Abstract

The aim of this study is to analyse inter-firm corruption and to ascertain whether the proximity of firms engaged in corruption is a significant factor. We draw on transaction cost theory to explore two forms of corrupt exchange (negotiated vs. productive) and the role of proximity in reducing transaction costs. We obtained original data from the judgements of the Italian Court of Cassation and clustered homogeneous proximities. We then used separate binomial logistic regressions to show how the relation between transaction properties, the consequences for transaction costs and forms of corrupt exchange lead to different outcomes for each subgroup of proximities. The results show that technological and geographical proximity are beneficial to both forms of exchange, leading to a reduction in exchange costs, in much the same way as legal activities. However, unlike legal exchanges, corrupt and in particular productive exchanges do not appear to benefit from social proximity.

Plain English Summary

The level of corruption among firms is underestimated, although it distorts competition. We apply transaction cost theory and examine the choice between two forms of corrupt exchange in situations of inter-firm proximity. Starting from the assumption that the main objective of a rational agent is to minimize costs, we adopt the following key concepts to examine how firms choose between these forms of exchange. First, corrupt exchanges are assumed to have specific transaction costs, that can be detection or enforcement costs. Second, these costs have an impact on the choice between the two forms of exchange as they can reduce their effect to different degrees. Third, proximity can further minimize the remaining costs, regardless of the choices made. Our results show that technological and geographical proximity can mitigate the costs of corrupt transactions, both in negotiated and productive exchanges and thus have an effect similar to those of legal activities. However, in contrast with legal exchanges, social proximity does not appear to be a reliable governance mechanism for corrupt exchanges, particularly in the case of productive exchanges. Our study has implications for judicial and investigative bodies. The types of proximity draw a map on which corrupt exchanges can be traced, enabling the advantages to be identified.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Business studies are turning increasing attention to corruption as a firm-level issue, with a transition from a more consolidated macro approach to a micro approach. In this perspective, the firm is regarded as the basic unit of corruption, involving organizational processes, roles and resources (Boudreaux et al., 2018; Collins & Reutzel, 2017; Jaakson et al., 2019). However, the focus on corruption as essentially a misuse of internal power and its entrenchment in organizational dynamics overlooks its relational nature. Corruption more typically occurs in hidden exchanges that are external rather than internal and involve other firms, with significant implications in terms of distorting competition and the misallocation of resources (Argandoña, 2003; Boudreaux et al., 2018).

To the best of our knowledge, no previous study has systematically examined such exchanges. Corruption as an exchange mechanism has mainly been viewed as involving firms and public actors (Basu, 2014; Lambsdorff & Teksoz, 2004, 2006; Cuervo-Cazurra, 2015), and exchanges between firms as involving legal exchanges (Lo & Hung, 2015; Brinkhoff et al., 2015).

In both cases, transaction cost theory (TCT) has often been applied. TCT regards an exchange as a transaction that poses problems and issues that are specific to each participating firm and addresses how these can be minimized (Hendrikse et al., 2015). This area of research complements studies into the proximity between firms engaged in legal exchanges, which provides a useful context for facilitating inter-firm coordination (Knoben & Oerlemans, 2006).

The nature of corruption among firms and the role played by proximity in illegal forms of exchange have not been fully understood. We address this gap in the literature by providing insights into the dynamics of inter-firm corruption, focusing on the firm as the key agent of the exchange, and exploring the factors that determine the choice between two forms of illegal exchange (negotiated vs. productive). We also examine whether proximity plays a role in inter-firm corruption by assessing the choices between illegal exchanges within clusters of proximate firms and identify proximity as predominantly geographical, social or technological.

Thus, we examine whether proximity plays a different role in legal and illegal exchanges. As in previous studies, the theoretical framework draws on transaction cost theory integrated with elements of exchange theory. Based on the assumption that the main objective of rational agents is to minimize costs, we use the following key concepts to explain how firms choose between forms of exchange. First, corrupt exchanges are characterized by specific transaction costs, which can be categorized as detection and enforcement costs. Second, these costs are generated by the properties of the transaction. Third, the costs determine the type of corrupt exchange, as they reduce their effects to different degrees. Finally, the type of proximity can further reduce transaction costs.

Corruption in the private sector is a major problem in Italy, giving rise to significant risks for companies operating there.Footnote 1 The general lack of microdata on these hidden activities means that researchers generally rely on perception-based measures, which are by definition subject to bias (Kaufmann & Wei, 1999). To address this problem, we constructed a dataset consisting of more than 600 judgements from the Italian Court of Cassation between 2011 and 2019 concerning private-sector corruption cases in Italy. These judgements represent the third and final step in Italian criminal proceedings and thus provide judicial evidence that is difficult to gather from other sources. We adopted a two-step research strategy to ascertain the impact of transaction costs on the choice between the two forms of exchange, according to the proximity of the firms to each other.

We first divided cases of inter-firm corruption into sub-groups by considering the characteristics of the proximity extracted from the data. We then evaluated whether the transaction properties within each sub-group had different effects on the likelihood of corrupt exchanges being negotiated or productive exchanges. We take transaction properties to be indirect measures of the transaction costs. Thus, we can assess both the choice of the agent and the role of proximity in mitigating the impact of the cost of transaction. The results show how the properties of a transaction, as indirect measures of cost, have different levels of significance and different effects on the likelihood of corrupt exchanges, for each subgroup of proximities.

The remainder of this article is organized as follows. In Sect. 2, we review the literature that applies TCT and the exchange theory to illegal transactions and contributions that examine the typologies and advantages of proximity. We then outline our hypotheses. Section 3, provides details of the research methodology and Sect. 4 reports the results of our study. We discuss the implications of our findings and summarize our conclusions in Sect. 5.

2 Literature review and hypotheses

2.1 Illegal transactions, detection and enforcement costs

Based on the main principles of TCT, we examine how corrupt firms resolve the main issues related to corrupt exchanges. The costs of carrying out illegal transactions are generally regarded as higher than those of legal transactions (Polinsky & Shavell, 1992). Illegal exchanges generally take place in a more insecure and unstable environment and are characterized by secrecy, to avoid legal sanctions. Corrupt exchanges are typically occluded and take an oral form. Any documentary evidence can be risky as it constitutes a source of damaging information for all the agents involved (Sartor & Beamish, 2018).

