Abstract

This study analyses the relationship between entrepreneurial dynamics and the level of competitiveness in Latin American countries. Based on a stage of economic development model, we demonstrate that Latin American countries under the model followed different paths related to competitiveness. These different paths can explain the effect of specific competitiveness conditions on entrepreneurial dynamics in Latin America.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is tremendous diversity in the level and time-series pattern of entrepreneurship across countries. Acs et al. (1994) show that the major explanation for this diversity is the stage of economic development. They also show that the negative relationship between entrepreneurship and economic development persists after controlling for a number of other factors. Although economic development is an extremely powerful force behind the secular decline in entrepreneurship, the convergence of several factors in the 1970s tended to stem the secular decline in entrepreneurship for many countries (Blau 1987). Of 23 OECD countries examined by Acs et al. (1994), 15 witnessed increased entrepreneurship during the 1970s or 1980s.

Recent studies confirm that during the last 2 decades, the development of new technologies and emergence of new business models have enabled the shift from large corporations to small and new ventures (Acs and Audretsch 1988; Jorgenson 2001; Audretsch and Thurik 2001; Thurow 2003). Entrepreneurship contributes to economic performance by introducing innovation, enhancing rivalry and creating competition (Wong et al. 2005). Nevertheless, the competitive impact of these entrepreneurial efforts differs between countries at the same level of development (Carree et al. 2002), between countries at different stages of development (Wennekers et al. 2005) and also among regions in a single country (Acs and Armington 2004).

Some emergent economies, such as Israel, Korea, Singapore and Ireland, have experienced a remarkable transformation in the last 20 years, both in terms of economic growth and institutional development. At the same time, Latin America and Africa have shown much lower levels of development. What is the “entrepreneurial reality” in Latin America?Footnote 1 While South America has made real progress in the past decade in the area of democracy, property rights and macroeconomic stability, the region still lags in the “softer” areas of education, knowledge creation and economic reform. Therefore, the region has been less successful in improving economic performance compared to other emerging markets (Blejer 2006; López-Claros et al. 2006). As a result, entrepreneurial activities and competitiveness—the efficiency-drive stage—cannot grow at sustainable rates. Amorós and Cristi (2008) argue:

Generally, Latin America countries present features of a “managed economy”, in which most of the small-scale production firms have minor significance in innovation, and the products manufactured and the services provided are of discreet value added in comparison with the large and concentrated companies. Latin American economies have a limited number of nascent ventures under the model of “entrepreneurial economy” because of the many restrictions present to create knowledge-based businesses.

For this reason, there is emerging interest in how efficiency can be increased in major industries, to increase exports and develop more value-added industries in these regions (Acs 2008).

In this paper we investigate the relationship between entrepreneurial activity and competitiveness performance in Latin American countries. This paper builds on earlier work to analyse entrepreneurial dynamics in developing countries. We use three different international data sources for our analysis. The Global Entrepreneurship Monitor (GEM early stage entrepreneurial activity and its components) measures entrepreneurial dynamics. Competitiveness indicators are taken from the Global Competitiveness Reports of the World Economic Forum, including the Growth and Global Competitiveness Index. The level of economic development is measured by per capita income, taken from the IMF World Economic Outlook database.

We construct a series of regressions to verify the relationship between entrepreneurial dynamics and the level of competitiveness and economic growth. We use longitudinal data for 55 countries over the period 2001–2006 and test different specifications of the data. While these relationships have been studied mainly using cross-sectional data, this paper advances our understanding of entrepreneurial dynamics using panel data.

The rest of the paper is structured as follows. In order to understand developing countries, we review the literature on economic development in Sect. 2 and focus on the role of entrepreneurship. In Sect. 3, we present the model for the analysis and describe the variables used. Section 4 shows the results, followed by the discussion and conclusion in Sect. 5. Our findings suggest entrepreneurship is truly relevant for developing economies. First, reducing replicative entrepreneurship leads to increased economic efficiency, while increasing innovative entrepreneurship leads to gap-filling and input-completing activities. However, our results for Latin America show little progress in this direction.

2 Entrepreneurship and competitive development

That the former colonies in Africa, much of Asia, Latin America and the Caribbean have experienced abysmal growth since independence is not a new proposition.Footnote 2 Easterly (2001) pointed out that despite modest growth in the 1960s and 1970s, economic growth from the 1980s onwards has been stagnant in developing countries. This stagnation has persisted in spite of extensive reforms removing growth-reducing distortions. This section will review the literature on import substitution and export promotion, evaluate the export promotion model and conclude with a discussion on the role of entrepreneurship in development.

2.1 Import substitution

A review of the literature reveals that the primary ternality goal of governments in many developing countries became industrialisation rather than meaningful economic development. Prebisch (1959), one of the major proponents for import substitution, found that “industrialisation is an inescapable part of the process of change accompanying a gradual improvement in per capita income”. Prebish (1959) develops a two-country model consisting of an advanced country specialising in industrial goods and a periphery country producing primary goods. The economy of the periphery is characterised by surplus labour and “disguised unemployment” in the traditional sector, from which the modern, industrial sector can draw labour. Finally, the income elasticity of demand for imported industrial goods is higher in the periphery country than in the advanced country.

The periphery economy has a choice industrialising by either increasing production for export or for domestic consumption. For Prebisch, import substitution was the most efficient way for developing countries to achieve industrialisation and income growth. Indeed, Prebish suggested that even if a developing country chose to increase exports and experienced an increase in income, there would be a large corresponding increase in import demand because of its relatively high income elasticity demand for imports. Therefore, domestic production of the imported good (i.e. import substitution) would still be required. Among Prebish’s policy recommendations were high tariffs, export taxes and production subsidies to domestic producers. While countries could have chosen to increase exports to produce the foreign currency to import these industrial goods, Singer (1999, p. 911) notes that industrialising developing countries “would find it initially easier to produce for an existing and known domestic market than for an unknown global market”.

