Abstract

This paper examines the relationship between corruption and financial sector development in 106 countries. Using dummy variables to capture different levels of corruption, and interaction terms to see if financial sector development depends on institutional structures, we find evidence to support the ‘sand the wheels’ hypothesis. The results suggest that a decline in corruption is associated with higher levels of financial sector development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A financial system plays a vital role in an economy’s growth process by channelling funds from savers to borrowers. In the absence of a well-functioning financial system, an economy will not reach its full potential. The development of a financial system, however, may be constrained by a number of factors. In the present study we focus on corruption as one such factor. Corruption is a form of rent seeking (Lambsdorff 2002; Rose-Ackerman 1999).Footnote 1 More specifically, corruption is “a special means by which private parties may seek to pursue their interests in the competition for preferential treatment. Just like other forms of rent-seeking, corruption represents a way to escape the invisible hand of the market and influence policies to one’s own advantage” (Lambsdorff 2002, p. 104). Rent seeking “is designed to describe behavior in an institutional setting where the individual efforts to maximize social value generate social waste rather than social surplus” (Buchanan 1980, p. 4).

In the present study, we investigate whether corruption throws sand into or greases the wheels of financial sector development. Under the ‘sand the wheels’ hypothesis, corruption can be costly for economic activity (Mauro 1995; Rose-Ackerman 1999). In countries with weak institutions, private sector banks may not play a large role in the financial sector or, alternatively, may be crowded out by the government sector. This view is supported by La Porta et al. (2002), who found that government ownership of banks was more extensive in countries with interventionist, inefficient governments and those with weak institutions. Under such circumstances, government ownership of banks would imply that it is in a position to regulate finance and influence the allocation of funds to buy votes, receive bribes, receive insider information or influence supervision. That implication is supported by La Porta et al. (2002), who found that more extensive government ownership of banks was associated with greater political influence on lending. The government is in a position to channel funds to projects that are of political interest or influence private banks through excessive regulation, thus reducing economic efficiency (La Porta et al. 2002; Shleifer and Vishny 1994).

Corruption can be costly for economic activity because corruption exhibits increasing returns to scale (Murphy et al. 1993). In other words, in highly corrupt societies, rent-seeking activities become more attractive than productive activities, causing the former to increase at a faster rate than output. Corruption thus leads to a redistribution of resources to rent seekers, with no corresponding benefits to the rest of society. Redistribution, in turn, causes credit to be channelled away from investors with the most productive investment opportunities to those with political connections. Thus, by distorting the allocation of resources, corruption can act as a disincentive to both investing and saving. Such disincentives can undermine the financial system’s decision-making processes by creating problems of adverse selection and moral hazard. To the degree that corruption encourages moral hazard and conflicts of interest, banks will lend to high-risk borrowers (Barth et al. 2004), causing the volume of non-performing loans to rise. Additionally, the uncertainty in financial contract enforcement, asymmetric information, lack of transparency and unclear property rights that a corrupt environment generates, can reduce financial sector efficiency by increasing transaction costs and widening the spread between lending and borrowing rates of interest. The highly restrictive environment under which corrupt regimes operate can further magnify problems associated with secrecy, lack of transparency and accountability because regulatory bodies fail to monitor financial activities. The lack of transparency diminishes the credibility of a financial system, reducing investor confidence and increasing market volatility (Williams and Beare 2003). Greater market volatility, in turn, reduces the incentive to save and invest. Under such conditions, state ownership of banks can lead to resource misallocations that are damaging to financial sector development. Therefore, if corruption exacerbates the adverse effects of regulation and state ownership, financial sector development will be lower in the presence of corruption. That is, corruption would ‘sand the wheels’ of financial sector development.

The alternative view is that corruption ‘greases the wheels’ of economic activity. That would only hold true, however, in a second-best scenario, where governance structures are weak. According to the ‘grease the wheels’ literature, corruption can speed up economic activity under circumstances of weak governance structures and ineffective policy (Aidt 2009; Méon and Sekkat 2005). According to that hypothesis, if an inefficient bureaucrat is paid a bribe, the process of obtaining licences and permits could be speeded-up (Shleifer and Vishny 1993). Thus, if corruption acts as an ‘escape hatch’ in the presence of weak institutions, financial sector development will be more advanced in the presence of high levels of corruption; in other words, it would ‘grease the wheels’ of financial sector development.

According to Leff (1964, p. 11), “Corruption provides the insurance that if the government decides to steam full speed in the wrong direction, all will not be lost.” Another efficiency enhancing argument in favor of corruption is that corruption avoids administrative delays acting as regulatory “speed money” (Bardhan 1997). Corruption also can improve financial sector efficiency by creating competition for limited government resources, leading to more efficient provision of financial services than would otherwise occur (Aidt 2003; Lambsdorff 2002). Therefore, in countries with weak institutions, corruption can have a positive effect on financial sector development by facilitating financial contract enforcement and permitting the circumvention of restrictive rules. Thus, if this alternative hypothesis holds, then the effect of corruption on financial sector activity would be conditional on governance structures (Méon and Sekkat 2005; Aidt 2009). Under such circumstances, extensive regulations and the state ownership of banks can in fact lead to financial sector development by speeding up administrative delays and helping avoid regulatory restrictions.

Most studies show that corruption slows down economic activity. The social waste associated with rent seeking has been highlighted by Tullock (1967). According to Tullock (1967), even if transfers themselves do not result in a welfare cost, a large volume of real resources could be invested in making or preventing such transfers, which impose a large cost on society as a whole. Arguing along the same lines, Mauro (1995) observes that what is beneficial for the individual may be harmful for society as a whole. When a bribe is offered to an official, for example, although it benefits an individual favor-seeker, the exchange could lead to delay and excessive regulation until the bribe is paid, slowing down economic activity in general. Such an outcome is supported by Kaufmann and Wei (1999), who also conclude that even if an individual firm finds it optimal to bribe in a corrupt environment, it is not optimal for society as a whole. Tirole (1996) shows in an overlapping generation model that corruption can be passed on from one cohort to another. Even if corruption helps to ‘grease the wheels’ of economic activity in the short term, in the long term it provides incentives for the continuation of such practices. Aidt et al. (2008) and Aidt (2009) refer to the dangers of stating that corruption can be efficient when corrupt practices are created in the first place. Thus, according to them, despite efficiency enhancing arguments in favor of corruption, corruption moves us into a second-best world.

