Abstract

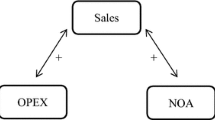

This article develops a consumption-based valuation model that treats earnings and cash flow as complementary information sources. The model integrates three ideas that do not appear in traditional valuation models: (i) earnings provide information about future shocks to cash flow; (ii) earnings contain indiscernible transient accruals; and (iii) investors use cash flow and earnings to make allocation and consumption decisions and set price. Accordingly, the quality of earnings affects production and consumption as well as price. Among other implications, the model reveals that a valuation coefficient is not just a capitalization factor; it is the product of a capitalization factor and a structural factor reflecting earnings quality and accounting bias.

Similar content being viewed by others

Notes

Because the market return can be identified with the investors’ aggregate consumption at each point in time, the finance literature generically refers to this type of economy as a consumption-CAPM economy (Breeden, 1979).

Gerald Feltham deserves credit for pointing out the essential role of production in this model. Christensen and Feltham (2003, Chapters 6–7) describe the “disappointing” (p. 245) value of information in a multi-period exchange economy sans information-based production choice. In a multi-period exchange setting with time-additive utilities, homogeneous investors, and uninsurable endowments, investors do not strictly Pareto prefer an accounting system with higher earnings quality over one with worst earnings quality. In contrast, investors might prefer higher earnings quality if firms use accounting information to make price-maximizing production decisions (Christensen & Feltham, 1988).

There are two effects that potentially may enable cash flow to provide incremental information to earnings in the Feltham and Ohlson (1996) model. First, “other information” in their model could be contemporaneous cash flow, in which case cash flow does provide incremental information to earnings. Second, Clubb (1996) shows that unexpected cash flow has explanatory power for contemporaneous unexpected return even within the Feltham and Ohlson setting. Unexpected accruals are part of the total outlay invested in positive net-present-value projects. Therefore, while unexpected accruals deserve a higher capitalization factor than unexpected cash flow from operations that has not been reinvested, there is no reason for the capitalization factor of unexpected cash flow to vanish. The model presented here develops a complementary relationship between earnings and cash flow that differs from both the “other information” effect and the Clubb effect.

While Reichelstein (2000) and Dutta and Reichelstein (2005) also consider cash flow and accruals as complementary information sources, they focus on performance evaluation and compensation design rather than valuation and consumption issues. Assuming risk-neutral pricing (i.e., exogenous state prices), their models do not admit consumption planning and do not formulate earnings quality as is done in this article.

Penman (2003) describes how to construct free cash flow from financial statements. Earnings correspond to what Penman calls “operating income”.

Steve Penman deserves acknowledgement for pointing this out. Also note that the reversing structure of \({\theta_{t+1}}\) and \({\delta_t}\) in earnings implies that \({\sum\nolimits_{t=0}^\infty {x_t} =\sum\nolimits_{t=0}^\infty {c_t}}\), which means there is no double counting of the \({\left\{{\theta_t, \delta_{t-1}} \right\}_{t=0}^\infty}\) shocks, and that the average dividend payout ratio is \({{E\left\lfloor {c_t} \right\rfloor} /{E\left\lfloor {x_t } \right\rfloor }=1}\).

Calibrating to the risk-free (rather than risk-adjusted) discount rate makes sense here because the accountant observes \({\theta_{t+1}}\) for recognition purposes and, hence, the value of \({\theta_{t+1}}\) is not risky from the accountant’s perspective.

Institutionally, the closest approximation to risk-free CRS production technology is government-backed consol bonds indexed to the CPI index to adjust for inflation risk.

While the setting is tractable even if investors have heterogeneous risk-aversion, I assume investors are identical for simplicity. Asset pricing with exponential utility functions and incomplete or differential information has attracted enormous attention in both accounting and finance. He and Wang (1995), Christensen and Feltham (2003), and Yee (2006a, b) offer references. Christensen and Feltham (2005, Sect. 25.4.2) provide an introduction to the “LEN” framework, which uses exponential utilities in a non-market agency setting.

Doubling strategies that may lead to unbounded amounts of borrowing are also forbidden. See Appendix.

If an investor starts with 1 dollar at the start of a period, consumes a fraction \({\phi^{-1}}\) of it and invests the remaining fraction in CRS production, then she has 1 dollar again at the end of the period. Hence, with access to CRS production, each dollar of wealth sustains period consumption of \({\phi^{-1}}\) dollars in perpetuity.

