Abstract

We examine the relation of time-varying idiosyncratic risk and momentum returns in REITs using a GARCH-in-mean model and incorporate liquidity risk in the asset pricing model. This is important because illiquidity may be more severe for REITs due to the nature of their underlying assets. We find that momentum returns display asymmetric volatility, i.e., momentum returns are higher when volatility is higher. Additionally, we find evidence that REITs with lowest past returns (losers) have higher idiosyncratic risks than those with highest past returns (winners) and that investors require a lower risk premium for holding losers’ idiosyncratic risks. Therefore, although losers have higher levels of idiosyncratic risks, their low risk premia cause low returns, which contribute to momentum. Lastly, we find a positive relation between REITs’ momentum return and turnover.

Similar content being viewed by others

Notes

Jegadeesh and Titman (2001) suggest that momentum returns cannot be explained by cross-sectional dispersion in returns. Behavioral explanations on momentum returns include investors’ underreaction to firm-specific news (Barberis et al. 1998 and Grinblatt and Han 2005) or overreaction to firm-specific news (Daniel et al. 1998, 2001, Hong and Stein 1999, and Barberis et al. 2003).

Lee and Swaminathan (2000) and Connolly and Stivers (2003) suggest that industry past volume predicts future returns. Grundy and Martin (2001) and Jegadeesh and Titman (2001) find that cross-sectional differences in expected returns is not the dominant cause of momentum. Chordia and Shivakumar (2002) show that most momentum can be explained by lagged treasury-bill yield, market dividend yield, term spread, and default spread. Johnson (2002) suggests that a cross-sectional dividend growth rate should be responsible for momentum. Ahn et al. (2003), Moskowitz (2003) provide a stochastic discount factor to measure risk premium in momentum, and report that when correct risk factor is used, momentum disappears.

A rise in stock price due to positive past returns (winners) will decrease leverage of firms, and thus decrease volatility. On the other hand, a drop in stock price due to negative past returns (losers) will increase leverage of firms, and therefore increase volatility. As a result, the negative relation between volatilities and returns can be explained by leverages of firms.

Bekaert and Wu (2000) examine the leverage effect and time-varying risk premium and suggest that asymmetric volatility is caused by the variance dynamics at the firm level, not by changes in leverage, and thus volatility feedback effect is the dominant cause. Wu (2001) examines both the leverage effect and volatility feedback effect and finds that the volatility feedback is significant both statistically and economically. Dennis et al. (2006) find that market-level systematic volatility is the major factor that causes asymmetric volatility in individual stock returns, and thus support the volatility feedback hypothesis.

See Fama and French (1993).

See Bollerslev, Chou and Kroner (1992) for a review of ARCH modeling.

Ang et al. (2006) find that firms with high idiosyncratic volatility have lower expected return.

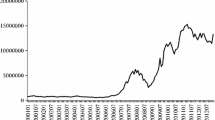

We select this sample period because before 1983 there are only a few number of REITs to form momentum portfolios.

10% is the conventional breakpoint used in momentum studies, whereas 30% is the breakpoint used in most REIT momentum studies due to REITs’ smaller sample size.

References

Ahn, D., Conrad, J., & Dittmar, R. F. (2003). Risk adjustment and trading strategies. Review of Financial Studies, 16(2), 459–485. doi:10.1093/rfs/hhg001.

Amihud, Y. (2002). Illiquidity and stock returns: cross-section and time-series effects. Journal of Financial Markets, 5, 31–56. doi:10.1016/S1386-4181(01)00024-6.

Ang, A., Hodrick, R., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. Journal of Finance, 51, 259–299. doi:10.1111/j.1540-6261.2006.00836.x.

Bali, T. G., & Cakici, N. (2008). Idiosyncratic volatility and the cross-section of expected returns. Journal of Financial and Quantitative Analysis, 48(1), 29–58.

Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor sentiment. Journal of Financial Economics, 49(3), 307–343. doi:10.1016/S0304-405X(98)00027-0.

Barberis, N., Shleifer, A., & Vishny, R. (2003). Style investing. Journal of Financial Economics, 68(2), 161–199. doi:10.1016/S0304-405X(03)00064-3.

