Abstract

Nowadays, renewable energies are important sources for supplying electric power demand and a key entity of future energy markets. Therefore, wind power producers (WPPs) in most of the power systems in the world have a key role. On the other hand, the wind speed uncertainty makes WPPs deferent power generators, which in turn causes adequate bidding strategies, that leads to market rules, and the functional abilities of the turbines to penetrate the market. In this paper, a new bidding strategy has been proposed based on optimal scenario making for WPPs in a competitive power market. As known, the WPP generation is uncertain, and different scenarios must be created for wind power production. Therefore, a prediction intervals method has been improved in making scenarios and increase the accuracy of the presence of WPPs in the balancing market. Besides, a new optimization algorithm has been proposed called the grasshopper optimization algorithm to simulate the optimal bidding problem of WPPs. A set of numerical examples, as well as a case-study based on real-world data, allows illustrating and discussing the properties of the proposed method.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The negative environmental impact of fossil fuels (Al-Awami and El-Sharkawi 2011), causes many countries in the world have become interested in investing in renewable energy (Mignon and Bergek 2016). In the meantime, wind energy is considered as one of the most economical types of renewable energies (Hosseini-Firouz 2013). This is why the use of this energy in power systems is increasingly expanding. Governments also continue their support to increase wind power by replacing it with fossil fuels (Afshar et al. 2018).

The deregulated electricity markets were first designed for conventional generators, where power plants offer their generated power several hours before actual power delivery (Sirjani and Rahimiyan 2018). Then the independent system operator (ISO) determines the market price and the share of each generator's production. However, for WPPs, given the uncertainty in their production, the proposed amount will be different from the amount produced. This difference will penalize WPPs (Sharma et al. 2014). For this reason, these WPPs should be presented in a deregulated electricity market with an accurate strategy. The bidding strategy model is generally divided into two game-theoretic and non-game theoretic models (Gallego-Castillo and Victoria 2015). For example, Bathurst et al. (2002) reduce imbalance costs and modeled wind power, proposed Markov Probabilities. Dent et al. 2011 optimized wind power production bids in the forward and real-time electricity market. Ghorbankhani and Badri (2018) presented a bi-level optimization problem in which in the first level, the virtual power plant profit maximized, and at the second level, the ISO is cleared market. Luo et al. (2014) is proposed the bi-level optimization of the bidding strategy, by considering the Conditional Value at Risk measure. Matevosyan and Söder (2005) minimized imbalance costs, to proposed optimal wind power production offers to the electricity market. Siriruk and Valenzuela (2011) modeled the effect of uncertainty on Nash equilibrium quantities and market price under Cournot competition on long-term markets. Soleymani et al. (2007) presented the bidding strategies for each Genco by considering the Nash equilibrium points. Soleymani et al. (2008) presented the bidding strategies for each Genco by considering the estimation of elctricity price and demand. Vahidinasab and Jadid (2009) presented a bilevel optimization method to determine optimal bidding strategy. In the proposed method, suppliers’ emission of pollutants is considered, and the supply function equilibrium (SFE) is used to model the strategic behavior of each supplier. Valenzuela and Mazumdar (2007) by using analytical models present two different market competition models. Generally, non-game theoretic models only pay attention to the behavior of a particular player. The other players of the model are simplified. Game theory models optimize the bidding strategy model by studying the interaction between the economic players of the systems. For example, Ahn and Niemeyer (2007) modeled market power in Korea’s emerging power market to show the effect of market power to increase market electricity prices. Bompard et al. (2010) proposed a new and efficient approach for the network constrained electricity markets to find supply function equilibrium. De la Torre et al. (2004), in auction-based multiperiod electricity markets, studied Nash equilibria. Gao and Sheble (2010) determined a suitable supply function equilibrium model and developed the equilibrium condition. Genc and Reynolds (2011) for uniform-price auctions specified the set of symmetric supply function equilibria. Haghighat et al. (2008) show the market pricing mechanism under imperfect competition affect a supplier’s profit. Kang et al. (2007) show the power suppliers can profit by bidding a price higher than the marginal production cost. Kebriaei et al. (2015), in a day-ahead electricity market, proposed two decision- making methods for repeated Cournot competition of the generators. Kian and Cruz (2005) use discrete-time Nash bidding strategies for the participants of dynamic oligopolistic electricity markets. Krause et al. (2006), in network-constrained pool markets, compared Nash equilibria analysis and agent-based modeling. Liu et al. (2010), in the electricity auction markets, investigated the main electricity bidding mechanisms. Shivaie and Ameli (2015), in security-constrained electricity markets, proposed a new approach for developing an optimal double-sided bidding strategy. Vahidinasab and Jadid (2010) employed the supply function equilibrium model to study the problem of developing optimal bidding strategies in oligopolistic energy markets. In both mentioned model, a set of stochastic and deterministic factors affect the behavior of system players. Some of these stochastic factors include demand, fuel prices, and wind production. In both models, there are a number of uncertainty parameters such as electrical load, electricity price, price of fuel, and wind production. In other words, participants in the electricity market do not have accurate estimates of these parameters and must manage the uncertainty associated with these parameters with various methods such as scenario generation, using high-precision prediction methods to make a profit in the electricity market.

