Abstract

Hedonic regression and repeat sales are commonly used methods in real estate analysis. While the merits of combining these models when constructing house price indices are well documented, research on the utility of adopting the same approach for residential property valuation has not been conducted to date. Specifically, house value estimates were obtained by combining predictions from repeat sales and various hedonic regression specifications, which were enhanced to account for spatial effects. Three of these enhancements—regression kriging, mixed regressive-spatial autoregressive, and geographically weighted regression—are widely utilized spatial econometric models. However, a fourth augmentation, which addresses systematic residual patterns in regressions with district indicator variables and the presence of outliers in housing data, was also proposed. The resulting models were applied to a dataset containing 16,417 real estate transactions in Oslo, Norway, revealing that when the repeat sales approach is included, it reduces the median absolute percentage error of solely hedonic models by 6.8–9.5%, where greater improvements are associated with less accurate spatial enhancements. These improvements can be attributed to the inclusion of both spatial and non-spatial information inherent in previous sales prices. While the former has limited utility for well-specified spatial models, the non-spatial information that is implicit in previous sales prices likely captures otherwise difficult to observe phenomena, potentially making its contribution highly valuable in automated valuation models.

Similar content being viewed by others

Notes

Extensive literature review has failed to uncover any publicly available research on this topic. However, some companies advertise automated valuation based on both models, e.g., Home Value Explorer® by FreddieMac (2017).

FINN covers approximately 70% of the Norwegian housing market (Norge et al. 2017). All properties in the dataset employed in the current investigation were announced on the site.

In Norway, cooperatives and apartment buildings can take on common debt, for example, to renovate the building. Especially for cooperatives, the common debt can be high compared with the transaction price of an apartment. The total price of a dwelling in Norway is the transaction price, plus the dwellings share of the total common debt.

The term simple kriging is used when the mean of the dependent variable is assumed to be known a priori (Cressie 1990).

Either administrative or generated by k-means, depending on the variable type required in the regression.

By testing different weighting and combinations we found no single optimal solution for multiple performance metrics, resulting in our choice of a “trail-and-error” based weight of 60% for the regression estimate that resulted on both high prediction and low volatility across multiple runs.

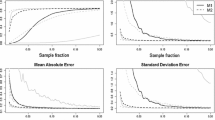

Generally, model performance is measured by median absolute percentage error (Q0.5).

Row 13 in Figure 4 shows unsatisfactory performance by VRT where district variables are omitted.

References

Amundsen, B. (2015). Rike og fattige flytter fra hverandre i Oslo [Rich and poor moving apart from each other in Oslo]. Forskning.no, Available at: https://forskning.no/samfunnsgeografi/2015/06/rike-og-fattige-flytter-fra-hverandre-i-oslo (accessed: 11 December 2017).

Anon. (2013). OECD, Eurostat, International Labour Organization, International Monetary Fund, The World Bank, and United Nations Economic Commission for Europe. Repeat sales methods. Handbook on Residential Property Prices Indices (RPPIs), OECD publishing, Paris, 67–72.

Anselin, L. (2010). Thirty years of spatial econometrics. Papers in Regional Science, 89(1), 3–25.

Bailey, M. J., Muth, R. F., & Nourse, H. O. (1963). A regression method for real estate price index construction. Journal of the American Statistical Association, 58(304), 933–942.

Basu, S., & Thibodeau, T. G. (1998). Analysis of spatial autocorrelation in house prices. The Journal of Real Estate Finance and Economics, 17(1), 61–85.

Bates, J. M., & Granger, C. W. (1969). The combination of forecasts. Journal of the Operational Research Society, 20(4), 451–468.

Bohling, G. (2005). Kriging. Data Analysis in Engineering and Natural Science, Kansas Geological Survey. Available at: http://people.ku.edu/~gbohling/cpe940/Kriging.pdf (accessed: 8 June 2018).

Bowen, W. M., Mikelbank, B. A., & Prestegaard, D. M. (2001). Theoretical and empirical considerations regarding space in hedonic housing price model applications. Growth and Change, 32(4), 466–490.

Can, A. (1992). Specification and estimation of hedonic housing price models. Regional Science and Urban Economics, 22(3), 453–474.

Can, A., & Megbolugbe, I. (1997). Spatial dependence and house price index construction. The Journal of Real Estate Finance and Economics, 14(1–2), 203–222.

Case, B., & Quigley, J. M. (1991). The dynamics of real estate prices. The Review of Economics and Statistics, 73(1), 50–58.

Case, K. E., & Shiller, R. J. (1987). Prices of single-family homes since 1970: New indexes for four cities. In NBER working paper series 2393. National Bureau of Economic: Research. https://doi.org/10.3386/w2393.