Bekaert, G., & Wu, G. (2000). Asymmetric volatility and risk in equity markets. Review of Financial Studies, 13(1), 1–42. doi:10.1093/rfs/13.1.1.

Black, F. (1976). Studies of stock price volatility changes, Proceeding of the 1976 meetings of American Statistical Association, Business and Economic Statistics Section, 177–181.

Black, A. J., & McMillan, D. G. (2006). Asymmetric risk premium in value and growth stocks. International Review of Financial Analysis, 15, 237–246. doi:10.1016/j.irfa.2004.12.001.

Bollerslev, T. R., Chou, Y., & Kroner, K. F. (1992). ARCH modeling in Finance: a review of the theory and empirical evidence. Journal of Econometrics, 52, 5–59. doi:10.1016/0304-4076(92)90064-X.

Brennan, M. J., & Subrahmanyam, A. (1996). Market microstructure and asset pricing: on the compensation for illiquidity in stock returns. Journal of Financial Economics, 41, 441–464. doi:10.1016/0304-405X(95)00870-K.

Brennan, M. J., Chordia, T., & Subrahmanyam, A. (1998). Alternative factor specifications, security characteristics, and the cross-section of expected stock returns. Journal of Financial Economics, 49, 345–373. doi:10.1016/S0304-405X(98)00028-2.

Campbell, J. Y. (1993). Intertemporal asset pricing without consumption data. American Economic Review, 83, 487–512.

Campbell, J. Y., & Hentschel, L. (1992). No news is good news: an asymmetric model of changing volatility in stock returns. Journal of Financial Economics, 31, 281–318. doi:10.1016/0304-405X(92)90037-X.

Christie, A. A. (1982). The stochastic behavior of common stock variances. Journal of Financial Economics, 10, 407–432. doi:10.1016/0304-405X(82)90018-6.

Chordia, T., & Shivakumar, L. (2002). Momentum, business cycle and time-varying expected returns. Journal of Finance, 57, 985–1019. doi:10.1111/1540-6261.00449.

Chui, A. C. W., Titman, S., & Wei, K. C. J. (2003). Intra-industry momentum: the case of REITs. Journal of Financial Markets, 6, 363–387. doi:10.1016/S1386-4181(03)00002-8.

Connolly, R., & Stivers, C. (2003). Momentum and reversals in equity-index returns during periods of abnormal turnover and return dispersion. Journal of Finance, 58, 1521–1555. doi:10.1111/1540-6261.00576.

Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor psychology and secu-rity market under- and overreaction. Journal of Finance, 53(6), 1839–1885. doi:10.1111/0022-1082.00077.

Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (2001). Overconfidence, arbitrage, and equilibrium asset pricing. Journal of Finance, 56(3), 921–965. doi:10.1111/0022-1082.00350.

Datar, V. T., Naik, N., & Radcliffe, R. (1998). Liquidity and stock returns: an alternative test. Journal of Financial Markets, 1, 203–219. doi:10.1016/S1386-4181(97)00004-9.

Dennis, P., Mayhew, S., & Stivers, C. (2006). Stock returns, implied volatility innovations, and the asymmetric volatility phenomenon. Journal of Financial and Quantitative Analysis, 41(2), 381–406.

Engle, R. F., & Ng, V. K. (1993). Measuring and testing the impact of news on volatility. Journal of Finance, 48, 1749–1778. doi:10.2307/2329066.

Engle, R. F., Lilien, D. M., & Robins, R. P. (1987). Estimating time-varying risk premia in the term structure: The ARCH-M model. Econometrica, 55, 391–407. doi:10.2307/1913242.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56. doi:10.1016/0304-405X(93)90023-5.

Fu, F. (2007). Idiosyncratic risk and the cross-section of expected stock returns, working paper.

Glosten, R. G., Jagannathan, R., Runkle, D. E. (1993). On the relation between the expected value and the volatility of the nominal excess return on stocks. Journal of Finance, 48(5), 1779–1801. doi:10.2307/2329067.

Grinblatt, M., & Han, B. (2005). Prospect theory, mental accounting, and momentum. Journal of Financial Economics, 78(2), 311–339. doi:10.1016/j.jfineco.2004.10.006.

