Abstract

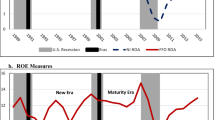

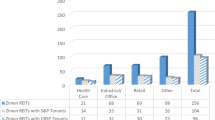

Relations between Real Estate Investment Trust (REIT) efficiency and operational performance, risk, and stock return are examined. REIT-level operational efficiency is measured as the ratio of operational expenses to revenue, where a higher operational efficiency ratio (OER) indicates a less efficient REIT. For a sample of U.S. equity REITs from the modern REIT era, operational performance, measured by return on assets (ROA) as well as return on equity (ROE), is negatively associated with previous-year operational efficiency ratios, which suggests that more efficient REITs generate better operating results. Results further show that more efficient REITs have lower levels of credit risk and total risk. Perhaps most important, empirical evidence shows that the cross-sectional stock return of REITs is partially explained by operational efficiency and that a portfolio consisting of highly efficient REITs earns, on average, a higher cumulative stock return than a portfolio consisting of low efficiency REITs.

Similar content being viewed by others

Notes

The measure is adjusted to reflect those costs that are directly associated with asset operations and management. The adjustment is made for expenses that are passed through to tenants. Not all property expenses are reimbursed so we also control for property type, which is the primary determinant of reimbursements.

We recognize there still exists a potential endogeneity issue between operational efficiency and firm performance and there may be possible unobserved heterogeneity that determines the observed relation between operational efficiency and firm performance. As this is one of the first papers on the topic, it is likely that more research needs to be done to refine all potential conclusions.

Theoretically, a reverse causality issue for REIT risk, especially stock return volatility, stock return and REIT operational efficiency should not exist. The empirical results that REIT operational efficiency has a negative (positive) relation with one period ahead firm risk (stock return) can provide reliable casual inference. It is not likely that the lower risk and/or higher return causes higher operational efficiency.

The sample period starts in 1995 because the property level data are used to calculate geographic diversification and property type diversification are only available from 1995. For robustness, we extend the sample to a longer period and find quantitatively similar empirical results, while not controlling for diversification. We also only address publicly traded REITs as Seguin (2016), Soyeh and Wiley (2018) and others argue that these firms are sufficiently different to warrant segmentation.

All revenue including nonrecurring. Revenue is net of interest expenses for banks, thrifts, lenders, FHLBs, investment companies, asset managers and broker-dealers, as defined by SNL.

Expenses reimbursed from tenants for common area maintenance and improvements, including operating expenses such as real estate taxes, insurance, and utilities, as defined by SNL.

When REIT accounting information is not available in one period, but is available for the pervious and subsequent periods, it is replaced by the estimation calculated from the characteristics in previous and subsequent periods using the formula: \( {Value}_{i,t}^x=\left({Value}_{i,t+1}^x+{Value}_{i,t-1}^x\right)/2 \). Where \( {Value}_{i,t}^x \) is the value of x (TA, TE, etc.) of REIT i in year t.

Kenneth R. French’s Data Library: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

These are common performance metrics for REITs.

When the IPO date is not available, we use the year a REIT status is established instead.

We recognize that REIT operational efficiency may also be an endogenous outcome of managerial decisions and other factors. For instance, ownership structure, corporate governance, investments in a growing market just by chance.

References

Adrian, T., & Shin, H. S. (2010). Liquidity and leverage. Journal of Financial Intermediation, 19(3), 418–437. https://doi.org/10.1016/j.jfi.2008.12.002

Allen, L., & Rai, A. (1996). Operational efficiency in banking: An international comparison. Journal of Banking and Finance, 20(4), 655–672. https://doi.org/10.1016/0378-4266(95)00026-7

Allen, P. R., & Sirmans, C. F. (1987). An analysis of gains to acquiring firm's shareholders: The special case of REITs. Journal of Financial Economics, 18(1), 175–184. https://doi.org/10.1016/0304-405X(87)90067-5

Allen, M. T., Madura, J., & Springer, T. M. (2000). REIT characteristics and the sensitivity of REIT returns. Journal of Real Estate Finance and Economics, 21(2), 141–152. https://doi.org/10.1023/A:1007839809578

Ambrose, B. W., Ehrlich, S. R., Hughes, W. T., & Wachter, S. M. (2000). REIT economies of scale: Fact or fiction? Journal of Real Estate Finance and Economics, 20(2), 211–224. https://doi.org/10.1023/A:1007881422383

Ambrose, B. W., Highfield, M. J., & Linneman, P. D. (2005). Real estate and economies of scale: The case of REITs. Real Estate Economics, 33(2), 323–350.

Anderson, R., Fok, R., Zumpano, L., & Elder, H. (1998). Measuring the efficiency of residential real estate brokerage firms. Journal of Real Estate Research, 16(2), 139–158.

Anderson, R., Lewis, D., & Springer, T. (2000). Operating efficiencies in real estate: A critical review of the literature. Journal of Real Estate Literature, 8(1), 1–18.