It is therefore important to understand how corruption affects financial sector development in order to formulate policies to deal with it. Following from the theoretical arguments, we investigate whether corruption sands or greases the wheels of financial sector activity. We test for this in different ways which include: using dummy variables to capture different levels of corruption and interaction terms to ask if financial sector performance is conditional on governance structures. We explore a variety of empirical methods, including fixed effects estimation to account for country-level, time-invariant unobservable influences on financial sector development, and system GMM estimation to correct for any potential endogeneity bias. Given the uncertainty and likely errors in empirical measures of corruption, the robustness of the results is tested using two different corruption datasets: the Transparency International (TI) and the International Country Risk Guide (ICRG 2014) datasets. A number of variables measuring financial sector size and quality are drawn from the existing literature. They include the ratio of M2 to GDP, the ratio of liquid liabilities to GDP, the ratio of domestic private-sector credit availability to GDP, the interest rate spread and non-performing loans (as in King and Levine 1993; Demirguc-Kunt and Maksimovic 1996; Levine and Zervos 1998, among others). The study covers 106 countries over the 1996–2012 period.

The rest of this study is organised as follows. Section 2 provides a short literature review of empirical studies. Section 3 presents the data, the model and estimation methodology. Section 4 discusses the empirical results and Section 5 concludes.

2 Related literature

This section summarizes the empirical literature on corruption and financial sector development focusing on: (1) studies maintaining that corruption ‘sands the wheels’ of economic activity and (2) studies maintaining that corruption ‘greases the wheels’ of economic activity.

The ‘sand the wheels’ hypothesis, suggests that corruption can adversely affect financial sector activity. That literature highlights inadequate supervisory policies, insider trading, extensive regulation and the absence of transparency as vital factors in the propagation of corrupt practices (Beck et al. 2006a, b; Barth et al. 2004; Wei 2000; Wei and Sievers 1999; Shleifer and Vishny 1993). Examining the association between bank supervisory policies and corrupt lending practices on firms’ ability to raise external financial resources, Beck et al. (2006a, b) show that countries in which supervisory agencies are powerful, private firms find it more difficult to raise external funds owing to greater government involvement in the channelling of loans. Greater supervisory powers are found to be associated with more national corruption, government ineffectiveness and absence of the rule of law. Similarly, Barth et al. (2004) observed that stronger regulatory restrictions on bank activity lead to a decline in banking sector efficiency. Arguing along the same lines, Shleifer and Vishny (1993) found that corruption can reduce financial sector efficiency because of the secrecy involved in bribe payments and the need for project approvals to pass through many hands. Correspondingly, Kaufmann (2010) noted that a lack of transparency in the presence of corruption leads to delays in the disclosure of a country’s true financial position (Kaufmann 2010). Du and Wei (2004) investigated the role of insider trading as an explanation for cross-country differences in stock market volatility. They find that countries with more insider trading have more volatile stock markets. Literature following the work of Manne (1966) however, suggests that insider trading increases stock market efficiency by allowing “inside” information to become public more quickly. Wei and Sievers (1999) similarly found that more corrupt countries exhibited greater correlation between inadequate supervisory policies and bank instability. That correlation strengthened further if banks are owned by the government. Such results are echoed by Barth et al. (2004) and La Porta et al. (2002), who observed that more extensive government ownership of banks led to greater politicization of the allocation of funds, which reduced economic efficiency.

The alternative view is that corruption ‘greases the wheels’ of financial sector activity. That view is consistent with the studies of Leff (1964), Nye (1967), Leys (1965), Johnson (1975), Wedeman (1997) and Dreher and Gassenbner (2013), who argued that corruption could avoid bad policies, thereby promoting economic activity in countries with weak institutions. For example, Leff (1964) argued that corruption could increase the rate of private sector investment and act as a hedge against bad policy, thus promoting economic development in countries with weak policies. According to Nye (1967), Johnson (1975) and Wedeman (1997), the economic impact of corruption depended on whether corrupt monies are consumed or invested, as well as whether they are retained at home or sent abroad. Johnson (1975) suggested that if corrupt monies are invested in productive activities having both forward and backward linkages, corruption could in fact expand economic activity. Wedeman (1997) identified three types of corruption—‘rent scraping’, looting and dividend collecting.Footnote 2 Wedeman noted that economic policies designed with the objective of earning rents (rent-scraping) could have one of two effects. Rent scraping could lead to a fall in the rate of return on capital investment leading to capital outflows, or it could lead to new investments and growth, in which case the money would remain at home. Wedeman argued that looting generates insecurity, leading to consumption of the rents at home or transfer of money out of the country. Dividend collecting, on the contrary, depends on the success of firms in generating profits, which gives officials the incentive to implement policies to promote investment. Therefore, according to those arguments, if the corrupt monies were retained at home generating investment, then corruption could in fact have a positive effect on financial sector development. Similarly, in countries with weak property rights, entrepreneurs could bribe officials to prevent closure of firms due to regulatory issues, or allocate their production facilities across several locations in fear of being caught (De Soto 1989, 2000; O’Driscoll and Hoskins 2003). Under the last set of conditions, corruption could ‘grease’ the wheels of small-scale economic activity in the short term; however, it is not conducive to exploiting economies of scale (De Soto 1989, 2000; O’Driscoll and Hoskins 2003). Dreher and Gassenbner (2013), examining if corruption is an efficient grease leading to a decline in the negative impact of regulation on entrepreneurship in highly regulated economies, found support for the grease in the wheels hypothesis.

