Abstract

We investigate the effects of new business formation on employment change in German regions. A special focus is on the lag-structure of this effect and on differences between regions. The different phases of the effects of new business formation on regional development are relatively pronounced in agglomerations as well as in regions with a high-level of labor productivity. In low-productivity regions, the overall employment effect of new business formation activity might be negative. The interregional differences indicate that regional factors play an important role.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Aims and scope

Recent studies have shown very clearly that the impact of new business formation on regional development is distributed over a longer period of time (Audretsch and Fritsch 2002; Fritsch and Mueller 2004, 2006; van Stel and Storey 2004). Moreover, these studies revealed pronounced differences in the magnitude of the effect across regions. This paper extends our earlier work on the impact of new business formation on regional development in Germany (Fritsch and Mueller 2004, 2006) in analyzing regional differences in much more detail. In contrast to our earlier study, we perform the analysis on the level of planning regions instead of districts as spatial units. Planning regions may be better suited as units of analysis because they account for economic interaction between districts. For this reason, the analysis is less likely to be subject to spatial autocorrelation.

The following section gives a brief overview of the main evidence found by earlier investigations of the effect of new business formation on economic development in Germany. Section 3 addresses data and measurement issues. The analysis of the short-, medium-, and long-term impact of new business formation on regional employment is reported in Sect. 4. Differences in the effects across regions are investigated in Sect. 5. The final section draws conclusions for policy as well as for further research.

2 New business formation and regional development in Germany--an overview of the empirical studies

The first empirical analyses of the employment effects of new business formation with comprehensive data from the German economy followed a ‘job-turnover’ approach (Cramer and Koller 1988; Boerie and Cramer 1992, Gerlach and Wagner 1993; Koenig and Weißhuhn 1990a, b). A main shortcoming of these analyses is that only the initial employment of the start-ups in their first year is counted as their contribution to employment. The development of start-ups in the following years was assigned to the incumbents. Therefore, these studies do not allow the assessment of the longer-term effects of new businesses on development, which are probably much more important than the initial employment effect around the time of start-up (Fritsch 2007). The analyses of the short-term effect of start-ups indicated that employment gains due to the set-up of new businesses were compensated very well by employment losses of incumbent establishments in most industries. Considerable employment losses were also the result of exiting establishments. As compared to the employment gains in incumbent businesses, the effect of new business formation on employment was rather small. Studies of employment in cohorts of new businesses found that, in most cases, employment reached a maximum after a few years and then declined below the initial level that was attained at the time of the start-upFootnote 1). Long-run survival rates tend to be rather low and only some few of the new ventures are generating a considerable amount of jobs. There are, however, great differences in the performance of entry cohorts with regard to industries and regions (Fritsch 2004; Engel and Metzger 2006; Weyh 2006). As a general pattern, employment of start-up cohorts in high-tech industries tends to increase above the initial level for a much longer period of time as compared to low-tech manufacturing or service industries.

The first empirical analyses, which related regional start-up rates to employment growth in Germany, only had data available for relatively short time series and found no significantly positive effect (Audretsch and Fritsch 1996; Fritsch 1997). For some of the time periods, the effect was even slightly negative. Conducting this type of analysis for a longer period of time, Audretsch and Fritsch (2002) did, indeed, find strong indications for long-term effects of start-ups. A notable result of their analysis was that new business formation in the 1980s did not contribute to the explanation of employment change during that period, but rather to employment change during the 1990s. Most strikingly, the effect of the 1980s start-ups on the 1990s employment change was stronger than that of the start-ups of the 1990s. Following this study, Fritsch and Mueller (2004) found a lag-structure related to the short-, medium- and long-term effects of new businesses on employment growth. The results clearly indicate that the initial employment effect is positive and is followed by pronounced negative displacement effects. Finally, the long-term employment effect of start-ups is positive but also rather indirect in nature (see Fritsch 2007, for a detailed description and interpretation).

Audretsch and Keilbach (2004) and Audretsch et al. (2006) followed a different approach by including a start-up rate into a regional production function in order to assess the contribution of entrepreneurship to economic performance. They found that the level of entrepreneurship does, indeed, have a positive effect on regional development, particularly the start-up rate in high-tech industries. A panel analysis covering the 1990s by Mueller (2006) found that general entrepreneurship is conducive to economic performance along with the input of labor, capital and knowledge. However, new business formation in innovative and knowledge-intensive industries makes an even greater contribution to economic growth.

