Abstract

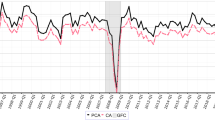

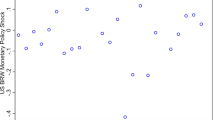

The paper compares unrestricted and restricted reduced-form estimates of productivity and efficiency performance constructed from non-structural stochastic frontier analysis (SFA) and the structural models of Olley–Pakes (OP), Ackerberg–Caves–Frazer (ACF), Pakes–McGuire (PM), and Midrigan–Xu (MX). These methods are used to estimate changes in firm-level manufacturing productivity in the British Isles before and after the 2007–2009 financial crisis using the Financial Analysis Made Easy (FAME) data set over the period 2005–2012. The empirical results indicate that overall technical efficiency was not impacted to any substantial degree by the financial crisis, according to all models. The empirical results also indicate substantial agreement in the predictions of productivity growth for the three models. The SFA framework (and related DEA approaches) is used internationally to set tariffs in regulated industries. To have SFA, and the OP/ACF/PM/MX models that are more highly leveraged on economic optimizing assumptions, provide comparable estimates of productivity and efficiency change is reassuring. However, it also would suggest that structural approaches may not provide regulators much new information about efficiency and productivity than would less structural approaches such as SFA, while being less transparent and more difficult to justify to regulators as well as to the courts to which regulated firms often turn for relief from tariffs they perceive to be unfair or onerous.

Similar content being viewed by others

Notes

This is the assumption for ACF correction to OP model. We can replace investment with intermediate input for ACF correction to Levinsohn–Petrin (LP) model when intermediate input rather than investment is used as proxy variable.

This Chilean firm-level production data is a well-known and broadly used dataset in the related literature (Mollisi and Rovigatti 2017). The sectorial subsample of Chilean firm-level production data that we adopt is available at R package “prodest” (https://rdrr.io/cran/prodest/man/chilean.html).

The SFA approaches in Section 7.1 also give an average efficiency of 44.6% for the newly established firm in 2005 (the entrants) in the British Isles. Therefore, this paper sets a corresponding efficiency level of 9 (out of 19) in the PM approach for new firms.

The probability of unemployed workers staying unemployed.

The probability of employed workers remaining employed.

Data are from Federal Reserve Bank of St. Louis at https://fred.stlouisfed.org/series/GBREPRNA.

Nash-in-quantities means the quantity is the strategic variable. In other words, the strategy space for each firm contains all the finite and non-negative levels of output. And each firm chooses the output to maximize profit, taking the output choice of its opponents as fixed. Nash-in-price is a similar game, but here it is supposed that the firms choose price instead of the output.

References

Ackerberg DA, Caves K, Frazer G (2015) Identification properties of recent production function estimators. Econometrica 83:2411–2451

Agrell PJ, Bogetoft P (2017) Regulatory benchmarking: models, analyses and applications. Data Envelopment Anal J 3:49–91

Agrell PJ, Bogetoft P (2018) Theory, techniques, and applications of regulatory benchmarking and productivity analysis, the Oxford handbook of productivity analysis, Oxford University Press, New York

Aigner D, Lovell CA, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econ 6:21–37

Amsler C, Prokhorov A, Schmidt P (2016) Endogeneity in stochastic frontier models. J Econ 190:280–288

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Economic Stud 58:277–297

Asmild M, Baležentis T, Hougaard JL (2016) Multi-directional productivity change: MEA-Malmquist. J Product Anal 46:109–119

Bai J (2009) Panel data models with interactive fixed effects. Econometrica 77:1229–1279

Bai J, Ng S (2002) Determining the number of factors in approximate factor models. Econometrica 70:191–221

Ball VE, San-Juan-Mesonada C, Ulloa CA (2014) State productivity growth in agriculture: catching-up and the business cycle. J Product Anal 42:327–338

Basu S, Fernald JG (1997) Returns to scale in US production: estimates and implications. J Political Econ 105:249–283

Battese GE, Coelli TJ (1992) Frontier production functions, technical efficiency and panel data: with application to paddy foarmers in India. J Productivity Anal 3:153–169

Benfratello L, Sembenelli A (2002) Research joint ventures and firm level performance. Res Policy 31:493–507

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87:115–143

Bogetoft P (2013) Performance benchmarking: measuring and managing performance. Springer Science & Business Media, New York, USA