The costs of illegal transactions have been identified as those of enforcement and detection (Von Lampe, 2008), representing the risks arising from illegal exchanges. The problem of enforcement concerns the risk of poor performance or failure to deliver the favours envisaged, as unlike legal agreements, illegal exchanges offer no protection. The cost of enforcement also involves the risk of betraying the secrecy of the agreements. Detection costs are external and refer to the risk that third parties, either public or private, will discover the agreement (Lambsdorff & Teksoz, 2004). Due to the unstable nature of the illegal exchange, the costs often complement each other and occur together. They can vary according to the properties of the transaction.

As discussed below, the properties of the transaction affect the exchanges in that they may lead to an increase in costs, with a main cost with a higher impact in terms of the risk of implementing the exchange and a minor cost with a lower impact. They may also lead to a similar increase, or alternatively a similar decrease, in the two sets of costs (Lambsdorff, 2002, 2006).

2.2 The properties of corrupt transactions and their impact on detection and enforcement costs

TCT defines three essential characteristics of a transaction: the uncertainty under which the transaction takes place, the frequency with which the transaction occurs and the level of transaction-specific investment (Williamson, 2008). These determine the trajectory (increasing/decreasing) and the degree (main/minor) of the transaction costs.

Uncertainty arising from the exchange can be regarded as environmental or behavioural. Environmental uncertainty refers to unexpected changes in the setting in which the exchange takes place (Barasa, 2018). As in the case of environmental uncertainty, low levels of institutional uncertainty mean that institutions are stable and effective, including efficient law enforcement agencies, that are regarded as significant obstacles to corruption (Yi et al., 2019). A low level of institutional uncertainty increases detection costs more than enforcement costs. Institutional efficiency substantially increases the risk of being detected and convicted. A secondary risk arising from corrupt exchanges is that one of the parties may have an incentive to betray the agreement in return for immunity from prosecution or a more lenient sentence.

The data obtained for this study covers legal proceedings at all levels, providing an overview of their efficiency. Judicial efficiency in the courts of first instance is reflected in a high proportion of confirmations in the superior courts.Footnote 2 This results in a reduction in the duration of overall proceedings and a greater chance of effective sentencing. In addition, the actors providing evidence of corruption are more numerous than in less productive court cases.Footnote 3

Conversely, an unstable environment in which the underground economy flourishes tends to encourage corruption, thus mitigating transaction costs, in which the main cost arises from detection as widespread crime slows down investigative and judicial procedures. The costs of enforcement can also decrease. Research indicates that in an overall culture of illegality, a system of threats and sanctions can be strengthened through the notion of betrayal (Della Porta & Vannucci, 2016). Our data show that in such environments corruption can be kept hidden and may work effectively over time, despite the involvement of a large number of individuals.

One particular case in a region with a flourishing underground economy involved a group of construction companies that, by corrupting the board of directors of four local banks, obtained illegal loans, with no interest or security. In return, the board of directors received apartments at extremely low prices. Over 100 people were involved, and most were prosecuted for crimes ancillary to their core corruption activities, such as withholding evidence, fraud and the exploitation of workers. This case brought to light a criminal organization that had operated undisturbed over a number of years to the benefit of the accomplicesFootnote 4 (Judgement 2965/2015).

In contrast with environmental uncertainty, behavioural uncertainty greatly increases the costs of both enforcement and detection. Corrupt deals are clearly not protected by the law and can result in a number of situations that provide the parties involved with incentives to fail to respect agreements and to maintain confidentiality (Krishnan et al., 2016). To the extent that corrupt practices are no longer confidential, they are no longer protected. Many judgements deal with cases in which a firm refuses to provide the agreed amount after obtaining services by means of corruption, or raises the price of the service at a later date, or demands further payment. The risk of detection is high, as the injured party under the terms of the corrupt deal may well reportFootnote 5 the deal to the judicial authorities particularly in cases in which it is for a substantial amount.

A case involving the sale of tractors between a manufacturer and an agricultural firm is relevant here. The agricultural firm agreed on a reduction in the purchase price in return for paying a percentage of the price in cash, while it actually received a delivery of only 10% of the goods agreed (33,257/2017). The injured party filed charges, despite being jointly involved in the corruption.

Frequency refers to the number of times a transaction is expected to take place. A high volume of transactions leads to a decrease in enforcement costs and an increase in detection costs. Information on all aspects of the corrupt activity can be obtained by repeating a transaction, thus lowering the general costs of control (Basu, 2014). An ongoing relationship can also sustain corruption: over time, threats may become credible and the rewards clear (Lambsdorff & Teksoz, 2004). However, repeated exchanges become more easily traceable than one-off transactions.

Asset specificity refers to the extent to which an investment is functional for just one transaction. Where a potential agreement is unsuccessful, the asset cannot easily be redeployed to another transaction without a significant reduction in value (Williamson, 1981). Real estate, physical assets and human capital investment can be specific to a transaction. In terms of corrupt exchanges, scholars have found that in general, the level of specificity of assets invested in operations increases the risks of opportunism and thus enforcement costs (Barasa, 2018). Detection costs are equally high for physical property as they are easily traceable.

Judgement 4823/2017 provides an example involving asset specificity and enforcement. In this case, industrial units were constructed by a builder on land owned by an entrepreneur, and purchased at a lower price, with payment in cash. It was later demonstrated that they failed to comply with safety standards, as they were built with highly carcinogenic material.

2.3 Negotiated and productive forms of illegal exchanges and detection and enforcement costs

Exchange theory provides a means of analysing the different forms of illegal exchange and can thus serve to integrate our framework (Lawler & Hipp, 2001).

We focus on negotiated and productive exchanges. Although there are other exchange patterns, these are the two principal forms and others are essentially sub-forms (Flynn, 2005). They are able to mitigate one kind of cost while being vulnerable to another, due to their respective exchange dynamics. Negotiated exchanges mitigate detection costs but are vulnerable to costs of enforcement, while productive exchanges mitigate enforcement costs but are vulnerable to detection costs.