When s = 0 in parts (c) and (d), \({z_t^{i\ast } \equiv E\left[ {z_t^{i\ast } \left| {\Upomega_t } \right.} \right]}\) and \({\Pi_t^{i\ast } \equiv E\left[ {\Pi_t^{i\ast } \left| {\Upomega_t } \right.} \right]}\). \({\frac{\partial }{\partial Q_j}}\) is the partial derivative holding all other model parameters, including \({\sigma_c^2 \equiv \sigma_\theta^2 +\sigma_\varepsilon^2 }\) and \({Q_{j^{\prime}}}\) for \({j^{\prime}\neq j}\), fixed. \({\frac{\partial}{\partial Q_j}_{\left|{\mathop{}\limits_{E\left[ {c_{t+1} \left| {\Upomega_t } \right.} \right]} ^ {B_t^{i\ast }}}\right.}}\) is the partial derivative holding \({B_t^{i\ast } \equiv W_t^{i\ast} -\left({P_t +c_t} \right)q_{t-1}}\), investors’ one-period-ahead cash flow expectation, and all other model parameters fixed. \({B_t^{i\ast}}\) is the amount of pre-consumption, pre-dividend wealth investor i has deposited in the CRS production technology at the start of period t. Peter Christensen deserves credit for identifying \({B_t^{i\ast}}\) as the reasonable variable to hold fix when computing these inequalities. That \({E\left[ {c_{t+1} \left| {\Upomega_t } \right.} \right]}\) is held fixed highlights the higher earnings quality is guaranteed to benefit investors only on an ex ante basis.

Part (c) might appear inconsistent with rational expectations in claiming that actual consumption \({z_t^{i\ast }}\) increases with earnings quality for all \({t\geq 1}\) while expected consumption \({E\left[ {z_{t+s}^{i\ast } \left| {\Upomega_t } \right.} \right]}\) decreases with earnings quality when \({s\geq \overline s}\). This apparent inconsistency resolves by noting that part (c) says that \({z_t^{i\ast}}\) increases conditional on fixed \({B_t^{i\ast}}\) and \({E\left[ {c_{t+1} \left| {\Upomega_t } \right.} \right]}\) and that \({E\left[ {z_{t+s}^{i\ast } \left| {\Upomega_t}\right.} \right]}\) decreases conditional on fixed \({B_t^{i\ast}}\) and \({E\left[ {c_{t+1} \left| {\Upomega_t} \right.} \right]}\) without any condition on \({B_{t+s}^{i\ast}}\) and \({E\left[ {c_{t+s+1} \left| {\Upomega_{t+s}} \right.} \right]}\). If \({B_{t+s}^{i\ast}}\) and \({E\left[ {c_{t+s+1} \left| {\Upomega_{t+s}} \right.} \right]}\) are held fixed, then \({E\left[ {z_{t+s}^{i\ast} \left| {\Upomega_t} \right.} \right]}\) would also increase with increasing earnings quality.

Part (e) supports results obtained by Kunkel (1982) and Christensen and Feltham (2003, Proposition 8.4) in an Arrow-Debreu setting. Because all investors act identically in the equilibrium of Proposition 1, it is tantamount to a situation where one investor plans consumption and production. Since this investor can choose to ignore any utility-decreasing information, higher earnings quality cannot reduce the investor’s equilibrium utility.

For example, Wal-Mart reported negative free cash flows that became more and more negative in the early 1990s as Wal-Mart expanded rapidly (Penman, 2003, Chapter 4). At the same time, Wal-Mart’s share price grew along with its (positive) reported earnings.

“≈” means approximately equal to.

I emphasize that the model here is a one-firm model. Hence, care must be taken before one can use these results to interpret cross-sectional studies. Even if current cash flow provides little incremental information to earnings on average in a large sample study (as Penman & Yehuda, 2003 find), it does not imply that cash flow is irrelevant for every firm.

\({\frac{\partial P_t }{\partial V_t^c }=0}\) corresponds to cash flow irrelevancy because, if \({\frac{\partial P_t }{\partial V_t^c }=0}\), then \({P_t =V_t^x -\frac{\rho }{RM}\Upsigma_P}\), which implies cum-dividend price \({P_t +c_t =\phi x_t -\frac{\rho}{RM}\Upsigma_P}\) does not depend on cash flow.

