (Dossou et al., 2021).

2 Literature Review

2.1 Empirical Findings on Urbanization and Income Inequality

According to previous studies, urbanization could positively or negatively contribute to income distribution (Sulemana et al., 2019). Beginning with the positive effect, Urbanization can affect income distribution through several channels. As argued by Turok and McGranahan (2013), urbanization can contribute to reduce income inequality through economic growth. Based on the influential work of Kuznets (1955), Kuznets argued that economic growth and income inequality could have inverted U-shaped relationship. As an explanation, after reaching the threshold, economic growth can contribute to reduce income inequality through industrialization which is highly related to urbanization. This has been further supported by endegenous growth and the new economic geography which play a significant role in promoting urbanization (Baldwin & Martin, 2004). For example, Turok and McGranahan (2013) argued that the process of creation of new firms is expected to improve job opportunities, which by extension could contribute to lessening income inequality. Similarly, Sulemana et al., (2019) postulated that the process of urbanization can stimulate structural change, which, in turn, could contribute to promoting economic growth and reducing income inequality.

Similarly, technological innovation remains an important channel through which urbanization could contribute to lowering income inequality (Kumar & Vishnoi, 2022). Innovation occurs in large cities due to cluster of industrialization. According to Nguyen et al., (2021), innovation can spur entrepreneurship, which by extension could contribute to providing job opportunities and thereby reducing income inequality. As argued by Goi (2017), innovations stems from large cities, which seems to contribute to promoting economic growth and creating job opportunities, by extension could contribute to lessening income inequality.

As urbanization is related to infrastructural development, Nchofoung and Asongu (2022) argued that investment in infrastructure could contribute to reducing income inequality by providing employment opportunities. This has been corroborated by the African Development (AfDB, 2016)’s report which documented that two-thirds of the urban infrastructural investments are still in the process to be realized between now and 2050 in Africa, which could contribute to enhancing economic growth, creating job opportunities and reducing income inequality. As documented by World Bank (2017), a rise in urbanization could contribute to increasing in urban infrastructure and services, which directly could contribute to promoting economic growth, job opportunities and reducing income inequality and poverty.

Structural change is another channel through which urbanization could contribute to reduce income inequality. According to Malah Kuete and Asongu, (2022), structural change means structural transformation which is defined as a process for an economy to move from low productivity and labour-intensive economic activities to higher productivity and skill-intensive activities. As documented by World Bank, urbanization has been seen an important factor to promote national economy through investing in infrastructure and human capital.Footnote 7 Further, it has been argued that such process could create job opportunities, which by extension could contribute to the reduction of income inequality. Moreover, the report documented that the growing in manufacturing sector is expected to improve employment opportunities, which in turn could contribute to the promotion of income distribution. This has been corroborated by Michaels et al., (2012) who argued that the conflation of industrialisation with urbanization can contribute to the reduction of income inequality through employment growth. In the same context, Gnangnon (2020) argued that urbanization could contribute to reduce income inequality through promoting manufacturing exports and services export diversification. In the same vein, Ogbonna et al., (2022) documented that urbanization and foreign direct investment are expected to promote sector growth, which by extension could contribute to lessen income inequality. In the same line, it has been argued that through urbanization, foreign direct investment could contribute to promote export diversification, which in turn could contribute to achieving achieve sustained employment generation (Gerschewski 2013; World Bank 2017).

Conversely, other studies show that urbanization can contribute to the exacerbation of income inequality. For example, unmanaged urban plan could lead to congestion, which by extension could lead to crime, social instability and retard economic activities. As a result, unmanaged urban plan could contribute to heightening income inequality (Ali et al., 2021). This has been substantiated by Lawrence (2002) who postulated that unplanned urbanization could increase homeless, which could increase crime, by extension could hamper economic growth and thereby increasing income inequality. In the same vein, Chen et al., (2016) said that an unplanned urbanization could lead to social deprivation, which in turn could hinder economic growth and exacerbate income inequality. Similarly, Ha et al., (2020) documented that a rise in urbanization could lead to the increase of income inequality in short term due to the wages disparities among rural and urban workers. In the same sense, Nijman and Dennis (2020) posited that a bourgeoning urbanization could lead to pollution which will negatively affect the marginalized people.

2.2 Empirical Findings on Governance Quality and Income Inequality

According to institutional economists such as Acemoglu et al., (2004) and North and Douglass (1989), good institution or governance is seen as a major input for economic growth. Recently, the World Economic Forum’s report argued that both private and public institutions could play a vital role in promoting long-term economic growth.Footnote 8 This has been corroborated by Dossou et al., (2021) who argued that economic institutions can ensure efficient markets which in turn could contribute to enhance economic growth. Recently, the positive effect of the quality of institutions on economic growth has been translated into socio-economic development. Recently, the relationship between the quality of institutions and income inequality has long been examined (Ofori et al., 2022a, 2022b, 2022c). However, the quality of institutions has a dual impact on income inequality. On the one hand, some scholars concluded that good institutions could contribute to promote income distribution (Ofori et al., 2022a, 2022b, 2022c). For example, Sou and Vinnicombe (2021) posited that good governance can contribute to reduce transaction cost which by extension could contribute to attracting foreign direct investment, create job opportunities and hence reduce income inequality. In the same vein, Ofori et al., (2022a, 2022b, 2022c) postulated that good institution is expected to reduce crime which can contribute to increase the confidence of foreign investors to create more job opportunities and reduce income inequality. In the same spirit, Dossou et al., (2021) said that good governance could foster trust and cooperation between public and private investors who can contribute to create employment opportunities and reduce income inequality.