In recent years, the bidding strategy of WPPs has attracted the attention of researchers. Laia et al. (2016) proposed the self-scheduling problem of a thermal and wind power producer in electricity market. Hosseini-Firouz (2013) has used stochastic programming to develop optimal solutions for problems related to wind power that contain uncertainty. The author has included variables such as availability of the wind, prices, and future needs for energy. Lei et al. (2016) have developed an optimal bidding decision concerning the strategic production of wind power by actors engaged in a day-ahead market. This model consists of stochastic market clearing and optimization of energy production and reserve. Sharma et al. (2014) developed an optimal proposing strategy for WPPs with several separate strategies in a market in which producing energy through wind is the dominant method. The oligopolistic aspects of the day-ahead market are limited by various behaviors of WPPs presented in the network; by special emphasis on the uncertainties about the availability of the wind; the stochastic Cournot model is used to develop the model. Singh and Fozdar (2019) propose a bidding strategy that contains wind power intended to increase the profit as much as possible. Since the behavior of various actors, which are competitors, is uncertain, it directly affects the process of binding; this, process decreases the applicability of the normal probability distribution function. Rayati et al. (2019) have developed a bi-level optimization intended to coordinate the balance between gas turbine units and electricity produced by wind power. The authors have embedded a barrier term to regulate the ideal bidding strategy according to the goals of the model. Afshar et al. (2018) proposed a technique to estimate the optimal bidding strategy in a day-ahead market that its actors have market power. The model is based on bid-based payments. Various possible scenarios are used to model uncertainties regarding power generation. Kostarelou and Kozanidis (2021) presented a diverse integer two-levels optimization problem to develop optimal bidding strategies for energy producers engaged in the day-ahead electricity markets for several periods.

Bajpai and Singh (2008) have developed a two-level optimization model, that was structurally adjusted as an MPEC problem and decoded using repetitive algorithms. In the study by Ghamkhari et al. (2017), which is based on a market with several competitors, the bidding strategy develops using the nonlinear programming and Lagrangian relaxation algorithm. Mohsenian-Rad (2016) has adjusted the MPEC problem to obtain a harmonized energy storage regarding the network's limitations. Kardakos et al. (2014) have proposed an optimal bidding strategy problem for price-maker energy generators based on the power transmission distribution factor formulation. In the study conducted by Foroud et al. (2011), the two-level model for a company that both generates and distributes energy is solved through a genetic algorithm. Sharma et al. (2014) have used a stochastic Cournot competition model to predict strategic behaviors of producers that use wind power in a network with several constraints in a day-ahead market that is oligopolistic. Baringo and Conejo (2013) have proposed a two-level stochastic optimization model intended to develop an appropriate strategy for energy producers that use wind power. Jorge and Usaola (2007) have used a mathematical model to develop an optimal binding and operation of units that use both wind and hydro powers. Dai and Qiao (2015) have developed a technique to develop bidding for conservative wind power generators based on an analytical approach and CVaR model.

In this paper, an optimal bidding strategy of WPPs has been proposed in the pay-as-bid market. For this purpose, the bi-level optimization problem is proposed. The first level is the calculation of the WPPs profit, and at the second level, the ISO is cleared market. WPPs and traditional GENCOs participate in the day-ahead market. In addition, WPPs participate in balancing the market to compensate for their energy deviation. Since the amount of power generated in WPPs is uncertain, therefore different scenarios must be created for wind power production. In this paper, PIs method has been used to making scenarios and increases the accuracy of the presence of WPPs in the balancing market. Using the PIs for scenario making, the effective scenarios have produced, and this point has led to a useful presence in the balancing market. So far, the prediction intervals (PIs) method has not been used to making scenarios. Another important point in this way, the heuristic optimization methods have been used to solve the bidding strategy of the WPPs. For this purpose, in this study, a new optimization algorithm has been proposed called GOA to find optimal bidding of WPPs. GOA is a novel population-based algorithm which presented by Saremi in 2017. In addition, the PSO algorithm has been considered, and the results of this method are compared with the GOA method. Considering all of the above conditions, this paper presented optimal 24-h scheduling for the presence of the wind power producers in the electricity power market.

This paper is organized as follows: In Sect. 2, the problem description is explained. In Sect. 3, the grasshopper optimization algorithm is described. The problem formulation and simulation procedure has been explained in Sects. 4 and 5. The experimental results are presented in Sect. 6. In Sect. 7, relevant conclusions are described.

