Abstract

Entrepreneurial ecosystems are wealthy environments in which entrepreneurs, firms, and governments can operate frictionless, contributing to innovation and economic growth. The investigation of the structure of such systems is an open issue. We provide insights on this aspect through the formulation of seven network-based principles associating specific network metrics to distinct structural features of entrepreneurial ecosystems. In this way, we aim to support the measurement of the structural characteristics of an entrepreneurial ecosystem and the design of policy interventions in case of unmet properties. The proposed methodology is applied to an original network built on the relationships occurring on Twitter among 612 noteworthy start-ups from seven different European countries. This is a novel way to conceptualize entrepreneurial ecosystems considering online interactions. Thus, this work represents a first attempt to analyze the structure of entrepreneurial ecosystems considering their network architecture to guide policy-making decisions. Our results suggest a partial ecosystem-like nature of the analyzed network, providing evidence about possible policy recommendations.

Plain English Summary

Entrepreneurial ecosystems can be considered complex systems characterized by many actors frequently interacting among them in a non-linear way. We propose a network-based approach to analyze such interactions, and to measure the structural characteristics of an entrepreneurial ecosystem. Specifically, we provide seven network-based principles that may help policy-makers monitor the structure of a given entrepreneurial ecosystem and design policy interventions to fulfill eventual missing properties. In this way, we fill a relevant gap in the literature that is the investigation of the structure of entrepreneurial ecosystems. We apply the methodology to an online network of European start-ups, showing the usefulness and flexibility of our approach, as well as the main implications of the obtained results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The concept of ecosystem is an integral part of the entrepreneurial world. It was borrowed from the field of ecology during the late 1980s (Van de Ven, 1986), where ecosystems are characterized by strongly interconnected groups of organisms that interact with each other and with the physical environment where they live, in order to maintain the dynamic equilibrium of the system (Jackson, 2011). The ecosystem metaphor marked a substantial shift in entrepreneurship studies, away from an individualistic perspective toward a deeper attention to collectivity and community, thus including social, cultural, and economic forces in the entrepreneurship process (Stam & Van de Ven, 2021). However, despite many years passed since its first introduction, the concept of entrepreneurial ecosystem gained momentum only recently (Stam, 2015), especially in the fields of management and innovation, as the growing number of papers published after 2010 proves (Tsujimoto et al., 2018). One of the possible reasons behind such a growing popularity may be that the ecosystem metaphor is one of the most apt for representing the many facets of active entrepreneurial environments.

The identification and the measurement of entrepreneurial ecosystems is crucial in the innovation field since actors, structures, and relations that characterize ecosystems lead to digital innovation and vice versa (Hinings et al., 2018; Granstrand & Holgersson, 2020). Nevertheless, the investigation of the structure of entrepreneurial ecosystems is an open issue in the current literature, as highlighted by Wurth et al. (2022) in their proposal for an “Entrepreneurial Ecosystem Research Program.” Our paper aims to shed light on this aspect, considering the architecture of a system a key factor for the diffusion of innovation as well as a key determinant for its global performance (Ferraro and Iovanella, 2016; Muller & Peres, 2019).

In more detail, we propose to contribute to the literature by adopting an innovative approach to the measurement of entrepreneurial ecosystems with respect to other methods, such as the European Index of Digital Entrepreneurship Systems (EIDES) family of indicators (Autio et al., 2020). According to Roundy et al. (2018) and Leendertse et al. (2021) indeed, entrepreneurial ecosystems can be analyzed using complexity theory to understand better their internal dynamics and the interactions among their members. In this way, we aim at answering two different research questions. Firstly, “what are the elements highlighted in the literature that can be identified as structural features of an entrepreneurial ecosystem?” Secondly, looking at these elements under a complex systems perspective, “is it possible to quantify such elements by means of network metrics?” Indeed, the most common way to represent complex systems is through the use of networks (Thurner et al., 2018). Moreover, according to Seppä and Tanev (2011), the presence of a network structure is a necessary condition for the existence of an ecosystem. Then, networks constitute valid, apt, and available models to represent entrepreneurial ecosystems.

We address the aforementioned research questions by formulating seven principles, each of them referring to a structural feature of entrepreneurial ecosystems that can be expressed by means of a consolidated metric from network science theory. Therefore, the first contribution of this study is the proposal of seven network-based metrics that aim to be a support to the measurement of the structural characteristics of an entrepreneurial ecosystem. In doing so, we propose to provide a set of indicators that may help several actors—such as practitioners and policy-makers—monitor the structure of an entrepreneurial ecosystem and design policy interventions aimed at fulfilling eventual missing properties.

Secondly, another key contribution of this paper is represented by measuring entrepreneurial ecosystems via social media data. Considering online connections to map entrepreneurial ecosystems is innovative to this field. According to the literature, entrepreneurial ecosystems are locally defined, and their actors interact mainly through social, financial, technological, and economic flows (Spigel, 2017; Stam & Van de Ven, 2021). Under this perspective, proximity emerges as a critical factor and enabler of entrepreneurial ecosystems (Isenberg, 2011). In this vein, analyzing ecosystems through online relationships contribute to extending the concept of proximity beyond regional and national borders, allowing the conceptualization of entrepreneurial ecosystems at the continental level. In fact, we report a case study of a Twitter network constituted by some among the most popular and promising start-ups belonging to seven different countries: Austria, France, Germany, Italy, Spain, Switzerland, and the UK. Their names are collected from accredited sources which provide every year a list of the most noteworthy start-ups in the international context.

Being start-ups the embodiment of entrepreneurship and innovation (Feldman, 2001; Isenberg, 2016), a start-up network seems a well-suited candidate for testing the characteristics of an entrepreneurial ecosystem. In fact, according to the widely used definition of Blank (2010), “a start-up is an organization formed to search for a repeatable and scalable business model.” Furthermore, the definition of a start-up ecosystem as “a society of founders with ideas and skills, young companies at early stages with talent, incubators with mentors and capital, early adopters, and media” (Aleisa, 2013) is definitely included in the wider concept of entrepreneurial ecosystem. Then, for all the actors of a start-up network, it is important to understand how the structure of this system affects their own activities (Spender et al., 2017).

The network that we take into account is built on an original dataset obtained by mining relationships among 612 start-ups on Twitter, a social networking platform frequently used for testing professional links across start-ups (Gloor et al., 2013; Perotti and Yu, 2015; Yue et al., 2019; Tumasjan et al., 2021). In the choice of Twitter as a proxy to build the network, we also rely on the study of Tajudeen et al. (2018), which sustains that well-performing innovative organizations show a high social media usage, and on the paper of Olanrewaju et al. (2020) that provides a comprehensive review on the importance of social media for entrepreneurship.

The paper is organized as follows. An overview of the state of the art on entrepreneurial ecosystems is reported in Section 2. Section 3 describes the approach of this study, which has its foundations in Social Network Analysis and complexity theory, before formulating the network-based principles characterizing the structure of entrepreneurial ecosystems. Section 4 introduces the case study, including the processes of data collection and network construction. The results obtained by the measurement of the network-based principles are reported in Section 5. Finally, Section 6 points out the main theoretical and practical contributions of this study, as well as the acknowledged possible limitations and further developments.

