Abstract

This article introduces a dynamic political-economy model of public debt which integrates climate policy. Strategic incentives are shaped by both an emission interaction and a budget interaction if public good provision contributes to a stock of persistent pollution. In a bipartisan system, politicians, who disagree on the optimal internalization of pollution, compete for office. The central finding is that bequeathing a large stock of pollution to the future government is not optimal for any incumbent regardless of their environmental preferences. This leads to strategic emission abatement in the first period. Additionally, while the incumbent engages in strategic deficit spending when reelection is uncertain, this effect is no longer necessarily inefficient when accounting for stock pollution. Both effects may increase welfare as a direct result of reelection uncertainty.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The political economy of public debt has received considerable attention in the previous literature as sovereign debt creates a link between current and future political decisions, even if today’s government will not remain in office. The reasons that current political decision-makers would embrace public debt as a strategic instrument are manifold and range from the aim of minimizing the pork barrel’s contribution to debt stabilization (Alesina & Drazen, 1991) over concerns regarding interregional or intergenerational redistribution (see Cukierman & Meltzer, 1989 or Weingast et al., 1981) to binding future governments’ allocation of public funds.Footnote 1

Likewise, the political economy of environmental policy has been examined at least since Buchanan and Tullock (1975), who showed why existing firms in a polluting industry would prefer the introduction of quotas over an emission tax. The subsequent theoretical literature has put its primary emphasis on analyzing how interest groups can influence environmental policy through lobbying (see Aidt, 1998 in particular and Oates & Portney, 2003 for an overview). However, to the best of my knowledge, a combined approach which intertwines the political economy of public debt and environmental policy has yet to be established.

This paper contributes to the integrated analysis by introducing stock pollutants in a political economy model of public debt with uncertain reelection. Specifically, I ask (i) how strategic debt incentives are affected by considering stock pollution, (ii) how emissions are influenced by strategic interactions, and (iii) how accounting for both effects influences welfare under reelection uncertainty. Strategic incentives are shaped not only by an intertemporal budget interaction (which is known from the literature) but also by an intertemporal emission interaction. This leads to the central finding that reelection uncertainty can have a beneficial effect on welfare through the strategic choice of public debt, current and future emissions.Footnote 2 At the very least, the detrimental fiscal effect of reelection uncertainty is attenuated by more ambitious emission abatement. Reelection uncertainty reduces first-period pollution in comparison to the outcome under certain reelection, if emissions are sufficiently persistent (as in the case of greenhouse gases). This result stems from the emission interaction and occurs even if the first-period government ignores environmental damages. Voting still leads to a strategic increase in public debt like in the underlying models without pollution. The possible implications for welfare are threefold. First, increasing marginal pollution damages (analogously, increasing social costs of carbon [SCC]) may provide a normative justification for positive public debt. In this case, both strategic incentives are welfare-increasing because certain reelection results in insufficient provision of clean public goods in the first period. Second, decreasing marginal damages can mandate public savings such that strategic debt is inefficient. If the environmental damage is relatively large, the welfare gains from strategic abatement may still outweigh this inefficiency. Third, in the case of a net welfare loss, accounting for the beneficial emission-abating effect attenuates the debt inefficiency. As a result, purely debt-focused analyses overestimate the welfare cost of reelection uncertainty.

To derive these findings, I employ a two-period model where the first-period government faces uncertainty about reelection in the second period and allocates funds between two public goods. While the provision of one good is clean (e.g., research and development subsidies to clean industries, spending on education or health services), the other good causes emissions (e.g., road infrastructure or fossil fuel subsidies) and, thus, adds to a stock of environmental pollution. In a bipartisan voting economy, two parties compete for office and disagree on how much of the pollution externality should be internalized. The government is either constituted by “environmentalists” (E) who (over-)internalize pollution damages or by “industrialists” (I) who consider the externality only partially (or not at all). This setup can be motivated, for instance, by the recent change to the computation of the SCC in the United States. Under the Clean Air Act, as adhered to by the Obama administration, the SCC measured the global costs of carbon emissions. Under the Trump administration, only “domestic” benefits from avoided climate change were taken into account, which reduced the SCC considerably (EPA, 2017). The Biden administration is currently adapting the measure to better account for global damages again.

As the novel feature of my model, debt no longer is the only channel through which the incumbent government can influence future policymaking. First-period borrowing serves as a strategic measure to confine future governments’ spending capabilities and shift funds to the first period, where the incumbent government can still allocate the public budget to its own liking. Additionally, the stock characteristic of first-period emissions creates a second channel through which the incumbent influences future decision making. For instance, suppose party I is initially in office but will be superseded by E in the second period. Party I prefers a higher level of the polluting good than E will provide in the second period. This causes the well-known incentive to accumulate debt and spend even more on the polluting good in the first period. However, since emissions remain in the atmosphere, party E would not just dispose of a smaller budget but also inherit a larger stock of emissions from the first period, which leads to even lower spending on the polluting good in the second period. Therefore, the emission interaction disciplines incumbent I to pollute less in the first period if emissions are sufficiently persistent. In the opposite case, where party E holds office in the first period but expects to be replaced by I in the second period, E anticipates that too much of the polluting good will be provided in the next period. To prevent pollution damages from spiking in the second period, E cuts first-period spending on the polluting good while running a strategically high deficit to restrict second-period provision by party I. Hence, any first-period government will strategically abate emissions. Voss (2014) provides several examples from German politics illustrating this effect. In the United States, the Obama administration declared several new national monuments in December 2016, including Bears Ears, Utah, which ties up considerable fossil and uranium deposits. When this act was signed, it was already clear that Democrats would be replaced in the presidential office. Hence, we may view this decision as a means to hedge against the change in office rather than to improve reelection probabilities. The monument was subsequently reduced to 15% of its size by the Trump administration, from which sprang several mining operations. President Biden has since fully restored the Bears Ears monument.

Voting uncertainty is empirically documented to be a driving factor of public debt (e.g., Woo, 2003). Since a change in office implies that second-period funds will not be spent optimally from the incumbent’s perspective, any first-period government has an incentive to leave fewer funds for the second period. Most contributions identify this strategic incentive to be detrimental to welfare. However, the integrated analysis of debt and climate policy shows that stock pollution provides a first-best justification to deviate from a balanced budget (Kellner & Runkel, 2021). Whether public debt or savings are optimal depends on several factors including how the marginal environmental damage evolves over time (e.g., estimates of the SCC typically increase, see Kornek et al., 2021). This implies that a balanced budget rule is no longer an effective instrument to restore the social optimum, unlike in the canonical literature on strategic debt.