For example, if somebody robs a bank of a million dollars, the bank’s valuation reduces by a million dollars even if crime is a fully diversifiable risk factor. This is simply because the realization of gain or loss (even if idiosyncratic) affects ex post valuations.

To keep the expressions shorter, I set accounting biasness parameter λ to unity in this subsection.

Starting with \({\delta_{-1} \equiv 0}\), investors roll this equation forward at each period to infer the value of δ0 at date t = 1, the value of δ1 at date t = 2, and so on.

References

Baginski, S., & Wahlen, J. (2003). Residual income risk, intrinsic values, and share prices. Accounting Review, 78(1), 327–351.

Barth, M., Cram, D., & Nelson, K. (2001). Accruals and the prediction of future cash flows. Accounting Review, 76(1), 27–58.

Barth, M., Beaver, W., Hand, J., & Landsman, W. (2004). Accruals, accounting-based valuation models, and the prediction of equity values. Working paper, Stanford Business School.

Beaver, W., Kettler, P., & Scholes, M. (1970). The association between market determined and accounting determined risk measures. Accounting Review, 45(4), 654–682.

Beaver, W., & Manegold, J. (1975). The association between market-determined and accounting-determined measures of systematic risk: Some further evidence. Journal of Financial and Quantitative Analysis, 10(2), 231–284.

Beaver, W. H. (1998). Financial Reporting—An accounting revolution, Third edition. Prentice Hall.

Breeden, D. (1979). An intertemporal asset pricing model with stochastic consumption and investment opportunities. Journal of Financial Economics, 7, 265–296.

Clubb, C. (1996). Valuation and clean surplus accounting: Some implications of the Feltham and Ohlson model for the relative information content of earnings and cash flows. Contemporary Accounting Research, 13(Spring), 329–337.

Christensen, P., & Feltham, G. (1988). Firm-specific information and efficient resource allocation. Contemporary Accounting Research, 5, 133–169.

Christensen, P., & Feltham, G. (2003). Economics of accounting: Volume I—Information in markets. Massachusetts: Kluwer Academic Publishers.

Christensen, P., & Feltham, G. (2005). Economics of accounting: Volume II—Performance evaluation. Massachusetts: Kluwer Academic Publishers.

Dechow, P., & Dichev, I. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77, 35–59.

Dechow, P. M., Kothari, S. P., & Watts, R. L. (1998). The relation between earnings and cash flows. Journal of Accounting and Economics, 25, 133–168.

Dutta, S., & Reichelstein, S. (2005). Stock price, earnings, and book value in managerial performance measures. The Accounting Review, 80(4), 1069–1100.

Elgers, P. (1980). Accounting-based risk predictions: A re-examination. Accounting Review, 55(3), 389–408.

Epstein, L., & Turnbull, S. (1980). Capital asset prices and the temporal resolution of uncertainty. Journal of Finance, 35(3), 627–643.

Feltham, G., & Ohlson, J. (1996). Uncertainty resolution and the theory of depreciation measurement. Journal of Accounting Research, 34(2), 209–234.

Financial Accounting Standards Board. (1978). Statement of Financial Accounting Concepts No. 1: objectives of financial reporting by business enterprises. Stamford: FASB.

Finger, C. A. (1994). The ability of earnings to predict future earnings and cash flow. Journal of Accounting Research, 32, 210–223.

Fischer, P., & Verrecchia, R. (2000) Reporting Bias. Accounting Review, 75(2), 229–245.

Garman, M., & Ohlson, J. (1980). A dynamic equilibrium for the ross arbitrage model. Journal of Finance, 35(3), 675–684.

Givoly, D., & Hayn, C. (2000). The changing time-series properties of earnings, cash flows and accruals: has financial reporting become more conservative? Journal of Accounting and Economics, 29, 287–320.

Greenberg, R. R., Johnson, G. L., & Ramesh, K. (1986). Earnings versus cash flows as a predictor of future cash flows. Journal of Accounting, Auditing and Finance, 1, 266–277.

Harrison, J., & Kreps, D. (1979). Martingales and arbitrage in multiperiod securities markets. Journal of Economic Theory, 20, 381–408.

He, H., & Wang, J. (1995). Differential information and dynamic behavior of stock trading volume. Review of Financial Studies, 8(4), 919–972.

