Abstract

We analyze licensing contracts in an oligopolistic downstream market where an outside innovator has private information with regard to its technology. Under complete information, the innovator uses a fee-only or a two-part contract to extract the rent that is generated from its innovation, so that all of the downstream firms receive nothing but their reservation payoff. By contrast, under incomplete information with respect to the efficiency of innovation, there can be a conflict between signaling and rent extracting: A contract by the efficient innovator that extracts too much rent invites the inefficient innovator to mimic it. In this case, the efficient type may give up charging the fixed fee and offer a royalty-only contract, so as to discourage the mimicking. Moreover, when the downstream market is sufficiently competitive, the royalty-only contract will eventually win vis-a-vis the two-part contract because it is more effective for the efficient type to signal itself.

Similar content being viewed by others

Notes

An exception is Schmitz (2002), who considers a duopolistic downstream market where the downstream firms’ benefits from the new product are private information, and the innovator has to decide how many licenses to sell. His model is different from ours in two respects: First, he deals with a screening-type model while we are concerned about the signaling effect of licensing; and second, he focuses on the optimal number of contracts that the innovator would offer, rather than the form of the contracts (i.e., fixed fees or royalties), while we deal with both issues.

Following most of the literature on licensing, we assume that the royalty rate is non-negative. If \(r_{\theta } < 0\) is allowed, then as argued by Katz and Shapiro (1985), such a contract would “likely be held to be illegal by antitrust authorities,” because it permits the patent holder to “earn its monopoly profits without fear of rivalry” by bribing (or subsidizing) the licensee(s) to exit the industry. For a similar setting, see, for example, Bousquet et al. (1998), Faulí-Oller and Sandonís (2002), and Sen and Tauman (2007). Liao and Sen (2005) offer some implications when negative royalties are allowed.

For a similar assumption, see, for example, Gallini and Wright (1990), and Macho-Stadler et al. (1996). As pointed out by the latter, a typical type of transmission of non-verifiable technology is know-how, and they find that 52% of the licensing contracts in their sample involve a transfer of know-how.

Since we focus on the separating equilibrium under incomplete information, this case can only occur off the equilibrium path.

Laffont and Martimort (2002) also argue that if an ex post verifiable signal that is correlated with the true type is available, then the contract can be conditional on the observed signal. In such a case, the complete information optimal allocation can be implemented. We would like to thank a referee for pointing this out.

In this case, there may not exist any separating equilibrium under incomplete information. See the discussion in the Conclusion.

Note that the industry profit is maximized at the monopolistic quantity, \(Q=\frac{a-c+\varepsilon _{\theta }}{2}\). When \(r_{\theta }=0\), the total output produced by all downstream firms given that the contract is accepted by them is \(Q_{I}=\frac{n(a-c+\varepsilon _{\theta })}{n+1}\), which is greater than the monopolistic quantity. Thus, by raising \(r_{\theta }\), the total quantity that is produced by the downstream firms will decrease and the industry profit will increase.

Since \(w(n,\varepsilon _{\theta }-r_{\theta })\) decreases in \(r_{\theta }\) and is equal to 0 when \(r_{\theta }=\varepsilon _{\theta }\), this assumption also implies that \(F_{\theta }\ge 0\).

One implication of this result is that a separating equilibrium cannot involve both types’ using fee-only contracts, because whichever offers a higher fee will be mimicked by the other. This is clearly different from the complete-information case in that the optimal contracts for both types are fee-only when \(\varepsilon _H \le \frac{a-c}{2n-1}\).

That is, \((\hat{r}_H, \hat{F}_H)\) solves \(\underset{\{r_H, F_H\}}{\max } U_{H}(r_H,F_H)=n[r_H q_{I}(n,\varepsilon _{H}-r_H)+F_H], \ \text {s.t.} \ \mathrm {PC}_L: 0 \le F_H \le w(n,\varepsilon _L -r_H)\). Note that if the downstream firms are misled and consider that this contract is offered by the L-type, they will accept it only with a fixed fee of no more than \(w(n,\varepsilon _L - \hat{r}_H)\) in Stage 2. However, after they accept the contract, the true technology \(\varepsilon _{H}\) will be realized in Stage 3, and they will have to produce \(q_{I}(n,\varepsilon _{H}-\hat{r} _H) \) while paying \(\hat{r}_H\).