List of symbols | |

|---|---|

Indices | |

\({\Psi }_{n}^{w}\) | Indices of the wind power units at bus n |

\({\Psi }_{n}^{g}\) | Indices of the conventional generation units at bus n |

\({\Psi }_{n}^{d}\) | Indices of the demands at bus n |

\({\Omega }^{\omega }\) | Indices of scenarios |

\({\Omega }^{w}\) | Indices of wind power |

\({\Omega }^{G}\) | Indices of conventional generation units |

Parameters | |

\({B}_{k}\) | Susceptance of line k |

C | Decreasing coefficient |

\({c}_{M}\) | Maximum of c |

\({c}_{m}\) | Minimum of c |

\({\widehat{e}}_{g}\) | Unity vector toward the center of the earth |

\({\widehat{e}}_{w}\) | Unity vector of wind direction |

\({f}_{k}^{max}\) | Transmission capacity of line k |

G | Gravitational constant |

Η | Parameters determining the contribution of PINAW |

\({l}_{d}\) | Lower bound in d-th dimension |

\(pro{b}_{\omega \text{,}t}\) | Probability of scenario \(\omega\) at time t |

\({P}_{i}^{max}\) | Installed capacity of ith WPP (MW) |

\({P}_{g}^{max}\) | Installed capacity of gth conventional GENCO (MW) |

T | Maximum iteration |

\({\widehat{T}}_{d}\) | Value of the best solution (Target) in d-th dimension |

U | Wind direction constant |

\({u}_{d}\) | Upper bound in d-th dimension |

\({\lambda }_{g}\) | The marginal cost of gth conventional GENCO ($/MWh) |

µ | Parameters determining the contribution of PICP |

\({\tau }_{+}\) | The surplus penalty coefficient in balancing Market |

\({\tau }_{-}\) | The defect penalty coefficient in balancing market |

Variables | |

\({A}_{i}\) | The wind advection |

Bmii,t,ω | Balancing market profit of ith WPP at time t ($) |

\({c}_{i}\) | A boolean variable which indicates the coverage behavior of PIs |

\({d}_{ij}\) | Distance between i-th and j-th grasshopper |

\({\widehat{d}}_{ij}\) | The unit vector from i-th grasshopper to j-th |

\({f}_{\text{k,t}}\) | Power flow through transmission line k at time t (MW) |

\({G}_{i}\) | Is the gravity force on the i-th grasshopper |

N | Is the number of samples |

\({P}_{\text{g,t}}\) | Power offered by gth conventional GENCO at time t (MW) |

\({P}_{\text{i,w,t}}\) | The power produced by ith WPP at time t (MW) |

\(Po{f}_{\text{i,t}}\) | Power offered to the day-ahead market by ith WPP at time t (MW) |

\({r}_{i}\) | A random number between 0 and 1 |

S | Function to define social forces |

\({S}_{i}\) | The social interaction |

\({X}_{i}\) | The position of the i-th grasshopper |

\({\delta }_{n\text{,}t}\) | Voltage angle at bus n at time t (rad.) |

\(\lambda\) | Accepted price in the day-ahead market ($/MWh) |

\({\lambda }_{t}\) | Price at time t ($/MWh) |

\({\lambda }_{i\text{,}w}\) | Offer price to day-ahead market by the ith block wind power unit |

Abbreviations | |

|---|---|

GenCo | Generation company |

GOA | Grasshopper optimization algorithm |

ISO | Independent system operator |

LUBE | Lower upper bound estimation |

NN | Neural network |

PICP | Prediction interval coverage probability |

PIs | Prediction intervals |

PSO | Particle swarm optimization |

WPPs | Wind power producers |

2 Problem description

In this section the problem and proposed method is explained.

2.1 Market structure

In this paper, WPPs participate in pool-based day-ahead and balancing market. The day-ahead electricity market before the actual electricity delivery is cleared. The difference between supply and demand is cleared by the balancing market. Since the production of WPPs is uncertain; therefore, the power scheduled is different from the actual product. One of the proposed methods to compensate for this defect is spot prediction of wind power production. While all existing methods for prediction of wind power production, include significant error. Thus, these uncertainties can model by a set of scenarios.

The main intention of the operator should be minimizing the observed imbalances of the system according to a process that contains prices of the energy and possible deviations in the production of energy by various actors as well as proving the produced energy to the day-ahead market (Laia et al. 2016). Thus, if the proposed power for the next hour is higher than the production of WPPs, this amount of shortage of production should be purchased from the market, which is at a price of it more than the day-ahead market price. Also, if the amount of proposed power is less than the production of the plant, this additional amount should be sold on the market. The price in the day-ahead market is higher than the sale price.

The equilibrium prices for buy and sell have been modeled using the by Eqs. (1) and (2), respectively:

In addition, these penalty coefficients are numbers between 0 and 1. Also, it is supposed that the unit pricing of WPPs for the day- ahead market includes one part of volume and price. Similarly, it is supposed that wind manufacturers also engage in the balancing market. Thus, this bi-level optimization problem, which in the first level WPP maximizes profit from both of market and in the second level ISO, cleared the market to minimize payable costs to the GENCOs. Both of these optimization problems are implemented by the GOA.

