Abstract

The previous literature has extensively examined the effect of firm-level bribery on firm performance but not through on-the-job training. This paper investigates the impact of paying bribes on the firm’s investment decisions in on-the-job training and offers mediating implications of corruption on firm performance. We empirically examine the relationship between bribery and on-the-job training using firm-level data from the World Bank Enterprise Surveys consisting of a sample of 94 developing countries with 20,601 firms. The findings show that bribery and on-the-job training intensity affects real annual sales growth rates negatively and positively, respectively. Furthermore, firms exposed to more bribery reduce their on-the-job training intensity. The results are robust to the different classifications of the firm’s size, different subsamples, and controls for the endogeneity of the on-the-job training and bribery.

Plain English Summary

Can bribery be an obstacle for the firm’s investment in on-the-job training and, therefore, its performance? When firms are exposed to higher costs due to bribery, they may be forced to shift their resources from efficient uses. For instance, training is one way of using the resources efficiently as it will increase labor productivity, and, therefore, decrease average production costs. Analyzing a large firm-level data, we find that if firms are exposed to more bribery, they tend to offer lower training to their employees, and their performance worsens. Thus, the main policy implication of this paper is that governments should provide some types of subsidies for the provision of on-the-job training. Improving firm performance through training would also improve the country’s prosperity, which in turn could eliminate corruption. Henceforth, the vicious cycle between bribery, education, and development could be broken down.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The economic implications of the country- and firm-level corruption have been long examined. Country-level corruption is one of the main obstacles to economic development and growth by reducing investment, human capital and physical capital productivity (see e.g., Mauro, 1995; Mo, 2001; Lambsdorff, 2003, for empirical investigation of corruption’s effect on economic growth and capital’s productivity). However, it has also been argued that corruption can “grease the wheels” (e.g., Huntington, 1968). In the spirit of the potentially positive role of corruption in the economy’s performance, Acemoglu and Verdier (2000) and Meon and Weill (2010) suggest that corruption is too costly to be fully eliminated and that corruption can improve the productivity of bureaucrats (see e.g., Lui (1985) for empirical support of the positive role of corruption under the existence of bureaucratic inefficiencies).

At the firm-level, a similar mixed set of results is obtained. One body of literature has found that corruption “sands the wheels” by negatively affecting a firm’s productivity and sales (Fisman and Svensson, 2007; Faruq et al., 2013; Şeker and Yang, 2014; Hanousek and Kochanova, 2016). Furthermore, corruption has also been found to reduce entrepreneurship (see e.g., Dutta and Sobel, 2016) and shifts resources toward the construction industry and away from the education industry and professional, scientific, and technical service industry (Boudreaux et al., 2018). Yet, another stream of firm-level analysis has provided contrary evidence that corruption is “greasing the wheels.” For instance, Vial and Hanoteau (2010) demonstrated that bribe payments positively and statistically affect individual plant growth (see also Jauregui et al., 2020). Similarly, Dreher and Gassebner (2013) found that corruption facilitates firm entry in highly regulated economies.

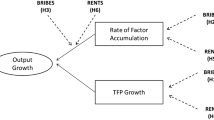

Even though firm-level analysis of corruption’s effect on firm performance has mixed results, most of this literature examined the direct impact of corruption on firm performance and has not explored the potential indirect effects of corruption on a firm’s operational decisions, which are also found to be important for firm’s sales and labor productivity growth. This paper aims to contribute to the literature by examining a channel by which corruption affects a firm’s performance through its effect on the intensity of on-the-job training it offers.Footnote 1

A stream of the literature identified the importance of on-the-job training for firm performance. Using Belgian firm-level data, Konings and Vanormelingen (2015) demonstrate that the effect of on-the-job training on the productivity premium is relatively larger than the wage premium. Similarly, Liu and Lu (2016), using Chinese firm-level data, find that training boosts firm productivity and wages, and its benefits are relatively larger for firms than for workers. Along the same lines, job training also seems to promote firm productivity in the UK, Portugal, and Italy (see Dearden et al., 2006; Almeida and Carneiro, 2009a; and Colombo and Stanca, 2014 for respective country analysis). Based on the relevance of on-the-job training for firm performance, Almeida and Aterido (2015) explore the determinants of on-the-job training and find that relatively larger firms, exporting firms, and firms with higher shares of skilled labor are more likely to invest in on-the-job training. Even though Almeida and Aterido (2015) consider various firm-related factors’ effect on firms’ decision to invest in on-the-job training, they do not consider bribery’s potential effect on their decision.

We provide a brief theoretical motivation of how bribery and on-the-job intensity may be related. First, training is an important element for firms to become more productive and reduce production costs. However, offering training is also a costly procedure for firms. In this setting, if firms are forced to pay a high amount of bribes, they have to cut down some costs to compensate for the additional cost imposed by the bribery. Therefore, to some extent, firms exposed to higher bribery may be pushed to reduce training intensity. Thus, corruption as part of the firms’ cost function reduces firms’ profitability, leading to a direct reduction of the produced quantity and an indirect reduction through reduced training.

Our paper contributes to the wider literature by providing a theoretical model and an empirical examination of the role of training in mediating the link between corruption and performance. Firstly, the previous literature examined the determinants of the on-the-job-training (see e.g., Almeida and Aterido, 2015), yet, this literature did not examine the effect of bribery on the training. Secondly, the existing literature examined the role of bribery on firm performance through other mechanisms. For instance, the literature found that bribery is detrimental to accessing credit (Wellalage et al., 2020) and that financial constraints magnify the harmful effects of corruption (Amin and Soh, 2020). However, to our knowledge, this is the first attempt to examine the role of bribery in affecting the job training decisions of firms. Therefore, by using the firm-level data from the World Bank Enterprise Surveys consisting of a sample of 94 developing countries with 20,601 firms, we examine the role of bribery for training offered by firms and the effects of bribery and on-the-job training on the firm performance.

Examining the effects of bribery and training on firm performance is challenging. The bureaucrats may target better-performing firms (Svensson, 2003; Fisman and Svensson, 2007). Similarly, better-performing and larger firms would offer more training to their employees (Almeida and Aterido, 2015). To control for the possible endogeneity (i.e., high-performing firms being targets of bribery and offering more training to their employees), we instrument a firm’s bribery exposure and training intensity by using the average bribery exposure and training in their sector and location cluster. A similar type of instrumental variable is used in the literature to examine the effect of different factors on the firm performance (Fisman and Svensson, 2007; Şeker, 2011; Aterido et al., 2011; Şeker and Yang, 2014; Wellalage et al., 2020). The details of the construction of the instrumental variables are discussed in the estimation strategy of the paper.

This paper is organized as follows. Section 2 provides a theoretical motivation. In Section 3, we describe the data. In Section 4, we offer an empirical estimation strategy, and in Section 5, we empirically estimate the effects of bribery on firm performance and on-the-job training. Finally, Section 6 concludes.