Conversely, on the other hand, some studies show that bad governance could contribute to increase income inequality. For example, Sou and Vinnicombe (2021) argued that bad governance could contribute to increase the level of corruption, which by extension could contribute to the exacerbation of income inequality. In the same vein, Xu et al., (2021) documented that bad governance could contribute to undermining political instability which could contribute to retard economic growth and increase income inequality.

3 Model Specification, Data and Methodology

3.1 Model Specification

To examine the moderating effect of governance quality on the urbanization-income inequality nexus, we followed an influential work by Kuznets (1955) who established an inverted U-shaped relationship between income inequality. Thus, the basic model can be specified as followed.

where IIE, GDPpc, GDPpc2, and \(\varepsilon_{it}\) denote income inequality, gross domestic product per capita, square of gross domestic product per capita and error term, respectively.

According to Xu et al., (2021), Canh et al., (2020), Le et al., (2020), and Ofori et al., (2021a, 2021b) income distribution can be affected by several factors, namely trade openness (TOP), foreign direct investment (FDI), industrialization (INDU), human capital (HC) and Information and communication technology (ICT). Therefore, the model 1 can extended as follows.

Theoretically, an inverted U-shape of Kuznets (1955) can be used to explain the relationship between urbanization and income inequality. According to Kuznets, at the early stage, economic growth seems to worsen incomē inequality, while later it seems to improve social welfare, income distribution and poverty reduction through promoting democracy and developing industrialization and urbanization. Moreover, economic development cannot be achieved without good governance as suggested by (Adams & Klobodu, 2019). According to the authors, implementing good policy toward urbanization can propel economic development. Considering these arguments, this study tries to capture the moderating effect of governance quality on the urbanization-income inequality nexus. Thus, the model 2 can be modified as follows.

where GOV is governance quality, which is control of corruption, governance effectiveness, regulatory quality, rule of law, political stability and voice and accountability, URB is urbanization.

3.2 Data

This study uses a panel of 46 African economiesFootnote 9 over the period 1996–2020. The descriptions and measurements of the variables are stated below.

3.3 Dependent Variable

-

Income inequality (IIE)

Following a study by Asongu and Odhiambo (2019), we use three income inequality indicators, namely the Palma ratio, Atkinson index and Theil index. The required data on the Palma ratio, Atkinson index and Theil index has been extracted from the Global Consumption and Income Project.

3.4 Independent Variable

-

Urbanization (URB)

Following a study by Nguyen et al., (2020) and Canh et al., (2020), this study uses urban population as a percentage of total population to proxy urbanization. The corresponding data was collected from the World Development Indicators (WDIs) of the World Bank.

-

Governance quality (GOV)

Following previous studies (Dossou et al., 2021; Ofori et al., 2022a, 2022b, 2022c; Pan et al., 2022; Xu et al., 2022), we use six governance indicators, namely rule of law, political stability, control of corruption, voice and accountability, regulatory quality, and governance effectiveness to proxy governance quality. Their data has been extracted from the World Governance Indicators (WGIs) of the World Bank.

3.5 Control Variables

-

Economic growth (GDPpc)

Economic growth plays a significant role in promoting income distribution. According to the influential work of Kuznets (1955), economic growth and income inequality could have an inverted U-shaped relationship. More precisely, income inequality tends to increase at the early stage of economic development, but after a certain threshold economic growth could contribute to lessen income inequality through prompting industrialization, democracy and improving social welfare (Le et al., 2020). Following the Kuznets’ work, several studies have examined the non-linear relationship between economic growth and income inequality (Nguyen et al., 2020). However, the findings of these studies are mixed (Nguyen et al., 2020). While some scholars found an inverted U-shaped relationship between economic growth and income inequality, other show a U-shaped relationship between economic growth and income inequality. According to previous studies, we use gross domestic product per capita to proxy economic growth. The data on gross domestic product per capita has been gleaned from the World Development Indicators (WDIs) of the World Bank.

-

Trade openness (TOP)

Trade openness has been considered as an important to promote economic growth (Xu et al., 2021). According to Khan and Nawaz (2019), trade openness can contribute to economic through providing technologies and employment opportunities. Very recently, the positive effect of trade openness on economic growth has been translated into socio-economic development (Xu et al., 2021). Consistent with this argument, several studies have assessed the influence of trade openness on income inequality. However, the findings issued by these are inconclusive. While some scholars found that trade openness could contribute to exacerbating income inequality (Khan et al., 2020; Xu et al., 2021), others show that trade openness could contribute to lessening income inequality (Canh et al., 2020; Le et al., 2020). Trade openness has been proxied by the sum of imports and exports divided by GDP. The data on trade openness has been collected from the World Development Indicators (WDIs) of the World Bank.

