Abstract

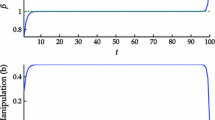

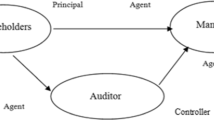

To investigate how the possibility of earnings manipulation affects managerial compensation contracts, we study a two-period agency setting in which a firm’s manager can engage in window-dressing activities to manipulate reported accounting earnings. Earnings manipulation boosts the reported earnings in one period at the expense of the reported earnings in the other period. We find that the optimal pay-performance sensitivity may increase and expected managerial compensation may decrease as the manager’s cost of earnings management decreases. When the manager is privately informed about the payoff of an investment project to the firm, we identify plausible conditions under which prohibiting earnings management can result in a less efficient investment decision for the firm and more rents for the manager.

Similar content being viewed by others

Notes

Drymiotes and Hemmer (2013) also consider a two-period agency setting in which the agent can manipulate earnings and earnings management reverses in the final period. However, the possibility of earnings manipulation does not affect optimal contracts in their model because contacts can only be based on aggregated earnings over the two periods.

Even though Liang (2004) assumes full commitment, he finds that prohibiting manipulation may be suboptimal under some circumstances. In his model, the induced level of earnings management depends on the agent’s private information, which the agent cannot directly communicate. Hence earnings management can sometimes allow for a more efficient allocation of compensation risk across periods.

See Ewert and Wagenhofer (2012) for a review of the related literature on earnings management in capital market settings.

The qualitative nature of our results remains unchanged if we allow for only a partial reversal of earnings management in the second period. A potentially interesting extension for future research would be to consider a setting in which the extent of reversal in a given period is ex ante uncertain.

The assumption of quadratic cost functions adds significant tractibility to our analysis and is quite common in the linear contracting literature. However, we believe that most of our results would remain valid for more general convex cost functions.

Our results would remain unchanged if the manager were unable to make long-term commitment. When the manager cannot commit to stay with the firm for two periods, a feasible contract must also satisfy the manager’s interim participation constraint. It can be verified that this additional constraint merely affects the timing of compensation and has no effect on the two parties’s payoffs.

We skip the proof, since it is a well-known result in the multiperiod len literature based on additively separable CARA preferences. See, for instance, Lemma 1 in Dutta and Reichelstein (2003).

It can be easily verified that the manager’s expected utility, as represented by the certainty equivalent expression in (2), is a concave function of a 1, a 2, and b, and hence these conditions are necessary as well as sufficient.

Put differently, the principal can eliminate earnings management incentives by compensating the manager solely on the basis of aggregate earnings \(e_{1}+\gamma\cdot e_{2}\). This is similar to the observation of Dutta and Reichelstein (2003) who consider an agency model in which the principal seeks to motivate an investment choice subject to an induced, rather than an intrinsic, incentive problem. The principal can make the agent completely internalize her investment objectives if the manager is compensated solely on the basis of aggregate cash flows.

It can be easily verified that our results continue to hold even when the manager contributes productive effort only in the first period (i.e., λ2 = 0). Lemma 1 shows that \(\beta_1^*>\tilde \beta_1\) and β *2 > 0 when λ2 = 0 and γ > 0. With full-commitment, therefore, it is optimal to hold the manager responsible for firm performance in the second period (even when there is no incentive problem in that period). This post-employment performance-based pay can be thought of as a form of “clawback" that is absent in the static setting of Goldman and Slezak (2006).

We note that the results of our two-period model readily extend to a T-period setting in which the manager can manipulate earnings in every period. For instance, when the periodic agency problems entail identical bonus rates over time, the manager would have persistent incentives to borrow earnings from the future in each period (as long as the discount factor is less than one). An increase in w would lead to less earnings management, higher firm profit, and higher managerial compensation. The impact of earnings management on the optimal contract terms would be more pronounced in the first and last periods than in the intermediate periods due to intertemporal cancelling out effect. Thus our two-period model captures the major intuition of a T-period setting in a simple way.