The above discussion suggests that the answer to the question about whether corruption greases or sands the wheels of financial sector activity is that “it depends”. Méon and Sekkat (2005) argued that corruption may have positive effects on economic growth in countries where institutions are weak and the question of whether corruption greases or sands the wheels of economic activity therefore is conditional on how corruption interacts with the quality of governance indicators. Using a number of quality of governance variables, they found that corruption reduces economic growth when the quality of governance deteriorates, supporting the “sand the wheels” hypothesis. Mendez and Sepulveda (2006) showed that the relationship between corruption and growth was quadratic, and that the relationship depends on the degree of political freedom in a country. Aidt (2003) similarly argued that in countries with well-developed institutions, corruption had a significant negative impact on growth, while in countries with poor institutions, corruption had no effect on growth. Del Monte and Papagni (2007) found a U-shaped relation between corruption and political concentration in a regional study of corruption in Italy. As corruption increases, the credibility and transparency of a financial system declines, leading to a fall in financial sector development. Murphy et al. (1993) suggested that over some range as more resources were devoted to rent seeking, the returns to rent seeking and production will fall, with the returns to production declining at a faster rate than the returns to rent seeking.

Surprisingly, only a very limited literature investigates the direct relationship between corruption and financial sector development. While the present study is related to the literature summarized above, it differs from existing studies by investigating for the first time, corruption’s direct influence on financial sector development. As mentioned above, we test for that relationship in a number of different ways.

3 Data, model and estimation methodology

3.1 Data

The data cover the 1996–2012 period for 106 countries. The sample constitutes a representative cross-section of regions in Eastern Europe and Central Asia, the Middle East and North Africa, Latin America and the Caribbean, East Asia and the Pacific, South Asia and Sub-Saharan Africa. The grouping of regions is based on the World Bank’s classification. The high income OECD countries are excluded from the analysis because corruption levels in the member countries are relatively low and their financial sectors are well developed. A potential concern is that by not including all of the observations available for the countries included in the sample, bias owing to missing observations is introduced. We correct for that possibility by imputing the data points for the countries included in the sample and estimating the models.Footnote 3

The dependent variables in the study are various measures of financial sector development, which are based upon the existing literature (King and Levine 1993; Demirguc-Kunt and Maksimovic 1996; Levine and Zervos 1998, among others). They include three measures of financial sector size: the ratio of M2 to GDP, which is a measure of the magnitude and depth of the financial sector; the ratio of liquid liabilities to GDP, which is a measure of the size of the financial sector relative to the economy; and the ratio of domestic private-sector credit to GDP, which is a measure both of the provision of bank credit to the private sector and the extent of financial intermediation activity.Footnote 4 Two measures of banking efficiency are used. They include the interest rate spread (the difference between the lending and borrowing rates) and non-performing loans to total gross loans. A narrower interest rate spread and a smaller volume of non-performing loans are interpreted as reflecting greater financial sector efficiency.

The main independent variable of interest is corruption. Given the uncertainty and likely errors in measuring corruption, the robustness of the results is tested using two different corruption datasets. One is the corruption measure from Transparency International (TI). Here, the estimate of corruption ranges from 0 (totally corrupt) to 10 (not corrupt). The other is the International Country Risk Guide (ICRG) corruption index. The ICRG index ranges from 0 (totally corrupt) to 6 (not corrupt). Note that higher values on the corruption indices denote better control of corruption. The ICRG index provides annual ratings of corruption for countries from surveys of country experts. It is a measure of corruption within the political system that threatens foreign investment by distorting the economic and financial environment, reducing the efficiency of government and business by enabling people to assume positions of power through patronage rather than performance, thereby leading to political instability (Political Risk Services Group 2017). The TI corruption index captures the perceptions of analysts, business people and country experts. It should be noted that a country’s ranking can change as the data sources change from year to year because of changes in governance quality perceptions reported by individuals, changes in the weights used, changes in the underlying sources used to construct the aggregate governance indicators and new countries entering the index (Triesman 2007).

A number of other control variables are used in the empirical analysis. GDP per capita and the secondary school enrollment ratio measure the level of economic development of a country. We can expect more financial literacy acquired in schools to lead to greater use of a nation’s financial system and, thus, more financial activity (Beck and Martinez Peria 2011). As more government spending can increase reduce banking sector competitiveness by crowding out private sector investment (Tanzi and Davoodi 2002; Montinolla and Jackman 2002), the share of public consumption in GDP also is entered as an independent variable.

We carry out a number of tests of the sand or grease the wheels hypothesis. The corruption indices are ordinal, not cardinal rankings. Therefore, an increase in a corruption index from 1 to 2 may not be the same as an increase from 2 to 3. We thus enter dummy variables to classify countries into high, medium and low levels of corruption. Méon and Sekkat (2005) argue that the debate about whether corruption greases or sands the wheels of economic activity depends on how corruption interacts with the quality of governance. If corruption has a positive effect on financial sector development when the quality of governance is low, then this would support the grease the wheels hypothesis. If, on the other hand, corruption has a negative effect on financial sector development when the quality of governance is low, then sand the wheels hypothesis would be supported. As pointed by Méon and Sekkat (2005) and Aidt (2009), the conditional effects of corruption can be tested by constructing an interaction term between corruption and measures of governance quality. We use the ‘rule of law’Footnote 5 Variables are from the World Bank’s governance indicators compiled by Kaufmann et al. (2012) to measure the quality of governance, as in Aidt (2009). Similarly, in the presence of extensive regulations, interventionist policies can slow down financial sector development (La Porta et al. 2002). We also enter state ownership of banks and an interaction term between corruption and state ownership. The data for the state ownership of banks are taken from Beck et al. (2006a, b).