Boucinha M, Ribeiro N, Weyman-Jones T (2013) An assessment of Portuguese banks’ efficiency and productivity towards euro area participation. J Product Anal 39:177–190

Bughin J, Dimson J, Hunt V, Allas T, Krishnan M, Mischke J, et al. (2018) Solving the United Kingdom’s productivity puzzle in a digital age. McKinsey Global Institute Discussion Paper

Burnside C (1996) Production function regressions, returns to scale, and externalities. J Monetary Econ 37:177–201

Chadha J, Crystal A, Pearlman J, Smith P, Wright S (2016) The UK economy in the long expansion and its aftermath. Cambridge University Press, Cambridge, UK

Chamberlain G (1984) Panel data. Handb Econ 2:1247–1318

Comin D (2010) Total factor productivity. In: Economic growth. Palgrave Macmillan, London, UK, 260–263

Cornwell C, Schmidt P, Sickles RC (1990) Production frontiers with cross-sectional and time-series variation in efficiency levels. J Econ 46:185–200

Cummins JD, Xie X (2013) Efficiency, productivity, and scale economies in the US property-liability insurance industry. J Product Anal 39:141–164

Curi C, Lozano-Vivas A (2015) Financial center productivity and innovation prior to and during the financial crisis. J Product Anal 43:351–365

Derbali A (2016) Global systemic risk ranking of Chinese financial institutions. J Chin Gov 1:340–372

Draca M, Machin S, Van Reenen J (2011) Minimum wages and firm profitability. American Economic. J Appl Econ 3:129–151

Eberhardt M, Helmers C (2010) Untested assumptions and data slicing: a critical review of firm-level production function estimators. Department of Economics, University of Oxford, Oxford, UK

Ericson R, Pakes A (1992) An alternative theory of firm and industry dynamics. Cowles Foundation for Research in Economics at Yale University, New Haven, Connecticut, USA

Faggio G, Salvanes KG, Van Reenen J (2010) The evolution of inequality in productivity and wages: panel data evidence. Ind Corp Change 19:1919–1951

Forni M, Hallin M, Lippi M, Reichlin L (2000) The generalized dynamic-factor model: Identification and estimation. Rev Econ Stat 82:540–554

Del Gatto M, Di Liberto A, Petraglia C (2011) Measuring productivity. J Economic Surv 25:952–1008

Girma S, Görg H, Hanley A (2008) R&D and exporting: a comparison of British and Irish firms. Rev World Econ 144:750–773

Gong B (2018a) Agricultural reforms and production in China changes in provincial production function and productivity in 1978–2015. J Dev Econ 132:18–31

Gong B (2018b) The Shale Technical Revolution—Cheer or Fear? Impact Analysis on Efficiency in the Global Oilfield Service Market. Energy Policy 112:162–172

Gong B (2018c) Different behaviors in natural gas production between national and private oil companies: Economics-driven or environment-driven? Energy Policy 114:145–152

Gong B (2019) New Growth Accounting. American Journal of Agricultural Economics forthcoming

Gong B (2020) Effects of ownership and business portfolio on production in oil and gas industry. Energy J 41:33–54

Goodridge P, Haskel J, Wallis G (2012) UK innovation index: productivity and growth in UK industries. CEPR discussion papers, London, UK

Graham DJ, Melo PS, Jiwattanakulpaisarn P, Noland RB (2010) Testing for causality between productivity and agglomeration economies. J Regional Sci 50:935–951

Graham DJ (2007) Agglomeration, productivity and transport investment. J Transp Econ Policy 41:317–343

Greene WH (1990) A gamma-distributed stochastic frontier model. J Econ 46:141–163

Griffith R, Harrison R, Reenen JV (2006) How special is the special relationship? Using the impact of U.S. R&D spillovers on U.K. firms as a test of technology sourcing. Am Economic Rev 96:1859–1875

Guariglia A, Mateut S (2010) Inventory investment, global engagement, and financial constraints in the UK: evidence from micro data. J Macroecon 32:239–250

Harris R, Li QC (2008) Evaluating the contribution of exporting to UK productivity growth: some microeconomic evidence. World Econ 31:212–235

Hausman JA, Taylor WE (1981) Panel data and unobservable individual effects. Econometrica 49:1377–1398

Helmers C, Rogers M (2010) Innovation and the survival of new firms in the UK. Rev Ind Organ 36:227–248

Helmers C, Rogers M (2011) Does patenting help high-tech start-ups? Res Policy 40:1016–1027