3 Data and measurement approach

Our analysis of the effect of new business formation on regional economic development over time is at the spatial level of planning regions (Raumordnungsregionen). Planning regions consist of at least one core city and the surrounding area. Therefore, the advantage of planning regions in comparison to districts (Kreise) is that they can be regarded as functional units in the sense of traveling to work areas and that they account for economic interactions between districts. Planning regions are slightly larger than what is usually defined as a labor market area. In contrast to this, a district may be a single core city or a part of the surrounding suburban area (see Federal Office for Building and Regional Planning 2003, for the definition of planning regions and districts). We restrict the analysis to the 74 planning regions of West Germany for two reasons. First, while data on start-ups for West Germany are currently available for the time period between 1983 and 2002, the time series for East Germany is much shorter first beginning in the year 1993. Second, many analyses show that the developments in East Germany in the 1990s were heavily shaped by the transformation process to a market economy and, therefore, it represents a rather special case that should be analyzed separately (e.g., Fritsch 2004; Kronthaler 2005). The Berlin region had to be excluded due to changes in the definition of that region after the unification of Germany in 1990.

The establishment file of the German Social Insurance Statistics provided the number of new businesses and employees (for a description, see Fritsch and Brixy 2004). This database comprises information about all establishments that have at least one employee subject to obligatory social insurance. Due to the fact that the database records only businesses with at least one employee, start-ups consisting of only owners are not included. Unfortunately, the German Social Insurance Statistics is completely on the level of establishments and does not allow us to separate new firms from new plants and new branches, which are created by existing firms. In order to avoid distortions caused by new large subsidiary plants of incumbent firms, new establishments with more than 20 employees in the first year of their existence are not counted as start-ups.Footnote 2 Data on regional gross value added and population density (population per square km) are from various publications of the German Federal Statistical Office.

New business formation activity is measured by the yearly start-up rates calculated according to the labor market approach; namely, the number of start-ups per period is divided by the number of persons in the regional workforce (in thousands) at the beginning of the respective period (see also Audretsch and Fritsch 1994). An important adjustment was made to control for the fact that not only does the composition of industries differ considerably across regions, but that the relative importance of start-ups and incumbent enterprises also varies systematically across industries. For example, start-up rates are higher in the service sector than in manufacturing industries. This means that the relative importance of start-ups and incumbents in a region is confounded by the composition of industries in that region. This would result in a bias of overestimating the level of entrepreneurship in regions with a high composition of industries where start-ups play an important role and underestimating the role of new business formation in regions with a high share of industries where the start-up rates are relatively low. To correct for the confounding effect of the regional composition of industries on the number of start-ups, a shift-share procedure was employed to obtain a sector-adjusted measure of start-up activity (see the Appendix of Audretsch and Fritsch 2002, for details). This sector-adjusted number of start-ups is defined as the number of new businesses in a region that could be expected if the composition of industries were identical across all regions. Thus, the measure adjusts the raw data by imposing the same composition of industries upon each region. Our analysis shows that this procedure leads to somewhat clearer results and higher levels of determination than the estimates using the non-adjusted start-up rate do. However, the basic relationships are left unchanged. Table A1 in the Appendix shows descriptive statistics for the variables used in the analysis for all regions as well as for different spatial categories.

Our indicator for regional development is the average yearly employment change over a two-year period (percentage), i.e., between the current period t0 and t2. A two-year average is used in order to avoid disturbances by short-term fluctuations. Due to the fact that start-up rates in subsequent years are highly correlated (Fritsch and Mueller 2007), we apply Almon polynomial lags for estimating the time lag-structure of the effect of new business formation on regional development (for details, see Greene 2003 as well as van Stel and Storey 2004; Fritsch and Mueller 2004). This method reduces the effects of multicollinearity in distributed lag settings by imposing a particular structure on the lag coefficients. A critical issue in applying the Almon lag procedure is determining which type of polynomial to assume. As in our earlier study (Fritsch and Mueller 2004), the third-order polynomial leads to the best fit of the model. Therefore, we conclude that a third-order polynomial is the best approximation of the lag-structure. The lag-structure related to the short-, medium- and long-term effects of new businesses is similar if a higher polynomial is applied; thus, the results are not presented hereFootnote 3. We always report the results from the Almon procedure as well as the unrestricted coefficients. Due to some slight heteroscedasticity in the data, we apply robust estimation techniques. Although the analysis is on the level of planning regions, spatial autocorrelation might still exist. In order to account for such effects we cluster the standard errors by the Federal States (Länder), which are an important level of policy making, in order to capture spillovers between planning regions. Models are conducted with fixed-effects in order to account for unobserved region-specific influences.

