Abstract

This paper examines the factors associated with the length of time that a firm’s market value is below its book value. From 1990 to 2010, approximately 19 % of firm quarter observations have a market value below their book value, and 46 % experience a market value below its below book value for more than 1 year. I investigate firm characteristics—accounting aggressiveness, asset liquidity, debt covenants, and cash flows; firm actions—merger, liquidation or an internal adaptation of resources; and accounting rules and their association with the length of time a firm’s book-to-market (BTM) ratio is greater than one. This paper extends the research on the adaptation option and also brings to light the unusual sample of observations that persist with a BTM ratio greater than one.

Similar content being viewed by others

Notes

To be consistent with Burgstahler and Dichev (1997), I use the term adaptation for internal redeployments of resources as well as external adaptations, which include sell-offs, spin-offs, divestitures, and liquidations.

Although somewhat higher, this result is consistent with Danielson and Press’s (2003) finding that from 1992 to 2000, 13 % of all firms have a BTM ratio greater than one.

For brevity, when I refer to asset overvaluation I include liability undervaluation as well.

The subscript i indicates firm observation and t is time.

A poisson regression is not appropriate due to the rigid condition in a poisson distribution that the conditional mean of the dependent variable is equal to its conditional variable (see Rock et al. 2001).

Two other proxies for conservatism include the BTM ratio and asymmetric timeliness. The BTM raio, suggested by Ohlson (Ohlson 1995, also see Beaver and Ryan 2000), is rejected due to the potential mechanical relation between the BTM ratio and the dependent variable. The second, provided by Basu (1997), considers the relation between economic events and earnings, hypothesizing that negative returns have a stronger relation with earnings than positive returns. Ball and Shivakumar (2005) argue that asymmetric timeliness is a conditional measure of conservatism, but because the hypothesis compares total conservatism, a more aggregate measure is appropriate. Also, the asymmetric timeliness measure is not well suited for firm-specific tests.

I have conducted an examination of all of the FASB standards from 1990 through 2010 and determined that the three selected standards predominate FASB’s attempt to enforce conservatism.

Table 5, Panel D shows the regression results using all observations.

Of the 1,616 observations from the financial and utility industries, 1,504 are financial. This large number of financial observations is surprising, given the regulatory environment of the industry, as well as the greater propensity for assets to be closer to fair market value. I encourage future research from those acquainted with the financial industry on this finding.

A firm can have more than one observation with a BTM ratio greater than one in the sample. On average, a firm has 1.2 observations in the sample of 1,712.

I assume unequal variances between the two groups. A test of variances easily rejects the null of equal variances between the two groups in almost all cases.

This analysis treats all observations as time independent. However, if an observation has a string of months with a BTM greater than one that begins before a particular standard but ends after, then this assumption is violated. To ensure that this is not driving results, I perform the analysis allowing the indicator variables D106, D121, and D142, to vary with time. The results are of the same tenor with this change.

References

Aleksanyan M, Karim K (2013) Searching for value relevance of book value and earnings: a case of premium versus discount firms. Rev Quant Financ Acc 41(3):489–511

Altman E (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23(4):589–609

Ball R, Shivakumar L (2005) Earnings quality in UK private firms: comparative loss recognition timeliness. J Account Econ 39(1):83–128

Ball R, Kothari SP, Robin A (2000) The effect of international institutional factors on properties of accounting earnings. J Account Econ 29(1):1–51

Barth E (1991) Relative measurement errors among alternative pension asset and liability measures. Account Rev 66(3):433–463

Barth E, Beaver W, Landsman W (1992) The market valuation implications of net periodic pension cost components. J Account Econ 15(1):27–62

Barth E, Beaver W, Landsman W (1998) Relative valuation roles of equity book value and net income as a function of financial health. J Account Econ 25(1):1–34

Basu S (1997) The conservatism principle and the asymmetric timeliness of earnings. J Account Econ 24(1):3–37

Beatty A, Weber J, Yu J (2008) Conservatism and debt. J Account Econ 45(2/3):154–174

Beaver W, Landsman W (1983) Incremental information content of Statement 33 disclosures. FASB, Stamford

Beaver W, Ryan S (2000) Biases and lags in book value and their effects on the ability of the book-to-market ratio to predict book return on equity. J Account Res 38(1):127–148

Berger P, Ofek E, Swary I (1996) Investor valuation of the abandonment option. J Financ Econ 42(1):1–31

Breen R (1996) Regression models: censored, sample selected, or truncated data, series: quantitative applications in the social sciences. Sage, Beverly Hills

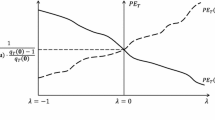

Burgstahler D, Dichev I (1997) Earnings, adaption, and equity value. Account Rev 72(2):187–215

