Abstract

We examine the potential for adaptation to climate change in Indian forests, and derive the macroeconomic implications of forest impacts and adaptation in India. The study is conducted by integrating results from the dynamic global vegetation model IBIS and the computable general equilibrium model GRACE-IN, which estimates macroeconomic implications for six zones of India. By comparing a reference scenario without climate change with a climate impact scenario based on the IPCC A2-scenario, we find major variations in the pattern of change across zones. Biomass stock increases in all zones but the Central zone. The increase in biomass growth is smaller, and declines in one more zone, South zone, despite higher stock. In the four zones with increases in biomass growth, harvest increases by only approximately 1/3 of the change in biomass growth. This is due to two market effects of increased biomass growth. One is that an increase in biomass growth encourages more harvest given other things being equal. The other is that more harvest leads to higher supply of timber, which lowers market prices. As a result, also the rent on forested land decreases. The lower prices and rent discourage more harvest even though they may induce higher demand, which increases the pressure on harvest. In a less perfect world than the model describes these two effects may contribute to an increase in the risk of deforestation because of higher biomass growth. Furthermore, higher harvest demands more labor and capital input in the forestry sector. Given total supply of labor and capital, this increases the cost of production in all the other sectors, although very little indeed. Forestry dependent communities with declining biomass growth may, however, experience local unemployment as a result.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a review of the studies of the relationships between impacts of climate change in forest sector and economic markets, Sohngen et al. (2007) conclude that ecologists and economists have not worked seriously together to assess climate impacts in ecosystems. Issues that require a close integration between ecological and economic approaches are typically less understood than those that can be addressed by modifications of either economic models or ecological models. This may be due to the fact that the focus of interest for ecologists and economists is different. Ecologists recognize the importance of economic drivers for assessments of impacts on ecological systems, and include these drivers to assess how the alternative economic development paths affect the ecological systems. The repercussions of different ecological responses to the economy are usually left out. Economists recognize the importance of eco-systems for economic analyses, but are reluctant about including the complexities of eco-systems beyond those with the most apparent implications for economic decision-making.

As a result, many questions remain unanswered. Sohngen et al. (2007) mention weaknesses related to the fact that economists and ecologists often work on widely different scales. Markets cannot be analyzed properly in a local setting. In fact, many studies emphasize the importance of analyzing markets for timber in a global context (see e.g. Reilly et al. 2007). Ecosystems, on the other hand, differ substantially over short distances. It may be impossible to “aggregate ecosystems”, similar to how sectors and regions are aggregated in economic models. Economic analyses moreover tend to concentrate on the timber value of forests, without taking other services, such as biodiversity, recreation and non-wood products, into account. The importance of the complexities, which the management of forests is subjected to is thereby underestimated. As a consequence, challenges may be oversimplified, but opportunities may also be neglected. Studies show how utilization of the diversity of forests may help overcome major negative impacts of climate change (Amacher et al. 2005) and moreover widen the options for climate change mitigation (Sathaye and Ravindranath 1998).

Thus, a broadening of the scope for analyses of climate change impacts on forests by better integrating economic and ecological models has been demanded. For analyses of impacts and adaptation to climate change, ecological models have the advantage of providing a spatial dimension, which captures variabilities over geographical areas. This is essential in studies of adaptation, which frequently emphasize the importance of considering adaptation as a local matter (Robinson et al. 2008). However, adaptation is also driven by market responses. To address these, one has to turn to economic equilibrium models. Markets are not limited to local communities, and equilibrium models are, moreover, based on national accounts data, which are difficult to break down to smaller regions. It is, therefore, difficult to take local characteristics into account in analyses of goods traded in global markets, such as forest products and emission permits. Therefore, one has to renounce some of the properties of both ecological and economic models to achieve a better integration between the two systems.

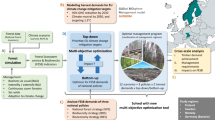

The objective of this study is to examine the potential for adaptation to climate change in Indian forests, and to derive the macroeconomic implications of impacts and adaptation for India. We use the ecological model IBIS to estimate the impacts of climate change in six Indian sub-regions (or zones) and implement the results into a global computable general equilibrium model focusing on India (GRACE-IN) where a forestry module is designed to optimise forest management in each of the six zones.

The Integrated Biosphere Simulator (IBIS) is designed to be a comprehensive model of the terrestrial biosphere (Foley et al. 1996). The model represents a wide range of processes, including land surface physics, canopy physiology, plant phenology, vegetation dynamics and competition, and carbon and nutrient cycling. The model generates global simulations of the surface water balance (e.g., runoff), the terrestrial carbon balance (e.g., net primary production, net ecosystem exchange, soil carbon, aboveground and belowground litter, and soil CO2 fluxes), and vegetation structure (e.g., biomass, leaf area index, and vegetation composition).