The enormous bureaucracy necessary to support import substitution lent itself to the perpetuation of permanent inefficiencies in industry as well as corruption in government. These are both important barriers to productive entrepreneurship. Baer (1972) found that government policies, which actively encouraged new entry often, led to markets with many small and inefficient firms. On the other hand, many firms were operating with excess capacity, high labour costs relative to productivity and foreign exchange shortages that impacted their ability to obtain necessary inputs—resulting in further slack. Bruton (1998) finds that the import licensing processes also created crippling mismatches between the time that capital investments were actually required and the time that import licences were obtained—again resulting in underutilisation.

2.2 Export promotion

With the failure of import substitution and the success of the newly industrialising Asian countries, conventional wisdom shifted to promote exports as a means of development. Like import substitution, the discovery of the export promotion strategy appeared to have occurred accidentally. By 1965, the export promotion strategy was formalised within South Korea’s Ministry of Commerce and Industry’s Export Promotion Subcommittee. South Korean export promotion policies included the establishment of subsidies and access to cheap credit for exporters, which were tied to export targets for firms in each sector. The South Korean government also concentrated on maintaining the quality of exports and on marketing efforts to US companies. Comparing the successful Asian economies with flagging Asian export promoters such as the Philippines, Amsden (1991, p. 284) found that subsidies in successful East Asian economies were linked to “concrete performance standards with respect to output, exports, and eventually, R&D.”

Krueger (1980) points out that the “experience has been that growth performance has been more satisfactory under export promotion strategies”. Indeed, because open economies are exposed to world prices derived from global productivity differences, domestic resources can be more efficiently allocated compared to countries where distorted domestic prices are the main guide for the production mix. Outward-oriented trade policies also allowed for the generation of scale economies without the use of monopolies, because production was for a large international market. Keesing (1967) found that even for small countries “the severe handicap of smallness cannot be abolished, but it can be minimised under an outward-looking strategy” because of the economies of scale associated with exporting to a larger market. Export orientation also generated foreign exchange necessary to fund capital investments, thereby eliminating the need for government intervention “in determining which industries should be encouraged or in allocating scarce foreign exchange in a regime of quantitative restrictions”. Keesing (1967, p. 1516) previously pointed out those inward-looking strategies “permit[ted] a high degree of government intervention” compared to outward-oriented economies.

How do exports affect growth? First, export orientation is associated with growth through its impact on foreign exchange earnings. Balassa (1971) finds that export growth is associated with “raising national income” and greater foreign exchange earnings. Dollar (1992) suggests that as export companies operate in foreign currency earning sectors, they can more readily and effectively utilise foreign currency debt compared to companies that produce for the domestic sector. Indeed, Sachs et al. (1995) suggest that, “The outward orientation of the East Asian economies had saved them from the developing country debt crisis that ravaged Latin America”.

Export orientation is also associated with structural changes within an economy, which can have positive effects on economic development. While the terms growth and development are often used synonymously, Brinkman (1995, p. 1183) points out that economic development involves, “a process of structural transformations” within an economy, while growth “relates to [the] replication of more and more of the same structure”. Additionally, export promotion strategies allow for economies of scale in industry as production is targeted to a much larger market versus production for only the domestic market. The small size of developing countries’ domestic markets often led to production inefficiencies that in “the absence of competition result[ed] in low-quality high-cost production”.

Sapsford and Garikipati (2006) suggest that international trade can have a positive effect on economic growth and therefore on poverty, because trade allows for a more efficient use of resources and exposes domestic producers to larger, more competitive markets, which encourages productivity improvements. Weiss (2005) also points out that exporting can generate important productivity spillovers. Akyüz and Gore (2001) conclude that development requires the production of increasingly more complex exports.

Finally, production is also more likely to occur along a country’s comparative advantage under an outward-oriented strategy. As exporters compete in an international market, there is incentive to improve productivity and technical progress, compared to producers who compete in protected domestic markets. Balassa (1988), for example, finds that Asian export-oriented countries experienced increasing levels of total factor productivity with increasing levels of exports. Referring to East Asian countries, Krueger (1998) finds that the role of productivity growth and government intervention was important for explaining the region’s ‘miracle’ growth. However, Rodrik et al. (1995, p. 69) contend “there is virtually no evidence that exports or outward orientation were associated with technological externalities”. While Rodrik et al. (1995) admit there are correlations between exports and technology spillovers, they argue that causation cannot be determined. Instead, Rodrik et al. (1995) suggest it may be that productive firms simply export more. Indeed, Rodrik et al. (1995) find growth in the East Asian miracle countries was more related to an increase in investments and capital accumulation, which was facilitated by export earnings. Lucas’s (1993) explanation of the Asian miracle growth offers some insights into this debate. For Lucas, capital, specifically human capital, was the important factor in explaining growth differentials. However, like Krueger and Balassa, Lucas recognised that human capital could be acquired “in the course of producing goods and engaging in trade”. However, it is not sufficient to simply increase the volume of exports. Instead, the increase in exports must also be accompanied by an increase in the variety and complexity of goods produced through ongoing innovation, or more likely, ongoing imitation.

2.3 The performance of the export promotion model

While export promotion strategies in South Korea, Singapore, Hong Kong and Taiwan emphasised productivity and created pseudo-market conditions, the strategies employed in Latin America, the Caribbean and Africa appear somewhat different. For these regions, export promotion consisted almost entirely of the creation of export processing zones, EPZs, special liberal carve-outs from the domestic economy where foreign exporting firms could operate. By the beginning of the 1980s, Wong and Chu (1984) found that 60 export-processing or free-trade zones had been established throughout the world. By 2004, there were over 4,000 EPZs throughout the world.Footnote 3 In their discussion of Asian EPZs, Wong and Chu (1984) find that despite the large incentives provided to attract foreign investment to these zones, many had not performed well in terms of stability of employment, technology transfer, the creation of forward and backward linkages with the local economy nor in the promotion of regional development compared to East Asia’s miracle countries domestic export promotion markets.

Alarcon and McKinley (1992) discuss the export promotion experiences of Mexico and Brazil in the 1980s and find little impact on development, linkages to the domestic economy and productivity growth (measured by “value added”). In the Caribbean, after failed attempts at import substitution and declining terms of trade for agriculture and primary product exports, governments began to embrace export promotion policies aimed at attracting foreign direct investment for the production of non-traditionally manufactured products by offering attractive incentives. Pantin’s (1990) and Goss and Conway’s (1992) discussions of export promotion through foreign direct investment reveal that these strategies had little impact on economic development for many Caribbean countries. Griffith (1990) finds that, notwithstanding the Caribbean region’s proximity to the United States and its relatively low labour costs, the impact of the Caribbean Basin Initiative (the CBI) and the resulting export processing zones were likely to be limited because of the “quality of investment occurring under the CBI”.