Kunkel, J. (1982). Sufficient conditions for public information to have social value in a production and exchange economy. Journal of Finance, 37, 1005–1013.

Lev, B., Li, S., & Sougiannis, T. (2005). Accounting estimates: Pervasive, yet questionable usefulness. University of Illinois and New York University working paper.

Livnat, J., & Zarowin, P. (1990). The incremental information content of cash-flow components. Journal of Accounting & Economics, 13, 25–46.

Lorek, K. S., & Willinger, G. L. (1996). A multivariate time-series prediction model for cash flow data. The Accounting Review, 71, 81–101.

Ohlson, J. (1990). A synthesis of security valuation theory and the role of dividends, cash flows, and earnings. Contemporary Accounting Research, 6(2), 648–676.

Ohlson, J., & Zhang, X.-J. (1998). Accrual accounting and equity valuation. Journal of Accounting Research, 36(Supplement), 85–111.

Penman, S. (2003). Financial statement analysis and security valuation, (2nd Edition). New York: Wiley.

Penman, S., & Yehuda, N. (2003). The pricing of earnings and cash flows and the validation of accrual accounting. Working paper, Columbia University.

Reichelstein, S. (2000). Providing managerial incentives: Cash flows versus accrual accounting. Journal of Accounting Research, 38(2), 243–269.

Yee, K. (2004). Combining value estimates to improve accuracy. Financial Analysts Journal, 60(4), 23–28.

Yee, K. (2006a). Earnings quality and the equity risk premium: A benchmark model. Contemporary Accounting Research, 23(3), 833–877.

Yee K. (2006b). Cross-firm information transfer: A CAPM perspective. Columbia University working paper.

Acknowledgements

I am indebted to Gerald Feltham (editor), whose insight into the role of production enriched my understanding, and to Peter O. Christensen (RAST discussant) for many stimulating comments. Acknowledgement is also due an anonymous referee, James Ohlson, Steve Penman, Bruce Miller, Jack Hughes, Brett Trueman, Jing Liu, David Aboody, Dan Gode (NYU-Columbia Conference discussant), Mike Kirschenheiter (AAA discussant), Jennifer Francis (FARS discussant), and other participants of these three conferences for their feedback. Jennifer Hersch and research assistants Yong Gyu Lee and Jing Li proofread earlier versions of this article.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Inferring the value of the trailing accrual shock

Investors infer the realization of \({\varepsilon_{t}}\) by inverting Eq. (1): \({\varepsilon_{t}=c_{t}-\gamma c_{t-1}-\theta_{t}}\). On the other hand, investors do not observe and cannot infer the realizations of the contemporaneous accrual shock \({\delta_{t}}\). The best they can do at date t is to infer the trailing accrual shock from public information \({\{\delta_{t-2}, c_{t-1}, x_{t-1}, \theta_{t}\}}\) by inverting Eq. (2): Footnote 21

This means that at any date t ≥ 1, investors know the values of \({\{\varepsilon_{t}, \delta_{t-1}\}}\) by inference. Thus, the public information set at each date t ≥ 1 is effectively \({\left\{ {\left\{{c_\tau } \right\}_{\tau =0}^t, \left\{{x_\tau } \right\}_{\tau =0}^t, \left\{{\theta_\tau } \right\}_{\tau =1}^t, \left\{{\varepsilon_\tau } \right\}_{\tau =1}^t, \left\{ {\delta_\tau } \right\}_{\tau =0}^{t-1}} \right\}}\).

1.2 Proofs of lemmas and propositions

1.2.1 Setup for remainder of proofs

The rest of the proofs build on the following setup. Each investor i solves the program given in assumption A3 for her optimal portfolio-consumption plan. When the variables of information set \({\Upomega_{\tau}}\) are normally distributed and P t is linear in these variables, this dynamic optimization problem can be solved using standard methods (He & Wang, 1995), which I only sketch here. The optimization problem is equivalent to

subject to two conditions:

Market clearance,

determines equilibrium market prices at each date. The second transversality condition prevents unlimited borrowing in perpetuity. In addition, I require (as is standard practice in solving these models) that the solution does not involve “doubling down” strategies that may entail going infinitely into debt, which is unrealistic (Harrison & Kreps, 1979). To solve for equilibrium prices and consumption paths:

-

(a)

Guess a trial solution \({J(W_{\tau}^{i})=-e^{-\alpha W_{\tau}^{i}+\varsigma}}\) for all \({\tau\geq t}\), where \({\{\alpha, \varsigma\}}\) are undetermined constants.