The economic model for Global Responses to Antropogenic Changes in the Environment focusing on India (GRACE-IN) can be regarded a standard computable general equilibrium (CGE) model, which is modified in two ways. First, in the forestry module, the supply of biomass is determined by the growth of forests in specific zones, and timber harvest is determined with reference to specified objectives of forest management. Second, India is divided into six zones in order to take into account the variations in expected climate change in different regions. The division into zones moreover opens the possibility to address geographical barriers to adaptation, which may result from immobility of primary input factors. It is worth noticing that adaptation in this study mainly refers to adjustment of own economic behavior by households and communities in response to changes in market signals due to the impacts of climate change without public-policy interventions. This type of adaptation falls within the concept of autonomous or spontaneous adaptation in the existing literature (e.g., IPCC 2007, Glossary).

In principle, all the services provided by forest can be considered in the macroeconomic analysis of the adaptation applied by this study. In order to do so, an overall evaluation of all the services has to be implemented to bridge the information gap between IBIS and GRACE-IN models. For example, IBIS may provide forest status of a specific zone but it cannot tell the economic value of biodiversity, recreation, and non-wood products embedded in the forest. Neither can GRACE-IN tell this evaluation even though these values can be considered in the forestry module of the GRACE-IN as long as relative evaluation is available. As a first attempt to link the ecological model (IBIS) to the economic model (GRACE-IN), only the timber value of forest is considered in this study by supplementing information on forest management.

Previous studies that integrate ecological and economic models to address impacts of climate change in forestry (van Vuuren et al. 2006; Lee and Lyon 2004, Sohngen and Mendelsohn 2003; Perez-Garcia et al. 2002, Brinkley 1988) either take a global perspective without focusing much on adaptation or are constrained to a regional analysis with insufficient links to global markets. This study combines adaptation within regions with repercussions from global impacts on forests in the market for forest products. We show what the impacts of climate change on the biomass means for the rotation age of the forests in different zones in India. The harvest is adjusted accordingly, but taking into account also a change in the rate of economical to total forests. The macroeconomic impacts are derived from the responses in Indian as well as global markets, where a relative factor price change and spurs changes in demand, locally as well as globally. Factor prices are considered zone specific, which means that the macroeconomic impacts of climate change differ across zones in India.

The paper is organized as follows: We start with a brief presentation of the ecological model IBIS and the economic model GRACE. Then, we present the forestry module, and show how the module is linked to the two models. Next, we present the integrated analysis of the impacts of climate change on the Indian economy and discuss consequences of adaptation in the forestry sector. Finally, we conclude and suggest some issues for further research.

2 The ecological model IBIS and the economic model GRACE-IN

IBIS was developed by the Center for Sustainability and the Global Environment (SAGE) researchers as a first step towards an improved understanding of global biospheric processes and studying their potential response to human activity (Foley et al. 1996). IBIS was constructed to link explicitly land surface and hydrological processes, terrestrial biogeochemical cycles, and vegetation dynamics within a single, physically consistent framework. Furthermore, IBIS was one of a new generation of global biosphere models, termed Dynamic Global Vegetation Models (DGVMs), which consider transient changes in vegetation composition and structure in response to environmental change. Previous global ecosystem models have typically focused on the equilibrium state of vegetation and could not allow vegetation patterns to change over time.

Version 2.5 of IBIS includes several major improvements and additions (Kucharik et al. 2000). SAGE continues to test the performance of the model, assembling a wide range of continental- and global-scale data, including measurements of river discharge, net primary production, vegetation structure, root biomass, soil carbon, litter carbon, and soil CO2-flux. With these field data and model results used for the contemporary biosphere (1965–1994), their evaluation shows that simulated patterns of run-off, net primary production, biomass, leaf area index, soil carbon, and total soil CO2-flux agreed reasonably well with measurements that have been compiled from numerous ecosystems. These results also compare favorably to other global model results (Kucharik et al. 2000).

For prediction of the distribution of vegetation, IBIS requires two sets of inputs. First, the climatic data, spatially explicit over the region in question; second, the soil data over the same region. The most important climatic data-sets include temperature, precipitation, relative humidity and wind speed. The data for a future scenario (say, 2085) was obtained from climate projections of the regional climate model of the Hadley Center (HadRM3), described in Rupakumar et al. (2006). This is corrected for biases in the model, by offsetting baseline (observed) data with model anomaly data (change predicted by the model). For this purpose, the baseline observed data is obtained from CRU, UK (New et al. 1999). The soil data are obtained from the International Geosphere-Biosphere Programme (IGBP, 2010). All input data is gridded to a 0.5 × 0.5 degree (latitude × longitude) resolution.