2 The concept of entrepreneurial ecosystem

The concept of entrepreneurial ecosystem is strongly debated in the scientific literature. However, a unique definition of entrepreneurial ecosystem does not exist, since each contribution introduces different concepts, and focuses on specific aspects. Most of the studies dealing with this topic adopt a qualitative approach, hence analyzing ecosystems in a descriptive way aimed at pointing out the founding elements and policies that encourage the establishment of an entrepreneurial ecosystem. What mostly emerges is that entrepreneurial ecosystems include a combination of social, institutional, financial, and cultural components (Van de Ven, 1993; Spigel, 2017).

Emphasis is given to the interactions among the members of the ecosystem, which should result into high network density, many connecting events, collaboration between large companies and local start-ups, together with an easy access to all kinds of relevant resources, and an enabling role of government in the background (Feld, 2012). Nevertheless, without some degrees of cohesion and shared values among the agents of an entrepreneurial ecosystem, they will operate autonomously, without commonality in their activities, and differently with respect to a system of interrelated actors (Roundy, 2017). Additionally, an entrepreneurial-market logic is essential, encapsulating a related set of goals and behaviors focused on innovation, the creation of new markets, new business models and technologies, and tolerance for uncertainty and failure (Cunningham et al., 2002). Spigel (2022) integrates previous contributions, finding that entrepreneurial ecosystems are nested rather than cohesive.

One of the main aspects that emerges in many works is the fundamental role that governments, and more specifically the policies they adopt, have for the correct establishment of an entrepreneurial ecosystem. Governments’ policies shape the institutional environment in which entrepreneurial decisions are made, by leveraging the presence of local research centers, increasing the availability of venture capital, encouraging a culture of risk taking, and creating strong local informational and business development networks (Feldman, 2001; Minniti, 2008). However, policy initiatives to promote the growth of innovative companies depend on the specific stage of firms development (Audretsch et al., 2020).

Several authors describe entrepreneurial ecosystems as complex systems, thus borrowing concepts from complexity theory. Isenberg (2016) affirms that the ecosystem metaphor implies the existence of a largely self-organizing, self-sustaining, and self-regulating system, and this aspect needs to be considered in the development of pro competition policies. The theme of self-organization is also treated by Stanley and Briscoe (2010) and Tan et al. (2020), whose studies depict ecosystems as robust, scalable architectures that can automatically solve complex and dynamic problems, possessing several properties, including self-organization, self-management, sustainability, and scalability. Self-organization is a term typically used in literature to describe a process in which small units assemble into larger structures without external intervention (Burnes, 2005); this process often combines with a co-evolutionary perspective that is frequently adopted in studies of complex adaptive systems and economy (Moore, 2006). According to Han et al. (2019), self-organization and co-evolution are just two of the interrelated complex properties that an entrepreneurial ecosystem exhibits, as well as non-linear interactions, (in)sensitivity to initial conditions, adaptation to the environment, and the emergence of successful actors.

The identification of entrepreneurial ecosystems is also crucial in the innovation field. Indeed, digital innovation and the emergence of ecosystems are strictly related. Specifically, the set of actors, structures, and activities, as well as the institutions and relations that characterize ecosystems, could lead to digital innovation and vice versa (i.e., the combined effects of digital innovation could bring to the emergence of new organizational forms and institutional building blocks) (Hinings et al., 2018; Granstrand and Holgersson, 2020).

Another concept strongly debated in literature concerns the social attributes of entrepreneurial ecosystems. Networks of entrepreneurs are characterized by a strong information flow, enabling an effective distribution of knowledge, labor, and capital (Malecki, 2018a). Greve and Salaff (2003) recognize that entrepreneurs use their social capital to access resources in establishing a firm. Other authors, such as Hoang and Antoncic (2003) and Motoyama and Knowlton (2017), adopt a social network perspective to the study of entrepreneurial ecosystems, analyzing the interconnections between entrepreneurs and entrepreneurship support organizations.

The network structure of entrepreneurial ecosystems makes intermediary organizations a key resource to spread information and knowledge within the network, and to facilitate the access to the venture capital market by entrepreneurs. Business accelerators and universities play a critical role in emerging entrepreneurial ecosystems. In particular, business accelerators forge a broader network of relationships with actors outside of the system, which in turn increase the capacity of the system itself and embed it within a global innovation system (Pustovrh et al., 2020). On the other hand, universities play a strategic role as drivers of regional economic growth by establishing and supporting university spin-off companies (Fuster et al., 2019), and acting as local and regional economic engines with the potential to generate new and disruptive technologies (Chan & Farrington, 2018).

Recent studies introduce the concept of dynamism in the entrepreneurial ecosystem approach. Mack and Mayer (2016) design a framework providing useful benchmarks to determine the stage of development of an entrepreneurial ecosystem, according to which at each stage different elements are more important than others. Malecki (2018b) sustains that ecosystems’ evolution is related to the degree to which mentors and business angels are able to support new entrepreneurs, while Colombelli et al. (2019) focus on the governance configurations that affect the evolution of entrepreneurial ecosystems.

Finally, further aspects are explored by Ives and Carpenter (2007), whose work highlights the interdependence between stability and diversity within ecosystems, and by Jacobides et al. (2018) that introduce an important but neglected characteristic of ecosystems, which is the presence of modularity as a condition that allows at least some degrees of explicit coordination, thus creating the opportunity for an ecosystem to emerge.

Alongside qualitative approaches, other authors analyze the concept of entrepreneurial ecosystem in a more principled way. Isenberg (2011) develops one of the first frameworks attempting to summarize the main elements of an entrepreneurial ecosystem. His model distinguishes six domains: finance, policy, culture, markets, human capital, and supports. Feld (2012) emphasizes the interaction between the players in the ecosystem and the access to all kinds of relevant resources, with an enabling role of the government at the background. In particular, his study shows a list of nine attributes that a successful community of start-ups should have to be an entrepreneurial ecosystem. Such attributes are as follows: leadership, intermediaries, network density, government, talent, support services, engagement, companies, and capital. Foster et al. (2013) determine which pillars of an entrepreneurial ecosystem are the most important for the growth and success of companies. The proposed pillars are as follows: accessible markets, human capital, funding and finance, support systems, regulatory framework and infrastructure, education and training, universities, and cultural support. Stangler and Bell-Masterson (2015) propose four indicators to measure an entrepreneurial ecosystem, which are density, fluidity, connectivity, and diversity. Stam (2015) identifies the framework and systemic conditions of the ecosystem that lead to entrepreneurial activities and to new value creation. The framework is extended in Stam and Van de Ven (2021) that introduce an integrative model of entrepreneurial ecosystems consisting of ten elements: formal institutions, culture, network, physical infrastructure, finance, leadership, talent, knowledge, intermediary services, and demand. Roundy (2017) combines entrepreneurship and management research to argue that entrepreneurial ecosystems are influenced by two dominant institutional rules: entrepreneurial market logic and community logic. The author also argues that hybrid support organizations—such as incubators, accelerators, and small business development centers—play a unique role in entrepreneurial ecosystems by exposing participants to the two guiding rules and promoting the presence of a greater diversity of venture types.