Helmers C, Rogers M, Schautschick P (2011) Intellectual property at the firm-level in the UK: the Oxford firm-level intellectual property database. Department of Economics, University of Oxford, Oxford, UK

Hsieh C-T, Klenow PJ (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 124:1403–1448

Kneip A, Sickles R, Song W (2003) On estimating a mixed effects model with applications to the U.S. banking industry. Rice University, Mimeo, Houston, Texas, USA

Kneip A (1994) Nonparametric estimation of common regressors for similar curve data. Ann Stat 22:1386–1427

Kumbhakar SC, Wang H-J (2005) Estimation of growth convergence using a stochastic production frontier approach. Econ Lett 88:300–305

Kutlu L (2018) A distribution-free stochastic frontier model with endogenous regressors. Econ Lett 163:152–154

Maskin E, Tirole J (1988a) A theory of dynamic oligopoly, I: overview and quantity competition with large fixed costs. Econometrica 56:549–569

Maskin E, Tirole J (1988b) A theory of dynamic oligopoly, II: price competition, kinked demand curves, and Edgeworth cycles. Econometrica 56:571–599

McGuckin RH, Nguyen SV, Taylor JR, Waite CA (1992) Post‐reform productivity performance and sources of growth in Chinese industry: 1980–85. Rev Income Wealth 38:249–266

Meeusen W, Van den Broeck J (1977) Efficiency estimation from Cobb-Douglas production functions with composed error. Int Economic Rev 18:435–444

Midrigan V, Xu DY (2014) Finance and misallocation: evidence from plant-level data. Am Economic Rev 104:422–458

Mollisi V, Rovigatti G (2017) Theory and practice of TFP estimation: the control function approach using Stata, CEIS Working Paper, Rome, Italy

Mundlak Y (1978) On the pooling of time series and cross section data. Econometrica 46:69–85

Olley GS, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64:1263–1297

Pakes A, Gowrisankaran G, McGuire P (1993) Implementing the Pakes-McGuire algorithm for computing Markov perfect equilibria in Gauss. Working paper. Yale University, New Haven

Pakes A (1996) Dynamic structural models, problems and prospects: mixed continuous discrete controls and market interaction, In: Advances in Econometrics: Vol. 2, Sixth World Congress, Cambridge University Press, New York, USA

Pakes A, McGuire P (1994) Computing Markov-perfect Nash equilibria: numerical implications of a dynamic differentiated product model. Rand J Econ 25:555–589

Perelman S (1995) R&D, technological progress and efficiency change in industrial activities. Rev Income Wealth 41:349–366

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74:967–1012

Pessoa JP, Van Reenen J (2014) The UK productivity and jobs puzzle: does the answer lie in wage flexibility? Econ J 124:433–452

Pitt MM, Lee L-F (1981) The measurement and sources of technical inefficiency in the Indonesian weaving industry. J Dev Econ 9:43–64

Riley R, Rincon-Aznar A, Samek L (2018) Below the aggregate: a sectoral account of the UK productivity puzzle. Economics Statistics Centre of Excellence Discussion Paper, London, UK

Schmidt P, Sickles RC (1984) Production frontiers and panel data. J Bus Economic Stat 2:367–374

Sickles RC (2005) Panel estimators and the identification of firm-specific efficiency levels in parametric, semiparametric and nonparametric settings. J Econ 126:305–334

Stevenson RE (1980) Likelihood functions for generalized stochastic frontier estimation. J Econ 13:57–66

Stock JH, Watson MW (2002) Forecasting using principal components from a large number of predictors. J Am Stat Assoc 97:1167–1179

Tenreyro S (2018) The fall in productivity growth: causes and implications. Speech at Preston Lecture Theatre, Queen Mary University of London, London, UK

Timmer MP, Voskoboynikov IB (2014) Is mining fuelling long-run growth in Russia? Industry productivity growth trends since 1995. Rev Income Wealth 60:S398–S422

Van Dijk M, Szirmai A (2011) The micro-dynamics of catch-up in Indonesian paper manufacturing. Rev Income Wealth 57:61–83

Acknowledgements

Dr. Binlei Gong acknowledges the support from the National Natural Science Foundation of China (71903172), the Research Program for Humanities and Social Science Grant by the Chinese Ministry of Education (18YJC790034), the Soft Science Research Program of Zhejiang Province (2020C25020), and Qianjiang Talent Program.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 Pakes–McGuire model

This method computes the MPN equilibria (Maskin and Tirole 1988a, 1988b) generated under the constraints of Ericson and Pakes (1992). We employ the same notations and equations from the original work (see Pakes et al. 1993, pp. 7–36) in this section.