The model provides estimates of vegetation growth and soil carbon accumulation for each 0.5 × 0.5 degree grid. In our simulations, the climate is kept steady for 200 years in the base-line scenario, thereby yielding the reference path for the growth of vegetation to which the alternative scenarios with climate change are compared.

GRACE-IN is a global computable general equilibrium model (CGE) which divides the world into three regions: EU, India, and the rest of the world (ROW). India is further divided into six zones. The division into zones is made, firstly, to better take into account the variability of climatic changes within India. Secondly, it allows us to analyze the impacts of possible market barriers to adaptation, which arise because of constraints to the mobility between zones of the primary input factors, labor, capital and natural resources. The zones are displayed in Fig. 1. The model divides the economy of each region into 11 sectors: agriculture, forestry; paper and pulp, lumber, coal, electricity, gas, refined oil, crude oil, services and other products including other manufacturing.

Ideally, a zone ought to represent homogenous vegetation types as well as homogenous socioeconomic factors. However, the vegetation types in India are heterogeneous also within relatively small areas. To attain homogenous vegetation types, one would have to divide India into many more zones. Table 1 shows the diversity of vegetation typologies in the six zones. Although there are differences, the variability within each zone is what characterizes most of them. Many vegetation types are also present in many regions. On the other hand, there are constraints to the number of zones that can be allowed in the GRACE model and limitations in the availability of socioeconomic data. The choice of only six zones is, in other words, a compromise, not sufficient to represent distinguished ecologies, but better than dealing with India as one only region.

Economic growth is calibrated to the A2_ASF scenario by IPCC (Nakicenovic and Swart 2000) by adjusting exogenous parameters. First, economic growth is driven by an exogenous choice of saving ratios in each region. All savings are collected by a global bank, which decides in which region to invest. More investments are allocated to regions with high returns to capital, but reallocation is subject to elasticities of transformation. The return to capital is leveled out across regions over time, and equalized in the long run. All investments are transformed to capital available for the next period.

The income to a region includes income shares of the remuneration to the primary factors of production labor, capital and natural resources and direct and indirect taxes collected by the regional government. Except for the returns to capital, the income is collected directly by a virtual regional manager. The returns to capital are first collected by a global trust, who returns it to the regional manager according to the share of regional capital stocks at the beginning of each period. Hence, the regional manager holds all the income to each of the three global regions.

Apart from the savings, economic growth can also be attributed to population growth, a change in the availability of natural resources and technological change. The model assumes full utilization of all available resources within each region, meaning that primary production factors are not reallocated across regions. There is a free flow of labour and capital between sectors within each sub-region. For India, the flow of labour and capital across zones is constrained, however. This is to reflect barriers to adaptation to climate change (see also Aaheim et al. 2009). The total supply of labour by regions is updated proportionally according to the UN population projections from 2008 (United Nations 2009).

Except for the energy sectors, technological change is included by exogenously chosen Hicks neutral rates. The technology of primary energy use by sector is updated over time. According to the A2_ASF scenario by IPCC (Nakicenovic and Swart 2000), primary energy use (coal, crude oil, and gas) will be changing at different rates towards 2100. In particular, oil reserves are expected to be depleted over the coming century, the use of crude oil approaches zero in 2100. To reflect this development, we have had to suppress the production level of primary energy goods in the GRACE_IN model, and replace it with a fixed maximum level of available natural resources with fixed production efficiencies.

Expectations of future scarcities are not reflected by the prices in the static part of the model. To adapt to the expectations of declining availability of fluid fossil fuels, the technologies in production sectors and for end users are updated exogenously by switching towards more affluent energy sources. For example, if the supply of coal increases, the electricity sector changes technologies in order to replace oil and gas based technologies to coal based technologies (without costs/expectations). For further details of the model, see (Aaheim and Rive 2005; Rive and Mideksa 2009).

Another feature of the GRACE-IN is that a forestry module is designed and introduced in the model to link the IBIS to GRACE-IN model. The module is described in detail in the following section.

3 The forestry module

The GRACE-IN model is built up with a set of nested CES-trees, where capital and natural resources form an aggregate of initial endowments in each sector. Forests constitute the natural resources in the forestry sector, and the annual harvest of trees is interpreted as the input of natural resources to the sector. As opposed to the other sectors of the model, where the input of natural resources is regarded as exogenous, the harvest of forests is subject to ecological processes which may be affected by climate change.