-

(b)

Assuming this trial function, derive the two first order conditions for \({\{z_{\tau}^{i},q_{\tau}^{i}\}}\) for each date \({\tau \geq t}\). Solving these two first order conditions for all \({\tau \geq t}\) yields \({\{z_{\tau}^{i,*}, q_{\tau}^{i,*}\}}\) in terms of the undetermined coefficients \({\{\alpha, \varsigma\}}\).

-

(c)

Require \({J({W_\tau^i })=-e^{-\rho z_\tau^{i,\ast } }+\beta E[ {J({({W_\tau^i -z_{_\tau }^{i,\ast }})R+\left({P_{\tau +1} +c_{\tau +1} -RP_\tau } \right)q_\tau^{i,\ast }})\left| {\Upomega_\tau^i } \right.}]}\) to obtain two equations. These equations imply that \({\alpha =\rho \phi^{-1}}\) and

$$ \varsigma =\ln \phi +\left({\frac{1}{R-1}} \right)\left\{{\ln \left({R\beta } \right)-\rho \phi^{-1}\left({E\left[ {q_\tau^i \Re_{\tau +1} \left| {\Upomega_\tau^i } \right.} \right]-\frac{\rho \phi^{-1}}{2}\hbox{var}\left[ {q_\tau^i \Re_{\tau +1} \left| {\Upomega_\tau^i } \right.} \right]} \right)} \right\}, $$where \({\phi \equiv \frac{R}{R-1}}\) and \({\Re_{\tau +1} \equiv P_{\tau +1} +c_{\tau +1} -RP_\tau}\).

-

(d)

Plug these equilibrium values of \({\{\alpha, \varsigma\}}\) into the expressions for \({\{z_{\tau}^{i,*},q_{\tau}^{i,*}\}}\) determined in Step b to obtain the expressions for the equilibrium portfolio-consumption plans stated in Lemma 1.

-

(e)

Impose \({\sum\nolimits_{i=1}^{M}q_{\tau}^{i}=1}\) to obtain the fundamental pricing equation

$$ E\left[ {P_{\tau +1} +c_{\tau +1} -RP_\tau \left| {\Upomega_\tau^i } \right.} \right]=\frac{\rho }{\phi M}\Upsigma_P \quad \forall \tau \geq 0, $$(A1)

where \({\Upsigma_P \equiv \hbox{var}\left[ {\Re_{\tau +1} \left| {\Upomega_\tau^i } \right.} \right]}\). While not used in this article, the stochastic discount factor in this economy is \({\mu_{t+1}^i =\beta \exp \left({-\rho \left({z_{i+1}^{i\ast } -z_i^{i\ast }} \right)} \right)}\), where \({z_i^{i\ast}}\) is the equilibrium consumption of any investor i.

Proof of Lemma 1

Step d of “Setup for remainder of proofs” states the procedure for deriving \({q_t^{i\ast}}\) and \({z_t^{i\ast}}\). Note that \({q_t^{i\ast } =1/M}\) simply because each of the M identical investors owns an identical fraction of the firm. When homogeneous information, \({\Upomega_{t}^{i}=\Upomega_{t}}\) for all i and Eq. (A1) implies Eq. (3) with \({\Upsigma_{P}}\) as defined following Eq. (A1). □