From these findings, I conclude that the total intertemporal welfare effect of reelection uncertainty is path-dependent. If party E is initially in office and replaced by I, reelection uncertainty not only affects the budget efficiency but causes a welfare loss due to excessive emissions in the second period. In contrast, if I constitutes the first-period government and is superseded by E, the strategic incentive to pollute less in the first period is reinforced by intrinsic emission abatement in the second period. Empirically, the latter case may be more relevant, implying that emission levels decrease as a result of voting uncertainty. Lower pollution damages either accompany the welfare gain from the budget interaction if the strategic debt is welfare-improving or attenuate the strategic inefficiency if public debt is excessively high. Consequently, there are two channels through which strategic incentives associated with voting uncertainty can improve welfare relative to the certain reelection outcome. Neither is observed in the traditional political economy models of public debt, which thus implies that certain reelection and balanced budget rules are superior to voting with the ability to issue debt from a welfare perspective. My results challenge these findings and provide a welfare-based rationale to embrace political competition.

This paper is closely related to the literature on the political economy of public debt. In particular, I build on and expand the framework established by Tabellini and Alesina (1990) who analyze the effects on public debt when voters decide about the allocation of funds between two public goods. The bipartisan approach with two parties alternating in office is similar to the models in Persson and Svensson (1989) and Alesina and Tabellini (1990). However, these seminal contributions focus exclusively on strategic debt incentives when the government provides nondurable, clean public goods. By neglecting other interactions, they concur that the public budget should be balanced in the optimum and that strategic debt is detrimental to welfare. Peletier et al. (1999) who modify one public good to be a durable investment which earns returns in the future and, recently, Bouton et al. (2020), who introduce entitlements (e.g., future pension payments) as a means to influence future decisions, both show that adhering to a balanced budget rule may be detrimental in the presence of a second interaction. Interestingly, both models reach this conclusion through fundamentally different interactions: productive investments increase future public spending capabilities to the benefit of all individuals, while entitlements redistribute to the current government’s supporters. My analysis joins their rank by unveiling yet another interaction with similar implications via damages from stock pollution. In another recent study, Piguillem and Riboni (2021) show that the debt inefficiency observed by the underlying literature can be attenuated when the incumbent and opposition party have to agree on relaxing debt rules. This interaction differs from the three above because both parties deliberately engage in a bargaining process. Regarding the strategic effect on emission abatement, Voss (2014) also shows that reelection uncertainty can induce the incumbent to pollute less than under certain reelection. However, this analysis does not consider the government’s ability to issue debt and, thus, ignores the budget interaction, which also affects the impact of voting on welfare in my model.

The remainder of the paper is organized as follows: Section 2 outlines the model. In Sect. 3, I derive the social planner’s solution as a benchmark and compare it to the certain reelection outcome. Section 4 provides the central results regarding political economy incentives under reelection uncertainty. A critical discussion of my findings in Sect. 5 is followed by the concluding Sect. 6.

2 Model

In order to facilitate the comparison between my findings and the existing literature, my model builds on the framework of Tabellini and Alesina (1990) where public funds have to be allocated between two different public goods, G and F, in a two-period partial equilibrium model. The quantities of goods G and F provided in period \(t=1,2\) are denoted by \(g_t\) and \(f_t\), respectively. The innovation of my model is that the provision of one public good is also associated with environmental pollution. I choose good G as the polluting good and F as the non-polluting good.Footnote 3 Pollution is generated at a constant ratio to the provision of \(g_t\) and causes damages

such that \(\gamma\) captures the persistence of pollutants. Without loss of generality, pollution from \(g_0\) is normalized to zero. When \(\gamma \in (0,1]\), pollution accumulates as a stock over time. For instance, this stock can represent the atmospheric concentration of greenhouse gas emissions. If the pollution decays immediately (\(\gamma =0\)), strategic interactions between different decision-makers would only arise from the level of public debt and not from the history of public good provision. Pollution then only affects the intra-period allocation of funds between \(g_t\) and \(f_t\). In this case, the results closely resemble the outcome in the underlying model where parties only differ in their preference rates for \(g_t\) and \(f_t\).Footnote 4

For both the environmentalists’ party, E, and the industrialists’ party, I, utility from consuming goods G and F in period t is given by \(u(g_t)\) and \(u(f_t)\), respectively, with \(u'>0>u''\). Moreover, party \(i=E,I\) acknowledges the share \(\theta _i\) of total pollution damage. Therefore, party i maximizes

where \(\mathbb {E}\) denotes the expectations operator. Future utility is not discounted to avoid confounding debt accumulation due to “consumption” smoothing with the political economy mechanism underlying strategic debt.

The only parameter in (2) specific to party i is \(\theta _i\). I refer to this as the pollution awareness or internalization preference parameter of party i. This specification allows for different interpretations. For instance, \(\theta _i\) may represent the degree to which parties acknowledge that the damage from climate change is driven by anthropogenic emissions.Footnote 5 Underestimating \(\theta _i\) can result from biased voter preferences, lobbying activities, egoistic politicians with vested interests in polluting industries, ideologies or misinformation on the true extent of anthropogenic climate change. Employing a different interpretation, as suggested by the Environmental Protection Agency (EPA) proposal mentioned in the introduction, a local politician may be aware of the full damages from pollution, yet, is only interested in the share of damages, \(\theta _i\), that occurs domestically. Hence, depending on the interpretation of \(\theta _i\), it can be rational for local parties to only partially internalize emission damages. In contrast, the social planner aggregates across all constituencies and knows the full extent of damages from provision of the polluting good such that \(\theta _i=\theta ^*=1\) in the first-best solution. I assume that the pollution awareness parameter is restricted to the interval \(\theta _i\in [0,1]\) and all voters i identify with either party E or I. Therefore, the spectrum of internalization preferences is restricted to no (\(\theta _i=0\)), partial (\(0<\theta _i<1\)) or full (\(\theta _i=1\)) internalization. It is also possible that environmental activists or poorly informed voters overestimate the extent of pollution damages and choose \(\theta _i>1\). This case is discussed whenever results are notably affected.Footnote 6

Turning to the government’s decision problem, the economy is endowed with exogenously given public funds normalized to one at the beginning of each period. Assuming that there is no outstanding debt at the beginning of the first period and that public debt, b, matures after one period, the first- and second-period budget constraints are given by

Equations (3a) and (3b) implicitly bind the second-period government to fully repay public debt inherited from the previous period. Like the private discount rate, the real interest rate is set to zero to ensure that environmental policy and strategic incentives are the only reasons to deviate from a balanced budget path. In each period, the incumbent determines the bundle of public goods, \(g_t\) and \(f_t\). Subsequent governments cannot be pre-committed to provide a specific bundle in future periods.