The forestry module applies the reported results on vegetation growth from IBIS. These are used to calibrate so-called Lotka-Volterra equation (Lotka 1910; Volterra 1926), which is implemented to describe the dynamics of the forests in the forestry module of GRACE-IN. The Lotka-Volterra equation was developed to describe the dynamics of fish stocks, but has also been extensively used in some cases to represent the growth of biomass in forests (see e.g. Shugart 1985). The equation is used to derive optimum conditions for forest management, and the analytical form is therefore essential. As a first attempt for illustration without introducing too much complexity, we abstract from the inherent property of forest, biodiversity, and assume the dynamics of a zone’s forest as a whole is represented by an easily tractable functional form instead of a strictly derived function. The natural growth of the total stock of forest \( \dot{S} \) in a zone is described by a quadratic function

where B, and c are positive parameters, estimated to fit the simulated results provided by the IBIS model. Since the function increases at low S, reaches its maximum when S = B/2c, while further growth is choked when S = B/c, it is natural to assume that the maximum coincides with the optimal forest stock and growth provided by the IBIS model, where the optimum is the stable situation of the forest system given initial biological and climate conditions. With this assumption, the two positive parameters B, and c are calibrated by the Eq. 1 together with first order condition at its maximum.

The harvesting of forests is modeled by two steps in the GRACE-IN model. The first step determines the commercial forest stock as a share of total forest. The second step determines the optimal combination of harvest and commercial stock. This is done to capture observed differences between definitions of productive forests based on biological criteria and observations of commercially driven forests. Without such a distinction, the model would assume that a change in net primary productivity is automatically harvestable. However, the cost of making the harvest commercial is subject to the distance between the spot where the harvest takes place and the market as well as variations in terrain. Hence, the capital stock in the forestry sector serves two purposes. One is the process of harvesting itself, the other is to help bring the timber to the market.

To distinguish commercial forest from productive forest, we therefore divide the capital stock in the forestry sector into two categories, each serving its specific purpose. The “ordinary” stock of capital relates to the harvesting process, while the second category, k 2 , includes infrastructure and other facilities needed to get access to the forest for commercial harvesting. The main problem with this approach is that the capital stock is not divided in this manner in the data. Hence, the division between the two categories of capital has to be calibrated with reference to observed differences between total productive forests and commercial forests.

The commercial forest is subject to the same biomass growth curve as the total productive forest in Eq. 1, but a positive k 2 is required to obtain a positive growth. This capital can be considered as a control available to forest managers to adjust the parameter B in Eq. 1, such that for the harvestable part of the forests, V, we have

where b and β are positive parameters. For \( {k_2} > {\left( {B/b} \right)^{{1}/\beta }} \) the harvestable growth will be strictly positive and approach the natural growth of V as k 2 →∞. The effectiveness of investments, expressed by b and β, may vary from forest to forest. For plantations, b will usually be small, such that the growth of V with capital investments and its natural growth coincide at a relatively low level of investments.

To determine the optimal amount of forest to harvest, the forest manager maximizes the present value of the expected social surplus generated by the forest activities, which is defined as

p is the current price (value) of harvested forest. f(k 1, y) is the harvest in the forestry sector, where k 1 is input of real capital in harvesting, and y is the use of all other input factors, including labour. w(V) is the non-market value of stock related services of the forest, such as recreation, bio-diversity and irrigation, and q y is the price of other input factors. r is the discount rate. The non-market value is assumed to be zero in this study due to data availability. The manager can determine the optimal level of forest harvest by directly choosing the variables of infrastructure investments k 2 and indirectly choosing k 1 and y by the license allocation.

The dynamic resource constraint for the manager is:

which implies the harvest cannot exceed the growth of forest at each time. This ensures the sustainable development of forest stock.

Two comments about the linkage between the recursive CGE structure of GRACE-IN and the solution to this problem are needed. First, the price of harvested forest and all input factors are endogenously generated by the static equilibrium in GRACE-IN. The price of harvested forest may include a permit price for carbon uptake in addition to the price of timber if a permit market is included and the harvest equals the growth of the managed forest.

Second, Eqs. 3–4 generate a dynamic solution while prices and quantities are fully determined by the static equilibrium generated in GRACE-IN. Then, the prices entering Eq. 3 refer to the static equilibrium conditions, although expected future changes will affect the solution. To be consistent, the prices are exogenous and assumed fixed over time when we solve the dynamic problem. Hence, expectations about changes in future prices are disregarded. The dynamic problem generates an optimal path and a static solution (stationary state) for quantities. For static equilibrium, we will confine ourselves to the stationary state solution. This will be further commented below.