2 Theoretical motivation

The theoretical mechanism which provides the underlying rationale for the empirical specification can be described within a Cournot oligopoly framework where firms compete in quantity. There is a game of three stages. In the first stage, each firm negotiates with one bureaucrat under a bargaining power game. This negotiation determines the level of bribery that each firm has to pay to a specific bureaucrat. Therefore, firms will know what external costs such as bribery will be in the first stage before starting their investment in training and the production process. In the second stage, knowing the level of bribery, firms decide on the optimal intensity of on-the-job training by considering the positive impact of training on labor productivity and the cost of providing training to their labor force.Footnote 2 Finally, in the third stage, firms know both the bribery level and the optimal training intensity and compete with other firms by choosing their production level. The game is solved by backward induction. The full description and solution of the model are available upon request.

In the economy, there exist n ≥ 2 identical firms, all producing a homogeneous good and paying a bribe to have the permission to produce. A random firm j produces quantity qj, and the total quantity produced in the economy is \(q=\sum \limits_{i=1}^n{q}_i.\) The inverse demand function, which gives us the price of the good, is \(P(q)=\alpha -\sum \limits_{i=1}^n{q}_i,\) with α > 0 indicates the market size. Moreover, each firm provides firm-specific training to its workers, and we denote that the training level inside the firm j to be Ij ∈ [0, 1], which shows the fraction of workers who are trained or the intensity of training per worker. Under the previous consideration of firm-specific training, we normalize the wages for workers to zero. The following convex function gives the cost of on-the-job training for firm j:

Parameter θ(η) is positive and decreases with the firm’s age η and represents the additional cost of training when on-the-job training provided by the firm changes. Similarly, the parameter γ(η) is positive and decreases with the firm’s age η, and it represents the additional cost of on-the-job training when the firm produces a higher quantity. Both parameters θ and γ are decreasing functions of the firm’s age η since an old firm has a comparative advantage of experience in providing training to its workers, resulting in a lower cost for any given level of training and produced quantity. The above cost function has two implications: (i) the higher level of training, the higher the cost of training, and (ii) the higher the produced quantity, the higher the provided intensity of training, which results in a higher cost.

The cost function for production depends negatively on the level of the training of the workers since more trained workers can be more productive, resulting in lower costs. Moreover, we have assumed that an experienced manager can supervise the quality of the on-the-job training more efficiently, which results in more productive workers due to on-the-job training (see the term mIj in the following equation).Footnote 3 Therefore, the functional form of the cost function for production is:

where m ∈ (0, 1) being the exogenously given manager’s experience level that each firm j has and c is a constant cost parameter. If either the manager’s experience or training intensity is zero, the production cost function from Eq. (2) will depend only on the produced quantity cqj.

From the gross profits of the firm, a fraction mπj will be paid to the manager according to her/his level of experience, and the rest (1 − m)πj will be the net profit that the firm seeks to maximize.Footnote 4 With b being the level of the bribe that each firm will pay after a negotiation with bureaucrats, the net-profit function is:

By solving the game by backward induction, in the third stage, the firm j maximizes profits with respect to (wrt) quantity qj by considering both training and bribery level. The endogenous price level and quantity create a new net-profit function which is a function of training, bribe, and the rest of the parameters:

In the second stage, firms choose optimally the training level that they will provide to their workers. The firms can find the optimal level of training under symmetry \({I}_j={I}_i={I}_{j^{\ast }}\forall i,j\in \left(1,\dots, n\right),\) by maximizing Eq. (4) wrt training:

The endogenous level of on-the-job training depends on the parameters (n, c, m, η, α) and the variable of bribery (b), which results in a new net-profit function \({\pi}_j^{new- net\ast }={f}_3\left(n,c,m,\eta, \alpha, b\right)\) that depends on the bribe level and parameters.

In the first stage, firms interact with the bureaucrats in a bargaining power game to determine the bribe’s equilibrium level. According to Emerson (2006), the probability of the detection of bribery by general authorities depends positively on the bribe’s level and according to Ahsan (2017), the probability of the detection of bribery depends positively on the quality of institutions (x). Therefore, we define the probability of hiding any illegal negotiation as ϕ(b, x) ∈ [0, 1]. The revenues of the bureaucrats, which will not be detected, is equal to ϕ(b, x)bqj. Finally, by assuming that manager’s experience increases the bargaining power of the firms, the bargaining power game that firms and bureaucrats solve is the following:

The above problem’s solution provides the equilibrium levels for the bribe, training, and produced quantity. All of these variables depend on the following parameters (n, c, m, η, α).

More precisely, we now have the following system of equations:

Based on the theoretical model, we can arrive at the following hypothesesFootnote 5:

Hypothesis 1 (H1): Bribery reduces both the on-the-job training and the produced quantity.

Hypothesis 2 (H2): Training intensity leads to a higher level of production.

3 Data

To estimate the effect of bribery on firm performance and on-the-job training, we use firm-level data from the World Bank Enterprise Surveys database. This data set collects information on firms’ financial statements, costs, and other firm characteristics and the obstacles firms face, such as bribery. There are various reasons why we use the World Bank Enterprise Surveys database for the analysis. First, these surveys collect information about firms comparable across different countries, allowing us to examine within- and cross-country effects of bribery on firm performance and their decision on the intensity of training offered. Secondly, the data set covers various firm-level characteristics, which would affect firms’ decisions to offer formal training and affect their performance, allowing us to control for various additional factors in our analysis. Thirdly, this data set also provides a detailed industry classification of firms and their geographic location, enabling us to construct an instrumental variable (which we will discuss in detail below) for the firm-level bribery. For each country, the geographical disaggregation differs based on the size of the country. However, these geographical locations consist of regions/cities/territories that show variation in terms of economic activity, and they serve as a proxy for economic activity.Footnote 6

Our analysis’s final data covers 20,601 firms operating in 94 developing countries surveyed between 2010 and 2017. Even though firm samples from each country surveyed in different periods, it should be noted that the analysis of this paper is a static one (not a panel one) as we have a sample of firms from each country only once, and we do not track the firm characteristics over time. For each of these countries, we selected the most recent wave of data available (see Table S1 in the Supplementary file for the list of countries and the survey year used for each country sample). For the analysis of this paper, we have three main variables of interest alongside the control variables. First, for firm performance, we use the real annual sales growth as used by the previous literature (see e.g., Beck et al., 2005; Fisman and Svensson, 2007; Şeker and Yang, 2014).Footnote 7 Real annual sales growth is calculated as a percentage change in sales between the last completed fiscal year and three years ago, divided by the number of years between the last completed fiscal year and the previous period. Before calculating the real annual growth sales, all sales values (both last and previous period) are deflated to 2009 using each country’s GDP deflators.

There is a wide range of discussion on the measurement of corruption through survey questions and the reliability of these survey questions (see e.g., Reinikka and Svensson (2006), Seligson (2006) and Kraay and Murrell (2016) for a detailed discussion on the measurement issues of corruption). Kraay and Murrell (2016) demonstrate that there are downward biases in survey-based estimates of corruption. Moreover, it is well reported that corruption is often underreported, particularly by firms that benefit from such behavior (see e.g., Banerjee et al., 2013). To overcome such measurement bias, Kraay and Murrell (2016) try to capture the frequency and consequences of reticent behavior by using conventional and random response questions. We overcome such measurement error with the use of the average country-location-industry bribery (see “Estimation strategy” section for construction of instrumental variables). In this paper, the bribery indicator is the proportion of instances in which a firm was either expected or requested to provide a gift or informal payment when conducting six specific business transactions (i.e., gift or informal payment requested during the applications made for (i) electricity, (ii) water connection, (iii) construction-related permit, (iv) import license, (v) operating license, and (vi) during the meetings with tax officials).