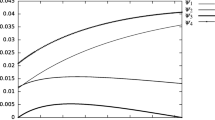

Since \(\frac{\partial w(n,\varepsilon _{\theta }-r)}{\partial r} < 0\), and \(\frac{\partial ^2 w(n,\varepsilon _{\theta }-r)}{\partial r^2}<0\), the \(\hbox {PC}_H\) and \(\hbox {PC}_L\) curves are decreasing in r and concave to the origin.

The Intuitive Criterion is proposed by Cho and Kreps (1987), which is an equilibrium refinement commonly used in signaling games to reduce the set of equilibria by requiring the off-equilibrium beliefs to be “reasonable.” It is “unreasonable” to believe that a deviating player is of some type if the deviation is definitely worse than the equilibrium payoff for that type (i.e., the deviation is equilibrium-dominated). Therefore, a perfect Bayesian equilibrium cannot survive the Intuitive Criterion if there is some type that is better off by playing that deviation, given that other players hold reasonable beliefs.

It is even possible that a royalty rate lower than that under complete information—\(r_{H}^{**}<r_{H}^*\)—is a more credible signal, as in the case that is shown in Fig. 3b.

As is shown in the “Appendix”, when n is sufficiently large, \(U_L (\varepsilon _H, 0) > U_L^*\). Thus, the L-type will be better off by deviating to a contract \((\varepsilon _H,0)\), and a two-part contract will invite the L-type to mimic.

Note that \(\frac{\partial U _{L}(r_{H}^{**},0)}{\partial n} =\frac{1}{(n+1)^2}(a-c+\varepsilon _{L}-r_{H}^{**}) r_{H}^{**}>0.\)

According to Proposition 1, the first-best contract for the L-type \((r_L^*, F_L^*)\) will converge to \((\varepsilon _{L}, 0)\) as \(n\rightarrow \infty \). Moreover, since \(\hbox {IC}_L\) is binding in the separating equilibrium, \(r_H^{**}\) is such that the L-type is indifferent between \((r_H^{**}, 0)\) and \((r_L^*, F_L^*)\) with \(r_L^* \rightarrow \varepsilon _{L}\) and \(F_L^* \rightarrow 0\). Based on the continuity of the payoff function, we have \(r_H^{**}\rightarrow \varepsilon _{L}\) as \(n\rightarrow \infty \).

It is not optimal to offer an exclusive contract that is royalty-only because the innovator can always collect more revenue when more firms accept it and so it is always dominated by a royalty-only non-exclusive contract. Therefore, in the following analysis when a suboptimal contract is concerned, we can rule out the royalty-only exclusive contract.

The reasoning is as follows. Given that the L-type offers its first-best contract \((r_L, F_L)=(\varepsilon _L, 0)\), and that \(F_H=0\) in the equilibrium because each downstream firm earns zero profit and any \(F_H>0\) will be rejected, if the H-type offers any \(r_H > \varepsilon _L\), it will be mimicked by the L-type. On the other hand, any \(r_H < \varepsilon _L\) is dominated by \(r_H = \varepsilon _L\). Therefore, there is no way for the H-type to separate itself by offering another royalty-only contract.

We are grateful to the editor Lawrence White for this insightful suggestion.

Note that when \(\varepsilon _{L}=0\) , a fee-only contract is optimal according to Proposition 1.

References

Antelo, M. (2012). Screening and signalling for technology licensing: a comparison. R&D Management, 42(4), 289–302.

Beggs, A. W. (1992). The licensing patent under asymmetric information. International Journal of Industrial Organization, 10(2), 171–191.

Bousquet, A., Cremer, H., Ivaldi, M., & Wolkowicz, M. (1998). Risk sharing in licensing. International Journal of Industrial Organization, 16(5), 535–554.

Cho, I.-K., & Kreps, D. M. (1987). Signaling games and stable equilibria. Quarterly Journal of Economics, 102(2), 179–221.

Erutku, C., & Richelle, Y. (2007). Optimal licensing contracts and the value of a patent. Journal of Economics and Management Strategy, 16(2), 407–436.

Fan, C., Jun, B. H., & Wolfstetter, E. G. (2018). Optimal licensing under incomplete information: the case of the inside patent holder. Economic Theory, 66(4), 975–1005.

Faulí-Oller, R., & Sandonís, J. (2002). Welfare reducing licensing. Games and Economic Behavior, 41(2), 192–205.

Gallini, N. Y., & Wright, B. D. (1990). Technology transfer under asymmetric information. Rand Journal of Economics, 21(1), 147–160.