The export promotion strategies pursued by the successful Asian industrialisers and the free zone-FDI oriented approaches of other developing countries resulted in significant differences for entrepreneurship. The more recent export promoters became trapped in low-skill production based on comparative advantages in abundant low-skill labour, geographic location and attractive incentives rather than utilising a dynamic process of increasingly sophisticated production based on human capital comparative advantages. Indeed, for many countries engaged in export promotion, Grossman and Helpman (1990, p. 91) predicted knowledge spillovers did not occur as “the technology flows [were] anything but automatic”. Using a knowledge spillover perspective, De Clercq et al. (2008) find that the relationship between FDI and international trade on the one hand and a country’s proportion of export-oriented new ventures on the other differs for higher-and lower-income counties. In addition, a country’s proportion of export-oriented new ventures affects the subsequent emergence of new businesses.

Describing the East Asian Miracle, Lucas (1993) points out that at each stage along its export promotion strategy, the quality of education and human capital along with physical capital improved. This dynamic process enabled both local and foreign entrepreneurs operating in successful East Asian economies to produce, on a large scale, an updated and new mix of goods with higher potential “learning spillover technologies”.

2.4 Why is entrepreneurship important for development?

Porter (1990) and Porter et al. (2002) define competitiveness according to the country economic development, distinguishing three specific stages: (1) factor-driven stage, (2) efficiency-driven stage and (3) innovation-driven stage, and two transitions between these stages. In the factor-driven stage countries compete through low-cost efficiencies in the production of commodities or low value-added products. To move into the second stage, the efficiency-driven stage, countries must increase their production efficiency and educate the workforce to be able to adapt in the subsequent technological development phase. To compete in this second stage, countries must have efficient productive practices on large markets that allow companies to exploit economies of scale. Industries in this stage are manufacturers or provide basic services.

In recent years, economists have come to recognise the input-completing and gap-filling capacities of potential entrepreneurial innovation and growth and the significant contribution of innovation and growth to prosperity and economic welfare (Levie and Autio 2008; Acs and Armington 2006; Schramm 2006; Audretsch 2007). Therefore, while most of the developed countries are in the innovation-driven stage, the biggest Latin American economies are only in the efficiency-driven stage (López-Claros et al. 2006). In order for economies to move into the innovation-driven stage it is necessary for them to promote innovation so they are able to reach the technological frontier and thus become a knowledge-based economy that is particular of the innovation-driven stage.

Economic development therefore implies “a process of structural transformations” leading to an overall higher growth trajectory (Brinkman 1995). According to Leibenstein (1968, p. 77)

Per capita income growth requires shifts from less productive to more productive techniques per worker, the creation or adoption of new commodities, new materials, new markets, new organisational forms, the creation of new skill and the accumulation of new knowledge; the entrepreneur as gap filler and input-completer is probably the prime mover of the capacity creation part of these elements in the growth process.

Again, economic development involves change, and the entrepreneur becomes the best agent for this change. Entrepreneurship matters for developing countries because markets matter. Indeed, the market, through its frequent adjustments in response to the “separate actions of different people” and “the conditions of supply of various factors of production”, communicated new information through prices that enabled the efficient allocation of resources. With the collapse of centrally planned economies, it has been seen that governments cannot allocate resources efficiently and that markets are indeed necessary.

The recognition of the importance of the entrepreneur and the necessity of the markets in which the entrepreneur operates has led many countries to work on perfecting their markets by eliminating barriers to entrepreneurship and other market failures. This is evidenced by the renewed focus of many of the international development organisations on private sector development, improvements in the business environment and small and medium enterprise policies (Klapper et al. 2006; Djankov et al. 2002).

3 The U-shaped model

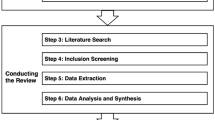

3.1 Methodology

The previous section discussed Latin American countries and their relatively “poor performance” on competitiveness and entrepreneurial dynamics. Most developed countries and other emergent regions (the “East-Asia miracle”) experienced a transition from the efficiency-driven stage to the innovation-driven stage (the entrepreneurial society), characterised by knowledge spillovers, increased competition and the existence of diversity among major firms. These allow flexibility and innovation in the economy, where new firms are crucial for technological improvement and innovation. We hypothesise that Latin American countries under ceteris paribus conditionsFootnote 4 show “descending behaviour” in their entrepreneurial dynamics rates. This behaviour suggests that as the competitiveness and economic growth of the region increase, entrepreneurial dynamics decrease. In order to examine these relationships, we use a series of regressions following this general model:

where E is entrepreneurial dynamics, GCI is global competitive index, GDP is per capita gross domestic product (adjusted PPP), X are control variables, i is the country index, and t is the time period.

We estimate the model pooling the cross section of countries with time-series data on each country over the period 2001–2006. We verified linear, logarithmic and inverse relation specifications, but also the quadratic specification using a general-to-specific modelling procedure, and tested the better statistical fit.Footnote 5 Additionally, we specify a different intercept coefficient for each country (fix effects) and test the relationship between entrepreneurial dynamics and level of economic growth. We do not include a fixed effect component in the model that relates entrepreneurial dynamics and GCI, because GCI captures differences in countries' institutional aspects already included in the GCI variable.Footnote 6

3.2 Dependent variables

GEM provides harmonised, internationally comparable data on entrepreneurial activity. By the end of 2006, 55 different countries participated in GEM, 10 of which were Latin American and Caribbean countries. GEM’s database contains various entrepreneurial measures that are constructed on a survey basis, known as the Adult Population Survey. This survey helps GEM estimate the percentage of the adult population (people between 18–64 years old) that is actively involved in starting a new venture. This Early Stage Entrepreneurial Activity IndexFootnote 7 disaggregates the entrepreneurial activity based on the main motives that entrepreneurs “follow”: The first one includes opportunity-based entrepreneurs (OPP) who have taken actions to create a new venture pursuing perceived business opportunities. The second category is the necessity-based entrepreneurs (NEC) who are involved “because they cannot find a suitable role in the world of work—creating a new business is their best available option” (Reynolds et al. 2005, p. 217). In order to capture variations between these indexes, our dependent variables are not only TEA, but OPP and NEC rates and RATIO (OPP/NEC) over a 7-year period (2001–2006).