2.1.1 Uncertainty characterization

As mentioned, the power production of WPPs is uncertain. Therefore, it is necessary to make an accurate forecast of power production, until having successful participation in the electricity market. However, mentioning this point is very important that most of the spot prediction of wind power production, include noticeable error. Therefore, different scenarios must be created for wind power production. In order to create wind power scenarios several methods have been proposed. For an accurate representation, a great number of scenarios must be made. Due to the computational and time limits, generated scenarios need to be reduced. In this paper, prediction intervals have been used to reduce the number of scenarios and increase the accuracy of the presence of WPPs in the balancing market. In the following, the proposed method for the production of the scenario is discussed.

2.1.2 Prediction intervals

Recently, for prediction problems neural networks have been widely used. For example, Chryssolouris et al. (1996) for physical system proposed a method to quantify the confidence intervals of a neural network. for the construction of PIs the delta and Bayesian techniques is introduced by Khosravi et al. (2011a). Sheng et al. (2013) based on Bayesian linear regression developed a bootstrapping reservoir computing network ensemble, and a simultaneous training method. These methods first perform a spot prediction and then predict the intervals based on this prediction. Recently, a novel technique named LUBE for PIs was developed by Khosravi et al., in (Khosravi et al. 2011b). To improve performance of traditional methods the intervals is created directly. The main concept of "LUBE" method is to directly create the upper and lower band of the intervals. The intervals should cover the main target as likely as possible, and the band should be as narrow as possible. By definition, future observations should be in the lower and upper band with a predetermined probability, which is called the "confidence level" ((1−α) %). Therefore, three indexes have been introduced to evaluate the forecast intervals, which are based on the coverage probability and the bandwidth.

The PICP is the main index for evaluating intervals. This index shows how much of the target is covered by the upper and lower bounds. This index is defined as follows:

If the intended value ranges between the lower and upper bounds, \(c_{i}\) = 1; otherwise, \(c_{i}\) = 0. If all target values are placed between the upper and lower bounds, then PICP = 100%.

In cases that upper and lower bounds are considered as extremes, we can easily obtain a high PICP (even 100% PICP) (Quan et al. 2014). However, these intervals have no useful information about the target. Therefore, also the width of the PIs should be considered. For this purpose, PINAW formulated this aspect as follow:

where R is the range of the target.

PICP and PINAW (or PINRW) evaluate only a sole dimension of PIs separately. Focus only on one aspect of the PIs may result in false values. To solve the above problems, an interesting index, called CWC, is proposed in (Khosravi et al. 2011c):

where γ(PICP) = 1 for training. µ and η are two controlling variables that show how many penalties can be considered for low probability intervals. The nominal confidence interval ((1 − α)%) can be considered as the target for selecting µ. the difference between the PICP and μ is magnified by η.

2.1.3 Scenario making using prediction intervals

In order to make scenarios using PIs, the following steps should be taken:

-

The power production data of the WPPs in a specified time period has been given to PIs.

-

The PI indicates the upper and lower bounds of power production of WPPs for a specified day.

-

Now, by specifying the upper and lower bounds, the scenarios are being created. In this paper, three scenarios have been made for each hour. These scenarios are upper and lower bound, and the average of these two bounds. The remarkable point in this method is that the number of scenarios has reduced significantly.

3 Grasshopper optimization algorithm (GOA)

Grasshopper is insects, and because of their damage to agriculture, they are considered as a pest. Although grasshoppers in nature are usually found individually, but they are part of the largest swarm of all creatures (Simpson et al. 1999). The main characteristic of grasshopper swarm is that in the larval stage, their movement is slow, and in adulthood, they move in long-range and big steps (Saremi et al. 2017).

The mathematical model of grasshopper behavior swarm is presented as follows (Topaz et al. 2008):

In order to provide random behavior, the Eq. (5) can be rewritten as follow:

The S function, which defines the social forces, is calculated as follow:

where f and l are the intensity of attraction the attractive length scale. The second term of Eq. (6) is gravity force function and calculated as follows:

The third part of Eq. (6) wind advection and calculated as follows:

By substituting the S, G and A in Eq. 6, this comes in as follow:

However, this equation cannot be used in optimization problem because the swarm does not contain global optimization point. Therefore, an adjusted version of this equation is suggested as follow to find a solution for this issue.

4 Mathematical formulation

Mathematical formulation of the profit of WPP and clearing problem of the ISO market is proposed in the following.

4.1 Wind power producer problem

The WPP profit function defined as follow:

Subject to

Equation (14) represents the profit of ith WPP. Since the production cost of these units is zero, then this is equal to revenue. Also, each WPP offers the amount of power that will maximize its profit from day-ahead and balancing markets. WPP’ offered bids in the day-ahead electricity market are presented in constraint (16). Equation (14) represents the balancing market income for each WPP in each scenario and a particular time.

4.2 ISO market clearing problem

The objective function of market clearing defined as follow:

This equation should be minimized.

Subject to:

Equation (16) is composed of two parts, the first part comprising the amount paid to WPPs, and the second part includes conventional generators costs. Constraint (18) represents the power balance at each time in the power system. Equation (19) presents the power flow through lines. Equation (20) represents transmission capacity limits. Equations (21) and (22) represent the upper and lower limits of conventional generators and WPPs. Also, the voltage angle limit of each bus is proposed in Eq. (23).