Heywood, J. S., Li, J., & Ye, G. (2014). Per unit versus ad valorem royalties under asymmetric information. International Journal of Industrial Organization, 37(1), 38–46.

Kamien, M. I., & Tauman, Y. (1986). Fees versus royalties and the private value of a patent. Quarterly Journal of Economics, 101(3), 471–491.

Kamien, M. I., Oren, S. S., & Tauman, Y. (1992). Optimal licensing of cost reducing innovation. Journal of Mathematical Economics, 21(5), 483–508.

Katz, M. L., & Shapiro, C. (1985). On the licensing of innovations. RAND Journal of Economics, 16(4), 504–520.

Katz, M. L., & Shapiro, C. (1986). How to license intangible property. Quarterly Journal of Economics, 101(3), 567–590.

Laffont, J.-J., & Martimort, D. (2002). The theory of incentives: the principal-agent model. Princeton, N.J.: Princeton University Press.

Liao, C.-H., & Sen, D. (2005). Subsidy in licensing: optimality and welfare implications. The Manchester School, 73(3), 281–299.

Lipsey, R. G., & Lancaster, K. (1956). The general theory of the second best. Review of Economic Studies, 24(1), 11–32.

Macho-Stadler, I., & Perez-Castrillo, J. D. (1991). Contrats de licences et asymétrie d’information. Annales d’Economie et de Statistique, 24, 189–208.

Macho-Stadler, I., Martinez-Giralt, X., & Perez-Castrillo, J. D. (1996). The role of information in licensing contract design. Research Policy, 25(1), 43–57.

Muto, S. (1993). On licensing policies in Bertrand competition. Games and Economic Behavior, 5(2), 257–267.

Schmitz, P. W. (2002). On monopolistic licensing strategies under asymmetric information. Journal of Economic Theory, 106(1), 177–189.

Sen, D., & Tauman, Y. (2007). General licensing schemes for a cost-reducing innovation. Games and Economic Behavior, 59(1), 163–186.

Wang, X. H., & Yang, B. Z. (1999). On licensing under Bertrand competition. Australian Economic Papers, 38(2), 106–119.

Acknowledgements

We sincerely thank the editor Lawrence White and the referee for their insightful comments and helpful suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 1

First, as was argued in the text, the fixed fee is determined such that the constraint \(\hbox {PC}_\theta \) is binding: \(F_{\theta }=w(n,\varepsilon _{\theta }-r_{\theta })=\Phi _{I}(n,\varepsilon _{\theta }-r_{\theta })-\Phi _{J}(n-1,\varepsilon _{\theta }-r_{\theta })\). By substituting this, the innovator of type \(\theta \) maximizes the following payoff:

The first-order condition with respect to (24) is:

where

and

By evaluating the above derivatives at \(r_{\theta }=0\), we find that when \(\varepsilon _{\theta }> \frac{a-c}{2n-1}\), \(\frac{\partial }{\partial r_{\theta }}[(p(Q_I)-c+\varepsilon _{\theta })Q_I]|_{r_{\theta }=0} > n\frac{\partial }{\partial r_{\theta }}\Phi _{J}|_{r_{\theta }=0}\). That is, the innovator can obtain a higher payoff by charging a positive \(r_{\theta }\). Thus, the solution is an interior one and the optimal royalty is:

It is easy to check that the interior solution \(r_{\theta }^* < \varepsilon _{\theta }\) under Assumption 1.

On the other hand, when \(\varepsilon _{\theta }\le \frac{a-c}{2n-1}\), \(\frac{\partial }{\partial r_{\theta }}[(p(Q_I)-c+\varepsilon _{\theta })Q_I]|_{r_{\theta }=0}\le n\frac{\partial }{\partial r_{\theta }}\Phi _{J}|_{r_{\theta }=0}\). Thus, charging a positive \(r_{\theta }\) can only decrease the innovator’s payoff. Thus, the solution is at the corner and the optimal royalty rate is \(r_{\theta }^*=0\). \(\square \)

Proof of Lemma 1

In a separating equilibrium, the payoff of the L-type cannot be lower than its equilibrium payoff under complete information—\(U_L(r^*_L, F^*_L)\)—because there will be a profitable deviation otherwise. On the other hand, the payoff can not be higher than \(U_L(r^*_L, F^*_L)\) either, because otherwise the payoff for the downstream firms would be lower than their reservation payoff and they would reject the contract. Therefore, the L-type will offer the optimal contract under complete information in the separating equilibrium.