Another difference is that, unlike our setting in which earnings are assumed to be independently distributed, Christensen et al. (2013) allow for earnings to be positively correlated. It is, however, easy to show that Proposition 2 (and all other results in our paper) readily extend to the case when the noise terms in earnings are correlated, e.g., \(Cov(\varepsilon_1,\varepsilon_2) \ne 0\).

However, they do not allow for any intraperiod renegotiation in the second period.

The analysis of the next section shows that the principal’s expected payoffs are increasing in w even when the manager is privately informed.

It is well known that many common distributions, such as uniform and normal, have decreasing inverse hazard rates.

We do not focus on the choice of depreciation method in this paper. Dutta and Reichelstein (2002) investigate how alternative depreciation methods affect managerial incentives.

See, for instance, Laffont and Tirole (1993).

Since \(G(\cdot,\cdot)\) achieves its maximum value at (β *1 , β *2 ), G(β *1 , β *2 ) − G(β *1 (θ *), β *2 (θ *)) ≥ 0, and hence Eq. (11) implies NPV(θ*) > 0. It thus follows that θ* > θ0.

However, we note that a less efficient investment decision does not imply lower payoffs for the firm. To the contrary, a straightforward application of the Envelope theorem reveals that the firm’s expected payoff is always increasing in the manager’s cost of earnings manipulation w.

We recall from Eq. (7) that \((\beta_1^*- \gamma \cdot \beta_2^*)\) is proportional to, and of the same sign as, \((\beta_1^0 - \gamma \cdot \beta_2^0). \)

References

Arya, A., Glover, J., & Sunder, S. (1998). Earnings management and the revelation principle. Review of Accounting Studies, 3, 7–34.

Bebchuk, L., & Fried, J. (2004). Pay without performance: The unfulfilled promise of executive compensation. Boston, MA: Harvard Business Press.

Bergstresser, D., & Philippon, T. (2006). CEO incentives and earnings management. Journal of Financial Economics, 80, 511–529.

Burns, N., & Kedia, S. (2005). The impact of performance-based compensation on misreporting. Journal of Financial Economics, 79, 35–67.

Cheng, Q., & Warfield, T. (2005). Equity incentives and earnings management. The Accounting Review, 80, 441–476.

Christensen, P., Frimor, H., & Sabac, F. (2013). The stewardship role of analyst forecasts, and discretionary versus non-discretionary accruals. European Accounting Review, 22, 257–296.

Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50, 344–401.

Demski, J. (1998). Performance measure manipulation. Contemporary Accounting Research, 15, 261–285.

Drymiotes, G., & Hemmer, T. (2013). On the stewardship and valuation implications of accrual accounting systems. Journal of Accounting Research, 51, 281–334.

Dutta, S., & Gigler, F. (2002). The effect of earnings forecasts on earnings management. Journal of Accounting Research, 40, 631–655.

Dutta, S., & Reichelstein, S. (2002). Controlling investment decisions: Hurdle rates and intertemporal cost allocation. Review of Accounting Studies, 7, 253–282.

Dutta, S., & Reichelstein, S. (2003). Leading indicator variables, performance measurement, and long-term versus short-term contracts. Journal of Accounting Research, 41, 837–866.

Dye, R. (1988). Earnings management in an overlapping generations model. Journal of Accounting Research, 26, 195–235.

Efendi, J., Srivastava, A., & Swanson, E. (2007). Why do corporate managers misstate financial statements? The role of option compensation and other factors. Journal of Financial Economics, 85, 667–708.

Erickson, M., Hanlon, M., & Maydew, E. (2005). Is there a link between executive compensation and accounting fraud? Journal of Accounting Research, 44, 113–143.

Ewert, R., & Wagenhofer, A. (2005). Economic effects of tightening accounting standards to restrict earnings management. The Accounting Review, 80, 1101–1124.

Ewert, R., & Wagenhofer, A. (2012). Earnings management, conservatism, and earnings quality. Foundations and Trends in Accounting.