1.1 Model

The definition of “industry structure” is the range of efficiency levels among the various businesses in the model. A firm’s profits arise from the industry structure as well as from the individual level of operational efficiency. Over the operating life of the firm, the efficiency of the business will change based on the stochastic environment of its operations. Decisions about investments, entries, and exits are made to achieve the highest level of future cash flow, based on expected discounted value (EDV), according to the current information set. Each business bases its decisions upon its prediction of the industry structure in the future conditional on its current information set. As a consequence, a given perception by each firm determines next period’s true distribution of the industry structure. Equilibrium is reached when the projected industry structure (i.e., the predicted distribution of the efficiencies of opponents) is, in fact, the distribution that results from the predictions. Therefore, the perceived distribution of future industry structures is the same as the actual distribution that results according to the behaviors of all opponents when those behaviors are selected to achieve EDV maximization of future net cash flows generated from those perceptions. Thus, as the authors claim (Pakes and McGuire 1994, p.557), this is a Markov-perfect Nash equilibrium where the variables of choice are the investment volume combined with the exit and entry decisions.

Industry structure: \(W = \left\{ {0, \ldots ,\bar w} \right\}\) is the set of efficiency values for each firm, where 0 is zero efficiency and \(\bar w\) is the maximum level of efficiency. N is the maximum number of firms that can be simultaneously active in the industry. A state [w, n] consists of a w ∈ W*, n ∈ N, where W* = {(w1, … , wN)|wj ∈ W, w1 ≥ w2 ≥ ⋯ ≥ wN}. For any firm, w represents the economic environment, including the efficiency level of all firms, while n indicates which element of this vector is the efficiency of its own. W* guarantees that the industry structure is represented as a weakly decreasing N-tuple to avoid having multiple w for the same industry structure.

Investment: A firm’s efficiency level for the next period is determined by a Markov process that depends on its current efficiency level, current investment, and exogenous factors. This model denotes x as the current investment, k ∈ W as the current efficiency level of a firm, and k′ ∈ W as its efficiency level in the next period. Let τ be the effect of firm-specific investment and v the effect of other firm-invariant exogenous variables that are the same for all firms. α is a coefficient relates to self-investment rising and δ is the probability of outside alternative rising, both decide the next period efficiency level. Then the controlled Markov process for the evolution of k′ is

where \({p}\left( \tau \right) = \left\{ {\begin{array}{*{20}{l}} {\left( {\alpha x} \right)/\left( {1 + \alpha x} \right),} \hfill & {{\mathrm{if}}\,\tau = 1} \hfill \\ {1/\left( {1 + \alpha x} \right),} \hfill & {{\mathrm{if}}\,\tau = 0} \hfill \end{array}} \right.\) and \({p}\left( v \right) = \left\{ {\begin{array}{*{20}{l}} {\delta ,} \hfill & {if\,v = 1} \hfill \\ {1 - \delta ,} \hfill & {if\,v = 0.} \hfill \end{array}} \right.\)

Maximum level of efficiency. Equation (6) ensures that efficiency can only improve with investment and shows that the incremental efficiency in a period is bounded with probability one. Hence, there exists an upper bound of efficiency \(\bar w\). PMM computes \(\bar w\) as the maximum efficiency level that a monopolist would ever reach by starting with a very large efficiency level and computing the monopolist’s problem to see where the monopolist stops his or her investment.

Exit and entry: Firms make the decision to exit if the future cash flow value drops below the stated scrap value of the business, which is denoted ϕ. The exiting business will only receive the current scrap value, not the current period profit. Business enters when the potential and expected future cash flow value is greater than the one-time cost of entry. The sunk cost of entry, X_E, is a random variable uniformly distributed between X_EL (lowest) and X_EH (highest). The potential entrants know the draw of X_E once they decide to enter. If they enter, they will not receive profit for that period, and enter with efficiency level W_E or W_E−1, depending on the value of v.

1.2 The algorithm

Matrices: Profit, Π, is an iteration-invariant matrix that calculates the one-shot game profit for each possible industry structure. Each iteration begins with the investment matrix, X, and the value function, V, from the output of the last iteration.