3 Network-based principles

According to Wurth et al. (2022), there are four main research streams that still need to be investigated in the entrepreneurial ecosystem literature, i.e., context, structure, microfoundations, and complex systems. The authors also include four cross-sectional themes in their proposal for an “Entrepreneurial Ecosystem Research Program,” which are methodologies and measurements, theory, critical research, and transdisciplinary research. In this work, our aim is to quantify structural elements of entrepreneurial ecosystems emerging from the literature by means of metrics from network analysis (Wasserman and Faust, 1994; Humphries & Gurney, 2008; Barabási, 2016; Newman, 2018). Thus, based on the research framework proposed by Wurth et al. (2022), we focus on the cross between structure and methodoligies and measurement.

First of all, being our approach innovative to the field, we need to introduce some theoretical prerequisites. Specifically, we combine elements from complexity theory and Social Network Analysis (SNA) to derive the network-based principles that characterize the structure of entrepreneurial ecosystems.

Complexity theory regards the identification and analysis over time of complex systems, including ecosystems, in which the constituent elements give rise to the collective behaviors of the system (Funtowicz and Ravetz, 1994; Thurner et al., 2018). Such complex systems can be described through their structural characteristics (e.g., organizations member features, behaviors, and interaction dynamics) and modeled as networks of interacting entities (Barabási, 2016; Newman, 2018; Russell & Smorodinskaya, 2018). In complex systems, interactions are usually non-uniform and heterogeneous but interactions between elements can be specific (Thurner et al., 2018).

Networks are the preferred tool for mapping such interactions and through different methods attributed to several disciplines, such as mathematics, statistics, physics, and computer science (Börner et al., 2007), permit to understand structures, roles and dynamics of complex systems. From this perspective, a network can be considered as an abstraction of observable reality able to explain the performance of real systems since it correlates form with functions, and structure with behaviors (Lewis, 2009; Cerqueti et al., 2018). Hence, network analysis can be useful to describe and analyze the structure and behaviors of several complex systems found in the real world, and to systematically explore performance drivers exploiting concepts such as emergence, adaptability, self-organization, resilience, and flexibility. In this respect, the rapidly increasing mass of data that has become available in many different domains contributes to making the empirical investigation of such complex systems more and more suitable at affordable efforts (Hassanien et al., 2015).

Among the different methods in network analysis, one of the most used tools is SNA. It is an instrument to conceptualize and investigate connections among social entities. In general terms, SNA can be considered as an archetype that abstracts social life in terms of connection structures among entities (Hu et al., 2015) and measures of centrality (Scott & Carrington, 2011). The use of network analysis to investigate the relationships within an entrepreneurial ecosystem is an innovative field of research (Cavallo et al., 2019). Some recent applications can be found in the literature on entrepreneurial and innovation ecosystems (e.g., Panetti et al., 2020; Cavallo et al., 2021).

In the end, our process leads to the definition of seven network-based principles characterizing the structure of entrepreneurial ecosystems, which are introduced and described as follows. In more detail, we identify seven distinct elements in the literature corresponding to structural characteristics of entrepreneurial ecosystems. Each element is associated to a network metric based on the meaning of that metric and its subsequent interpretation in an economic environment. These principles are also resumed in Table 1, together with the associated network metric and a brief explanation of the latter one; we also report the major contributions on entrepreneurial ecosystems that highlight the relevance of the related element.

Each network-based principle needs to be interpreted according to a baseline scenario in order to understand if the values we observe are either exceeding or underperforming benchmark values. In network theory, the baseline scenario is usually represented by a set of Erdös Rényi (ER) random graphs. In graph theory indeed, the ER random graph is one of the most commonly used reference models. According to this model, a random network having N nodes is created, and then M edges are generated by pairing among nodes randomly and uniformly (Erdős & Rényi, 1960). Comparing the obtained results to this benchmark model allows to identify underlying mechanisms in the observed system that depart from the scenario expected by chance (Peel et al., 2017).

3.1 Connectivity

Connectivity is an important element for an entrepreneurial ecosystem since the involvement of all the actors is a key factor for a virtuous environment. Connectivity affects the possibility to interact between all the members of a system.

We associate connectivity to small-world-ness index. This parameter is based on the trade off between a high global clustering coefficient and a short average path length (Humphries & Gurney, 2008). Specifically, it is defined as follows:

where γ is the standardized clustering coefficient, and λ is the standardized average shortest path. Standardization is made by comparing the respective values in the analyzed network with the mean of the corresponding measures over a set of ER random graphs. The clustering coefficient corresponds to the probability that the adjacent nodes of a node are connected, thus capturing the degree to which the neighbors of every node in the network link to each other. The average shortest path is instead the mean of all the shortest paths—which is the path with the fewest number of links—between any couple of nodes. The notion of “small-world” relies on the idea of “six degrees of separation,” a popular concept stemming from the experiment conducted by the psychologist Stanley Milgram in the 1960s, according to which the social distance between any two individuals is definitely short (Milgram, 1967). Specifically, a network is considered to display a small-world structure if S > 1.

Networks characterized by small-world structure show the presence of hubs connecting a large number of small degree nodes, thus creating short distances between them. For this reason, this metric is appropriate to quantify how well a system is connected considering both cohesiveness and mean distance among nodes.

3.2 Density

Density is required as entrepreneurial ecosystems necessitate a high number of interactions among their members to facilitate the establishment of reliable relationships and a frequent knowledge exchange. Density determines the frequency of the interactions between the members of a system.

We associate density to mean degree. The degree of a node corresponds to the number of links incident upon the node. Thus, mean degree represents the average number of connections established by a general node in the network. A distinct behavior of real networks consists in the emergence of giant components. According to Barabási (2016), these dynamics take place in the so called “supercritical regime,” i.e., when 〈k〉 > 1, where 〈k〉 is the mean degree of the network. The network is instead in the “connected regime” if 〈k〉 > lnN, where N is the number of nodes of the network. Therefore, we evaluate the density of the ecosystem by comparing the mean degree to these two thresholds.

In the end, the mean degree reveals if the members of a system frequently exchange information each other.

3.3 Stability

Stability refers to the identification of ecosystems as robust structures endowed by the capacity of solving complex and unpredictable problems. Stability implies strong connections among the members of a system, making the system able to recover from shocks and to survive over time.

We associate stability to network robustness. The study of a system’s stability via network robustness consists in investigating variations in the underlying network topology (Albert et al., 2000; Barabási, 2016; Thurner et al., 2018; Liu et al., 2022). According to Barabási (2016), the breakdown of a network following a random node removal is not gradual. Indeed, removing a limited number of nodes has reduced impact on network topology. However, once the fraction of removed nodes (f) exceeds a critical threshold (fc), the network becomes suddenly disconnected. Following the Molloy-Reed criteria, the critical threshold is defined as:

where 〈k〉 and 〈k2〉 are the mean and the second moment of nodes’ degree, respectively.