In negotiated exchanges, two actors with divergent interests engage in a quid pro quo deal. Typically, this is characterized by clarity about the expected performance and therefore is rarely affected by unforeseen developments. This can include how to avoid leaving traces of the collaboration, thus mitigating the cost of detection. However, due to the divergent interests of the parties, there is a high risk of non-reciprocity, so this type is particularly vulnerable to costs of enforcement (Molm et al., 2003). An example of mutually acknowledged clear terms of exchange is provided in judgement 32,400/ 2017, in which an accounting firm falsified the accounting results of a listed company for years, thus hiding its insolvency. In return, the company diverted illegal assets through the reporting of fictitious consultancy services to the auditing firm.

Productive exchanges occur when the parties are part of a scheme that can only be achieved if everyone contributes. The scheme is therefore collective and the interests are joint, so this exchange mitigates the enforcement costs. However, a scheme of this kind requires more frequent interactions that are likely to leave more traces than a negotiated exchange. They are vulnerable to the cost of detection, particularly in the long term. One example is the joint production of personal computers by two firms using defective devices with the aim of dividing up the proceeds (judgement 35,080/2014).

According to TCT, decisions about the form of the exchange should be aimed at minimizing the transaction costs. The corrupt agent has to make a number of choices depending on the degree (main/minor) and the trajectory (increasing/decreasing) of the transaction costs. The main cost and the minor cost are determined by the characteristics of the transaction. A corrupt agent needs to choose the form that can mitigate the main costs as they are a highly risky part of the exchange. Although minor costs give rise to less risk, they can still be significant. Thus, the agent tends to select a negotiated exchange when the risk of detection represents the main cost. Conversely, a productive exchange will be preferred when the issue of the enforcement represents the main cost. This situation is inverted in the case of transactions resulting in a decrease in both types of cost. In addition, if the two costs are both main costs, the agent tends to choose a form that can mitigate one of them, and then, the second main cost is associated with a higher risk. Finally, the choice of exchange may be limited to minimizing the minor costs, because this may be more suited to fulfilling the agent’s interests, although it will be affected by the main cost, thus giving rise to a high risk of non-fulfilment (Table 1).

2.4 Proximity: typologies and advantages in mitigating transaction costs

Proximity can represent a meso-dimension in which transactions between firms occur and can therefore favour inter-firm exchanges. The three main types are geographical, social and technological (Bouba-Olga & Grossetti, 2008). Geographical proximity concerns the spatial distance between parties and can promote the development of face-to-face collaboration by reducing the time commitment and improving coordination (Kapetaniou & Lee, 2019; Nesticò & Galante, 2015). Social proximity refers to the socio-cultural perception of closeness, such as the existence of socially embedded relationships between individuals and organizations. Individual embeddedness within a family or other relationships facilitates identification with the group, leading to shared norms and creating expectations of support from other group members (Uzzi, 1997). Technological proximity consists of commonalities in the business backgrounds and practices of firms and is based on the homogeneity of technological experience and knowledge between firms (Evans & Bridson, 2005). Inter-organizational proximity based on similar technological expertise optimizes both reciprocal control and coordination (Knoben & Oerlemans, 2006). However, studies of these proximities generally focus on legal exchanges.

One issue that remains relatively unexplored is whether proximity can be considered a mechanism for improving corrupt exchanges aimed at reducing enforcement and detection costs. Consequently, the issue of whether proximity functions differently within legal and illegal exchanges should be examined. Studies of illegal deals are limited and generally focus on particular aspects and are not theoretically related to the concept of proximity.

For example, some studies (Anderson & Jap, 2005; Bernard, 2006) have noted how relational ties can encourage opportunities for deviant or illegal behaviour. Others have identified how family-based firms share illegal codes of conduct that are easily learned and accepted, thus reducing information costs (Spapens & Moors, 2019). Rapidly executed transactions, direct supervision and trust arising from personal ties have been identified as essential elements for reducing enforcement and detection costs in corrupt deals (Nese & Troisi, 2019; Rose-Ackerman, 1999).

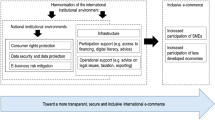

The arguments in studies of proximity in legal exchanges can be extended in the sense that proximity may also act as a mechanism related to corruption, as it can generally reduce enforcement and detection costs. First, geographical proximity can reduce costs by taking advantage of rapid coordination, particularly those of external detection, and to a lesser extent those of enforcement. Second, social proximity can reduce enforcement costs in particular, due to the mutual trust among the parties. Third, technological proximity can improve co-ordination, which is particularly useful in minimizing detection costs, and to a lesser extent, enforcement costs. From the TCT perspective, proximity can minimize costs that remain an issue after the choice of the exchange.

The conceptual framework of this study is outlined in Fig. 1.

Thus, based on the above considerations about the forms of exchanges and proximity, we can formulate the following hypothesesFootnote 6:

-

Hypothesis 1(a) In the case of transactions giving rise to main costs of detection, a negotiated form of exchange is more likely to take place in each of the three proximity contexts.

-

Hypothesis 1(b) In the case of transactions giving rise to main costs of detection, a productive exchange is more likely to take place in the presence of geographical or technological proximity.

-

Hypothesis 2(a) In the case of transactions giving rise to main costs of enforcement, a productive exchange is more likely to take place in the presence of geographical or technological proximity.

-

Hypothesis 2(b) In the case of transactions giving rise to main costs of enforcement, a negotiated exchange is more likely to take place in the presence of social proximity.

3 Methodology

3.1 Data sources

To identify the different measures of corruption, we drew on judgements of the Italian Cassation Court over an eight-year period between 2011 and 2019 (Holmes, 2015). This data source has both specific and general advantages and drawbacks for this study. First, the specific advantages are first of all that the Court of Cassation hands down sentences that are more important than those of the lower courts, and thus, we can identify the entire judicial process from them. Second, the judgements provide reliable information about individual cases, whereas institutional sources typically provide aggregate data. The drawbacks are as follows. First of all, the three levels of judicial proceedings in Italy (the courts of first instance, the appeal courts and the Court of Cassation) are not used in all cases: the defendant may agree to a plea bargain or simply not appeal. Second, the records of individual judgements can vary significantly in terms of clarity and comprehensibility. Third, the focus of judgements is on the firm as the main unit of corruption and as the main perpetrator of the crime, and thus, the role of secondary actors involved in the crime belonging to different firms is not considered. Additional information about the firms was obtained from the Bureau Van Dijk ORBIS data (https://orbis.bvdinfo.com/).