Because OPP (or the general TEA) could incorporate any type of entrepreneurial activity including self-employment, this rate can include low-growth or no-growth entrepreneurship. In the GEM data, nearly 50% of all start-up attempts do not expect to create any jobs within 5 years (Autio 2007). In order to separate high-potential entrepreneurs, GEM methodology computes the High-Expectation TEA (HEA) index, which is the percentage of adult-age population involved in TEA who expect to create 20 or more jobs within 5 years.Footnote 8 The GEM 2007 Executive Report and GEM 2007 Global Report on High-Growth Entrepreneurship suggest that in middle- and low-income countries, early stage entrepreneurial activity may be dominated more by low-growth entrepreneurial initiatives. For this reason, following Levie and Autio (2008), our third dependent variable is the relative HEA (rHEA) index, which indicates the ratio between HEA and TEA: (rHEA = HEA/TEA). “rHEA thus provides an indication of the anatomy, rather than population-level prevalence (or volume), of high-growth entrepreneurship”. These rates are over a 7-year period (2001–2006).

Our last dependent variable is the relative prevalence rate of International Orientation of Early Stage Entrepreneurs (EXPEA). This measure is the proportion of the adult-age population involved in TEA who responds that they have 25% or higher number of customers in other countries. In other to capture the importance of “entrepreneurial export orientation” related to the better performance of external trade policy for entrepreneurial activities, we only use the relative high foreign market rate orientation—that is, more than 50% of customers in other countries. GEM methodology started to compute these rates in 2002. For this reason we only can use the 5 year period from 2002–2006. If a country was in the efficiency-driven stage, one would expect export driven entrepreneurship might be an important determinant of efficiency. Hessels et al. (2008) find GDP per capita has a direct positive relationship with high job growth and export aspirations.

3.3 Independent variables

The World Economic Forum using the McArthur and Sachs (2002) methodology developed the Growth Competitiveness Index (GCI). In the 2005–2006 period, the World Economic Forum introduced a new and more comprehensive competitiveness index, which was called the Global Competitiveness Index (Global CI). Footnote 9 Word Economic Forum’s Global Competitiveness Programme and Professor Xavier Sala-i-Martin developed the Global CI. This new index evaluates and benchmarks many critical factors, which were absent from the GCI. The Global CI aims to measure “the set of institutions, policies and factors that set the sustainable current and medium-term levels of economic prosperity” (Sala-i-Martin and Artadi 2004, p. 52). In our estimation we use GCI as an independent variable between the years 2001–2005 and the Global CI from 2006.

Our second independent variable is gross domestic product per capita for the period 2001–2007. Per capita income growth rate is a good proxy to measure the economic growth and is one of main sources of economic development (Wennekers et al. 2005). These variables are adjusted by the purchasing power parity per US dollars, GDP per capita (PPP). The data were taken from The International Monetary Fund’s World Economic Outlook Database published in September 2007.

3.4 Control variables

In addition to the independent variables, and to solve the potential collinearity, we introduce control variables for country degree of economic welfare and regional dimension. We use a dummy variable HINCOME with value 1 for GEM’s high-income countries (see the Appendix). For the regional approach we use a dummy variable LATAM with value 1 for GEM’s Latin American and Caribbean participant countries. A correlation matrix is as follows (Table 1).

4 Results

We test six models on total entrepreneurial activity, opportunity, necessity, opportunity/necessity, high expectation and export orientation. Our first results from the regressions models indicate that the R 2 values and the likelihood ratio tests are higher for the quadratic specification on total entrepreneurial activity and opportunity-based entrepreneurial activities. Logarithmic specification is better on necessity-based, high-growth expectation and international orientation entrepreneurial activities. Linear specification is for opportunity/necessity ratio. Some significant and negative effects of competitiveness rates, and economic growth on the different entrepreneurial dynamics rates, suggest that for developing countries competitiveness is more oriented to structural production efficiency instead of enhancing the entrepreneurial dynamics of the country.

4.1 Total entrepreneurial activity

We test the linear, logarithmic, inverse and quadratic specifications using the TEA variable. Quadratic specification (U-shape) had a better statistical fit (adjusted R 2 values) and superior statistical specification. We found multicollinearity between GDP and GCI using the fixed effect model. To solve this problem, we test three models: First, a general without fixed effect, but controlling for LATAM; second, a specific model only using GDP with fixed effect; and third, a specific model with GCI and control variables:

The results are shown in Table 2. In the general model (1a), GCI and GDP are significant and negative, and GCI and GDP squared are significant and positive. The LATAM control variable is significant and positive. These results are consistent with the previous results of Wennekers et al. (2005) and Amorós and Cristi (2008). On specific models (1b and 1c), we found the expected relationships—U-shaped relationship—with GCI and GDP. LATAM is significant and positive, and HICOME is negative and significant. These results are consistent with Carree et al. (2007) that rich or competitive countries face a decreasing degree of total entrepreneurship activity.

4.2 Opportunity

Similarly, the TEA model with quadratic specification (U shape) for OPP had a better statistical fit (adjusted R 2 values) and superior statistical specification:

The results are shown in Table 3. In the general model (2a), GDP is significant and negative, and GDP squared is significant and positive. The LATAM control variable is significant and positive. On specific models (2b and 2c), we found the expected relationships—U-curve—with GCI and GDP. LATAM is significant and positive, and HICOME is negative but not significant. Again, the possible explanation for the insignificant relationship between high-income control variable and opportunity rates is that low-middle income countries have relatively higher rates in entrepreneurial dynamics (Bosma et al. 2008), but not necessarily “high quality” entrepreneurship activities.