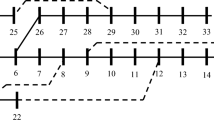

5 Simulation procedure

In order to solve this bi-level optimization problem, the following steps must be done:

Step 1 Scenario making by PIs: In the first step, by using PIs for each hour, wind power generation scenarios are made.

Step 2 Time counter initialization: Time counter starts with t = 1.

Step 3 Optimal bidding strategy: At this step, firstly, random values are proposed for the power and price of the WPPs. Then, GOA is utilized to determine the winning power of any power plant and the price in the day-ahead market by using Eqs. (17) to (23). In the following, the GOA has used the Eqs. (14) to (16) and the previous stage information to optimize the price and power production of WPPs. This process will continue until a maximum number of iteration is reached.

Step 4 Update time counter: For each hour, the amount of power produced by the WPPs is specified.

Step 5 End.

A diagram of the simulation procedure is shown in Fig. 1.

6 Numerical results

In order to illustrate the efficiency of the proposed method, the optimal bidding strategy problem has been implemented on a three-bus system.

6.1 Wind speed data and PIs

In this paper, PIs are utilized to making these scenarios. The data relating to wind power in 2017 in the town Sotaventogalicia in Spain ([Online]. Available: http://www.Sotaventogalicia.Com/.,n.d) have been utilized as input for PIs.

In other words, for the last day of 2017, PIs are the forecasted lower and upper bound of wind power production. This format of PIs is similar to spot forecasts. The datasets are divided into training, validation, and test set. To determine the optimal structure of NNs, Median values of PINAWs (with satisfied PICPs) are used. Once the training process terminates, PIs for the test is generated. Therefore, for the last day of 2017, using PIs, the upper and lower limits of wind production have been estimated. Now, by specifying the upper and lower bounds, the scenarios are being created. In this paper, three scenarios have been made for each hour. These scenarios are upper and lower bound, and the average of these two bounds. The result of this prediction is proposed in Fig. 2. The upper and lower bound, and the average of these two are considered as wind energy scenarios. In other words, for every hour of the day, three scenarios have been made. These scenarios are shown in Fig. 3. The probability of all scenarios has been assumed (1/3).

6.2 6.2. Three-bus system

6.2.1 The detail of the three-bus system

It is assumed in the 3-bus system, a conventional producer unit and a single load connected to each bus, that contains three transmission lines. The value of susceptance of each line is 5 p.u. and the maximal transmission load is defined as 100 MW. The profile of the demand factor is shown in Fig. 4. The capacity of the wind power plant is equal to 120 MW, and it’s located on bus 2. Also, The cost of wind power producing is considered zero. The data of the conventional generators are given in Table 1 (Afshar et al. 2018). Similarly, three loads are located in each bus are described in Table 2 (Afshar et al. 2018). These values are for peak demand. In order to analyze the balancing market effect on bidding strategy, two states are considered as follow for the balancing market price:

State 1 \({\tau }_{+}=0.3\), \({\tau }_{-}=0.15\)

State 2 \({\tau }_{+}=0.15\), \({\tau }_{-}=0.3\)

These τ values are used from Afshar et al. 2018. The important point is that in all of the mentioned states, the produced wind power is considered the same. Then, two different modes of the three-bus system, which include unlimited and congested transmission modes, are investigated.

6.2.2 Unlimited transmission mode

In this mode, it is supposed that no transmission congestion occurs. Also, to demonstrate the efficiency and effectiveness of the proposed method, the presence of WPPs in the electricity market has been proposed in two different cases:

-

(1)

Strategic presence In this case, the WPPs act with strategy.

-

(2)

Non-strategic presence In this case, WPPs bids his forecasted produced power at zero-price to day-ahead market. ISO clears the market by Eqs. (9) to (15). The results of spot forecasting are presented in Fig. 5.

The hourly profit for WPP for the two mentioned cases and state 1 is shown in Fig. 6. As shown in the figure, for most hours of the day, the profit of case 1 is greater than case 2. In other words, a strategic presence more useful than non-strategic presence. For example, in the 11th-hour profit of case 1 is 4642.7 $, and in case 2 is 4318.02 $.

Similarly, for state 2, where the purchase and sale price varies with state 1, the profit from the day-ahead market and balancing market is shown in Fig. 7. As shown in this figure, in this state, the amount of profit from Model 1 is also higher in most of the hours a day. In other words, the presented strategy in the market is more profitable for the WPP.

The proposed power in the day-ahead market for the first and second states are shown in Fig. 8. As it has been observed, because of the low purchase price in the balancing market for state 1, in most of the time in a day, the WPP has preferred to offer more power to the day-ahead market. Similarly, in state 2, due to higher purchasing price, the WPP offered a lower amount of power for the day- ahead market.