A network shows enhanced robustness if its critical threshold is greater than the randomized network predicition, i.e., \(f_{c}>f_{c}^{ER}\), where \(f_{c}^{ER}\) is defined as follows:

Then, the stability of a system can be determined by analyzing changes in the dimension of the giant component when random failures occur.

3.4 Leadership

Leadership, intended as the presence of a strong group of entrepreneurs and companies, is another fundamental aspect of an entrepreneurial ecosystem. The existence of leaders provides directions and role models, and it is critical in building and maintaining a healthy environment as well as in guiding the community to exploit attractive opportunities.

We associate leadership to page rank centralization. Page rank is a centrality measure ranking the nodes according to the number and the quality of their connections and the connections of their neighbors (Page et al., 1999), and it is also the fundamental logic behind the rationale of the Google algorithm. Page rank centralization computes the graph-level centrality score, i.e., how much the network is centralized, based on the aforementioned centrality measure. Specifically, the normalized page rank centralization P of a general network G is defined as follows:

where pv is the page rank of vertex v, maxwpw is the maximum value of page rank in the network, and pmax is the maximum theoretical page rank for a node in a network with the same number of vertices (Freeman, 1978; Wasserman and Faust, 1994).

Thus, leadership patterns emerge in the presence of a page rank centralization that is higher than the mean of the same metric over a set of ER random graphs.

3.5 Diversity

Diversity is defined as the presence of different classes and venture types, whose members interact regardless the category they belong to. Diversity contributes to the establishment of a wealthy, heterogeneous, and rich environment, facilitating the cross-fertilization of ideas, and sharing expertise among actors.

We associate diversity to assortativity. According to Newman (2018), a network is assortative if a significant fraction of links run between nodes of the same type. This metric is defined as the Pearson correlation coefficient of degree or attributes between pairs of linked nodes (Newman, 2002), then ranging between − 1 and 1. Thus, assortativity can be calculated based on different characteristics of a node, revealing the extent to which members of different nature (e.g., metadata referring to different domains, such as countries) and different relevance (e.g., in terms of number of connections) interact with each other (Cinelli et al., 2020).

Therefore, a diverse and heterogeneous environment is expected to show neutral behaviors avoiding preferential mechanisms.

3.6 Intermediaries

Intermediaries, embodied by support organizations such as accelerators, incubators, universities, and research centers, are emphasized as a key resource for an entrepreneurial ecosystem. Intermediaries carry out two crucial activities: they act as brokers between different actors of a system, and they channel the information flow toward peripheral members.

We associate intermediaries to betweenness centralization. Betweenness centrality is a centrality measure determining the number of times a node lies on the shortest path between any two other nodes, thus channeling and controlling the exchange of knowledge in the network (Newman, 2018). Betweenness centralization computes the graph-level centrality score based on the early introduced centrality measure. Specifically, the normalized betweenness centralization B of a general network G is defined as follows:

where bv is the betweenness of vertex v, maxwbw is the maximum value of betweenness in the network, and bmax is the maximum theoretical betweenness for a node in a network with the same number of vertices (Freeman, 1978; Wasserman and Faust, 1994).

Then, distinct intermediaries connecting different network components emerge if the value of betweenness centralization is higher than the mean of the same metric over a set of ER random graphs.

3.7 Feedback loops

Feedback loops, caused by upward and downward links, are an essential characteristic of an entrepreneurial ecosystem, showing the interdependence between the actors of the system. This notion derives from the original concept of ecosystem, which is generally an environment based on mutual relationships (e.g., the carbon balance of the terrestrial ecosystems).

We associate feedback loops to reciprocity coefficient. This metric computes the probability that a link from a node to another is reciprocated within the network (Wasserman & Faust, 1994). Reciprocity coefficient determines the fraction of mutual relationships between the members of a system.

Specifically, feedback loops frequently occur if the reciprocity coefficient is higher than the mean of the same metric over a set of ER random graphs.

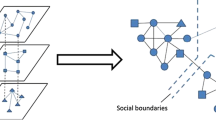

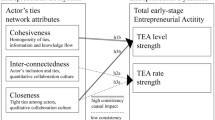

For the sake of clarity, we summarize our research framework in Fig. 1.

4 The case study: an international start-up network on Twitter

We present an empirical case study about the assessment of the network-based principles of an entrepreneurial ecosystem, taking into account an original network made up of some among the most popular and promising start-ups from seven different countries: Austria, France, Germany, Italy, Spain, Switzerland, and the UK. In this way, we aim to measure the structural elements of a potential entrepreneurial ecosystem built by using the relationships occurring in April 2020 among a final set of 612 selected start-ups, considering Twitter as a proxy for connectivity.

We consider the analysis of an online network an intriguing case study for many reasons. At first, the pandemic changed the way in which most of the relationships (especially in a working environment) occur (Almeida et al., 2020). Digital platforms have been emerging as essential to communicate, and they will probably keep this key role in the future as well (Seetharaman, 2020). As a consequence, the concept of proximity, which is essential in the definition of entrepreneurial ecosystems, has changed. Rather than geographical and physical, we need to consider other kinds of proximity, and our case study provides an example of that. Secondly, Twitter is one of the most used social networking platforms among innovative firms, and its usage increases networking capabilities as well as the possibility to establish professional links between different companies (Gloor et al., 2013; Perotti & Yu, 2015; Tajudeen et al., 2018). Some recent works related to business are exploiting information deriving from Twitter in order to gain relevant insights about companies. For instance, Tumasjan et al. (2021) study the role of digital traces on Twitter as a predictor of business venturing opportunities, finding that Twitter is particularly important when start-ups are still young. Yue et al. (2019) inspect the engagement among Fortune 200 and top startup CEOs on Twitter. A more comprehensive review on the importance of social media for entrepreneurship can be found in Olanrewaju et al. (2020). Finally, analyzing relationships occurring in an online platform allows us to go beyond regional and national borders—as entrepreneurial ecosystems are usually defined—and deal with an entrepreneurial ecosystem at the continental level.

In the Twitter network, a following relationship can be considered as an expression of interest toward another actor in the sense that it expresses the desire to be up-to-date with the news posted by the followed actor. Indeed, the following relationships on Twitter are among the main factors that rule the timeline, i.e., what the users see on the platform, and, in turn, the information they automatically have access to.

In order to define formally the relationships on Twitter, let us consider a generic couple of start-ups, A and B. If A is a follower of B, it means that A has an interest in B. Similarly, if B is a follower of A, it means that B has an interest in A. If A and B follow each other, then A is accounted in the list of B’s followers while B is accounted in the list of A’s followings. Accordingly, being the relationship of interest mutual, B is accounted in the list of A’s followers while A is accounted in the list of B’s followings.

Data processing, network analysis, and all simulations are conducted using the software R (R. Core Team, 2014), specifically the “igraph” package (Csardi and Nepusz, 2006). Network extraction is realized by interacting with Twitter’s API through the “rtweet” package (Kearney, 2019).

4.1 Data collection

The process of data collection follows a three-step procedure.

