Abstract

In many industrialised countries, including the Netherlands, the share of solo self-employed workers has strongly increased in recent years. This development is subject to a lot of public debate as it is feared that this increase is caused by ‘quasi’ self-employment. There still seems to be little consensus, however, on what constitutes ‘genuine’ self-employment and what not. In this article we present a theoretical framework for ‘quasi’ solo self-employment and discuss how the various indicators for ‘quasi’ self-employment that are used in the literature fit in this framework. We then compare the outcomes of different indicators by applying them to solo self-employed workers in the Netherlands. The data used for the analysis are taken from the Dutch Labour Force Survey (NL-LFS) 2017 complemented with the European Labour Force Survey (EU-LFS) ad hoc module 2017 on self-employment. Our results show that about 7% of the solo self-employed workers is dependent on one client. Furthermore, almost 20% of all solo self-employed had an involuntary start. The correspondence between dependency and involuntariness is very low: less than 2% of the solo self-employed workers are both dependent and involuntary. Both dependency and voluntariness are related to the fiscal and legal status of the solo self-employed workers and to the type of work activities. Solo self-employed workers that own their own business and who mainly sell products are less likely to be dependent and/or involuntary self-employed compared to those who do not own a business and/or offer services. Dependency is hardly related to the unfavourable outcomes of solo self-employment. Involuntariness, on the contrary, seems to have some impact on outcomes. Those who became self-employed because they couldn’t find a job as an employee have a higher probability to be unsatisfied with their job, to have financial problems or problems due to a lack of work or a low income. Nevertheless even among the involuntary solo self-employed workers, the majority does not report negative outcomes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In many European countries the share of solo self-employed workers has strongly increased in recent years (Kösters, 2017). In the Netherlands currently 12 per cent of the workers is solo self-employed, an increase of almost 4 percentage points since 2007. This development is subject to a lot of public debate. Some state that the increase of solo self-employment is not a sign of more entrepreneurial activity but that, on the contrary, many employees are pushed into self-employment because of a lack in alternative employment options. According to this view employers want to save on labour costs and social security contributions (Kautonen et al., 2010) by offering workers self-employed arrangements instead of regular employment contracts. This type of solo self-employed is being supervised by the firm which makes it comparable to a hierarchical employer-employee working relationship (Thörnquist, 2015), but without all social protection and labour law rights for employees. Others point to the fiscal facilities that favour self-employment (Kunda et al., 2002). These facilities do not stimulate ‘genuine’ entrepreneurship but stimulate employees to accept or even demand solo self-employed arrangements instead of regular employment contracts because these arrangements seem to lead to higher incomes, at least in the short run. But since these arrangements do not provide any social protection (such as disability or pension benefits) future incomes are more uncertain.

The public debate about these workers in the grey area between employment and self-employment is not limited to the Netherlands. Also, in other countries there is concern about this supposedly growing group of vulnerable solo self-employed workers. In the UK this debate dates back to the 1980s, a period that witnessed a considerable growth in self-employment (Smeaton, 2003). Although this growth was welcomed by the British government as a positive development contributing to employment growth, other observers feared that the rise in self-employment was due to a decline in wage–employment opportunities (Bögenhold & Staber, 1991) pushing vulnerable workers towards self-employment. Bögenhold and Staber (1991) found indeed some evidence that self-employment has risen with unemployment. Moreover Hakim (1988) showed that about a third of the self-employed had involuntarily entered self-employment. The debate on rising self-employment initially focused on the question whether the rise in self-employment was a sign of more entrepreneurial activity or instead a rise in false self-employment (Smeaton, 2003). In the 2000’s the debate in the UK shifted to the question whether the new solo self-employed were the successful workers who were pulled towards self-employment because of the associated benefits or the marginal workers who were pushed towards self-employment because of a lack of alternative employment options. Böheim and Muehlberger (2009) find some evidence that in the UK it is indeed the most vulnerable workers who are pushed into (dependent) self-employment. Other European countries where ‘quasi’ solo self-employment is subject of debate are Germany (Dietrich & Patzina, 2018), Austria (Heineck et al., 2004; Muehlberger & Bertolini, 2008), Italy (Muehlberger & Pasqua, 2006), Finland (Kautonen et al., 2009, 2010), the Czech Republic and Spain (Eurofound, 2017). Research for all these countries focuses on identifying the vulnerable self-employed workers by making a hard distinction between ‘genuine’ self-employed workers and the ‘quasi’ and vulnerable self-employed.

Although there is a lot of debate on what is alternately called ‘quasi’, ‘bogus’, ‘false’ or ‘fake’ self-employment there is no generally recognized definition of ‘quasi’ self-employment. On the one hand there are researchers who consider dependency on a single principal as ‘quasi’ self-employment and on the other hand are those for whom the involuntariness of the decision is an indicator of ‘quasi’ self-employment. Furthermore, regardless of the criteria chosen for ‘quasi’ self-employment much of the literature on ‘quasi’ self-employment implicitly assumes that ‘quasi’ self-employment leads to unfavourable socio-economic outcomes for workers considered. In this article we present a theoretical framework for ‘quasi’ solo self-employment and discuss how the various indicators for ‘quasi’ self-employment that are used in the literature fit within this framework. We then compare the outcomes of different indicators by applying them to solo self-employed workers in the Netherlands. Our contribution to the literature is twofold. Firstly, by empirically comparing those indicators we provide evidence of their consistency. In other words, to what extent do the groups of workers labelled as ‘quasi’ self-employed by the different indicators overlap? Secondly, we explore to what extent self-employed workers who satisfy some or all of the proposed criteria for ‘quasi’ self-employment indeed experience less favourable social and financial outcomes of self-employment.