Iterative procedure: The algorithm calculates Π and iterates on X and V until the maximum of the element-by-element difference between successive iterations in these two matrices is below a specified tolerance level. For each iteration, the calculation is done separately for each of the industry structures, using the previous values of X and V. Beginning with the most efficient firm within the industry structure, its choice is updated using the most recent value of the iteration. The decision is renewed based on the value of the investment, exit, and entry. The value function is not included. These figures are used to calculate the policies for the firm with the next-highest efficiency. In turn, these updated choices are applied to the firm ranked third in efficiency, and so on.

Updating exit and entry: By comparing the value function of an incumbent competitor with the scrap value, a firm can predict if that incumbent competitor exits. The PMM defines the strategy set so that a firm must exit if it perceives that a competitor with a higher efficiency level than its own has exited. For any [w, n], this model defines w′ as the industry structure that results after exit has been accounted for, and m as the number of active firms in w′. After the decision of exit, this model iterates on whether there will be an entry if m < N. The value of future cash flows in state [w′, n] is compared with the one-time sunk cost in this process.

Updating investment: Each firm chooses an optimal investment policy based on its perception of future competitors. The calculation is done separately for every [w, n] ∈ (W*, N). The value function at the ith iteration is

where

In this value function, w′ is the incumbent’s efficiency level after updating for exit; m(w′) is the number of active competitors at w = w′; c is the cost in dollars of a dollar’s worth of investment (equals 1 if no tax); λ(w′, n) is the probability of entry; e(j) is a vector, all of whose elements are zero except for the jth element, which is one; i is a vector, all of whose elements are one; τ is the vector containing the random τ of competitors; ne is the position of the entrant for any industry structure; ne = m(w′) + 1 unless the permutation cycle has been reordered; \(w_{1}^{\prime} , \ldots ,w_{N}^{\prime}\) are the elements of the vector w′; and x1, …, xN (except xn) is the investment of the N − 1 competitors at w′. A symbol (..) in a summation indicates that the element is omitted. Cl(·) sums over the probability-weighted average of the possible states of future competitors, but not over the investing firm’s own future states. It also indicates the firm’s expected discounted value for each of the two possible realizations of the firm’s own investment process, τ.

We denote xi[w′, n] as the investment level that solves Eq. (7). To calculate it, the model first derives the optimal level of investment, x[w′, n], given that this investment is nonzero and that the firm does not exit. The actual level of investment, therefore, is either this number or zero, where zero is the solution if the optimal investment still leads to an exit decision or if x[w′, n] is negative. Let Dx denote the derivative with respect to x. The first-stage investment is thus

It is worth noting that \(D_x\left\{ {\frac{1}{{1\; + \;\alpha x}}} \right\} = \frac{\alpha }{{\left( {1 \;+\; \alpha x} \right)^2}} = \alpha \left( {1 - {p}\left( x \right)} \right)^2\), where \({p}\left( x \right) = \frac{{\alpha x}}{{1 \;+ \;\alpha x}}\). So, if v1 = Cl(w′ + e(n), n) and v2 = Cl(w′, n), the investment can be rewritten as

Taking the inverse of p(x), it can be seen that

It is straightforward to derive the optimal value function by plugging the optimal investment into Eq. (8) and computing

If Vi(w, n) = ϕ, then this model sets x = 0 with probability one. Hence, the actual investment is determined as

where I{·} is the indicator function that takes the value of one if the condition is true, and the value of zero otherwise.

Calculating the probability of entry: After the exit decision is made, the value of entry is the value of an incumbent who realized that (1) there would be no other entry, and (2) if she enters, there would be no profits or investments in the current period for her. The expected discounted value of entering is

A firm would like to enter if and only if Ve > X_E, which is the random entry cost. Since the random cost is uniformly distributed between X_EL and X_EH, the probability of entry by an incumbent whose competitors are specified by w′ and m(w′) < N is

UpdatingN: This model starts with the one-firm problem and solves for its value function and optimal policies. Then it proceeds to the two-firm problem, using the fixed values that is solved for in the one-firm problem as the starting values for X and V:

where V∞(·) is the fixed point for the one-firm problem. Analogously, for the N-firm problem with N > 2, the starting values are

The elements of X are updated in the same way as V. This process is then repeated until λ(w′, n) = 0 for all (w′, n) with m(w′) ≥ N − 1.