In this framework, political economy incentives arise from uncertainty about the ruler’s identity after voting at the beginning of the second period. For reelection uncertainty to arise, there must be some exogenous factor which determines the majority’s decision to vote for either party I or E. Tabellini and Alesina (1990) argue that this is the case when the (perceived) costs of voting participation or the eligibility to participate in elections change. Both reasons may be relevant in the context of environmental pollution and climate change. Environmental catastrophes caused by climate change could be the catalyst for people, who previously abstained to cast their vote in future elections. Similarly, the recent surge in global movements like Fridays for Future indicates that adolescents’ awareness of environmental issues may be comparably high (see Hornsey et al., 2016 or Lewis et al., 2019). Thus, with several jurisdictions across the globe, e.g., California, France or New Zealand, currently discussing whether to lower the legal age of voting, eligibility could also have a substantial effect on the outcome of future elections.

3 Social planner’s problem and certain reelection

To establish a benchmark, I initially abstract from voting uncertainty and assume that politician i can be sure of reelection. In the underlying studies by Persson and Svensson (1989), Alesina and Tabellini (1990), and Tabellini and Alesina (1990), certain reelection fosters no incentive to deviate from a balanced budget which coincides with the first-best outcome. The strategic incentive to issue debt due to reelection uncertainty, then, implies that voting causes a budget inefficiency in their analyses.

However, if the provision of \(g_t\) causes emissions and politicians do not consider the true extent of environmental damages, public debt under certain reelection is no longer equal to the first-best solution. To show this, first consider that the party with preferences \(\theta _i\) is in office in both periods, where i is either I or E. Hence, the decision-maker can maximize welfare over all variables in advance such that government i’s optimization problem reads

where the public budget constraints, (3a) and (3b), were already substituted for \(f_1\) and \(f_2\). The respective first-order conditions read

Let \(D_1'+\gamma D_2'\) be the cumulative marginal damage of first-period emissions, whereas \(D_2'\) denotes the cumulative marginal damage of second-period emissions. Then, the first-order conditions (5a) to (5c) lend a basis for the following result.

Lemma 1

Whenever the cumulative marginal damage of emissions decreases [increases] over time, it is socially optimal to accumulate a positive level of savings [public debt] in the first period. Under certain reelection, any politician with preferences \(\theta _i\ne 1\) deviates from the first-best budget balance. In particular, if the politician ignores pollution damages (\(\theta _i=0\)), they run an inefficient balanced budget (\(b=0\)).

Proof

See “Proof of Lemma 1” Appendix.

Lemma 1 has two implications for the subsequent analysis. First, it is socially optimal to deviate from a balanced budget and issue public debt or accumulate savings depending on how the cumulative marginal damage of emissions evolves over time. Hence, a balanced budget rule may be suitable to eliminate inefficient strategic behavior, yet, can never restore the first-best solution if persistent environmental pollution is taken into account. While subject to the simplifying assumption of exogenous public endowments, this result can also be observed in a model with endogenous carbon taxation (Kellner & Runkel, 2021).

Second, when the damages from a stock pollutant are not fully internalized by the ruling party, the government will not implement the optimal level of public debt. Therefore, the public budget under certain reelection is at most second-best and might even be less efficient than the outcome under voting. This insight differs fundamentally from the results in Tabellini and Alesina (1990). However, it is not possible to generally determine whether the partially-internalizing government chooses inefficiently high or low debt. In the “Numerical example and public budget balance under certain reelection” Appendix, I provide a numerical example which reveals that the outcome is contingent on the government’s internalization preference as well as the explicit functional form of the damage functions in both periods.

4 Recursive solution under reelection uncertainty

4.1 Political decision in the final period

To answer the central questions of this paper—how reelection uncertainty affects the levels of public debt, pollution and welfare—I employ a recursive approach by solving the second-period government’s decision problem first. At the beginning of the second period, public debt (or savings), b, and past emissions from the provision of \(g_1\) are already predetermined by the previous government’s decisions. Hence, the second-period government chooses the public goods bundle \((g_2, f_2)\) according to

where provision of the clean good, \(f_2\), has been substituted for by \(1-b-g_2\) according to budget constraint (3b). The internalization parameter, \(\theta _2\), either equals \(\theta _E\) or \(\theta _I\), depending on which party is in office in \(t=2\). From the respective first-order condition

optimal provision levels of both public goods can be derived implicitly as

The expressions in (8) reveal that the second-period decision is contingent on the acting government’s pollution awareness, \(\theta _2\), but is also affected by “inherited” variables, namely public debt, b, and the stock of emissions which remain from provision of the polluting good in the first period, \(\gamma g_1\).Footnote 7 If \(\theta _2=0\), the second-period government ignores the externality and chooses provision of \(g_2\) and \(f_2\) such that marginal utilities are equal (implying \(g_2=f_2\) in a specification with identical utility functions and equal preferences for both goods). In this case, the pollution stock remaining from the first-period provision of \(g_1\) also becomes irrelevant for the allocation in \(t=2\) and the expressions are identical to the reaction functions defined by Tabellini and Alesina (1990) for a politician who values both public goods equally.

Applying the implicit function theorem to Eq. (7), the marginal effect of the stock of emissions on the provision of the polluting good in \(t=2\) may be derived as

as \(u''(\cdot )<0\) and \(D_2''(\cdot )>0\). Hence, the second-period government will never offset the entire increase in first-period emissions, even if pollution does not decay at all. Analogously, differentiating the second expression in (8) allows one to derive the partial effect of \(g_1\) on the demand for the clean good as

Ceteris paribus, higher provision of the polluting good in the first period will also increase marginal damages in the second period, creating an incentive for the second-period government to shift funds away from G and instead increase the provision of the clean good, F. The internalization parameter, \(\theta _2\), defines how elastic this reaction will be. The higher the second-period government’s internalization preference is, the stronger it responds to a larger stock of inherited pollution.

Finally, the total differentials of (8) can also be arranged to obtain the marginal effect of debt on second-period provision of the two public goods as

and

The marginal effect of public debt on both goods is negative and on the interval \((-1,0)\) as higher debt reduces the overall budget available in \(t=2\). While (9) and (10) show that the second-period decision-maker will not react to increased pollution in \(t=1\) if they ignore the climate externality (\(\theta _2=0\)), any government has to respond to higher borrowing by cutting the provision according to (11) and (12). However, how a tightened budget affects spending on either good depends on \(\theta _2\) once more.