4.3 Necessity

In this model, we also verified linear, logarithmic and inverse relations specification, as well as the quadratic specification. Logarithmic (log–log model) was once best adjusted:

The results are shown in Table 4. The specific models (3b and 3c) confirm the effects of CGI and GDP per capita on the NEC rates are significant and negative. LATAM is positively related to NEC, while HINCOME is negatively related, both significantly. These relationships confirm that for Latin American counties (and other low-middle income countries), the degree of competitiveness does not have the same effect to “reduce” the existence of necessity-based entrepreneurial activities.

4.4 Ratio between opportunity and necessity

In this model, the dependent variable is a ratio, so we only use a linear model:

The results are shown in Table 5. The whole model 4b for GDP is not significant. The models 4a and 4c show that LATAM is negative but not significant, while HINCOME is positive and significant. These results confirm countries with high relative prevalence of opportunity-driven entrepreneurship are high-income countries (Bosma et al. 2008). For Latin America again, the necessity-motivated entrepreneurs have an important share of the total entrepreneurial activity, and in many cases (like Argentina and Brazil in 2002) the NEC rate is over the OPP.

4.5 High-expectation entrepreneurial activity

Again we test different specification, and the logarithmic model (Log–Log model) had the better statistical fit:

Table 6 reports estimation results for these models. We find a positive and significant effect of GDP and GCI on the specific models (5b and 5c) and GDP on the general model (5a), but no significance for LATAM and HINCOME. A possible explanation is if high-income countries have higher relative high-expectation entrepreneurship activities than low- and middle-income economies (Autio 2007), some of these economies, such as China, Russia, Croatia and, in Latin America, Argentina, have high relative rates on high-expectation entrepreneurship. On the other hand, some high-income economies present very low rates of early stage entrepreneurial activities with high growth expectations.

4.6 International orientation entrepreneurial activity

Similar to previous models, the logarithmic model has the better statistical fit:

Table 7 reports estimation results for these models. In the general model 6a, we find GCI and LATAM have a significant negative result on the international orientation, whereas GDP is significant and positive. The constant is negative and not significant. In the specific models 6b and 6c, GPP and GCI respectively have no significant relationship on export orientation, but on model 6c, LATAM is again negatively significant and HINCOME positively significant. The GEM Global Report 2007 gives us a possible explanation for these relationships. The report notes many high-income smaller countries, like Hong-Kong, Singapore, UAE and many European countries, rely strongly on export orientation, and this dynamic is transferred to the entrepreneurs (Bosma et al. 2008). This is not similar in Latin American countries, with relatively low international orientation entrepreneurship activity rates.

4.7 Specific Latin American context

To explain specific context for entrepreneurial dynamics, we select five Latin American countries with more than two observed periods:Footnote 10 Argentina, Brazil, Chile, Mexico and Venezuela. Although only Argentina and Brazil have measurements for the entire sample period, the selected countries exhibit different behaviours using a partial graphical description of the models.

The particular cases of Argentina and Brazil show a very singular trajectory, indicating that entrepreneurial dynamics, competitiveness and economic growth change depending on country situation. These results show that countries with low and middle incomes have a high rate of entrepreneurial activity derived from the fact that a large part of the population has not been able to find another source of employment (see Fig. 1). The economic crisis in Argentina between 2002 and 2003 increased the necessity-based entrepreneurship. In Argentina’s crisis period, the total entrepreneurial activity increased from 10.52% in 2001 to 19.73% in 2003, having the necessity-based “peak” precisely in 2003 with an estimated 7.46% of the adult population in necessity entrepreneurship. Brazil faces similar conditions. After the crisis period’s generality, the medium-sized and large companies are strengthened, and they start to become a source of employment again (Listerri et al. 2006). In some countries like Chile and Mexico with low unemployment rates (7% second semester of 2007 in Chile), more people abandon their necessity venture or self-employment, moving to formal employment.

The main “problem” in Latin American entrepreneurship rates is that opportunity-based rates decrease with relative speed or have several variations (see Fig. 2). Again, these results suggest that low and middle developed countries (all Latin American countries) may present more volatile entrepreneurship rates (Wong et al. 2005).

Latin American countries in this sample also present a relative decrease in their competitive indexes. A possible explanation is low innovation and technology development. If those factors increase, the GCI index grows, then “business opportunities” from new technologies and innovation are captured by big firms that absorb necessity entrepreneurship, thus reducing opportunity rates. A similar situation could be “transferred” to high expectation and internationally oriented entrepreneurs: Only big firms can capture the benefits of maximising, exports and only few small firms have the capabilities to become high-growth internationally oriented firms.

In sum, analysing the opportunity “U-curve” approach reveals there is some level of GCI at which the relationship changes and greater competitiveness improves the entrepreneurial activity, and moves from the efficiency-driven stage to the innovation-driven stage (Amorós and Cristi 2008). The low relative competitiveness rates and the analysed paths provided by our results suggest that this is not taking place in Latin America. Of course, one issue is that the TEA measures developed by GEM are at best inappropriate for an analysis of developed countries, as mentioned in the introduction. A more comprehensive measure of entrepreneurial activity that is able to rank both developed and developing countries might paint an entirely different picture of entrepreneurship in Latin America.

5 Discussion and conclusions

5.1 Theory

It should be evident from the results in this paper that the family of TEA measures of entrepreneurship is limited for providing a reliable measure of entrepreneurship in both developed and developing countries and therefore is also inadequate to drive policy (Acs et al. 2008a, b). There are three observations. First, the U-shaped approach is useful in understanding the decline in self-employment in developing countries both across countries and over time, but not useful in explaining entrepreneurship (broadly defined). Second, the U-shaped approach is not very useful in explaining the role of developing countries in the efficiency-driven stage of development, either as they enter the efficiency-driven stage or leave the efficiency-driven stage. Finally, while the U-shaped framework was originally developed to understand the increase in entrepreneurship in high-income OECD countries, the model is also of limited value here, as many have questioned the U-shaped model and suggested that only a L-shaped relationship exists. In some sense, the chapter on this line of research has reached a dead end as discussed in the introduction to this special issue (Acs et al. 2008a, b).