-

Foreign direct investment (FDI)

Consistent with neo-classical growth model, foreign direct investment has been acknowledged as an important tool to promote economic growth (Magombeyi & Odhiambo, 2017). It has been argued that foreign direct investment can spur economic growth through promoting export diversification, providing job opportunities, improving wages and social welfare and promoting technological transfer (Xu et al., 2021). Based on this argument, recent studies have examined the influence of foreign direct investment on income inequality (Basu & Guariglia, 2007; Sharma & Abekah, 2017; Wu & Hsu, 2012). However, the findings of these studies are not uniforms. Whereas some studies concluded that foreign direct investment could contribute to the exacerbation of income inequality, other show that foreign direct investment could contribute to lessen income inequality (Le et al., 2020; Xu et al., 2021). Consistent with previous studies, we use foreign direct investment inflows as a percentage of GDP. The data on foreign direct investment inflows has been emanated from the World Development Indicators (WDIs) of the World Bank.

-

Industrialization (INDU)

It has been widely argued that industrialization plays a significant role in enhancing economic growth. According Canh et al., (2020), industrialization can contribute to promote economic growth through providing job opportunities. Similarly, Nguyen et al., (2020) documented that an increase industrialization could contribute to reduce income inequality through absorbing low skilled labor, which in turn could contribute to reducing income inequality. Following previous studies, we use the percentage of industrial value-added to GDP (%) to proxy industrialization. The data on industrialization has been collected from the World Development Indicators (WDIs) of the World Bank.

-

Information and communication technology (ICT)

In recent decades, Information and communication technologies has been recognized as an important factor to drive economic growth (Appiah-Otoo & Song, 2021; Ofori & Asongu, 2021). According to Appiah-Otoo and Song (2021), ICT can contribute to improve market compettotion which is expected to increase jobs and thereby reducing income inequality. Similarly, Asongu and Odhiambo (2019) argued that ICT can contribute to boosting productivity and economic growth, which by extension could contribute to reducing income inequality. Therefore, an increasing in ICT is expected to reduce income inequality. Following a study by Asongu and Odhiambo (2019), we use internet penetration to proxy ICT. The data on ICT has been collected from the World Development Indicators (WDIs) of the World Bank.

3.6 Estimation Strategy

To unearth the moderating effect of governance quality on the relationship between urbanization and income inequality, this study uses the two-step system generalized method of moment (GMM) estimation technique developed by Arellano and Bover, (1995). The motivation behind this choice can be explained as follows. First, the consideration of a lagged dependent variable as an explanatory variable explains the presence of endogeneity problem. According to Njangang et al., (2021) Xu et al., (2021), Dossou et al., (2021), using traditional technique, namely Ordinary least square (OLS), fixed effect (FE) and random effect (RE) could lead to biased and inconsistent results. Second, according to Tchamyou et al., (2019) Ofori et al., (2021a, 2021b), the system generalized method of moment (GMM) estimation technique can be used when the sample countries is greater than the number of period. This has been corroborated by this study which uses 46 countries over period 1996–2020 (25 years).

4 Results and Discussion

4.1 Descriptive Statistics and Correlation Matrix

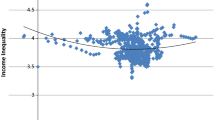

Tables 1 and 2 show respectively the descriptive statistics and correlation matrix. As shown in Table 1, the mean value of the Palma ratio, Atkinson index, and Theil index is 6.383, 0.698 and 0.649 respectively. It means that inequality still persists in Africa. According to Figs. 2 and 3, South Africa and Botswana have registered the highest value while Algeria has recorded the minimum value. The mean value of urbanization is 41.493. As shown by Fig. 3, the most urbanized country is Gabon, while the least urbanized country is Burundi. This is consistent with Sulemana et al., (2019) who used the Gini index as a proxy of income inequality to assess the influences of urbanization on income inequality.

The average value of governance effectiveness, control of corruption, political stability, regulatory quality and voice and accountability is − 0.656, − 0.561, − 0.511, − 0.590, − 0.596, and − 0.508, respectively. This corroborated the results of Ouedraogo et al., (2021) who examined the impact of governance quality on human capital development argued that the quality of institutions is poor in Africa.

From the correlation matrix disclosed in Table 2, the results unveil that urbanization is positively correlated with the three income inequality indicators. This means that urbanization might be one of the source of income inequality in Africa. However, the results reveal that governance quality is negatively correlated with the three income inequality indicators, meaning that improving governance quality could contribute to improve income distribution in Africa.

4.2 System GMM Result on the Effect of Urbanization and Governance Quality on Income Inequality

The empirical results of the joint effect of urbanization and governance quality on income inequality has been disclosed in Table 3.

Beginning with control variables, the results unveil that the associated coefficients of gross domestic product and its square term are significantly positive and negative respectively. This implies that economic growth and income inequality have an inverted U-shaped relationship. This corroborated the seminal of Kuznets (1955), who argued that at the earlier stage of economic development, income inequality growth up to a turning point of economic development and then lessens. According to Le et al.,(2020), such a reduction can be made through promoting democracy, wage and social welfare and developing industrialization. Our findings also agreed with Nguyen et al., (2020) who examined the determinants of income inequality for 97 countries over period 2002–2014, but contradicts the findings of Ofori et al.,(2021a, 2021b), who examined the drivers of income inequality for 48 African economies from 1996 to 2020.