6.2.3 Transmission congestion mode

One of the important subjects that can affect the performance of the WPPs in the electricity energy market is the transmission capacity limits. To illustrate this issue and its impact on the network, transmission capacity for all lines of this network is considered 100 MW. Given all of the above conditions, the results of the simulation are presented in two cases. These two cases are strategic presence and non-strategic presence. The hourly profit for WPP for the two mentioned cases in state 1 and state 2 are shown in Figs. 9 and 10, respectively.

As seen in these Figures, the amount of profits is higher in transmission congestion mode. The reason for this is that the market price has increased. This fact shows that the congestion mode is affected by the rising the maximum accepted price at the day-ahead market.

Accepted power for the day-ahead market is shown in Fig. 11. As shown in the figure, the amount of power accepted for the day-ahead market in state 1 is more than state 2 in most of the hours in the day.

In Table 3, the overall profit earned by WPP from different cases and states for the three-bus system is presented. Also, this amount of profit is presented for two unlimited transmission mode and transmission congestion mode. As shown in the table, the amount of profit for strategic presence is greater than non-strategic presence. Therefore, strategic presence has led to an increase in WPP profit.

6.2.4 Comparing the results of using GOA and PSO

To demonstrate the efficiency of the GOA, the simulation of the bidding strategy problem is implemented by using the PSO algorithm. The PSO algorithm, which is in the category of the population-based algorithm, is somewhat similar to the GOA. Therefore, the daily profit obtained from WPP using GOA and PSO for the three-bus system in both modes is presented in Figs. 12 and 13.

As seen, the results of these figures show that, by employing GOA as the optimization method, WPP makes more profit in both states. For example, in unlimited transmission mode for the first and second states, the daily profit has been increased respectively 7.7% and 5.03%. In addition, in transmission congestion mode, the daily increment profit for the first and second states respectively are 4.2% and 2.6%.

7 Conclusion

In this paper, the optimal strategy presence of WPPs in the pay-as-bid market is investigated. To solve this bi-level optimization problem, the Grasshopper optimization algorithm has been used. The first level is the calculation of the WPPs profit, and the second level is the ISO market clearing problem. By Implementing this problem on the three-bus network, these results are taken:

-

(1)

The importance of considering the balancing market as part of the compensation to the WPPs is highlighted. Also, the presented model can be implemented on large and small networks.

-

(2)

The proposed model can implement on all models of the WPP. Also, the presented model can be implemented on large and small networks.

-

(3)

The simulation results show that the strategic presence of the WPP in the electricity energy market has a positive impact on their daily profit.

-

(4)

GOA is a powerful algorithm for simulating an optimal bidding strategy problem.

References

Afshar K, Ghiasvand FS, Bigdeli N (2018) Optimal bidding strategy of wind power producers in pay-as-bid power markets. Renew Energy 127:575–586. https://doi.org/10.1016/j.renene.2018.05.015

Ahn N, Niemeyer V (2007) Modeling market power in Korea’s emerging power market. Energy Policy 35(2):899–906. https://doi.org/10.1016/J.ENPOL.2005.12.027

Al-Awami AT, El-Sharkawi MA (2011) Coordinated trading of wind and thermal energy. IEEE Trans Sustain Energy 2(3):277–287. https://doi.org/10.1109/TSTE.2011.2111467

Bajpai P, Singh S (2008) Impact of transmission constraints on supply-side bidding strategy using BLP approach. 2008 IEEE Power and Energy Society General Meeting - Conversion and Delivery of Electrical Energy in the 21st Century, 1–7

Baringo L, Conejo AJ (2013) Strategic offering for a wind power producer. IEEE Trans Power Syst 28(4):4645–4654

Bathurst GN, Weatherill J, Strbac G (2002) Trading wind generation in short term energy markets. IEEE Trans Power Syst 17(3):782–789. https://doi.org/10.1109/TPWRS.2002.800950

Bompard E, Lu W, Napoli R, Jiang X (2010) A supply function model for representing the strategic bidding of the producers in constrained electricity markets. Int J Electr Power Energy Syst 32(6):678–687. https://doi.org/10.1016/J.IJEPES.2010.01.001

Chryssolouris G, Lee M, Ramsey A (1996) Confidence interval prediction for neural network models. IEEE Trans Neural Netw 7(1):229–232. https://doi.org/10.1109/72.478409

Dai T, Qiao W (2015) Optimal bidding strategy of a strategic wind power producer in the short-term market. IEEE Trans Sustain Energy 6(3):707–719

De la Torre S, Contreras J, Conejo AJ (2004) Finding multiperiod nash equilibria in pool-based electricity markets. IEEE Trans Power Syst 19(1):643–651. https://doi.org/10.1109/TPWRS.2003.820703

Dent CJ, Bialek JW, Hobbs BF (2011) Opportunity cost bidding by wind generators in forward markets: analytical results. IEEE Trans Power Syst 26(3):1600–1608. https://doi.org/10.1109/TPWRS.2010.2100412

Foroud AA, Amirahmadi M, Bahmanzadeh M, Abdoos AA (2011) Optimal bidding strategy for all market players in a wholesale power market considering demand response programs. Eur Trans Electr Power 21(1):293–311