Our research is related to the literature on atypical work and dual labour markets. Due to amongst others, increased international competition and rapid technical change, firms are confronted with more fluctuations in the demand for their products and need to be able to quickly adjust the size of their workforce (Kalleberg, 2003, 2009). Many firms have responded to these developments by segmenting their workforce in a core of permanent (regular) workers and a periphery of workers in non-standard employment arrangements. ‘Quasi’ solo self-employment is one of many non-standard employment arrangements next to, for example, temporary agency hires, on call work, direct hire (short) fixed term contracts and the use of independent contractors (solo self-employed workers). While the core workers have secure and well paid jobs, the work at the periphery is characterised by uncertainty, low pay, few training possibilities and unfavourable working conditions. This dualization between the core and the periphery of the workforce has far reaching consequences, not only for individuals it concerns, but also for society as a whole as it is expected to have a negative impact on the sustainability of the social security system (Rueda, 2014, Häusermann & Schwander, 2012).

Another strand of the literature that is related to our research is the literature on undeclared work and the informal economy. As mentioned above, firms might prefer to use solo self-employment arrangements instead of regular employment contracts to save on labour costs and social security contributions. By exiting the formal economy altogether and imposing informal employment relationships they can save on taxes as well (Pfau-Effinger, 2009; Williams, 2013; Williams & Horodnic, 2015; Ødegård et al., 2012; Thörnquist, 2013). In both cases it is expected that the most vulnerable workers are affected most by such practises (Williams et al., 2013).

The next section presents a theoretical framework and discusses the various criteria applied in the literature to distinguish ‘genuine’ self-employment from ‘quasi’ self-employment. Section 3 discusses the data and methodology. Section 4 presents the results and Sect. 5 concludes.

2 Self-Employed or Not?

Although there is much debate on the topic of so called ‘quasi’, ‘fake’, ‘false’ or ‘bogus’ self-employment there still seems to be little consensus on what constitutes genuine self-employment and what not. Self-employed workers are often defined as “individuals who earn no wage or salary but who derive their income by exercising their profession or business on their own account and at their own risk” (Parker, 2004, p8). The literature on self-employment provides several criteria that are used to distinguish ‘quasi’ self-employment from ‘genuine’ self-employment (see for example Szaban & Skrezek-Lubasínska, 2018) but none of these criteria seems to be comprehensive. The criteria used can be arranged in two dimensions: (1) the degree of dependence of the self-employed workers on one or on a small number of principals and (2) the degree of involuntariness of the decision to start as a solo self-employed worker. Before we discuss dependency and involuntariness in more detail it is useful to place these two dimensions in a simple framework for analysing ‘quasi’ solo self-employment (Fig. 1). The archetype of the ‘quasi’ self-employed worker prominent in the public debate is the employee who was forced by his former employer to accept a self-employed arrangement, performing the same activities as before, still in a hierarchical subordinate working relationship but now lacking the social protection and labour law rights for employees (Kösters & Smits, 2020). This archetype of the ‘quasi’ solo self-employed worker, complies with both sets of criteria of ‘quasi’ self-employment, this self-employed worker is both dependent on a single client and had an involuntary start (dependent & involuntary self-employed workers, type 1 in Fig. 1). At the other end of the spectrum we have the solo self-employed workers who do not comply with any of the criteria for ‘quasi’ solo self-employment: they are not dependent on a single client and had a voluntary start (independent & voluntary, type 4). In between these two extremes are the solo self-employed workers who are dependent on a single client but had a voluntary start (dependent & voluntary, type 2) and self-employed workers who are not dependent but had an involuntary start (independent & involuntary, type 3).

Dependency on a single principal is a widely used criterion for ‘quasi’ self-employment (see Muehlberger, 2007; Böheim & Muehlberger, 2009; ILO, 2003). The idea behind this criterion is that firms have an incentive to contract out work previously performed by employees to self-employed workers to save on labour costs and social security contributions (Kautonen et al., 2010). If these self-employed workers perform tasks within the hierarchy of the firm, this work arrangement is comparable to a hierarchical employer-employee working relationship, in which the self-employed worker depends on the firm for his work and income. Usually two forms of dependency are distinguished, organizational dependency and economical dependency. Organizational dependency refers to the situation in which the worker is highly integrated in the principal’s organization. It is the principal who decides on how, where and when the work has to be performed. Economical dependency occurs when all or most of the self-employed worker’s income stems from one client (Kautonen et al., 2010).

The prevalence of dependent self-employment varies considerably between countries (see also Table 6 in the appendix). Estimates based on the European Working Conditions Survey (EWCS) 2015 range from 11% of the self-employed (including self-employed with employees) in Denmark to 63% of the self-employed in Romania (Williams & Lapeyre, 2017). Among the western European countries, Austria and the UK stand out with an estimated 43% of all self-employed being economically and organizationally dependent. The estimate for the Netherlands is 23% of all self-employed.

Although dependency is clearly an indication of the economic vulnerability of the self-employed workers, it is questionable whether dependency is a sufficient criterion to determine whether the work arrangement is indeed a ‘quasi’ self-employed arrangement. ‘Genuine’ self-employed, even those who have employees, might also be economically dependent on a single client (Kautonen et al., 2010). Furthermore, economical dependency may be a temporary situation, when starting up a business it may take some time to increase the customer base. Also organizational dependency will probably depend to a large extent on the type of work that needs to be done and as such not only ‘false’ self-employed workers but also ‘genuine’ self-employed workers with or without employees may engage in inter-firm cooperation that involve some extent of organizational dependency on other firms (Kautonen et al., 2010). For example, franchise-arrangements in which the franchisor dictates how to operate the business. Or the outsourcing of facility management services like cleaning and catering to contractors. As these services need to be provided on site of the client, the contractor is restricted how, when and where the work is performed.