The judgements were selected from the Court website (http://www.italgiure.giustizia.it/sncass/), using the site search engine and the keywords “Firm corruption”. Judgements on corruption cases involving public actors or dummy companies were excluded. We found approximately 2480 judgements from which we randomly selected 622 cases of inter-firm corruption using the Excel Randomize tool.

3.2 The variables

Here, we describe the variables used in the cluster analysis that define the proximity of the firms. We then consider the specific properties of corrupt transactions as exploratory variables, and forms of exchange as dependent variables, in the logistic regressions.

For the proximity variables, as stated above we focus on those related to geographical, social and technological proximity. The mean travel time between firms is a commonly used proxy for geographical proximity (Ponds et al., 2007). We operationalized the mean travel time in minutes, using Google Maps API.

Friendships (Geldes et al., 2015) and collaboration with family members (Adjei et al., 2016) were used as a proxy for social proximity. Both were implemented as dichotomous variables, assuming a value of 1 when a friend or family member was also involved in a crime, and 0 when they were not.

Patent data and the activities of firms in the same technological sector were used as a proxy for the technological proximity of firms involved in the crimes. Patent data are often used as a proxy for measuring the technological proximity of firms (Rosenkopf & Almeida, 2003).

The industrial standard classifications (NACE codes) provided by the Italian National Institute of Statistics were also used as a proxy for technological proximity for firms involved in corrupt exchanges (Orlando, 2004). Patents shared by firms were operationalized as a number and the industrial classification was coded as a dichotomous variable assuming a value of 1 if the firms shared the same NACE code, and 0 if they did not.

We distinguished between dependent and explanatory variables in the logistic regressions.

The dependent variable of interest in this study refers to the choice between negotiated and productive forms of exchange. Thus, we used a binary dependent variable equal to 1 if a negotiated exchange was chosen and to 0 if a productive exchange was chosen. The distinction between productive and negotiated exchanges was ascertained by a close reading of the judgements, as the various cases could essentially be considered respective sub-forms.

The explanatory variables operationalize the properties of the exchanges as indirect measures of transaction costs. Specifically, the efficiency of the judicial system and the underground and cash-intensive economy were used as proxies for environmental uncertainty. The efficiency of the judicial system was measured using the Directional Distance Frontier Model (DDF) (Falavigna et al., 2015). The model returns scores for each court and a value of 1 indicates that the court is efficient, while values lower than 1 indicate inefficiency. Our measurement of the underground and cash-intensive local economy considers the level of tax evasion and irregular labour in specific Italian provinces (Transcrime, 2013). The values range from 1 to 5, indicating increasing levels of intensity of the underground economy. The economic hardship of the firm and the number of firms involved were used as a proxy for behavioural uncertainty. Financial pressures can lead to difficulties controlling other actors, and in managing the time and resources necessary for the exchange (Kapitsinis, 2019; Kominis & Dudau, 2018). Opportunism is also a substantial risk in illegal activities: the larger the number of firms involved, the greater the chance of opportunistic behaviour. A higher number of firms gives rise to more exchanges and higher overall transaction costs. The economic standing of the firm is clearly described in the judgements and was coded as a dichotomous variable that assumes a value of 1 in the presence of economic hardship, and 0 otherwise. Additionally, the number of firms involved was used as a proxy for behavioural uncertainty. We then considered the duration of the corruption activities over time as a proxy for frequency. Long-term activity obviously generates a higher frequency of corrupt exchanges. Finally, the specificity of assets was constructed as a dummy variable with three choices: human capital, real estate and monetary assets, as specified in each judgement. These show different levels of specificity, the highest being an industrial site used for specific activities, the lowest being monetary exchanges. In the model, the variable of human capital was used as a benchmark. To fully account for corruption relating to specific characteristics within the boundaries of the firm, three control variables were adopted: the type of firm, the age of the firm and the number of employees. The type of firm is a dichotomous variable distinguishing between corporate and co-operative undertakings; the variable assumes a value of 1 when the firm is corporate, and 0 when it is a co-operative. The age of the firm has been used in other studies on corruption (La Rocca et al., 2017) as a proxy for experience. Finally, the number of employees is used as a reliable proxy for the size of the firm (Nguyen, 2019). The variables used in the logistic regressions and their related measures are summarized in Table 2.

3.3 Research method

The two-step method that we adopted consisted of an initial cluster analysis of the proximity variables and then individual logistic regressions within each cluster to enable a comparison-based appraisal. Cluster analysis followed by regression models is a common approach in business studies (Dai et al., 2015; Gao & Yang, 2014), yielding more reliable results than traditional regression methods because the observations on which the regressions are performed have a more uniform data structure (Klimberg et al., 2017). Therefore, the first analytical step was to group the proximities of the firms.

The proximity variables outlined above define the setting in which the exchanges between firms occur for each observation.Footnote 7 These settings are generally complex, showing mixed proximity characteristics. For example, an exchange may be carried out by firms within the same NACE classification, sharing three licences, with a travel time between them of 50 min and involving family members. In another exchange, the setting could involve the presence of friends and family members with a travel time between them of 20 min. Thus, cluster analysis is useful, as it considers the complex nature of proximity, enhancing the internal structure of the data. It also enables similarities of proximities in different corruption cases to be identified. Analytically, similar observations are segmented into a number of clusters based on the observed values of the characteristics of each proximity. Similarity means that certain groups share relatively similar characteristics with others and are significantly different from other groups. Thus, the clusters represent different groups of complex proximities, enabling groups to be classified based on the percentage of observations relating to a proximity type inside a cluster.

Hierarchical cluster analysis was performed using R-project. We selected Ward’s method for calculating Euclidean Distance from the various clustering criteria in the software code. Ward’s minimum variance criterion (1963) is based on the sum-of-squared errors (SSE): two elements/clusters form a new cluster when the within-cluster sum-of-squared error is at a minimum (Everitt et al., 2011).

The second step of the analysis was to perform regressions for the clusters. The regression models evaluated the impact of the transaction characteristic variables, defined in Sect. 3.2, on the likelihood of establishing either a negotiated or productive corrupt exchange. The explanatory variable represents an indirect measure of the transaction costs. As transaction costs are not observable, the level of the characteristic is used as a proxy for the costs associated with the exchange (Cainelli & Iacobucci, 2015). As a result, the models confirm proximity as a mechanism for reducing transaction costs, as in the hypotheses in Sect. 2.4.