Across the table, the estimated coefficient of trade openness is negative and statistically significant, meaning that higher trade openness can boost economic growth by improving job opportunities and reducing income inequality. This findings agreed with Njangang et al., (2022) who postulated that a positive balance of trade could contribute to enhancing economic growth and reducing income inequality both in developed and developing economies. This supports the World bank (2020)’s report which pointed out the benefits of the Africa Continental Free Trade Areas (AfCFTA). According to the report, the Africa Continental Free Trade Areas (AfCFTA) is expected to boost economic growth in Africa by $450 billion in 2035. This could significantly contribute to improving wages, social welfare and reducing income inequality. According to the same source, the Africa Continental Free Trade Areas (AfCFTA) could help to leave 30 million Africans out of extreme poverty.

However, corresponding coefficient of foreign direct investment is positive and statistically significant, meaning that as foreign direct investment increases, income inequality also increases. This finding is consistent with the argument of Fofack and Ndikumana (2009), who argued that the repatriation of FDI’s benefit could contribute to retarding economic growth and increasing income inequality. Our findings are consistent with Basu and Guariglia (2007) for 119 developing economies, but contradict the findings of Xu et al., (2021) for 38 sub-Saharan African economies and Le et al., (2020) for 90 developed and developing countries.

The coefficient of industrialization has been found to be positive and statistically significant, implying that an increase in industrialization could contribute to boost economic growth through improving job opportunities for both skilled and unskilled labor. Our findings also support the argument of World Economic Forum, which documented that the transformation of Africa’s manufacturing sector into high-tech sector could contribute to creating a decent jobs and reducing income inequality and poverty in the continent.Footnote 10

The impact of ICT on income inequality is positive and statistically significant, implying that an increase in ICT development could contribute to heightening income inequality. This finding is not surprising give the low level of ICT development in Africa (Asongu & Odhiambo, 2019).

Considering our variable of interest, we have found that urbanization is positively and significantly related with income inequality, meaning that an increase in urbanization may contribute to the exacerbation of income inequality in Africa. The finding is not surprising given the unplanned and unequal urban growth in Africa. The finding is consistent with (Ali et al., 2021; Sulemana et al., 2019; Xiao et al., 2021). For instance, this finding is consistent with the arguments of Sulemana et al., (2019) who used the Gini index as proxy of income inequality to examine the relationship between urbanization and income inequality for a panel of 48 sub-Saharan African economies over the period 1996–2016. According to the authors, urban growth in Africa has been related to uncontrolled rural–urban migration which has led to an increase of income inequality and poverty. This finding has also been corroborated by Xiao et al., (2021), who argued that unplanned urbanization could lead to crime and political instability, which by extension could retard economic growth and increase income inequality. Further, the authors also argued that uncontrolled urbanization could lead to the increase of living cost, which in turn, could remain unaffordable for the poor people and thus increase income inequality. In the same vein, our finding is in line with the result of Ali et al., (2021) who posited that unplanned urbanization with low rate of urban infrastructure could hinder economic growth and increase income inequality. Similarly, the result is in line with Xiao et al., (2021)’s work which documented that uncontrolled urbanization could lead to the environmental pollution which could negatively affect agriculture productivity. Consequently, it contributes to increasing income inequality through environmental degradation. In the same spirit, uncontrolled urbanization could lead to an increase in informal economy which in turn could negatively affect economic growth and income distribution.

However, the results unveil that the impact of governance quality on income inequality is negative and significant. This means that improving institutions could contribute to boosting economic growth and reduce income inequality. This finding is corroborated by Ofori et al., (2022a, 2022b, 2022c), who posited reducing corruption could contribute to boosting investment in education which could play a significant role in promoting income distribution in Africa. Our finding is also consistent with Dossou et al., (2021) who argued that legal and economic institutions matter to achieve sustainable development goal which consists to reduce income inequality and poverty by 2030. According to authors, these institutions seem to regulate market in order to attract foreign direct investment which is expected to create job opportunities and reduce income inequality. Likewise, our finding agreed with World Bank’s reportFootnote 11 which documented that improving institutions could enhance sustained economic growth, which by extension could contribute to improving wages, social welfare, reducing income inequality and poverty. In the same vein, our finding supports the argument of World Economic Forum’s report which argued that an improving in institutions could contribute to boost better cooperation among private and public sector, which is expected to boost productivity and improve income distribution.Footnote 12

Moreover, the coefficient of the interaction of governance quality and urbanization is negative and statistically significant, meaning that an improved in governance quality could promote urbanization which in turn could lessen income inequality. This is the uniqueness of this study. Our finding support the argument of Li et al., (2016) who argued that good institutions could economically protect property rights in order to promote urban businesses which could contribute to improving jobs opportunities and income distribution. Similarly, good governance could to boost urban infrastructural development, which in turn could positively affect urban growth and reduce income inequality. Also, Enserink and Koppenjan (2007) posited that reducing corruption could economically promote urban businesses which could contribute to improving wages, living standards, reducing income inequality and poverty. Similarly, Our finding is also corroborated by Henderson (2005) who argued that good governance can positively affect financial development which by extension can promote urban businesses and reduce income inequality. Socially, good governance can help to low crime which could contribute promote urban businesses which in turn could contribute to reduce income inequality.

