Abstract

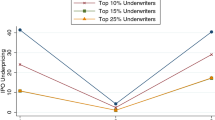

This paper investigates how underwriter-issuer matching choices and firm risks affect the cost of equity issuance. We show that underwriter-issuer matching is not random; it reflects underwriter reputation and risk concerns, issuers’ quality, and equity market conditions. We apply Heckman self-selection estimation model to control for the endogenous underwriter-issuer matching. We find that the matching choice leads to considerable heterogeneity in pricing of issuer systematic and firm-specific risks in seasoned equity offering (SEO) underwriting fees. Low-reputation underwriters require compensation for bearing issuer’s systematic risk but not for firm-specific risk, while high-reputation underwriters do the opposite. Moreover, evidence in this paper suggests that the underwriter-issuer matching decision entails a non-linear relation between SEO spread and underwriter reputation: high- and low- reputation underwriters earn higher spreads than medium-reputation underwriters. Our findings highlight the importance of accounting for underwriter-issuer matching in assessing SEO underwriting contracts. The results are robust to alternative underwriter reputation measure, model specifications, sample periods, and different samples of firms.

Similar content being viewed by others

Notes

Mandelker and Raviv (1977) analyze underwriting fee as a function of an issuer’s risk. They show that the best underwriting contract is a function of the riskiness of the issue and the risk attitudes of both the underwriter and the issuer.

Section 2 provides full discussion on sorting methodologies.

All of our results are qualitatively unchanged if we also include issues smaller than $10 million or larger than $1 billion.

The full discussion on variable construction is provided in Sect. 2. The definitions and data sources for all variables are reported in the “Appendix”.

We provide full discussion on the classification of underwriters by their reputation measures in Sect. 2.

We thank the referee for suggesting the Chow test.

We thank the referee for pointing out this issue.

Chen et al. (2004) provide review on the application of nonlinear models in corporate finance research.

We thank the referee for suggesting this test.

References

Aggarwal RK, Krigman L, Womack KL (2002) Strategic IPO underpricing, information momentum, and lockup expiration selling. J Financ Econ 66:105–137

Altinkilic O, Hansen RS (2000) Are there economies of scale in underwriting fees? Evidence of rising external financing costs. Rev Financ Stud 13:191–218

Amihud Y (2002) Illiquidity and stock returns: cross-section and time-series effects. J Financ Mark 5:31–56

Ang JS, Zhang S (2006) Review underwriting relationships: information production costs, underwriting fees, and first mover advantage. Rev Quant Financ Acc 27(2):205–229

Baltagi BH (2001) Economic analysis of panel data. Wiley, New Jersey

Banerjee S, Dai L, Shrestha K (2011) Cross-Country IPOs: what explain differences in underpricing? J Corp Financ 17:1289–1305

Blackwell DW, Marr MW, Spivey MF (1990) Shelf registration and the reduced due diligence argument: implications of the underwriter certification and the implicit insurance hypotheses. J Financ Quant Anal 25:245–259

Butler A, Grullon G, Weston JP (2005) Stock market liquidity and the cost of issuing equity. J Financ Quant Anal 40:331–348

Carter RB, Manaster S (1990) Initial public offerings and underwriter reputation. J Financ 45:1045–1067

Carter RB, Dark FH, Singh AK (1998) Underwriter reputation, initial returns, and the long-run performance of IPO stocks. J Financ 53:285–311

Chemmanur TJ, Fulghieri P (1994) Investment bank reputation, information production, and financial intermediation. J Financ 49:57–79

Chen HC, Ritter JR (2000) The seven percent solution. J Financ 55:1105–1131

Chen SS, Ho KW, Lee CF, Shrestha K (2004) Non-linear models in corporate finance research: review, critique, and extensions. Rev Quant Financ Acc 22(2):141–169

Chow G (1960) Tests of equality between sets of coefficients in two linear regressions. Economics 28:591–605

Fernando CS, Datchev VA, Spindt PA (2005) Wanna dance? How firms and underwriters choose each other. J Financ 60:2437–2469

Hansen RS, Torregrosa P (1992) Underwriter compensation and corporate monitoring. J Financ 47:1537–1555

Heckman JJ (1979) Sample selection bias as a specification error. Economics 47:153–161

Jo H, Kim Y, Shin D (2012) Underwriter syndication and corporate governance. Rev Quant Financ Acc 38(1):61–86

Lee G, Masulis RW (2009) Seasoned equity offerings: quality of accounting information and expected flotation costs. J Financ Econ 92:443–469

Loughran T, Ritter JR (2004) Why has IPO underpricing changed over time? Financ Manag 33:5–37

Loureiro G (2010) The reputation of underwriters: a test of the bonding hypothesis. J Corp Financ 16:516–532

