Abstract

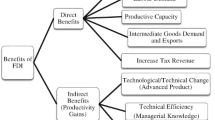

This paper examines the productivity effect of technology spillovers via vertical linkages through foreign direct investment (FDI) in India. An analysis of firm-level panel data from the Indian manufacturing sector from 2000–2001 to 2007–2008 employing the semi-parametric method of Levinsohn–Petrin to correct the endogeneity bias in productivity estimation shows productivity improvements in domestic firms due to vertical technology spillovers are only through backward linkages from FDI. The study confirms that firms in high-technology industries benefit more from vertical technology spillovers from foreign firms compared to firms in low-technology industries. It also shows that minority-owned foreign firms are more prone to technology spillovers than majority-owned foreign firms. Nonetheless, domestic firms in high-technology industries are able to access both horizontal as well as vertical technology spillovers from majority-owned foreign firms. The paper concludes that technology spillovers from FDI are not spontaneous, but are constrained by the technological ability of domestic firms and the ownership structure of foreign firms.

Similar content being viewed by others

Notes

The United Nations Conference on Trade and Development’s (UNCTAD) report on “Changes in National Regulations of FDI” says that from 1991 to 2002, 1,551 (95 %) of the 1,641 changes introduced by 165 countries in their FDI laws were in the direction of creating a more favourable environment for FDI in both developed and developing countries (UNCTAD 2003, Table 1.8).

Of the total FDI inflows, the manufacturing sector in India shares a major proportion, followed by the tertiary sector (SIA Newsletter, Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India, 2009).

Studies, for example, Aitken et al. (1996), suggest that foreign firms pay higher wages than domestic enterprises, instigating a “brain drain” by luring the most capable managers away from domestic firms.

Technology spillovers via backward linkages may take place through (1) direct knowledge transfer from foreign customers to local suppliers; (2) higher requirements for product quality and on-time delivery introduced by multinationals, which induce domestic suppliers to upgrade their production management or technology; and (3) multinational entry increasing demand for intermediate products, which allows local suppliers to reap the benefits of scale economies (Javorcik 2004). Similarly, technology spillovers via forward linkages from foreign firms occur when foreign firms provide knowledge embodied in products, processes, and technology to domestic customers in downstream industries, which help domestic firms boost their productivity (Blomstrom and Kokko 1998).

According to a survey conducted by the World Bank among Czech and Latvian firms, 23 % of the firms stated that the presence of foreign multinational firms enhanced their knowledge about new technologies, 13 % stated the enhancement of marketing know-how, and 5 % found access to better employees. Fewer than 10 % of firms reported that the foreign presence allowed for a better input mix. In fact, about 46 % of multinationals reported relying on global suppliers. About 29 % of the domestic respondents considered inward FDI to be responsible for their loss of market share (Javorcik and Spatareanu 2005).

Due to lack of absorptive capacity, domestic firms fail to decode the sophisticated technology embodied in the products of foreign firms. So majority owned foreign firms might not cause spillovers to domestic firms in the same industry. They may not generate vertical technology spillovers as well since they require more sophisticated inputs for their production, which domestic firms may find difficult to supply (UNCTAD 2001).

See Blomstrom and Zejan (1991), who find that Swedish firms with a relatively brief experience of foreign production are likely to choose minority ventures when they go abroad.

Log indicates logarithm to the base 10.

See Sect. 3.3 for the detail discussion of variables.

A similar approach has been used by Dimelis and Louri (2002) for defining majority and minority-owned foreign firms.

The rationale for employing manufacturing industries is that more than 30 % of FDI was coming to this sector during the study period.

Since our data base does not provide the equity holding information of the firm prior to 2000-01, the analysis is restricted to the period from 2000-01 to 2007-08.

We follow Tukey (1977) to correct the outliers of the sample. Tukey’s Exploratory Data Analysis includes a resistant rule for identifying possible outliers in univariate data. Using the lower and upper quartiles Q L and Q U , it labels as “outside” any observations below Q L − 1.5 (Q U − Q L ) or above QU + 1.5 (Q U − Q L ).

GFA is the sum of gross intangible assets, gross land and buildings, gross plant and machinery, gross computers, gross electrical installations and fittings, gross transport infrastructure, gross transport equipment and vehicles, gross communication equipment, gross furniture and fixtures, gross social amenities, and gross other assets.

See Appendix 1 for calculation of revaluation factor.

Firms having foreign equity at least 10 % of total equity are classified as foreign firms or foreign affiliates.

To illustrate the backward FDI, consider there are three industries such as wheat flour milling, pasta production, and baking. Suppose that half the wheat flour industry’s output is purchased by the bakery industry and the other half by the pasta industry. Further, assume that the bakery industry does not have any foreign factories but that foreign factories produce half the pasta industry output. The calculation of the backward FDI for the flour industry would be 0.25 = 0.5 (0.0) + 0.5 (0.5).