Table 6 of the “Appendix” reports summary statistics and data sources for the variables used in the study. The TI corruption index ranges from 0 (high corruption) to 10 (no corruption) and the ICRG corruption index ranges from 0 (totally corrupt) to 6 (not corrupt). The mean value of the TI corruption index in the sample is 3.07, while the mean value of the ICRG index is 2.26. Wide variation across countries in the financial sector variables is evident as can be seen from these statistics. For example, private credit is less than 10% of GDP in Chad, Congo (Republic and Democratic Republic) and Guinea-Bissau, whereas it is greater than 100% in China. Similarly, M2/GDP exceeds 100% in Jordan, China, Malaysia and Lebanon, while it is less than 10% for most years in the Democratic Republic of Congo. The interest rate spread varies from negative in some years for Iran, to positive and very large for some of the South American countries. Table 1 reports correlations between financial sector size and efficiency and the corruption indicators. A positive correlation of 0.89 is found between the two corruption indices. All three of the financial sector size variables are positively correlated with the corruption indicators; in other words, lower levels of corruption are positively associated with higher levels of private-sector credit availability, liquid liabilities and M2. The financial sector efficiency variables are correlated negatively with the corruption indicators, suggesting that more corruption is associated with narrower interest rate spreads and fewer non-performing loans.

As the data have a time-series dimension, we conduct Fisher-type unit root tests on the data, the results of which are reported in Table 7 of the “Appendix”. The benefit of the test is that it can be applied to unbalanced panel data. The test’s null hypothesis is that all panels contain a unit root; the alternative hypothesis is that at least one panel is stationary. We report the ADF Chi square statistics, which apply to finite samples. The p-values reported within parentheses are all below 0.01, rejecting the null hypothesis of non-stationarity at the 1% level of statistical significance for all data series. The Phillips–Perron (PP) Chi squared statistics yield similar results.

3.2 The model and methodology

The preliminary estimation is carried out using panel country and time fixed effects. Both fixed and random effects models were estimated. However, the results of the Hausman test provided greater support for the fixed effects model. Therefore, the paper reports results only for panel fixed effects estimation. The fixed effects estimator permits controlling for any unobserved country-specific, time-invariant effects. The panel data model can be expressed by Eq. (1) as follows:

where yit is the financial development indicator for country i in period t and yit−1 is a lagged value of the dependent variable. Vector Xit represents all independent variables, including corruption and the control variables, \(\varpi_{i}\) captures the country-specific effect, ηt, takes into account the relevant time effect and µit is a random error term. Interaction terms are entered into the above specification to investigate differential effects conditional on governance quality.

It can be argued that all explanatory variables used in our empirical model are not strictly exogenous. An approach that allows controlling for the joint endogeneity of explanatory variables by using internal instruments is the Arellano and Bover (1995)–Blundell and Bond (1998) system GMM estimator. In brief, Eq. (2), which involves variables in levels, is combined with Eq. (3), which involves variables in first differences.Footnote 6 Equation (2) is instrumented by lagged first differences of the variables, whereas Eq. (3) is instrumented by lagged variables in levels.

The variable definitions are the same as for Eq. (1) above. The GMM estimator is based on the assumption that the error terms are not serially correlated and that the explanatory variables are weakly exogenous or not significantly correlated with future realizations of the error terms, under which the following moment condition holds for the first difference estimator:

As mentioned above, the levels’ equation is instrumented with lagged first differences of the variables, which leads to an additional moment condition as follows:

Diagnostic tests, namely the Hansen test for over-identifying restrictions, under which the null hypothesis is that the instruments are not correlated with the residuals, and the Arellano–Bond test for second-order correlation in the first-differenced residuals are carried out. A problem encountered with the system GMM estimator is that too many instruments can lead to a finite sample bias by overfitting the endogenous variables and reducing the power of the Hansen test (see Roodman 2009). Following Roodman (2009), we collapse the instrument matrix using two lags for the system GMM estimators. We also test the system GMM estimators in order to explore the robustness of the results to the lag structure; we find one lag to be sufficient. The equation in levels can suffer from a weak instrument problem when the variance ratio is large (see Bun and Windmeijer 2010). In order to test for this, the Lagrange Multiplier test of Kleibergen (2005)Footnote 7 and the Cragg and Donald (1993) Wald F-statistic test for weak instrument asymptotics also are carried out.

4 Empirical results

4.1 Preliminary results

The preliminary estimation is carried out using fixed effects estimation to control for time-invariant country effects. As mentioned above, the corruption indices are ordinal and not cardinal. We therefore created three dummy variables by grouping the countries into high, medium and low levels of corruption. Countries on the TI index with corruption levels of 3 and below are coded as ‘highly corrupt’, those with corruption levels of above 3 and below 7 are coded as having ‘medium’ levels of corruption, and those with corruption levels of 7 and above are treated as having ‘low’ levels of corruption. Similarly, on the ICRG index, countries with corruption levels of 2 and below are coded as ‘highly corrupt’, those with corruption levels of above 2 and below 5 are coded as having ‘medium’ levels of corruption, and those with corruption levels of 5 and above are treated as having ‘low’ levels of corruption. Countries with ‘low’ levels of corruption are the benchmark groups. The results are reported in Table 2.

Control variables are included for per capita income and human capital to account for the level of development of the country, government expenditure to GDP is entered because high public spending can strain the financial system of a country and countries for which the rule of law is weak are likely to be more corrupt. With the exception of three variables (corruption, rule of law indices and secondary school enrollment shares), the variables have been transformed logarithmically.

