Abstract

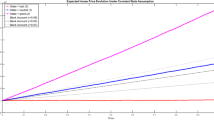

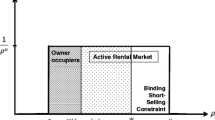

This paper develops a utility indifference model for evaluating various prices associated with forward transactions in the housing market, based on the equivalent principle of expected wealth utility derived from the forward and spot real estate markets. Our model results show that forward transactions in the housing market are probably not due to house sellers’ and buyers’ heterogeneity, but to their demand for hedging against house price risk. When the imperfections of real estate markets and the risk preferences of market participants are taken into consideration, we are able to show that the idiosyncratic risk premium, which mainly depends on the participants’ risk preferences and the correlation between the traded asset and the real estate, is a remarkable determinant of house sellers’ and buyers’ forward reservation prices. In addition, we also find that the market clearing forward price usually will not converge toward the expected risk-neutral forward price. The sellers’ or buyers’ risk aversion degrees and market powers are also identified to play crucial roles in determining the clearing forward price.

Similar content being viewed by others

Notes

These fundamental assumptions usually imply market completeness. In a complete market, the payoff of a contingent claim can be completely spanned by establishing a traded asset portfolio, such that any risk associated with the derivative can be completely hedged away via building the replicating portfolio. Accordingly, the unique price of the derivative can be determined according to no-arbitrage or risk-neutral arguments.

Since no compensation is required for investment risk in a complete market as discussed above, all investors in this market are indifferent toward risk and are risk-neutral. Further, financial market completeness suggests that there exists a risk-neutral probability measure under which the expected rate of return on a financial product in this market should be equal to the risk-free interest rate.

The ELW model allows for the risk preferences of real estate investors, and is therefore different from these standard pricing models.

More specifically, Lai et al. (2004) apply the standard real-options model to the valuation of forward house sales strategies in order to analyze the option-like features embedded in forward sales contracts, such as house developers/buyers’ default options. Unlike Lai et al. (2004), we incorporate forward house sales into the issue of optimal portfolio choices in an incomplete market setting so as to investigate the important implication of forward sales for hedging price risk in the housing market.

Our model is different from the ELW model in several aspects. The ELW model takes into account the important role of forward contracts in hedging real estate price uncertainty in a simple two-period endowment economy, and investigates the implication of counterparty default risk on the forward pricing issue. In contrast, our model evaluates various prices associated with forward house transactions in a continuous-time setting using the stochastic dynamic control methodology, which has been widely employed for dynamic investment analysis in financial literature (see, e.g., Merton 1969, and Miao and Wang 2007). Also, our model analyzes forward house transactions in an optimal household portfolio context, so that the important implication of idiosyncratic risk in the housing market for these transactions can be addressed in this analysis.

For the purpose of this study, we focus our attention on both agents’ optimal problem of expected terminal wealth utility in an asset portfolio setting, so that the implication of forward transactions for price risk hedging in the housing market can be addressed in the proposed model framework.

γ 1 and γ 2 can also be interpreted as the two agents’ precautionary savings motive (Kimball 1990).

Power utility, also known as constant relative risk aversion (CRRA) utility, is a category of utility function widely used in investment portfolio analysis (e.g., Cocco 2005; Yao and Zhang 2005; Leung 2007; Davis and Martin 2009). Based on the specification of the CRRA utility, these studies make use of simulation techniques to investigate household portfolio choices. The CARA utility function is another category of utility function usually used in investment portfolio analysis. The CARA-based framework facilitates simplifying portfolio analysis and therefore also has been widely used in developing utility indifference models (e.g., Musiela and Zariphopoulou 2004a, 2004b; Miao and Wang 2007; Henderson 2007; Edelstein et al. 2009). Similar to these studies, our model makes use of the CARA utility function in order to derive tractable closed-form solutions, and carry out numerical analysis, for the examined optimization problems. Based on the CARA utility, we can interpret the coefficient of absolute risk aversion as the precautionary saving motive, as mentioned above. In addition, given the important implication of idiosyncratic risk for our pricing issue, our main results and insights are actually not limited by the particular choice of the CARA utility, as in Miao and Wang (2007), while the wealth effect is not taken into consideration in this analysis. Miao and Wang (2007, p. 616) provide a more detailed discussion on the usefulness of the CARA utility under incomplete markets, compared with the power utility.

This assumption can be relaxed further by allowing for the two agents’ heterogeneous beliefs regarding the price evolutions of the risk-free bond, traded stock and real estate, while the main findings and insights of this study are not dependent on the assumption.

This suggests that we require taking into account the dynamic optimization problem of household portfolios associated with financial assets.

It can be shown that the wealth process is governed by the stochastic differential equation \( d{X_s} = r\left( {{X_s} - \theta } \right)ds + \theta \left( {{{{d{S_s}}} \left/ {{{S_s}}} \right.}} \right) \).

See, e.g., Young and Zariphopoulou (2002).