Collins D, Kothari SP (1989) An analysis of intertemporal and cross-sectional determinants of earnings response coefficients. J Account Res 11(2/3):143–181

Collins D, Pincus M, Xie H (1999) Equity valuation and negative earnings: the role of book value of equity. Account Rev 74(1):29–61

Danielson M, Press E (2003) Accounting returns revisited: evidence of their usefulness in estimating economic returns. Rev Account Stud 8(4):493–530

Duke J, Hunt H (1990) An empirical examination of debt covenant restrictions and accounting-related debt proxies. J Account Econ 12(1):45–63

Dye R, Sridhar S (2008) A positive theory of flexibility in accounting standards. J Account Econ 46(2/3):312–333

Fields T, Lys T, Vincent L (2001) Empirical research on accounting choice. J Account Econ 31(1–3):255–307

Frankel R, Lee C (1998) Accounting valuation, market expectation, and cross-sectional stock returns. J Account Econ 25(3):283–319

Givoly D, Hayn C (2000) The changing time-series properties of earnings, cash flows and accruals: has financial reporting become more conservative? J Account Econ 29(3):287–320

Hayn C (1995) The information content of losses. J Account Econ 20(2):125–153

Henning S, Lewis B, Shaw W (2000) Valuation of the components of purchased goodwill. J Account Res 38(2):375–386

Hirshleifer D, Hou K, Teoh S, Zang Y (2004) Do investors overvalue firms with bloated balance sheets? J Account Econ 38:297–331

Jensen M, Ruback R (1983) The market for corporate control: the scientific evidence. J Financ Econ 11(1):5–50

Krull L (2004) Permanently reinvested foreign earnings, taxes, and earnings management. Account Rev 79(3):745–767

Kwon S, Yin Q, Han J (2006) The effect of differential accounting conservatism on the “over-valuation” of high-tech firms relative to low-tech firms. Rev Quant Financ Acc 27(2):143–173

Landsman W (1986) An empirical investigation of pension fund property rights. Account Rev 61(4):662–691

Marquardt C, Wiedman C (2004) How are earnings managed? An examination of specific accruals. Contemp Account Res 21(2):461–491

Nikolaev V (2010) Debt covenants and accounting conservatism. J Account Res 48(1):51–89

Ohlson J (1995) Earnings, book values, and dividends in equity valuation. Contemp Account Res 11(2):661–687

Oler M (2011) Entrenched management and the adaptation option. Working paper, Virginia Tech University

Oler D, Smith K (2012) The characteristics and fate of firms that publicly seek to be acquired. Investment analysis and portfolio management, vol 6. Elsevier, Amsterdam

Perfect SB, Wiles KW (1994) Alternative constructions of Tobin’s q: an empirical comparison. J Empir Financ 1(3/4):313–341

Petroni K (1992) Optimistic reporting within the property–casualty insurance industry. J Account Econ 15(4):485–508

Ramirez P, Hachiya T (2008) Measuring the contribution of intangibles to productivity growth: a disaggregate analysis of Japanese firms. Rev Pac Basin Financ Mark Policies 11(2):151–186

Riedl E (2004) An examination of long-lived asset impairments. Account Rev 79(3):823–852

Rock S, Sedo S, Willenborg M (2001) Analyst following and count-data econometrics. J Account Econ 30(3):351–373

Schlingemann F, Stulz R, Walkling R (2002) Divestitures and the liquidity of the market for corporate assets. J Financ Econ 64(1):117–144

Shevlin T (1991) The valuation of R&D firms with R&D limited partnerships. Account Rev 66(1):1–21

Sloan R (1996) Do stock prices fully reflect information in accruals and cash flows about future earnings? Account Rev 71(3):289–315

Watts R (2003) Conservatism in accounting part I: explanations and implications. Account Horiz 17(3):207–221

Watts R, Zimmerman J (1986) Positive accounting theory. Pretince-Hall Inc, New Jersey

Acknowledgments

I appreciate the helpful comments and suggestions from my dissertation committee, David Burgstahler, Jarrad Harford, and Terry Shevlin, as well as those from Long Chen, Bowe Hansen, Derek Oler, Shiva Rajgopal, D. Shores, and workshop participants at the University of Washington, the BYU Accounting Consortium, the University of Alberta, Texas Tech University, George Mason University, the 2009 Annual American Accounting Association Meeting, and the 2011 Virginia Accounting Research Conference, and from the anonymous reviewer. I am also grateful to Lew Thorson for his programming assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is based on the author’s dissertation at the University of Washington.

Rights and permissions

About this article

Cite this article

Oler, M. Determinants of the length of time a firm’s book-to-market ratio is greater than one. Rev Quant Finan Acc 45, 509–539 (2015). https://doi.org/10.1007/s11156-014-0445-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-014-0445-5