Case, B., Pollakowski, H. O., & Wachter, S. M. (1991). On choosing among house price index methodologies. Real Estate Economics, 19(3), 286–307.

Case, B., Clapp, J., Dubin, R., & Rodriguez, M. (2004). Modeling spatial and temporal house price patterns: A comparison of four models. The Journal of Real Estate Finance and Economics, 29(2), 167–191.

Chan, Y. L., Stock, J. H., & Watson, M. W. (1999). A dynamic factor model framework for forecast combination. Spanish Economic Review, 1(2), 91–121.

Clapp, J. M., Giaccotto, C., & Tirtiroglu, D. (1991). Housing price indices based on all transactions compared to repeat subsamples. Real Estate Economics, 19(3), 270–285.

Clemen, R. T. (1989). Combining forecasts: A review and annotated bibliography. International Journal of Forecasting, 5(4), 559–583.

Cleveland, W. S. (1979). Robust locally weighted regression and smoothing scatterplots. Journal of the American Statistical Association, 74(368), 829–836.

Cliff, A. D., & Ord, K. (1970). Spatial autocorrelation: A review of existing and new measures with applications. Economic Geography, 46, 269–292.

Corcoran, C., & Liu, F. (2014). Accuracy of Zillow’s home value estimates. Real Estate Issues, 39(1), 45–49.

Cressie, N. (1990). The origins of kriging. Mathematical Geology, 22(3), 239–252.

Dubin, R. A. (1988). Estimation of regression coefficients in the presence of spatially autocorrelated error terms. The Review of Economics and Statistics, 70(3), 466–474.

Dubin, R. A. (1998). Spatial autocorrelation: a primer. Journal of Housing Economics, 7(4), 304–327.

Eurostat. (2016). Distribution of population by tenure status, type of household and income group − EU-SILC survey. Available at: http://appsso.eurostat.ec.europa.eu/nui/show.do?datasetÆilc_lvho02&langÆen (accessed: 20 May 2018).

Farber, S., & Yeates, M. (2006). A comparison of localized regression models in a hedonic house price context. Canadian Journal of Regional Science, 29(3), 405–420.

Fik, T. J., Ling, D. C., & Mulligan, G. F. (2003). Modeling spatial variation in housing prices: A variable interaction approach. Real Estate Economics, 31(4), 623–646.

Fotheringham, A. S. (2009). Geographically weighted regression. In S. Fotheringham & P. Rogerson (Eds.), The SAGE handbook of spatial analysis, 243–254. London: SAGE Publications Ltd.

Fotheringham, A. S., Brunsdon, C., & Charlton, M. (2002). Geographically weighted regression: The analysis of spatially varying relationships. New York: Wiley.

FreddieMac. (2017). Home Value Explorer. Available at: http://www.freddiemac.com/hve/hve.html (accessed: 5 December 2017).

Geary, R. C. (1954). The contiguity ratio and statistical mapping. The Incorporated Statistician, 5(3), 115–146.

Gelfand, A. E., Ghosh, S. K., Knight, J. R., & Sirmans, C. F. (1998). Spatio-temporal modeling of residential sales data. Journal of Business & Economic Statistics, 16(3), 312–321.

Goovaerts, P. (1999). Using elevation to aid the geostatistical mapping of rainfall erosivity. Catena, 34(3–4), 227–242.

de Haan, J. & E. Diewert (2013), "Hedonic Regression Methods”. Handbook on Residential Property Price Indices, OECD Publishing, Paris, https://doi.org/10.1787/9789264197183-7-en.

Harris, P., Fotheringham, A., Crespo, R., & Charlton, M. (2010). The use of geographically weighted regression for spatial prediction: An evaluation of models using simulated data sets. Mathematical Geosciences, 42(6), 657–680.

Harris, P., Brunsdon, C., & Fotheringham, A. S. (2011). Links, comparisons and extensions of the geographically weighted regression model when used as a spatial predictor. Stochastic Environmental Research and Risk Assessment, 25(2), 123–138.

Helbich, M., Brunauer, W., Hagenauer, J., & Leitner, M. (2013). Data-driven regionalization of housing markets. Annals of the Association of American Geographers, 103(4), 871–889.

Hengl, T., Heuvelink, G. B. M., & Stein, A. (2003). Comparison of kriging with external drift and regression kriging. Technical note, ITC. Available at: https://webapps.itc.utwente.nl/librarywww/papers_2003/misca/hengl_comparison.pdf (accessed: 11 May 2018).

Hengl, T., Heuvelink, G. B. M., & Rossiter, D. G. (2007). About regression-kriging: From equations to case studies. Computers & Geosciences, 33(10), 1301–1315.