According to the diagnostic test, our model seems to be well specified. As shown Table 3, the p-value of AR (2) is not significant, meaning that there is no second order autocorrelation. Moreover, the instruments generated by results of the system GMM is 28, which is less than the number of countries, so our results are valid.

4.3 Robustness Check

4.3.1 Robustness Check 1

To verify the robustness of our study, we use an alternative indicator of income inequality, namely the Atkinson index. As shown in Table 4, the results remain unchanged compared to the results in Table 3.

4.3.2 Robustness Check 2

We also use the Theil index as an alternative indicator of income inequality to examine the robustness of our main estimation. The results are similar to the results in Table 3. But, for brevity, these results are not reported but are available on request.

4.3.3 Robustness Check3

The Structural Equations Models (SEM) has been used as an alternative method to examine the mediating effect of governance quality between income inequality and urbanization. The results are similar to the results in Table 3. But, for brevity, these results are not reported but are available on request.

5 Conclusion and Policy Recommendations

Urbanization or large cities have been considered as important factor to promote urban growth and national economic growth. Many studies have argued that achieving sustainable development depends on urban cities. Consistent with this argument, a voluminous study has investigated the influence of urbanization on economic growth and found that urbanization propels economic growth. Recently, the positive contribution of urbanization to economic growth has been translated into socio-economic development. Thus, recent studies have examined the influence of urbanization on income inequality both in developed and developing countries. However, the findings issued by these studies are mixed and inconclusive. Moreover, the study on the relationship between urbanization and income inequality in Africa remains scanty. Additionally, previous studies have largely ignored the role governance quality on this relationship. To fill the gap in the literature, we examine the moderation of governance quality on the relationship between urbanization and income inequality in 46 Africa countries over period 1996–2020. The empirical evidence is based on the two-step system GMM estimation technique. The results show that urbanization has been found to have a positive effect on income inequality, meaning that increase in urbanization induces income inequality. However, the results show that as governance quality improves, income inequality declines. Moreover, the impact of the interaction between governance quality and urbanization on income inequality is positive and statistically significant. This means that good governance remains a catalyst factor to promote urbanization in order to induce income distribution.

Based on the above results and discussions the following policy implications are recommended. First, governments and policy makers in Africa should craft appropriate urban strategies which will reduce urban poverty and inequality. For example, an appropriate policy toward industrialization must be implanted by African governments in order to provide job opportunities for low skilled labor when they migrate from rural areas to urban towns. Moreover, as the migration could end up the informal sector, the African governments should implement policy toward increasing educational opportunities, accessing health and other social amenities in the rural areas. Implementing these policies could contribute to reduce the migration from rural areas to urban areas. Second, there is a need to improve and reform institutions which will promote efficiency and inclusive economic development. in regard, control of corruptions and adopting rule of law are paramount significant. Finally, governments and policy makers should also adopt suitable policies and strategies for foreign direct investment which will create adequate job opportunities and reduce inequality. in this aspect, priority should be given to labor intensive investment projects which will reduce unemployment challenges.

Although this is the first study to examine the moderating effect of governance quality on the urbanization-income inequality nexus, this study has mainly focused on the case Africa. Therefore, future research should focus on the other developing nations, namely Latin America and Asia. It is also suggested that future research should consider a single country as a case study to investigate the moderation of governance quality on the urbanization-income inequality relationship. Additionally, due to the gap between developing economies and developed economies in terms of institutions quality, urbanization and innovation, future research should investigate the same subject in developed countries.

Notes

The Palma | Uncounted.

Theil index—Wikipedia.

World Bank’s Response to COVID-19 (Coronavirus) in Africa.

The countries include Algeria, Angola, Benin, Botswana, Burkina Faso, Burundi, Cabo Verde, Cameroon, Central African Republic, Chad, Comoros, Congo. Dem. Rep, Congo. Rep., Cote d'Ivoire, Djibouti, Egypt, Arab Rep., Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Morocco, Mozambique, Namibia, Niger, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Seychelles, South Africa, Sudan, Tanzania, Togo, Tunisia, Uganda, Zambia.

References

Acemoglu, D., Johnson, S., & Robinson, J. (2004). Institutions as the Fundamental Cause of Long-Run Growth. NBER Working Paper No. pp 10481.