So, dependency may occur even among ‘genuine’ self-employed workers. The reverse is also true, the absence of economical or organizational dependency does not necessarily imply that a worker is ‘genuinely’ self-employed. There are many examples of work previously done by employees now performed by solo self-employed workers, notably in the publishing and creative industry (Smeaton, 2003; Stanworth & Stanworth, 1997), that are not characterized by organizational and economical dependency. Digitalization decreases the need to perform tasks like writing articles, graphic design within the hierarchy of the firm, pushing workers in those industries often reluctantly to self-employment (Stanworth & Stanworth, 1997).

Finally it is worth noting that there is some evidence that part of the dependent solo self-employed workers are workers who possess highly demanded scarce skill. Those workers have a preference to work as solo self-employed workers even though the firm would like to hire them as employees. As solo self-employed workers they can bargain a higher numeration then as employees (Kösters & Smits, 2020). The latter might happen if there are sectoral agreements or firm-level rules with respect to maximum wages for specific types of employees (Houseman et al., 2003). Clearly these are not the vulnerable workers referred to in the public debate.

A second set of criteria to categorize ‘quasi’ and ‘genuine’ self-employed workers is therefore the involuntariness of their employment situation. Involuntariness with respect to the decision to become self-employed implies a lack of alternative employment options (Kautonen et al., 2009, 2010; Szaban & Skrzek-Lubansinka, 2018). For example, because workers could only continue to work for their former employer by accepting a self-employment arrangement instead of a regular employment contract or because they were unemployed and did not succeed to find a job as an employee. Although there is a lot of public debate on the former, there is little empirical evidence that ‘forced’ self-employment is indeed very common. Román et al. (2011) used the European Community Household Panel (ECHP) for the period 1994–2001 and found that only 0.5% of all employed workers in their sample switched from salary employment to self-employment while continuing to work for the same employer. Kautonen et al. (2009) studied involuntary self-employment in Finland and found that in 2006 5% of the solo self-employed workers were pushed into self-employment by their former employer (Table 6 in the appendix). Kösters and Smits (2017) found that in 2016 in the Netherlands less than 3% of the solo self-employed workers who recently started their own business had been pushed by their former employer. For the UK it is estimated that in 2000 7% of the solo self-employed working men became self-employed upon request of their former employer, for women this was even 0% (Smeaton, 2003). However, starting a business because of unemployment seems to be much more common. For the UK this concerned 26% of the self-employed men and 10% of the self-employed women in 2000, for the Netherlands 21% in 2016 (Kösters & Smits, 2017; Smeaton, 2003). However, even if the decision to become self-employed was dictated by negative circumstances the business may still be successful. These successful solo self-employed workers might prefer to remain self-employed even if they had the possibility to obtain a job as an employee. Therefore, it is important not only to consider involuntariness at the start of the career as a solo self-employed worker but also later in the career. Research for the UK (Smeaton, 2003) shows that the vast majority (70%) of the solo self-employed workers prefers to remain self-employed. Figures from Eurostat (2018) show that for all self-employed (including self-employed with employees) in the EU-28 an average of 2% would prefer to work as an employee. In countries like Greece, Italy and Romania this percentage is higher (ranging from 9 to 5%) (see also Table 6 in the appendix).

The incidence of dependent and/or involuntary solo self-employment is likely to be related to the legal and fiscal status of the solo self-employed worker. In the Netherlands, for example, a distinction can be made between self-employed entrepreneurs and ‘other’ self-employed. The former declares income from profits to the tax authorities and is usually also registered at the Chamber of Commerce. To qualify for profit declaration one should work at least 1225 hours per year in their self-employed job. The latter doesn’t own a registered business but works as a freelancer declaring result from labour other than profit or wage employment to the tax authorities. These are mostly small self-employed jobs. Legally and fiscally solo self-employed who own a business thus have more rules to comply with to show their self-employment, than a solo self-employed who doesn’t own a business. We therefore expect that: Solo self-employed who do not own a business (‘other’ self-employed) are more likely to be dependent and/or involuntary (type 1, 2 or 3) whereas solo self-employed who do own a business (entrepreneurs) are more likely to be independent and voluntary (type 4) (Hypothesis 1a).

The type of activities that need to be performed by the solo self-employed worker is another aspect to consider. An important distinction in this respect is between service activities and activities that involve the production and/or sale of (material) products (Kösters & Smits, 2020). Solo self-employed in service activities are more likely to be hiring their services to organizations and maybe even for just one organization or unwillingly for the employer they used to be working as an employee whereas solo self-employed who sell products usually sell to multiple customers. It is therefore to be expected that: Solo self-employed who offer services or their own labour are more likely to be dependent and/or involuntary (type 1, 2 or 3) whereas solo self-employed selling products are more likely to be independent and voluntary (type 3) (Hypothesis 1b).

Both sets of criteria for ‘quasi’ self-employment point to a certain vulnerability of solo self-employed workers. Workers who depend on a single client presumably face more economic uncertainty than solo self-employed workers with a larger client base, since the loss of that single client implies a loss of all their income generated from self-employment. The same is true for involuntariness, being pushed toward self-employment by a lack of other employment options certainly points to a weak labour market position. It is unclear, however, to what extent ‘quasi’ solo self-employment is related to worse social and financial outcomes compared to ‘genuine’ self-employed workers (Szaban & Skrezek-Lubansinka, 2018).