See Appendix 2 for details of the construction of an industry × industry coefficient matrix.

When a firm produces the maximum output it can, given the resources it employs, such as labour and machinery, and the best technology available then it achieves technical efficiency. X-inefficiency occurs if technical efficiency is not being achieved due to lack of competition in the economy (Leibenstein 1966).

Another method is Blundell and Bond’s (2000) Generalised Method of Moment (GMM) estimator. This method uses lagged inputs for the endogeneity problem but it is not applicable with short time series data. It cannot be employed in the present study for the same reason.

See Horowitz (2001) for an overview of the bootstrap.

Low-technology and high-technology firms are firms belonging to low-technology and high- technology industries respectively. For classifying manufacturing industries into high technology and low technology, we follow the Organisation for Economic Co-operation and Development (OECD) classification, which uses R&D expenditure and the output of 12 OECD countries to classify manufacturing industries (OECD 2007). See Appendix 4 for details.

References

Aitken B, Harrison A, Lipsey RE (1996) Wages and foreign ownership: a comparative study of Mexico, Venezuela, and the United States. J Int Econ 40:345–371

Aitkin BJ, Harrison AE (1999) Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. Am Econ Rev 89:605–618

Balakrishnan P, Pushpangadan K, Suresh Babu M (2000) Trade liberalisation and productivity growth in manufacturing: evidence from firm-level panel data. Econ Polit Wkly 35:3679–3682

Bhattacharya M, Chen JR, V Pradeep (2008) Productivity spillovers in Indian manufacturing firms. Department of Economics, Discussion Paper 30/08, MOHASH University

Blalock G, Gertler PJ (2008) Welfare gains from foreign direct investment through technology transfer to local suppliers. J Int Econ 74:402–421

Blomstrom M, Kokko A (1998) Multinational corporations and spillovers. J Econ Surv 12:247–277

Blomstrom M, Kokko A (2003) The economics of foreign direct investment incentives, NBER Working Paper 9489

Blomstrom M, Zejan M (1991) Why do multinational firms seek out joint ventures? NBER Working Paper 2987

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Econom Rev 19:321–340

Caves RE (1982) Multinational enterprises and economic analysis. Cambridge University Press, Cambridge

Dahlman CJ, Ross-Larson B, Westphal LE (1987) Managing technological development: lesson from the newly industrializing countries. World Dev 15:759–775

Das S (1987) Externalities and technology transfer through multinational corporations. J Int Econ 22:171–182

Dennison EF (1967) Why growth rates differ: post-war experience in nine western countries. The Brookings Institution, Washington

Dimelis S, Louri H (2002) Foreign ownership and productivity efficiency: a quantile regression analysis. Oxf Econ Pap 54:449–469

Fosfuri A, Mota M, Ronde T (2001) Foreign direct investment and spillovers through workers’ mobility. J Int Econ 53:205–222

Girma S, Görg H (2002) Foreign direct investment, spillovers and absorptive capacity: evidence from quantile regressions. GEP Research Paper 02/14, University of Nottingham

Glass AJ, Saggi K (1998) International technology transfer and the technology gap. J Dev Econ 55:369–398

Glass AJ, Saggi K (2002) intellectual property rights and foreign direct investment. J Int Econ 56:387–410

Gorg H, Greenaway D (2004) Much ado about nothing? Do domestic firms really benefit from foreign direct investment? World Bank Res Obs 19:171–197

Griliches Z, Mairesse J (1995) Production functions: the search for identification. NBER Working Papers 5067

Haddad M, Harrison A (1993) Are there positive spillovers from direct foreign investment? Evidence from panel data for Morocco. J Dev Econ 42:51–74

Horowitz JL (2001) The bootstrap. In: Heckman JJ, Leamer E (eds) Handbook of econometrics, vol 5. North-Holland, Amsterdam, pp 3159–3228

Javorcik BS (2004) Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am Econ Rev 94:605–627

Javorcik BS, Spatareanu M (2005) Disentangling FDI spillover effects: what do firm perceptions tell us? In: Moran TH, Graham E, Blomstrom M (eds) Does foreign direct investment promote development?. Institute for International Economics and Center for Global Development, Washington

Javorcik BS, Saggi K, Spatareanu M (2008) To share or not to share: Does local participation matter for spillovers from foreign direct investment? J Dev Econ 85:194–217

Kathuria V (2002) Liberalisation, FDI, and productivity spillovers—an analysis of Indian manufacturing firms. Oxf Econ Pap 54:688–718

Keller W (2004) International technology diffusion. J Econ Lit 42:752–782

Kokko A (1994) Technology, market characteristics, and spillovers. J Dev Econ 43:279–293