Next, we claim that \(r_{H}^{**} > r_{L}^{**}=r_{L}^*\). In a separating equilibrium, the \(\hbox {IC}_{H}\) and \(\hbox {IC}_{L}\) constraints are

where \(q_{H}=q_{I}(n,\varepsilon _{H}-r_{H}),\) \(\tilde{q}_{H}=q_{I}(n, \varepsilon _{H}-r_{L})\), \(q_{L}=q_{I}(n,\varepsilon _{L}-r_{L}),\) and \(\tilde{q}_{L}=q_{I}(n,\varepsilon _{L}-r_{H})\). By adding up the above conditions, we have \(r_{L}q_{L}+r_{H}q_{H}\ge r_{L}\tilde{q}_{H}+r_{H} \tilde{q}_{L},\) or equivalently,

We immediately obtain \(r_{H}\ge r_{L}\).

Now we show that \(r_{H}\not = r_L.\) Suppose that \(r_{H}=r_{L}.\) Then, in this case, \(q_{H}=\tilde{q}_{H}\) and \(q_{L}=\tilde{q}_{L}\). By substituting them into (27) and (28), we obtain \(F_{L}=F_{H}\), which is a contradiction to the presumption of a separating equilibrium. Therefore, it must be the case that \(r^{**}_{H} > r^{**}_{L}\) in the separating equilibrium.

Finally, we claim that the complete-information optimal contract cannot constitute a separating equilibrium. Suppose that the H-type offers the optimal contract \((r^*_H, F^*_H)\) in Proposition 1. Then it can be shown that \(U _{L}(r^{*}_{H},F^{*}_{H}) > U_L (r^{*}_{L},F^{*}_{L})\) if

However, (29) always holds under Assumption 1 since the RHS is greater than \(a-c\) (because \(\frac{4n^{2}}{4n^{2}-7n+1}>1\) for any \(n \ge 2\)). That is, the L-type always has the incentive to mimic the H-type, and so \((r^*_H, F^*_H)\) cannot constitute a separating equilibrium. We also note that when \(n \rightarrow \infty \), (29) becomes \( \varepsilon _{H}<a-c\), which is indeed the condition that we provide in Assumption 1. \(\square \)

Proof of Proposition 2

We have shown in Lemma 1 that the L-type will offer the complete-information contract in a separating equilibrium. To characterize the H-type’s separating equilibrium contract \((r_{H}^{**}, F_{H}^{**})\), we take the following three steps:

Step 1 We eliminate the strictly dominated strategies: Clearly, the H-type will not play the strictly dominated strategies. Since \((\hat{r}_H, \hat{F}_H)\) is the optimal contract when the innovator is perceived as an L-type, it means that the H-type can guarantee at least as high a payoff as \(U_H(\hat{r}_H, \hat{F}_H)\) under any belief. Any contract that is inferior to \((\hat{r}_H, \hat{F}_H)\) can be eliminated. This implies that \((r_{H}^{**}, F_{H}^{**})\) must satisfy \(\hbox {MC}_H\) or (13).

Step 2 We identify the relevant constraints for \((r_{H}^{**}, F_{H}^{**})\): First, \(\hbox {IC}_L\) must be satisfied for the L-type not to mimic \((r_{H}^{**}, F_{H}^{**})\). Second, \(\hbox {PC}_H\) must be satisfied for \((r_{H}^{**}, F_{H}^{**})\) to be accepted by the downstream firms. Finally, we argue that \(\hbox {IC}_H\) is redundant. Since \((\hat{r}_H, \hat{F}_H)\) is the contract satisfying \(\hbox {PC}_L\) that maximizes the H-type’s payoff, and the \(\hbox {PC}_L\) curve is strictly concave, this means that \(U_H(\hat{r}_H, \hat{F}_H)>U_H(r_{L}^*, F_{L}^*)\). By combining it with \(\hbox {MC}_H \), we have \(U_H(r_{H}^{**}, F_{H}^{**}) >U_H(r_{L}^*, F_{L}^*)\), which means that \(\hbox {IC}_H\) must be slack. Hence, the separating equilibrium contract \((r_{H}^{**}, F_{H}^{**})\) is required to satisfy \(\hbox {IC}_L\), \(\hbox {PC}_H\) and \(\hbox {MC}_H\).