Finally, we use the training intensity variable for the on-the-job training, which is the proportion of the full-time employees offered formal training during the last fiscal period. The formal training includes classroom work, seminars, lectures, workshops, and audio-visual presentations and demonstrations; however, it does not include training to familiarize workers with the equipment and machinery. Even though formal job training definition is broad and could vary across countries and different industries, such differences would be less of a concern as we would be clustering firms at the same country-location-industry in our empirical setting.

We also use the standard set of control variables used by the previous literature while examining the determinants of firm performance and the firm’s decision on the intensity of training to be offered to their employees. We control for standard firm characteristics such as firm size and age, top manager’s experience, and foreign ownership of the firm as it is found to promote higher sales growth due to its access to better technology and knowledge base, which reduces the cost of R&D (Şeker, 2012). Moreover, we control whether firms export or not as exporting firms found to be more productive and grow faster (Bernard et al., 2007; Greenaway and Kneller, 2007; Şeker and Yang, 2014). We also control whether one individual owns firms as they tend to take fewer risks or pursue fewer opportunities (Şeker and Yang, 2014). Another important factor for firms’ performance is whether they can access external finance (Beck et al. 2005; Şeker and Yang, 2014).

In addition, we include a crime variable, which could be a proxy for protecting the firm’s property rights. BenYishay and Pearlman (2014) find that higher rates of property crime are associated with a significantly lower probability an enterprise plans to expand or experiences income growth in the subsequent 12 months. The crime variable measures the losses due to theft and vandalism against the firm, represented as the percentage of the annual sales. These additional firm-specific variables are controlled as these factors are likely to alter production’s marginal cost for any firm. Recent studies have also found that female ownership also affects firm performance (see e.g., Dezsö and Ross, 2012; Alonso-Almeida, 2013; Belitski and Desai, 2021). Finally, we also control for whether the formality of firms has any impact on the firm performance (see e.g., Li and Yueh (2011) and see e.g., Bruhn (2011, 2013); Jessen and Kluve (2021) for the effectiveness of interventions in reducing the informal sector).

Finally, we also use three sets of dummy variables. First, we use sector dummies, which could capture the market size that firm operates. Following a similar strategy of Şeker and Yang (2014), we use three general sector groupings: manufacturing (ISIC 15–37), services including retail (ISIC 51–52), and other service sectors like transportation, hotels, and restaurants, and construction services (see Table S2 in the Supplementary file for the list of industries and the number of firms in each specific industry). We also include country dummies, which could capture country-specific unobserved characteristics such as institutional quality differences and time dummies, which can control for unobserved time effects for the year of the survey. A similar set of variables is also used when examining the determinants of the firm’s training intensity. Table 1 provides the variables’ definitions and descriptions.

Tables 2 and 3 offer the summary statistics and pairwise correlation coefficients, respectively. The average real annual growth of firms is −0.25 with good variation among them, where the percentage of the employees offered training is 19%. On average, these firms face one bribery request out of six business transactions (i.e., 0.17), 8% of these firms’ sales were direct exports, and 36% and 21% of firms were classified as medium and large, respectively, and the top manager’s experience is 18 years. On average, 38% of the firms have sole ownership, and 30% firm’s working capital is financed by banks, suppliers, or other sources. The correlation coefficients suggest that firm performance is negatively correlated with bribery, the firm’s age, and losses due to crime. Furthermore, solely owned firms tend to perform relatively worse. Firm performance is higher if the training intensity is higher, export more of their product, externally financed, and their top manager had a longer period of experience in the sector, had female ownership, and was formally registered.

4 Estimation strategy

From the theoretical motivation, we observe in Eqs. (7) and (8) that bribery affects both the provided training and the produced quantity. The expected sign of bribery in both equations is expected to be negative since it increases the external costs of the firm. From Eq. (9), we observe that bribery is an endogenous variable and Eq. (2) suggests that more training reduces the production cost of a firm and this helps the firm to be more competitive and to sell a higher amount of production, which justifies the training to be an explanatory variable with a positive impact on the produced quantity (see, Eq. (11) below). Since a firm’s performance can be captured better through real sales growth than the production level (see e.g., Beck et al., 2005; Fisman and Svensson, 2007; Şeker and Yang, 2014), we use in Eq. (11) below the growth rate of sales as a dependent variable.

Based on the previous discussion, we first examine the determinants of the training intensity (i.e., the proportion of full-time employees offered formal training), especially the effect of bribery on the training intensity. To do this, we use a standard equation where the dependent variable is the training intensity:

where \(Training\ {Intensity}_i^t\) is the proportion of the full-time employees offered formal training by firm i at the time of survey t, which is the year of the survey. It could be assumed that the firm’s decision on the training intensity is a function of the extent of bribery paid by firm i at the specific year of survey t \(\left( Bribery\ {Indicator}_i^t\right)\) and other observable characteristics of the firm \(\left({X}_i^t\right)\) such as firm’s size, age, whether firm exports or have foreign ownership, top manager’s experience, lost due to crime, female ownership, and formality and unobservable country -and time- and industry-specific factors \(\left({v}_c,{v}_t\ \mathrm{and}\ {\delta}_{ind}\right.\left.\mathrm{respectively}\right)\), and \({\varepsilon}_i^t\) is the error term.

We also examine whether bribery indicator and training intensity are related to the firm’s performance. To do this, we use the following equation where the dependent variable is the growth of real annual sales:

where \({y}_i^t\) is the real annual growth sales of firm i at time t of the survey. \(Bribery\ {Indicator}_i^t\) is the proportion of instances in which firm i was either expected or requested to provide a gift or informal payment when conducting six specific business transactions at the time of survey t. \(Training\ {Intensity}_i^t\) is a variable that is the proportion of the full-time employees offered formal training by firm i at the time of survey t. The vector \({X}_i^t\) is the firm-level control variables, unobservable country- and time- and industry-specific factors \(\left({v}_c,{v}_t\ \mathrm{and}\ {\delta}_{ind}\right.\left.\mathrm{respectively}\right)\), and \({\varepsilon}_i^t\) is the error term.

However, one of the major concerns is the endogeneity of bribery indicator and training intensity due to two reasons. First, the bureaucrats may target better-performing firms (Svensson, 2003; Fisman and Svensson, 2007). Similarly, better-performing and larger firms would offer more training to their employees (Almeida and Aterido, 2015). Secondly, bribery levels are self-reported by firms and they tend to be underreported, particularly by firms that benefit from such behavior (see e.g., Banerjee et al., 2013). Hence, there may be measurement error. Due to the second source of endogeneity, ordinary least squares (OLS) estimates are potentially downward-biased, which can be handled using an instrumental variable (IV) model. The direction of the bias could be explained as follows. Firm-specific unobservable factors may affect both the bribery (training) levels and the growth of the firm. As described by Fisman and Svensson (2007), a firm may have a favorable demand forecast (i.e., firm-specific unobserved factor), which would affect both the firm’s growth and the bribery (training) levels positively as the bureaucrats are likely to demand higher bribery and firm may choose to increase training levels for the new demand forecast. Therefore, the coefficient estimate of bribery and training will be biased toward zero, resulting in an underestimate of the effects of bribery and training (see Fisman and Svensson, 2007 and Seker and Yang, 2014 for a detailed explanation of the direction of the bias).