Fisher, P., & Verrecchia, R. (2000). Reporting bias. The Accounting Review, 75, 229–245.

Feltham, G., & Xie, J. (1994). Performance measure congruity and diversity in multi-task principal/agent relations. The Accounting Review, 69, 429–453.

Fudenberg, D., & Tirole, J. (1990). Moral Hazard and renegotiation in agency contracts. Econometrica, 58, 1279–1319.

Gaver, J., Gaver, K., & Austin, J. (1995). Additional evidence on bonus plans and income management. Journal of Accounting and Economics, 19, 3–28.

Goldman, E., & Slezak, S. (2006). An equilibrium model of incentive contracts in the presence of information manipulation. Journal of Financial Economics, 80, 603–626.

Healy, P. (1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7, 85–107.

Healy, P., & Wahlen, J. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizon, 13, 365–383.

Holthausen, R., Larcker, D., & Sloan, R. (1995). Annual bonus schemes and the manipulation of earnings. Journal of Accounting and Economics, 19, 29–74.

Johnson, S., Ryan, H., & Tian, Y. (2009). Executive compensation and corporate fraud: The source of incentives matter. Review of Finance, 13, 115–145.

Ke, B. (2004). The influence of equity-based compensation on CEO’s incentives to report strings of consecutive earnings increases. Unpublished working paper. Penn State University.

Laffont, J., & Tirole, J. (1993). A theory of incentives in procurement and regulations. Cambridge, MA: MIT Press.

Liang, P. J. (2004). Equilibrium earnings management, incentive contracts, and accounting standards. Contemporary Accounting Research, 21, 685–718.

Nan, L. (2008). The agency problems of hedging and earnings management. Contemporary Accounting Research, 25, 859–889.

Sankar, M., & Subramanayam, K. (2001). Reporting discretion and private information communication through earnings. Journal of Accounting Research, 30, 365–385.

Acknowledgments

We thankStefan Reichelstein (the editor), two anonymous referees, Ivan Marinovic (the discussant), and participants at the 2013 Review of Accounting Studies conference for helpful comments and suggestions. We are also grateful to the seminar participants at Columbia University, Carnegie Mellon University, Stanford University, Houston University, UCLA, the University of Illinois at Chicago, the University of Illinois at Urbana-Champaign, the University of Texas at Dallas, the University of Toronto, and the Indian School of Business for many helpful suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Lemma 1

Let G(β 1,β 2) denote the principal’s objective function in (5). It can be easily checked that G 11 < 0, G 22 < 0, and \(G_{11}\cdot G_{22} - G_{12}^2 > 0\). Therefore G(β 1,β 2) is globally concave, and the optimal bonus coefficients \(\beta_{t}^{\ast}\) are given by the following first-order conditions:

The result then follows by the solution to the above two linear equations in β *1 and β *2 .

1.2 Proof of Proposition 1

Let us first consider the case when \(\beta_1^0 = \gamma \cdot \beta_2^0\). We note from (7) that \(\beta_1^* - \gamma \cdot \beta_2^* = 0\). Substituting this in (16) and (17) reveals that:

and hence \(\beta_t^* = \frac{\lambda_t^2}{\Upphi_t} = \beta_t^0. \) It thus follows that when \(\beta_1^0 = \gamma \cdot \beta_2^0, \) the spread between the discounted bonus rates (\(\beta_1^* - \gamma \cdot \beta_2^*\)) and the average bonus rate (i.e., \(\frac{\beta_1^* + \beta_2^*}{2}\)) are both independent of w.

For the case when \(\beta_1^0 \neq \gamma \cdot \beta_2^0\), we have:

From the expressions for the optimal bonus coefficients in Lemma 1, we get:

Differentiating with respect to w and simplifying yield:

It thus follows that:

The conclusions in parts (i) and (ii) of Proposition 1 then follow.