We conducted a binomial logistic regression to evaluate the likelihood of a corrupt exchange being either negotiated or productive. This model is particularly appropriate when dependent variables are dichotomous. It describes the linear relationship among the logit of the dependent variable, \(y\), and a number \(k\) of the explanatory variable, \(x\). Formally, the logistic regression can be written as:

in which \(y\) is the binary dependent variable, in our case the form of exchange. Betas are the parameters of the model to be estimated. In particular, β0 is the intercept, i.e. the value the model assumes when all the other variables are zero. When considering the factors in Table 2, the model can be represented by:

where \(u\) is the error term.

Sartor and Beamish (2018) used the model to analyse corruption in foreign markets using the transaction costs theory, and it has been applied in organizational studies of corruption (Alfano & Troisi, 2019; Nese & Troisi, 2019). Four regressions were conducted, as described in the next section.

4 Results

We identified the most clearly defined groups through a dendrogram analysis (Fig. 2) and the greatest silhouette coefficient (i.e. 0.21) using Ward’s criterion. The coefficient value confirms the existence of a good but not perfectly defined boundary between the three kinds of proximity.

Table 3 shows the summary statistics of the characteristics of the specified proximity for the three clusters. In cluster 1, observations in which firms are mainly characterized by technological proximity were grouped together. Most of these firms (65%) shared patents and were classified with the same NACE code (86%). Cluster 2 was exclusively related to geographical proximity between firms. Almost all were separated by a travel time of less than one hour. Finally, cluster 3 contains observations related to social proximity, in which corruption involved the presence of a family member (100% of the observations) and friends (48%). Cluster analysis thus resulted in the identification of three clusters corresponding to (1) predominantly technological, (2) exclusively geographical and (3) predominantly social proximity.

The results of the logistic regression models and the diagnostic test are given in Table 4. Models 1–3 refer, respectively, to clusters 1–3, while model 4 considers the entire sample. The R-squared values for models 1–3 (0.43, 0.49 and 0.62, respectively, for models 1, 2 and 3) are higher than that of model 4 (0.25). This confirms that regressions on clusters of data give a more uniform data structure and thus provide more reliable results than regressions on the entire sample. Table 4 indicates that the impact of the explanatory variables has both different levels of significance and differences in the signs of the beta coefficients according to the different proximity subgroups (i.e. clusters). This indicates how each proximity can differentiate the relationship between the different levels of properties, the consequent transaction costs and forms of exchange.

In particular, the likelihood of choosing a negotiated exchange within technological and geographical proximity is significantly related to the efficiency of the judicial system (1.987, p < 0.01) (2.602, p < 0.01). An increase in judicial efficiency increases the occurrence of negotiated agreements. A negotiated agreement is more likely to occur in situations of technological and geographical proximity when related to firms facing economic hardship (1.101, p < 0.001 and 1.408, p < 0.01 respectively). The choice of a negotiated agreement in a context of social proximity is more likely to occur when more firms are involved (1.375, p < 0.001). In a situation of geographical proximity, a negotiated agreement is more likely to be chosen when real estate (2.473, p < 0.05) or money (3.006, p < 0.01) are exchanged rather than human capital. These results lend support to hypothesis 1(a). Finally, a negotiated exchange is related to the type of firm in geographical and social proximity (1.380, p < 0.01 and 3.416, p < 0.01 respectively). In both cases, a negotiated agreement is more likely when the firm is a corporation.

Productive exchanges are more likely in situations of technological proximity if the number of firms involved increases, supporting hypothesis 2 (a) (− 0.374, p < 0.001). Consistent with hypothesis 1 (b), productive agreements related to lasting exchanges are more likely in situations of technological and geographical proximity (− 0,062 p < 0.001 and − 0.052, p < 0.05, respectively).

However, productive exchanges are more likely to take place in situations of social proximity when related to a high level of activity in the underground economy (− 1.691, p < 0.01) and to economic hardship on the part of firms (− 1.748, p < 0.05). In both cases, hypothesis 1(b) is not supported. In situations of social proximity, productive agreements are more likely to occur with an exchange of money (− 2.572, p < 0.05) rather than human capital. This result does not support hypothesis 2(b).

Finally, productive agreements are significantly related to the age of a firm in situations of technological and social proximity (− 0.020, p < 0.01, − 0.094, p < 0.01 respectively). Older firms appear to prefer productive to negotiated forms of exchange.

5 Discussion and conclusion

This article examined the issues involved in choosing between types of corrupt exchange and also the role of inter-firm proximity. TCT provided a useful theoretical framework for analysing the dynamics of inter-firm corruption in the form of illegal and occluded exchanges. We related such choices to their distinct abilities to minimize the costs of transactions and explore the role of proximity in further reducing transaction costs.

Our study makes two main contributions to the literature on corruption and proximity.

First, the focus on corruption in private-sector firms enables us to extend the conceptual model of transaction costs applied to corruption in the public sector and also to distinguish private-sector from public-sector corruption, often regarded as a means of “greasing the wheels” of legal agreements to minimize costs (Barasa, 2018; Basu, 2014). An alternative and novel approach is proposed for examining private-sector corruption, aimed at understanding how and under what circumstances the transaction costs that are inherent in illegal agreements can be minimized. Unlike public-sector corruption, private-sector corruption does not necessarily involve facilitating legal agreements among firms. Private-sector corruption can be viewed as one or more exclusively illegal acts, with the sole purpose of making a profit by illicit means through altering market rules.

Second, we shift the focus from how proximity can mitigate the costs of legal exchanges (Knoben & Oerlemans, 2006) to its effect on corrupt exchanges, which is another novel contribution. Thus, we offer a new perspective on proximity together with a new area of application for TCT. This is significant as scholars have argued that the transaction costs associated with illegal deals are generally higher than those associated with legal exchanges (Lambsdorff, 2002).

Our study highlights how the particular characteristics of corrupt exchanges give rise to much greater transactional difficulties than legal contracts. They also generate specific enforcement and detection costs that have different effects on negotiated and productive types of corrupt exchange. Negotiated exchanges can better minimize the costs of detection while productive exchanges are more suited to minimizing detection costs. The type of proximity that characterizes the exchange plays a key role as a market mechanism to further reduce transaction costs. Corrupt agents may take further advantage of proximity to mitigate the costs of the transaction when they have not been addressed through the form of exchange chosen.

