Abstract

Sales and profit margins are two popular earnings components discussed in the media. We study properties of one-year-ahead analyst forecasts of these two components. As sales are in dollar amounts and profit margin is a ratio, we propose robust statistical methods to assess and contrast their forecast properties. We find that four performance properties associated with earnings forecasts—optimism, relative accuracy with respect to benchmark model forecasts, forecast suboptimality, and serial correlation of forecast errors—apply to both sales and profit margins. Sales forecasts, in general, perform better than profit margin forecasts. Further evidence also shows that sales forecasts perform better than profit margin forecasts in terms of how their forecast errors explain earnings forecast errors and how realized surprises affect adjustments of the respective forecasts. We also find that a better information environment, surrogated by size, improves sales forecasts more than profit margin forecasts. All of these findings suggest that forecasting profit margins is inherently more difficult than forecasting sales.

Similar content being viewed by others

Notes

Profit margin is a ratio of earnings to sales, defined as earnings/sales. Therefore earnings = sales* profit margin. We use IBES data to generate earnings (= shares outstanding*EPS).

Even a cursory review of financial media clearly suggests that the analysis of firms’ performance centers on sales and profit margin, and these two metrics provide the standard breakdown of earnings. For example, a Wall Street Journal article on Oct. 28, 2016, titled “AB InBev Cuts Revenue Forecast,” reported that “Anheuser-Busch InBev NV cut its revenue forecast for the year after the world’s largest brewer reported weak third-quarter results. …” Another Wall Street Journal article on Oct. 11, 2015, titled “The Number to Watch This Earnings Season,” reported that “As third-quarter U.S. corporate results roll out this week, many investors are putting an increased focus on profit margins as a sign of companies’ ability to propel earnings higher. …”

These properties are widely accepted under broad circumstances, which rules out conditioning variables, such as analysts’ independence and capability, firm size, earnings risk, etc. This paper focuses on broad circumstances.

Our definition of size group is based on the annual average market value of all NYSE, AMEX, and NASDAQ firms in CRSP. In other words, we will not have the same number of observations in each size group. However, we also conduct robustness checks using the same number of observations for each size group.

In a strict sense, the RAS for optimism focuses on the ratio that an analyst forecast is lower than the realization, i.e., less optimal, rather than the accuracy. The smaller the RAS, more observations are optimal, implying higher optimism. For easy reference, we use the term RAS when discussing our first three performance properties. For the analysis of analyst forecast optimism, if RAS is higher than 50%, then analyst forecast conservatism exists. As it is considered that conservatism is better than optimism, a higher RAS implies better performance.

Our approach discards OLS because of the pervasive presence of data outliers and heteroscedasticity. These dysfunctional data attributes are as true for profit margin as for sales and related forecasts. Instead, we apply the Theil-Sen method of estimation (Wilcox 2012, p. 484). This method is insensitive to outliers, eliminating any need for trimming or winsorization. No less important, coefficient estimates are independent of any scaling of both sides of the equation estimated. The Theil-Sen method adds the advantage of being more efficient than OLS in capital market settings, as Ohlson and Kim (2015) report.

By performing better, we mean less optimism, higher accuracy relative to our selected benchmark model, and less suboptimality. Analyst forecasts of sales and profit margin bear similar levels of serial correlations.

A simple form: AF(t + 1) = AF(t) + (1 + v)*AFE(t), where AF represents the analyst forecasts and AFE represents the analyst forecast errors.

For example, Ertimur et al. (2003) investigate the differential market reactions to revenue and expense surprises around earnings announcement dates. Rees and Sivaramakrishnan (2007) examine the value implications of joint analyst forecast errors of revenue and earnings. Keung (2010) finds that the market responds more vigorously to analysts’ earnings forecast revisions when sales forecasts are also provided.

For example, we find that both analyst forecasts of sales and profit margin are optimistically biased mainly in the three smallest firm size groups.

For example, DuPont formula: ROA = profit margin*asset turnover. Financial analysts often provide forecasts of ROA.

It would, of course, be interesting to determine if the results in these papers extend to S and PM individually, but such an inquiry is way beyond the scope of the current paper.