Research shows that in many Western countries, compared to employees, self-employed workers have a higher risk on a low income and poverty but also report a higher job satisfaction than employees (Hyytinen et al., 2013; Hamilton, 2000; Hundley, 2001; Cueto & Pruneda, 2017). It may well be that self-employed workers trade off a lower income for a higher job satisfaction, for example due to more autonomy in their work (Cueto & Pruneda, 2017; Josten & Vlasblom, 2017). There is far less evidence on the social and financial outcomes of ‘quasi’ solo self-employed workers compared to ‘genuine’ self-employed workers. Dirven et al. (2017) show that workers who are pushed into self-employment both report less job satisfaction and have lower incomes than those who became self-employed for the perceived benefits but the differences are small.

As explained above both dependency on a single client and an involuntary start as a solo self-employed worker point to a certain vulnerability of solo self-employed workers. For that reason we expect that: Dependent & involuntary solo self-employed (type 1) will experience the worst socio-economic outcomes while independent & voluntary solo self-employed workers (type 4) will experience the best outcomes (Hypothesis 2a).

Furthermore involuntariness is thought to be a better indication of vulnerability than dependency, as there is evidence that some of the (voluntary) dependent solo self-employed workers are workers who possess highly demanded scarce skills which allows them to bargain profitable self-employment arrangements (Kösters & Smits, 2020). So we expect that: Independent & involuntary solo self-employed workers (type 3) experience worse outcomes than dependent & voluntary solo self-employed workers (type 2) (Hypothesis 2b).

3 Data and Methodology

3.1 Data

The data used for the analysis are taken from the Dutch Labour Force Survey (NL-LFS) 2017 and the European Labour Force Survey (EU-LFS) ad hoc module 2017 matched with administrative data from the System of Social Statistical Datasets (SSD) of Statistics Netherlands (Bakker, Van Rooijen, & Van Toor, 2014).

3.1.1 Dutch Labour Force Survey (NL-LFS)

The NL-LFS is a household survey in which information is collected on the labour market situation of the Dutch population aged 15 years and older. The survey is conducted using a rotating panel with five waves. Respondents are asked about their labour market situation five times in a time period of one year, having approximately three months between the subsequent waves. Yearly approximately 3% of all households are in the sample, this comes down to around 200 thousand households. The response rate is almost 60%.

The NL-LFS contains information on the (self-reported) employment status. Respondents who are employed are asked whether they are employees or self-employed. Those who report to be self-employed are asked whether they employ employees or not. The solo self-employed workers are the self-employed workers without employees. As discussed in Sect. 2 the legal and fiscal status as well as the type of activities performed by solo self-employed workers are expected to have an impact on the incidence of ‘quasi’ solo self-employment. Within the group of solo self-employed workers, we therefore distinguish solo self-employed workers who have their own business or private practice (solo self-employed entrepreneurs) and ‘other’ solo self-employed workers such as independent professionals or freelancers. In general, the solo self-employed entrepreneurs are registered at the Chamber of Commerce while the ‘other’ solo self-employed very often are not. The former usually declare income from profits while the latter declare labour income other than salary, tips or business profits. Within the group of solo self-employed entrepreneurs, a further distinction can be made between those who mainly sell products (solo self-employed entrepreneur-products) and those who mainly sell their own labour/services (solo self-employed entrepreneur-labour). Of all solo self-employed workers 70% is a solo self-employed entrepreneur-labour, 22% a solo self-employed entrepreneur-products and 8% an ‘other’ solo self-employed worker.

There are considerable differences in occupations between solo self-employed entrepreneurs-labour, solo self-employed entrepreneurs-products and ‘other’ solo self-employed workers. Solo self-employed entrepreneurs-labour often work in technical or business and administrative occupations while the majority of the solo self-employed entrepreneurs-products work in sales and public relations (PR) occupations or agricultural occupations. The ‘other’ solo self-employed workers are relatively often found in teaching and health and welfare occupations.

3.1.2 European Labour Force Survey (EU-LFS) Adhoc Module 2017

Information on dependency, the voluntariness of the decision to become self-employed and a number of subjective socio-economic outcomes come from the EU-LFS ad hoc module 2017. This is a questionnaire module with a yearly changing topic in the European Labour Force Survey (EU-LFS), which in 2017 addressed the self-employed (Eurostat, 2018). In the NL-LFS this information is collected in the second wave.

3.1.3 System of Social Statistical Datasets (SSD)

Finally administrative data on incomes from the System of Social Statistical Datasets (SSD) is used to construct a number of objective socio-economic indicators. The SSD is a system of interlinked and standardized registers and surveys that contains information on persons, households, jobs, benefits and more (Bakker, Van Rooijen, & Van Toor, 2014). The (integral) income information available in the SSD comes from the Dutch Tax Administration.

3.1.4 Indicators of Quasi Self-Employment: Dependency and Involuntariness

The EU-LFS ad hoc module 2017 contains information on both economical and organizational dependency and involuntariness. A solo self-employed worker is considered to be economically dependent on a single client if during the last 12 months he or she has been working for only one client or obtained at least 75% of his or her revenue from one client. Organizational dependency refers to the situation in which it is not the solo self-employed worker who decides about his working hours but the client (or another party). The two dependency indicators available in the LFS only partly overlap with the three indicators available in the European Working Conditions Surveys (EWCS) to which we referred in the previous section (see also Table 6 in the appendix). Dependency on a single client is an indicator for economic dependency in both surveys. In the LFS, however, those who have more than one client but obtain more than 75% of their revenue on a single client are considered economically dependent while in the EWCS only the number of clients matters (Eurofound, 2013). Furthermore the EWCS uses two different indicators for organizational dependency: (1) not being able to hire employees and (2) not being able to make the most important decisions about how to run their business. Those indicators, apart from the fact that they are not available in the EU-LFS, are to our opinion less appropriate for our research as we also include the so called ‘other’ solo self-employed, many of which do not legally have a business, as discussed above. Finally, while we consider those who are both economically and organisationally dependent as the dependent self-employed, Williams and Lapeyre (2017) using the EWCS to study dependent self-employment, classify those who meet at least one of the three criteria for dependency as dependent self-employed.Footnote 1