Humberset, K. (2018). Her må du punge ut 85.000 kroner for én kvadratmeter [Here you have to pay 85,000 NOK for one square meter]. aftenposten.no. Available at: https://www.aftenposten.no/bolig/Her-ma-du-punge-ut-85000-kroner-for-n-kvadratmeter-10982b.html (accessed: 4 June 2018).

Kitanidis, P. K. (1993). Generalized covariance functions in estimation. Mathematical Geology, 25(5), 525–540.

Koenker, R., & Bassett, G., Jr. (1978). Regression quantiles. Econometrica: Journal of the Econometric Society, 46(1), 33–50.

Krause, A. L., & Bitter, C. (2012). Spatial econometrics, land values and sustainability: Trends in real estate valuation research. Cities, 29, S19–S25.

LeSage, J. P., & Pace, R. K. (2014). The biggest myth in spatial econometrics. Econometrics, 2(4), 217–249.

Levin, J. (2001). Information and the market for lemons. RAND Journal of Economics, 32(4), 657–666.

Monsrud, I. J. & Takle, M. (2018). Price index for existing dwellings. Statistics Norway. Available at: https://www.ssb.no/en/priser-og-prisindekser/statistikker/bpi (accessed: 7 June 2018).

Moran, P. A. (1950). A test for the serial independence of residuals. Biometrika, 37(1/2), 178–181.

Eiendom Norge, Eiendomsverdi & FINN.no. (2017). Eiendom Norges boligprisstatistikk [Real Estate Norway housing price statistics]. Available at: http://eiendomnorge.no/wpcontent/uploads/2017/11/Boligstatistikk_oktober_01.pdf (accessed: 4 December 2017).

Odeh, I. O. A., McBratney, A. B., & Chittleborough, D. J. (1995). Further results on prediction of soil properties from terrain attributes: Heterotopic kriging and regression kriging. Geoderma, 67(3–4), 215–226.

Olaussen, J. O., Oust, A., & Solstad, J. T. (2017). Energy performance certificates–informing the informed or the indifferent? Energy Policy, 111, 246–254.

Oslo Kommune. (2018). Finn bydelen din her [Find your city district here]. Available at: https://www.oslo.kommune.no/politikk-og-administrasjon/bydeler/bydelsvelger/ (accessed: 13 May 2018).

Pace, R. K., Barry, R., Gilley, O. W., & Sirmans, C. F. (2000). A method for spatial–temporal forecasting with an application to real estate prices. International Journal of Forecasting, 16(2), 229–246.

Páez, A., Long, F., & Farber, S. (2008). Moving window approaches for hedonic price estimation: An empirical comparison of modelling techniques. Urban Studies, 45(8), 1565–1581.

Park, B., & Bae, J. K. (2015). Using machine learning algorithms for housing price prediction: The case of Fairfax County, Virginia housing data. Expert Systems with Applications, 42(6), 2928–2934.

Reichert, A. K. (1990). The impact of interest rates, income, and employment upon regional housing prices. The Journal of Real Estate Finance and Economics, 3(4), 373–391.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Sinnott, R. W. (1984). Virtues of the haversine. Sky and Telescope, 68(2), 159.

Trawiński, B., Lasota, T., Kempa, O., Telec, Z., & Kutrzyński, M. (2017). Comparison of ensemble learning models with expert algorithms designed for a property valuation system. In N. Nguyen, G. Papadopoulos, P. Jędrzejowicz, B. Trawiński, & G. Vossen (Eds.), Computational collective intelligence, ICCCI 2017, lecture notes in computer science, vol 10448. Cham: Springer.

Wheeler, D. C., & Calder, C. A. (2007). An assessment of coefficient accuracy in linear regression models with spatially varying coefficients. Journal of Geographical Systems, 9(2), 145–166.

Yao, J., & Fotheringham, A. S. (2016). Local spatiotemporal modeling of house prices: A mixed model approach. The Professional Geographer, 68(2), 189–201.

Yoo, S.-H. (2001). A robust estimation of hedonic price models: Least absolute deviations estimation. Applied Economics Letters, 8(1), 55–58.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

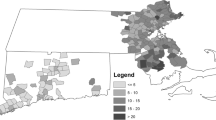

Out-of-sample residuals from the hedonic regression without spatial enhancements or district indicators (referred to in Section 5 as the benchmark model) depicted on the map of Oslo. Lines represent administrative district boundaries, while marker color indicates residual value for each dwelling. Observations: 3284

Rights and permissions

About this article

Cite this article

Oust, A., Hansen, S.N. & Pettrem, T.R. Combining Property Price Predictions from Repeat Sales and Spatially Enhanced Hedonic Regressions. J Real Estate Finan Econ 61, 183–207 (2020). https://doi.org/10.1007/s11146-019-09723-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-019-09723-x