Adams, S., & Klobodu, E. K. M. (2019). Urbanization, economic structure, political regime, and income inequality. Social Indicators Research, 142(3), 971–995. https://doi.org/10.1007/s11205-018-1959-3

Ajide, K. B., & Alimi, O. Y. (2021a). Income inequality, human capital and terrorism in Africa: Beyond exploratory analytics. International Economics, 165, 218–240. https://doi.org/10.1016/j.inteco.2021.01.003

Ajide, K. B., & Alimi, O. Y. (2021b). Natural resource rents, inequality, and terrorism in Africa. Defence and Peace Economics, 00(00), 1–19. https://doi.org/10.1080/10242694.2021.1879412

Ali, I. M. A., Attiaoui, I., Khalfaoui, R., & Tiwari, A. K. (2021). The effect of urbanization and industrialization on income inequality: an analysis based on the method of moments quantile regression. Social Indicators Research, 161, 1–22. https://doi.org/10.1007/s11205-021-02812-6

Appiah-Otoo, I., & Song, N. (2021). The impact of ICT on economic growth-Comparing rich and poor countries. Telecommunications Policy, 45(2), 102082. https://doi.org/10.1016/j.telpol.2020.102082

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68, 29–51.

Asongu, S. A., & Odhiambo, N. M. (2019). How enhancing information and communication technology has affected inequality in Africa for sustainable development : An empirical investigation. Sustainable Development, 27(4), 647–656. https://doi.org/10.1002/sd.1929

Baldwin, R. E., & Martin, P. (2004). Agglomeration and regional growth. pp 4(04)

Basu, P., & Guariglia, A. (2007). Foreign direct investment, inequality, and growth. Journal of Macroeconomics, 29(4), 824–839. https://doi.org/10.1016/j.jmacro.2006.02.004

Canh, N. P., Schinckus, C., Thanh, S. D., & Hui Ling, F. C. (2020). Effects of the internet mobile and land phones on income inequality and The Kuznets curve: Cross country analysis. Telecommunications Policy, 44(10), 102041. https://doi.org/10.1016/j.telpol.2020.102041

Castells-Quintana, D., Ramos, R., & Royuela, V. (2015). Income inequality in European Regions: Recent trends and determinants. Review of Regional Research, 35(2), 123–146. https://doi.org/10.1007/s10037-015-0098-4

Chen, G., Glasmeier, A. K., Zhang, M., & Shao, Y. (2016). Urbanization and income inequality in post-reform China: A causal analysis based on time series data. PLoS ONE, 11(7), 1–16. https://doi.org/10.1371/journal.pone.0158826

Di Clemente, R., Strano, E., & Batty, M. (2021). Urbanization and economic complexity. Scientific Reports, 11(1), 1–10. https://doi.org/10.1038/s41598-021-83238-5

Dossou, T. A. M., Kambaye, E. N., Berhe, M. W., & Alinsato, A. S. (2023). Toward efforts to lessen income inequality in Asia : Exploring synergies between tourism and governance quality. Tourism Management Perspectives, 46, 101086. https://doi.org/10.1016/j.tmp.2023.101086

Dossou, T. A. M., NdomandjiKambaye, E., Bekun, F. V., & Eoulam, A. O. (2021). Exploring the linkage between tourism, governance quality, and poverty reduction in Latin America. Tourism Economics, 555, 1–25. https://doi.org/10.1177/13548166211043974

Ekeocha, D. O. (2021). Urbanization, inequality, economic development and ecological footprint : Searching for turning points and regional homogeneity in Africa. Journal of Cleaner Production, 291, 125244. https://doi.org/10.1016/j.jclepro.2020.125244

Enserink, B., & Koppenjan, J. (2007). Public participation in China: Sustainable urbanization and governance. Management of Environmental Quality: An International Journal, 18(4), 459–474. https://doi.org/10.1108/14777830710753848

Fofack, H., & Ndikumana, L. (2009). Potential gains from capital flight repatriation for sub-Saharan African countries. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1462023

Folarin, O., & Adeniyi, O. (2019). Does tourism reduce poverty in sub-Saharan African Countries? Journal of Travel Research. https://doi.org/10.1177/0047287518821736

Gerschewski. S. (2013). Do local firms benefit from foreign direct investment? An analysis of spillover effects in developing countries. Asian Social Science, 9(4), 67–76. https://doi.org/10.5539/ass.v9n4p67

Gnangnon, S. K. (2020). Manufacturing exports and services export diversification. International Trade Journal, 00(00), 1–22. https://doi.org/10.1080/08853908.2020.1779877

Goi, C. (2017). The impact of technological innovation on building a sustainable city. International Journal of Quality Innovation. https://doi.org/10.1186/s40887-017-0014-9

Ha, N. M., Le, N. D., & Trung-Kien, P. (2020). The impact of urbanization on income inequality: A study in Vietnam. Journal of Risk and Financial Management, 7(5), 111–118. https://doi.org/10.13106/JAFEB.2020.VOL7.NO5.111

Henderson, J. V. (2005). Chapter 24 Urbanization and Growth (pp. 1543–1591). In Handbook of Economic Growth: Elsevier. https://doi.org/10.1016/S1574-0684(05)01024-5

Khan, I., & Nawaz, Z. (2019). Trade, FDI and income inequality: Empirical evidence from CIS. International Journal of Development Issues, 18(1), 88–108. https://doi.org/10.1108/IJDI-07-2018-0107

Khan, I., Nawaz, Z., & Saeed, B. B. (2020). Does trade openness and FDI reduce inequality? Evidence from South Asia. International Journal of Finance and Economics, 26(4), 6459–6470. https://doi.org/10.1002/ijfe.2131

Kumar, R., & Vishnoi, S. (2022). Urbanization and sustainable development for inclusiveness using ICTs. Telecommunications Policy, 46(6), 102311. https://doi.org/10.1016/j.telpol.2022.102311

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review, 45(1), 1–28.