Indicators for involuntariness are based on questions regarding the reasons someone had to become self-employed. Being ‘forced’ by the former employer to the lack of alternative employment options are reasons that indicate involuntariness. As discussed above, involuntariness at the start of self-employment does not necessarily imply that the current self-employed situation is still involuntary. Therefore, we also consider the involuntariness of the current situation. Self-employed workers are asked whether they have a preference to remain self-employed or would rather become an employee. The latter case is an indication for current involuntariness of the self-employment situation. As the current involuntariness is endogenous, it may also depend on the socio-economic outcomes experienced by the self-employed worker, we will not treat current involuntariness as an indicator for ‘quasi’ self-employment but as a (negative) outcome from self-employment.

3.1.5 Socio-Economic Outcomes

As discussed above ‘quasi’ self-employed are expected to be more vulnerable than ‘real’ self-employed. A common finding in the literature is that self-employed workers, compared to employees, have a higher risk to experience poverty but report higher job satisfaction. In this article we focus on poverty and job satisfaction as the main socio-economic outcomes as well. With respect to poverty we consider both subjective and objective indicators. The subjective indicators are based on questions in the EU-LFS ad hoc module 2017 regarding difficulties experienced by the self-employed workers. More specifically we consider two subjective indicators for the risk on poverty (1) whether the solo self-employed worker reports “times with little money to live on” as a problem and (2) whether the solo self-employed worker reports “times when there is no work to do”.

The objective poverty indicators are based on income information from the SSD. These concern: (1) earning a low personal income from work and (2) living in a low income household. A low personal income is defined as a net personal income from work below the Dutch social benefit level for a single person (CBS Statline, 2019a). The low household income threshold represents the same purchasing power for all households and is adjusted annually for price changes using the consumer price index (CPI). The level is based on the welfare benefit level for a single person in 1979 (CBS Statline, 2019b).

Job satisfaction in the EU-LFS is measured on a four-point scale. We consider those who report to be satisfied to some or a large extent as satisfied with their job as a solo self-employed worker and those who report to be not satisfied at all or to be satisfied to a small extent as not satisfied.

3.1.6 Control Variables

As the possibilities to be ‘genuine’ or ‘quasi’ self-employed might depend on personal and job characteristics we also added control variables to our model. It is for example known that women more often than men choose to become self-employed to improve the balance between work and family life (Dirven et al., 2017). We therefore added sex as a control variable. As older people have more experience on the labour market, they are more likely to choose to become self-employed than younger people, age is therefore also a control variable. Field of occupation is added as a control variable, as occupations differ in the type of interaction that is needed between the solo self-employed worker and the client which in turn might have an impact on the degree of dependency. Other control variables are level of education and duration of the self-employed job. Table 1 provides the descriptives of all variables used in the analysis.

3.2 Method

For both sets of criteria for ‘quasi’ self-employment discussed above (dependency and involuntariness) we first determine the proportion of solo self-employed workers for which these criteria apply. Next we examine to what extent both sets of criteria overlap and classify the solo self-employed workers in our data set in 4 groups distinguished in Fig. 1: solo self-employed workers that are ‘quasi’ self-employed according to both the dependency and involuntariness criteria (type 1: dependent & involuntary), solo self-employed workers who only fulfill the dependency criteria (type 2: dependent & voluntary), solo self-employed workers who only fulfil the involuntariness criteria (type 3: independent & involuntary) and solo self-employed workers who fulfill neither set of criteria (type 4: independent & voluntary). Subsequently, to analyse how this classification is related to a certain type of self-employed (an entrepreneur-labour, an entrepreneur-products or an ‘other’ self-employed) we estimate a multinomial logit model for the probability to belong to each of the four groups (hypothesis 1a and 1b). The results of this regression are presented in the form of average marginal effects. An average marginal effect is the average absolute change in the probability to belong to a certain group due to a 1-unit increase of the independent variable (see also Breen et al., 2018), or in short the probability to be in a certain group relative to all other groups. The marginal effects are weighted by population proportion weights.

Finally, we investigate to what extent self-employed workers who satisfy either one or both sets of the criteria for ‘quasi’ self-employment indeed experience less favourable social and financial outcomes of self-employment (hypothesis 2a and 2b). For each type of socio-economic outcome, we estimate a logit model in which the probability to experience such an outcome is explained by the four categories of ‘quasi’ self-employment and personal and job characteristics.

4 Results

4.1 Incidence of ‘Quasi’ Self-Employment: Dependency and Involuntariness

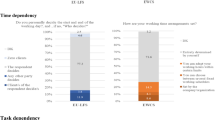

About 7% of all solo self-employed workers in the Netherlands reports to have only one client. Another 13% has more than one client but generates at least 75% of their income from the main client. So, one fifth of the solo self-employed workers in the Netherlands is economically dependent on one client. Furthermore, nearly one third of the solo self-employed workers is organizationally dependent on their clients. About 7% of the solo self-employed workers is both economically and organizationally dependent on their client. This figure is higher than the EU-28 average of 4% of the self-employed (Eurostat, 2018).

Very few solo self-employed workers report to have started their self-employment career because their previous employer wanted them to do so (2.5%). A lack of alternative employment options is mentioned far more often: 17% of the solo self-employed workers says to have started because they couldn’t find a job as an employee. All in all, about 19% started their career involuntary.