4 The effect of new business formation on regional employment over time

The model for the analysis of the effect of new business formation on regional employment over time relates the start-up rate of the current year (t0) as well as the start-up rate of the ten preceding years (t−1 to t−10) to the average rate of employment change between t0 and t+2 (Table 1). A time lag for the start-up rate of ten years was chosen because this was the time-period for which a statistically significant effect of the start-up rate on employment change was found.Footnote 4 Start-up rates dating back more than ten years were not included into the model because they did not prove to have any significant effect. In order to control for all kinds of regional characteristics, which might affect the relationships between new firm formation and employment change, we incorporated population density (number of inhabitants per square km) as an independent variable in our models. Population density in a region is highly correlated with a number of factors such as the wage level, real estate prices, quality of communication infrastructure, qualification of the workforce and diversity of the labor market, presence of small businesses as well as industry structure (e.g., share of employees in services) in the respective region. Therefore, population density can be regarded as a catch-all variable for these regional characteristics. Region-specific characteristics that are not related to population density are accounted for by the fixed-effects of the panel estimation technique applied.

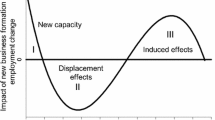

Estimations at the level of planning regions (Fig. 1 and Table 1) lead to about the same shape of the lag-structure as our earlier analyses (Fritsch and Mueller 2004). In an initial phase, there is a positive short-term effect at the time when the new businesses are set up and create new employment. The second phase is a negative medium-term effect, which is dominated by the displacement of competitors as well as the exit of newly founded businesses. Finally, in a third phase, a positive long-term effect occurs that is probably due to improvements on the supply-side of the regional economy. The long-term effect reaches a maximum after approximately seven years and fades away after about nine years. Remarkably, the coefficients are considerably smaller than what was found in our analysis on the level of districts (Fritsch and Mueller 2004). The reason for these differences is that extreme values for single districts are evened out in data at the level of planning regions, which are much larger than districts. The size of the coefficients that we find on the level of planning regions is comparable to the coefficients of the analysis for the Netherlands (van Stel and Suddle 2007) and for Great Britain (Mueller et al. 2007). Population density that was included as a control variable did not prove to be significant in any of the models.Footnote 5

The sum of the coefficients for the start-up rates in the different years gives the overall effect of new business formation on employment change (c.f., Gujarati 2003, 658). The value of 0.597 for the unrestricted model and 0.460 for the model applying the Almon lag procedure (Table 1) indicates that each additional new business per 1,000 workforce leads to an average increase of employment growth by about a 0.5 percentage point.Footnote 6 It may, however, be argued that negative coefficients of the restricted coefficients that occur after the end of the third phase, which is dominated by supply-side effects (e.g., for the start-up rate t−10 in Table 1), should not be considered because of lacking theoretical justification. Excluding the negative coefficient for the start-up rate in t−10 in the model with the Almon lag leads to an overall effect on employment change according to this model of 0,485.

5 Differences across regions

Regions may differ considerably with regard to the characteristics of the new and incumbent businesses as well as with regard to their ability to absorb the positive effects of new business formation. We use two variables for analyzing such regional differences. One of these variables is population density or degree of agglomeration, which serves as a catch-all indicator for a number of locational characteristics. The second variable is labor productivity as measured by GDP per working population.