Ertimur et al. (2003) suggest that one of the drivers for the differential market responses to sales and expense surprises is the relative persistence between sales and expenses. Their findings imply that the sales number is more reliable than expenses. Because sales is affected by growth, if growth is very uncertain, it may not be more persistent than profit margin (behaving more or less like a random walk). Hence Ertimur et al.’s findings may not be strictly applied to sales versus profit margin. Moreover, they are silent on the size effect. Rees and Sivaramakrishnan (2007) examine the value implications of joint analyst forecast errors of revenue and earnings and document a significant increase (reduction) in the market premium to meeting earnings forecasts when the revenue forecast is also met (not met). Keung (2010) finds that the market responds more vigorously to analysts’ earnings forecast revisions when sales forecasts are also provided. These two studies suggest that sales provides information beyond earnings. Profit margin may also provide more information beyond earnings; however, this cannot be concluded without empirical analysis.

Other studies relate to the forecasting of sales or cost components of earnings. For example, Curtis et al. (2014) forecast the sales of the retail industry by modeling the growth rates of branch stores and sales generated by each store. Myungsun and Prather-Kinsey (2010) show that analysts incorrectly anticipate the growth rate of expenses by using the growth rate of sales when making expenses forecasts (and hence the earnings forecast errors are positively associated with the growth rate of sales). Ertimur et al. (2011) suggest that less renowned analysts are more likely than reputable analysts to issue disaggregated earnings forecasts.

Years 2002 to 2016 are defined as the forecasting years, so the dataset includes the actual values up to year 2017. We start at 2002 because, prior to 2002, sales forecast data are rare, especially for smaller firms.

We also use the consensus measure of analyst forecasts, which is provided by I/B/E/S every month, and the market value on the day when I/B/E/S provides the summary statistics. Our results are qualitatively similar.

We define size break points using all listed firms, so that readers can obtain a clear sense of what we mean by large or small firms in the actual capital market. For robustness checks, we also set the break points evenly on the final sample, such that each size group has equal observations. The findings are qualitatively similar, but the size effect becomes less obvious, as expected. The untabulated results are available upon request.

In a strict sense, the RAS for analyst forecast optimism is not for accuracy assessment but rather for relative optimism comparison. For easy reference, we simply use the term “RAS” across all our relative score measures.

We use an iterative method to identify a factor K for each size-year group, such that the absolute value of (yearly RAS – 50) is minimized. We also calculate K for each observation, i.e., K*AF(X,t + 1) = X(t + 1). The median Ks are very similar for the forecasts of sales; however, because profit margin is sometimes negative, this method is not applicable.

Alternatively, if analyst forecasts are higher than the realizations (i.e., optimistic), a K that is smaller than 1 will bring down the higher forecasts to the realizations.

We provide details in the appendix for several analyses. Details of other analyses are available upon request.

Note that, for the largest group, the RAS is higher than 50, implying conservative estimation or conservatism. The significant difference in RAS of 1.6 for the largest group thus implies that sales forecasts are more conservative than the profit margin forecasts.

It makes sense that the factor K analysis shows significant results, due to the fact that factor K considers the extent of optimism rather than the RAS, which only considers whether optimism exists. The formal test should have more power.

Random walk models have long played an important role in the EPS forecasting literature, starting out with the work of Ball and Watts (1972) as well as that of Fried and Givoly (1982). The murky issue of the need to adjust for (secular) growth, due to earnings retention, has also existed. To the best of our knowledge, the literature does not seem to have arrived at a consensus regarding recognition of the problem and the best way to deal with it. Part of the problem has been the offsetting effect due to the forecast optimism. Indeed, Bradshaw et al. (2012) show that random walk forecasts are more accurate than analyst forecasts for long horizons under the circumstances that the forecasts are likely to be more optimistic than usual.

The modeling of positive sales growth rate—as opposed to one with a zero rate—is critical for all size groups, except the two smallest ones. Untabulated RAS tests, BM(S, t + 1) versus a random walk model, show that BM(S, t + 1) is more accurate for groups 3 through 5. Group 2 is a draw, and group 1 is in favor of the random walk model. Group 1 thus reflects that sales growth is more of a dubious empirical fact. Using an inferior benchmark model to assess relative accuracy may bias upward the relative accuracy performance of analyst forecasts. Keeping this in mind in evaluating our findings, we do not find that analyst forecasts of sales perform with extra accuracy for groups 1 and 2; hence we conclude that the potential bias is not much of a problem.