The coefficients on the dummy variables for countries with ‘high’ and ‘medium’ levels of corruption are negative and statistically significant. The results in Panel A indicate that relative to the group with ‘low’ corruption, countries with ‘high’ and ‘medium’ corruption experience less financial sector development. In column (1), for example, private credit in the ‘high’ corruption group is 5% lower than in the ‘low’ corruption group, and private credit is 2% lower in the group with ‘medium’ levels of corruption than in the ‘low’ corruption group. The larger negative coefficient on the ‘high’ corruption group relative to the group with ‘medium’ levels of corruption, suggests that private-sector credit availability increases as a country becomes less corrupt. Similarly, the marginal effect of corruption on M2 and liquid liabilities is larger for the ‘high’ corruption group than in the group with ‘medium’ levels of corruption, indicating that as a country becomes less corrupt, the financial sector size variables increase. Taking a look at the coefficients on the interest rate spread and non-performing loans, the larger positive coefficients on the ‘high’ corruption group relative to the group with ‘medium’ levels of corruption suggest that interest rate spreads and non-performing loans decline as a country becomes less corrupt. Those results provide evidence in favor of the ‘sand the wheels’ hypothesis. Similar results are obtained in Panel B for the estimations using the ICRG index, providing additional support for the ‘sand the wheels’ hypothesis.

Taking a look at the control variables, the results indicate that a country’s level of development as measured by per capita income and secondary school enrollment rates and a stronger rule of law have positive and significant effects on financial sector development. Higher per capita incomes, educational attainment and closer adherence to the rule of law lead to increases in private credit availability, M2 and liquid liabilities, as well as to narrower interest rate spreads and fewer non-performing loans, suggesting that higher levels of economic development, greater financial literacy and a stronger rule of law all are associated with larger financial sector size and greater efficiency. More government spending leads to an increase in the supply of money, liquid liabilities and private credit, implying that larger governments (relative to GDP) leads to an increase in financial sector size, but not efficiency. This is not an unreasonable result, as the continued reliance of the government on state owned banks can lead to a lack of competitiveness, and rising overhead costs and interest margins (Cooray 2011). Given that the results are qualitatively similar using both corruption indices, we report results only using the TI index in subsequent estimation.

Next, we test our hypothesis that the effects on the financial sector depend on governance quality by interacting the ‘rule of law’ variable from Kaufmann et al. (2012) with the TI corruption index, as in Méon and Sekkat (2005), Méon and Weill (2010) and Aidt (2009).Footnote 8 If the sand the wheels hypothesis holds, corruption will have a negative effect on financial sector development when the quality of governance is low. If, on the other hand, the grease the wheels hypothesis holds, corruption will have a positive effect on financial sector development when the quality of governance is low. We also include state ownership of banks and interact that variable with the corruption index, as direct government intervention into the financial sector can lead to banking system inefficiency. The results are reported in Table 3.

The coefficients on the corruption dummy variables are statistically significant. Consistent with the results reported in Table 2, compared to the group of countries with ‘low’ corruption, countries with ‘high’ and ‘medium’ corruption experience lower levels of financial sector development. In column (2), for instance, M2, which measures the magnitude and depth of the financial sector, in the ‘high’ corruption group is 4% less than in the ‘low’ corruption group; and M2 is 2% lower the group with ‘medium’ levels of corruption than in the ‘low’ corruption group. Once again, the larger negative coefficient on the ‘high’ corruption group compared to the ‘medium’ corruption group suggests that, as a country becomes less corrupt, it experiences a higher level of financial sector development. The same result is found for private credit and liquid liabilities. Similarly, the coefficients on the interest rate spread and non-performing loans are larger in the ‘high’ corruption group than in the ‘low’ corruption group. While larger interest rate spreads and more non-performing loans are observed in the ‘medium’ corruption group than in the ‘low corruption group, the coefficients are smaller than those for the ‘high’ corruption group, suggesting that as the level of corruption falls, non-performing loans and interest rate spreads also fall.

The interaction between corruption and rule of law is negative for the financial sector size variables and positive for the financial sector efficiency variables for both groups of countries. The negative marginal effects on the financial sector size variables and positive marginal effects on the financial sector efficiency variables for the ‘high’ corruption group, however, are larger than in the ‘medium’ corruption group, suggesting that as corruption declines, institutions have a stronger positive effect on financial sector development. That conclusion is supported by the marginal effects on the ‘high’ corruption group, which range from 0.006 for private credit to 0.001 for M2, while the marginal effects on the ‘medium’ corruption group are 0.008 for private credit and 0.002 for M2. The interaction between corruption and government ownership of banks suggests that in the ‘high’ corruption group, direct government regulation of banks has a negative effect on financial sector development, while in the group with ‘medium’ levels of corruption, the coefficients are not statistically significant. Per capita income, the rule of law and human capital have positive and significant effects on financial sector development; government expenditure has a positive and significant effect on the financial sector size variables. Government ownership of banks has a negative effect on the financial sector size variables.

4.2 Robustness checks

Table 4 reports system GMM estimates. We repeat the estimation in Table 3 using system GMM.

The results are similar to the results reported above under the fixed effects estimation, suggesting support for the sand the wheels hypothesis. Once again, the coefficients on the corruption dummy variables are statistically significant. The countries with ‘high’ and ‘medium’ levels of corruption experience lower levels of financial sector development than those with ‘low’ levels of corruption. The larger negative marginal effect in the ‘high’ corruption group compared to the group with ‘medium’ levels of corruption suggests that as a country becomes less corrupt, it experiences higher levels of financial sector development.

The interactions between corruption and rule of law are negative for financial sector size in both groups of countries and negative for financial sector efficiency. The larger negative marginal effect in the ‘high’ corruption group suggests that as the rule of law strengthens, the negative effect of corruption on the financial sector starts decreasing. The interaction between corruption and government ownership of banks indicates that direct government regulation of banks has a negative effect on financial sector development in the ‘high’ corruption group, while it has no effect on the ‘medium’ corruption group. Per capita income, the rule of law and human capital have positive and significant effects on financial sector development, and government expenditure has a positive significant effect on financial sector size variables. Government ownership of banks has a negative effect on financial sector size.