1.3 Profit function

The one-shot profit function that is utilized in this model is based on a homogenous product, Nash-in-quantities (Cournot) marketFootnote 11 where differences in efficiencies among firms are reflected by differences in marginal costs. Let producers’ different but constant marginal costs, θ(wn), be a firm’s specific efficiency index multiplied by a common factor price index. Accordingly, if sτ and sv are the logarithms of the firm’s efficiency index and of the factor price index, respectively, then wn ≡ sτ−sv and θ(wn) = γexp(−Wn).

Let qn be firm n’s output, Q = Σqn, f be the fixed cost of production, and D be the vertical intercept of the demand curve. The profits are given by

The unique Nash equilibrium for this problem has quantities and price as

where n* is the number of firms with positive q*. Finally, the profit of the current period is

1.4 Social planner’s problem

We are interested in finding out how the social planner will respond when the technology is exactly the same as that faced by the MPN competitors. The result enables us to compare the average efficiency level (and TFP loss ratio) to the MPN case.

In the homogenous products, Nash-in-quantities profits model, the social planner will set p = mc for the firm with the lowest marginal cost (with the highest efficiency level), and produce until supply equals demand. The methodology used to solve the social planner’s issues is similar to the one used in the case of MPN competitors. The social planner’s role is to maximize the stochastic profit function or the projected value of social surplus, i.e. the producer plus consumer surplus. The value function is then constructed using the value function, as defined in Eq. (7).

Since the social planner controls the entire economy, any industry structure results in only one state, not in N states. Moreover, one does not need to form perceptions about entry and exit or the behavior of cohorts, as the single agent (i.e., the social planner) controls all active firms at any time.

Appendix 2 Midrigan–Xu model

We also apply the benchmark model introduced by Midrigan and Xu (2014). We outline below its set-up, decision rules, definition of equilibrium, TFP function, and first-best allocation of the economy. Our discussion uses the same notations and equations from Midrigan and Xu (2014).

2.1 Set up

The economy is populated by a measure Nt of producers and a measure one of workers. The labor productivity and producer’s population grow at constant rates. Producers operate either in a traditional sector that uses only labor and an unproductive technology, or in a modern sector that uses capital and labor and a more productive technology. We will focus on financial misallocation in the modern sector. A one-time sunk entry cost is required for producers in the traditional sector who want to enter into the modern sector. Moreover, one-period noncontingent security and equity claims to producers’ profits are the only two kinds of financial instruments in the model.

Traditional sector producers: A certain amount, (γ − 1)Nt, of new producers enter the economy at the end of period t, but only in the traditional sector. Producers in this sector face decreasing returns on technology (η < 1) that produces output Yt using labor Lt as the only factor of production:

The model assumes that entrants draw the permanent productivity component z from some distribution G(z), whose mean is normalized to unity. et is a transitory productivity component that evolves over time according to a finite-state Markov process of E = (e1, … , eT) with transition probabilities fi,j = Pr(et+1 = ej|et = ei). Entrants draw their initial productivity component ei from the stationary distribution associated with f, which we denote with \(\overline {f_i}\).

All producers in the traditional sector aim to maximize their lifetime utility, which is \(E_0\mathop {\sum}\nolimits_{t = 0}^\infty {\beta ^t\log (C_t)}\). However, the budget constraints they face depend on whether remaining in the traditional sector or switching to the modern sector.

On the one hand, the budget constraint for those who stay in the traditional sector is

where Dt denote the producer’s debt position, which is non-positive since these producers are not allowed to borrow. All entering producers have no wealth, i.e. the initial D is equal to zero. Moreover, W and r are the equilibrium wage and interest rate.

On the other hand, traditional sector producers who enter the modern sector require an investment equal to exp(z)κ units of output, which is proportional to the permanent productivity component. Besides internal funds, both of the two financial instruments including one-period risk-free debt and equity claims to future profits are potential channels to finance the physical capital, Kt+1, and intangible capital, exp(z)κ. In terms of debt, the borrowing constraint is

where θ ∈ [0, 1] governs the strength of financial frictions in the economy, which requires the debt below a fraction of its capital stock. For equity claims, denote Pt as the price of the claim to the entire stream of profits, where profits are defined as \({\mathrm{{\Pi}}}_t^m = Y_t - WL_t - \left( {r + \delta } \right)K_t\), where δ is the capital depreciation rate. The model assumes that producers can only issue claims to a fraction, θχ, of their future profits, where χ ∈ [0, 1]. θ is characterizing the degree of financial development of the economy since it decides the producer’s ability to both borrow and issue equity. The budget constraint of a producer that enters the modern sector is therefore

Modern sector producers: The production function for the producers in the modern sector is

where ϕ ≥ 0 determines the relative productivity of this sector, α controls the share of labor in production, and Kt is the amount of capital used in the previous period.