To control for the possible endogeneity (i.e., high-performing firms being targets of bribery and offering more training to their employees), we instrument a firm’s bribery exposure and training intensity by using the average bribery exposure and training in their sector and location cluster. These instrumental variables are also helpful for overcoming measurement errors. Pounov (2016) and Amin and Soh (2020) use a country-industry average of bribery measures to account for potential measurement error in their empirical analysis since computing an aggregate measure of bribery for a given country, location, and industry reduce measurement errors. In a similar manner, Fisman and Svensson (2007), Şeker (2011), Aterido et al. (2011), Şeker and Yang (2014), Wellalage et al. (2020) use average bribery measures in a given country-location-industry cluster as an instrumental variable to account for reverse causality, which also tackles the potential measurement errors (see e.g., Pounov, 2016 and Amin and Soh, 2020).

The economic activity across locations determines the bribery level that firms are exposed (Dollar et al., 2006), highlighting the relevance of the location for the bribery. Similarly, labor regulations vary across different regions (Almeida and Carneiro, 2009b), and the firms located in the capital or large cities have better access to training centers and higher quality of training with lower-cost options (Almeida and Aterido, 2015), pointing out the relevance of location for the training. On the other hand, firm-level bribery exposure is also closely linked with industry-specific factors (Svensson, 2003; Fisman and Svensson, 2007). Furthermore, the training offered is also closely associated with the sector where the firm operates as the returns to the training investment, the use of technology, capital, and labor intensity may differ by sector activity (Almeida and Aterido, 2015). As such, the extent of exposure to bribery and training offered by an individual firm is partly explained by the average bribery and training intensity in the country-location-industry cluster that is exogenous to the characteristics of the individual firm. Hence, we control for potential endogeneity of bribery indicator and training intensity by instrumenting a firm’s extent of bribery exposure and training by the average bribery and training intensity in a country-location-industry cluster with the use of two-stage least squares (2SLS) estimator.

Finally, we should note that we do not use the interaction term between bribery indicator and training intensity to capture the indirect effects of both variables on the firm performance. The interaction term would suggest that the effect of training on the firm performance would change together with the level of bribery. In other words, the interaction term would suggest that for firms with similar levels of training but different exposures to bribery, similar training would have different effects on performance, an effect that we are not examining here. Our main focus in the paper is to investigate whether corruption could lead to a lower level of training because of its cost implications and in that case, rather than interaction, we look at whether corruption has a mediating effect on firm performance through its effect on training, something that is closely associated with the literature examining mediating effects (see e.g., Solé-Ollé and Sorribas-Navarro, 2018; Ciziceno and Travaglino, 2019).

5 Empirical analysis

5.1 Baseline estimations

We first examine the determinants of the training intensity based on Eq. (10). Table 4 provides the 2SLS estimation results when the training intensity is the dependent variable and the bribery at the firm level is instrumented with the country-location-industry average of bribery. We use the same set of explanatory variables in each column, but we control for different sets of industry, year, and country unobserved effects. We carry out three sets of regressions where we do not use any year, industry, and country dummies (column I), use the year and industry dummies (column II), and finally use all the year, industry, and country dummies (column III). In all cases, we tested for the exogeneity of bribery, and in all cases, the null hypothesis of exogeneity is rejected at the 10% level. Furthermore, first-stage F-statistics for the instruments are greater than 10, suggesting that the instrumental variables are strong (Cameron and Trivedi, 2010).

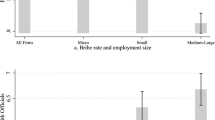

Overall, we find that bribery significantly decreases the training intensity (i.e., the proportion of full-time employees that a firm offers training). We find that a unit increase in bribe (i.e., firm that pays no bribe versus a firm that pays bribe in all six transactions) would decrease the training intensity by 0.0412, 0.0358, and 0.0374 units, respectively, for the cases not controlling for any unobserved effects, controlling for industry and year fixed effects and controlling for industry, year, and country fixed effects, respectively. On average, the percentages of employees offered training by the firms that are fully bribed are 4.12%, 3.58%, and 3.74% lower compared to the firms that are not bribed in any transactions. Concerning other control variables, we find that the firms’ training intensity is higher if firms are larger, have a more experienced manager, export more, are externally financed, have female ownership, and are formally registered. On the other hand, solely owned firms offer a lower training intensity. Similarly, firms that are more exposed to criminal activities offer lower training intensity. All of the control variables have the expected signs and their effect on the training intensity is also sizeable. For instance, if a firm’s direct exports increase by 1%, the percentage of employees trained increases by 6%. Similarly, solely owned firms and firms with female ownership and formally registered, the percentage of employees trained is 2.2% lower, and 4.4% and 3.9% higher than the firms that do not have sole and female ownership and are not registered formally, respectively. Thus, given the importance of other firm characteristics for the training intensity, the economic impact of bribery on training intensity is sizeable as the percentage of employees offered training in bribed firms is 4% lower after accounting for other characteristics of the firms.

Table 5 reports the 2SLS estimates when we examine the determinants of firm performance where we use the country-location-sector averages of the bribery indicator and training intensity as instrumental variables for the firm-level bribery indicator and training intensity. We also report the additional test results below the table. Durbin Wu-Hausman F-statistic is significant, rejecting the hypothesis of the exogeneity of the variables. Furthermore, F-statistics of the first-stage regression is above ten, suggesting the presence of a strong instrument, and Shea’s partial R-square shows that the instrumental variables are positively associated with the endogenous variables. Columns 1, 2, and 3 of Table 5 present results when we do not control for any fixed effects; we control for the year and industry fixed effects; and we control for industry, year, and country dummies, respectively. In all cases, we find that firms that were bribed more and firms with lower training intensity experienced lower sales growth rates. Estimations based on column III of Table 5 suggest that firms that were fully exposed to bribe (i.e., bribery indicator is equal to one) experienced 8.02% lower annual sales growth rates than those that were not bribed. On the other hand, firms that offered formal training to all employees experienced 4.5% higher annual sales growth than firms that did not provide formal training. In other words, a standard deviation increase in training (i.e., 0.34) and bribery indicator (i.e., 0.35) would lead to a rise in sales growth by 1.5% and a decrease in sales growth by 2.8%, respectively, suggesting that the economic impact of training and bribery on firm performance is quite sizeable.