Dependency and involuntariness hardly overlap. Less than 2% (1.65%) of the solo self-employed workers is both (economically and organizationally) dependent on a single client and had an involuntary start of the self-employed career (dependent & involuntary).

As expected (Hypothesis 1a and 1b) dependency and involuntariness are indeed related to the type of solo self-employment (see Table 2). Compared to solo self-employed entrepreneurs who mainly offer their own labour, self-employed entrepreneurs who mainly sell products have a lower probability of being both dependent & involuntary self-employed (a decrease of 1.4 percentage points) and also a lower probability of being dependent& voluntary self-employed (a decrease of 2.8 percentage points). The ‘other’ solo self-employed workers, have a higher chance on the other hand to be dependent & voluntary solo self-employed workers (an increase of 7.8 percentage points) and less often as independent & involuntary self-employed workers (decrease of 5.9 percentage points). The differences in ‘quasi’ self-employment between these types of solo self-employed are hardly related to differences in personal or occupational characteristics. The exception is the lower probability of solo self-employed entrepreneurs-products to be dependent & voluntary self-employed, which can be traced back to the lower incidence of these workers in ICT occupations. In ICT occupations we see a lot of dependent solo self-employed workers but this concerns mostly entrepreneurs who offer their own labour.

Being both a dependent and involuntary solo self-employed worker, is related to the occupational field of the solo self-employed worker. Especially solo self-employed workers in teacher occupations, sales and PR occupations, business and administrative occupations and technical occupations have a higher probability to be both dependent and involuntary self-employed. Those working in agricultural occupations have a lower probability to be involuntary self-employed. Finally, solo self-employed workers in transport occupations have a lower probability to be both independent and voluntary self-employed.

Age seems to have little impact on the probability to be ‘quasi’ self-employed, although we see that workers between 55 and 65 years have a higher incidence of involuntary self-employment. These are the workers who, in the Netherlands, after losing their job as an employee, have the lowest probability to find another employee job.

Surprisingly, educational level doesn’t seem to matter for ‘quasi’ self-employment. Woman have a higher probability of involuntary solo self-employment. The number of years since the start of the self-employment career is related to involuntariness. Those that started more than two years before the interview date are less likely to be involuntary self-employed. This may be a selection effect, however, as those who made an involuntary start are probably more likely to stop shortly after the start (because of other opportunities).

4.2 Outcomes of Solo Self-Employment

As mentioned before, involuntariness at the start of the solo self-employed career does not necessarily imply that the current situation is still involuntary, but our results show that these two types of involuntariness are strongly related. Nearly 9% of the solo self-employed workers say to prefer a job as an employee. For those who had an involuntary start and are also dependent on one client, this probability is 10 percentage points higher than for solo self-employed who are not ‘quasi’ self-employed by either criterion (Table 3). For those who had an involuntary start but are not dependent this is nearly 8 percentage points higher. Dependency does not seem to be related with current involuntariness.

It is mostly the ‘other’ solo self-employed workers who prefer to work as an employee. Furthermore, women and solo self-employed workers younger than 25 have a higher probability to prefer working as an employee. Not surprisingly, solo self-employed workers in agricultural occupations less often report a preference to be an employee.

Job (un)satisfaction shows the same pattern as current involuntariness. The overall probability of being not satisfied with the job is quite low, 1.7%, but this probability is 3 percentage points higher among those who started involuntary. There are however, no differences in job (un)satisfaction between the different groups of solo self-employed workers, neither is job (un)satisfaction related to any of the personal and job characteristics included in the model.

Although job satisfaction is high, a relatively large part of the solo self-employed report financial problems (19%) or periods without clients (21%) (see Table 4). Again, the probabilities to experience any of these problems are much higher among those who had an involuntary start. Without controls for the type of solo self-employment or personal and job characteristics we find marginal effects for the probabilities of experiencing financial problems and periods without work of respectively 15 and 11 percentage points. The type of solo self-employment does matter, however. Compared to entrepreneurs who offer their own labour, entrepreneurs who sell products have a higher probability to report financial problems but a lower probability to report periods without work (about 5 percentage points in either direction). Periods without work seem to be related to the personal and job characteristics of the entrepreneurs who sell products. They are working in agricultural occupations more often. Solo self-employed workers in public administration, protective services and legal occupations, agriculture occupations, health and welfare occupations and transport and logistics occupations have a lower probability to report periods without clients. For the ‘other’ solo self-employed workers both the probability of experiencing financial problems and the probability to experience periods without work is lower than for the entrepreneurs-labour.

The probability to report financial problems is slightly higher for those between 45 and 65 years old compared to other age categories and also for those working in artistic occupations (and to a lesser extent in agricultural occupations). Finally, we see that self-employed workers who started more than two years ago, have a lower probability to experience periods without work. Again, this may be the result of a selection process as those who have periods without work more often are likely to have lower survival rates as solo self-employed.

Nearly 32% of the solo self-employed workers has a low personal income and 7.5% is member of a low income household. Again involuntariness seems to be the determining factor (see Table 5). Furthermore ‘other’ solo self-employed workers more often have a low personal income while entrepreneurs-products have a higher risk to be part of a low income household. Female solo self-employed workers have a higher risk on a low personal income. The same is true for young solo self-employed workers and those who started their business less than two years ago. Surprisingly education and occupation do not seem to matter. The risk of being part of a low income household does not depend on any personal characteristics.

These results only partially support our expectations. We expected that dependent and involuntary solo self-employed workers would experience the worst socio-economic outcomes while the independent and voluntary self-employed workers would have the best outcomes (Hypothesis 2a). Furthermore we expected that the negative impact on socioeconomic outcomes of involuntariness would be larger than the negative impact of dependency (Hypothesis 2b). We find that the independent & involuntary workers experience the worst outcomes. This suggests that involuntariness is indeed related to more unfavourable socio-economic conditions while dependency is not.