Anderson, R. I., Fok, R., Springer, T., & Webb, J. (2002). Technical efficiency and economies of scale: A non-parametric analysis of REIT operating efficiency. European Journal of Operational Research, 139(3), 598–612. https://doi.org/10.1016/S0377-2217(01)00183-7

Ang, J. S., Cole, R. A., & Lin, J. W. (2000). Agency costs and ownership structure. Journal of Finance, 55(1), 81–106. https://doi.org/10.1111/0022-1082.00201

Baker, H. K., & Chinloy, P. (Eds.). (2014). Public real estate markets and investments. USA: Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199993277.001.0001

Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross-section of stock return. Journal of Finance, 61(4), 1645–1680. https://doi.org/10.1111/j.1540-6261.2006.00885.x

Bauer, R., Eichholtz, P., & Kok, N. (2010). Corporate governance and performance: The REIT effect. Real Estate Economics, 38(1), 1–29. https://doi.org/10.1111/j.1540-6229.2009.00252.x

Berger, A. N., Hancock, D., & Humphrey, D. B. (1993a). Bank efficiency derived from the profit function. Journal of Banking and Finance, 17(2), 317–347. https://doi.org/10.1016/0378-4266(93)90035-C

Berger, A. N., Hunter, W. C., & Timme, S. G. (1993b). The efficiency of financial institutions: A review and preview of research past, present and future. Journal of Banking and Finance, 17(2), 221–249. https://doi.org/10.1016/0378-4266(93)90030-H

Bers, M., & Springer, T. (1997). Economies-of-scale for real estate investment trusts. Journal of Real Estate Research, 14(3), 275–290.

Bers, M., & Springer, T. M. (1998a). Sources of scale economies for REITs. Real Estate Finance, 14(4), 47–56.

Bers, M., & Springer, T. M. (1998b). Differences in scale economies among real estate investment trusts: More evidence. Real Estate Finance, 15(1), 37–44.

Bianco, C., Ghosh, C., & Sirmans, C. F. (2007). Corporate governance and firm performance - evidence from REITs. Journal of Portfolio Management, 33(5), 175–191. https://doi.org/10.3905/jpm.2007.699613

Bikker, J. A., & Haaf, K. (2002). Competition, concentration and their relationship: An empirical analysis of the banking industry. Journal of Banking and Finance, 26(11), 2191–2214. https://doi.org/10.1016/S0378-4266(02)00205-4

Bonin, J. P., Hasan, I., & Wachtel, P. (2005). Bank performance, efficiency and ownership in transition countries. Journal of Banking and Finance, 29(1), 31–53. https://doi.org/10.1016/j.jbankfin.2004.06.015

Brounen, D., & de Koning, S. (2013). 50 years of real estate investment trusts: An international examination of the rise and performance of REITs. Journal of Real Estate Literature, 20(2), 197–223.

Campa, J. M., & Kedia, S. (2002). Explaining the diversification discount. Journal of Finance, 57(4), 1731–1762. https://doi.org/10.1111/1540-6261.00476

Capozza, D. R., & Seguin, P. J. (1999). Focus, transparency and value: The REIT evidence. Real Estate Economics, 27(4), 587–619. https://doi.org/10.1111/1540-6229.00785

Carhart, M. M. (1997). On persistence in mutual fund performance. Journal of Finance, 52(1), 57–82. https://doi.org/10.1111/j.1540-6261.1997.tb03808.x

Chung, R., Fung, S., & Hung, S. Y. K. (2012). Institutional investors and firm efficiency of real estate investment trusts. Journal of Real Estate Finance and Economics, 45(1), 171–211. https://doi.org/10.1007/s11146-010-9253-4

Cronqvist, H., Högfeldt, P., & Nilsson, M. (2001). Why agency costs explain diversification discounts. Real Estate Economics, 29(1), 85–126. https://doi.org/10.1111/1080-8620.00004

Danielsen, B., & Harrison, D. (2007). The impact of property type diversification on REIT liquidity. Journal of Real Estate Portfolio Management, 13(4), 329–344.

Demsetz, R. S., & Strahan, P. E. (1997). Diversification, size, and risk at bank holding companies. Journal of Money, Credit and Banking, 29(3), 300–313. https://doi.org/10.2307/2953695

Devaney, M., & Weber, W. L. (2005). Efficiency, scale economies, and the risk/return performance of real estate investment trusts. Journal of Real Estate Finance and Economics, 31(3), 301–317. https://doi.org/10.1007/s11146-005-2791-5

Elayan, F., Meyer, T., & Li, J. (2006). Evidence from tax-exempt firms on motives for participating in sale-leaseback agreements. Journal of Real Estate Research, 28(4), 381–410.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56. https://doi.org/10.1016/0304-405X(93)90023-5

Fama, E. F., & French, K. R. (2002). Testing trade-off and pecking order predictions about dividends and debt. Review of Financial Studies, 15(1), 1–33. https://doi.org/10.1093/rfs/15.1.1

Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1–22. https://doi.org/10.1016/j.jfineco.2014.10.010

Giacomini, E., Ling, D. C., & Naranjo, A. (2017). REIT leverage and return performance: Keep your eye on the target. Real Estate Economics, 45(4), 930–978. https://doi.org/10.1111/1540-6229.12179

Gyourko, J., & Nelling, E. (1998). The predictability of equity REIT returns. Journal of Real Estate Research, 16(3), 251–269.