4.2 Political decision in the first period

The identity of the ruling party in the first period is ex ante known and described by \(\theta _1\) which, again, is drawn from the set \(\{E,I\}\). However, under voting uncertainty, \(\theta _1\) does not necessarily coincide with \(\theta _2\). Thus, the incumbent government maximizes its expected intertemporal welfare over the decision variables \((g_1,f_1,b)\). Since the reaction functions, \(g_2^v\) and \(f_2^v\), also depend on the unknown internalization parameter \(\theta _2\), the incumbent’s optimization problem in \(t=1\) equals

where \(g_2^v\) and \(f_2^v\) are determined by (7) to (12). For tractability, I assume that entrance into the political “market” is restricted to parties E and I (i.e., one of them will take office in the second period) and that the reelection probability is ex ante known. Following the approach with alternating governments in the style of Persson and Svensson (1989) and Alesina and Tabellini (1990), I focus on the scenario where the incumbent knows that it will be superseded in the second period.Footnote 8 Thus, the optimization problem in (13) can be restated without the expectations operator and \(\theta _1\ne \theta _2\). The associated first-order conditions follow as

where I employ that

which can be obtained from expanding and rearranging (7). The last summand on the LHS of (14) and (15), respectively, captures the political economy incentives under uncertainty and vanishes when \(\theta _1=\theta _2\), i.e., in the certain reelection scenario. There are two intertemporal interactions between the incumbent and future government in the model with stock pollution. The first occurs because the incumbent can influence future spending by issuing debt or accumulating savings. I will refer to this as the budget interaction which is already well known in the political economy literature and typically causes inefficient deficit spending in the first period. The second interaction is less deliberate and is a result of slowly decaying emissions. This emission interaction disciplines both the future government and the incumbent to abate emissions, because (unlike the budget interaction) it affects the composition of the public goods bundle in both periods.

4.3 Strategic effects on public debt

The strategic effect on public debt is contingent on both the budget and the emission interaction. To examine the efficiency of the budget balance under reelection uncertainty and how it compares to the certain reelection outcome, I employ the quadratic model specified in the “Numerical example and public budget balance under certain reelection” Appendix. This leads to the following result.Footnote 9

Proposition 1

Compared to the case of certain reelection (\(\theta _1=\theta _2\)), reelection uncertainty (\(\theta _1\ne \theta _2\)) always creates a strategic incentive to issue higher public debt in the first period regardless of the identity of the incumbent government, \(\theta _1\). This effect becomes more pronounced, the more \(\theta _2\) deviates from \(\theta _1\).

Proof

See “Proof of Proposition 1” Appendix.

As Proposition 1 shows, reelection uncertainty creates a strategic incentive to issue public debt for any incumbent government which increases with the parties’ disagreement on optimal internalization. If party E is in office in the first period, i.e., \(\theta _1=\theta _E>\theta _I=\theta _2\), the environmentalists anticipate that the future industrialist government will overspend on the polluting good while providing too little of the clean good from the incumbent’s perspective. This creates an incentive to issue additional public debt (or, depending on how cumulative marginal damages evolve, reduces the level of public saving) and spend more on the clean good today. If the first-period government is constituted by industrialists, I, the strategic effect is identical though differently motivated: in I’s opinion, the future environmentalist government will spend too much on the clean good while providing an insufficient amount of the polluting good. They will also divert funds from the second period and increase spending on the clean good.

However, counter to intuition, higher debt does not translate into increased spending on the polluting good, even with an industrialist incumbent, if emissions are rather persistent, as will subsequently be shown by Proposition 2. This results from the fact that public debt is no longer the only channel through which incumbent and future government interact. Due to persistent stock pollution, the provision of the polluting good cannot increase freely but has to take future reactions to a larger pollution “inheritance” into account. Since the optimal composition of the public goods bundle in the first period is implicitly defined by (14), the potential to “sink” excess borrowing into the clean good is also limited. Therefore, the value of strategic debt is lower due to the emission interaction. In the model without pollution by Tabellini and Alesina (1990), the incumbent simply scales up provision of both goods to maintain a constant ratio between \(g_1\) and \(f_1\).

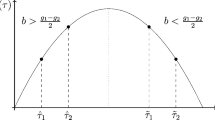

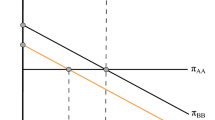

Figure 1 illustrates the results from a numerical analysis of the quadratic model which also indicates that the incentive to issue strategic debt diminishes as the atmospheric persistence of emissions increases. Without loss of generality, the example is computed with the parameters \(\alpha ,\beta ,\delta _1,\delta _2\) set to unity. Each panel depicts public debt in \(t=1\) as a function of the second-period internalization rate, \(\theta _2\), for an ex ante given preference \(\theta _1\) and various emission persistence rates, \(\gamma\). In all cases, public debt is minimized when \(\theta _1=\theta _2\) which corresponds to certain reelection. In addition, the graphs become flatter as the atmospheric persistence of emissions increases. When the incumbent has to afford higher deficit spending in the first period at the expense of leaving a very persistent stock of emissions to the second-period government, strategic debt accumulation becomes less attractive.

The effect of voting uncertainty on public budget efficiency relative to the certain reelection outcome is no longer as clear-cut as in Tabellini and Alesina (1990), where voting is always associated with an inefficiency as first-best debt and debt in the case of certain reelection coincide. As depicted by Fig. 4 in Appendix, accounting for stock pollution from public good provision implies that public debt under certain reelection can be inefficiently high or low relative to the first-best budget balance. Hence, whenever debt under certain reelection is already too high, strategic effects arising from voting uncertainty will exacerbate the debt inefficiency. For instance, this is the case when the incumbent government ignores the bulk of environmental damages, i.e., when \(\theta _1\) is close to zero, and the cumulative marginal damage of emissions decreases over time such that it is optimal to accumulate public savings.

In contrast, if public debt is too low under certain reelection (e.g., for \(\theta _1\) close to zero and increasing cumulative marginal damages), the strategic incentive to issue debt can improve budget efficiency. Such an efficiency gain is especially likely when an environmentally unaware incumbent faces competition from a “greener” party. Granted, it is still possible that the strategic effect causes public debt to overshoot the first-best level, which may result in a less efficient budget than under certain reelection. Whether public debt under certain reelection of a politician who misjudges the true extent of emission damages is inefficiently high or low to begin with, depends on the parameterization. Therefore, the analytical model cannot generally rule out either case. Nonetheless, my findings regarding public debt shed a more favorable light on reelection uncertainty than Tabellini and Alesina (1990).

4.4 Strategic effect on first-period provision of the polluting good

Next, I focus on how strategic incentives affect the provision of the polluting good in the first period. As already hinted at above, the direction of the strategic effect depends on whether the budget interaction dominates the emission interaction and vice versa. The findings are summarized by the following proposition.

Proposition 2

Compared to the case of certain reelection (\(\theta _1=\theta _2\)), reelection uncertainty (\(\theta _1\ne \theta _2\)) reduces [increases] first-period spending on the polluting good regardless of the incumbent’s identity, \(\theta _1\), if the stock pollutant decays slowly [quickly] (\(\gamma >[<]\tilde{\gamma }=1/3\)). This effect becomes more pronounced, the more \(\theta _2\) deviates from \(\theta _1\).