In real estate markets, however, prices cannot be fully observed across time due to the illiquidity of real estate, so it is not feasible to build a perfect portfolio replicating the payoff of a contingent claim associated with real estate in all states of nature. This causes the incompleteness of real estate markets, which also complicates the analysis of portfolio optimization and the pricing of derivative securities.

Brownian motion processes have been widely used to model the evolution of real estate price (see, e.g., Kau et al. 1990; Childs et al. 1996, and Downing et al. 2005). The category of Brownian motion processes specified in (8) allows flexibility in modeling several special processes that are probably adopted in governing the dynamics of real estate price in the real estate literature, as in Grenadier (2002), such as arithmetic, geometric and mean-reverting Brownian motion processes.

In actual forward house purchases, most house buyers usually first pay a fraction of the house value as a down payment, according to the construction schedule, and then make subsequent installment payments prior to the scheduled due dates (Chang and Ward 1993; Lai et al. 2004). For the purpose of this study, however, we assume that the house buyer holds a liquid asset portfolio whose value is sufficient for meeting the full payment requirement of the house value, and he will directly pay the full house value in a lump-sum payment of the forward or spot housing transaction. Such an assumption simplifies our analysis and facilitates interesting insights into price risk hedging in the housing market via forward transactions.

Since the risk-hedging implication of forward contracts in the housing market is one of our major concerns, our model allows for forward house transactions to be priced like standard forward contracts, where the time of entering into a forward contract and the contract maturity date usually need to be pre-determined or given, for risk-hedging purposes. As a result, our model does not consider the timing issue of forward housing transactions.

This implies that the present model allows for the illiquidity of real estate and continuous or multiple house trades are not allowed over the time period from time 0 to time T. This situation resembles a European option vs. an American option, and we treat forward house contracts as a European instrument.

One can readily see that the wealth process evolves following the stochastic differential equation \( d{Y_s} = r\left( {{Y_s} - \phi } \right)ds + \phi \left( {{{{d{S_s}}} \left/ {{{S_s}}} \right.}} \right) \).

In \( \overline V ( \cdot, \cdot ),{\gamma_1}\,{\text{should}}\,{\text{be replaced by }}{\gamma_2} \).

If the house value follows a geometric Brownian motion, the relationship \( {{{\left( {a - r} \right)}} \left/ {b} \right.} = {{{\left( {\mu - r} \right)}} \left/ {\sigma } \right.} \) holds and arbitrage opportunities are excluded. This ensures completeness of the housing market.

See Shreve (2004, Chapter 5).

Like other indifference pricing studies (see Henderson and Hobson 2009), this present model cannot generate a fair market value for the forward property, due to the inexistence of its unique price, but predicts the reservation prices of these two agents, which are closely associated with their particular risk preferences. Accordingly, we can also calculate the bid-ask price spread associated with the forward house transaction.

Alternatively, we can also specify a geometric Brownian motion process to govern the housing price dynamics. However, such a specification will make our analysis more complicated due to the unavailability of relevant analytical solutions.

The exact comparative static derivatives are similar to those presented in Appendix C.

References

Benth, F. E., Cartea, Á., & Kiesel, R. (2008). Pricing forward contracts in power markets by the certainty equivalence principle: Explaining the sign of the market risk premium. Journal of Banking & Finance, 32, 2006–2021.

Brueckner, J. K. (1997). Consumption and investment motives and the portfolio choices of homeowners. Journal of Real Estate Finance and Economics, 15(2), 159–180.

Capozza, D. R., & Li, Y. (1994). The intensity and timing of investment: the case of land. The American Economic Review, 84(4), 889–904.

Case, K. E., & Shiller, R. J. (1996). Mortgage default risk and real estate prices: the use of index-based futures and options in real estate. Journal of Housing Research, 7, 243–258.

Case, K. E., Shiller, R. J., & Weiss, A. N. (1993). Index-based futures and options trading in real estate. Journal of Portfolio Management, 19, 83–92.

Chang, C. O., & Ward, C. W. (1993). Forward pricing and the housing market: the pre-sales housing system in Taiwan. Journal of Property Research, 10, 217–227.

Chau, K. W., Wong, S. K., & Yiu, C. Y. (2007). Housing quality in the forward contracts market. Journal of Real Estate Finance and Economics, 34, 313–325.

Childs, P., Ott, S., & Riddiough, T. (1996). The pricing of multiclass commercial mortgage-backed securities. Journal of Financial and Quantitative Analysis, 31(4), 581–603.

Cocco, J. F. (2005). Portfolio choice in the presence of housing. Review of Financial Studies, 18(2), 535–567.

Davis, M., & Martin, R. (2009). Housing, home production, and the equity and value premium puzzles. Journal of Housing Economics, 18, 81–91.

Díaz, A., & Luengo-Prado, M. J. (2008). On the user cost and homeownership. Review of Economic Dynamics, 11, 584–613.

Downing, C., Stanton, R., & Wallace, N. (2005). An empirical test of a two-factor mortgage valuation model: how much do house prices matter. Real Estate Economics, 33(4), 681–710.