1.3 Proof of Proposition 2

Recall that \(|b^{\ast}|=\frac{|\beta_{1}^{\ast}-\gamma \cdot\beta_{2}^{\ast}|}{w}. \) Substituting for \(\beta_{1}^{\ast}- \gamma \cdot \beta _{2}^{\ast}\) from (7) and simplifying yield:

It therefore follows that the equilibrium amount of earnings management \(|b^{\ast}|\) is decreasing in w.

The firm’s expected profit can be expressed as:

Differentiating with respect to w and applying the Envelope Theorem reveal that

To prove the last part, we note that the present value of the manager’s expected compensation is given by:

Substituting the expressions for the optimal bonus coefficients yields:

Differentiating with respect to w gives:

This proves that the expected compensation is increasing in w.

1.4 Proof of Lemma 2

The objective function in (10) can be maximized pointwise. The optimal bonus coefficients will solve the following first-order conditions:

The above equations simplify to the first-order conditions in (16) and (17) for the case when I(θ) = 0, and hence \(\beta_{t}^*(\theta)=\beta_{t}^{\ast}\) in the non-investment region. When I(θ) = 1, the above equations solve to yield the following optimal bonus coefficients:

and

Since \(H(\cdot)\) is decreasing, it can be easily verified that \(\beta _{t}^{\ast}(\theta)\) is increasing in θ for each t.

With respect to the investment policy, the principal will accept the project if and only if

Applying the Envelope Theorem, it can be easily verified that the left hand side of (20) is increasing in θ.

Note that \(\beta_{t}^*(\bar{\theta})=\beta_{t}^{\ast}\), since \(H(\bar{\theta })=0\). Hence (20) holds as an inequality at \(\theta=\bar {\theta}\). On the other hand, the inequality in (20) fails to hold at θ0. Consequently, there exists a unique \(\theta^{\ast}\in(\theta^{0},\bar{\theta})\) such that the principal invests if and only if \(\theta\geq\theta^{\ast}\).

To complete the proof, we need to show that the resulting incentive scheme is globally incentive compatible. It is well known that an incentive scheme is incentive compatible provided it is locally incentive compatible (i.e., the incentive compatibility condition in (9) holds), and \(\frac{\partial } {\partial \theta}CE(\hat \theta, \theta)\) is (weakly) increasing in \(\hat \theta\). For the incentive scheme identified above,

which is increasing in \(\hat \theta\) since \(\beta_t^*(\cdot)\) is increasing, and the optimal \(I (\cdot)\) is an upper-tail investment policy.

1.5 Proof of Proposition 3

Using the expressions for the optimal bonus coefficients in (18) and (19), it can be shown that:

Hence

The conclusion in Proposition 3 follows.

1.6 Proof of Proposition 4

Note that the optimal cutoff \(\theta^{\ast}\) is given by:

where

-

(i)

\(G\left( \beta_{1},\beta_{2}\right) \equiv\sum_{t=1}^{2}\gamma^{t}\cdot\left[ \lambda_{t}^{2}\cdot\beta_{t}-\frac{1}{2}\cdot \Upphi_t\cdot\beta_{t}^{2}\right] -\frac{\gamma}{2}\cdot w^{-1}\cdot\left( \beta_{1}-\beta_{2}\right) ^{2}, \)

-

(ii)

\(\beta_{t}^*\left( \theta\right) \) uniquely maximizes \(G\left( \beta_{1},\beta_{2}\right) -[\gamma\cdot x_{1}\cdot\beta_{1}+\gamma^{2}\cdot x_{2}\cdot\beta_{2}]\cdot H\left( \theta\right) , \) and

-

(iii)

β * t uniquely maximizes \(G\left( \beta_{1},\beta _{2}\right)\).

Differentiating the above expression for \(\theta^{\ast}\) with respect to w and using the Envelope Theorem yield:

Since

substituting for \(\beta_{t}^{\ast} \) and \(\beta_{t}\left( \theta^{\ast}\right) \) and simplifying yield:

Since \(H^{\prime}(\cdot)<0\), we get:

Since x 2 = 1 − x 1, we note that:

It thus follows that \(\frac{d \theta^*}{d w} = 0\) when x 1 = δ. When x 1 < δ, the term inside the curly brackets on the right hand side of (21) is positive because \(\beta_1^0 > \gamma \cdot \beta_2^0\). Hence \(\frac{d \theta^*}{d w} < 0\) when x 1 < δ.