The coefficients on the other set of explanatory variables also have the expected signs where medium and large firms grew faster than small firms, with large firms having the fastest growth rate. Based on the estimations in column III of Table 5, larger (medium)-sized firms grew 2.0% (1.2%) more compared to smaller ones. Similarly, older firms also grew relatively slower. The negative sign of the firm’s age on the growth rate of sales is that perhaps younger firms have the ability to insert more modern production methods and are also better at promoting sales compared to the older firms. The current literature in this area shows a decline in firms’ dynamism over time (Decker et al., 2016; Decker et al., 2017; Alon et al., 2018). On the other hand, companies with more experienced top managers also experienced higher growth in their sales. In comparison, the coefficients on the remaining variables (i.e., exports, sole ownership, external finance, and crime variables) have expected signs but are not significant at the 10% level in most of the specifications.Footnote 8

Table 6 provides the direct, mediation (through training intensity), and total effects of each variable on firm performance. The direct effects are the significant estimates from column III of Table 5. The mediating effects of different variables on firm performance are obtained by using the significant estimates from columns III of Tables 4 and 5. For instance, real annual growth sales of the firms that were fully exposed to bribe (i.e., bribery indicator equal to one) would be 0.168% lower than those not bribed due to the mediating effect (i.e., 4.491 times −0.0374). This mediating effect of the bribery indicator is 2.05% of the total effect of the bribery indicator. Furthermore, it should also be noted that the firms with more experienced managers and female ownership export more, with more than one owner, that are externally financed and relatively larger and formally registered, offer more intensive training to their employees (see Table 4). In other words, we also find that other firm characteristics also affect training intensity, and subsequently, they also have a partial mediating effect on firm performance through training. For instance, for firms with female ownership and are formally registered, the percentage of training offered to the employees is 4.38% and 3.87% higher than the firms that do not have female ownership and are not formally registered, respectively. Hence, female ownership and formally registered firms experienced 0.197% and 0.174% higher annual real sale growth rates as they offered higher training to their employees. In sum, even though the partial mediating effect of bribery on firm performance through training intensity is limited (i.e., 2.05% of the total effect of the bribery), the partial mediating effect of other firm characteristics through training is quite sizeable as a standard deviation increase in training leads to an increase in sales growth by 1.5%.

5.2 Robustness checks

To assess the robustness of the baseline estimations, we carry out an additional analysis using alternative specifications. The results are presented in Tables 7 and 8 when the dependent variable is the training intensity and firm performance, respectively. In all of the specifications, we also control the industry, year, and country fixed effects.

Firstly, we used at least 30 observations for country-location-industry clusters in the baseline estimations. To check whether the results are robust to the choice of minimum observation number for country-location-industry clusters, we repeat our analysis when we use at least 40 observations for the clusters. The results are reported in columns (1) of Tables 7 and 8. The findings are still robust to the choice of minimum numbers of observations used for clusters in our analysis, and the firms that were bribed more offered a lower percentage of training to their employees (column 1 of Table 7), and both the bribery indicator and training intensity are negatively and positively associated with firm performance (column 1 of Table 8), respectively.

Secondly, even though we control for the country-specific factors (i.e., country dummies) and regressions that are clustered at the country-location-industry level, the training practices in different geographical regions may vary. To check whether the results are robust to the exclusion of some countries from the analysis, we excluded the African and the Middle East and North African (MENA) countries from the sample, and the results are reported in columns 2 and 3 of Tables 7 and 8, respectively. Even though we excluded these countries from the analysis, our findings align with the baseline specifications.

Thirdly, large firms are defined as firms with more than 100 employees, but the specification of a large firm could vary across different industries. Most of the firms in the manufacturing sector have more than 100 employees. For instance, the mean, standard deviation, and maximum of employee numbers in the manufacturing of food and beverages industry (manufacture of wearing apparel; dressing and dyeing of fur) are 103, 213, and 2900 (194, 435, and 5000), respectively. Therefore, we carried our analysis with the use of alternative specifications of medium and large firms. In columns 4 and 5 of Tables 7 and 8, we specify large firms with at least 200 employees and 500 employees, respectively. Even though we changed the specification of the large and medium-sized firms, our findings are in line with the baseline specifications.

In the baseline estimations, we only used one instrumental variable for the bribery indicator (i.e., average bribery indicator in the country-location-industry cluster). We use the judiciary system as an additional instrumental variable for the bribery indicator to test the instruments’ validity. The judiciary system is closely associated with the bribe paid by firms (Hunt and Laszlo, 2012) and quality of property rights (Cull and Xu, 2005; Johnson et al., 2000) and has been used as an instrumental variable for bribery by previous literature (Wellalage et al., 2020). Therefore, we include an additional instrumental variable, a judiciary dummy variable, equal to one if firms consider courts to be the biggest obstacle that firms face and zero otherwise.Footnote 9 Columns 6 of Tables 7 and 8 report the results. A Sargan chi-square test indicated that the instrumental variables for firm-level bribery indicator and training intensity are valid. Finally, our main findings are in line with the baseline specifications with the use of an additional instrumental variable for the bribery indicator.

Finally, the existing literature has also been using alternative firm performance measures such as firm productivity (see e.g., Konings and Vanormelingen, 2015; Liu and Lu, 2016) or labor productivity growth (Belitski and Desai, 2021). To check whether the results are robust, we also use labor productivity growth as an alternative firm performance measure, and the results are presented in column 7 of Table 8. Even though we use an alternative firm performance measure, we found that the bribery indicator and training intensity significantly affect labor productivity growth negatively and positively, respectively. Finally, when we examine the significance of other control variables for firm performance compared to the baseline specification (column 3 of Table 5), we find that the firms with more experienced managers that export more and have foreign ownership experienced higher labor productivity growth, which are in the lines with the existing literature.

Overall, we carried out estimations with different specifications and found that bribery lowers the proportion of training offered by firms to their employees. We confirm the corruption’s mediating effect on firm performance through training. Finally, we should also note that the exogeneity of the bribery indicator and training intensity is rejected (i.e., Durbin-Hausman-Wu F-statistic), and F statistics from the first stage regression analyses are larger than 10, suggesting that the instrumental variables are strong in all specifications.

6 Conclusion

This study provides a framework to analyze how bribery could affect firm performance through firms’ training intensity. In the theoretical motivation, training, even if it is costly for the firm, reduces production costs since the workforce is more productive, and managerial experience helps supervise the production process and increases the firms’ bargaining power against bureaucrats. Lower corruption reduces the external costs of a firm, and the provision of training is more affordable if firms are exposed to less bribery. Therefore, we examine the effect of corruption on training and corruption’s mediating effect on firm performance through training. Based on our motivation, this paper uses the World Bank Enterprise Survey firm-level data consisting of a large number of firms from 94 developing countries to examine the effects of bribery on a firm’s performance and firm’s decision on the intensity of training offered to their employees.

Our findings show that higher training intensity and lower bribery lead to higher real annual sales growth. Even though the effect of bribery on the training intensity is relatively large, the indirect effect of bribery on annual sales growth through its effect on training intensity is relatively small. However, since other firm characteristics also affect training intensity, they also have a partial mediating effect through training. Finally, we also carried out additional sets of robustness checks by using an additional set of control variables proposed in the literature, different classifications of the firm’s size, and different subsamples. In addition, we used alternative minimum numbers of the country-location-industry cluster to construct instrumental variables and used an additional instrumental variable. Our baseline estimation results were robust to the different robustness checks and the choice of minimum observations for clusters, and the use of an additional instrumental variable.