Proof

See “Proof of Proposition 2” Appendix.

Proposition 2 reveals that whether to strategically increase the first-period provision of the polluting good or abate does not depend on the incumbent’s identity, i.e., \(\theta _1\), but on the atmospheric persistence of emissions, \(\gamma\). Hence, the incumbent government appears “greener” than it actually is due to the strategic interactions when emissions are sufficiently persistent and reelection is uncertain.

Intuitively, it may be expected that whenever the potential second-period government is less concerned about environmental damages and emissions are persistent (\(\theta _1>\theta _2\) and \(\gamma >\tilde{\gamma }\)), an incumbent from party E wants to hedge against excessive pollution in the future. Incumbent E is aware that a higher provision of \(g_1\) will not just limit future emissions by draining funds from the second period, but also causes pollution damages in both periods. Knowing that their successor will always emit too much pollution from E’s perspective, incumbent E can reduce the second-period stock of pollution by providing less of the polluting good in the first period. This effect attenuates the incentive to shift funds to the first period whenever the incumbent is “greener” than the future government.

However, the emission-abating effect of uncertainty also occurs, as long as \(\gamma >\tilde{\gamma }\), when the incumbent prefers a lower internalization rate than the potential future government (\(\theta _1<\theta _2\)). If, initially, the industrialists’ party I is in office, they anticipate that their successor from party E, who always provides too little of the polluting good from incumbent I’s perspective, will provide even less when the stock of emissions inherited from the previous period is already high. By reducing the provision of the polluting good in the first period and, thus, “bequeathing” more funds and fewer emissions to \(t=2\), the incumbent ensures that the second-period government E does not cut provision of \(g_2\) too drastically. Hence, even a politician who prefers a low internalization rate, or completely ignores the externality, decides to provide less of the polluting good in \(t=1\) than when reelection is certain.

Since there are two strategic interactions between the incumbent and future government at play in the integrated model, the incentive to issue debt and increase first-period provision outweighs the emission interaction if the atmospheric persistence of emissions is below the threshold \(\tilde{\gamma }\). In this case, any incumbent, even the environmentalists, values the benefit from deficit spending on their preferred public goods bundle more than increased second-period pollution damages. Due to rapidly decaying emissions, the incumbent can transfer funds to the first period in order to increase the provision of both public goods without having to fear that, if \(\theta _1<\theta _2\), their successor will severely cut spending on \(g_2\), as the inherited stock of emissions, \(\gamma g_1\), remains small. On the other hand, if \(\theta _1>\theta _2\), the incumbent is aware that abstaining from the polluting good in the first period will not significantly reduce damages in the future as the second-period stock of emissions is primarily driven by their successor’s decisions. Hence, reelection uncertainty always increases emissions in the first period when pollution persistence is low.

Figure 2 illustrates the insight from Proposition 2 in the numerical example. The graphs depict first-period provision of the polluting good, \(g_1\), as a function of the expected internalization rate, \(\theta _2\), for ex ante known realizations of \(\theta _1\) and \(\gamma \gtrless \tilde{\gamma }\). The numerical examples suggest that the magnitude of the response increases as emissions become more persistent.

4.5 Intertemporal pollution damages under reelection uncertainty

Whether the emission-abating effect of reelection uncertainty in the first period also translates to overall lower intertemporal pollution damages further depends on the second-period decisions. Providing less of the polluting good in the first period directly reduces the (marginal) damage from pollution in the first period, results in a lower stock of inherited emissions at the beginning of the second period and increases the provision of \(g_2\) according to (9). To what extent the second-period government reacts to the incumbent’s emission abatement also depends on their pollution awareness, \(\theta _2\). Total intertemporal pollution damages amount to

Note that (17) assumes the social planner’s perspective with \(\theta ^*=1\), i.e., TD measures the true or global welfare loss from pollution. This can be employed to derive the following proposition.

Proposition 3

Compared to the case of certain reelection (\(\theta _1=\theta _2\)), reelection uncertainty increases [decreases] total intertemporal pollution damages if \(\theta _1>\theta _2\) [\(\theta _1<\theta _2\) and \((2-\gamma -3\gamma ^2)(\theta _2\delta _2)^3\gtrless 0\) is sufficiently large] and \(\gamma <[>]\tilde{\gamma }=1/3\). This effect becomes more pronounced, the more \(\theta _2\) deviates from \(\theta _1\).

Proof

See “Proof of Proposition 3” Appendix.

Considering practical implications for climate policy, the most important conclusion from Proposition 3 is that the expected total welfare loss from pollution damages can decrease as a direct result of voting uncertainty when emissions are rather persistent and the incumbent competes against a green(er) party, i.e., \(\gamma >\tilde{\gamma }\) and \(\theta _2>\theta _1\). This case appears most relevant when the appeal of green parties is increasing, as observed in many industrialized countries (e.g., see Grant & Tilley, 2019), while incumbent governments still consist of centrist or conservative parties which, traditionally, might prefer less stringent climate policy. In this case, incumbent I abates emissions in anticipation of the potential successor’s strong response to inheriting a high stock of pollution. Additionally, if party E actually takes office in the second period, they will also provide less of the polluting good than party I would if reelected due to \(\theta _E>\theta _I\). Thus, voting leads to emission abatement in both periods, which results in a lower overall welfare loss from pollution damages.

In contrast, if the competing party’s pollution awareness is lower than the incumbent’s and emissions decay relatively quickly (\(\theta _2<\theta _1\) and \(\gamma <\tilde{\gamma }\)), strategic incentives lead to higher emissions in the first period than caused in the case of certain reelection. Coupled with a higher second-period provision of the polluting good by the environmentally less aware successor, total damages would increase as a result of reelection uncertainty.

Under the conditions of Proposition 3, the second-period provision of the polluting good, \(g_2\), is decreasing in \(\Delta\) such that second-period emissions are highest [lowest] in \(\theta _2=0[=1]\) for any ex ante known internalization preference \(\theta _1\). This result contrasts with the findings for public debt and first-period provision of the polluting good. Both of these variables reach their minimum [maximum] in the certain reelection-outcome and increase [or decrease in the case of \(g_1\) if \(\gamma >1/3\)] with voting uncertainty regardless of the competitor’s identity, \(\theta _2\).

Figure 3 illustrates the results from Proposition 3 in the numerical model. Notably, for the parameter specification defined above, TD is always decreasing, including the case of atmospheric persistence levels below the threshold \(\tilde{\gamma }\), e.g., as depicted for \(\gamma = 0.2\). Even though the incumbent would strategically increase \(g_1\) according to Proposition 2, a “green” second-period government can still compensate for the hike in \(D(g_1)\) by abating \(g_2\) as the stock of pollution decays relatively quickly.