The results of the study support our hypotheses in terms of the choice of negotiated exchanges, particularly through geographical and technological proximity where a low level of environmental uncertainty makes this choice more likely. The pressure of an efficient justice system deters agents from the riskier type of exchange. Technological and geographical proximity can also mitigate the minor enforcement costs affecting negotiated exchanges. In the same contexts, this type of exchange is more likely to occur if the main firm taking part in the exchange is dealing with economic hardship. Behavioural uncertainty increases the costs of both enforcement and detection. The internal risk of non-reciprocity and the risk of betrayal are both considered to be high. Geographical and technological proximity can mitigate the enforcement costs that the negotiated exchange cannot reduce, but the agent’s financial control over the transaction may be weak. Rapid and successful transactions also depend on the agent’s ability to manage time effectively and to procure the resources to carry them out (Kapitsinis, 2019).

If geographical proximity is solely considered, the negotiated exchanges are more likely in relation to a specific site asset. The main costs of detection are generated by asset specificity, so agents may choose a negotiated exchange as this is less vulnerable to such costs. Geographical proximity also mitigates minor enforcement costs in the exchange, which are typical of opportunistic situations. The location of a site is typically more significant for agents acting in the same area. Finally, in terms of social proximity, negotiated agreements are more likely in cases involving numerous firms as this type of proximity efficiently reduces the main costs of enforcement that a negotiated exchange cannot minimize, as a result of the relationship of trust.

With regard to the choice of productive exchanges, the results support our hypothesis only in the cases of geographical and technological proximity. However, productive exchanges are most common in cases of social proximity, and thus, our hypothesis on this point is not supported.

The duration is significantly related to this type of exchange, in situations of both technological and geographical proximity. The main cost of detection arising from duration is greatly reduced by such proximity. Geographical proximity can lead to tighter control and quicker transactions (Kapetaniou & Lee, 2019; Molm et al., 2003). Better coordination can also lead to quicker transactions due to experience and greater professionalism (Knoben & Oerlemans, 2006), thus facilitating the completion of the exchange. In the context of technological proximity alone, if more firms are involved, productive exchange is more likely to be affected, and although both detection and enforcement costs will then increase, these issues can be overcome. By efficiently combining trust and coordination, productive exchanges can be selected as they minimize enforcement costs by satisfying mutual interests. Technological proximity also enables firms to reduce the costs of detection by optimizing their coordination (Evans & Bridson, 2005).

Finally, the underground economy is more likely to affect productive exchanges in situations of social proximity. Social proximity cannot optimize the exchange, as it has the same advantages as combining interests and reciprocal support (Spapens & Moors, 2019; Uzzi, 1997). There is equivocal support for the claim that productive exchanges in a social proximity context can mitigate costs associated with economic hardship. As for the costs of enforcement, the risk that the other party can exploit the weakness of the firm is high. Furthermore, if trust works, it just characterizes productive exchange, so any additional trust through social bonds could turn out to be redundant. Neither productive exchanges nor social proximity can minimize the main detection costs arising from asset specificity. These costs are important in productive exchanges: when associated with behavioural uncertainty: they can be as high as the enforcement costs. A productive agreement is more likely to occur when money is exchanged rather than human capital. The choice of the form of exchange suffers most from the problem of detection that arises from asset specificity. As noted above, social proximity cannot significantly mitigate this cost.

The issue of proximity in inter-firm corruption can now be addressed. Geographical and technological proximity tend to favour corrupt exchanges between firms and in particular the choice of the negotiated exchange. However, social proximity does not effectively mitigate transaction costs, which are often related to productive exchanges. In addition, proximity has different effects on illegal and legal transactions. Technological and geographical proximity can be considered neutral mechanisms of governance that can similarly reduce the costs of both legal and illegal inter-firm activities. The key concepts of shared competencies in terms of technological proximity, and face-to-face relationships in terms of geographical proximity, can increase opportunities in both. However, social proximity is one of the main focuses in this analysis. The unifying element of trust resulting from close links does not appear to be an efficient governance mechanism for reducing the cost of corrupt activities, in contrast with standard practice legal exchanges.

This research contributes to our understanding of corruption in inter-organizational co-operation, by clarifying how the choice between two hidden agreements can be made. The prevention of corrupt exchanges can be informed by a greater understanding of their dynamics. We reveal how different contexts offer specific advantages in corrupt agreements through proximity, which has implications for investigative activities. Our results highlight the need for increased awareness of the importance of proximity. Our study is highly contextualized, which represents its main limitation, as it focuses on crimes involving private firms in one national setting. The dataset is deliberately narrow, and the nature of the data oriented our approach. Thus, the main unit of analysis considered was the lead firm involved. The concept of proximity is also limited in terms of the data from the judgements, as this only provides insights into a small sample of a much wider phenomenon. No direct inferences can be made with regard to other corruption practices, nor to other countries, although the research design could inform further studies undertaken elsewhere. Using objective data about hidden phenomena (i.e. corrupt exchanges and the underground economy) can also be problematic, and thus, we may not capture its full extent. In addition, our reliance on court judgements may simply capture the actions taken by criminal justice and anticorruption bodies, rather than the corruption itself. However, these data offer important insights into the dynamics of corruption and provide details that are difficult to obtain elsewhere.

Finally, the corruption we examine is on a domestic scale. This overlooks the corruption within transnational inter-firm relationships. An in-depth understanding of the dynamics of corruption in more complex environments is thus necessary, to cast light on a range of scenarios in terms of proximity and transaction costs.

Notes

Jeurissen & Van Luijk (1998) conducted a study of perceptions of ethical behaviour among managers of companies from nine EU countries and the USA. Among these, Italy was perceived as the country in which the payment of bribes in business was most prevalent.

In total, 68% of cases in the courts of first instance end in less than a year compared with an average of 50% in inefficient courts, and more than 70% of verdicts were confirmed compared to 55% in inefficient courts.

The ratio is one out of three trials vs. one out of seven.

The investigation, which involved a number of law enforcement agencies, resulted from a tax inspection by the financial police into one of the directors involved in the criminal activity.

Cases of behavioural uncertainty account for around 10% of the sample.

These hypotheses do not encompass all possible combinations of proximities, transaction costs and exchange forms but simply reflect how proximity can effectively reduce transaction costs.