4.1.1 Step 1

The lists of the most promising start-ups for each country in 2019/2020 are collected from accredited sources which provide every year the names of the most noteworthy start-ups in the international context. Specifically, we select those start-ups with a website up and running at the time of data collection. The list of the sources used within this study is the following: Sifted, Seedtable, StartupItalia, Top 100 Swiss Startup Award, Startups, StartupsReal by El Referente. A description of each source as well as the related access date is provided in the Supplementary Material.

4.1.2 Step 2

All the start-ups identified during the previous step are classified in fifteen different categories according to their business activities. The identification criteria are based on the description of each category, which is reported in the Supplementary Material.

This classification is obtained in a twofold way: some sources from which start-ups are taken explicitly indicate the category of each start-up; for the remaining cases, the category is retrieved from the description of the company as provided either on its website or on its Twitter profile.

4.1.3 Step 3

We exclude all the start-ups that do not own a Twitter account, as being Twitter the proxy we refer to build the network. The final dataset comprises 612 start-ups out of an initial set of 712 start-ups. The distribution of the selected start-ups over different countries and categories is represented in Figs. 2 and 3, respectively.

4.2 Network construction and visualization

The network of start-ups is built by downloading follower and following relationships for each of the 612 accounts, through the interaction with Twitter’s Standard API.

The resulting network includes 612 nodes, corresponding to the aforementioned set of start-ups, and 1150 directed edges. In more detail, each start-up corresponds to a node, while an edge stands for the relationship between two different start-ups, i.e., there is a directed link from i to j if start-up i follows start-up j on Twitter, while there is a directed link from j to i if start-up j follows start-up i (or, equivalently, start-up i is followed by start-up j) on Twitter. The bulk of these links take place among 419 start-ups, representing the giant component of the network, i.e., the greatest subset of nodes all mutually connected by any path. More precisely, the network is structured in the following way: a giant component, made up of 419 nodes; eight small connected components, six of which are made up of 2 nodes, while the other ones are made up of 3 and 5 nodes; the remaining components consist in 173 isolated nodes. The network is displayed in Fig. 4.

5 Empirical results

The following section shows the results we obtain by measuring the seven network-based principles of the network introduced in Section 4. Hereafter, we address each principle formulated in Section 3, and then we summarize all the results in Table 2.

5.1 Connectivity

We standardize clustering coefficient and average shortest path by comparing them with the mean of the corresponding values over 1000 ER random graphs characterized by the same number of nodes and edges. The computed small-world-ness index results in 33.7, thus suggesting the network to be properly small-world.

5.2 Density

The mean degree of the network is equal to 3.76. According to Barabási (2016), since the mean degree is greater than 1, the network is in the “supercritical regime”. However, the obtained value is lower than lnN = 6.42, i.e., the critical threshold identifying the “connected regime.”

5.3 Stability

A significant fraction of nodes needs to be removed to suddenly disconnect the network of start-ups. Specifically, the critical threshold corresponds to 0.86, which is greater than the threshold of the randomized network prediction, resulting in 0.73. The enhanced robustness of the network emerges also from Fig. 5, where we represent the portion of nodes belonging to the giant component (\(P_{\infty }(f)\)) while progressively removing an increasing fraction of random chosen nodes (f ), with respect to the initial portion of nodes in the network belonging to the giant component (\(P_{\infty }(0)\)). Since the error tolerance analysis could be influenced by the nodes that are randomly chosen at each step of the algorithm, this kind of simulation is repeated 1000 times, in order to smooth out eventual fluctuations of the outcome. The evaluation of network robustness is then enriched by the comparison with the average results obtained over 1000 ER random graphs with the same number of nodes and edges.

Error tolerance analysis: effects on the giant component. \(P_{\infty }(f)\) is the number of nodes belonging to the giant component over the total amount of nodes in the network, when removing a specific fraction of nodes f; \(P_{\infty }(0)\) is the number of nodes belonging to the giant component over the total amount of nodes in the network, when removing 0 nodes, i.e., the initial portion of nodes in the network belonging to the giant component. \(P_{\infty }(f)/P_{\infty }(0)\) represents the portion of nodes belonging to the giant component when removing a certain fraction of nodes f, normalized by the initial portion of nodes belonging to the giant component

The results are strongly influenced by the structure of the network, since the huge amount of small degree nodes allows the network to efficiently react in case of random failures. Therefore, the connections among the start-ups are stable enough to guarantee that the size of the giant component will not considerably decrease, and that the network will not become highly disconnected.

5.4 Leadership

The network level of centralization based on the values of page rank is equal to 0.02. The average value of centralization over 1000 ER random graphs characterized by the same number of nodes and edges is 0.006. Therefore, the network structure shows the presence of leadership patterns.

5.5 Diversity

Concerning the assortativity coefficient to degree, the network results to be quite neutral, being the coefficient equal to − 6.8 × 10− 3. On the other hand, the values of assortativity to the two attributes of the start-ups, which are country of origin and category, are 0.73 and 0.23, respectively. Therefore, we can observe a clear evidence of the effect of geographical proximity in the establishment of relationships within the network. A quite similar phenomenon is determined by the membership of the start-ups to the same category. On the other hand, the activity of the start-ups in the network does not show preferential mechanisms between similar nodes in terms of their size.

5.6 Intermediaries

The network level of centralization based on the values of betweenness centrality is equal to 0.04. The average value of centralization over 1000 ER random graphs characterized by the same number of nodes and edges 0.06. Therefore, the network structure does not highlight the presence of distinct intermediaries.

5.7 Feedback loops

The reciprocity coefficient in the analyzed network is equal to 0.32, namely about 1/3 of relationships are mutual. This value definitely overperforms the average reciprocity coefficient over 1000 ER random graphs that is 3.1 × 10− 3. Then, we can conclude that the presence of feedback loops is frequent within the network of start-ups.

6 Conclusion and discussion

In this paper, we propose an innovative approach to the measurement of the structure of entrepreneurial ecosystems. Since entrepreneurial ecosystems can be considered complex systems characterized by a multitude of actors frequently interacting among them, we adopt a network-based approach to analyze the connections between the members of an entrepreneurial ecosystem. Specifically, we address some important structural features that, according to the literature, characterize entrepreneurial ecosystems: connectivity, density, stability, leadership, diversity, intermediaries, and feedback loops.

We associate each element to a consolidated network metric. In doing so, we provide seven network-based principles characterizing entrepreneurial ecosystems that can be measured and assessed to monitor and evaluate the structure of a given entrepreneurial ecosystem. In this way, we shed light on an open issue in the current literature, which is the investigation of the structure of entrepreneurial ecosystems. In particular, the measurement of the structural features of an entrepreneurial ecosystem is of fundamental importance to tailor proper policies fostering collaboration and innovation, since all the actors, structures, and practices that characterize entrepreneurial ecosystems strongly contribute to digital innovation and economic growth.