Simple t-tests and binomial tests are performed for each size group on whether the 15 yearly sums of diagonal are significantly different from the null of 50. Both tests reach the same conclusions for significance. Detailed results are available upon request.

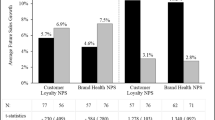

To demonstrate the firm size effects on analyst forecasts, we perform the following tests. We contrast by simple t-tests the 15 yearly RAS of group 5 with RAS of groups 4, 3, 2, and 1 per sales and profit margin in Tables 2, 3, and 4. If there is a size effect, we should observe increasing differences for the four group pairs {(5–4), (5–3), (5–2), (5–1)}. For Table 2, the p-values for the differences are (0.453, 0.021, 0.000, 0.000) for sales and (0.328, 0.002, 0.000, 0.000) for profit margin. For Table 3, the p-values are (0.944, 0.316, 0.016, 0.000) for sales and (0.195, 0.012, 0.001, 0.102) for profit margin. For Table 4, the p-values are (0.760, 0.899, 0.118, 0.000) for sales and (0.977, 0.085, 0.000, 0.013) for profit margin. Results show that the differences are most significant for the (5–2) and (5–1) pairs, indicating the presence of a size effect when the size differences are large.

We show the derivation as follows: AFE(Earnings) = S*PM – AF(S)*AF(PM) = [S-AF(S) + AF(S)]*[PM –AF(PM) + AF(PM)] – AF(S)*AF(PM) = [AFE(S) + AF(S)]*[AFE(PM) + AF(PM)] – AF(S)*AF(PM). The first term can be expanded to four elements, with the last element being cancelled out with the second term (i.e., AF(S)*AF(PM)): AFE(Earnings) = AFE(S)*AFE(PM) + AFE(S)*AF(PM) + AF(S)*AFE(PM). Rearranging the expression leads to Equation (5).

Binomial tests are performed for each size group on whether the percentages of times that |AFEA(S, t + 1)| < |AFEA(PM, t + 1)| are significantly different from the null of 50. The tests are all significant. Details are available upon request.

Ali et al. (1992) apply adaptive expectations modeling to EPS. Our approach is essentially the same in an empirical sense, except that we examine both sales and profit margin, which has a significant impact on what one should expect to find on the basis of prior reasoning. For an extension of this paper to allow for a nonlinear setting, see Mest and Plummer (2000).

2002 and 2003 are excluded from the estimation of k(1) and k(2) for group 1 because these two years contains an insufficient number of firm-year observations for the Theil-Sen estimation, but inference results are similar if these two years are included. To conserve space, we do not report the yearly coefficients, but they are available upon request.

References

Abarbanell, J. S., & Bernard, V. L. (1992). Tests of analysts’ overreaction/underreaction to earnings information as an explanation for anomalous stock price behavior. Journal of Finance, 47(3), 1181–1207.

Ali, A., Klein, A., & Rosenfeld, J. (1992). Analysts use of information about permanent and transitory earnings components in forecasting annual EPS. Accounting Review, 67(1), 183–198.

Ball, R., & Watts, R. (1972). Some time series properties of accounting income. Journal of Finance, 27(3), 663–681.

Bradshaw, M. T. (2011). Analysts’ forecasts: What do we know after decades of work? SSRN. Retrieved from http://ssrn.com/abstract=1880339.

Bradshaw, M. T., Drake, M. S., Myers, J. N., & Myers, L. A. (2012). A re-examination of analysts’ superiority over time-series forecasts of annual earnings. Review of Accounting Studies, 17(4), 944–968.

Bradshaw, M. T., Richardson, S. A., & Sloan, R. G. (2006). The relation between corporate financing activities, analysts’ forecasts and stock returns. Journal of Accounting and Economics, 42(1–2), 53–85.

Brown, L. D., Hagerman, R. L., Griffin, P. A., & Zmijewski, M. E. (1987). Security analyst superiority relative to univariate time-series models in forecasting quarterly earnings. Journal of Accounting and Economics, 9(1), 61–87.