An observation is a case of data collection.

References

Adjei, E. K., Eriksson, R. H., & Lindgren, U. (2016). Social proximity and firm performance: The importance of family member ties in workplaces. Regional Studies, Regional Science, 3(1), 303–319. https://doi.org/10.1080/21681376.2016.1189354

Alfano, G., & Troisi, R. (2019). Corrupt political leaders and the failures of the institutional checks. In A. Mesquita, & P. Silva, (Eds.) ECMLG 2019 15th European Conference on Management, Leadership and Governance (1st ed., pp. 17–26). Academic Conferences and Publishing Ltd. https://doi.org/10.34190/MLG.19.030

Anderson, E., & Jap, S. D. (2005). The dark side of close relationships: The very factors that make partnerships with customers or suppliers beneficial can leave those relationships vulnerable to deterioration. MIT Sloan Management Review, 46(3), 75–83.

Argandoña, A. (2003). Private-to-private corruption. Journal of Business Ethics, 47(3), 253–267. https://doi.org/10.1023/A:1026266219609

Barasa, L. (2018). Corruption, transaction costs, and innovation in Africa. African Journal of Science, Technology, Innovation and Development, 10(7), 811–821. https://doi.org/10.1080/20421338.2018.1519061

Basu, G. (2014). Concealment, corruption, and evasion: A transaction cost and case analysis of illicit supply chain activity. Journal of Transportation Security, 7(3), 209–226. https://doi.org/10.1007/s12198-014-0140-8

Bernard, T. (2006). ShellShock: Why do good companies do bad things? Corporate Governance: An International Review, 14, 181–193. https://doi.org/10.1111/j.1467-8683.2006.00498.x

Bouba-Olga, O., & Grossetti, M. (2008). Socio-économie de proximité. Revue d’Economie Regionale Urbaine, 3(Octobre), 311–328. https://doi.org/10.3917/reru.083.0311

Boudreaux, C. J., Nikolaev, B. N., & Holcombe, R. G. (2018). Corruption and destructive entrepreneurship. Small Business Economics, 51(1), 181–202. https://doi.org/10.1007/s11187-017-9927-x

Brinkhoff, A., Özer, Ö., & Sargut, G. (2015). All you need is trust? An examination of inter-organizational supply chain projects. Production and Operations Management, 24(2), 181–200. https://doi.org/10.1111/poms.12234

Cainelli, G., & Iacobucci, D. (2015). Vertical integration, organizational governance, and firm performance: Evidence from Italian business groups. Managerial and Decision Economics, 36(8), 517–527. https://doi.org/10.1002/mde.2691

Collins, J. D., & Reutzel, C. R. (2017). The effects of interfirm ties on illegal corporate behavior. Business and Society Review, 122(2), 251–282. https://doi.org/10.1111/basr.12117

Cuervo-Cazurra, A. (2015). Corruption. Wiley Encyclopedia of Management, 6, 1–3. https://doi.org/10.1002/9781118785317.weom060041

Dai, W., Chuang, Y. Y., & Lu, C. J. (2015). A clustering-based sales forecasting scheme using support vector regression for computer server. Procedia Manufacturing, 2, 82–86. https://doi.org/10.1016/j.promfg.2015.07.014

Della Porta, D., & Vannucci, A. (2016). The hidden order of corruption: An institutional approach. Ashgate.

Evans, J., & Bridson, K. (2005). Explaining retail offer adaptation through psychic distance. International Journal of Retail & Distribution Management, 33(1), 69–78. https://doi.org/10.1108/09590550510577138

Everitt, B. S., Landau, S., Leese, M., & Stahl, D. (2011). Hierarchical clustering. Cluster Analysis, 5, 71–110., Wiley Series in Probability and Statistics. https://doi.org/10.1002/9780470977811

Falavigna, G., Ippoliti, R., Manello, A., & Ramello, G. B. (2015). Judicial productivity, delay and efficiency: A directional distance function (DDF) approach. European Journal of Operational Research, 240(2), 592–601. https://doi.org/10.1016/j.ejor.2014.07.014

Flynn, F. J. (2005). Identity orientations and forms of social exchange in organizations. Academy of Management Review, 30(4), 737–750. https://doi.org/10.5465/amr.2005.18378875

Gao, Z., & Yang, J. (2014). Financial time series forecasting with grouped predictors using hierarchical clustering and support vector regression. International Journal of Grid and Distributed Computing, 7(5), 53–64.

Geldes, C., Felzensztein, C., Turkina, E., & Durand, A. (2015). How does proximity affect interfirm marketing cooperation? A study of an agribusiness cluster. Journal of Business Research, 68(2), 263–272. https://doi.org/10.1016/j.jbusres.2014.09.034

Hendrikse, G., Hippmann, P., & Windsperger, J. (2015). Trust, transaction costs and contractual incompleteness in franchising. Small Business Economics, 44(4), 867–888. https://doi.org/10.1007/s11187-014-9626-9

Holmes, L. (2015). Corruption: A very short introduction (Vol. 426). Oxford University Press.

Jaakson, K., Johannsen, L., Pedersen, K. H., Vadi, M., Ashyrov, G., Reino, A., & Sööt, M. L. (2019). The role of costs, benefits, and moral judgments in private-to-private corruption. Crime, Law and Social Change, 71(1), 83–106. https://doi.org/10.1007/s10611-018-9790-y

Jeurissen, R. J. M., & Van Luijk, H. J. L. (1998). The ethical reputations of managers in nine EU-countries: A cross-referential survey. Journal of Business Ethics, 17(9–10), 995–1005. https://doi.org/10.1023/A:1006007029718

Kapetaniou, C., & Lee, S. H. (2019). Geographical proximity and open innovation of SMEs in Cyprus. Small Business Economics, 52(1), 261–276. https://doi.org/10.1007/s11187-018-0023-7

Kapitsinis, N. (2019). The impact of economic crisis on firm relocation: Greek SME movement to Bulgaria and its effects on business performance. GeoJournal, 84(2), 321–343. https://doi.org/10.1007/s10708-018-9863-6

Kaufmann, D., & Wei, S. J. (1999). Does “grease money” speed up the wheels of commerce?. National Bureau of Economic Research Working Paper Series No. 7093. https://doi.org/10.3386/w7093