4.6 Total welfare effect of strategic interactions

In order to assess the total welfare impact of voting, recall that reelection uncertainty can either attenuate or exacerbate the budget inefficiency and affects provision of the polluting good in both periods. Therefore, the total impact generally depends on the calibration and is only analytically unique in certain cases. From the social planner’s perspective, any government with \(\theta _1<1\) provides an inefficiently high quantity of the polluting good under certain reelection. For persistence rates below the threshold \(\tilde{\gamma }\), voting further increases over-provision of \(g_1\). In this case, the intertemporal sum of pollution damages increases due to voting uncertainty when \(\theta _2<\theta _1\). If excessively high pollution is further accompanied by a strategic budget inefficiency, total welfare decreases as a result of reelection uncertainty. In this case, certain reelection is to be preferred in terms of welfare optimization.

This result can be overturned when the successor demands a higher internalization rate than the incumbent (\(\theta _2>\theta _1\)) and emissions are sufficiently persistent (\(\gamma >\tilde{\gamma }\)). Then, the first-period government provides less of the polluting good due to strategic incentives, reducing the deviation from the first-best allocation. Additionally, the intertemporal sum of pollution damages also shrinks as a result of uncertain reelection under the conditions of Proposition 3. If strategic debt accumulation decreases the budget inefficiency, the overall welfare effect of voting uncertainty is clearly positive. Yet, even if the budget becomes less efficient, it can be outweighed by the positive welfare effect of lower pollution. The net effect then depends on the quantitative magnitudes of the individual effects on public debt, first-period provision of the polluting good and cumulative pollution damages.

While this finding may appear vague, it carries a significant normative implication. In the underlying model without environmental pollution, voting uncertainty always leads to inefficient strategic incentives and welfare loss. This result can also arise in the integrated model with stock pollution. Though not necessarily so due to the emission interaction and normative reasons to deviate from a balanced budget. From a welfare-maximizing perspective, the unambiguous superiority of certain reelection over voting is no longer tenable and, in fact, it may be efficient to foster competition for political offices.

To gain a better understanding of the possible outcomes, Table 1 provides numerical results for various damage parameters and internalization preferences. In nearly all cases with \(\theta _2>\theta _1\), i.e., when party I is the incumbent and competes against party E for office in the second period, voting uncertainty increases welfare relative to the certain reelection benchmark. For the parameter specification at hand, the welfare function is strongly affected by pollution damages. As a result, even if strategic debt accumulation causes budget inefficiency, this effect is outweighed by the emission-abating effect of voting uncertainty. The opposite occurs if party E rules in the first period and party I takes office in the second period leading to higher total pollution damages than under certain reelection.

5 Discussion

The model introduced above builds on a number of assumptions which, in part, are standard to the canonical model by Tabellini and Alesina (1990) or necessary concessions to derive analytical results despite the intertemporal interactions induced by stock pollution. As in the underlying literature, I examine a two-period model to keep the results comparable to previous work. Since stock pollution decays gradually, the decision of how much to provide of the polluting public good in the first period would be shaped by strategic interactions with many future periods depending on the discount rate and the emission decay rate. The strategic incentive to abate can be expected to increase if emissions are very persistent and the incumbent expects not to be in office for an extended time.

In contrast, allowing for endogenous revenue raising via taxation might have a limited impact on the strategic incentive to abate emissions while reducing the strategic value of debt. The stock relation between first- and second-period emissions remains unaffected by enriching the model with regard to public revenue sourcing.

Furthermore, the government’s sole objective is to maximize its electorate’s welfare, i.e., politicians derive no personal benefit from being in office and act as perfect agents of their voters. This aspect is closely linked to the assumption that the reelection probability is exogenously given and unaffected by the incumbent’s policy. Strategic incentives could change, e.g., an industrialist incumbent might abate even more emissions, if they anticipate that the median voter’s preference shifts towards higher internalization. By doing so, the ruling party “forfeits” its electorate's interest to a degree but increases its chances to remain in office.

Additionally, I assume a deterministic relation between provision of the polluting public good, the stock of emissions and environmental damages. In reality, climate damages in particular are subject to a substantial degree of uncertainty. However, the qualitative results above do not hinge on this simplification. With a stochastic relation, optimal policy and strategic behavior would be driven by expected emission quantities and expected damages, which create an additional layer of uncertainty. If damage functions are characterized by fat tails with potentially very high losses stemming from pollution, (partially) internalizing governments face an incentive to spend even less on the polluting public good which creates strategic effects similar to an increase in \(\theta _2\). This effect can be reinforced if risk aversion differs systematically along party lines, e.g., if industrialists attribute less value to unlikely extreme risks, their “perceived damages” are even lower (comparable to a reduction of \(\theta _I\) in the model).

The cumulative marginal damage of emissions (which may be equated to the social cost of carbon for greenhouse gas emissions) determines the optimal policy as well as the strategic behavior of partially internalizing politicians. In the model at hand, the damage function only depends on domestic emissions. If emissions in the rest of the world are included, abatement efforts by other constituencies would decrease the marginal damage of domestic emissions. This has the twisted effect that the cost–benefit approach leads to a higher optimal level of domestic emissions and climate policy becomes less ambitious regardless of the government’s identity. Consequently, the emission interaction loses relevance for the strategic behavior of the incumbent, and borrowing could increase. This neglects that strategic interactions also occur between governments, i.e., a national government might prefer to abate even more to position itself as a climate champion and increase its credibility and weight in international negotiations.

Targeted emission reductions (such as in the Paris Agreement) take an interesting role as fiscal rules due to the strategic effect of stock pollution on public debt.Footnote 10 If reduction targets are an effective commitment mechanism, the upper limit of future emissions (thus, provision of \(g_2\)) is ex ante known regardless of which party takes office. This can have two different implications for the incentive to issue strategic debt depending on the incumbent’s identity. If \(\theta _1<\theta _2\), the incumbent is aware that its ability to incentivize future provision of the polluting good is capped at the reduction target. Hence, strategic borrowing and provision of \(g_1\) can increase. If the emission reduction target is less ambitious than the potential second-period government’s preferences, strategic incentives remain unaffected. In contrast, if \(\theta _1>\theta _2\), the “greener” incumbent can leave a higher budget to the future government, again, knowing that spending on \(g_2\) is capped and, beyond that point, the remaining funds will be used to provide the clean good. In this case, emission reduction targets can be employed as an effective fiscal rule to prevent inefficient strategic borrowing.