The static first order conditions for Eqs. 3–4, which has to be met at all points in time, are:

The first equation defines the demand for capital and other input in the forestry sector, and corresponds to the first order conditions underlying the demand system in GRACE-IN. The surplus (p−q j /f’ j ) is the shadow price of harvest, q v . This shadow price enters the equilibrium model as the price of natural resources in the forestry sector. The second equation in Eq. 5 defines the demand for infrastructure capital, and states that the marginal productivity of k 2 equals the shadow price of harvest.

The model defines the optimal stock of biomass by the stationary state solution for the stock V. Then, it follows from Eq. 4 that the harvest equals the growth. An elaboration of Eq. 5 coupled with the dynamic first order conditions of Eqs. 3–4 gives the optimum condition for stationary state:

The condition has a straightforward interpretation: harvest equals the growth at a stock of biomass where the owner is indifferent between cutting and yield a return in alternative investments, or to let the forest grow one more year and yield the return in terms of higher income from the harvest. A value connected to the stock itself implies that harvest should be postponed to maintain a larger biomass. How much depends on the value. From Eqs. 1–3, postponement implies an extension of the rotation period. It may be noted that the rotation period is affected by changes in physical growth, rate of return and to stock-related values, but is not affected by a change in the price of timber.

The GRACE-IN model implements the stationary state solution in Eq. 6, and is run in intervals over 10 years. To justify our negligence of the dynamic solution, we then assume implicitly that agents adapt the harvest fully to changes in the biomass, rates of return or other stock related values within 10 years. The dynamic solution indicates that the gap between an initial optimal level and stationary state is closed by between 80% and 90% over 10 years, depending on the choice of parameters.

4 Scenarios and impacts on forests

For this analysis, India is split into six zones as shown in Fig. 1. Detailed National accounts data desired by GRACE-IN are unavailable for these zones. All zones were given the same macro-economic structure, and similar to the sectoral composition of the Indian economy. However, the scale varies according to reported GDP for each zone. Divisions into zones were made to capture differences regarding forests and forestry. Table 2 displays an overview of the main characteristics of forests and forestry in the six zones. India’s forests are characterized by a broad diversity, and it is difficult to pick out dominating species. When turning to harvest, however, teak dominates, except in the northern and eastern parts, where sal dominates. Most of the biomass is found in the southern zones of the country, which also harvest the most.

The IBIS model calculates the biomass in kg/m2, which was converted to sawtimber in m3/ha. For the standing biomass in each zone, a time-dependent sawlog recovery factor, is defined and estimated by the relationship

α indicates the maximum recovery rate of the biomass, S, which is set to 0.85. β is a sawlog recovery parameter, which indicates the speed at which the biomass grows, and was set to 0.03. t indicates time.

A Lotka-Volterra function is calibrated on the basis of the sawlog recovery factor for each zone. From Eq. 7, the optimal rotation time (the time at which a stand is considered mature and ready for harvesting) is found by maximizing the net present value of accumulated growth. Assuming that non-timber values of forests is zero, the optimal rotation time fixes the relationship between the growth and the stock of the biomass on the Lotka-Volterra curve, Eq. 6. A slight inconsistency occurs because Eq. 7 does not take into account the effect of higher density, which is inherent in Eq. 2. The error is small; however, as the density effect is modest at the point of optimal harvest. The calibrated Lotka-Volterra curves for each zone are shown in Fig. 2.

The model was run over the period 2004 to 2085 for three scenarios; a reference scenario, a climate change scenario where only the Indian forests are affected (CCI), and the same climate change scenario where forests are affected globally (CCG). The reference scenario corresponds to the A2_ASF scenario of the IPCC (Nakicenovic and Swart 2000), which describes a fragmented world with increasing differences, relatively high population growth and more than tripled emissions of greenhouse gases over the 21st century. In 2085, temperature increases between 3.5°C in South to 4.6°C in North in the six zones. Precipitation also increases in all zones, between 16.5% in South to 43.1% in the North East.

A summary of the direct impacts to the forests in the climate change scenarios are shown in Table 3. The estimates refer to the changes in year 2085. It is assumed that the forested area is unaltered. Climate change implies an increase in all zones except the Central zone. The variation is large; from more than 37% increase in the North–East zone to 9.3 reductions in the Central zone. In the South and Central zones the net primary productivity declines, while it increases in the other four zones, and up to nearly 80% in the West.

As pointed out earlier, the rotation period is determined by the speed of the growth of the biomass, and the impacts on the rotation period can be derived directly from the physical impacts of climate change. As a part of the adaptation process, the rotation period increases in all zones, except for the North, where it declines by 1 year. The most significant change takes place in the West zone where the rotation period increases by 6 years.