Bun and Windmeijer (2010) showed that equations estimated in levels can suffer from a weak instrument problem when the variance ratio of the individual fixed effects to the errors is large. In the presence of weak instruments, the estimators are biased and the results are inaccurate. We perform the Cragg–Donald Wald F test and the Kleibergen (2005) Lagrange multiplier (LM)Footnote 9 test in order to see if our instruments are weak. From the underidentification test, we can conclude that the excluded instruments are relevant. Newey and Windmeijer (2009) showed that these test statistics are robust to weak instrument asymptotics. The Hansen test and the serial correlation test confirm that the moment conditions cannot be rejected.

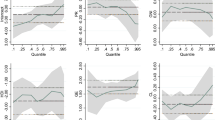

To account for regional factors that may affect the relationship between corruption and financial sector development, we group the countries on the basis of their geographical locations. The regions are classified according to the World Bank: Latin America and the Caribbean, Eastern Europe and Central Asia, Middle East and North Africa, South Asia, East Asia and the Pacific. The results are reported in Table 5.

Consistent with the previous results, the interaction between corruption and rule of law is negative for all countries. The coefficient on the ‘high’ corruption group is larger than that for the ‘medium’ corruption group, suggesting that the negative effect of corruption on the financial sector starts weakening as the rule of law strengthens. The interaction between corruption and government ownership of banks suggests that in the ‘high’ corruption group, direct government regulation of banks has a negative effect on financial sector development. The results on the other control variables are similar to those obtained above.

The estimated regional coefficients indicate that in Africa the financial sector size variables are significant and smaller than in the benchmark group, Eastern Europe and Central Asia, and that non-performing loans and the interest rate spread are significantly larger than in the base group. Evidence shows that the banking systems in Africa are concentrated and in general inefficient at financial intermediation, which explains the lack of depth and larger spreads and margins of these banks (European Investment Bank 2013). In the Middle East and North Africa, the estimated coefficients on the financial sector size variables are significantly larger than in Eastern Europe and Central Asia, and the coefficients on non-performing loans and the interest rate spread are smaller than in the base group. In Latin American and the Caribbean, the coefficients on money supply and non-performing loans are positive and significant, suggesting that both are larger than in the benchmark group. In South Asia, the coefficient on money supply is positive and significant, while in East Asia and the Pacific the coefficients on non-performing loans and the interest rate spread are negative and significant. Higher non-performing loans in Central Asia and Eastern Europe compared to East Asia and the Pacific and the Middle East and North Africa, could be due to unemployment and inflation associated with economic transition.

4.3 Additional robustness checks

As discussed by Nunn and Puga (2012), it is possible that the results reported herein are driven by outliers. We test for that possibility by excluding outlying observations from the sample. We first estimate the models using OLS and obtain Cook’s D for each observation. We then drop the observations with Cook’s distance exceeding 1. The iteration process begins by calculating weights based on absolute residuals. The iteration stops when the maximum change in weights from one iteration to the next is below tolerance.Footnote 10 Two types of weights, the Huber weight and biweights are employed. In Huber weighting, observations with small residuals receive a weight of 1 and larger residuals are assigned lesser weights. With biweighting, all cases with a non-zero residual are down-weighted. The models are reestimated by dropping the most influential points and down-weighting the large absolute residuals (Bruin 2006). The basic conclusions do not change.

Next, based on the general to specific work of Hoover and Perez (1999) and Hendry and Krolzig (2005), we use the ‘genspec’ command put forward by Clarke (2013) in STATA, which permits running a series of regressions and settling at our final model. We first made sure that the general unrestricted model (GUM) did not suffer from any diagnostic problems on the basis of heteroscedasticity, non-normality and incorrect functional form. No mis-specification was observed in the GUM and this reduced to the final model, which was checked by a Doornik–Hansen test for normality of errors, the Breusch–Pagan test for homoscedasticity of errors, the RESET test for the linearity of coefficients and an in-sample and out-of-sample stability F-test for normality of errors. The models pass these diagnostic tests.

Owing to problems associated with the TI and ICRG corruption indices associated with changing methodologies and inter-year variation, along with reliance on different underlying sources for constructing the indices (Triesman 2007), we also estimated the models using the Kaufmann et al. (2012) Corruption Index (results not reported). The basic conclusions do not change.

We also carried out the estimation for countries with weak institutions, i.e., countries ranking 6 or below on the polity index. The coefficients on the interaction terms are consistent with the results reported in previous tables. The positively signed coefficients on per capital income, and secondary school enrollment ratio suggest that all have positive effects on financial sector development, while government expenditure negatively impact such development.

5 Conclusions

This study examines the relationship between corruption and financial sector development. Using a number of different tests, including dummy variables for different levels of corruption, interactions between corruption and the quality of governance and between corruption and government ownership of banks, we find evidence to support the ‘sand the wheels’ hypothesis. The results suggest that corruption has adverse effects on financial sector development, consistent with the studies of Beck et al. (2006a, b), Barth et al. (2004), Wei (2000) and Wei and Sievers (1999), among others. The results also suggest that the redistribution of resources to rent seekers channels them away from productive activities, increasing interest rate spreads and transaction costs, leading to a decline in financial sector efficiency.

Weak property rights and ineffective rule of law are related closely to corruption. Strong property rights improve a country’s growth and development prospects. Resource endowments neither are necessary nor sufficient for development in the presence of weak property rights (O’Driscoll and Hoskins 2003). Argentina provides an example of a country which is rich in natural resources, including oil. It nevertheless has faced economic crises owing to weak institutions and bad policies. De Soto (1989, 2000) cited Peru as an example of a country in which 15% of gross income from manufacturing was paid out in the form of bribes to government officials. In countries such as those, corruption will not ‘grease the wheels’ of economic progress.

Notes

Wedeman (1997) defined looting as theft of public funds and property; rent scraping as the manipulation of macroeconomic policy to produce rents; and dividend collecting as the transfer of a certain proportion of profits earned by privately owned firms to government officials.