This paper’s findings have various policy implications since the firm’s performance is a crucial micro ingredient for achieving macro-level prosperity. First of all, since corruption is a pressing phenomenon in developing countries, and due to financial and resource constraints, these countries cannot provide a high quality of education. Furthermore, firm-specific on-the-job training (e.g., specific production methods and procedures and software skills) cannot be compensated with formal education and plays an irreplaceable role in growth and productivity. Therefore, the provision of on-the-job training should be protected either through subsidies (i.e., lowering the training investment cost of firms) or through the governmental provision of specific training to improve firm performance, as a means to overcome lower productivity issues. Secondly, for a country to attract high-tech foreign firms that diffuse knowledge and technology across firms and countries (Xu and Sheng, 2012; Orlic et al., 2018), it is essential to support through some types of subsidies on the provision of on-the-job training even for domestic firms because through this way, the economy will have enough amount of skilled labor force which in turn will be an essential motivation for foreign high-tech firms to invest in an economy (Todo et al., 2009). Furthermore, we should note that more on-the-job training is required in the production process of technology-intensive sectors and that corruption is likely to divert resources mainly from technologically advanced sectors (Boudreaux et al., 2018). Third, through the previous procedures, the economy will get rid of the vicious cycle of corruption since improving firm performance will help the economy reach a level of development, which is a necessary condition for overcoming corruption since bureaucrats have a lower inclination to demand bribes in richer countries (Jetter et al., 2014; Jetter and Parmeter, 2018).

Finally, we can propose the following policy implications by looking at the other firm-level characteristics that are important for firm performance. Firstly, firms with female ownership have lower interactions with bureaucrats and, therefore, experience lower corruption (Dollar et al., 2001; Rivas, 2013; Breen et al. 2017; Hanousek et al. 2019). Therefore, an extension of female representation in the firm ownership and boards would eliminate firm-level bribery and henceforth training intensity of the firms is not affected as much due to lower bribery exposure. Similarly, the governments should seek to get more women involved in the firms’ ownership, which could be done by decreasing the gender gap in education or through labor regulations seeking gender equality in the representation of women in firm managerial roles. Secondly, external funding can help firms overcome the pressure of bribery since firms can have higher liquidity and as such, they can invest more in training. Yet, countries with high corruption levels would require to introduce deep and substantial changes in order to improve their financial sectors, while governments should also provide additional financial support to firms to enhance their liquidity. Furthermore, formally registered firms tend to offer higher training to their employees. Therefore, governments should reform their registry process, provide tax incentives, and have information interventions to increase the number of registered firms. For instance, Bruhn (2011) showed that reform in Mexico that simplified business entry regulation increased the number of registered businesses by 5%. Similarly, tax incentives and information interventions were found to be effective in increasing firm formalization in low- and middle-income countries (Jessen and Kluve, 2021).

Future research might extend our analysis by endogenizing the firm size and manager’s experience using instrumental variables for these factors. Furthermore, another promising future work would be investigating what types of policies (at the local or international level) are more effective under high corruption for making firms more able to sustain a high level of training.

Notes

There are many papers which highlight the importance of on-the job training for the production process. Indicative we mention the following three papers. Firstly, Heckman et al. (1998) find empirically that post-schooling investment through job training is even more important than schooling. Secondly, Acemoglu and Pischke (1999) emphasize the value of on-the-job training by explaining that firms prefer to reduce wages in order to provide training to their workers. Finally, Heywood et al. (2008) suggest that on-the-job training makes a workforce which is more adaptable to changing technological conditions.

The provision of training is a cost for the firm since it requires resources for training to take place. Therefore, providing training to a higher proportion of its employees will increase the total costs of the firm. On the other hand, workers with training imply more productive and efficient workers, which reduces the cost of production (i.e., the average cost of producing a unit decreases due to more efficient workers). Considering these two cost implications, the firms will endogenously find the optimal level of training that they will provide to their workers (in our paper, the optimal intensity of training).

In this paper, the manager’s performance is related to the ability to have negotiation power with the bureaucrats. The managers will also determine the level of bribery through their negotiation with the bureaucrats and supervise the training process of the workers. The production level is determined through the competition among firms by taking into account the size of the market. McEnrue (1988) empirically shows that the experience and the performance of managers are strongly related. In the same line, Mion and Opromolla (2014) show empirically that managers’ experience in exports from previous firms makes them have higher export performance in their new jobs and receive higher wages.

Since the focus of the paper is empirical, we have omitted the complete solution of the model to conserve space but it is available from the authors on request.

For instance, the geographical location of China consists of the following 25 cities: Beijing; Chengdu; Dalian; Dongguan; Foshan; Guangzhou; Hangzhou; Hefei; Jinan; Luoyang; Nanjing; Nantong; Ningbo; Qingdao; Shanghai; Shenyang; Shenzhen; Shijiazhuang; Suzhou; Tangshan; Wenzhou; Wuhan; Wuxi; Yantai; Zhengzhou. On the other hand, the geographical location for Turkey consists of 6 territories (regions) as follows: Aegean; Black Sea; Central Anatolia; Eastern and Southeastern Anatolia; Marmara; Mediterranean. The detailed geographical clusters for each country could be obtained via: https://www.enterprisesurveys.org/

During the survey year, firms were also asked to report their sales three fiscal years ago. Hence, we were able to obtain the real annual growth rates of sales, which is used as one of our dependent variables.

We confirm that the effect of bribery indicator on training intensity, and the effects of bribery indicator and training intensity on firm performance are underestimated (i.e., positively biased) when the OLS method is used. The OLS estimation results are available in Tables S3 and S4 of the Supplementary file.

The survey question for this variable is as follows: “By looking at card, can you tell me which of the elements of the business environment included in the list, if any, currently represents the biggest obstacle faced by this establishment?” The following options were provided to the firms: 1-Access to finance, 2-Access to land, 3-Business licensing and permits, 4-Corruption, 5-Courts, 6-Crime, theft and disorder, 7-Customs and trade regulations, 8-Electricity, 9-Inadequately educated workforce, 10-Labor regulations, 11-Political instability, 12-Practices of competitors in the informal sector, 13-Tax administration, 14-Tax rates, 15-Transport.

References

Acemoglu, D., & Pischke, J. S. (1999). Beyond Becker: Training in imperfect labour markets. The Economic Journal, 109(453), 112–142. https://doi.org/10.1111/1468-0297.00405

Acemoglu, D., & Verdier, T. (2000). The choice between market failure and corruption. American Economic Review, 901, 194–211. https://doi.org/10.1257/aer.90.1.194

Ahsan, R. N. (2017). Does corruption attenuate the effect of red tape on exports? Economic Inquiry, 55(3), 1192–1212. https://doi.org/10.1111/ecin.12445

Alonso-Almeida, M. (2013). Influence of gender and financing on tourist company growth. Journal of Business Research, 66(5), 621–631. https://doi.org/10.1016/j.jbusres.2012.09.025

Almeida, R. K., & Aterido, R. (2015). Investing in formal on-the-job training: Are SMEs lagging much behind? IZA Journal of Labor and Development, 4(8), 1–23. https://doi.org/10.1186/s40175-015-0029-3

Almeida, R. K., & Carneiro, P. (2009a). The return to the firm investment in human capital. Labour Economics, 16(1), 97–106. https://doi.org/10.1016/j.labeco.2008.06.002