This is a novel approach to the measurement of entrepreneurial ecosystems with respect to previous methods. For instance, considering the EIDES family of indicators, there are two main novelties introduced by our approach. Firstly, the indicators characterizing the EIDES correspond to statistics published (in almost all cases) annually by international institutions, such as Eurostat, World Economic Forum, and others. It follows that the EIDES represents a well-recognized ex-post indicator aimed at measuring the digital development of entrepreneurial ecosystems. Differently, the proposed approach, being based on network metrics, allows monitoring the structure of an entrepreneurial ecosystem in real-time, without the need to wait for the publication of national and international statistics. Secondly, as linked to country-level statistics, the EIDES does not allow dealing with entrepreneurial ecosystems at the international level. Even if entrepreneurial ecosystems are usually defined in terms of local districts at the regional or national level, the investigation of the establishment of innovation and digital ecosystems at the international level is gaining attention recently, especially in a European policy context. Our approach, being based on connections between organizations, can be applied in an international context in all the cases in which the analyzed ecosystem is characterized by interactions between foreign partners, as in the case study we report. Nevertheless, in the future we intend to create an overall index including all the network-based measures, being coherent with the EIDES family of indicators.

We also contribute to the literature by proposing an alternative conceptualization of ecosystems considering online relationships. In particular, we provide an example of a network constituted by 612 start-ups belonging to seven different countries, built by considering the relationships occurring among them on Twitter. This is an innovative way to investigate entrepreneurial ecosystems that can gain increasing attention in the next future. The pandemic indeed, shifted several relationships toward digital platforms, extending the concept of proximity that is central in the definition of entrepreneurial ecosystems. In particular, Twitter is one of the most important social networking platforms among high-technology firms, and it has been recently used as a predictor of start-ups’ success (Tumasjan et al., 2021). Finally, online relationships can extend beyond regional and national borders, allowing the establishment of entrepreneurial ecosystems at the continental level.

As a further development, we would like to integrate the network of start-ups on Twitter with other kinds of network including other types of actors to investigate their interactions in a multi-layer ecosystem. In this way, we aim to detect the interrelated dynamics and mechanisms that affect entrepreneurial ecosystems online and offline, simultaneously.

The proposed approach also leaves room for some policy implications. Indeed, it can provide real-time indications on how an entrepreneurial ecosystem is structurally developing, allowing for timely interventions in case of unmet properties. In this way, we contribute to a claimed gap in the current analysis, which is the need of data-driven approaches to model and measure entrepreneurial ecosystems. More generally, the proposed methodology aims to support policy-makers and institutions funding the establishment of collaborative networks and entrepreneurial and innovation ecosystems. The results obtained from the measurement of the network-based principles in fact can help these actors evaluate the impact of their policies on the structure of a specific system.

Looking at the results, we find that the members of the analyzed network are able to communicate with each other in few steps due to the small-world structure of the system, despite the low number of edges in the network. The average number of connections established by a start-up suggests the network to be in the “supercritical regime,” thus departing from the ER random scenario. However, the mean degree is not sufficiently high to allow the network to shift toward the “connected regime.” One possible reason of such behavior could be the stage of development of the analyzed network, as well as the early adoption of Twitter in the business processes. In conclusion, our findings highlight a partial ecosystem-like nature of the analyzed network, pointing out those elements that need to be better established in order to consider it a proper entrepreneurial ecosystem. An eventual limitation of our case study is related to the fact that start-ups might be connected via their founders or CEOs on Twitter rather than via their corporate accounts.

This work represents a first attempt to analyze the social network structure of a system to guide policy-making decisions. In the future, we aim to apply the methodology in the presence of other ecosystems, in order to collect data to perform a comparative analysis among different systems.

References

Albert, R., Jeong, H., & Barabási, A.L. (2000). Error and attack tolerance of complex networks. Nature, 406(6794), 378–382. https://doi.org/10.1038/35019019.

Aleisa, E. (2013). Startup Ecosystems: Study of the ecosystems around the world; Focusing on Silicon Valley, Toronto and Moscow.

Almeida, F., Duarte Santos, J., & Augusto Monteiro, J. (2020). The challenges and opportunities in the digitalization of companies in a post-COVID-19 world. IEEE Engineering Management Review, 48(3), 97–103. https://doi.org/10.1109/EMR.2020.3013206.

Audretsch, D., Colombelli, A., Grilli, L., Minola, T., & Rasmussen, E. (2020). Innovative start-ups and policy initiatives. Research Policy, 49(10), 104027. https://doi.org/10.1016/J.RESPOL.2020.104027.

Autio, E., László, S., Komlósi, E., & Mónika, T. (2020). EIDES 2020, - the European index of digital entrepreneurship systems. Publications Office of the European Union, Luxembourg. https://doi.org/10.2760/150797.

Barabási, A.L. (2016). Network science. Cambridge: Cambridge University Press.

Blank, S. (2010). Why startups are agile and opportunistic – Pivoting the business model. Steve Blank.

Börner, K., Sanyal, S., Vespignani, A., & et al. (2007). Network science. Annual Review of Information Science and Technology, 41(1), 537–607. https://doi.org/10.1002/aris.2007.1440410119.

Burnes, B. (2005). Complexity theories and organizational change. International Journal of Management Reviews, 7(2), 73–90. https://doi.org/10.1111/j.1468-2370.2005.00107.x.

Cavallo, A., Ghezzi, A., & Balocco, R. (2019). Entrepreneurial ecosystem research: Present debates and future directions. International Entrepreneurship and Management Journal, 15 (4), 1291–1321. https://doi.org/10.1007/S11365-018-0526-3.

Cavallo, A., Ghezzi, A., & Sanasi, S. (2021). Assessing entrepreneurial ecosystems through a strategic value network approach: Evidence from the San Francisco Area. Journal of Small Business and Enterprise Development, 28(2), 261–276. https://doi.org/10.1108/JSBED-05-2019-0148.

Cerqueti, R., Ferraro, G., & Iovanella, A. (2018). A new measure for community structures through indirect social connections. Expert Systems with Applications, 114, 196–209. https://doi.org/10.1016/J.ESWA.2018.07.040.

Chan, Y.E., & Farrington, C.J. (2018). Community-based research: Engaging universities in technology-related knowledge exchanges. Information and Organization, 28(3), 129–139. https://doi.org/10.1016/j.infoandorg.2018.08.001.

Cinelli, M., Peel, L., Iovanella, A., & Delvenne, J.C. (2020). Network constraints on the mixing patterns of binary node metadata. Physical Review E, 102(6), 062310. https://doi.org/10.1103/PhysRevE.102.062310.

Colombelli, A., Paolucci, E., & Ughetto, E. (2019). Hierarchical and relational governance and the life cycle of entrepreneurial ecosystems. Small Business Economics, 52(2), 505–521. https://doi.org/10.1007/S11187-017-9957-4.

Csardi, G., & Nepusz, T. (2006). The igraph software package for complex network research. InterJournal Complex Systems, 1695(5), 1–9.

Cunningham, B.J., Gerrard, P., Schoch, H., & Lai Hong, C. (2002). An entrepreneurial logic for the new economy. Management Decision, 40(8), 734–744. https://doi.org/10.1108/00251740210437707.

Erdős, P, & Rényi, A (1960). On the evolution of random graphs. Publications of the Mathematical Institute of the Hungarian Academy of Sciences, 5(1), 17–60.

