Abstract

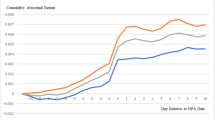

Prior work shows that both short sales and put options contain information about future stock prices. In this study, we compare the return predictability in short sales to the return predictability in put options. The motivation for this comparison is based on the theoretical argument that informed traders can choose between short sales and put options when establishing short positions in a particular stocks. Results in this paper suggest that the underperformance of stocks with high short-selling activity is approximately four times larger than the underperformance of stocks with high put-option activity. While stocks that are most likely to face binding short-sale constraints drive the underperformance caused by put-option activity, we still find that short sales are generally more informative about future prices.

Similar content being viewed by others

Notes

Other studies (Senchack and Starks 1993; Aitken et al. 1998; Christophe et al. 2004; Boehmer et al. 2008; Dechow et al. 2001; Desai et al. 2002; Engelberg et al. 2010; Wu et al. 1996) also document that short sales contain information about future price movements. While studies show that short sales generally contain information, results regarding the informativeness of options is less conclusive. While some studies report empirical evidence that support the theory that informed trading varies between the options and stock markets (Anthony 1988; Cao et al. 2005; Easley et al. 1998; Mayhew and Stivers 2003; Pan and Poteshman 2006; Back 1993; Chan et al. 2002; Figlewski and Webb 1993; Gu and Yang 2007) Other papers question the level of informativeness in options trading (Wei et al. 2010; Stephan and Whaley 1990; Chan et al. 1993; Finucane 1999; Bhattacharya 1987; Kluger and Wyatt 1995).

Qualitatively similar results are shown in Pan and Poteshman (2006).

We also require stocks in our sample to have a CRSP share code of 10 or 11 thus eliminating securities that are not ordinary common stocks such as REITs, ETFs, Closed-End Funds, etc.

In unreported tests, we rerun our entire analysis with partitioning the short-sale data into exempt and non-exempt short sales. The conclusions we draw are similar those reported in this paper that suggest that short sales (in general) contain more information about future returns that put-call ratios.

We use three-factor risk-adjusted returns and raw returns throughout the analysis for robustness and find qualitatively similar results.

Boehmer et al. (2008) also show that the return predictability of the short ratio remains for at least 20 days.

We recognize that the scale of the short ratio and the put-call ratio differs. Therefore, we standardize both ratios similar to Lakonishok and Vermaelen (1986) and Koski and Scruggs (1998). In particular, we subtract the mean ratio for each stock (across the sample time period) from the ratio for each stock on day t. We then divide this difference by the standard deviation of each stock (across the sample time period). This standardization procedure allows each stock to have standardized ratio with a zero mean and a unit variance. With each stock having a similarly distributed standardized short ratio and standardize put-call ratio, we are able to compare the estimates for β 3 and β 4 .

References

Admati A, Pfleiderer P (1988) A theory of intraday patterns: volume and price variability. Rev Financ Stud 1:3–40

Aitken M, Frino A, McCorry M, Swan P (1998) Short sales are almost instantaneously bad news: evidence from the Australian stock exchange. J Financ 53:2205–2223

Anthony J (1988) The interrelation of stock and options market trading-volume data. J Financ 43(4):949–964

Asquith P, Pathak P, Ritter J (2005) Short interest, institutional ownership, and stock returns. J Financ Econ 78(2):243–276

Back K (1993) Asymmetric information and options. Rev Financ Stud 6(3):435–472

Barclay M, Warner J (1993) Stealth trading and volatility: which trades move prices? J Financ Econ 34:281–306

Battalio RH, Schultz P (2010) Regulatory uncertainty and market liquidity: the 2008 short sale ban’s impact on equity options. Forthcoming, J Financ

Bhattacharya M (1987) Price changes of related securities: the case of call options and stocks. J Financ Quant Anal 22(1):1–15

Black F (1975) Fact and fantasy in the use of options. Financ Anal J 31(4):36–72

Black F, Myron S (1972) The valuation of option contracts and a test of market efficiency. J Financ 27(2):399–417

Blau B, Van Ness B, Van Ness R (2009) Short selling and weekend effect for NYSE stocks. Financ Manage 38:603–630

Boehmer E, Jones C, Zhang X (2008) Which shorts are informed? J Financ 63:491–527

Cao C, Chen Z, Griffin J (2005) Informational content of option volume prior to takeovers. J Bus 78(3):1073–1109