Almeida, R., & Carneiro, P. (2009b). Enforcement of labor regulation and firm size. Journal of Comparative Economics, 37(1), 28–46. https://doi.org/10.1016/j.jce.2008.09.004

Alon, T., Berger, D., Dent, R., & Pugsley, B. (2018). Older and slower: The startup deficit’s lasting effects on aggregate productivity growth. Journal of Monetary Economics, 93, 68–85. https://doi.org/10.1016/j.jmoneco.2017.10.004

Amin, M., & Soh, Y. C. (2020). Does corruption hurt employment growth of financially constrained firms more? Policy Research Working Paper No, 9286. World Bank. https://openknowledge.worldbank.org/handle/10986/33981

Aterido, R., Hallward-Driemeier, M., & Pagés, C. (2011). Big constraints to small firms’ growth? Business environment and employment growth across firms. Economic Development and Cultural Change, 59(3), 609–647. https://doi.org/10.1086/658349

Banerjee, A., Hanna, R., & Mullainathan, S. (2013). Corruption. In R. S. Gibbons & J. Roberts (Eds.), Handbook of organizational economics. Princeton University Press. https://doi.org/10.1515/9781400845354-029

Beck, T., Demirguc-Kunt, A., & Maksimovic, V. (2005). Financial and legal constraints to growth: Does firm size matter? The Journal of Finance, 60(1), 137–177. https://doi.org/10.1111/j.1540-6261.2005.00727.x

Belitski, M., & Desai, S. (2021). Female ownership, firm age and firm growth: a study of South Asian firms. Asia Pacific Journal of Management, 38, 825–855. https://doi.org/10.1007/s10490-019-09689-7

BenYishay, A., & Pearlman, S. (2014). Crime and microenterprise growth: Evidence from Mexico. World Development, 56, 139–152. https://doi.org/10.1016/j.worlddev.2013.10.020

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130. https://doi.org/10.1257/jep.21.3.105

Boudreaux, C. J., Nikolaev, B. N., & Holcombe, R. G. (2018). Corruption and destructive entrepreneurship. Small Business Economics, 51, 181–202. https://doi.org/10.1007/s11187-017-9927-x

Breen, M., Gillanders, R., McNulty, G., & Suzuki, A. (2017). Gender and corruption in business. The journal of development studies, 53(9), 1486–1501. https://doi.org/10.1080/00220388.2016.1234036

Bruhn, M. (2011). License to sell: The effect of business registration reform on entrepreneurial activity in Mexico. The Review of Economics and Statistics, 93(1), 382–386. https://doi.org/10.1162/REST_a_00059

Bruhn, M. (2013). A tale of two species: Revisiting the effect of registration reform on informal business owners in Mexico. Journal of Development Economics, 103, 275–283. https://doi.org/10.1016/j.jdeveco.2013.03.013

Cameron, A., & Trivedi, P. (2010). Microeconometrics using Stata. Stata Press (2nd ed.).

Ciziceno, M., & Travaglino, G. A. (2019). Perceived corruption and individuals’ life satisfaction: The mediating role of institutional trust. Social Indicators Research, 141, 685–701. https://doi.org/10.1007/s11205-018-1850-2

Colombo, E., & Stanca, L. (2014). The impact of training on productivity: Evidence from a panel of Italian firms. International Journal of Manpower, 35(8), 1140–1158. https://doi.org/10.1108/IJM-08-2012-0121

Cull, R., & Xu, L. C. (2005). Institutions, ownership, and finance: The determinants of profit reinvestment among Chinese firms. Journal of Financial Economics, 77(1), 117–146. https://doi.org/10.1016/j.jfineco.2004.05.010

Dal Bó, E., & Rossi, M. A. (2007). Corruption and inefficiency: Theory and evidence from electric utilities. Journal of Public Economics, 91(5-6), 939–962. https://doi.org/10.1016/j.jpubeco.2006.11.005

Dearden, L., Reed, H., & Van Reenen, J. (2006). The impact of training on productivity and wages: Evidence from British panel data. Oxford Bulletin of Economics and Statistics, 68(4), 397–421. https://doi.org/10.1111/j.1468-0084.2006.00170.x

Decker, R. A., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2016). Where has all the skewness gone? The decline in high-growth (young) firms in the U.S. European Economic Review, 86, 4–23. https://doi.org/10.1016/j.euroecorev.2015.12.013

Decker, R. A., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2017). Declining dynamism, allocative efficiency, and the productivity slowdown. American Economic Review, 107(5), 322–326. https://doi.org/10.1257/aer.p20171020

Dezsö, C., & Ross, D. (2012). Does female representation in top management improve firm performance? A panel data investigation. Strategic Management Journal, 33(9), 1072–1089. https://doi.org/10.1002/smj.1955

Dollar, D., Fisman, R., & Gatti, R. (2001). Are women really the “fairer” sex? Corruption and women in government. Journal of Economic Behavior & Organization, 46(4), 423–429. https://doi.org/10.1016/S0167-2681(01)00169-X

Dollar, D., Hallward-Driemeier, M., & Mengistae, T. (2006). Investment climate and international integration. World Development, 34(9), 1498–1516. https://doi.org/10.1016/j.worlddev.2006.05.001

Dreher, A., & Gassebner, M. (2013). Greasing the wheels? The impact of regulations and corruption on firm entry. Public Choice, 155(3-4), 413–432. https://doi.org/10.1007/s11127-011-9871-2

Dutta, N., & Sobel, R. (2016). Does corruption ever help entrepreneurship? Small Business Economics, 47, 179–199. https://doi.org/10.1007/s11187-016-9728-7

Emerson, P. M. (2006). Corruption, competition and democracy. Journal of Development Economics, 81(1), 193–212. https://doi.org/10.1016/j.jdeveco.2005.04.005

Faruq, H., Webb, M., & Yi, D. (2013). Corruption, bureaucracy and firm productivity in Africa. Review of Development Economics, 17(1), 117–129. https://doi.org/10.1111/rode.12019

Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics, 83, 63–75. https://doi.org/10.1016/j.jdeveco.2005.09.009

Greenaway, D., & Kneller, R. (2007). Firm heterogeneity, exporting and foreign direct investment. Economic Journal, 117, 134–161. https://doi.org/10.1111/j.1468-0297.2007.02018.x

Hanousek, J., & Kochanova, A. (2016). Bribery environments and firm performance: Evidence from CEE countries. European Journal of Political Economy, 43, 14–28. https://doi.org/10.1016/j.ejpoleco.2016.02.002

Hanousek, J., Shamshur, A., & Tresl, J. (2019). Firm efficiency, foreign ownership and CEO gender in corrupt environments. Journal of Corporate Finance, 59, 344–360. https://doi.org/10.1016/j.jcorpfin.2017.06.008

Heckman, J., Lochner, L., & Taber, C. (1998). Tax policy and human-capital formation. The American Economic Review, 88(2), 293–297 https://www.jstor.org/stable/116936

Heywood, J. S., Jirjahn, U., & Wei, X. (2008). Teamwork, monitoring and absence. Journal of Economic Behavior and Organization, 68(3-4), 676–690. https://doi.org/10.1016/j.jebo.2008.09.004

Hopp, W. J., Tekin, E., & Van Oyen, M. P. (2004). Benefits of skill chaining in serial production lines with cross-trained workers. Management Science, 50(1), 83–98. https://doi.org/10.1287/mnsc.1030.0166

Hunt, J., & Laszlo, S. (2012). Is bribery really regressive? Bribery’s costs, benefits, and mechanisms. World Development, 40(2), 355–372. https://doi.org/10.1016/j.worlddev.2011.06.001

Huntington, S. P. (1968). Political order in changing societies. Yale University Press.