Feld, B. (2012). Startup communities: Building an entrepreneurial ecosystem in your city. Wiley: New York.

Feldman, M.P. (2001). The entrepreneurial event revisited: Firm formation in a regional context. Industrial and Corporate Change, 10(4), 861–891. https://doi.org/10.1093/icc/10.4.861.

Ferraro, G., & Iovanella, A. (2016). Revealing correlations between structure and innovation attitude in inter-organisational innovation networks. International Journal of Computational Economics and Econometrics, 6(1), 113. https://doi.org/10.1504/IJCEE.2016.073364.

Foster, G., Shimizu, C., Ciesinski, S., Davila, A., Hassan, S., Jia, N., & Morris, R. (2013). Entrepreneurial ecosystems around the globe and company growth dynamics. In World economic forum, (Vol. 11 pp. 1–36).

Freeman, L.C. (1978). Centrality in social networks conceptual clarification. Social Networks, 1(3), 215–239.

Funtowicz, S., & Ravetz, J.R. (1994). Emergent complex systems. Futures, 26(6), 568–582. https://doi.org/10.1016/0016-3287(94)90029-9.

Fuster, E., Padilla-Meléndez, A., Lockett, N., & Del-Águila-Obra, A.R. (2019). The emerging role of university spin-off companies in developing regional entrepreneurial university ecosystems: The case of Andalusia. Technological Forecasting and Social Change, 141, 219–231. https://doi.org/10.1016/j.techfore.2018.10.020.

Gloor, P.A., Dorsaz, P., Fuehres, H., & Vogel, M. (2013). Choosing the right friends - Predicting success of startup entrepreneurs and innovators through their online social network structure. International Journal of Organisational Design and Engineering, 3(1), 67–85. https://doi.org/10.1504/ijode.2013.053668.

Granstrand, O., & Holgersson, M. (2020). Innovation ecosystems: A conceptual review and a new definition. Technovation, 90–91, 102098. https://doi.org/10.1016/j.technovation.2019.102098.

Greve, A., & Salaff, J.W. (2003). Social networks and entrepreneurship. Entrepreneurship Theory and Practice, 28(1), 1–22. https://doi.org/10.1111/1540-8520.00029.

Han, J., Ruan, Y., Wang, Y., & Zhou, H. (2019). Toward a complex adaptive system: The case of the Zhongguancun entrepreneurship ecosystem. Journal of Business Research, 128, 537–550. https://doi.org/10.1016/j.jbusres.2019.11.077.

Hassanien, A.E., Azar, A.T., Snasael, V., Kacprzyk, J., & Abawajy, J.H. (2015). Big data in complex systems. In SBD. https://doi.org/10.1007/978-3-319-11056-1, Vol. 9. Springer.

Heimann, M., & Reichstein, M. (2008). Terrestrial ecosystem carbon dynamics and climate feedbacks. Nature, 451(7176), 289–292. https://doi.org/10.1038/nature06591.

Hinings, B., Gegenhuber, T., & Greenwood, R. (2018). Digital innovation and transformation: An institutional perspective. Information and Organization, 28(1), 52–61. https://doi.org/10.1016/J.INFOANDORG.2018.02.004.

Hoang, H., & Antoncic, B. (2003). Network-based research in entrepreneurship: A critical review. Journal of Business Venturing, 18(2), 165–187. https://doi.org/10.1016/S0883-9026(02)00081-2.

Hu, W., Gong, Z., LH, U., & Guo, J. (2015). Identifying influential user communities on the social network. Enterprise Information Systems, 9(7), 709–724. https://doi.org/10.1080/17517575.2013.804586.

Humphries, M.D., & Gurney, K. (2008). Network ‘Small-World-Ness’: A quantitative method for determining canonical network equivalence. PLoS ONE, 3(4), e0002051. https://doi.org/10.1371/journal.pone.0002051.

Isenberg, D.J. (2011). The entrepreneurship ecosystem strategy as a new paradigm for economic policy: Principles for cultivating entrepreneurship. Presentation at the Institute of International and European Affairs, 1(781), 1–13.

Isenberg, D.J. (2016). Applying the ecosystem metaphor to entrepreneurship: Uses and abuses. The Antitrust Bulletin, 61 (4), 564–573. https://doi.org/10.1177/0003603X16676162.

Ives, A.R., & Carpenter, S.R. (2007). Stability and diversity of ecosystems. Science, 317(5834), 58–62. https://doi.org/10.1126/science.1133258.

Jackson, D.J. (2011). What is an innovation ecosystem? National Science Foundation, 1(2), 1–13.

Jacobides, M.G., Cennamo, C., & Gawer, A. (2018). Towards a theory of ecosystems. Strategic Management Journal, 39(8), 2255–2276. https://doi.org/10.1002/smj.2904.

Kearney, M.W. (2019). rtweet: Collecting and analyzing Twitter data. Journal of Open Source Software, 4(42), 1829. https://doi.org/10.21105/joss.01829.

Leendertse, J., Schrijvers, M., & Stam, E. (2021). Measure twice, cut once: Entrepreneurial ecosystem metrics. Research Policy, 104336. https://doi.org/10.1016/J.RESPOL.2021.104336.

Lewis, T.G. (2009). Network science. New Jersey: Wiley and Sons, 10, 9780470400791.

Liu, X., Li, D., Ma, M., Szymanski, B.K., Stanley, H.E., & Gao, J. (2022). Network resilience. Physics Reports, 971, 1–108. https://doi.org/10.1016/J.PHYSREP.2022.04.002.

Mack, E., & Mayer, H. (2016). The evolutionary dynamics of entrepreneurial ecosystems. Urban Studies, 53(10), 2118–2133. https://doi.org/10.1177/0042098015586547.

Malecki, E.J. (2018a). Entrepreneurs, networks, and economic development: A review of recent research. Reflections and extensions on key papers of the first twenty-five years of advances. Advances in Entrepreneurship, Firm Emergence and Growth, 20, 71–116. https://doi.org/10.1108/S1074-754020180000020010.

Malecki, E.J. (2018b). Entrepreneurship and entrepreneurial ecosystems. Geography Compass, 12(3), e12359. https://doi.org/10.1111/gec3.12359.

Miles, M.P., & Morrison, M. (2020). An effectual leadership perspective for developing rural entrepreneurial ecosystems. Small Business Economics, 54(4), 933–949. https://doi.org/10.1007/S11187-018-0128-Z.

Milgram, S. (1967). The small world problem. Psychology Today, 2(1), 60–67.

Minniti, M. (2008). The role of government policy on entrepreneurial activity: Productive, unproductive, or destructive? Entrepreneurship Theory and Practice, 32(5), 779–790. https://doi.org/10.1111/j.1540-6520.2008.00255.x.

Moore, J.F. (2006). Business ecosystems and the view from the firm. The Antitrust Bulletin, 51(1), 31–75. https://doi.org/10.1177/0003603X0605100103.

Motoyama, Y., & Knowlton, K. (2017). Examining the connections within the startup ecosystem: A case study of St. Louis. Entrepreneurship Research Journal, 7(1), 1–32. https://doi.org/10.1515/ERJ-2016-0011.