Step 3 We prove the existence of a separating equilibrium: We need to find an off-equilibrium belief to support a contract within the specified region to be a separating equilibrium. We use a belief in which any deviation away from the equilibrium contract will make the innovator be perceived as the L-type. Under this belief, if the deviation is outside the \(\hbox {PC}_L\) curve, it will be rejected by the downstream firms. If the deviation is inside the \(\hbox {PC}_L\) curve, then by definition, it is inferior to \((\hat{r}_H, \hat{F}_H)\). Thus, no deviation is profitable, and a contract in the region that is specified in the Proposition can be supported as a separating equilibrium. \(\square \)

Proof of Lemma 2

The reason why \(\hbox {MC}_H\) is slack is clear: Since \(w(n,\varepsilon _{L}-r)< w(n,\varepsilon _{H}-r) \) for a given r, \(\hbox {PC}_H\) is more lenient than \(\hbox {PC}_L\). As argued in Proposition 2, \((\hat{r}_H, \hat{F}_H)\) is chosen such that \(\hbox {PC}_L\) is binding. Apparently, there must exist another contract that is also a separating equilibrium but gives the innovator a higher payoff—\(U_H(r_{H}^{**}, F_{H}^{**}) > U_H(\hat{r}_H, \hat{F}_H)\)—because the latter is the least that the H-type can obtain. Thus, \(\hbox {MC}_H\) is slack in the best separating equilibrium.

Next, we show that \(\hbox {IC}_{L}\) must be binding. Suppose that the H-type offers a contract \((r_H, F_H)\) that is the best separating contract while it makes \(\hbox {IC}_{L}\) slack. We separate two cases: First, suppose that \(\hbox {PC}_{H}\) is not binding either. Then the H-type can simply offer another contract with \((r_H, F^{\prime })\), where \(F^{\prime }=F_H+\delta \) with a small \(\delta >0\), which does not violate \(\hbox {IC}_{L}\) or \(\hbox {PC}_{H}\) but can make the innovator strictly better off. This contradicts the presumption that \((r_H, F_H)\) is the best separating contract.

Second, consider the situation where \(\hbox {PC}_{H}\) is binding. We first note that \(r_{H}^*<r_H\) must be the case. If \(r_{H}^* \ge r_H\) instead, it means that the complete-information contract \((r_{H}^*, F_{H}^*)\) itself can be supported as a separating equilibrium, because it lies in the region that is specified in Proposition 2, which has been ruled out by our Assumption 1. Then by substituting \(F_H=w(n,\varepsilon _{H}- r_H)\), the payoff function \(U_H(r_H)\) is strictly concave in \(r_H\) and reaches its maximum at the complete-information optimal contract \(r_{H}^*\).

Now consider another contract with \((r^{\prime }, F^{\prime })\), where \(r^{\prime }=r_H-\delta \) with a small \(\delta \). By the continuity of the payoff function \(U_L(r_H)\), \(\hbox {IC}_L \) is still satisfied under this contract. However, since \(r_{H}^* \le r_H -\delta < r_H\), we have \(U_{H}(r_H-\delta , w(n, \varepsilon _{H}-r_H+\delta ))>U_{H}(r_H, F_H)\), which means that there is a profitable deviation that makes the H-type strictly better off. This again contradicts the presumption that \((r_H, F_H)\) is the best equilibrium contract. Therefore, \(\hbox {IC}_L\) is always binding. \(\square \)

Proof of Proposition 3

According to the discussion in the context, the maximization problem for the H-type is:

With regard to the constraint, we note that the values of \(nr_H(\frac{ a-c+\varepsilon _{L}-r_H}{n+1})\) and \(n[r_H(\frac{a-c+\varepsilon _{L}-r_H}{ n+1})+w(n,\varepsilon _{H}-r_H)]\) are both quadratic and strictly concave functions of \(r_H\). Moreover, since \(w(n,\varepsilon _{H}-r_H)>0\) when \(r_H < \varepsilon _{H}\), and \(w(n,\varepsilon _{H}-r_H)=0\) when \(r_H=\varepsilon _{H}\), the latter is always larger than the former in the range \(r_H\in [0,\varepsilon _{H})\) and they are equal when \(r_H=\varepsilon _{H}\). It can also be easily checked that both functions attain their maximum values at some \(r_H < \varepsilon _H\) under Assumption 1. Then there are two cases to consider:

Case 1: If \(U_L^{*} \) is so high that there exists \(r_H < \varepsilon _{H}\) such that \(U_L^{*} =n[r_H(\frac{a-c+\varepsilon _{L}-r_H }{n+1})+w(n,\varepsilon _{H}-r_H)]\), then the solution \(r^{**}_H\) is the “larger root” of this equation: This \(r_{H}^{**}\) makes the constraint \(\hbox {PC}_H\) binding and \(r_{H}^{**}>r_{H}^*\), which is the intersection of the \(\hbox {PC}_{H}\) and LL curves in Figure 3a. In this case, the equilibrium contract for the H-type is two-part with \(F_{H}^{**}=w(n, \varepsilon _{H}-r_{H}^{**})> 0\). Note that this \(r_{H}^{**}\) is located at the decreasing stage of the deviation payoff function for the L-type, \(n[r_H(\frac{a-c +\varepsilon _{L}-r_H}{n+1})+w(n,\varepsilon _{H}-r_H)]=U_L(r_H, F_H)\), which means that \(\frac{\partial U_{L}(r_{H}^{**}, F_{H}^{**})}{\partial r_H}<0\). The reason is that, if instead \(\frac{\partial U_{L}(r_{H}^{**}, F_{H}^{**})}{\partial r_H} \ge 0\), by increasing \( r_H\), the payoff for the innovator will be higher, while the constraint in (30) will still be satisfied and slack on the RHS.

Case 2: If \(U_L^{*} \) is so low that there exists no \(r_H \in [0, \varepsilon _{H}]\) such that \(U_L^{*}=n[r_H (\frac{a-c+\varepsilon _{L}-r_H}{n+1})+w(n,\varepsilon _{H}-r_H)]\), then the solution is the root that satisfies \(U_L^{*} =nr_H(\frac{ a-c+\varepsilon _{L}-r_H}{n+1})\). That is, the optimal \(r^{**}_H\) makes the LHS of the constraint (30) binding. In this case, the equilibrium contract for the H-type is royalty-only—\(F_H^{**}=0\)—which is the intersection of the LL curve and r-axis in Fig. 3b. Note that this \(r_{H}^{**}\) is located at the increasing stage of the deviation payoff function for the L-type—\(n[r_H (\frac{a-c+\varepsilon _{L}-r_H}{n+1})]=U_L(r_H, 0)\)—which means that \(\frac{\partial U_{L}(r_{H}^{**}, 0)}{\partial r_H}>0\). The reason is that, if instead \( \frac{\partial U_{L}(r_{H}^{**}, F_{H}^{**})}{\partial r_H}< 0\), by increasing \(r_H\), the payoff for the innovator will be increased, while the constraint will still be satisfied and slack on the LHS of (30).

The next task is to find the condition that separates these two cases. First, since the larger root that satisfies \(U_L^{*} =n[r_H(\frac{ a-c+\varepsilon _{L}-r_H}{n+1})+w(n,\varepsilon _{H}-r_H)]\) is in the decreasing stage of the function on the RHS in (30), and \( w(n,\varepsilon _{H}-r_H)=0\) when \(r_H=\varepsilon _{H}\), then if

there exists an \(r_H < \varepsilon _{H}\) such that Case 1 will occur. On the other hand, if (31) does not hold, Case 2 will occur.

Second, we note that \(U _{L}(\varepsilon _{H},0) =\frac{n\varepsilon _{H}(a-c+\varepsilon _{L} -\varepsilon _{H})}{n+1}\) is linear in \(\varepsilon _{L}\), and when \(\varepsilon _{L}=0\), \(U_{L}(\varepsilon _{H},0) =\frac{n\varepsilon _{H}(a-c-\varepsilon _{H})}{n+1}>0\) under Assumption 1. On the other hand, according to (24), \(U_L^{*}\) is a quadratic and strictly concave function of \(\varepsilon _{L}\) with \( U_L^{*}(0)=0\).Footnote 23 Moreover, as \( \varepsilon _{L}\rightarrow \varepsilon _{H}\), the equilibrium payoff for the L-type is close to that for the H-type. Since \(U_{L}(\varepsilon _{H},0) |_{\varepsilon _{L} \rightarrow \varepsilon _{H}}\) is the payoff when a suboptimal royalty-only contract is used, while \(U_L^{*} (\varepsilon _{L})|_{\varepsilon _{L}\rightarrow \varepsilon _{H}}\) is the payoff when the optimal contract in Proposition 1 is chosen, we have \(U _{L}(\varepsilon _{H},0) < U_L^{*}(\varepsilon _{L})\) when \(\varepsilon _{L}\rightarrow \varepsilon _{H}\).