Lawrence, R. J. (2002). Inequalities in urban areas: Innovative approaches to complex issues. Scandinavian Journal of Public Health, 30(59_Suppl), 34–40. https://doi.org/10.1177/14034948020300030601

Le, T. H., Nguyen, C. P., Su, T. D., & Tran-Nam, B. (2020). The Kuznets curve for export diversification and income inequality: Evidence from a global sample years. Economic Analysis and Policy, 65, 21–39. https://doi.org/10.1016/j.eap.2019.11.004

Li, B., Chen, C., & Hu, B. (2016). Governing urbanization and the New Urbanization Plan in China. Environment and Urbanization, 28(2), 515–534. https://doi.org/10.1177/0956247816647345

Liu, Y., & Long, C. (2021). Urban and rural income gap: Does urban spatial form matter in China? SAGE Open, 11(1), 21582440211002216. https://doi.org/10.1177/21582440211002215

Magombeyi, M. T., & Odhiambo, N. M. (2017). Foreign direct investment and poverty reduction. Comparative Economic Research, 20(2), 73–89. https://doi.org/10.1515/cer-2017-0013

MalahKuete, Y. F., & Asongu, S. A. (2022). Infrastructure development as a prerequisite for structural change in Africa. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-022-00989-w

Meniago, C., & Asongu, S. A. (2018). Revisiting the finance-inequality nexus in a panel of African countries. Research in International Business and Finance, 46, 399–419. https://doi.org/10.1016/j.ribaf.2018.04.012

Michaels, G., Rauch, F., & Redding, S. J. (2012). Urbanization and structural transformation. Quarterly Journal of Economics, 127(2), 535–586. https://doi.org/10.1093/qje/qjs003

Nchofoung, T. N., & Asongu, S. A. (2022). Effects of infrastructures on environmental quality contingent on trade openness and governance dynamics in Africa. Renewable Energy, 189, 152–163. https://doi.org/10.1016/j.renene.2022.02.114

Nguyen, C. P., Nguyen, B., Duy Tung, B., Dinh, Su., & T. (2021). Economic complexity and entrepreneurship density: A non-linear effect study. Technological Forecasting and Social Change, 173, 121107. https://doi.org/10.1016/j.techfore.2021.121107

Nguyen, C. P., Schinckus, C., Su, T. D., & Chong, F. H. L. (2020). The Influence of Tourism on Income Inequality. Journal of Travel Research. https://doi.org/10.1177/0047287520954538

Nijman, J., & Dennis, Y. (2020). Urban inequalities in the 21st century economy. Applied Geography, 117, 102188.

Njangang, H., Asongu, S. A., Tadadjeu, S., Nounamo, Y., & Kamguia, B. (2022). Governance in mitigating the effect of oil wealth on wealth inequality: A cross-country analysis of policy thresholds. Resources Policy, 76, 102561. https://doi.org/10.1016/j.resourpol.2022.102561

Njangang, H., Beleck, A., Tadadjeu, S., & Kamguia, B. (2021). Do ICTs drive wealth inequality? Evidence from a dynamic panel analysis. Telecommunications Policy, 46(2), 102246. https://doi.org/10.1016/j.telpol.2021.102246

North, D. C. (1989). Institutions and economic growth: An historical introduction. World Development, 17(9), 1319–1332.

Ofori, I. K., Afful, B., & Saddam, J. (2022b). Towards shared prosperity in sub - Saharan Africa : How does the effect of economic integration compare to social equity policies ? African Development Review, 34(1), 97–113. https://doi.org/10.1111/1467-8268.12614

Ofori, I. K., Amègnonna, T., Dossou, M., Akadiri, S. S., & Ofori, I. K. (2022c). Towards the quest to reduce income inequality in Africa : Is there a synergy between tourism development and governance ? synergy between tourism development and governance ? Current Issues in Tourism. https://doi.org/10.1080/13683500.2021.2021157

Ofori, I. K., & Armah, M. K. (2021). Towards the reversal of poverty and income inequality setbacks due to COVID-19: The role of globalisation and resource allocation. International Review of Applied Economics, 36(5–6), 647–674. https://doi.org/10.2139/ssrn.3879887

Ofori, I. K., Armah, M. K., Taale, F., & Ofori, P. E. (2021b). Addressing the severity and intensity of poverty in Sub-Saharan Africa: How relevant is the ICT and financial development pathway? Heliyon, 7(10), e08156. https://doi.org/10.1016/j.heliyon.2021.e08156

Ofori, I. K., & Asongu, S. A. (2021). ICT diffusion, foreign direct investment and inclusive growth in sub-Saharan Africa. Telematics and Informatics, 65, 101718. https://doi.org/10.1016/j.tele.2021.101718