Edelstein, R., Liu, P., & Wu, F. (2009). The market for real estate presales: Heterogeneous agent, risk aversion and hedging premia. UCB Working Paper.

Englund, P., Hwang, M., & Quigley, J. M. (2002). Hedging housing risk. Journal of Real Estate Finance and Economics, 24, 163–197.

Flavin, M., & Yamashita, T. (2002). Owner-occupied housing and the composition of the household portfolio. The American Economic Review, 92(1), 345–362.

Grenadier, S. R. (2002). Option exercise games: An application to the equilibrium investment strategies of firms. Review of Financial Studies, 15(3), 691–721.

Henderson, V. (2005). Explicit solutions to an optimal portfolio choice problem with stochastic income. Journal of Economic Dynamics & Control, 29, 1237–1266.

Henderson, V. (2007). Valuing the option to invest in an incomplete market. Mathematics and Financial Economics, 1(2), 103–128.

Henderson, V., & Hobson, D. (2009). Utility indifference pricing: an overview. In R. Carmona (Ed.), Indifference pricing: theory and applications (pp. 44–73). New Jersey: Princeton University Press.

Isik, M. (2005). Incorporating decision makers’ risk preferences into real options models. Applied Economics Letters, 12, 729–734.

Jarrow, R. A., & Oldfield, G. S. (1981). Forward contracts and futures contracts. Journal of Financial Economics, 9, 373–382.

Kau, J. B., Keenan, D. C., Muller, W. J., III, & Epperson, J. F. (1990). Pricing commercial mortgages and their mortgage-backed securities. Journal of Real Estate Finance and Economics, 3, 333–356.

Kimball, M. (1990). Precautionary saving in the small and in the large. Econometrica, 58, 53–73.

Lai, R. N., Wang, K., & Zhou, Y. Q. (2004). Sale before completion of development: pricing and strategy. Real Estate Economics, 32(2), 329–357.

Leung, C. (2007). Equilibrium correlations of asset price and return. Journal of Real Estate Finance and Economics, 34, 233–256.

Leung, B. Y. P., Hui, E. C. M., & Seabrooke, B. (2007a). Asymmetric information in the Hong Kong forward property market. International Journal of Strategic Property Management, 11, 91–106.

Leung, B. Y. P., Hui, E. C. M., & Seabrooke, B. (2007b). Pricing of presale properties with asymmetric information problems. Journal of Real Estate Portfolio Management, 13(2), 139–152.

Merton, R. (1969). Lifetime portfolio selection under uncertainty: the continuous-time case. The Review of Economics and Statistics, 51, 247–257.

Miao, J., & Wang, N. (2007). Investment, consumption, and hedging under incomplete markets. Journal of Financial Economics, 86, 608–642.

Musiela, M., & Zariphopoulou, T. (2004a). An example of indifference prices under exponential preferences. Finance and Stochastics, 8(2), 229–239.

Musiela, M., & Zariphopoulou, T. (2004b). A valuation algorithm for indifference prices in incomplete markets. Finance and Stochastics, 8(3), 399–414.

Ortalo-Magné, F., & Rady, S. (2002). Tenure choice and riskiness of non-housing consumption. Journal of Housing Economics, 11, 266–279.

Shilling, J. D. (2003). Is there a risk premium puzzle in real estate? Real Estate Economics, 31, 501–525.

Shreve, S. (2004). Stochastic calculus for finance II: Continuous time models. New York: Springer Verlag.

Wang, J. (1996). The term structure of interest rates in a pure exchange economy with heterogeneous investors. Journal of Financial Economics, 41, 75–110.

Wong, S. K., Yiu, C. Y., Tse, M. K. S., & Chau, K. W. (2006). Do the forward sales of real estate stabilize spot prices. Journal of Real Estate Finance and Economics., 32, 289–304.

Yao, R., & Zhang, H. H. (2005). Optimal consumption and portfolio choices with risky housing and borrowing constraint. Review of Financial Studies, 18(1), 197–239.

Young, V. R., & Zariphopoulou, T. (2002). Pricing dynamic insurance risks using the principle of equivalent utility. Scandinavian Actuarial Journal, 4, 246–270.

Acknowledgement

We would like to thank Robert Edelstein, Tyler Yang, Charles Leung, Peng Liu, Yuming Fu, Qian Wenlan, Christian Rehring, Li Gan, Twan-Shan Yang, Che-Chun Lin, an anonymous referee, and seminar participants at the Asia-Pacific Real Estate Research Symposium, Asian Real Estate Society-American Real Estate and Urban Economics Society Joint International Conference, and Southwestern University of Finance and Economics for helpful comments. The research funding from the Southwestern University of Finance and Economics “Project 211” grants is acknowledged.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fan, GZ., Pu, M. & Ong, S.E. Optimal Portfolio Choices, House Risk Hedging and the Pricing of Forward House Transactions. J Real Estate Finan Econ 45, 3–29 (2012). https://doi.org/10.1007/s11146-011-9323-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9323-2