Frade PMS, Pereira JP, Santana JJE, Catalão JPS (2019) Wind balancing costs in a power system with high wind penetration—evidence from Portugal. Energy Policy 132:702–713. https://doi.org/10.1016/j.enpol.2019.06.006

Gallego-Castillo C, Victoria M (2015) Cost-free feed-in tariffs for renewable energy deployment in Spain. Renew Energy 81:411–420. https://doi.org/10.1016/j.renene.2015.03.052

Gao F, Sheble GB (2010) Electricity market equilibrium model with resource constraint and transmission congestion. Electr Power Syst Res 80(1):9–18. https://doi.org/10.1016/J.EPSR.2009.07.007

Genc TS, Reynolds SS (2011) Supply function equilibria with capacity constraints and pivotal suppliers. Int J Ind Organ 29(4):432–442. https://doi.org/10.1016/J.IJINDORG.2010.08.003

Ghamkhari M, Sadeghi-Mobarakeh A, Mohsenian-Rad H (2017) Strategic bidding for producers in nodal electricity markets: a convex relaxation approach. IEEE Trans Power Syst 32(3):2324–2336

Ghorbankhani E, Badri A (2018) A bi-level stochastic framework for VPP decision making in a joint market considering a novel demand response scheme. Int Trans Electr Energy Syst 28(1):1–18. https://doi.org/10.1002/etep.2473

Haghighat H, Seifi H, Rahimi Kian A (2008) The role of market pricing mechanism under imperfect competition. Decis Support Syst 45(2):267–277. https://doi.org/10.1016/J.DSS.2007.12.011

Hosseini-Firouz M (2013) Optimal offering strategy considering the risk management for wind power producers in electricity market. Int J Electr Power Energy Syst 49(1):359–368. https://doi.org/10.1016/j.ijepes.2013.01.015

Jorge M, Usaola JG (2007) Combining hydro-generation and wind energy Biddings and operation on electricity spot markets. Electr Power Syst Res 77:393–400. https://doi.org/10.1016/j.epsr.2006.03.019

Kang DJ, Kim BH, Hur D (2007) Supplier bidding strategy based on non-cooperative game theory concepts in single auction power pools. Electr Power Syst Res 77(5–6):630–636. https://doi.org/10.1016/J.EPSR.2006.05.012

Kardakos EG, Simoglou CK, Bakirtzis AG (2014) Optimal bidding strategy in transmission-constrained electricity markets. Electr Power Syst Res 109:141–149. https://doi.org/10.1016/j.epsr.2013.12.014

Kebriaei H, Rahimi-Kian A, Nili Ahmadabadi M (2015) Model-based and learning-based decision making in incomplete information cournot games: a state estimation approach. IEEE Trans Syst Man Cybern Syst 45(4):713–718. https://doi.org/10.1109/TSMC.2014.2373336

Khosravi A, Mazloumi E, Nahavandi S, Creighton D, Van Lint JWC (2011a) Prediction intervals to account for uncertainties in travel time prediction. IEEE Trans Intell Transp Syst 12(2):537–547. https://doi.org/10.1109/TITS.2011.2106209

Khosravi A, Nahavandi S, Creighton D (2011b) Prediction interval construction and optimization for adaptive neurofuzzy inference systems. IEEE Trans Fuzzy Syst 19(5):983–988. https://doi.org/10.1109/TFUZZ.2011.2130529

Khosravi A, Nahavandi S, Creighton D, Atiya AF (2011c) Lower upper bound estimation method for construction of neural network-based prediction intervals. IEEE Trans Neural Netw Publ IEEE Neural Netw Counc 22(3):337–346. https://doi.org/10.1109/TNN.2010.2096824

Kian AR, Cruz JB (2005) Bidding strategies in dynamic electricity markets. Decis Support Syst 40(3–4):543–551. https://doi.org/10.1016/j.dss.2004.09.004

Kostarelou E, Kozanidis G (2021) Bilevel programming solution algorithms for optimal price-bidding of energy producers in multi-period day-ahead electricity markets with non-convexities. Optim Eng 22(1):449–484

Krause T, Beck EV, Cherkaoui R, Germond A, Ernst D (2006) A comparison of Nash equilibria analysis and agent-based modelling for power markets. Int J Electr Power Energy Syst 28(9):599–607. https://doi.org/10.1016/J.IJEPES.2006.03.002

Laia R, Pousinho HMI, Melíco R, Mendes VMF (2016) Bidding strategy of wind-thermal energy producers. Renew Energy 99:673–681. https://doi.org/10.1016/J.RENENE.2016.07.049

Lei M, Zhang J, Dong X, Ye JJ (2016) Modeling the bids of wind power producers in the day-ahead market with stochastic market clearing. Sustain Energy Technol Assess 16:151–161. https://doi.org/10.1016/J.SETA.2016.05.008

Liu Z, Zhang X, Lieu J (2010) Design of the incentive mechanism in electricity auction market based on the signaling game theory. Energy 35(4):1813–1819. https://doi.org/10.1016/J.ENERGY.2009.12.036