Consider now the case when x 1 > δ. Let ψ(x 1) denote the term inside the curly brackets on the right hand side of (21). Note that when x 1 > δ, \(sgn \left [\frac{d \theta^*}{d w} \right] = sgn [\psi(x_1)]. \) If \([\beta_1^0 - \gamma \cdot \beta_2^0] > \frac{H(\theta^*)} {2 \cdot \Upphi_1}, \) we note that ψ(x 1) is positive for x 1 = 1 (which implies x 2 = 0). Since \(\psi(\cdot)\) is decreasing, this implies that ψ(x 1) > 0 for all values of \(x_1 \in [0,1]. \) It therefore follows that \(\frac{d \theta^*}{d w} > 0\) for all \(x_1 \in (\delta,1]. \)

Suppose now \(0 < [\beta_1^0 - \gamma \cdot \beta_2^0] < \frac{H(\theta^*)} {2 \cdot \Upphi_1}\). In this case, we note that ψ(1) < 0 and ψ(δ) > 0. Since \(\psi(\cdot)\) is monotonically decreasing, this implies that there exists a unique cutoff \(\bar x\) such that \(\frac{\partial \theta^*}{\partial w} > 0\) for all \(x_1 \in (\delta,\bar x)\) and \(\frac{d \theta^*}{dw} < 0\) for all \(x_1 > \bar x\).

This completes the proof of Proposition 4.

1.7 Proof of Proposition 5

Let

denote the manager’s expected information rents. Differentiating with respect to w yields:

Using the expressions (18) and (19) for the optimal bonus coefficients, it can be easily verified that:

where, for brevity, we define \(\Upomega=\frac{\left( \Upphi_1\Upphi _{2}\right) ^{2}}{\left( \gamma \Upphi_1+ \Upphi_2+w\cdot\Upphi_1\cdot\Upphi_2\right) ^{2}}. \)

It thus follows that:

When x 1 = δ, we have \(\frac{x_{1}}{\Upphi_1}=\frac{\gamma\cdot x_{2}}{\Upphi_2}\equiv \frac{\gamma}{\gamma\Upphi_1+\Upphi_2}. \) Therefore,

Now we study how \(\frac{\partial R}{\partial w}\) changes with x 1 at x 1 = δ (i.e., at \(\frac{x_{1}}{\Upphi_1}=\frac{\gamma\cdot x_{2}}{\Upphi_2}\equiv\frac{\gamma}{\gamma\Upphi_1+\Upphi_2}). \) Recall that we have assumed β 01 > γβ 02 without loss of generality. Since \(\frac{x_{1}}{\Upphi_1}-\frac{\gamma\cdot x_{2}}{\Upphi_2}\) increases as x 1 increases,

For uniform distribution, \(H^{\prime}\left( \cdot\right) =-1\). Hence,

Hence \(\frac{\partial}{\partial x_1}\left[\frac{\partial R} {\partial w}\right] > 0\) when evaluated at x 1 = δ. Since \(\frac{\partial R}{\partial w} = 0\) at x 1 = δ, it follows that \(\frac{\partial R}{\partial w}\) is positive (negative) for values of x 1 greater (less) than δ in a neighborhood of x 1 = δ. This completes the proof of Proposition 5.

1.8 Proof of Proposition 6

where m > 0 is as defined in connection with (7).

Since \(H^{\prime}\left( \theta \right) <0\), we have:

Rights and permissions

About this article

Cite this article

Dutta, S., Fan, Q. Equilibrium earnings management and managerial compensation in a multiperiod agency setting. Rev Account Stud 19, 1047–1077 (2014). https://doi.org/10.1007/s11142-014-9279-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-014-9279-6