Hardin III, W. G., Nagel, G., Roskelley, K. D., & Seagraves, P. A. (2017). Motivated institutional monitoring and firm performance. Journal of Real Estate Research, 39(3), 401–439.

Hartzell, J. C., Sun, L., & Titman, S. (2014). Institutional investors as monitors of corporate diversification decisions: Evidence from real estate investment trusts. Journal of Corporate Finance, 25, 61–72. https://doi.org/10.1016/j.jcorpfin.2013.10.006

Jacewitz, S., & Kupiec, P. (2012). Community bank efficiency and economies of scale. FDIC Special Study.

Kuhle, J., Walther, C., & Wurtzebach, C. (1986). The financial performance of real estate investment trusts. Journal of Real Estate Research, 1(1), 67–75.

Lang, L. H., & Stulz, R. M. (1994). Tobin's q, corporate diversification, and firm performance. Journal of Political Economy, 102(6), 1248–1280.

Lewis, D., Springer, T. M., & Anderson, R. I. (2003). The cost efficiency of real estate investment trusts: An analysis with a Bayesian stochastic frontier model. Journal of Real Estate Finance and Economics, 26(1), 65–80. https://doi.org/10.1023/A:1021522231824

Ling, D. C., Ooi, J. T., & Xu, R. (2016). Asset growth and stock performance: Evidence from REITs. Real Estate Economics. https://doi.org/10.1111/1540-6229.12186

Linneman, P. (1997). Forces changing the real estate industry forever. Wharton Real Estate Review, 1(1), 1–12.

McIntosh, W., Liang, Y., & Tompkins, D. (1991). An examination of the small-firm effect within the REIT industry. Journal of Real Estate Research, 6(1), 9–17.

McIntosh, W., Ott, S. H., & Liang, Y. (1995). The wealth effects of real estate transactions: The case of REITs. The Journal of Real Estate Finance and Economics, 10(3), 299–307. https://doi.org/10.1007/BF01096944

Morri, G., & Beretta, C. (2008). The capital structure determinants of REITs. Is it a peculiar industry? Journal of European Real Estate Research, 1(1), 6–57. https://doi.org/10.1108/17539260810891488

Mueller, G. (1998). REIT size and earnings growth: Is bigger better, or a new challenge? Journal of Real Estate Portfolio Management, 4(2), 149–157.

Norman, E., Sirmans, S., & Benjamin, J. (1995). The historical environment of real estate returns. Journal of Real Estate Portfolio Management, 1(1), 1–24.

Rajan, R. G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. Journal of Finance, 50(5), 1421–1460. https://doi.org/10.1111/j.1540-6261.1995.tb05184.x

Ro, S., & Ziobrowski, A. J. (2011). Does focus really matter? Specialized vs. diversified REITs. Journal of Real Estate Finance and Economics, 42(1), 68–83. https://doi.org/10.1007/s11146-009-9189-8

Seguin, P. J. (2016). The relative value of public non-listed REITs. Journal of Real Estate Research, 38(1), 59–91.

Soyeh, K., & Wiley, J. (2018). Liquidity management at REITs: Listed & public non-traded. Journal of Real Estate Research, forthcoming.

Tien, S., & Sze, L. (2003). The role of Singapore REITs in a downside risk asset allocation framework. Journal of Real Estate Portfolio Management, 9(3), 219–235.

Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. The Journal of Finance, 43(1), 1–19. https://doi.org/10.1111/j.1540-6261.1988.tb02585.x

Tom, G., & Austin, J. (1996). Risk and real estate investment: An international perspective. Journal of Real Estate Research, 11(2), 117–130.

Vogel, J. H. (1997). Why the new conventional wisdom about REITs is wrong. Real Estate Finance, 14, 7–12.

Zardkoohi, A., & Kolari, J. (1994). Branch office economies of scale and scope: Evidence from savings banks in Finland. Journal of Banking and Finance, 18(3), 421–432. https://doi.org/10.1016/0378-4266(94)90001-9

Acknowledgements

We thank an anonymous referee and C. F. Sirmans (Editor). Their insightful comments contributed to a much-improved paper. We are also grateful for helpful comments from seminar participants at the 2017 ARES annual meeting in San Diego and 2017 ERES annual conference in Delft. All errors remain those of the authors.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This table presents the definition of variables used in the paper.

Rights and permissions

About this article

Cite this article

Beracha, E., Feng, Z. & Hardin, W.G. REIT Operational Efficiency: Performance, Risk, and Return. J Real Estate Finan Econ 58, 408–437 (2019). https://doi.org/10.1007/s11146-018-9655-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-018-9655-2