A second part of the adaptation process is a change in the supply of timber. However, this is followed by a change of prices, which brings about changes in the shadow price, or rent, of the biomass. The rent can be understood as the value of having land forested. It decreases gradually year by year in the four zones where the biomass increases, from 14% East to 32% in West in 2085. In South and Central zones, the rent increases by 7% and 9%, respectively, in 2085. In other words, more biomass reduces the value of holding the land as forested area. Then, alternative uses of land become more attractive, and more biomass may therefore increase the risk of deforestation.

The third part of the adaptation process is the adjustment of the effectiveness of harvest, which is indicated by investments in infrastructure (k 2 in the model). With higher biological growth, one may harvest the same quantity of timber on less area, and therefore suffice with less infrastructure. On the other hand, the demand for timber increases as the price decreases. The outcome of these two effects is displayed in Fig. 3. The stock increases in four of the six zones in 2045, and five of the six zones in 2085. Thus, the effect of higher demand dominates the effect of the need to utilize less forest when the biomass growth increases in three of the four zones with positive biological effect of climate change. In the two zones where the biological effect is negative, the increase in infrastructure is quite substantial. The result of a higher growth of biomass because of climate change thus leads to a higher pressure on forested land, which can be read out of the changes in infrastructure. This adds to the decline in forest rent in most of India, and may put a further pressure on deforestation.

The effect on harvest as compared with the initial growth in NPP is shown in Fig. 4, which displays the figures for 2085. Adaptation is substantial, as harvest changes less, in some zones much less, than the change in net primary productivity. In the West zone, where the net primary productivity increases by nearly 80% in 2085, the harvest increases by only 22.5% that year. In the Central zone, where the reduction in net primary productivity is 11%, harvest is lowered by only 4%. There are only minor differences between the CCI and the CCG scenarios, not only for harvest, but for most of the macroeconomic results as well. This will be further commented on in the next section.

5 Macroeconomic impacts

This study considers impacts of climate change on forests only. The macroeconomic implications of these changes are minor, as forestry contributes only a minor share of the Indian economy. The contribution to India’s GDP from forestry increases by only 1% in 2085 in both climate change impact scenarios when compared with the reference scenarios. On the other hand, forestry is an integrated part of the Indian economy, and it was shown in the previous section that adaptation to climate change in the forestry sector is strongly driven by market responses, such as changes in product prices and rent.

Agents in the forestry sector moreover respond to the fact that the shadow price of timber (rent) changes relative to other factor prices by substituting between timber and other input factors. In the zones where the rent decreases, agents will harvest more per unit of m3 of timber production, and instead use less of other input factors, such as labour and capital. This implies that a higher share of the biomass in a given area is used in the production process, and less labour and capital is used. In the zones where the rent increases, the share of the biomass per unit of timber production declines.

Also the prices of labour and capital are affected, although to a very little extent, as forestry contribute to a very small share of the total economies in the six zones. Because of the constraints to mobility of the primary input factors (labour, capital and natural resources), the factor prices respond differently in the different zones. Note also, that although the prices on labour and capital in each zone change very little, indeed, the zones are huge. The burden of these changes is carried by those communities where forestry contributes a major activity. If mobility is constrained over some decades also across communities within zones, the impacts on wage levels in smaller communities may be substantial. If the wages are “sticky”, such that reductions in the wage level cannot be implemented, local unemployment would be the result.

A reduction in forest harvest therefore has two effects on the general economic activity in the zone. First, the price of labour and capital is affected, and in opposite directions, as shown in Fig. 5. The change in wages follow the initial impacts on the forests, and are reduced in the South and the Central zones, where the biomass growth decreases, while increasing in the other four zones, where the biomass growth increases. The increase in wages is higher in the mid century than towards the end of the period. The demand for more infrastructure following a lower growth in the biomass in the South and Central zones, contributes to an increase in the price of capital. The price of capital falls in the other four zones, as less capital is demanded for infrastructure. For capital, the change increases gradually over the entire period, although the rate of change in wages is higher than for capital also in 2085. Hence, agents tend to substitute labour for capital in the four zones where the biomass growth increases, and capital for labour in the two other zones.

The second effect of the reduction in forest harvest is that the production of goods and services may move towards zones where capital and labour can be provided at a lower cost. Wages constitute a larger share of costs, and responds more significantly than capital. Therefore, the total costs of labour and capital increase in the regions where the biomass increases. This last effect may in some cases turn the impact on GDP from a loss to a benefit if activities move to zones where the total costs of production decline (Aaheim et al. 2009). In this study, the impacts on total production costs is, however, too small to give such an effect. However, some advantages of the ability to move activities around can be traced. The total production from the lumber industry, which is the main user sector of timber, and is easier to move to less costly zones than forestry, changes more than other industries. As shown in Fig. 6, the change in the lumber industry in some zones is up to nearly three times the average change in the region.