Chakravarty S, Gulen H, Mayhew S (2004) Informed trading in stock and option markets. J Financ 59(3):1235–1258

Chan K, Chung Y, Johnson H (1993) Why option prices lag stock prices: a trading-based explanation. J Financ 48(5):1957–1967

Chan K, Chung Y, Fong W (2002) The informational role of stock and option volume. Rev Financ Stud 15(4):1049–1075

Christophe S, Ferri M, Angel J (2004) Short selling prior to earnings announcements. J Financ 59:1845–1875

Christophe S, Ferri M, Hsieh J (2010) Informed trading before analyst downgrades: evidence from short sellers. J Financ Econ 95:85–106

D’Avolio G (2002) The market for borrowing stock. J Financ Econ 66:271–306

Danielsen B, Sorescu S (2001) Why do option introductions depress stock prices? A study of diminishing short sale constraints. J Financ Quant Anal 36(4):451–484

Dechow P, Hutton A, Meulbroek L, Sloan R (2001) Short-sellers, fundamental analysis, and stock returns. J Financ Econ 61(1):77–106

Desai H, Ramesh K, Thiagarajan S, Balachandran B (2002) An investigation of the informational role of short interest in the Nasdaq market. J Financ 57(5):2263–2287

Diamond D, Verrecchia R (1987) Constraints on short-selling and asset price adjustment to private information. J Financ Econ 18(2):277–311

Diether K, Lee K, Werner I (2009) Short-sale strategies and return predictability. Rev Financ Stud 22:575–607

Easley D, O’Hara M, Srinivas P (1998) Option volume and stock prices: evidence on where informed traders trade. J Financ 53(2):431–465

Easley D, Hvidkjaer S, O’Hara M (2002) Is information risk a determinant of asset returns? J Financ 57(5):2185–2221

Edwards A, Hanley K (2010) Short selling in initial public offerings. J Financ Econ 98:21–39

Engelberg J, Reed A, Ringgenberg M (2010) How are shorts informed? Short sellers, news, and information processing, Working Paper

Evans R, Geczy C, Musto D, Reed A (2009) Failure is an option: impediments to short selling and options prices. Rev Financ Stud 22:1955–1980

Figlewski S, Webb G (1993) Options, short sales, and market completeness. J Financ 48(2):761–777

Finucane T (1999) A new measure of the direction and timing of information flow between markets. J Financ Mark 2(2):135–151

Gu A, Yang C (2007) Short sales constraints and return volatility: evidence from the chinese A and H share markets. Rev Pac Basin Financ Mark Policies 10(4):469–478

Jennings R, Starks L (1986) Earnings announcements, stock price adjustment, and the existence of options markets. J Financ 41:107–125

Kluger B, Wyatt S (1995) Options and efficiency: some experimental evidence. Rev Quant Financ Acc 5:179–201

Koski J, Scruggs J (1998) Who trades around the ex-dividend day? Evidence from NYSE audit file data. Financ Manage 27(3):58–72

Lakonishok J, Vermaelen T (1986) Tax-induced trading around ex-dividend days. J Financ Econ 3:287–319

Manaster S, Rendleman R (1982) Option prices as predictors of equilibrium stock prices. J Financ 37(4):1043–1057

Mayhew S, Stivers C (2003) Stock return dynamics, option volume, and the information content of implied volatility. J Futures Mark 23(7):615–646

Nagel S (2005) Short sales, institutional investors and the cross-section of stock returns. J Financ Econ 78(2):277–309

Pan J, Poteshman AM (2006) The information in option volume for future stock prices. Rev Financ Stud 19(3):871–908

Senchack AJ, Starks L (1993) Short-sale restrictions and market reaction to short-interest announcements. J Financ Quant Anal 28(2):177–194

Stephan J, Whaley R (1990) Intraday price change and trading volume relations in the stock and stock option markets. J Financ 45(1):191–220

Wei H, Lee Y, Wei P (2010) Do option traders on value and growth stocks react differently to new information? Rev Quant Financ Acc 34:371–381

Wu C, Li Q, Wei J (1996) Incomplete-information capital market equilibrium with heterogenous expectations and short sale restrictions. Rev Quant Financ Acc 7:119–136

Xu J (2007) Price convexity and skewness. J Financ 62:2521–2552

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Blau, B.M., Wade, C. Comparing the information in short sales and put options. Rev Quant Finan Acc 41, 567–583 (2013). https://doi.org/10.1007/s11156-013-0377-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-013-0377-5