With regard to population density, we follow the common classification of German planning regions in highly agglomerated areas, moderately congested regions, and rural areas. This classification is based on population density and the settlement structure in a region (Federal Office for Building and Regional Planning 2003). An analysis for agglomerations, moderately congested regions, and rural areas shows that new business formation in agglomerations does not only create relatively pronounced positive short-term (direct) effects but also leads to comparatively high, positive long-term (supply-side) effects. Also the negative medium-term (displacement) effects are slightly stronger for the agglomerations. As can be clearly seen from Fig. 2, the effects of new business formation on employment change are much more pronounced in the agglomerations than in the other spatial categories. This holds particularly for the short-term employment effects. While the overall effect on employment change over a period of ten years is highest in the agglomerations, the difference between the moderately congested areas and the rural regions is not that clear (Table 2). The results for the rural regions, however, should be regarded with caution because only two of the eleven coefficients for start-up rates in the unrestricted model prove to be statistically significant and the coefficients for the Almon lags remain insignificant.Footnote 7

In order to test if these differences between the three types of regions are statistically significant, we carried out a likelihood ratio test (LR test) comparing the models including the interaction dummies from (Table A2) with the general model (Table 1). We conclude from this test that these differences are statistically significant.Footnote 8

The relatively strong positive long-term employment effect of start-ups in agglomerations may be explained by a correspondingly high degree of competition in these areas facilitating the selection process and stimulating the performance of surviving firms. A higher level of competition in agglomerations directly results from the high density of businesses in an area, i.e., more firms demanding similar inputs or supplying goods and services on the same market. The conjecture of a relatively high-level of competition in agglomerations is supported by empirical analyses that find a higher level of start-ups (Brixy and Niese 2006; Fritsch and Falck 2007) but a lower probability of survival (Fritsch et al. 2006; Engel and Metzger 2006; Weyh 2006) in these areas. Another explanation for a stronger effect of new business formation on developments in the agglomerations could be based on the observation that the share of start-ups in knowledge-intensive industries and in high-tech industries tends to be relatively high in the agglomerations and relatively low in rural areas (Audretsch et al. 2006, 87–90; Bade and Nerlinger 2000).Footnote 9 Assuming that knowledge-intensive or innovative start-ups impose a greater challenge on incumbent firms than non-innovative start-ups (Fritsch 2007), the higher share of such new businesses in agglomerations may be responsible for the more pronounced effects of new business formation in these regions (see also Mueller 2006). The pattern that we find for the rural areas suggests that start-ups in this type of region induce pronounced long-term supply-side effects. However, the respective coefficients are not statistically significant and these results should, therefore, be regarded with great caution.

Drawing a distinction between regions according to their economic performance, namely, labor productivity, the differences of the effects of new business formation on employment are much more pronounced. We classify regions with labor productivity levels in the lower quartile of the distribution (i.e., ≤25 percent) as low-productivity regions. Regions with a value of labor productivity in the upper quartile (≥75 percent) are classified as high-productivity regions. Regions with a labor productivity value in the second and the third quartiles are categorized as medium-productivity regions.Footnote 10 There is some positive correlation between the regional level of labor productivity and the degree of agglomeration. However, conducting the analysis for different categories of labor productivity performance in agglomerations, medium congested regions and rural regions separately would result, in some of the groups, in an insufficient number of regions to allow for a meaningful analysis.Footnote 11

The results indicate that low-productivity regions experience a relatively small short-term employment effect of new business formation, which is clearly offset by a negative displacement effect. Furthermore, the positive supply-side effect appears to be rather poor in these regions (Fig. 3). Remarkably, the overall employment effect of new businesses in low-productivity regions is negative. According to the estimates with the Almon polynomial, the overall employment effect is not statistically significantFootnote 12.

In contrast to low-productivity regions, the effects in high-productivity regions are rather positive in all three phases so that new business formation results in a relatively strong employment increase. However, after nine years the effect is fading away. In regions with a medium-productivity level, the positive effect on employment change in the first phase is lower than that in high-productivity regions but stronger than in regions with a low level of productivity. While we find a slightly negative impact for the second phase (displacement effects) in the medium-productivity regions, the third phase (supply side effects) is long lasting with a pronounced increase of employment. A likelihood ratio test (LR test) comparing the models including the interaction dummies from Table A4 with the general model (Table 1) indicated that these differences are statistically significantFootnote 13.