Proof of Proposition 1

Lemma 1 implies that \({\Upsigma_P \equiv \hbox{var}\left[ {\Re_{t+1} \left| {\Upomega_t } \right.} \right]}\), \({CE\Re =\frac{\phi^{-1}\rho }{2M^2}\Upsigma_P}\), \({E\left[ {q_t^{i\ast } \Re_{t+1} \left| {\Upomega_t} \right.} \right]=\frac{\phi^{-1}\rho }{M^2}\Upsigma_P}\), and \({z_{t+1}^{i\ast } -z_t^{i\ast } =\phi^{-1}\left\{{q_t^{i\ast } \Re_{t+1} +\hbox{I}-CE\Re } \right\}}\), which implies \({\hbox{var}\left[ {z_{t+1}^{i\ast } -z_t^{i\ast } \left| {\Upomega_t } \right.} \right]=({\frac{1}{\phi M}})^2\Sigma_P}\). Since \({\frac{\partial \Upsigma_P }{\partial Q_j } < 0}\) for \({j\in \left\{{1,2} \right\}}\) by Corollary 2 (proved independently below), parts (a) and (b) follow. Parts (c) and (d) are proved by relating \({E\left[ {z_{t+s}^{i\ast } \left| {\Upomega_t} \right.} \right]}\) and \({E\left[ {\Pi_{t+s}^{i\ast } \left| {\Upomega_t } \right.} \right]}\) to \({\Upsigma_P}\). The formulas in Lemma 1 imply \({W_{t+s}^{i\ast } =W_t^{i\ast} +\hbox{I}\,s+\sum\nolimits_{u=1}^s {\left\{{q_{t+u-1}^{i\ast } \Re_{t+u} -CE\Re } \right\}}}\),

and

The latter two formulas are valid for all \({t\geq 1}\) and \({s\geq 0}\). Plugging in \({W_t^{i\ast } =B_t^{i\ast } +\left({P_t +c_t } \right)q_{t-1}}\) and taking the partial derivatives holding \({B_t^{i\ast}}\) and \({E\left[ {c_{t+1} \left| {\Upomega_t } \right.} \right]}\) fixed yields parts (c) and (d). Finally, the discussion leading up to Eq. (A1) and the formulas in Lemma 1 imply that the value of investor i’s equilibrium utility function (a.k.a. the “derived utility”) \({J\left({W_\tau^{i\ast }} \right)=E[ {-\sum\nolimits_{\tau =t}^\infty {\beta^{\tau -t}e^{-\rho z_\tau^{i\ast }}} \left| {\Upomega_t } \right.}]}\) equals

Hence,

which proves part (e). I thank Peter Christensen for pointing out an error in an earlier statement of part (e). □

Proof of Proposition 2

Equation (1) implies \({\sum\nolimits_{\tau =1}^\infty {\frac{E\left[ {c_{t+\tau } \left| {\Upomega_t } \right.} \right]}{R^\tau }} =\frac{E\left[ {c_{t+1} \left| {\Upomega_t } \right.} \right]}{R-\gamma}}\), which means evaluating Eq. (8) requires evaluating \({E\left[ {c_{t+1} \left| {\Upomega_t } \right.} \right]}\). Plugging \({s_t \equiv \frac{1}{\lambda }\left\{{x_t -c_t +\lambda \theta_t +\lambda \delta_{t-1}} \right\}}\) into Eq. (7) and rearranging yields

where \({\phi}\) and \({\hat{x}_{t}}\) are as defined in the Proposition. Rearranging this further yields

Plugging Eq. (A2) into Eq. (8) yields Eq. (10). Next, we evaluate \({\Upsigma_{P}}\) starting from Eq. (9). To this end, recalling that \({Q_{P}\equiv \frac{\sigma_{\theta}^{2}}{\sigma_{\theta}^{2}+\sigma_{\delta}^{2}}}\), \({Q_{c}\equiv \frac{\sigma_{\theta}^{2}}{\sigma_{\theta}^{2}+\sigma_{\varepsilon}^{2}}}\), and \({\sigma_{c}^{2}\equiv \sigma_{\theta}^{2}+\sigma_{\varepsilon}^{2}}\) and rearranging Eq. (9) yields

Finally, observing that \({(1-Q_{P})Q_{C}+(1-Q_{C})=1-Q_{P}Q_{C}}\) proves the formula for \({\Upsigma_{P}}\). □

Proof of Corollary 1

\({\frac{\partial P_t}{\partial V_t^c }=0}\) implies \({P_{t}=V_{t}^{x}-\frac{\rho}{RM}\Upsigma_{P}=\phi \hat{x}_{t}-c_{t}-\frac{\rho}{RM}\Upsigma_{P}}\). Hence, \({\frac{\partial P_{t}}{\partial V_{t}^{x}}=1}\). The second part of the Proposition is proved in the main text preceding the Proposition. □

Proof of Corollary 2

Follows from taking the partial derivative of Eq. (11). □

Rights and permissions

About this article

Cite this article

Yee, K.K. Using accounting information for consumption planning and equity valuation. Rev Acc Stud 12, 227–256 (2007). https://doi.org/10.1007/s11142-007-9026-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-007-9026-3