Abstract

The bank efficiency literature lacks an agreed definition of bank outputs and inputs. This is problematic given the long-standing controversy concerning the status of deposits, but also because bank efficiency estimates are known to be affected by the inclusion of additional outputs such as non-traditional (fee-based) activities or risk measures. This paper proposes a data-driven identification of bank outputs and inputs using the directional technology distance function. While previous applications of this tool used symmetric expansion or contraction directions, we focus on a set of orthogonal directions, each corresponding to an assumption on the input/output status of an individual variable. These directions correspond to a set of different specifications, whose estimated coefficients can be used to determine the input or output status of all variables except the regressand. Our empirical analysis revealed a very consistent pattern across the alternative specifications estimated. There is strong evidence that customer deposits are an input, and that non-performing loans are an important undesirable output. Finally, the orthogonal expansions/contractions we consider avoid the simultaneity problem raised by the “convenient normalization” commonly used to impose linear homogeneity in stochastic frontier estimation.

Similar content being viewed by others

Notes

When no undesirable outputs are produced, \( P\left( x \right) = \left\{ {y:\left( {x,y} \right) \in T} \right\} \) and \( L\left( y \right) = \left\{ {x:\left( {x,y} \right) \in T} \right\} \).

Färe et al. (2005) assume that an increase in desirable outputs must be accompanied by a decrease in undesirable outputs.

Regressors may still be endogenous if all N inputs, including \( x_{1} \), are determined simultaneously. In this case, instrumental variables methods will be required to address endogeneity.

Possible problems of serial correlation and heteroskedasticity are left for future research.

Only one bank has a shorter sample, as it began operations in 1995Q2.

For each independent variable, these partial derivatives were also tested jointly across all time periods. In all cases the null hypothesis of a zero derivative was rejected at a 1% significance level.

We experimented with a large number of alternative ways of incorporating commission income, labor, and capital. For example, we included real wage costs instead of headcount employment; we used total commission income instead of net commission income; we used depreciation on tangible assets instead of their real value; and we added purchased materials and services as one of inputs. However, the main conclusions were unaffected.

In this case the second-order partial derivative with respect to loans is zero by construction.

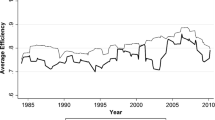

In other work, we used the estimated specifications to derive bank inefficiency scores from the composite residuals (Jondrow et al. 1982) and calculated the decomposition of the Luenberger productivity indicator (Chambers 1996, 2002) into annual technical change and efficiency change. However, we failed to find evidence of trends or statistically significant changes. Stagnant productivity may reflect a considerable increase in inputs, particularly customer deposits, which offset the simultaneous growth in outputs.

References

Aigner D, Lovell CAK, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econom 6:21–37

Atkinson SE, Primont D (2002) Stochastic estimation of firm technology, inefficiency, and productivity growth using shadow cost and distance functions. J Econom 108:203–225

Atkinson SE, Cornwell C, Honerkamp O (2003a) Measuring and decomposing productivity change: stochastic distance function estimation versus data envelopment analysis. J Bus Econ Stat 21(2):284–294

Atkinson SE, Färe R, Primont D (2003b) Stochastic estimation of firm inefficiency using distance functions. South Econ J 69(3):596–611

Basu S, Inklaar R, Wang JC (2011) The value of risk: measuring the service output of US commercial banks. Econ Inquiry 49:226–245

Battese GE, Coelli T (1988) Prediction of firm-level technical efficiencies with a generalised frontier production function and panel data. J Econom 38:387–399

Berger AN, Humphrey DB (1992) Measurement and efficiency issues in commercial banking. In: Griliches Z (ed) Measurement issues in the service sectors. University of Chicago Press, pp 245–279

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Operation Res 98:175–212

Berger AN, Hanweck GA, Humphrey DB (1987) Competitive viability in banking: scale, scope, and product mix economies. J Monetary Econ 20:501–520

Casu B, Girardone C (2005) An analysis of the relevance of off-balance sheet items in explaining productivity change in European banking. Appl Finan Econ 15:1053–1061

Chambers RG (1996) A new look at exact input, output, productivity, and technical change measurement. Maryland Agricultural Experimental Station

Chambers RG (2002) Exact nonradial input, output, and productivity measurement. Econ Theory 20:751–765

Chambers RG, Chung Y, Färe R (1996) Benefit and distance functions. J Econ Theory 70:407–419

Chambers RG, Chung Y, Färe R (1998) Profit, distance functions and Nerlovian efficiency. J Optim Theory Appl 98:351–364

Christensen LR, Jorgenson DW, Lau LJ (1971) Conjugate duality and the transcendental logarithmic production function. Econometrica 39:255–256

Coelli T, Perelman S (1999) A comparison of parametric and non-parametric distance functions; with applications to European railways. Eur J Operation Res 117:326–339

Colangelo A, Inklaar R (2012) Bank output measurement in the euro area: a modified approach. Rev Income Wealth 58:142–165

