Abstract

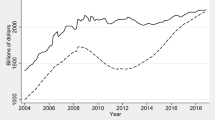

This paper examines the contrasting influence of portfolio lending and securitization in the resolution of distressed commercial real estate. The empirical analysis utilizes a large and unique data set of distressed commercial mortgages. The data set is constructed based on the recent financial crisis and includes portfolio and securitized loans. The main hypotheses address the marginal impact of portfolio versus securitized loans on the likelihood of resolution, resolution outcome, time to resolution and capital recovery rates. Conditional on a loan becoming troubled, we find that distressed commercial real estate loans held in a portfolio are more likely to be resolved and experience higher foreclosure rates compared to those that are securitized. Furthermore, portfolio loans experience shorter time to resolution and higher capital recovery rates when resolution is relatively swift. Our study is intended to contribute to the growing literature on distressed asset resolution and to provide new perspectives on how different lending options impact the financial resolution and workout process in a distressed commercial mortgage market.

Similar content being viewed by others

Notes

We gratefully acknowledge Real Capital Analytics (RCA) for assisting us with the data.

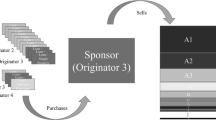

In August 2010, Goldman Sachs, Citigroup and Starwood joined together to issue the $788.5 million GS Mortgage Securities Trust 2010-C1 (“GSMST Transaction”). The GSMST Transaction was really the first deal in the U.S. to implement significant changes into the standard CMBS transaction. Although the term of CMBS 2.0 had been used for some time before, the GSMST Transaction is considered the first U.S. CMBS transaction to implement CMBS 2.0. All loans in our sample were originated before 2009 and hence, all fall into the category of CMBS 1.0.

We start with 11340 commercial mortgages that become troubled at some point during the sample period. After deleting observations where we cannot identify the lender and do not have loan or property characteristics data at origination, we have 4054 observations in the final sample.

Mortgages can be securitized at a later data after origination. We don’t have data to identify such . However, Ghent and Valkanov (2013) finds that less than 3 % of non-conduit originations in the CMBSs, after merging the RCA data with TREPP loan data. An, Deng and Gabriel (2011) also shows that the majority of commercial real estate loans are securitized at origination or not at all. Given the rarity of portfolio loans being securitized at a date after origination in practice, we expect that our main conclusion remains.

The potentially troubled situations include tenant bankruptcies, owners financially troubled, mezzanine takeover, slow lease-up, etc.

Maturity default refers to the loans that are known to be past maturity but a new financing arrangement is unknown.

It is unclear how RCA records those loans that became current. In our sample, the distressed loans are either resolved or remain troubled.

RCA classifies the distress status into four major groups – Troubled, Restructured/Extension and Resolved. Troubled includes foreclosures, borrower bankruptcy and Lender REO. Restructured is the status where the ownership or debt terms of the mortgage have changed but a long term solution to the cause of distress may not have been reached. Resolved is the status where properties have moved out of distress via refinancing or through a sale to a financially stable third party. However, their classification is rather broad. Hence, we reclassify the resolution outcome based on RCA data and descriptions of each troubled event. In addition, RCA troubled asset data does not include loans that return to “current” status. We also do not have sufficient information to identify whether loans re-default.

RCA provides the estimate of total outstanding balance at the start of distressed cycle. In our sample, there are 28 development loans that have increasing balances over time. Their outstanding balances are higher than the loan amounts at origination. We also use the loan amount at origination as a proxy for distressed size. In various sensitive and robustness checks, the main conclusions remain.

The inverse Mills ratio is defined as f(x′β)/F(x′β) if a loan is securitized and − f(−x′β)/F(−x′β) if a loan is not securitized, where f is the probability density function and F is the cumulative density function. The x represents the matrix of data points and β is the vector of coefficients from the first stage Probit regression.

In our analysis, the hazard function is defined as the probability density of a loan being resolved at time t, conditional on its being in the distressed status before time t: \( \lambda (t)={ \lim}_{\varDelta t\to 0}\frac{ \Pr \Big( t< T< t+\varDelta t\left| T\ge t\Big)\right.}{\varDelta t}=\frac{f(t)}{1- F(t)} \), where f(t) is the probability density function of the time duration for the loan to become resolved at t and F(t) is the cumulative density function. The Cox hazard model of analyzing the effects of a set of covariates or explanatory variables on the hazard rate can be specified as λ(t) = exp(x′β)λ 0(t), where β is the vector of unknown regression coefficients, x is the vector of covariates, and λ 0(t) is the baseline hazard function revealing the pattern of hazard rates over time for the average distressed loan in the sample. The Cox’s partial likelihood function is then applied to estimate the regression parameters. Further details of the Cox hazard model are specified in Cox and Oakes (1984). We thank an anonymous referee for this helpful suggestion on applying the Cox hazard model to analyze time to resolution.

These results are available upon request. The table has been removed for space considerations.

References

Adelino, M., Gerardi, K., & Willen, P. (2013a). Why Don’t Lenders Renegotiate More Home Mortgages? Redefaults, Self-Cures and Securitization. Journal of Monetary Economics, 60, 835–853.