Leibenstein H (1966) Allocative efficiency vs. “X-efficiency”. Am Econ Rev 56:392–415

Levinsohn J, Petrin A (2003) Estimating production function using inputs to control for unobservables. Rev Econ Stud 70:317–341

Lipsey RE, Sjoholm F (2005) The impact of inward FDI on host countries: Why such different answers? In: Moran TH, Graham E, Blomstrom M (eds) Does foreign direct investment promote development?. Institute for International Economics and Center for Global Development, Washington, pp 23–43

Mansfield E, Romeo A (1980) Technology transfer to overseas subsidiaries by U.S.-based firms. Q J Econ 95:737–750

Marschak J, Andrews WH (1944) Random simultaneous equation and the theory of production. Econometrica 12:143–205

Moran TH (1998) Foreign direct investment and development. Institute for International Economics, Washington

Moran TH (2001) Parental supervision: the new paradigm for foreign direct investment and development. policy analysis in international economics 64. Institute for International Economics, Washington

Muller T, Schnitzer M (2006) Technology transfer and spillovers in international joint ventures. J Int Econ 68:456–468

OECD (2007) Annex 1: classification of Manufacturing Industries based on Technology. In: OECD (ed) OECD Science, Technology and Industry Scoreboard 2007: Innovation and performance in the global economy. OECD Publishing, pp 219–221. http://www.oecd-ilibrary.org/science-and-technology/oecd-science-technology-and-industry-scoreboard-2007_sti_scoreboard-2007-en

Olley GS, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64:1263–1297

Reserve Bank of India (2009) Database on Indian economy. Reserve Bank of India (Accessed in 2009)

Siddharthan NS, Lal K (2004) Liberalisation, MNE and productivity of Indian enterprises. Econ Polit Wkly 39:448–452

Smeets R (2008) Collecting the pieces of the FDI knowledge spillovers puzzle. World Bank Res Obs 23:107–138

Srivastava V (1996) Liberalization, productivity and competition: A panel study of India manufacturing. Oxford University Press, Delhi

Studies in Methods: Input-Output Tables and Analysis, Series F, No. 14, Rev. 1, United Nations, New York, 1973

Tukey JW (1977) Exploratory data analysis. Addison-Wesley, London

UNCTAD (2001) World Investment Report. United Nations Publications, New York

UNCTAD (2003) World investment report. United Nations Publications, New York

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48:817–838

Wooldridge JM (2003) Cluster sample methods in applied econometrics. Am Econ Rev 93:133–139

Acknowledgments

I am deeply grateful to Prof. P. Mohanan Pillai and Dr. M. Parameswaran for their guidance and invaluable suggestions. I am thankful to Prof. Pierre Mohnen and Prof. Jacques Mairesse for their valuable insights at GLOBELICS 2011, Buenos Aires, Argentina. I am also thankful to three anonymous referees for their useful comments which have improved the paper substantially. None of them are accountable for any errors that may still remain in the paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Capital stock estimation

For the estimation of capital stock we have employed the perpetual inventory method of Srivastava (1996). Balakrishnan et al. (2000) have also used this method to estimate capital stock for their study. The method goes in the following manner

and so on.

Here, \(K_{t}\) is the capital stock at replacement cost in the base year t and \(I_{t}\) is the investment in the year t. The year 2004–2005 is taken as the base year because we have the maximum number of observations for this year. We have hence converted the reported \(GFA_{2004 - 05}^{h}\) into \(GFA_{2004 - 05}^{r}\) using a revaluation factor computed using the procedure given in Srivastava (1996) (h and r denote historical costs and replacement costs respectively).

1.1 Capital stock at replacement cost in the base year

Given the available data, there is no perfect way to estimate capital stock at replacement cost in the base year and any method used is an approximation. Our method of estimation is based on the following assumptions.

-

(a)

No firm has any capital stock in the base year (2004–2005) of a vintage earlier than 1985-86. The year 1985–1986 itself is chosen because the life of machinery is assumed to be 20 years, as noted in the report of the Census of Machine Tools (1986) of the Central Machine Tool Institute Bangalore (National Accounts Statistics: Sources and Methods’ New Delhi: Central Statistical Organization, 1989). For firms incorporated before 1985-86 it is assumed that the earliest vintage capital in their capital mix dates back to the year of incorporation. Clearly, as stated by Srivastava (1996) the year of incorporation and the vintage of the oldest capital in the firm’s asset mix may not coincide for some firms, but the assumption is made for want of a better alternative.

-

(b)

The price of capital changes at a constant rate \(\pi = \frac{{P_{t} }}{{P_{t - 1} }} - 1\) from 1985–1986 or the year of incorporation up to 2004–2005 (base year). The values for \(\pi\) are obtained from a series of price deflators constructed from CSO’s data on gross fixed capital formation of manufacturing published in various issues of National Accounts Statistics (NAS) of India.