Luo X, Chung C, Yang H, Tong X (2014) Optimal bidding strategy for generation companies under CVaR constraint. Int Trans Electr Energy Syst 24(10):1369–1384. https://doi.org/10.1002/etep.1765

Matevosyan J, Söder L (2005) Minimization of imbalance cost trading wind power on the short term power market. 2005 IEEE Russ Power Tech PowerTech 21(3):1396–1404. https://doi.org/10.1109/PTC.2005.4524621

Mignon I, Bergek A (2016) Investments in renewable electricity production: the importance of policy revisited. Renew Energy 88:307–316. https://doi.org/10.1016/j.renene.2015.11.045

Mohsenian-Rad H (2016) Coordinated price-maker operation of large energy storage units in nodal energy markets. IEEE Trans Power Syst 31(1):786–797

Online. http://www.sotaventogalicia.com/. (n.d.).

Quan H, Srinivasan D, Khosravi A (2014) Short-term load and wind power forecasting using neural network-based prediction intervals. IEEE Trans Neural Netw Learn Syst 25(2):303–315. https://doi.org/10.1109/TNNLS.2013.2276053

Rayati M, Goodarzi H, Ranjbar AM (2019) Optimal bidding strategy of coordinated wind power and gas turbine units in real-time market using conditional value at risk. Int Trans Electr Energy Syst 29(1):1–16. https://doi.org/10.1002/etep.2645

Saremi S, Mirjalili S, Lewis A (2017) Grasshopper optimisation algorithm: theory and application. Adv Eng Softw 105:30–47. https://doi.org/10.1016/J.ADVENGSOFT.2017.01.004

Sharma KC, Bhakar R, Tiwari HP (2014) Strategic bidding for wind power producers in electricity markets. Energy Convers Manage 86:259–267. https://doi.org/10.1016/J.ENCONMAN.2014.05.002

Sheng C, Zhao J, Wang W, Leung H (2013) Prediction intervals for a noisy nonlinear time series based on a bootstrapping reservoir computing network ensemble. IEEE Trans Neural Netw Learn Syst 24(7):1036–1048. https://doi.org/10.1109/TNNLS.2013.2250299

Shivaie M, Ameli MT (2015) An environmental/techno-economic approach for bidding strategy in security-constrained electricity markets by a bi-level harmony search algorithm. Renew Energy 83:881–896. https://doi.org/10.1016/J.RENENE.2015.05.024

Simpson SJ, McCAFFERY AR, HAGELE BF (1999) A behavioural analysis of phase change in the desert locust. Biol Rev 74(4):461–480. https://doi.org/10.1111/j.1469-185X.1999.tb00038.x

Singh S, Fozdar M (2019) Optimal bidding strategy with the inclusion of wind power supplier in an emerging power market. IET Gener Transm Distrib 13(10):1914–1922

Siriruk P, Valenzuela J (2011) Cournot equilibrium considering unit outages and fuel cost uncertainty. IEEE Trans Power Syst 26(2):747–754. https://doi.org/10.1109/TPWRS.2010.2058818

Sirjani B, Rahimiyan M (2018) Wind power and market power in short-term electricity markets. Int Trans Electr Energy Syst 28(8):1–11. https://doi.org/10.1002/etep.2571

Soleymani S, Ranjbar AM, Shirani AR (2007) New approach for strategic bidding of Gencos in energy and spinning reserve markets. Energy Convers Manage 48(7):2044–2052. https://doi.org/10.1016/J.ENCONMAN.2007.01.002

Soleymani S, Ranjbar AM, Shirani AR (2008) New approach to bidding strategies of generating companies in day ahead energy market. Energy Convers Manage 49(6):1493–1499. https://doi.org/10.1016/j.enconman.2007.12.033

Topaz CM, Bernoff AJ, Logan S, Toolson W (2008) A model for rolling swarms of locusts. Eur Phys J Spec Top 157(1):93–109. https://doi.org/10.1140/epjst/e2008-00633-y

Vahidinasab V, Jadid S (2009) Multiobjective environmental/techno-economic approach for strategic bidding in energy markets. Appl Energy 86(4):496–504. https://doi.org/10.1016/J.APENERGY.2008.08.014

Vahidinasab V, Jadid S (2010) Normal boundary intersection method for suppliers’ strategic bidding in electricity markets: an environmental/economic approach. Energy Convers Manage 51(6):1111–1119. https://doi.org/10.1016/J.ENCONMAN.2009.12.019

Valenzuela J, Mazumdar M (2007) Cournot prices considering generator availability and demand uncertainty. IEEE Trans Power Syst 22(1):116–125. https://doi.org/10.1109/TPWRS.2006.889142

Funding

Open access funding provided by Università degli Studi di Roma La Sapienza within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Heydari, A., Memarzadeh, G., Astiaso Garcia, D. et al. Interval prediction algorithm and optimal scenario making model for wind power producers bidding strategy. Optim Eng 22, 1807–1829 (2021). https://doi.org/10.1007/s11081-021-09610-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11081-021-09610-6