The overall effect of new business formation on employment change appears to be related to the regional level of labor productivity (Table 2). Over a period of ten years, new business formation activity in regions with high-productivity leads to a considerably larger subsequent employment growth than in regions with a lower productivity level. In high-productivity regions, the coefficients for the start-up rates add up to 1.452 in the unrestricted model and 1.016 in the model with the Almon lags. In those regions with a medium-level of labor productivity, this sum amounts to 0.969 and 0.824, respectively (Table 2). For the low-productivity regions, this effect is negative (−0.012 and −0.133). Remarkably, the coefficients in the model with the Almon lags were not statistically significant at the five percent level for these regions. We can conclude from these results that the higher the productivity level of a region is, the more pronounced the employment increase that results from start-up activity would be.

There are several possible explanations for a relationship between the level of regional labor productivity and the size of the employment effects of new businesses. One reason for the observed pattern could be the competitiveness of the regional economy. If new businesses do not operate entirely on the regional market but also supply on the national and international market, the displacement effects are not necessarily restricted to the respective region but may well occur in other regions. Assuming that competition works according to a survival of the fittest scenario so that the displacement effect will predominantly challenge the low-productivity firms, the respective employment losses are more likely to occur in low-productivity regions as compared to regions with a higher productivity level. This implies that the regional employment effects of new business formation will particularly rely on the competitiveness of the incumbent firms in that region. Thus, high- and low-productivity regions differ with regard to the size of the displacement effects.

A second explanation for higher positive-employment effects of new businesses in high-productivity regions could be based on the embeddedness of new and incumbent establishments in their regional environments (Clark et al. 2004). They, particularly, depend on the qualification of the regional workforce as well as on the supply of other inputs in their region. The availability of high-productivity inputs in a region may not only have a positive effect on a firms’ level of competitiveness but may also be conducive for realizing further improvements, i.e., innovation. This can pertain to all three effects of new businesses on regional employment but may be particularly relevant to the third-phase supply-side effects.

Thirdly, high-productivity regions have a higher share of start-ups in high-tech or in knowledge-intensive industries.Footnote 14 Cohort analyses of newly founded businesses clearly show considerably larger employment growth in new businesses affiliated to such industries as compared to other sectors of the economy (Engel and Metzger 2006; Weyh 2006). Therefore, the direct employment effects of start-ups in high-tech and in knowledge-intensive industries should be relatively high. Moreover, innovative entries represent a larger challenge to the incumbents than non-innovative entries and will, therefore, have a stronger impact on the incumbents that should lead to relatively pronounced productivity enhancing supply-side effects.

The lag-structure of the different effects in high-, medium-, and low-productivity regions (Fig. 3) are in line with these interpretations. Our estimates clearly show that the negative displacement effects are most pronounced in the low-productivity regions while the employment effect in the second phase remains positive in the high-productivity regions. There is also a marked difference with regard to the supply-side effects according to the regional productivity level. While these supply-side effects appear to be negligible in the low-productivity regions, they are quite pronounced in the regions with medium- and high-productivity. The supply-side effects are a little larger for the high-productivity regions, but the difference to the medium-productivity regions is not very distinct. We also find a correspondence between the first phase employment effects and the regional productivity level. The higher the regional productivity level is, the larger the employment growth in the first years after start-up will be.

In summarizing our results, we can say that the effect of new business formation on employment growth tends to be considerably more pronounced in regions with a high density of economic activity. This indicates that a higher level of local competition leads to larger displacement and long-term supply-side effects. There is also a clear difference in the effects according to the level of regional labor productivity. The higher the regional productivity level is, the larger the positive-employment effects are. Our estimates for the low-productivity regions suggest that the overall result of new business formation for employment might be negative. Thus, stimulating new business formation may not be recommended as a growth strategy for all circumstances. Evidently, the effects of new businesses formation on economic development may be considerably shaped by regional conditions, particularly the productivity and competitiveness of the incumbents. This role of the regional context deserves further investigation in future analyses.

6 Conclusions for policy and further research

The set-up of new businesses in a region may have positive as well as negative effects on the development of that region. These effects are, in a certain manner, distributed over time. The creation of new capacities leads to an increase of regional employment, however only for a short time. After a period of one or two years, there tends to be a declining effect on regional employment. We suppose that this decline results from the displacement of incumbents or the exit of new businesses, which fail to be competitive. Competition and market selection may result in considerable improvements of competitiveness. We regard such positive supply-side effects as an explanation of rising employment that we observe between five to ten years after the new businesses have been started.

