Abstract

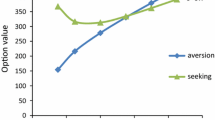

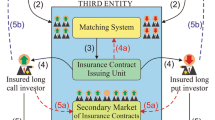

Closed-form solutions are derived and interpreted for European options, with stochastic strike prices, that maintain constant elasticity of the strike with respect to the price of the underlying asset. We refer to such options as CUES. CUES preserve the relative shares of exercise price risk for both the buyer and writer of the option, regardless of whether the price of the underlying asset moves up or down. The relevance of the CUES concept is established through applications in two distinct fields. First, it is established that CUES-like options are embedded in private equity investments. This concept is then used in a novel application to determine the equity share of a private company corresponding to a given level of investment. Secondly, the advantages that CUES would provide over traditional executive stock option grants are considered and it is shown that CUES can provide enhanced incentive-alignment without increasing options expense to the company.

Similar content being viewed by others

References

Bakshi, G., P. Carr, and L. Wu. (2005). “Stochastic Risk Premiums, Stochastic Skewness in Currency Options, and Stochastic Discount Factors in International Economies,” Working Paper, University of Maryland.

Bakshi, G. and D. Madan. (2000). “Spanning and Derivative-Security Valuation,” Journal of Financial Economics 55, 205–238.

Blenman, L.P. and S.P. Clark. (2005). “Power Exchange Options,” Finance Research Letters 2, 97–106.

Carr, P., H. Geman, D. Madan, and M. Yor. (2002). “The Fine Structure of Asset Returns: An Empirical Investigation,” Journal of Business 75(2), 305–332.

Chan, T. (1999). “Pricing Contingent Claims on Stocks Driven by [l]evy processes,” Annals of Applied Probability 9(2), 504–528.

Damodaran, A. (2002). Investment Valuation, 2nd ed. John-Wiley and Sons.

Esser, A. (2003). “General Valuation Principles for Arbitrary Payoffs and Application to Power Options under Stochastic Volatility,” Financial Markets and Portfolio Management 17(3), 351–372.

Fischer, S. (1978). “Call Option Pricing when the Exercise Price is Uncertain, and the Valuation of Index Bonds,” Journal of Finance 33(1), 169–176.

Gu, A.Y. (2002). “Valuing the Option to Purchase an Asset at a Proportional Discount,” Journal of Financial Research 25, 99–109.

Hall, B.J. and K.J. Murphy. (2000). “Optimal Exercise Prices for Executive Stock Options,” American Economic Review, 209–214.

Heston, S. (1993). “A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options,” Review of Financial Studies 6(2), 327–343.

Hull, J. and A. White. (1987). “The Pricing of Options on Assets with Stochastic Volatilities,” Journal of Finance 42(2), 281–300.

Karatzas, I. and S.E. Shreve. (1998). Methods of Mathematical Finance. Springer-Verlag.

Kou, S.G. (2002). “A Jump-Diffusion Model for Option Pricing,” Management Science 48(8), 1086–1101.

Lee, I., S. Lochhead, J. Ritter, and Q. Zhao. (1996). “The Costs of Raising Capital,” Journal of Financial Research 19, 59–74.

Madan, D.B. and F. Milne. (1991). “Option Pricing with v. g. Martingale Components,” Mathematical Finance 1(4), 39–55.

Madan, D.B. and E. Seneta. (1990). “The Variance Gamma ([vg]) Model for Share Market Returns,” Journal of Business 63, 511–524.

Margrabe, W. (1978). “The Value of an Option to Exchange one Asset for Another,” Journal of Finance 33(1), 177–186.

Merton, R.C. (1976). “Option Pricing when Underlying Stock Returns are Discontinuous,” Journal of Financial Economics 3(1), 125–144.

Ogden, J.P., F.C. Jen, and P.F. O'Connor. (2003). Advanced Corporate Finance. Pearson Education.

Ross, S.A. (2004). “Compensation, Incentives, and the Duality of Risk Aversion and Riskiness,” Journal of Finance 61(1), 207–225.

Slee, R.T. (2004). Private Capital Markets. John-Wiley and Sons.

Zhang, P.G. (1997). Exotic Options: A Guide to the Second Generation Options. Worldwide Scientific.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification: G130

Rights and permissions

About this article

Cite this article

Blenman, L.P., Clark, S.P. Options with Constant Underlying Elasticity in Strikes. Rev Deriv Res 8, 67–83 (2005). https://doi.org/10.1007/s11147-005-3850-z

Issue Date:

DOI: https://doi.org/10.1007/s11147-005-3850-z