Adelino, M., Gerardi, K., & Willen, P. (2013b). Identifying the effect of securitization on foreclosure and modification rates using early-payment defaults. Working paper.

Agarwal, S., Amromin, G., Ben-David, I., Chomsisengphet, S., & Evanoff, D. D. (2011). The Role of Securitization in Mortgage Renegotiation. The Journal of Financial Economics, 102(3), 559–578.

Ambrose, B. W., Capone, C. A., & Deng, Y. (2001). Optimal put exercise: an empirical examination of conditions for mortgage foreclosure. Journal of Real Estate Finance and Economics, 23(2), 213–234.

Ambrose, B. W., & Sanders, A. B. (2003). Commercial Mortgage-backed Securities: Prepayment and Default. Journal of Real Estate Finance and Economics, 26(2–3), 179–196.

Ambrose, B.W., Sanders, A. B. & Yavas, A. (2010). Special servicers and adverse selection in informed intermediation: theory and evidence. Pennsylvania State University, Institute for Real Estate Studies, Working paper.

An, X., Deng, Y., & Gabriel, S. (2011). Asymmetric Information, Adverse Selection, and the Pricing of CMBS. Journal of Financial Economics, 100(2), 304–325.

Brown, D. (2000). Liquidity and Liquidation: Evidence from Real Estate Investment Trusts. Journal of Finance, 1, 469–485.

Brown, D., Ciochetti, B., & Riddiough, T. (2006). Theory and Evidence on the Resolution of Financial Distress. Review of Financial Studies, 19, 1357–1397.

Chen, J., & Deng, Y. (2013). Commercial Mortgage Workout Strategy and Conditional Default Probability: Evidence from Special Serviced CMBS Loans. Journal of Real Estate Finance and Economics, 46, 609–632.

Ciochetti, B. & Riddiough, T. (1998). Timing, loss recovery and economic performance of foreclosed commercial mortgages. Working paper.

Ciochetti, B. A., Deng, Y. H., Lee, G., Shilling, J. D., & Yao, R. (2003). A Proportional Hazards Model of Commercial Mortgage Default with Originator Bias. Journal of Real Estate Finance and Economics, 27, 5–23.

Clauretie, T. M., & Herzog, T. (1990). The effect of state foreclosure laws on loan losses: Evidence from the mortgage insurance industry. Journal of Money, Credit and Banking, 22(2), 221–233.

Cox, D. R. & Oakes, D. (1984). Analysis of survival data. Monographs on statistics and applied probability. Chapman and Hall.

Crockett, J. H. (1990). Workouts, Deep Pockets, and Fire Sales: An Analysis of Distressed Real Estate. AREUEA Journal, 18(1), 76–90.

Fan, G. Z., Ong, S. E., & Sing, T. F. (2006). Moral Hazard, Effort Sensitivity and Compensation in Asset-Backed Securitization. Journal of Real Estate Finance and Economics, 32, 229–251.

Foote, C., Gerardi, K., Goette, L., & Willen, P. (2009). Reducing Foreclosures: No Easy Answers. NBER Macroeconomics Annual, 24, 89–138.

Gan, Y. H. & Mayer, C. (2006). Agency conflicts, asset substitution, and securitization. NBER Working paper

Ghent, A. & Valkanov, R. (2013). Comparing securitized and balance sheet loans: size matters. Working paper.

Gonas, J. S., Highfield, M., & Mullineaux, D. (2004). When are Commercial Loans Secured? Financial Review, 39(1), 79–99.

Harding, J. P., & Sirmans, C. F. (2002). Renegotiation of Troubled Debt: The Choice Between Discounted Payoff and Maturity Extension. Real Estate Economics, 30(3), 475–503.

Heckman, J. (1976). Sample selectivity problems as a specification error. Econometrica, 47(1), 153–162.

Liu, P., & Quan, D. (2013). Foreclosure of Securitized Commercial Mortgages – A Model of the Special Servicer. Journal of Real Estate Finance and Economics, 46, 321–338.

Pennington-Cross, A. (2003). Credit History and the Performance of Prime and Nonprime Mortgages. Journal of Real Estate Finance and Economics, 27(3), 279–301.

Piskorski, T., Seru, A., & Vig, V. (2010). Securitization and distressed loan renegotiation: Evidence from the subprime mortgage crisis. Journal of Financial Economics, 97(3), 360–397.

Riddiough, T. J., & Wyatt, S. B. (1994). Strategic Default, Workout, and Commercial Mortgage Valuation. Journal of Real Estate Finance and Economics, 9, 5–22.

Acknowledgments

We thank Brent Ambrose, Xudong An, David T. Brown, David Geltner, Walt Torous, and an anonymous referee for helpful comments and suggestions. We also thank participants of the 2013 Maastricht-NUS-MIT (MNM) Symposium and the 2014 AREUEA-ASSA conference for comments. We are especially grateful to Real Capital Analytics (RCA) for data and insightful guidance. Downs thanks The Kornblau Institute at VCU for support.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Downs, D.H., Xu, P. Commercial Real Estate, Distress and Financial Resolution: Portfolio Lending Versus Securitization. J Real Estate Finan Econ 51, 254–287 (2015). https://doi.org/10.1007/s11146-014-9471-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-014-9471-2