We impute the data points using the ‘mi impute’ command in STATA. This command replaces missing values with multiple sets of simulated values to complete fill in the observations, applies estimation to each completed dataset and adjusts the obtained parameter estimates for missing-data uncertainty (Rubin 1987). Fifteen percent of the observations are imputed.

M2 includes, M1+ savings deposits and money market deposit accounts, small time deposits (e.g., CDs), and money market mutual funds. M1 includes cash in circulation plus demand deposits (money held in checking accounts), plus travellers cheques, plus “other” checkable deposits (interest-bearing checking accounts) (Mishkin 2010).

‘Rule of law’ reflects perceptions of the extent to which agents have confidence in and abide by the formal rules of society and, in particular, the quality of contract enforcement, property rights, the police and the courts, as well as the likelihood of being the victim of crime and violence (Kaufmann et al. 2012).

The system GMM estimator may not correct for the potential omitted variable bias, however. We attempt to correct for the omitted variable bias by entering the lagged values of the dependent variable as a regressor in the system GMM estimation, as past values of the dependent variable can influence contemporaneous values. The fixed effects estimator corrects for the omitted variable bias by controlling for fixed effects. The system GMM estimator however, corrects for potential endogeneity.

Note, we also tested the models by interacting corruption with the ‘voice and accountability’ and ‘government effectiveness’ indices. The results are not reported because of the large number of additional dependent variables. The conclusions are similar to those with found by interacting corruption with the ‘rule of law’.

Tolerance is simply 1 minus regression R-square. Low values indicate possible multicollinearity.

References

Aidt, T. (2003). Economic analysis of corruption: A survey. Economic Journal, 113, 632–652.

Aidt, T. (2009). Corruption, institutions and economic development. Oxford Review of Economic Policy, 25, 271–291.

Aidt, T., Dutta, J., & Sena, V. (2008). Governance regimes, corruption and growth: Theory and evidence. Journal of Comparative Economics, 36, 195–220.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variables estimation of error components models. Journal of Econometrics, 68, 29–51.

Bardhan, P. (1997). Corruption and development: A review of issues. Journal of Economic Literature, 35, 1320–1346.

Barth, J., Caprio, G., Jr., & Levine, R. (2004). Bank regulation and supervision: What works best? Journal of Financial Intermediation, 13, 205–248.

Baum, C., Schaffer, M., & Stillman, S. (2007). Enhanced routines for instrumental variables/GMM estimation and testing. Stata Journal, 7, 465–506.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2006a). Bank supervision and corruption in lending. Journal of Monetary Economic, 53, 2131–2163.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2006b). Bank concentration and crises. Journal of Banking and Finance, 30, 1581–1603.

Beck, T., & Martinez Peria, M. (2011). What explains the price of remittances? An examination across 119 country corridors. World Bank Economic Review, 25, 105–131.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Bruin, J. (2006). Newtest: Command to compute new test. UCLA: Statistical consulting group. http://www.ats.ucla.edu/stat/stata/ado/analysis/. Accessed Jan 2016.

Buchanan, J. M. (1980). Rent-seeking and profit-seeking. In J. Buchanan, R. D. Tollison, & G. Tullock (Eds.), Towards a theory of the rent-seeking society. College Station, TX: Texas A&M University Press.

Bun, M., & Windmeijer, F. (2010). The weak instrument problem of the system GMM estimator in dynamic panel data models. Econometrics Journal, 13, 95–126.

Claessens, S., & Laeven, L. (2003). Financial development, property rights, and growth. Journal of Finance, 58, 2401–2436.

Clarke, D. (2013). GETS: Stata module to implement a general-to-specific modelling algorithm, Statistical Software Components S457705, Boston College Department of Economics. Revised September 28, 2013.

Cooray, A. (2011). The role of the government in financial sector development. Economic Modelling, 28, 928–938.

Cragg, J. G., & Donald, S. (1993). Testing identifiability and specification in instrumental variables models. Econometric Theory, 9, 222–240.

De Soto, H. (1989). The other path: The economic answer to terrorism. New York, NY: Basic Books.

De Soto, H. (2000). The mystery of capital: Why capitalism triumphs in the west and fails everywhere else. New York, NY: Basic Books.

Del Monte, A., & Papagni, E. (2007). The determinants of corruption in Italy: Regional panel data analysis. European Journal of Political Economy, 23, 379–396.

Demirguc-Kunt, A., & Maksimovic, V. (1996). Stock market development and financing choices of firms. World Bank Economic Review, 10, 341–369.

Demirguc-Kunt, A., & Maksimovic, V. (1998). Law, finance, and firm growth. Journal of Finance, 53, 2107–2137.

Dreher, A., & Gassenbner, M. (2013). Greasing the wheels? The impact of regulation and corruption on firm entry. Public Choice, 155, 413–432.

Du, J., & Wei, S. (2004). Does insider trading raise market volatility? Economic Journal, 114, 916–942.

European Investment Bank. (2013). Banking in sub-Saharan Africa challenges and opportunities, Luxembourg.

Hendry, D. F., & Krolzig, H. (2005). The properties of automatic “GETS” modelling. Economic Journal, 115, C32–C61.

Hoover, K. D., & Perez, S. (1999). Data mining reconsidered: Encompassing the general-to-specific approach to specification search. Econometrics Journal, 2, 167–191.

Johnson, E. (1975). An economic analysis of corrupt government, with special application for less developed countries. Kyklos, 28, 47–61.

Kaufmann, D. (2010). Can corruption adversely affect public finances in industrialized countries? Brookings. http://www.brookings.edu/research/opinions/2010/04/19-corruption-kaufmann. Retrieved July, 2013.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2012). World governance indicators project. Washington, DC: World Bank.

Kaufmann, D., & Wei, S. (1999). Does ‘Grease Money’ speed up the wheels of commerce? NBER working paper no. 7093, Cambridge, MA.