India is a net importer of timber, and the impacts in India will therefore depend on the world market for timber, including what happens with the forests in other countries under climate change. The predicted climatic change for India implies a reduction of imports and an increase in the exports. The impacts on the trade are much stronger in the CCI-scenario than in the CCG scenario. Exports from forestry increase by 3.3% in 2045 and 5.0% in 2085 in the CCI scenario. Corresponding figures for the CCG scenario are 0.9% and 1.7%, respectively. For the imports, the relative differences are smaller. The decrease for India in 2045 and 2085 are 1.8% and 2.5%, respectively, in the CCI scenario, and 1.3% and 1.8%, respectively, in the CCG scenario. Hence, most of the impacts occur in the first half of the period. When comparing different zones, we find that the pattern from the changes in harvest is sustained.

6 Conclusions

This study was motivated by the claim that adaptation to climate change in forestry may be driven by many factors which are poorly analyzed because of a lack of studies that link ecological and economic functions closely together. We apply the ecological model IBIS to represent the ecosystem in the computable general equilibrium model GRACE to analyze the impacts of climate change in India. GRACE includes a separate module for forestry, where the biological constraints are taken directly from the IBIS model and incorporated into a forest management framework. This enables analyses of a broad range of options, including the choice of rotation period, selection of economically harvestable forests and the choice of factor composition in the forestry sector. The GRACE model moreover differentiates between six Indian zones, thereby enabling a study of the variability of impacts of climate change, and it connects India to the global economy, which allow for analyses of the implications for trade.

This study divide adaptation to impacts of climate change in forests into four main components: a change in the rotation period, responses to the change of forest rent, investments in infrastructure to harvest, and change of technology choices by substitution. We find that the responses to climate change are significant within all the components, when we take into account the fact that forestry contributes a relatively small share of the total Indian economy. The changes in rotation period range from a reduction of 1 year and an increase of 6 years in the six zones. These changes are strictly related to the properties of biomass, and an ecological model is needed to assess them. Investments in infrastructure tend to mitigate the impact of climate change on forests, because the rent on forests changes in the opposite direction as the change in biomass growth. Hence, the economic impacts on forestry are lowered by up to 2/3 when compared with the biological impacts of climate change on forests. We find that higher biomass growth may actually increase the risk of deforestation, because the value of holding land as forests decrease in four of the six zones, while at the same time, the intensity of harvest increases in five of the six zones in 2085.

A combination of market effects and adjustments of technologies further strengthens the dependencies between the impacts in different zones. We find that the lumber industry, which uses a major part of the output from the forestry sector, takes the advantage of its ability to move activities across zones. However, the zones from where the lumber industry moves does not manage to take sufficiently advantage of a lower cost level, and the macroeconomic impacts for each zone therefore follow the pattern indicated by the direct biological impacts of climate change on the forests. One the other hand, the macroeconomic implications for each zone are very small because forestry is small compared with the total Indian economy. The impacts to smaller local communities where forestry contributes to a large part of the economic activity may nevertheless be significant.

This study also highlights the need for further examination of the impacts of climate change on forests. We have concentrated on the harvest in forest plantations, under the assumption that the natural forests are not subject to harvest. Implications for the potential for carbon sequestration are not considered. More research is also needed to establish a biomass growth function in GRACE-IN, which better captures the yields estimated by the ecological models of typical Indian forests. There are limitations in the forestry module in GRACE-IN because data are unavailable, such as the capital stock in infrastructure and data on non-utilized natural forests. The biomass growth function is calibrated, without possibilities to check if the curvature fits observations. Finally, the importance of local social characteristics and institutional barriers, which are essential for addressing adaptation, is not sufficiently taken into account by dividing India into only six sub-regions.

It is worth noticing that the results of this study have to be interpreted by caution due to several simplifications in the modeling process. For example, the Lotka-Volterra equation adopted in the forestry module only captures the aggregate dynamics of the forest and ignores the details of the forest system. The ignorance then implies the quality of the forest system is unaffected by climate change over time. Another example is that the unmarketed value of the forest is not included in this study due to data availability. The full employment assumption in the GRACE-IN is also an example. All these simplifications call for further studies.