Goyal, A., & Santa-Clara, P. (2003). Idiosyncratic risk matters!. Journal of Finance, 58(3), 975–1007. doi:10.1111/1540-6261.00555.

Grundy, B. D., & Martin, J. S. (2001). Understanding the nature of the risks and the source of the rewards to momentum investing. Review of Financial Studies, 4(1), 29–78. doi:10.1093/rfs/14.1.29.

Guo, H., & Savickas, R. (2006). Idiosyncratic volatility, stock market volatility, and expected stock returns. Journal of Business and Economic Statistics, 24, 43–56. doi:10.1198/073500105000000180.

Hong, H., & Stein, J. C. (1999). A unified theory of underreaction, momentum trading and overreaction in asset markets. Journal of Finance, 54, 2143–2184. doi:10.1111/0022-1082.00184.

Hung, K., & Glascock, J. (2008). Momentum profitability and market trend: evidence from REITs. Journal of Real Estate Finance and Economics, 37(1), 51–70. doi:10.1007/s11146-007-9056-4.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: implications for stocks market efficiency. Journal of Finance, 48, 65–91. doi:10.2307/2328882.

Jegadeesh, N., & Titman, S. (2001). Profitability of momentum strategies: an evaluation of alternative explanations. Journal of Finance, 56, 699–720. doi:10.1111/0022-1082.00342.

Jirasakuldech, B., Campbell, R. D., & Emekter, R. (2009). Conditional volatility of equity real estate investment trust returns: a Pre- and Post-1993 comparison. The Journal of Real state Finance and Economics, 38(2), 137–154. doi:10.1007/s11146-007-9079-x.

Johnson, T. C. (2002). Rational momentum effects. Journal of Finance, 57(2), 585–608. doi:10.1111/1540-6261.00435.

Laux, P. A., & Ng, L. K. (1993). The sources of GARCH: empirical evidence from an intraday returns model incorporating systematic and unique risk. Journal of International Money and Finance, 12, 543–560. doi:10.1016/0261-5606(93)90039-E.

Lee, C. M. C., & Swaminathan, B. (2000). Price momentum and trading volume. Journal of Finance, 55, 2017–2069. doi:10.1111/0022-1082.00280.

Malkiel, B. G., & Xu, Y. (1997). Risk and return revisited. Journal of Portfolio Management, 23, 9–14.

Malkiel, B. G., & Xu, Y. (2008). Idiosyncratic risk and security returns, working paper.

Merton, R. (1980). On estimating the expected return on the market: an exploratory investigation. Journal of Financial Economics, 8, 326–361. doi:10.1016/0304-405X(80)90007-0.

Moskowitz, T. J. (2003). An analysis of covariance risk and pricing anomalies. Review of Financial Studies, 16, 417–457. doi:10.1093/rfs/hhg007.

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: a new approach. Econometrica, 59, 347–370. doi:10.2307/2938260.

Ooi, J. T. L., Wang, J., & Webb, J. R. (2009). Idiosyncratic Risk and REIT Returns. Journal of Real Estate Finance and Economics, 38(4). doi:10.1007/s11146-007-9091-1.

Pastor, L., & Stambaugh, R. F. (2003). Liquidity risk and expected stock returns. Journal of Political Economy, 111(3), 642–685. doi:10.1086/374184.

Sadka, R. (2006). Momentum and post-earnings-announcement drift anomalies: the role of liquidity risk. Journal of Financial Economics, 80(2), 309–349. doi:10.1016/j.jfineco.2005.04.005.

Wu, G. (2001). The determinants of asymmetric volatility. Review of Financial Studies, 14, 837–859. doi:10.1093/rfs/14.3.837.

Wu, G., & Xiao, Z. (2002). A generalized partially linear model of asymmetric volatility. Journal of Empirical Finance, 9, 287–319. doi:10.1016/S0927-5398(01)00057-3.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hung, SY.K., Glascock, J.L. Volatilities and Momentum Returns in Real Estate Investment Trusts. J Real Estate Finan Econ 41, 126–149 (2010). https://doi.org/10.1007/s11146-008-9165-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-008-9165-8