Producers in the modern sector can save and borrow at the risk-free rate, r, subject to the constraint (11). Their budget constraint is

The model assumes, as is standard in the investment literature, that output at date t + 1 is produced with capital held in period t. The choice of how much to invest at the end of period t is, however, measurable with respect to et+1. This assumption of timing explains why the expected return to equity equals the risk free return.

Workers: A unit measure of workers is available in the economy, each of whom supplies γtvt efficiency units of labor, where vt is the worker’s idiosyncratic efficiency that evolves over time according to a finite-state Markov process. These workers have the same log preferences (utility function) as producers do. However, their budget constraint is

where at denote a worker’s holdings of risk-free assets and \(\omega _t^i\) denote the number of shares he or she owns of producer i. The total asset holdings, \(a_{t + 1} + {\int} {P_t^i\omega _{t + 1}^idi}\), are non-negative because the model assumes that workers cannot borrow.

Once again, there is no aggregate risk in this economy due to the assumption of timing. As a result, the lack of arbitrage implies that the return on the risk-free security is equal to the expected return on equity claims:

2.2 Recursive formulation and decision rules

Modern sector producers: The risk-free assumption on capital implies that producer profits are solely a function of its net worth, which is denoted as A = K − D. Moreover, profits, output, and the optimal choice of capital and labor are all homogeneous of degree one in (A, exp(z)) so this model can rescale all variables by exp(z) including the rescaled net worth a = A/exp(z). Given the new notation, the Bellman equation is

Similarly, the budget constraint in Eq. (13) can be rewritten as

where

Furthermore, the borrowing constraint in Eq. (11) reduces to

This model characterizes the producer’s net worth accumulation decision of the producer by

where μ(a, e) is the multiplier on the borrowing constraint (17). The producer’s return to savings increases with the expectation that the borrowing constraint will be binding in future periods. Therefore, the producers have the incentive to accumulate net worth.

Accordingly, the decisions on the optimal level of capital and labor simplifies to

and

Dispersion of net worth and productivity of businesses due to borrowing constraints causes dispersion in the marginal product of capital of individual producers. In turn, this causes TFP reductions due to misallocation. In the rescaled formulation of the problem, it is worth noting that the producer’s permanent productivity component, z, has no independent effect on allocations.

Traditional sector producers: The next thing to consider is the problem of producers in the traditional sector. Since capital is not an input for these producers, their net worth is a = −d. This model also denotes x as their savings. The Bellman equation for such producers is

subject to

where

In each period, the producer’s decision on whether to stay in the traditional sector or switch to the modern sector depends on the relative value of these two options. This decision also determines the evolution of its net worth. A producer who remains in the traditional sector simply inherits its past savings, a′ = x, while a producer that enters the modern sector has

where p(a′, ei) is the rescaled price of the equity claim to that satisfies

The producers in the modern sector may have negative net worth since they can borrow against the intangible capital. Besides the collateral constraint in Eq. (17), the natural borrowing constraint is

which guarantees the producer’s solvency even under the worst possible sequence of productivity shocks. This constraint may be more stringent than the collateral constraint and motivate producers to accumulate enough savings before entering the modern sector even in the absence of a collateral constraint.

2.3 Equilibrium

Denote \(n_t^m\left( {a,e} \right)\) as the measure of modern-sector producers and \(n_t^\tau \left( {a,\,e} \right)\) as the measure of traditional sector producers. The population of producers in these two sectors sum to Nt = γt: \({\int\nolimits_{A \times E}} {dn_t^m\left( {a,e} \right)\, + }{\int\nolimits_{A \times E}} {dn_t^\tau \left( {a,e} \right) = N_t}\).

On the one hand, the number of producers in the modern sector evolves according to

where ξ(a, e) is an indicator of whether a producer in the traditional sector switches, \(A = \left[ {\underline a,\,\bar a} \right]\) is the compact set of values that a producer’s net worth can take and A is a family of its subsets, am(.) is the amount of net worth for a producer in the modern sector, and aτ,s(.) is the savings decision of a producer who switches.

On the other hand, the measure of producers in the traditional sector is

where \(\overline {f_j}\) is the stationary distribution of the transitory productivity and aτ(.) is the net worth of a producer that stays in the traditional sector.