Performing the analysis for different types of regions shows that the magnitude of the effects of new business formation on regional development may be rather different. Obviously, the characteristics of the regional environment play an important role for the effects of new business formation. Further research should, therefore, focus on such differences and the importance of the regional environment. Our analysis suggests that regional density and the regional productivity may influence the effects. Regional characteristics affect not only the propensity to start a business (Brixy and Niese 2006; Fritsch and Falck 2007) but also survival chances of new businesses (Fritsch et al. 2006; Engel and Metzger 2006; Weyh 2006) and their effects on regional development.

Policy should be well aware of the different effects of new businesses on regional employment and of the role of the regional environment. The regional level of labor productivity that seems to be important for the effects of new businesses is mainly shaped by the incumbent businesses and not by the new firms, which tend to enter at a below-average productivity level (Bartelsman and Doms 2000; Farinas and Ruano 2005). Therefore, the presence of highly competitive incumbent firms can be regarded as an important prerequisite for a strong effect of new businesses formation in that region. Accordingly, a regional development policy should not completely disregard the incumbents and their role for transforming the impulses of new businesses into employment.

Notes

The share of new establishments in the data with more than 20 employees in the first year is rather small (about 2.5 percent).

The results are available from the authors upon request.

If only the start-up rates of the preceding eight or nine periods are used in the analysis, there are then no basic changes in the results.

A main reason for insignificance of population density in the fixed-effect regression is probably that the value of this variable does not change much over time. The coefficients for the fixed-effects range between −2.9 and 3.3 with a median of −0.18 and a mean value of about zero.

It could be argued that only the statistically significant coefficients should be included in the calculation of the overall effect. We do not follow this argument because the statistical significance of start-up rates in single years is not a reliable indication for relevance due to the pronounced multicollinearity between the start-up rates for the different years.

Running the regressions for the rural regions only, both a second as well as a third-order polynomial did not lead to significant values of the coefficients for the Almon lags. The coefficients resulting from the second-order polynomial also indicated a u-shaped curve for these regions. Separate regressions for the agglomerations and the moderately congested areas with different types of polynomial always resulted in a better fit for the third-order polynomial.

In terms of the LR test the log likelihood value for the unrestricted model is −900.17 and that of the restricted model (i.e. ‘restricting’ the effects to be the same in agglomerations, moderately congested areas and rural regions) −932.41. The corresponding LR test statistic thus equals 64.48. The critical value of the chi-squared distribution with 22 degrees of freedom (there are 22 restrictions corresponding to the 22 additional terms) is 40.29 at the 1% significance level. Hence the null hypothesis of valid restrictions is rejected.

According to our data, the share of start-ups in knowledge intensive industries in the agglomerations in the years 1998–2002 is 33.6 percent as compared to 28.4 percent in rural regions and 30.0 percent in the intermediate category, the moderately congested regions. The share of startup in high-tech industries on all manufacturing start-ups is 11.9 percent in agglomerations, 9.7 in moderately congested regions and 10.0 in the rural regions. For the classification of German industries see Grupp and Legler (2000) and BMBF (2005). Unfortunately, our database only allows a rather crude identification of knowledge intensive and high-tech industries in the years prior to 1998.

Regions are classified according to the average labor productivity in the period of analysis. See Table A3 in the Appendix for this classification. We do not classify regions according to labor productivity in the year of start-up because this would, for some regions, lead to changes over time that would not allow the application of fixed-effects regression techniques.

Twelve out of the 19 regions with high labor productivity belong to the agglomerations; four of them are moderately congested areas and three are rural regions. Of the regions with medium/low labor productivity, 11/1 are classified as agglomerations; 18/12 are moderately congested and 7/6 are rural regions.

Running the regressions for the low-productivity regions only, both, a second as well as a third-order polynomial did not lead to significant values of the coefficients for the Almon lags. The coefficients resulting from the second-order polynomial also indicated a u-shaped curve. Separate regressions for the high-productivity and the medium-productivity regions with different types of polynomial always resulted in a better fit for the third-order polynomial.