Acs and Szerb (2008) develop a new family of global entrepreneurship indices. For example, the Complex Global Entrepreneurship Context Index (CDC) has three sub-indexes that measure entrepreneurial activity, entrepreneurial strategy and entrepreneurial attitudes. The relationship between GDP growth and the CDC index is one where the relationship between competitiveness and entrepreneurship is more linear or mildly S-shaped and not U-shaped (Virgill 2008). For 53 countries over the time period 2005–2006, all but one Latin American country were in the bottom half of the index. The exception was Chile, which ranked 12th. Argentina ranked 31st, Colombia, 34th, Uruguay 35th, Venezuela 42nd, Mexico 52nd and Brazil 53rd. As we move beyond the U-shaped approach for measuring entrepreneurship (first developed by Acs et al. 1994), a deeper and more nuanced understanding of entrepreneurship among countries and over time will emerge to guide policy.

5.2 Policy

The models analysed the relationship between entrepreneurial dynamics and competitiveness, and economic growth during the period 2001 to 2006. Even though our empirical results are certainly not conclusive as we stated in the previous section, with the Latin American countries that were part of the sample used for this study, we corroborate the significant and negative effects of competitiveness rates, GCI and economic growth and GDP per capita on the total opportunity and necessity entrepreneurial rates. Furthermore, Latin American countries face significant and negative effects on international orientation entrepreneurship. These results have important implications for public policy. The results suggest that for the sample countries (and in general for developing countries), competitiveness has oriented towards structural production efficiency instead of towards improving innovation and entrepreneurship in the country.

From this analysis, Latin American countries could move towards two kinds of public policy: First, Latin American countries must work to achieve the efficiency-driven stage, which implies stable regulatory and macroeconomic conditions (Amorós and Cristi 2008). This means continuation with the reduction of unemployment and necessity-based entrepreneurship. This latter type of “entrepreneurship” is still present in many Latin American countries (Listerri et al. 2006; Bosma et al. 2008), and as we described earlier, is highly related to a country's economic conditions. This kind of public policy—efficiency driver oriented—is indispensable, but insufficient. If Latin American countries only follow the “natural tendency” and do not consider the promotion of entrepreneurship as a main concern of their policy agenda (Wennekers et al. 2005), they only will reduce the necessity-based entrepreneurship without achieving higher growth in opportunity-based or internationally oriented high-expectation entrepreneurship. A second kind of policy to gain more competitiveness (and plan the transition to the innovation-driven stage) is to advance policy in which innovative entrepreneurship should be promoted in order to create new and better firms with new business models, not only isolated or low value-added firms. High-expectation entrepreneurial activities (dynamic new ventures) reflect better performance of competitiveness and economic development (Autio 2007). This “way” implies that there must be better strategies to accelerate growth and move more rapidly, thus allowing major innovation activity and a real impact of competitiveness and economic development on entrepreneurial dynamics, as was pointed out above with export processing zones integrated with entrepreneurship.

We hope this research contributes to additional knowledge on a general perspective of the entrepreneurial dynamics for developing countries and gives more bases to emphasise the imperative for the creation of highly competitive new ventures in Latin America and the Caribbean.

Notes

According 2005 IADB Report (Ferriter 2006), the average growth rate is 4.9%.

This section draws heavily on Acs and Virgill (forthcoming).

International Labour Organisation, Export Processing Zones: Epz Employment Statistics [4 February 2004 (cited October 31 2006)]; available from http://www.ilo.org/public/english/dialogue/sector/themes/epz/stats.htm.

There exist different economic, demographic, social and institutional factors that influence the economic growth and could be related to the entrepreneurial activity. See Wennekers et al. (2005, p. 298).

We performed a series of Akaike tests and Schwarz tests, such as a selection criteria for different models specifications.

This may explain why the inclusion of a set of dummies for each country in preliminary models for entrepreneurial dynamics as a function of GCI induces substantial collinearity in the estimation.

Like TEA, the HEA varies across GEM participant countries. For complete measures and explanation about HEA indexes, see the GEM 2007 Report on High-Growth Entrepreneurship (Autio 2007).

The Global CI uses the same Porter’s competitiveness stages to determine three sub-indexes based on the nine pillars: Basic requirements subindex (Stage 1: factor-driven): Institutions (pillar 1), infrastructure (pillar 2), macroeconomic (pillar 3) and health and basic education (pillar 4). Efficiency enhancers subindex (Stage 2: efficiency-driven): Higher education and training (pillar 5), market efficiency (pillar 6), technological readiness (pillar 7). Innovation and sophistication factor subindex (Stage 3: innovation-driven): Business sophistication (pillar 8) and innovation (pillar 9). A brief description on the construction of the index is provided in Chap. 1.1 (see Appendix B and Appendix C) of GCR 2005–2006 (López-Claros et al. 2005, pp. 40–42). With these concepts, the Global CI uses the model of developmental stages by weighing each of the sub-indexes differently, depending on the stage a given country is in. Latin American and Caribbean countries are weighed on basic requirements and efficiency enhancers.

We omit Peru in this graphical analysis.

References

Acs, Z. J. (2008). Foundations of high impact entrepreneurship. Foundations and Trends in Entrepreneurship, 4(6), 535–619.

Acs, Z. J., & Armington, C. (2004). Employment growth and entrepreneurial activity in cities. Regional Studies, 38(8), 911–928.

Acs, Z. J., & Armington, C. (2006). Entrepreneurship, geography and American economic growth. Cambridge, UK: Cambridge University Press.

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: An empirical analysis. American Economic Review, 78(4), 678–690.

Acs, Z. J., Audretsch, D. B., & Evans, D. S. (1994). The determinants of variation in self-employment rates across countries and over time. London, UK: Centre for Economic Policy and Research.

Acs, Z. J., Desai, S., & Hessels, J. (2008a). Entrepreneurship, economic development and institutions. Small Business Economics, 31(3) this issue

Acs, Z. J., Desai, S., & Klapper, L. (2008b). What does “entrepreneurship” data really show? A comparison of the Global Entrepreneurship Monitor and World Bank Group datasets. Small Business Economics, 31(3) this issue

Acs, Z. J., & Szerb, L. (2008). A complex global entrepreneurship context index (CEC). Faculty of Business and Economics, mimeo: University of Pecs.

Acs, Z. J., & Virgill, N. (2008). Entrepreneurship and economic development. Foundations and Trends in Entrepreneurship (in press)

Akyüz, Y., & Gore, C. (2001). African economic development in a comparative perspective. Cambridge Journal of Economics, 25, 265–288.