Based on the above reasoning, if we fix n and \(\varepsilon _{H}\), there then exists an \(\widehat{\varepsilon }_{L}\), such that when \(\varepsilon _{L} > \widehat{\varepsilon }_{L}\), \(U _{L} (\varepsilon _{H},0) < U_L^{*}\), in which case the equilibrium contract is two-part, and when \( \varepsilon _{L} \le \widehat{\varepsilon }_{L}\), \(U_{L}(\varepsilon _{H},0) \ge U_L^{*}\), in which case the equilibrium contract for the H-type is royalty-only.

Finally, the best separating equilibrium is the only separating equilibrium that can survive the Intuitive Criterion. Suppose that a contract \((r_H, F_H)\) constitutes a separating equilibrium that is, however, different from the best one—\((r_{H}^{**}, F_{H}^{**})\)—that was described in the Proposition. Then consider a deviation by the H-type—\((r^{\prime }, F^{\prime })\)—which is close to \((r_H, F_H)\). As we have shown, the equilibrium contract for the L-type—\((r_{L}^*, F_{L}^*)\)—is such that \(\hbox {IC}_L\) binds, which means that \(U_L(r_{L}^*, F_{L}^*)= U_L(r_{H}^{**}, F_{H}^{**})> U_L(r^{\prime }, F^{\prime })\). Thus, this deviation is never profitable for the L-type—it is equilibrium-dominated for the L-type but not for the H-type—and by applying the Intuitive Criterion, the downstream firms must believe that this deviation comes from the H-type. However, given this off-equilibrium belief, there exists a profitable deviation \((r^{\prime }, F^{\prime })\) such that \(U_H(r_H, F_H) < U_H(r^{\prime }, F^{\prime })\), unless \((r_H, F_H)\) is the best one among all the separating equilibrium contracts. Therefore, the only separating equilibrium that can survive the Intuitive Criterion is the best separating contract. \(\square \)

Proof of Proposition 4

We first show the relationship between the equilibrium payoff for the L-type \(U_L^{*}\) and n. According to (24),

By the envelope theorem, we have \(\frac{d U_L^{*}}{d n} =\frac{\partial U_L^{*}}{\partial n}\). Let \(\lambda =\varepsilon _L -r^{*}_L=\frac{ (n+1)\varepsilon _L +(n-1)(a-c)}{2(n^{2}-n+1)}\). Then we can show that for large n,

Moreover, when \(n\rightarrow \infty \), \(U _{L} (\varepsilon _{H},0)\rightarrow (a-c+\varepsilon _{L} -\varepsilon _{H})\varepsilon _{H}\), and \(U^{*}_L\rightarrow (a-c+\varepsilon _{L}-\varepsilon _{L})\varepsilon _{L}\) since \(r_{L}^*\rightarrow \varepsilon _{L}.\) Thus, \(U _{L} (\varepsilon _{H},0) > U^{*}_{L}\) since \((a-c +\varepsilon _{L}-\varepsilon _{H})\varepsilon _{H}-(a-c +\varepsilon _{L}-\varepsilon _{L})\varepsilon _{L}=(a-c -\varepsilon _{H})(\varepsilon _{H}-\varepsilon _{L})>0.\)

Since \(U _{L}(\varepsilon _{H},0)\) increases in n and \(U^{*}_L\) decreases in n for large n, and \(U_{L} (\varepsilon _{H},0)> U_L^{*}\) as \(n\rightarrow \infty \), there must exist an \(\widehat{n}\) such that \(U _{L}(\varepsilon _{H},0) > U^{*}_L\) for \(n > \widehat{n}\), in which case the equilibrium contract is royalty-only. On the other hand, when \(n < \widehat{n}\), \(U_{L}(\varepsilon _{H},0) > U^{*}_L\) can occur, in which case the equilibrium contract is two-part. \(\square \)

Rights and permissions

About this article

Cite this article

Wu, CT., Peng, CH. & Tsai, TS. Signaling in Technology Licensing with a Downstream Oligopoly. Rev Ind Organ 58, 531–559 (2021). https://doi.org/10.1007/s11151-020-09788-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-020-09788-6