5 Conclusions and Recommendations

This paper considers two types of criteria used in the literature to distinguish ‘quasi’ from ‘genuine’ solo self-employment: (1) dependency on a single client and (2) involuntariness of the decision to start solo self-employment. It is shown that these criteria have a very low correspondence, that is the percentage of workers that might be classified as ‘quasi’ self-employed according to both sets of criteria is quite low, less than 2% of the Dutch solo self-employed workers.

We expected that dependency and involuntariness are related to the type of solo self-employment (hypothesis 1a and 1b). Compared to solo self-employed entrepreneurs who mainly offer their own labour, self-employed entrepreneurs who mainly sell products have a lower probability of being both dependent & involuntary self-employed and also a lower probability of being dependent and voluntary self-employed. The ‘other’ solo self-employed workers, have a higher chance on the other hand to be dependent and voluntary solo self-employed workers and less often as independent and involuntary self-employed workers.

We also expected that dependent and involuntary solo self-employed workers would experience the worst socio-economic outcomes while the independent and voluntary self-employed workers would have the best outcomes (Hypothesis 2a). Furthermore we expected that the negative impact of involuntariness would be larger than the negative impact of dependency (Hypothesis 2b). Our expectations are not fully confirmed. We only found evidence for hypothesis 2a: involuntariness is related to more unfavourable socio-economic conditions while dependency is not. Self-employed workers who started involuntarily have a higher probability to report financial problems or periods without work and also have a higher risk on a low personal income or being a member of a low income household. Nevertheless even among the solo self-employed workers who started involuntarily the majority seems to be satisfied with their job and don’t have a preference to work as an employee.

Given these results, an interesting question for future research is whether starting self-employment when there are no other employment options is actually a rewarding strategy. Compared to remain unemployed, starting as a self-employed worker prevents skills obsolescence and offers the possibility to gain new experiences. Of course, as mentioned before, the involuntary solo self-employed workers in our data set might be a selective group, as those who started a business but failed are not in our sample. Future research on involuntary self-employment should, therefore, take a longitudinal perspective. Comparing the careers of involuntary starters with the careers of voluntary starters. Additionally a comparison should be made with the careers of workers who after job loss, didn’t start solo self-employment but remained unemployed for some time.

Our results suggest that the distinction between ‘quasi’ and ‘genuine’ solo self-employed workers is not particularly useful if one is interested in identifying the marginal, vulnerable solo self-employed workers. Policy makers concerned with marginal workers could therefore better directly target the marginal self-employed workers, that is the self-employed workers who have difficulties to survive and show unfavourable socio-economic outcomes. The number of socio-economic outcomes considered in this study is limited, however. Further research should consider a wider range of outcomes, measuring precariousness including access to social security and health outcomes.

Notes

Eurofound (2013, 2017) defines the dependent solo self-employed as those who are dependent according to at least two out of the three available indicators for dependency, those who are dependent according to one indicator are labeled as being in the grey zone between independent and dependent self-employment. The EWCS results for the EU-28 show that 14% of the solo self-employed workers in 2015 met at least two out of the three criteria for dependency and 29% met one of the criteria (Eurofound 2017).

References

Bögenhold, D., & Staber, U. (1991). The decline and rise of self-employment. Work, Employment and Society, 5(2), 223–239.

Böheim, R., & Muehlberger, U. (2009). Dependent Self-employment: Workers between employment and self-employment in the UK. Journal of Labour Market Research, 42(2), 182–195.

Breen, R., Karlson, K. B., & Holm, A. (2018). Interpreting and understanding logits, probits, and other nonlinear probability models. Annual Review of Sociology, 44(1), 39–54.

CBS Statline (2019a), Welfare of persons; key figures https://opendata.cbs.nl/statline/#/CBS/en/dataset/83740ENG/table?dl=A50C

CBS Statline (2019b) Welfare of households; key figures https://opendata.cbs.nl/statline/#/CBS/en/dataset/83739ENG/table?dl=B4FC

Cueto, B., & Pruneda, G. (2017). Job satisfaction of wage and self-employed workers. Do job preferences make a difference? Applied Research Quality Life, 2017(12), 103–123.

Dietrich, H., Patzina, A. (2018). Bogus self-employment in Germany. Also a question of definition. IAB-Forum, available at: https://www.iab-forum.de/en/bogus-self-employment-in-germany-also-a-question-of-definition/ (accessed 30 August 2019).

Dirven, H. J., van der Torre, W., & van den Bossche, S. (2017). Een slechte start en dan? De werksituatie van zelfstandig ondernemers met negatieve en positieve startmotieven. Tijdschrift Voor Arbeidsvraagstukken, 33(3), 286–302.

Eurofound. (2013). Self-employed or not self-employed? Working conditions of ‘economically dependent workers. Eurofound.

Eurofound. (2017). Sixth european working conditions survey—overview report (2017 update). Publications Office of the European Union.

Eurostat. (2018). Labour force survey (LFS) ad-hoc module 2017 on the self-employed persons. Assessment report. Luxembourg: Eurostat.

Hakim, C. (1988). Self-employment in Britain: Recent trends and current issues. Work, Employment and Society, 2(4), 421–450.

Hamilton, B. H. (2000). Does entrepreneurship pay? An empirical analysis of the returns to self-employment. Journal of Political Economy, 108(3), 604–631.