King, R., & Levine, R. (1993). Finance and growth: Schumpeter might be right. Quarterly Journal of Economics, 108, 717–738.

Kleibergen, F. (2005). Testing parameters in GMM without assuming that they are identified. Econometrica, 73, 1103–1123.

Krueger, A. (1974). The political economy of the rent seeking society. American Economic Review, 64, 291–303.

La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (2002). Government ownership of banks. Journal of Finance, 57, 265–301.

Lambsdorff, J. G. (2002). Corruption and rent seeking. Public Choice, 113, 97–125.

Leff, N. (1964). Economic development through bureaucratic corruption. American Behavioral Scientist, 82, 337–341.

Levine, R., & Zervos, S. (1998). Stock markets, banks and economic growth. American Economic Review, 26, 1169–1183.

Leys, C. (1965). What is the problem about corruption? Journal of Modern African Studies, 3, 215–230 (Reprinted in Political corruption: A handbook, A. J. Heidenheimer, M. Johnston, & V. T. LeVine (Eds.), Oxford: Transaction Books, pp. 51–66, 1989).

Manne, H. C. (1966). Insider trading and the stock market. New York, NY: The Free Press.

Marshall, M., & Jaggers, K. (2015). Polity IV project. Available at: http://www.systemicpeace.org/polity/polity15.htm#nam. Retrieved Dec, 2015.

Mauro, P. (1995). Corruption and growth. The Quarterly Journal of Economics, 110, 681–712.

Mendez, F., & Sepulveda, F. (2006). Corruption, growth and political regimes: Cross country evidence. European Journal of Political Economy, 22, 82–98.

Méon, P., & Sekkat, K. (2005). Does corruption grease or sand the wheels of growth? Public Choice, 122, 69–97.

Méon, P., & Weill, L. (2010). Is corruption an efficient grease? World Development, 38, 244–259.

Mishkin, F. S. (2010). Economics of money, banking and financial markets (9th ed.). Columbia, London: Columbia University, Pearson.

Montinolla, G., & Jackman, R. (2002). Sources of corruption: A cross country study. British Journal of Political Science, 32, 147–170.

Moreira, M. (2003). A conditional likelihood ratio test for structural models. Econometrica, 71, 1027–1048.

Murphy, K., Shleifer, A., & Vishny, R. (1993). Why is rent-weeking so costly for growth? American Economic Reivew Papers and Proceedings of the Hundred and Fifth Annual Meeting, 83, 409–414.

Newey, W. K., & Windmeijer, F. (2009). Generalized method of moments with many weak moment conditions. Econometrica, 77, 687–719.

Nunn, N., & Puga, D. (2012). Ruggedness: The blessing of bad geography in Africa. Review of Economics and Statistics, 94, 20–36.

Nye, J. (1967). Corruption and political development: A cost-benefit analysis. American Political Science Review, 61, 417–427.

O’Driscoll, D., Jr., & Hoskins, L. (2003). Why property rights? Policy Analysis, 482, 1–17.

Political Risk Services Group. (2017). Guide to data variables. http://epub.prsgroup.com/list-of-all-variable-definitions. Retrieved Nov 2, 2017.

Posner, R. (1975). The social cost of monopoly and regulation. Journal of Political Economy, 83, 807–827.

Report, I. C. R. G. (2014). ICRG report on methodology. London: ICRG.

Roodman, D. (2009). Practioners’ corner: A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71, 135–158.

Rose-Ackerman, S. (1999). Corruption and government, causes, consequences and reform. Cambridge: Cambridge University Press.

Rubin, D. (1987). Multiple imputation for nonresponse in surveys. New York, NY: Wiley.

Shleifer, A., & Vishny, R. (1993). Corruption. The Quarterly Journal of Economics, 108, 599–617.

Shleifer, A., & Vishny, R. (1994). Politicians and firms. Quarterly Journal of Economics, 109, 995–1025.

Stock, J. H., Wright, J. H., & Yogo, M. (2002). A survey of weak instruments and weak identification in generalized method of moments. Journal of Business and Economic Statistics, 20, 518–529.

Tanzi, V., & Davoodi, H. (2002). Corruption, public investment, and growth. In G. T. Abed & S. Gupta (Eds.), Governance, corruption, and economic performance (pp. 280–299). Washington, DC: International Monetary Fund, Publication Services.

Tirole, J. (1996). A theory of collective reputations. Review of Economic Studies, 63, 1–22.

Triesman, D. (2007). What have we learnt about the causes of corruption from ten years of cross national empirical research. Annual Review of Political Science, 10, 211–244.

Tullock, G. (1967). The welfare costs of tariffs, monopolies, and theft. Western Economic Journal, 5, 224–232.

Wedeman, A. (1997). Looters, rent-scrapers, and dividend-collectors: Corruption and growth in Zaire, South Korea, and the Philippines. Journal of Developing Areas, 31, 457–478.

Wei, S. (2000). How taxing is corruption on international investors? Review of Economics and Statistics, 82, 1–11.

Wei, S., & Sievers, S. (1999). The cost of crony capitalism. Asian competitiveness report (pp. 50–55). Geneva: World Economic Forum.

Williams, J., & Beare, M. (2003). The business of bribery: Globalization, economic liberalization and the ‘Problem’ of corruption. In M. Beare (Ed.), Critical reflections on transnational organized crime, money laundering and corruption (pp. 88–119). Canada: University of Toronto.

Acknowledgements

Open access funding provided by Johannes Kepler University Linz. We wish to thank the Associate Editor, Peter Kurrild-Klitgaard and three anonymous referees for valuable suggestions. We also wish thank seminar participants at Macquarie University, and conference participants at the Southern Economic Association, Washington, for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Cooray, A., Schneider, F. Does corruption throw sand into or grease the wheels of financial sector development?. Public Choice 177, 111–133 (2018). https://doi.org/10.1007/s11127-018-0592-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-018-0592-7