The loglikelihood value for the unrestricted model is −892.59 and that of the restricted model (i.e. ‘restricting’ the effects for the different types of regions to be the same) −932.41. The corresponding LR test statistic thus equals 79.64. The critical value of the chi-squared distribution with 22 degrees of freedom (there are 22 restrictions corresponding to the 22 additional terms) is 40.29 at the 1% significance level. Hence the null hypothesis of valid restrictions is rejected.

The share of start-ups in knowledge-intensive industries in the 1998–2002 period is 35.2 percent in the high productivity regions, 30.0 percent in regions with medium labor productivity and 28.0 in the low productivity regions. The share of start-ups in high-tech industries on all manufacturing start-ups in high-, medium- and in low productivity regions is 11.8, 10.2 and 9.8 percent, respectively. For the classification of German industries see Grupp and Legler (2000) and BMBF (2005).

References

Audretsch, D. B., & Fritsch, M. (1994). On the measurement of entry rates. Empirica, 21, 105–113.

Audretsch, D. B., & Fritsch, M. (1996). Creative destruction: Tubulence and economic growth. In H. Ernst & M. Perlman (Eds.), Behavioral Norms, Technological Progress, and Economic Dynamics: Studies in Schumpeterian Economics (pp. 137–150). Ann Arbor: University of Michigan Press.

Audretsch, D. B., & Fritsch, M. (2002). Growth regimes over time and space. Regional Studies, 36, 113–124.

Audretsch, D. B., & Keilbach, Max C. (2004). Entrepreneurship capital and economic performance. Regional Studies, 38, 949–959.

Audretsch, D. B., Keilbach, Max C., & Lehmann, E. E. (2006). Entrepreneurship and Economic Growth. New York: Oxford University Press.

Bade, F.-J., & Nerlinger, E. A. (2000). The spatial distribution of new technology-based firms: Empirical results for West Germany. Papers in Regional Science, 79, 155–176.

Bartelsman, E. J., & Doms, M. (2000). Understanding productivity: Lessons from longitudinal microdata. Journal of Economic Literature, 38, 569–594.

Boeri, T., & Cramer, U. (1992). Employment growth, incumbents and entrants--evidence from Germany. International Journal of Industrial Organization, 10, 545–565.

Brixy, U., & Niese, M. (2006). The determinants of regional differences in new firm formation in Western Germany. In P. Nijkamp, R.L. Moomaw & I. Traistaru (Eds.), Entrepreneurship, Investment, and Spatial Dynamics: Lessons and Implications for an Enlarged EU (pp. 109–120). Cheltenham: Elgar.

Bundesministerium für Bildung und Forschung (BMBF), (2005). Zur technologischen Leistungsfähigkeit Deutschlands 2005, Berlin: Federal Ministry for Education and Research.

Clark, G. L., Feldman, M. P., & Gertler, M. (2004). Economic geography, transition and growth. In G. L. Clark, M. Gertler & M. P. Feldman (Eds.), The Oxford Handbook of Economic Geography (pp. 3–17). Oxford: Oxford University Press.

Cramer, U., & Koller, M. (1988). ‘Gewinne und Verluste von Arbeitsplätzen in Betrieben--der ``Job-Turnover”-Ansatz, Mitteilungen aus der Arbeitsmarkt- und Berufsforschung 21, 361–377.

Engel, D., & Georg M. (2006). Direct employment effects of new firms’, In M. Fritsch & J. Schmude (Eds.), Entrepreneurship in the Region (pp. 75–93) New York: Springer.

Farinas, J. C., & Ruano, S. (2005). Firm productivity, heterogeneity, sunk costs and market selection. International Journal of Industrial Organization, 23, 505–534.

Federal Office for Building and Regional Planning (Bundesamt für Bauwesen und Raumordnung). (2003). Aktuelle Daten zur Entwicklung der Städte, Kreise und Gemeinden, (Vol. 17). Bonn: Federal Office for Building and Regional Planning.

Fritsch, M., (1997). New firms and regional employment change. Small Business Economics, 9, 437–448.

Fritsch, Michael (2004). Entrepreneurship, entry and performance of new businesses compared in two growth regimes: East and West Germany. Journal of Evolutionary Economics, 14, 525–542.

Fritsch, M., & Brixy, U. (2004). The establishment file of the German social insurance statistics. Schmollers Jahrbuch/Journal of Applied Social Science Studies, 124, 183–190.