Muller, E., & Peres, R. (2019). The effect of social networks structure on innovation performance: A review and directions for research. International Journal of Research in Marketing, 36(1), 3–19. https://doi.org/10.1016/j.ijresmar.2018.05.003.

Newman, M. (2002). Assortative mixing in networks. Physical Review Letters, 89, 208701. https://doi.org/10.1103/physrevlett.89.208701.

Newman, M. (2018). Networks. Oxford: Oxford University Press.

Olanrewaju, A.S.T., Hossain, M.A., Whiteside, N., & Mercieca, P. (2020). Social media and entrepreneurship research: A literature review. International Journal of Information Management, 50, 90–110. https://doi.org/10.1016/J.IJINFOMGT.2019.05.011.

Page, L., Brin, S., Motwani, R., & Winograd, T. (1999). The pagerank citation ranking: Bringing order to the web. Tech. rep., Stanford InfoLab.

Panetti, E., Parmentola, A., Ferretti, M., & Reynolds, E.B. (2020). Exploring the relational dimension in a smart innovation ecosystem: A comprehensive framework to define the network structure and the network portfolio. The Journal of Technology Transfer, 45(6), 1775–1796. https://doi.org/10.1007/S10961-019-09735-Y.

Peel, L., Larremore, D.B., & Clauset, A. (2017). The ground truth about metadata and community detection in networks. Science Advances, 3(5), e1602548. https://doi.org/10.1126/sciadv.1602548.

Perotti, V., & Yu, Y. (2015). Startup tribes: Social network ties that support success in new firms.

Pustovrh, A., Rangus, K., & Drnovšek, M. (2020). The role of open innovation in developing an entrepreneurial support ecosystem. Technological Forecasting and Social Change, 152, 119892. https://doi.org/10.1016/j.techfore.2019.119892.

R. Core Team. (2014). R: A language and environment for statistical computing. http://www.R-project.org.

Roundy, P.T. (2017). Hybrid organizations and the logics of entrepreneurial ecosystems. International Entrepreneurship and Management Journal, 13(4), 1221–1237. https://doi.org/10.1007/s11365-017-0452-9.

Roundy, P.T., Bradshaw, M., & Brockman, B.K. (2018). The emergence of entrepreneurial ecosystems: A complex adaptive systems approach. Journal of Business Research, 86, 1–10. https://doi.org/10.1016/j.jbusres.2018.01.032.

Russell, M.G., & Smorodinskaya, N.V. (2018). Leveraging complexity for ecosystemic innovation. Technological Forecasting & Social Change, 136, 114–131. https://doi.org/10.1016/j.techfore.2017.11.024.

Scott, J., & Carrington, P.J. (2011). The SAGE handbook of social network analysis. SAGE Publications.

Seetharaman, P. (2020). Business models shifts: Impact of Covid-19. International Journal of Information Management, 54, 102173. https://doi.org/10.1016/j.ijinfomgt.2020.102173.

Seppä, M., & Tanev, S. (2011). The future of co-creation. Open Source Business Resource Retrieved from http://www.osbr.ca/ojs/index.php/osbr/article/view/1287:6--12.

Spender, J.C., Corvello, V., Grimaldi, M., & Rippa, P. (2017). Startups and open innovation: A review of the literature. European Journal of Innovation Management, 20(1), 4–30. https://doi.org/10.1108/EJIM-12-2015-0131.

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49–72. https://doi.org/10.1111/etap.12167.

Spigel, B. (2022). Examining the cohesiveness and nestedness entrepreneurial ecosystems: Evidence from British FinTechs. Small Business Economics, 1–19. https://doi.org/10.1007/s11187-021-00589-z.

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759–1769. https://doi.org/10.1080/09654313.2015.1061484.

Stam, E., & Van de Ven, A.H. (2021). Entrepreneurial ecosystem elements. Small Business Economics, 56(2), 809–832. https://doi.org/10.1007/s11187-019-00270-6.

Stangler, D., & Bell-Masterson, J. (2015). Measuring an entrepreneurial ecosystem. Available at SSRN 2580336. https://doi.org/10.2139/SSRN.2580336.

Stanley, J., & Briscoe, G. (2010). The ABC of digital business ecosystems. arXiv:10051899, https://doi.org/10.48550/arxiv.1005.1899.

Tajudeen, F.P., Jaafar, N.I., & Ainin, S. (2018). Understanding the impact of social media usage among organizations. Information and Management, 55 (3), 308–321. https://doi.org/10.1016/j.im.2017.08.004.

Tan, F.T.C., Ondrus, J., Tan, B., & Oh, J. (2020). Digital transformation of business ecosystems: Evidence from the Korean pop industry. Information Systems Journal, 30(5), 866–898. https://doi.org/10.1111/isj.12285.

Thurner, S., Hanel, R., & Klimek, P. (2018). Introduction to the theory of complex systems. Oxford: Oxford University Press.

Tsujimoto, M., Kajikawa, Y., Tomita, J., & Matsumoto, Y. (2018). A review of the ecosystem concept — Towards coherent ecosystem design. Technological Forecasting &, Social Change, 136 (July 2017), 49–58. https://doi.org/10.1016/j.techfore.2017.06.032.

Tumasjan, A., Braun, R., & Stolz, B. (2021). Twitter sentiment as a weak signal in venture capital financing. Journal of Business Venturing, 36 (2), 106062. https://doi.org/10.1016/J.JBUSVENT.2020.106062.

Van de Ven, A.H. (1986). Central problems in the management of innovation. Management Science, 32(5), 590–607. https://doi.org/10.2307/2631848.

Van de Ven, A.H. (1993). The development of an infrastructure for entrepreneurship. Journal of Business Venturing, 8(3), 211–230. https://doi.org/10.1016/0883-9026(93)90028-4.

Wasserman, S., & Faust, K. (1994). Social network analysis: Methods and applications Vol. 8. Cambridge: Cambridge University Press. https://doi.org/10.1017/CBO9780511815478.

Wurth, B., Stam, E., & Spigel, B. (2022). Toward an entrepreneurial ecosystem research program. Entrepreneurship Theory and Practice, 46(3), 729–778. https://doi.org/10.1177/1042258721998948.

Yue, C.A., Thelen, P., Robinson, K., & Men, L.R. (2019). How do CEOs communicate on Twitter? A comparative study between Fortune 200 companies and top startup companies. Corporate Communications: An International Journal, 24(3), 532–552. https://doi.org/10.1108/CCIJ-03-2019-0031.

Acknowledgements

We would like to thank the reviewers for their valuable and insightful comments.

Funding

Open access funding provided by Universit degli Studi di Roma La Sapienza within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ancona, A., Cinelli, M., Ferraro, G. et al. Network-based principles of entrepreneurial ecosystems: a case study of a start-up network. Small Bus Econ 61, 1497–1514 (2023). https://doi.org/10.1007/s11187-023-00738-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-023-00738-6

Keywords

- Entrepreneurial ecosystem

- Network-based approach

- Network-based principles

- Complexity theory

- Start-ups

- Social media