Ofori, I. K., Dossou, T. A. M., & Akadir, S. S. (2021a). Towards the quest to reduce income inequality in Africa: Is there a synergy between tourism development and governance? Current Issues in Tourism. https://doi.org/10.1080/13683500.2021.2021157

Ofori, I. K., Osei, D. B., & Alagidede, I. P. (2022a). Inclusive growth in Sub-Saharan Africa: Exploring the interaction between ICT diffusion, and financial development. Telecommunications Policy, 46(7), 102315. https://doi.org/10.1016/j.telpol.2022.102315

Ogbonna, O. E., Ogbuabor, J. E., Manasseh, C. O., & Ekeocha, D. O. (2022). Global uncertainty, economic governance institutions and foreign direct investment inflow in Africa. Economic Change and Restructuring, 55(4), 2111–2136. https://doi.org/10.1007/s10644-021-09378-w

Ouedraogo, I., NgoaTabi, H., AtanganaOndoa, H., & Jiya, A. N. (2021). Institutional quality and human capital development in Africa. Economic Systems, 46(1), 100937. https://doi.org/10.1016/j.ecosys.2021.100937

Pan, X., Dossou, T. A. M., Berhe, M. W., & Kambaye, E. N. (2022). Towards efforts to promote renewable energy development in Africa : Does governance quality matter ? Energy & Environment. https://doi.org/10.1177/0958305X221120259

Sharma, B., & Abekah, J. (2017). Foreign direct investment, foreign aid and incomes inequality: Empirical insights from African and South American countries. Transnational Corporations Review, 9(1), 1–7. https://doi.org/10.1080/19186444.2017.1290912

Shi, Y., Paul, S., & Paramati, S. R. (2020). The impact of financial deepening on income inequality: Empirical evidence from Australia. International Journal of Finance & Economics, 27(3), 3564–3579. https://doi.org/10.1002/ijfe.2338

Sou, J. P. U., & Vinnicombe, T. (2021). Does governance quality matter for FDI-led tourism development? A supply-side perspective. Tourism Economics. https://doi.org/10.1177/13548166211052814

Sulemana, I., Nketiah-Amponsah, E., Codjoe, E. A., & Andoh, J. A. N. (2019). Urbanization and income inequality in Sub-Saharan Africa. Sustainable Cities and Society, 48, 101544. https://doi.org/10.1016/j.scs.2019.101544

Tchamyou, V. S., Asongu, S. A., & Odhiambo, N. M. (2019). The Role of ICT in Modulating the Effect of Education and Lifelong Learning on Income Inequality and Economic Growth in Africa *. African Development Review, 31(3), 261–274. https://doi.org/10.1111/1467-8268.12388

Turok, I., & McGranahan, G. (2013). Urbanization and economic growth: The arguments and evidence for Africa and Asia. Environment and Urbanization, 25(2), 465–482. https://doi.org/10.1177/0956247813490908

Ujunwa, A., Okoyeuzu, C., Nkwor, N., & Ujunwa, A. (2021). Potential impact of climate change and armed conflict on inequality in sub-Saharan Africa. South African Journal of Economics, 89(4), 480–498. https://doi.org/10.1111/saje.12271

Wall, R. (2018). The state of African cities. In The State of African Cities 2014. https://doi.org/10.18356/c3c61ac9-en

World Bank. (2011). https://web.worldbank.org/archive/website01306/web/pdf/wdr2011_full_text.pdf.

World Bank. (2017). High-density cities hold the key to transforming economic geography.

World Bank (2020). https://www.worldbank.org/en/topic/trade/publication/the-african-continental-freetrade-area

Wu, J. Y., & Hsu, C. C. (2012). Foreign direct investment and income inequality: Does the relationship vary with absorptive capacity? Economic Modelling, 29(6), 2183–2189. https://doi.org/10.1016/j.econmod.2012.06.013

Xiao, W., Liu, W., & Li, C. (2021). Can the urban spatial structure accelerate urban employment growth? Evidence from China. Growth and Change, 53(4), 1668–1693. https://doi.org/10.1111/grow.12594

Xu, C., Han, M., Amegnonna, T., Dossou, M., & Bekun, F. V. (2021). Trade openness, FDI, and income inequality : Evidence from sub - Saharan Africa. African Development Review, 33(1), 193–203. https://doi.org/10.1111/1467-8268.12511

Xu, C., Yang, Y., Amègnonna, T., Dossou, M., Berhe, W., & Kambaye, E. N. (2022). Does corruption undermine tourism development in Africa ? Current Issues in Tourism. https://doi.org/10.1080/13683500.2022.2069553

Zhao, L. (2020). Tourism, institutions, and poverty alleviation: Empirical evidence from China. Journal of Travel Research. https://doi.org/10.1177/0047287520947792

Zhao, L., & Xia, X. (2020). Tourism and poverty reduction: Empirical evidence from China. Tourism Economics, 26(2), 233–256. https://doi.org/10.1177/1354816619863266

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No potential conflict of interest was reported by the authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Dossou, T.A.M. Income Inequality in Africa: Exploring the Interaction Between Urbanization and Governance Quality. Soc Indic Res 167, 421–450 (2023). https://doi.org/10.1007/s11205-023-03120-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-023-03120-x