Färe R, Grosskopf S (2004) New directions: efficiency and productivity. Kluwer Academic Publishers, Boston

Färe R, Primont D (1995) Multi-output production and duality: theory and applications. Kluwer Academic Publishers, Boston

Färe R, Grosskopf S, Noh DW, Weber WL (2005) Characteristics of a polluting technology: theory and practice. J Econom 126(2):469–492

Färe R, Martins-Filho C, Vardanyan M (2010) On functional form representation of multi-output production technologies. J Prod Anal 33:81–96

Fixler D, Zieschang K (1992) User costs, shadow prices, and the real output of banks. In: Griliches Z (ed) Output measurement in the service sectors. University of Chicago Press, Chicago

Fixler D, Zieschang K (1999) The productivity of the banking sector: integrating financial and production approaches to measuring financial service output. Canadian J Econ 32(2):547–569

Grosskopf S, Hayes KJ, Taylor LL, Weber WL (1997) Budget constrained frontier measures of fiscal equality and efficiency in schooling. Rev Econ Stat 21:116–124

Guarda P, Rouabah A (2006) Measuring banking output and productivity: a user cost approach to Luxembourg data. In: Bandyopadhyay PK, Gupta GS (eds) Measuring productivity in services: new dimensions. Icfai University Press, Hyderabad

Guarda P, Rouabah A (2007) Banking output and price indicators from quarterly reporting data. Central Bank of Luxembourg working paper 27

Hancock D (1985) The financial firm: production with monetary and nonmonetary goods. J Political Econ 95:859–880

Hancock D (1986) A model of the financial firm with imperfect asset and deposit elasticities. J Bank Finan 10:37–54

Humphrey DB (1992) Flow versus stock indicators of bank output: effects on productivity and scale economy measurement. J Finan Serv Res 6:115–135

Hunter WC, Timme SG (1995) Core deposits and physical capital: a reexamination of bank scale economies and efficiency with quasi-fixed inputs. J Money Credit Bank 27(1):165–185

Jondrow J, Lovell CAK, Schmidt P (1982) On the estimation of technical inefficiency in the stochastic frontier production function models. J Econom 19:233–238

Koutsomanoli-Filippaki A, Margaritis D, Staikouras C (2009) Efficiency and productivity growth in the banking industry of Central and Eastern Europe. J Bank Finan 33:557–567

Kumbhakar S, Lovell CAK (2000) Stochastic frontier analysis. Cambridge University Press, Cambridge

Lozano-Vivas A, Pasiouras F (2010) The impact of non-traditional activities on the estimation of bank efficiency: international evidence. J Bank Finan 34:1436–1449

Luenberger DG (1992) Benefit functions and duality. J Math Econ 21:461–481

Luenberger DG (1995) Microeconomic theory. McGraw-Hill, New York

McAllister PH, McManus D (1993) Resolving the scale efficiency puzzle in banking. J Bank Finan 17:389–405

Meeusen W, van den Broek J (1977) Efficiency estimation from Cobb-Douglas production functions with composed error. Int Econ Rev 18(2):435–444

OECD (2010). OECD Economic Surveys: Luxembourg 2010, OECD Publishing

Park PH, Weber WL (2006) A note on efficiency and productivity growth in the Korean Banking Industry, 1992–2002. J Bank Finan 30:2371–2386

Rogers K (1998) Nontraditional activities and the efficiency of US commercial banks. J Bank Finan 22:467–482

Sealey CW, Lindley J (1977) Inputs, outputs and a theory of production and cost at depository financial institutions. J Finan 32:1252–1266

Shephard RW (1953) Cost and production functions. Princeton University Press, Princeton

Shephard RW (1970) Theory of cost and production functions. Princeton University Press, Princeton

Sickles RC, Good DH, Getachew L (2002) Specification of distance functions using semi- and nonparametric methods with an application to the dynamic performance of eastern and western European air carriers. J Prod Anal 17:133–155

Tortosa-Ausina E (2003) Nontraditional activities and banks efficiency revisited: a distributional analysis for Spanish financial institutions. J Econ Bus 55:371–395

Triplett JE (1990) Banking output. In: Eatwell et al. (eds) New palgrave dictionary of money and finance, Macmillan, London

Acknowledgements

The authors would like to thank two anonymous referees and the associate editor for many helpful suggestions. We are also grateful for comments by Rolf Färe, Subal Kumbhakar, Kristiaan Kerstens and the participants of the VI North American Productivity Workshop and the 2011 conference on Banking, Productivity & Growth in Luxembourg. Financial support from the Fonds National de la Recherche through the PERFILUX project is gratefully acknowledged. Any remaining errors are solely our responsibility. The opinions expressed in this paper are those of the authors and do not necessarily reflect the view of their institutions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Guarda, P., Rouabah, A. & Vardanyan, M. Identifying bank outputs and inputs with a directional technology distance function. J Prod Anal 40, 185–195 (2013). https://doi.org/10.1007/s11123-012-0326-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-012-0326-7