Fritsch, M., & Mueller, P. (2004). The effects of new business formation on regional development over time. Regional Studies, 38, 961–975.

Fritsch, M., & Mueller, P. (2006). The evolution of regional entrepreneurship and growth regimes. In M. Fritsch & J. Schmude (Eds.), Entrepreneurship in the Region (pp. 225–244). New York: Springer.

Fritsch, M., Brixy, U., & Falck, O. (2006). The effect of industry, region and time on new business survival--A multi-dimensional analysis. Review of Industrial Organization, 28, 285–306.

Fritsch, M., & Weyh, A. (2006). How large are the direct employment effects of new businesses?--An empirical investigation. Small Business Economics, 27, 245–260.

Fritsch, M., (2007). How does new business formation affect regional development? Introduction to the special issue. Small Business Economics, doi: 10.1007/s11187-007-9057-y (this issue).

Fritsch, M., & Falck, O. (2007). New business formation by industry over space and time: A multi-dimensional analysis. Regional Studies, 41, 157–172.

Fritsch, M., & Mueller, P. (2007). The persistence of regional new business formation-activity over time--assessing the potential of policy promotion programs. Journal of Evolutionary Economics, 17, 299–315.

Gerlach, K., & Wagner, J. (1993). Gross and net employment flows in manufacturing industries. Zeitschrift für Wirtschafts- und Sozialwissenschaften, 113, 17–28.

Greene, W. H. (2003). Econometric Analysis, 5th ed. Upper Saddle River, NJ: Prentice Hall.

Grupp, H., & Legler, H. (2000). Hochtechnologie 2000. Karlsruhe: Fraunhofer Institute for Systems and Innovation Research (ISI).

Gujarati, D. N. (2003). Basic Economcetrics, 4th ed. Boston: McGraw-Hill.

Koenig, A. (1994). Betriebliche Beschäftigungsdynamik und personeller Strukturwandel: eine Longitudinalanalyse, Frankfurt/Main: Campus.

Koenig, A., & Weißhuhn, G. (1990a). Changes in enterprise size and employment levels in the branches of the federal republic of Germany 1980 to 1986. In R. Schettkat & M. Wagner (Eds.), Technological Change and Employment (pp. 111–132). Berlin: de Gruyter.

Koenig, A., & Weißhuhn, G. (1990b). Size of enterprises and gains of losses in employment in the economic sectors of West Germany 1980, 1986--A longitudinal analysis of employment in ‘New’, ‘Surviving’ and ‘Closed’ enterprises. In E. Matzner & M. Wagner (Eds.), The Employment Impact of New Technology (pp. 103–135). Aldershot: Avebury.

Kronthaler, F. (2005). Economic capability of East German regions: Results of a cluster analysis. Regional Studies, 39, 739–750.

Mueller, P. (2006). Exploring the knowledge filter: How entrepreneurship and university-industry relationships drive economic growth. Research Policy, 35, 1499–1508.

Mueller, P., van Stel, A. & Storey, D. J. (2007). The effects of new firm formation on regional development over time: The case of Great Britain. Small Business Economics, doi: 10.1007/s11187-007-9056-z (this issue).

Van Stel, A., & Storey, D. J. (2004). The link between firm births and job creation: Is there a upas tree effect? Regional Studies, 38, 893–909.

Van Stel, A., & Suddle, K. (2007). The impact of new firm formation on regional development in the Netherlands. Small Business Economics, doi: 10.1007/s11187-007-9054-1 (this issue).

Wagner, J. (1994). The post-entry performance of new small firms in German manufacturing industries. Journal of Industrial Economics, 42, 141–154.

Weyh, A. (2006). What characterizes successful start-up cohorts? In M. Fritsch & J. Schmude (Eds.), Entrepreneurship in the Region (pp. 61–74). New York: Springer.

Acknowledgements

We are indebted to two anonymous referees for helpful comments on an earlier version of this article.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License ( https://creativecommons.org/licenses/by-nc/2.0 ), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Fritsch, M., Mueller, P. The effect of new business formation on regional development over time: the case of Germany. Small Bus Econ 30, 15–29 (2008). https://doi.org/10.1007/s11187-007-9067-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-007-9067-9