Maddala GS (1983) Limited dependent and qualitative variables in econometrics. Econ Soc Monogr, No 3, Cambridge University Press, Cambridge

Mandelker G, Raviv A (1977) Investment banking: an economic analysis of optimal underwriting contracts. J Financ 32:683–694

Megginson WL, Weiss KA (1991) Venture capitalist certification in initial public offerings. J Financ 46:879–903

Slovin MB, Sushka ME, Lai KW (2000) Alternative flotation methods, adverse selection, and ownership structure: evidence from seasoned equity issuance in the UK. J Financ Econ 57:157–190

Acknowledgments

We thank the journal editor, an anonymous referee, Alex Butler, and seminar participants at 2010 Southwest Finance Association and 2011 Financial Management Association for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Variables definitions

Appendix: Variables definitions

1.1 Key variables

1.1.1 Total risk

It is proxied by stock volatility of a firm. The stock volatility estimated from daily stock returns from 14 to 2 months before SEO issuance.

1.1.2 Firm systematic risk

Firm’s beta estimated from CAPM model.

1.1.3 Firm-specific risk

The standard error of residual from CAPM model using the daily stock returns from 14 to 2 months before SEO issuance.

1.1.4 Market share

Following Butler et al. (2005), we construct underwriter market share for each bookrunner as the total principal value issued by each bookrunner divided by the total principal amount of issues over the past 3 years.

1.1.5 Bookrunner reputation

We calculate Megginson–Weiss reputation measure following Fernando et al. (2005). When there are multiple bookrunners in an issue, Bookrunner Reputation takes the highest reputation score among all participating bookrunners.

1.2 Other variables

1.2.1 AMEX exchange indicator

A dummy equal one if the issuing firm is listed in AMEX exchange, and zero otherwise.

1.2.2 Analyst forecast dispersion

The average of the standard deviation of analyst 1-year EPS forecasts scaled by the forecast mean over the past 12 months.

1.2.3 Book-to-market ratio

The most recent available book equity value divided by market capitalization 2 months before the SEO offer date.

1.2.4 CPI adjusted market size

The average of monthly market capitalization from 14 to 2 months before SEO issuance, adjusted for inflation level in January 2000.

1.2.5 CPI adjusted past average stock price

The average of monthly stock prices from 14 to 2 months before SEO issuance, adjusted for inflation based on CPI level in January 2000.

1.2.6 Dummy for commercial bank entry

A dummy equal one if the SEO is issued after the entry of commercial bank to equity underwriting market, and zero otherwise.

1.2.7 Dummy for having same runner in previous deal

A dummy equal to one if issuing firm used the same underwriter in previous equity issuance (IPO or SEOs), and zero otherwise.

1.2.8 Dummy for no S&P credit rating

A dummy equal 1 if the issuing firm has no credit rating assigned by S&P, and zero otherwise.

1.2.9 Dummy for overallotment

A dummy equal one if the SEO has an overallotment option.

1.2.10 Dummy for previously choosing high (low) reputation underwriter

A dummy equal to one if issuing firm chooses a high- (low-) reputation investment banks in previous equity issuance (IPO or SEOs), and zero otherwise.

1.2.11 Endogenous selection variable matching with high (low) reputation IB

The inverse Mills ratio used to adjust for self-selection.

1.2.12 Illiquidity

Amihud illiquidity measure, calculated as the average daily absolute return to dollar volume ratio (Amihud 2002) over a one-year period 2 months prior to the SEO offering date.

1.2.13 Industry dummy

The definition of industry is based on Fama–French 12 industry classification, available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

1.2.14 Market excess returns

The cumulative market excess returns from 8 to 2 months before the issuance.

1.2.15 NASDAQ exchange indicator

A dummy equal one if the issuing firm is listed in NASDAQ exchange, and zero otherwise.

1.2.16 Number of SEO bookrunner

The total number of bookrunners in current SEO issue.

1.2.17 Relative offer size

The ratio of the number of offered shares to total number of shares outstanding prior to the SEO offering.

1.2.18 Secondary shares as % of shares offered

The percentage of secondary shares to total issuing shares.

1.2.19 Std market excess returns

The standard deviation market excess returns from 8 to 2 months before the issuance.

1.2.20 Underpricing

It equals negative one times the return from the closing price the day before SEO to the SEO offer price.

1.2.21 Variance coefficient of illiquidity

The ratio of standard deviation of Amihud illiquidity measure to its mean.

Rights and permissions

About this article

Cite this article

Cao, C.X., Chen, C. & Wang, J.Q. Underwriter reputation and pricing of risk: evidence from seasoned equity offerings. Rev Quant Finan Acc 44, 609–643 (2015). https://doi.org/10.1007/s11156-013-0420-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-013-0420-6