Klimberg, R. K., Ratick, S., & Smith, H. (2017). A novel approach to forecasting regression and cluster analysis. Advances in Business and Management Forecasting, 12, 87–101. https://doi.org/10.1108/S1477-407020170000012006

Knoben, J., & Oerlemans, L. A. (2006). Proximity and inter-organizational collaboration: A literature review. International Journal of Management Reviews, 8(2), 71–89. https://doi.org/10.1111/j.1468-2370.2006.00121.x

Kominis, G., & Dudau, A. (2018). Collective corruption–How to live with it: Towards a projection theory of post-crisis corruption perpetuation. European Management Journal, 36(2), 235–242. https://doi.org/10.1016/j.emj.2017.12.001

Krishnan, R., Geyskens, I., & Steenkamp, J. B. E. (2016). The effectiveness of contractual and trust-based governance in strategic alliances under behavioral and environmental uncertainty. Strategic Management Journal, 37(12), 2521–2542. https://doi.org/10.1002/smj.2469

La Rocca, M., Cambrea, D. R., & Cariola, A. (2017). The role of corruption in shaping the value of holding cash. Finance Research Letters, 20, 104–108. https://doi.org/10.1016/j.frl.2016.09.014

Lambsdorff, J. G. (2002). Corruption and rent-seeking. Public Choice, 113(1–2), 97–125. https://doi.org/10.1023/A:1020320327526

Lambsdorff, J. G., & Teksoz, S. U. (2004). Corrupt relational contracting. In J. G. Lambsdorff, M., Taube, & M. Schramm (Eds.), The New Institutional Economics of Corruption (1st ed., pp152–165). London and New York: Routledge

Lambsdorff, J. G. (2006). Measuring corruption–the validity and precision of subjective indicators (CPI). In C. Sampford, A Shacklock, C. Connors & F Galtung (Eds.), Measuring Corruption (1st ed., pp. 81–100). Ashgate: Aldershot. https://doi.org/10.4324/9781315594385-12

Lawler, E. J., & Hipp, L. (2010). Corruption as social exchange. In S. R. Thye & E. J. Lawler (Eds.), Advances in group processes (vol 27) (269–296). Bingley: Emerald. https://doi.org/10.1108/S0882-6145(2010)0000027013

Lo, Y.-J., & Hung, T. M. (2015). Inter-organizational relationships and firm performance: A study of the US equity underwriting market in the investment banking industry. Journal of Management & Organization, 21(5), 650–674. https://doi.org/10.1017/jmo.2014.89

Molm, L. D., Peterson, G., & Takahashi, N. (2003). In the eye of the beholder: Procedural justice in social exchange. American Sociological Review, 68(1), 128–152. https://doi.org/10.2307/3088905

Nese, A., & Troisi, R. (2019). Corruption among mayors: Evidence from Italian court of cassation judgments. Trends in Organized Crime, 22(3), 298–323. https://doi.org/10.1007/s12117-018-9349-4

Nesticò, A., Galante, M. (2015). An estimate model for the equalisation of real estate tax: A case study, International Journal of Business Intelligence and Data Mining, Vol. 10, Issue 1, pp. 19–32. Inderscience Enterprises Ltd., Geneva, Switzerland. https://doi.org/10.1504/IJBIDM.2015.069038

Nguyen, T. D. (2019). Does firm growth increase corruption? Evidence from an instrumental variable approach. Small Business Economics, 55, 237–256. https://doi.org/10.1007/s11187-019-00160-x

Orlando, M. J. (2004). Measuring spillovers from industrial R&D: On the importance of geographic and technological proximity. RAND Journal of Economics, 35(4), 777–786. https://doi.org/10.2307/1593773

Polinsky, A. M., & Shavell, S. (1992). Enforcement costs and the optimal magnitude and probability of fines. The Journal of Law and Economics, 35(1), 133–148. https://doi.org/10.1086/467247

Ponds, R., Van Oort, F., & Frenken, K. (2007). The geographical and institutional proximity of research collaboration. Papers in Regional Science, 86(3), 423–443. https://doi.org/10.1111/j.1435-5957.2007.00126.x

Rose-Ackerman, S. (1999). Political corruption and democracy. Connecticut Journal of International Law, 14, 363. https://doi.org/10.1017/CBO9781139175098

Rosenkopf, L., & Almeida, P. (2003). Overcoming local search through alliances and mobility. Management Science, 49(6), 751–766. https://doi.org/10.1287/mnsc.49.6.751.16026

Sartor, M. A., & Beamish, P. W. (2018). Host market government corruption and the equity-based foreign entry strategies of multinational enterprises. Journal of International Business Studies, 49(3), 346–370. https://doi.org/10.1057/s41267-017-0115-7

Spapens, T., & Moors, H. (2019). Intergenerational transmission and organised crime. A study of seven families in the south of the Netherlands. Trends in Organized Crime, 23(1), 227–241. https://doi.org/10.1007/s12117-019-09363-w

Transcrime – Joint Research Centre on Transnational Crime (2013). Assessing the risk of money laundering in Europe Final Report of Project IARM, www.transcrime.it/iarm

Uzzi, B. (1997). Social structure and competition in interfirm networks: The paradox of embeddedness. Administrative Science Quarterly, 42(1), 35–67. https://doi.org/10.2307/2393808

Von Lampe, K. (2008). Organized crime in Europe: Conceptions and realities. Policing: A Journal of Policy and Practice, 2(1), 7–17. https://doi.org/10.1093/police/pan015

Williamson, O. E. (1981). The economics of organization: The transaction cost approach. American Journal of Sociology, 87(3), 548–577.

Williamson, O. E. (2008). Outsourcing: Transaction cost economics and supply chain management. Journal of Supply Chain Management, 44(2), 5–16. https://doi.org/10.1111/j.1745-493X.2008.00051.x

Yi, J., Meng, S., Macaulay, C. D., & Peng, M. W. (2019). Corruption and foreign direct investment phases: The moderating role of institutions. Journal of International Business Policy, 2(2), 167–181. https://doi.org/10.1057/s42214-019-00024-x

Funding

Open access funding provided by Università degli Studi di Salerno within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Troisi, R., Alfano, G. Proximity and inter-firm corruption: A transaction cost approach. Small Bus Econ 60, 1105–1120 (2023). https://doi.org/10.1007/s11187-022-00649-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00649-y