Alarcon, D., & McKinley, T. (1992). Beyond import substitution: the reconstruction projects of Brazil and Mexico. Latin American Perspectives, 19(2), 72–87.

Amorós, J. E., & Cristi, O. (2008). Longitudinal analysis of entrepreneurship and competitiveness dynamics in Latin America. International Entrepreneurship and Management Journal (in press). DOI 10.1007/s11365-008-0082-3

Amsden, A. H. (1991). Diffusion of development: The late-industrializing model and greater East Asia. The American Economic Review, 81(2), 282–289.

Audretsch, D. B. (2007). The Entrepreneurial Society. Oxford, UK: Oxford University Press.

Audretsch, D. B., & Thurik, R. (2001). What is new about the new economy: sources of growth in the managed and entrepreneurial economy. Industrial and Corporate Change, 10(1), 267–315.

Autio, E. (2007). 2007 GEM global report on high-growth entrepreneurship. Babson Park MA., London, UK: Babson College, London Business School and Mazars.

Baer, W. (1972). Import substitution and industrialization in Latin America: Experiences and interpretations. Latin American Research Review, 7(1), 95–122.

Balassa, B. (1971). Trade policies in developing countries. The American Economic Review, 61(2), 178–187.

Balassa, B. (1988). The lessons of East Asian development: An overview. Economic Development and Cultural Change, 36(3), S273–S290.

Blau, D. (1987). A time-series analysis of self-employment in the United States. Journal of Political Economy, 95, 445–467.

Blejer, M. (2006). Latin America and the external environment: A missed Opportunity? In A. López-Claros (Ed.), The Latin America competitiveness review 2006 (pp. 43–46). Geneva: World Economic Forum.

Bosma, N., Jones, K., Autio, E., & Levie, J. (2008). Global entrepreneurship monitor, executive report 2007. Babson Park, MA, London, UK: Babson College-London Business School.

Brinkman, R. (1995). Economic growth versus economic development: Towards a conceptual clarification. Journal of Economic Issues, 29(4), 1171–1188.

Bruton, H. J. (1998). A reconsideration of import substitution. Journal of Economic Literature, 36(2), 903–936.

Carree, M., van Stel, A., Thurik, R., & Wennekers, S. (2002). Economic development and business ownership: An analysis using data of 23 OECD countries in the period 1976–1996. Small Business Economics, 19(3), 271–290.

Carree, M., van Stel, A., Thurik, R., & Wennekers, S. (2007). The relationship between economic development and business ownership revisited. Entrepreneurship and Regional Development, 19(3), 281–291.

De Clercq, D., Hessels, J., & van Stel, A. (2008). New ventures’ export orientation: Outcome and source of knowledge spillovers. Small Business Economics, 31(3) this issue

Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2002). The regulation of entry. Quarterly Journal of Economics, 117, 1–37.

Dollar, D. (1992). Outward-oriented developing economies really do grow more rapidly: Evidence from 95 L.D.C.’s, 1976–1985. Economic Development and Cultural Change, 40(3), 523–544.

Easterly, W. (2001). The lost decade: Developing countries’ stagnation in spite of policy reform 1980–1998. Journal of Economic Growth, 6, 135–157.

Ferriter, J. (Ed.). (2006). IADB Annual inform 2005. Washington, D.C.: Inter-American Development Bank.

Goss, B., & Conway, D. (1992). Sustainable development and foreign direct investment in the Eastern Caribbean: A strategy for the 1990’s and beyond? Bulletin of Latin American Research, 11(3), 307–326.

Griffith, W. H. (1990). Caricom countries and the Caribbean basin initiative. Latin American Perspectives, 17(1), 33–54.

Grossman, G. M., & Helpman, E. (1990). Trade, innovation and growth. The American Economic Review, 80(2), 86–91.

Hessels, J., van Gelderen, M., & Thurik, R. (2008). Entrepreneurial aspirations, motivations and their drivers, Small Business Economics, 31(3) this issue

Jorgenson, D. (2001). Information technology and the US economy. American Economic Review, 91, 1–32.

Keesing, D. B. (1967). Outward-looking policies and economic development. The Economic Journal, 77(306), 303–320.

Klapper, L., Laeven, L., & Rajan, R. (2006). Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82(3), 591–629.

Krueger, A. O. (1980). Trade policy as an input to development. The American Economic Review, 70(2), 288–292.

Krueger, A. O. (1998). Why trade liberalization is good for growth. The Economic Journal, 108(450), 1513–1522.

Levie, J., & Autio, E. (2008). A theoretical grounding and test of the GEM model. Small Business Economics, 31(3) this issue

Leibenstein, H. (1968). Entrepreneurship and development. American Economic Review, 58(2), 72–83.

Listerri, J. J., Kantis, H., Angelelli, P., & Tejerina, L. (2006). Is youth entrepreneurship a necessity or an opportunity? A first exploration of household and new enterprise surveys in Latin America sustainable. Development Department Technical Papers Series. Washington, D. C: Inter-American Development Bank

López-Claros, A., Altinger, L., Blanke, J., Drzeniek, M., & Mía, I. (2006). Assessing Latin American competitiveness: Challenges and opportunities. In A. López-Claros (Ed.), The Latin America competitiveness review 2006 (pp. 3–36). Geneva: World Economic Forum.

López-Claros, A., Blanke, J., Drzeniek, M., Mía, I., & Zahidi, S. (2005). Underpinning economic growth: Results from the competitiveness indexes. In A. Lopez-Claros, M. Porter & K. Schwab (Eds.), Global competitiveness report 2005–2006: Policies underpinning rising prosperity (pp. 3–42). New Hampshire: Palgrave Macmillan.

Lucas, R. E. (1993). Making a miracle. Econometrica, 61(2), 251–272.

McArthur, J. W., & Sachs, J. (2002). The growth competitiveness index: Measuring technological advancement and the stages of development. In M. Porter, J. Sachs, P. K. Cornelius, J. W. McArthur & K. Schwab (Eds.), The global competitiveness report 2001–2002 (pp. 28–51). New York: Oxford University Press.