Brown, L. D., Han, J. C. Y., Keon Jr., E. F., & Quinn, W. H. (1996). Predicting analysts’ earnings surprise. Journal of Investing, 5(1), 17–23.

Collins, W. A., & Hopwood, W. S. (1980). A multivariate-analysis of annual earnings forecasts generated from quarterly forecasts of financial analysts and univariate time-series models. Journal of Accounting Research, 18(2), 390–406.

Conroy, R., & Harris, R. (1987). Consensus forecasts of corporate earnings: Analysts’ forecasts and time series methods. Management Science, 33(6), 725–738.

Cowen, A., Groysberg, B., & Healy, P. (2006). Which types of analyst firms are more optimistic? Journal of Accounting and Economics, 41(1–2), 119–146.

Curtis, A. B., Lundholm, R. J., & McVay, S. E. (2014). Forecasting sales: A model and some evidence from the retail industry. Contemporary Accounting Research, 31(2), 581–608.

Das, S., Levine, C. B., & Sivaramakrishnan, K. (1998). Earnings predictability and bias in analysts’ earnings forecasts. Accounting Review, 73(2), 277–294.

Datar, S. M., & Rajan, M. V. (2018). Horngren’s cost accounting: A managerial emphasis (16th ed.). Hoboken, NJ: Pearson Education.

Dechow, P. M., Hutton, A. P., & Sloan, R. G. (2000). The relation between analysts’ forecasts of long-term earnings growth and stock price performance following equity offerings. Contemporary Accounting Research, 17(1), 1–32.

Dugar, A., & Nathan, S. (1995). The effect of investment banking relationships on financial analysts' earnings forecasts and investment recommendations. Contemporary Accounting Research, 12(1), 131–160.

Easterwood, J. C., & Nutt, S. R. (1999). Inefficiency in analysts’ earnings forecasts: Systematic misreaction or systematic optimism? Journal of Finance, 54(5), 1777–1797.

Elgers, P., & Murray, D. (1992). The relative and complementary performance of analyst and security-price-based measures of expected earnings. Journal of Accounting and Economics, 15(2–3), 303–316.

Elgers, P. T., & Lo, M. H. (1994). Reductions in analysts’ annual earnings forecast errors using information in prior earnings and security returns. Journal of Accounting Research, 32(2), 290–303.

Ertimur, W., Mayew, J., & Stubben, S. R. (2011). Analyst reputation and the issuance of disaggregated earnings forecasts to I/B/E/S. Review of Accounting Studies, 16(1), 29–58.

Ertimur, Y., Livnat, J., & Martikainen, M. (2003). Differential market reactions to revenue and expense surprises. Review of Accounting Studies, 8(2/3), 185–211.

Fan, D. K. K., So, R. W., & Yeh, J. J. (2006). Analyst earnings forecasts for publicly traded insurance companies. Review of Quantitative Finance and Accounting, 26(2), 105–136.

Francis, J., & Philbrick, D. (1993). Analysts’ decisions as products of a multi-task environment. Journal of Accounting Research, 31(2), 216–230.

Frankel, R., & Li, X. (2004). Characteristics of a firm’s information environment and the information asymmetry between insiders and outsiders. Journal of Accounting and Economics, 37(2), 229–259.

Fried, D., & Givoly, D. (1982). Financial analysts’ forecasts of earnings: A better surrogate for market expectations. Journal of Accounting and Economics, 4(2), 85–107.

Gong, G., Li, L., & Wang, J. (2011). Serial correlation in management earnings forecast errors. Journal of Accounting Research, 49(3), 677–720.

Granger, C. W. J., & Ramanathan, R. (1984). Improved methods of combining forecasts. Journal of Forecasting, 3(2), 197–204.

Guerard Jr., J. B. (1989). Combining time-series model forecasts and analysts’ forecasts for superior forecasts of annual earnings. Financial Analysts Journal, 45(1), 69–71.

Han, B., Manry, D., & Shaw, W. (2001). Improving the precision of analysts’ earnings forecasts by adjusting for predictable bias. Review of Quantitative Finance and Accounting, 17(1), 81–98.