6 Conclusion

In this paper, I build on the analytical framework by Tabellini and Alesina (1990) and introduce an environmental externality in their political economy model of public debt. Politicians allocate public funds in order to provide clean and polluting public goods which generate utility for their electorates. Provision of the polluting good also causes emissions which accumulate as a gradually decaying stock pollutant and cause a welfare loss. I find that when politicians do not consider the true extent of pollution damages and disagree on the optimal internalization rate of emissions, the strategic dependencies between incumbent and future government are no longer restricted to a budget interaction but, additionally, an emission interaction occurs. As a result, persistent pollutants (such as greenhouse gases) create a strategic incentive to abate emissions regardless of the incumbent’s environmental preferences. Additionally, strategic debt accumulation is no longer necessarily detrimental. Both effects imply that reelection uncertainty can be associated with a welfare gain, which contradicts the findings from the underlying model by Tabellini and Alesina (1990) which does not account for stock pollution. Future research might focus on providing additional evidence from calibrated models and empirical studies. Furthermore, endogenizing reelection probabilities as well as public revenues via taxation and including climate policy commitment mechanisms, while beyond the scope of this analytical paper, seem highly relevant to increase the power of the existing political economy models.

Code availability

All code used in the numerical examples is available on request from the author.

Notes

Alesina and Passalacqua (2016) provide a survey of the literature on the political economy of public debt.

This concise choice of wording was proposed by an anonymous reviewer.

All subsequent findings intuitively also hold in scenarios where both public goods cause pollution, but provision of \(g_t\) is more polluting than providing the same quantity of \(f_t\).

Unlike Tabellini and Alesina (1990), I assume that, apart from varying internalization preferences, all parties have the same preference for both goods. Therefore, I restrict my attention to strategic incentives arising from the environmental impact of good G. Note that there would be additional strategic interactions affecting the public budget if preference rates vary between parties.

With this interpretation, the welfare function, (2), should also include the share of emission damages, \((1-\theta _i)D_t(g_t)\), believed to be a natural constant. Since it is regarded as exogenously given by the decision-maker, this term does not affect the optimization problem and may be omitted for the sake of brevity.

Note that regarding its interpretation, my approach to model voter preferences is more in line with the models of bipartisan systems by Alesina and Tabellini (1990) and Persson and Svensson (1989), as every voter’s preference is perfectly aligned with either party E or I. In the median voter perspective taken by Tabellini and Alesina (1990), an arbitrary politician always implements the median voter’s internalization preference. Thus, the politician merely acts as the voters’ agent and does not represent any party’s agenda. Analytically, the bipartisan approach is expedient because all possible realizations of \(\theta _i\) are ex ante known.

Since \(\gamma\) is an exogenously given parameter, I do not explicitly specify it as an argument of \(g^v\) and \(f^v\). Still, \(g_1\) only affects the second-period outcome if \(\gamma >0\).

This approach allows one to save considerably on notation at no loss of generality. If reelection probabilities are ex ante known, the expected outcome under reelection uncertainty is just a weighted average of the certain reelection and “certain loss of office” scenarios.

Note that all subsequent findings can also be derived in the general model if the difference between internalization preferences is marginal, i.e., \(\Delta =\theta _2-\theta _1\rightarrow 0\). The quadratic model is more convenient for expository purposes and allows large deviations between \(\theta _1\) and \(\theta _2\).

Thanks are due to an anonymous reviewer for pointing out this aspect.

References

Aidt, T. S. (1998). Political internalization of economic externalities and environmental policy. Journal of Public Economics, 69(1), 1–16.

Alesina, A., & Drazen, A. (1991). Why are stabilizations delayed? American Economic Review, 81(5), 1170–1188.

Alesina, A., & Passalacqua, A. (2016). The political economy of government debt. Handbook of Macroeconomics, 2, 2599–2651.

Alesina, A., & Tabellini, G. (1990). A positive theory of fiscal deficits and government debt. The Review of Economic Studies, 57(3), 403–414.

Bouton, L., Lizzeri, A., & Persico, N. (2020). The political economy of debt and entitlements. The Review of Economic Studies, 87(6), 2568–2599.

Buchanan, J. M., & Tullock, G. (1975). Polluters’ profits and political response: Direct controls versus taxes. The American Economic Review, 65(1), 139–147.

Cukierman, A., & Meltzer, A. H. (1989). A political theory of government debt and deficits in a neo-Ricardian framework. The American Economic Review, 79(4), 713–732.

EPA. (2017). Regulatory impact analysis for the review of the clean power plan: Proposal. U.S. Environmental Protection Agency, Office of Air and Radiation.

Grant, Z. P., & Tilley, J. (2019). Fertile soil: Explaining variation in the success of green parties. West European Politics, 42(3), 495–516.

Hornsey, M. J., Harris, E. A., Bain, P. G., & Fielding, K. S. (2016). Meta-analyses of the determinants and outcomes of belief in climate change. Nature Climate Change, 6(6), 622–626.

Kellner, M., & Runkel, M. (2021). Climate policy and optimal public debt. CESifo Working Paper. No. 8865.

Kornek, U., Klenert, D., Edenhofer, O., & Fleurbaey, M. (2021). The social cost of carbon and inequality: When local redistribution shapes global carbon prices. Journal of Environmental Economics and Management, 107, 102450.

Lewis, G. B., Palm, R., & Feng, B. (2019). Cross-national variation in determinants of climate change concern. Environmental Politics, 28(5), 793–821.

Oates, W. E., & Portney, P. R. (2003). The political economy of environmental policy. Handbook of Environmental Economics, 1, 325–354.

Peletier, B. D., Dur, R. A. J., & Swank, O. H. (1999). Voting on the budget deficit: Comment. American Economic Review, 89(5), 1377–1381.

Persson, T., & Svensson, L. E. O. (1989). Why a stubborn conservative would run a deficit: Policy with time-inconsistent preferences. The Quarterly Journal of Economics, 104(2), 325–345.

Piguillem, F., & Riboni, A. (2021). Fiscal rules as bargaining chips. The Review of Economic Studies, 88(5), 2439–2478.

Tabellini, G., & Alesina, A. (1990). Voting on the budget deficit. The American Economic Review, 80(1), 37–49.

Voss, A. (2014). Strategic choice of stock pollution: Why conservatives (appear to) turn green. CAWM Discussion Paper, Centrum für Angewandte Wirtschaftsforschung Münster.

Weingast, B. R., Shepsle, K. A., & Johnsen, C. (1981). The political economy of benefits and costs: A neoclassical approach to distributive politics. Journal of Political Economy, 89(4), 642–664.

Woo, J. (2003). Economic, political, and institutional determinants of public deficits. Journal of Public Economics, 87(3–4), 387–426.