Häusermann, S., & Schwander, H. (2012). Varieties of Dualization Labor Market Segmentation and Insider-Outsider Divides Across Regimes. In P. Emmenegger, S. Häusermann, B. Palier, & M. Seeleib-Kaiser (Eds.), The Age of Dualization The Changing Face of Inequality in Deindustrializing Societies. Oxford: Oxford University Press.

Heineck, G., Haider, A., & Neuwirth, N. (2004). Determinanten abhängiger selbständigkeit in österreich. Wien: Österreichisches Institut für Familienforschung

Houseman, S. N., Kalleberg, A. L., & Erickcek, G. A. (2003). The role of temporary agency employment in tight labor markets. International and Labor Relations Review, 57(1), 105–127.

Hundley, G. (2001). Why and when are the self-employed more satisfied with their work? Industrial Relations, 40(2), 293–316.

Hyytinen, A., Ilmakunnas, P., & Toivanen, O. (2013). The return-to-entrepreneurship puzzle. Labour Economics, 20(2013), 57–67.

ILO. (2003). Report V. The scope of the employment relationship. Paper presented at the International Labour Conference 91st Session.

Josten, E., & Vlasblom, J. D. (2017). Maakt zzp’er worden tevreden? Tijdschrift Voor Arbeidsvraagstukken, 33(3), 269–283.

Kalleberg, A. L. (2003). Flexible firms and labor market segmentation effects of workplace restructuring on jobs and workers. Work and Occupations, 30(2), 154–175.

Kalleberg, A. L. (2009). Precarious work, insecure workers: Employment relations in transition. American Sociological Review, 74(1), 1–22.

Kautonen, T., Down, S., Welter, F., Vainio, P., Palmroos, J., Althoff, K., & Kolb, S. (2010). Involuntary self-employment as a public policy issue: A cross-country European review. International Journal of Entrepreneurial Behaviour & Research, 16(2), 112–129.

Kautonen, T., Palmroos, J., & Vainio, P. (2009). ‘Involuntary self-employment’ in Finland—a bleak future? International Journal of Public Policy, 4(6), 533–548.

Kösters, L. (2017). Nederlandse wet- en regelgeving rondom zzp’ers in internationaal perspectief. Tijdschrift Voor Arbeidsvraagstukken, 33(3), 303–319.

Kösters, L., & Smits, W. (2017). Zelfstandig of toch niet? Tijdschrift Voor Arbeidsvraagstukken, 33(3), 360–369.

Kösters, L., Smits, W. (2020). False self-employment: the role of occupations. International Journal of Manpower 42(2), 322–337.

Kunda, G., Barley, S. R., & Evans, J. (2002). Why do contractors contract? The experience of highly skilled technical professionals in a contingent labor market. Industrial and Labor Relations Review, 55(2), 234–261.

Millán, A., Millán, J. M., & Román, C. (2018). Are false own-account workers less job satisfied than true ones? Applied Economics Letters, 25(13), 945–950.

Muehlberger, U. (2007). Dependent self-employment: Workers on the border between employment and self-employment. Palgrave MacMillan.

Muehlberger, U., & Bertolini, S. (2008). The organizational governance of work relationships between employment and self-employment. Socio-Economic Review, 6(3), 449–472.

Muehlberger, U., & Pasqua, S. (2006). The “Continuous Collaborators” in Italy. Hybrids between employment and self-employment? Turijn: ChilD.

Ødegård, A. M., Berge, Ø., & Alsos, K. (2012). A case study of temporary work agencies in the Norwegian construction sector: A growing informal market beyond regulation? Transfer: European Review of Labour and Research, 18(4), 461–470. https://doi.org/10.1177/1024258912458875

Parker, S. C. (2004). The economics of self-employment and entrepreneurship. Cambridge University Press.

Pfau-Effinger, B. (2009). Varieties of undeclared work in european societies. British Journal of Industrial Relations, 47(1), 79–99. https://doi.org/10.1111/j.1467-8543.2008.00711.x

Román, C., Congregado, E., & Millán, J. M. (2011). Dependent self-employment as a way to evade employment protection legislation. Small Business Economics, 2011(37), 363–392.

Rueda, D. (2014). Dualization, crisis and the welfare state. Socio-Economic Review, 12(2), 381–407.

Smeaton, D. (2003). Self-employed workers: Calling the shots or hesitant independents? A consideration of the trends. Work, Employment and Society, 17(2), 379–391.

Stanworth, C., & Stanworth, J. (1997). Managing an externalised workforce: Freelance labour-use in the UK book publishing industry. Industrial Relations Journal, 28(1), 43–55.

Szaban, J., & Skrzek-Lubasínska, M. (2018). Self-employment and entrepreneurship: A theoretical approach. Journal of Management and Business Administration, 26(2), 89–120.

Thörnquist, A. (2013), False (Bogus) Self-Employment in East-West Labour Migration Recent trends in the Swedish construction and road haulage industries. TheMES No. 41/13. Norrkoping: Linkoping University, ISVREMESO.

Williams, C. C. (2013). Evaluating cross-national variations in the extent and nature of informal employment in the European Union. Industrial Relations Journal, 44(5–6), 479–494.

Williams, C. C., & Horodnic, I. A. (2015). Self-employment, the informal economy and the marginalisation thesis. International Journal of Entrepreneurial Behavior & Research, 21(2), 224–242. https://doi.org/10.1108/IJEBR-10-2014-0184

Williams, C. C., & Lapeyre, F. (2017). Dependent self-employment: Trends, challenges and policy responses in the EU. ILO.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kösters, L., Smits, W. ‘Genuine’ or ‘Quasi’ Self-Employment: Who Can Tell?. Soc Indic Res 161, 191–224 (2022). https://doi.org/10.1007/s11205-021-02794-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-021-02794-5