A balanced growth equilibrium must satisfy the following five conditions:

(I) the labor market clearing condition:

(II) the asset market clearing condition:

or

(III) producer and worker optimization,

(IV) the no-arbitrage condition in Eq. (23),

(V) the laws of motion for the measures in Eqs. (25) and (26).

All variables with time subscripts grow at a constant rate γ while all other variables are fixed. Solving the balanced growth equilibrium is equal to solving the stationary system where all the time-variant variables are rescaled by γt.

2.4 Efficient allocations

The value of TFP in the economy is reduced by financial frictions, which occur in two ways: either by affecting a company’s entry decision into the modern sector or by causing losses in the modern sector due to misallocation. The strength of these two paths is defined using two separate computations. The first computation determines the level of TFP losses in the modern sector as a result of capital misallocation when the number of modern producers (nm) is given. The equilibrium of the model is taken as the stationary level. This calculation is similar to the one that was stated by Hsieh and Klenow (2009). The second computation calculates the optimal allocation of producers across the traditional and modern sectors by solving a planner’s problem (i.e. nm is not fixed). The broader question in this calculation is identifying the level of consumption in the economy and how it is limited by financial frictions that develop along the way at both intensive and extensive margins.

TFP losses from misallocation in the modern sector: Let i index producers and M be the set of all producers in the modern sector. Also, let L and K be the total amount of labor and capital used in that sector, respectively. Integrating the decision rules (19) and (20) across producers, the total amount of output produced by the modern sector is

This expression shows that TFP of the modern sector is determined by the exogenous productivity gap, ϕ, and an endogenous component that depends on the measure of producers, their efficiency, and the extent to which they are bind.

To calculate the efficient level of TFP given a measure of M producers, the model allocates capital and labor across producers so that the marginal products of capital and labor are the same across producers in order to maximize total output in the modern sector. Accordingly, the efficient level of output is given by

Comparing Eqs. (29) and (30) and using the fact that the shadow cost of capital, r + δ + μ, is proportional to its average product, as in Eq. (20), the TFP losses from misallocation are

To clarify Eq. (31), suppose that the logarithm of yi/ki and ei are jointly normally distributed. Equation (31) then reduces to

so that the TFP losses are proportional to the variance of the average product of capital. In other words, higher variability in the average product of capital across producers generates more TFP losses.

Efficient (first-best) allocations: To calculate the efficient allocation, this model must also derive the optimal number of producers across the two sectors. This can be done by solving the social planner’s problem that is only constrained by the aggregate resource constraint in Eq. (28) and by the production technologies that we have assumed. Accordingly, their study chooses the amount of capital, K, the number of producers in the two sectors, \(n_i^\tau\) and \(n_i^m\), and the allocation of labor across those sectors, Lτ and Lm, to maximize

subject to the restrictions on the measurements implied by Markov transition probabilities, fi,j, and to the labor constraint, Lτ + Lm = 1.

2.5 Summary

In short, the model has three kinds of players: workers, traditional producers, and modern producers. Traditional producers use only labor and unproductive technology, and cannot borrow money. Modern producers, on the other hand, use capital, labor, and more productive technology; they can also borrow. Traditional producers can become modern producers, but to do so they must incur a sunken entry fee, and they are allowed to borrow and issue claims to part of the future profit during that period of transformation. The amount that a producer can borrow is subject to collateral constraints. Workers face uninsurable idiosyncratic labor income risk and have access to financial markets. There are two types of financial instruments available: a one-period non-contingent security and equity claims to producers’ profits.

These three kinds of players all try to maximize their lifetime utility. The equilibrium requires (I) a labor market clearing condition, (II) an asset market clearing condition, (III) producer and worker optimization, (IV) the no-arbitrage condition, and (V) the laws of motion. Equation (3) is used to calculate the TFP loss due to financial misallocation. On the one hand, the actual TFP level in the equilibrium can be derived under this setup. On the other hand, the efficient level of TFP, TFPe, is the solution to the planner’s problem that is not restricted in any way concerning the allocation of labor and capital across firms.

Rights and permissions

About this article

Cite this article

Gong, B., Sickles, R.C. Non-structural and structural models in productivity analysis: study of the British Isles during the 2007–2009 financial crisis. J Prod Anal 53, 243–263 (2020). https://doi.org/10.1007/s11123-019-00571-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-019-00571-8

Keywords

- Productivity

- Non-structural and structural models

- Stochastic frontier analysis

- Olley–Pakes

- Pakes–McGuire