Acknowledgements

This paper was supported by the German Research Foundation (DFG, Grant No.: RU 1466/2-1) and the German Federal Ministry of Education and Research (via Kopernikus-Projekt Ariadne, Grant No.: 03SFK5J0). I thank two anonymous referees as well as the participants of the political economy session at the 75th Annual Congress of the International Institute of Public Finance for their constructive comments and valuable suggestions. All errors that remain are mine.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Lemma 1

From (5c), \(f_1=f_2\) follows directly regardless of \(\theta _i\). Subtracting (5b) from (5a) and employing (5c), results in

which defines the relation between \(g_1\) and \(g_2\). The sign of the RHS of (18) is positive [negative] if \(D_1'+\gamma D_2'>[<]D_2'\). Due to \(u'(g_t)>0>u''(g_t)\), any politician with \(\theta _i>0\) (including the social planner with \(\theta ^*=1\)) provides \(g_1<[>]g_2\). Combining (3a) and (3b) and solving for b yields

Knowing that \(f_1=f_2\) and \(g_1<[>]g_2\), results in \(b<[>]0\) whenever \(\theta _i>0\) and \(D_1'+\gamma D_2'>[<]D_2'\). This proves the first claim in Proposition 1. The second sentence directly follows from the fact that the social planner used \(\theta _i=\theta ^*=1\), such that any politician with \(\theta _i\ne 1\) chooses inefficient levels of \(g_1\), \(g_2\) and b. To prove the last statement in Proposition 1, consider that conditions (5a) and (5b) reduce to \(u'(g_t)=u'(f_t)\) if \(\theta _i=0\), which implies \(g_1=g_2\). From (19), \(g_1=g_2\) and \(f_1=f_2\), I immediately obtain that \(b=0\). \(\blacksquare\)

1.2 Numerical example and public budget balance under certain reelection

Using Cramer’s rule, the effect of \(\theta _i\) on the debt level under certain reelection can be derived as

where f has been substituted for \(f_1=f_2\) due to (5c). Since \(g_1=g_2\) if the party in office ignores the environmental damage, it is straightforward to see that the sign of \(\partial b/\partial \theta _i\) only depends on the first product on the RHS of (20) when \(\theta _i=0\). Thus, for small increases in \(\theta _i\) close to zero, the government starts borrowing [saving] whenever it is socially optimal to accumulate public debt [savings]. Yet, as \(\theta _i\) increases, the sum of the last two terms on the RHS of (20) can attenuate or even overturn this effect. For the numerical analysis, I use a functional specification with

for both public goods \(g_t\) and \(f_t\), as well as the quadratic damage function

to illustrate the potential effects in a numerical example. Figure 4 is obtained by arbitrarily setting \((\alpha ,\beta ,\gamma )=(1,1,0.6)\). The qualitative effects do not hinge on these parameters. However, it becomes apparent that whether public debt or savings, respectively, are inefficiently high or low under certain reelection depends on the damage parameters \(\delta _t\) which also define if cumulative marginal damages increase or decrease over time.

1.3 Proof of Proposition 1

To prove Proposition 1, I introduce the preference distance parameter, \(\Delta =(\theta _2-\theta _1)\), measuring how much preferred internalization rates differ between periods. Since \(\theta _1\) is ex ante known, \(\Delta\) can be varied by either increasing or decreasing \(\theta _2\). Hence, the distance parameter takes values on the interval \(\Delta \in [-1,1]\). Cramer’s rule can be applied to the system of equations

which restate (7), (14) and (15). The marginal effect of \(\Delta\) on b then equals

where the Jacobian matrix of cross-derivatives, |J| reads

To obtain \(J_b\), substitute for the last column of J with the vector

In the quadratic specification, |J| can be factorized as

which is negative for all possible values of \(\theta _1\) and \(\theta _2\), considering that \(1+\gamma (3\gamma -2)>0\) if \(\gamma \in [0,1]\). The determinant of \(J_{b}\) equals

Thus, the marginal effect in (24) equals zero for \(\Delta =0\), i.e., in the certain reelection outcome. Analogously, \(\partial b/\partial \Delta\) is negative [positive] if the second-period government prefers a lower [higher] internalization rate than the incumbent, i.e., when \(\Delta <[>]0\). Hence, b is u-shaped in \(\Delta\) and increases as \(\Delta\) deviates from zero. \(\blacksquare\)

1.4 Proof of Proposition 2

The marginal effect of a change in \(\Delta\) on \(g_1\) can be derived analogously to the proof of Proposition 1 by employing Cramer’s rule to obtain

Recall that \(|J|<0\). Since the numerator of (29) is given by

the marginal effect becomes zero in \(\Delta =0\). Furthermore, \(\partial g_1/\partial \Delta >[<]0\) if \(\Delta <[>]0\) and \(\gamma >\tilde{\gamma }=1/3\) such that \(g_1\) is inversely u-shaped over \(\Delta\) with its maximum in \(\Delta =0\). For \(\gamma <\tilde{\gamma }\), \(\partial g_1/\partial \Delta <[>] 0\) if \(\Delta <[>]0\) and \(g_1\) is u-shaped. The effect increases with the difference between \(\theta _1\) and \(\theta _2\), i.e., with absolute value of \(\Delta\). \(\blacksquare\)

1.5 Proof of Proposition 3

To derive Proposition 3, first, differentiate TD with regard to \(\Delta\) to obtain

where \(\partial g_1/\partial \Delta\) is already known to be negative if \(\theta _1>\theta _2\) and \(\gamma <\tilde{\gamma }\) or \(\theta _1<\theta _2\) and \(\gamma >\tilde{\gamma }\) from Proposition 2. The marginal effect on the second-period provision, \(\partial g_2/\partial \Delta\), can be derived using Cramer’s rule such that its numerator is given as

where all terms in curly brackets are (weakly) positive when \(\gamma \in [0,1]\) except for the last term, i.e., \(2-\gamma -3\gamma ^2\gtrless 0\). Hence, a sufficient condition for this term to be positive is \(\gamma \le 2/3\). Additionally, the sum in the last line of (32) can also be rewritten as

such that \(\theta _1\ge \theta _2/3\) is another sufficient condition for \(|J_{g_2}|>0\). Together with \(|J|<0\), this implies that \(\partial g_2/\partial \Delta\) is always negative for \(\Delta <0\), i.e., \(\theta _1>\theta _2\) and negative for \(\Delta >0\) if \((2-\gamma -3\gamma ^2)(\theta _2\delta _2)^3\) is sufficiently large. When both, \(\partial g_1/\partial \Delta\) and \(\partial g_2/\partial \Delta\) are negative for \(\Delta <[>]0\), \(\partial TD/\partial \Delta <0\).\(\blacksquare\)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kellner, M. Strategic effects of stock pollution: the positive theory of fiscal deficits revisited. Public Choice 194, 157–179 (2023). https://doi.org/10.1007/s11127-022-01022-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-022-01022-z