Hughes, J., Liu, J., & Su, W. (2008). On the relation between predictable market returns and predictable analyst forecast errors. Review of Accounting Studies, 13(2–3), 266–291.

Hutton, A. P., Lee, L. F., & Shu, S. Z. (2012). Do managers always know better? The relative accuracy of management and analyst forecasts. Journal of Accounting Research, 50(5), 1217–1244.

Hwang, L. S., Jan, C. L., & Basu, S. (1996). Loss firms and analysts’ earnings forecast errors. Journal of Financial Statement Analysis, 1(2), 18–30.

Keung, E. C. (2010). Do supplementary sales forecasts increase the credibility of financial analysts’ earnings forecasts? Accounting Review, 85(6), 2047–2074.

Lim, T. (2001). Rationality and analysts’ forecast bias. Journal of Finance, 56(1), 369–385.

Lobo, G. J. (1992). Analysis and comparison of financial analysts, time-series, and combined forecasts of annual earnings. Journal of Business Research, 24(3), 269–280.

Lobo, G. J., & Nair, R. D. (1990). Combining judgmental and statistical forecasts: An application to earnings forecasts. Decision Sciences, 21(2), 446–460.

Markov, S., & Tamayo, A. N. E. (2006). Predictability in financial analyst forecast errors: Learning or irrationality? Journal of Accounting Research, 44(4), 725–761.

McNichols, M., & O’Brien, P. C. (1997). Self-selection and analyst coverage. Journal of Accounting Research, 35, 167–199.

Mendenhall, R. R. (1991). Evidence on the possible underweighting of earnings-related information. Journal of Accounting Research, 29(1), 170–179.

Mest, D. P., & Plummer, E. (2000). Revisions in analysts' earnings forecasts: Evidence of non-linear adaptive expectations. Journal of Forecasting, 19(6), 467–484.

Myungsun, K. I. M., & Prather-Kinsey, J. (2010). An additional source of financial analysts’ earnings forecast errors: Imperfect adjustments for cost behavior. Journal of Accounting, Auditing and Finance, 25(1), 27–51.

Newbold, P., Zumwalt, J. K., & Kannan, S. (1987). Combining forecasts to improve earnings per share prediction. International Journal of Forecasting, 3(2), 229–238.

Nutt, S., Easterwood, C., & Easterwood, J. (1999). New evidence on serial correlation in analyst forecast errors. Financial Management, 28(4), 106–117.

O’Brien, P. C. (1988). Analysts forecasts as earnings expectations. Journal of Accounting and Economics, 10(1), 53–83.

Ohlson, J. A., & Kim, S. (2015). Linear valuation without OLS: The Theil-Sen estimation approach. Review of Accounting Studies, 20(1), 395–435.

Rees, L., & Sivaramakrishnan, K. (2007). The effect of meeting or beating revenue forecasts on the association between quarterly returns and earnings forecast errors. Contemporary Accounting Research, 24(1), 259–290.

Richardson, S., Teoh, S. H., & Wysocki, P. D. (2004). The walk-down to beatable analyst forecasts: The role of equity issuance and insider trading incentives. Contemporary Accounting Research, 21(4), 885–924.

So, E. C. (2013). A new approach to predicting analyst forecast errors: Do investors overweight analyst forecasts? Journal of Financial Economics, 108(3), 615–640.

Soliman, M. T. (2008). The use of DuPont analysis by market participants. Accounting Review, 83(3), 823–853.

Swaminathan, S., & Weintrop, J. (1991). The information content of earnings, revenues, and expenses. Journal of Accounting Research, 29(2), 418–427.

Wiedman, C. I. (1996). The relevance of characteristics of the information environment in the selection of a proxy for the market’s expectations for earnings: An extension of Brown, Richardson, and Schwager (1987). Journal of Accounting Research, 34(2), 313–324.

Wilcox, R. (2012). Introduction to robust estimation and hypothesis testing (3rd ed.). Boston, MA: Academic Press.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(PDF 246 kb)

Rights and permissions

About this article

Cite this article

Cheng, C.S.A., Chu, K.C.K. & Ohlson, J. Analyst forecasts: sales and profit margins. Rev Account Stud 25, 54–83 (2020). https://doi.org/10.1007/s11142-019-09521-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-019-09521-z