Jauregui, A., Heriot, K. C., & Mitchell, D. T. (2020). Corruption and formal-sector entrepreneurship in a middle-income country: Spatial analysis of firm births in the Mexican states. Small Business Economics. https://doi.org/10.1007/s11187-020-00388-y

Jessen, J., & Kluve, J. (2021). The effectiveness of interventions to reduce informality in low- and middle-income countries. World Development, 138, 105256. https://doi.org/10.1016/j.worlddev.2020.105256

Jetter, M., Montoya Agudelo, A., & Ramírez Hassan, A. (2014). The effect of democracy on corruption: Income is key. World Development, 74, 286–304. https://doi.org/10.1016/j.worlddev.2015.05.016

Jetter, M., & Parmeter, C. F. (2018). Sorting through global corruption determinants: Institutions and education matter – Not culture. World Development, 109, 279–294. https://doi.org/10.1016/j.worlddev.2018.05.013

Johnson, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2000). Tunneling. American Economic Review, 90(2), 22–27. https://doi.org/10.1257/aer.90.2.22

Konings, J., & Vanormelingen, S. (2015). The impact of training on productivity and wages: Firm-level evidence. Review of Economics and Statistics, 97(2), 485–497. https://doi.org/10.1162/REST_a_00460

Kraay, A., & Murrell, P. (2016). Misunderestimating corruption. Review of Economics and Statistics, 98(3), 455–466. https://doi.org/10.1162/REST_a_00536

Lambsdorff, J. G. (2003). How corruption affects productivity. Kyklos, 56(4), 457–474. https://doi.org/10.1046/j.0023-5962.2003.00233.x

Liu, Q., & Lu, R. (2016). On-the-job training and productivity: Firm-level evidence from a large developing country. China Economic Review, 40, 254–264. https://doi.org/10.1016/j.chieco.2016.08.001

Li, X. M., & Yueh, L. (2011). Does incorporation improve firm performance? Oxford Bulletin of Economics and Statistics, 73(6), 753–770. https://doi.org/10.1111/j.1468-0084.2011.00674.x

Lui, F. T. (1985). An equilibrium queuing model of bribery. Journal of Political Economy, 93(4), 760–781. https://doi.org/10.1086/261329

Mauro, P. (1995). Corruption and growth. Quarterly Journal of Economics, 110(3), 681–712. https://doi.org/10.2307/2946696

McEnrue, M. P. (1988). Length of experience and the performance of managers in the establishment phase of their careers. Academy of Management Journal, 31(1), 175–185. https://doi.org/10.2307/256504

Meon, P.-G., & Weill, L. (2010). Is corruption an efficient grease? World Development, 383, 244–259. https://doi.org/10.1016/j.worlddev.2009.06.004

Mion, G., & Opromolla, L. D. (2014). Managers’ mobility, trade performance, and wages. Journal of International Economics, 94(1), 85–101. https://doi.org/10.1016/j.jinteco.2014.06.001

Mo, P. H. (2001). Corruption and economic growth. Journal of Comparative Economics, 29(1), 66–79. https://doi.org/10.1006/jcec.2000.1703

Morita, H. (2005). Multi-skilling, delegation and continuous process improvement: A comparative analysis of US–Japanese work organizations. Economica, 72(285), 69–93. https://doi.org/10.1111/j.0013-0427.2005.00402.x

Orlic, E., Hashi, I., & Hisarciklilar, M. (2018). Cross sectoral FDI spillovers and their impact on manufacturing productivity. International Business Review, 27(4), 777–796. https://doi.org/10.1016/j.ibusrev.2018.01.002

Pounov, C. (2016). Corruption’s asymmetric impacts on firm innovation. Journal of Development Economics, 118, 216–231. https://doi.org/10.1016/j.jdeveco.2015.07.006

Reinikka, R., & Svensson, J. (2006). Using micro-surveys to measure and explain corruption. World Development, 34(2), 359–370. https://doi.org/10.1016/j.worlddev.2005.03.009

Rivas, M. F. (2013). An experiment on corruption and gender. Bulletin of Economic Research, 65(1), 10–42. https://doi.org/10.1111/j.1467-8586.2012.00450.x

Şeker, M. (2011). Rigidities in employment protection and exporting. World Development, 40(2), 238–250. https://doi.org/10.1016/j.worlddev.2011.05.008

Şeker, M. (2012). Importing, exporting, and innovation in developing countries. Review of International Economics, 20(2), 299–314. https://doi.org/10.1111/j.1467-9396.2012.01023.x

Şeker, M., & Yang, J. S. (2014). Bribery solicitations and firm performance in the Latin America and Caribbean region. Journal of Comparative Economics, 42(1), 246–264. https://doi.org/10.1016/j.jce.2013.05.004

Seligson, M. A. (2006). The measurement and impact of corruption victimization: Survey evidence from Latin America. World Development, 34(2), 381–404. https://doi.org/10.1016/j.worlddev.2005.03.012

Solé-Ollé, A., & Sorribas-Navarro, P. (2018). Trust no more? On the lasting effects of corruption scandals. European Journal of Political Economy, 55, 185–203. https://doi.org/10.1016/j.ejpoleco.2017.12.003

Svensson, J. (2003). Who must pay bribes and how much? Evidence from a cross section of firms. Quarterly Journal of Economics, 118, 207–230. https://doi.org/10.1162/00335530360535180

Todo, Y., Zhang, W., & Zhou, L.-A. (2009). Knowledge spillovers from FDI in China: The role of educated labor in multinational enterprises. Journal of Asian Economics, 20(6), 626–639. https://doi.org/10.1016/j.asieco.2009.09.002

Vial, V., & Hanoteau, J. (2010). Corruption, manufacturing plant growth, and the Asian paradox: Indonesian evidence. World Development, 38(5), 693–705. https://doi.org/10.1016/j.worlddev.2009.11.022

Wellalage, N. H., Locke, S., & Samujh, H. (2020). Firm bribery and credit access: Evidence from Indian SMEs. Small Business Economics, 55, 283–304. https://doi.org/10.1007/s11187-019-00161-w

Xu, X., & Sheng, Y. (2012). Productivity spillovers from foreign direct investment: Firm-level evidence from China. World Development, 40(1), 62–74. https://doi.org/10.1016/j.worlddev.2011.05.006

Acknowledgements

We thank the two anonymous reviewers and the editor, Professor Sameeksha Desai, for their valuable comments and suggestions.

Funding

This works was financially supported by the Social Sciences and Humanities Research Council of Canada (grant number: 4301).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

ESM 1

(DOCX 30 kb)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Boikos, S., Pinar, M. & Stengos, T. Bribery, on-the-job training, and firm performance. Small Bus Econ 60, 37–58 (2023). https://doi.org/10.1007/s11187-022-00633-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00633-6