-

(c)

Investment changes at a constant rate \(g = \frac{{I_{t} }}{{I_{t - 1} }} - 1\). Here the rate of growth of gross fixed capital formation in manufacturing at 1993-94 prices is assumed to apply to all firms. Again different average annual growth rates are obtained for firms established after 1985–1986.

Using the values of \(\pi\) and g, we arrive at a revaluation factor (\({\text{R}}^{\text{G }}\)) to arrive at measure of capital stock at replacement cost for the base year. Let us denote \(GFA_{t}^{h}\) and \(GFA_{t}^{r}\) as gross fixed asset at historical costs and replacement cost respectively and \(I_{t}\) is the real investment at time t. The \(GFA_{t}^{h}\) can be defined as

which can be rewritten as

and similarly \(GFA_{t}^{r}\) can be written as

which can be rewritten as

Now if the earliest vintage of capital dates back infinitely, the revaluation factor \(R^{G}\), defined as the ratio of the \(GFA_{t}^{r}\) to the \(GFA_{t}^{h}\), will be

(The superscripts r and h denote values at replacement and historical cost respectively). In this study we have assumed that the capital stock has finite economic life. Now the revaluation factor becomes

where \(\tau\) is the life of the machine.

Now we can scale up the GFA in the base year by the revaluation factor to obtain an estimate of the capital stock at replacement costs at the current prices. We then deflate the capital stock at replacement cost by the wholesale price index for machinery and machine tools (with base 1993–1994 = 100) to arrive at a measure of the capital stock in real terms for the base year.

It is to note that we have used gross fixed asset rather than net fixed asset. Dennison (1967) argues that a true measure of capital stock falls somewhere between the gross and the net stock of capital, hence advocates the use of a weighted average of the two with higher weight for the gross as the true value is expected to be closer to it. This is however not feasible empirically as the reliable data on accounting and economic rate of depreciation are not available in India.

Appendix 2: Methodology for industry × industry coefficient matrix

For our study, we need to construct an \(industry \times industry\) coefficient matrix using the “Input–Output Transaction Table of India” of 2003–2004, published by the Central Statistical Organization (CSO). The Input–Output Transaction Table consists of two matrices—the absorption matrix (commodity–industry), and the make matrix (industry–commodity). The former records the value of purchases of commodities by industries and the latter records the value of commodities produced by industries. There are two basic assumptions, which combine both information in the make and absorption matrices to estimate a “pure” table of \(industry \times industry\) or \(commodity \times commodity\) (Input–Output Tables and Analysis 1973). They are generally referred to as the commodity technology and industry technology assumptions. The former assumes that a commodity has the same input structure in whichever industry it is produced. The industry technology assumption, on the other hand, assumes that all commodities produced by an industry are produced with the same input structure and thus commodities will have different input structures depending on the industry in which they are produced.

The following briefly gives the methodology in mathematical terms for constructing “pure” tables. The basic data available from industry input and output tabulations satisfy the following relationships:

where \(q_{j}\) = total output of the jth commodity group, \(g_{i}\) = total output (of all products and by-products) of the ith industry group, \(f_{j}\) = final demand of the jth commodity, \(X_{jk}\) = output of the jth commodity used as input in the kth sector (industry group), \(M_{ij}\) = output of the jth commodity produced by the ith industry group. The above symbols without subscript refer to the corresponding vectors.

We can put all the mathematical expressions of the input–output relationships explained above into a simplified accounting framework (see Table 4).

Given the industry technology assumption, the industry × industry coefficient matrix can be constructed using the above accounting data. Symbolically, it is defined as follows.

where E is the \(industry \times industry\) coefficient matrix, D is the market share matrix, the columns of which show proportions in which various industries produce the total output of a particular commodity. Symbolically, it is as D = M (q)\(^{ - 1}\), and B is the \(commodity \times industry\) coefficient matrix, defined as B = X (g)\(^{ - 1}\). Here q is the diagonal matrix with diagonal elements as the elements of vector q and similarly g is the diagonal matrix with diagonal elements as the elements of vector g. For constructing the \(industry \times industry\) coefficient matrix, we first have to aggregate the input–output transaction table for the manufacturing sector to two-digit level. Then we construct \(industry \times industry\) coefficient matrix using the make and absorption matrices.

Appendix 3

Appendix 4

Rights and permissions

About this article

Cite this article

Malik, S.K. Conditional technology spillovers from foreign direct investment: evidence from Indian manufacturing industries. J Prod Anal 43, 183–198 (2015). https://doi.org/10.1007/s11123-014-0425-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-014-0425-8

Keywords

- Manufacturing industries

- Multinational enterprises

- Foreign direct investment

- Technology spillovers

- Total factor productivity