Minniti, M., Bygrave, W. D., & Autio, E. (2006). Global entrepreneurship monitor executive report 2005. Babson Park, MA, London, UK: Babson College-London Business School.

Pantin, D. A. (1990). Prospects for the FDI export model in Jamaica and the Caribbean. Latin American Perspectives, 17(1), 55–72.

Porter, M. (1990). The competitive advantage of nations. New York: The Free Press.

Porter, M., Sachs, J., & McArthur, J. (2002). Executive summary: Competitiveness and stages of economic development. In M. Porter, J. Sachs, P. K. Cornelius, J. W. McArthur & K. Schwab (Eds.), The global competitiveness report 2001–2002 (pp. 16–25). New York: Oxford University Press.

Prebisch, R. (1959). Commercial policy in the underdeveloped countries. The American Economic Review, 49(2), 251–273.

Reynolds, P., Bosma, N., Autio, E., Hunt, S., De Bono, N., Servais, I., et al. (2005). Global entrepreneurship monitor: Data collection design and implementation 1998–2003. Small Business Economics, 24(3), 205–231.

Rodrik, D., Grossman, G. M., & Norman, V. (1995). Getting interventions right: How South Korea and Taiwan grew rich. Economic Policy, 10(20), 53–107.

Sachs, J., Warner, A., Aslund, A., & Fisher, S. (1995). Economic reform and the process of global integration. Brookings Papers on Economic Activity, 1995(1), 1–118.

Sala-i-Martin, X., & Artadi, E. V. (2004). The global competitiveness index. In M. Porter, K. Schwab, X. Sala-i-Martin & A. López-Claros (Eds.), The global competitiveness report 2004–2005 (pp. 51–80). New Hampshire: Palgrave Macmillan.

Sapsford, D., & Garikipati, S. (2006). Trade liberalisation, economic development and poverty alleviation. The World Economy, 29(11), 1571–1579.

Schramm, C. J. (2004). Building entrepreneurial economies. Foreign Affairs, 83(4), 104–115.

Schramm, C. J. (2006). The entrepreneurial imperative. New York: Collins.

Singer, H. (1999). Beyond terms of trade-convergence and divergence. Journal of International Development, 11(6), 911–916.

Thurow, L. (2003). Fortune favours the bold: What we must do to build a new and lasting global prosperity. New York: Harper Collins.

Virgill, N. (2008). Export processing zones: Tools of development or reform delay? Doctoral Dissertation, School of Public Policy, George Mason University

Weiss, J. (2005). Export growth and industrial policy: Lessons from the East Asian miracle experience. Asian Development Bank Institute Discussion Paper, 26

Wennekers, S., Van Stel, A., Thurik, R., & Reynolds, P. (2005). Nascent entrepreneurship and the level o economic development. Small Business Economics, 24(3), 293–309.

Wong, K.-Y., & Chu, D. (1984). Export processing zones and special economic zones as generators of economic development: The Asian experience. Geografiska Annaler, 66(1), 1–16.

Wong, P. K., Ho, Y. P., & Autio, E. (2005). Entrepreneurship, innovation and economic growth: Evidence from GEM data. Small Business Economics, 24(3), 335–350.

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Participant countries in GEM 2001–2006 and their income classification

Country | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

|---|---|---|---|---|---|---|---|

High-income countries | |||||||

1. | Australia | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

2. | Austria | ✶ | |||||

3. | Belgium | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

4. | Canada | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

5. | Denmark | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

6. | Finland | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

7. | France | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

8. | Germany | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

9. | Ireland | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

10. | Israel | ✶ | ✶ | ✶ | |||

11. | Italy | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

12. | Japan | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

13. | Korea | ✶ | ✶ | ||||

14. | The Netherlands | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

15. | New Zealand | ✶ | ✶ | ✶ | ✶ | ✶ | |

16. | Norway | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

17. | Portugal | ✶ | ✶ | ||||

18. | Singapore | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

19. | Spain | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

20. | Sweden | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

21. | United Kingdom | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

22. | United Status | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

23. | Austria | ✶ | |||||

24. | Czech Republic | ✶ | |||||

25. | Greece | ✶ | ✶ | ✶ | ✶ | ||

26. | Hong Kong | ✶ | ✶ | ✶ | |||

27. | Iceland | ✶ | ✶ | ✶ | ✶ | ✶ | |

28. | Slovenia | ✶ | ✶ | ✶ | ✶ | ✶ | |

29. | Switzerland | ✶ | ✶ | ✶ | |||

30. | Taiwán | ✶ | |||||

31. | United Arab Emirates | ✶ | |||||

Middle and low income | |||||||

32. | Argentina | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

33. | Brazil | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

34. | Chile | ✶ | ✶ | ✶ | ✶ | ||

35. | China | ✶ | ✶ | ✶ | ✶ | ||

36. | Colombia | ✶ | |||||

37. | Croatia | ✶ | ✶ | ✶ | ✶ | ✶ | |

38. | Ecuador | ✶ | |||||

39. | Hungary | ✶ | ✶ | ✶ | ✶ | ✶ | |

40. | India | ✶ | ✶ | ✶ | |||

41. | Indonesia | ✶ | |||||

42. | Jamaica | ✶ | ✶ | ||||

43. | Jordan | ✶ | |||||

44. | Latvia | ✶ | ✶ | ||||

45. | Malasia | ✶ | |||||

46. | Mexico | ✶ | ✶ | ✶ | ✶ | ||

47. | Peru | ✶ | ✶ | ||||

48. | Philippines | ✶ | |||||

49. | Poland | ✶ | ✶ | ✶ | ✶ | ||

50. | Russia | ✶ | ✶ | ✶ | |||

51. | South Africa | ✶ | ✶ | ✶ | ✶ | ✶ | ✶ |

52. | Thailand | ✶ | ✶ | ✶ | |||

53. | Turkey | ✶ | |||||

54. | Uganda | ✶ | ✶ | ||||

55. | Uruguay | ✶ | |||||

56. | Venezuela | ✶ | ✶ | ||||

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Acs, Z.J., Amorós, J.E. Entrepreneurship and competitiveness dynamics in Latin America. Small Bus Econ 31, 305–322 (2008). https://doi.org/10.1007/s11187-008-9133-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-008-9133-y