References

Aaheim A, Rive N (2005) A model for global responses to anthropogenic changes in the environment (GRACE), Report 2005:05. CICERO, Oslo

Aaheim A, Amundsen H, Dokken T, Ericson T, Wei T (2009) A macroeconomic assessment of impacts and adaptation of climate change in Europe. CICERO Report 2009:06 p 50

Amacher GA, Malik A, Haight R (2005) Not getting burned, the importance of fire prevention in forest management. Land Econ 81:284–302

Brinkley CS (1988) A case study of the effects of CO2-induced climatic warming on forest growth and the forest sector: B. Economic effects on the world’s forest sector. In: Parry ML, Carter TR, Konjin NT NT (eds) The impacts of climatic variations on agriculture. Kluwer, Dortrecht

Foley JA, Prentice IC, Ramankutty N, Levis S, Pollard D, Sitch S, Haxeltine A (1996) An integrated biosphere model of land surface processes, terrestrial carbon balance, and vegetation dynamics. Glob Biogeochem Cycles 10(4):603–662

IGBP (2010) Global Soil Data Task of the International Geosphere-Biosphere Programme Data and Information System (IGBP-DIS) Potsdam, Germany; Available via: http://www.daac.ornl.gov/SOILS/igbp.html

IPCC (Intergovernmental Panel on Climate Change. Climate Change) (2007) Impacts, adaptation and vulnerability (Working Group II contribution to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change). Cambridge University Press, February 2008. ISBN0521880106

Kucharik CJ, Foley JA, Delire C, Fisher VA, Coe MT, Lenters J, Young-Molling C, Ramankutty N, Norman JM, Gower ST (2000) Testing the performance of a dynamic global ecosystem model: water balance, carbon balance and vegetation structure. Glob Biogeochem Cycles 14(3):795–825

Lee DM, Lyon KS (2004) A dynamic analysis of the global timber market under global warming: an integrated modeling approach. South Econ J 70(3):467–489

Lotka AJ (1910) Contribution to the theory of periodic reaction. J Phys Chem 14(3):271–274

Nakicenovic N, Swart R (ed) (2000) Emission scenarios. Special report from Intergovernmental Panel of Climate Change. Cambridge University Press

New M, Hulme M, Jones PD (1999) Representating twentieth century space-time climate variability. Part 1: development of a 1961–90 mean monthly terrestrial climatology. J Climate 12:829–856

Perez-Garcia J, Joyce LA, McGuire AD, Xiao X (2002) Impacts of climate change on the global forest sector. Clim Change 54:439–461

Reilly J, Paltsev S, Fetzer B, Wang X, Kicklighter D, Melillo J, Prinn R, Sarofim M, Sokolov A, Wang C (2007) Global economic effects of change in crops, pasture, and forests due to changing climate, carbon dioxide and ozone. Energy Policy 35:5370–5383

Rive N, Mideksa T (2009) Disaggregating the electricity sector in the GRACE model. Report 2009:02. CICERO, Oslo

Robinson M, Wallström M, Brundtland GH (2008) Global justice must be part of the emission debate. Canberra Times, 12th December 2008

Rupakumar K, Sahai AK, Kumar KK, Patwardhan SK, Mishra PK, Revadekar JV, Kamala K, Pant GB (2006) High-resolution climate change scenarios for India for the 21st century. Curr Sci 90(3):334–344

Sathaye JA, Ravindranath NH (1998) Climate change mitigation in the energy and foresty sectors of developing countries. Annu Rev Energy Env 23:387–437

Shugart HH (1985) A theory of forest dynamics. The ecological implications of forest succession models. The Blackburn, Caldwell

Sohngen BL, Mendelsohn R (2003) An optimal control model of forest carbon sequestration. Am J Agric Econ 85(2):448–457

Sohngen B, Alig R, Solberg B (2007) The forest sector, climate change, and the global carbon cycle—environmental and economic implications, mimeo, Available via: http://aede.osu.edu/people/sohngen.1/forests/Forestry_Climate_Survey_2007_v4.pdf. Cited on 1st March 2010

United Nations (2009) World population prospects: The 2008 revision population database, Available via: http://esa.un.org/unpp/

van Vuuren DP, Sala OE, Pereia HM (2006) The future of vascular plant diversity under four global scenarios. Ecol Soc 11(2):25, online

Volterra V (1926) Variazioni e fluttuazioni del numero d’individui in specie animali conviventi. Mem Acad Lineci Roma 2:31–113

Acknowledgements

We thank two anonymous referees for comments on previous versions of this paper. The research was conducted under the project “Impact of climate change on tropical forest ecosystems and biodiversity in India”, funded by the Royal Norwegian Embassy, as a collaboration between Indian Institute of Science in Bangalore and CICERO in Oslo. We thank the Royal Norwegian Embassy for their support. We thank IITM, Pune, and in particular K Krishna Kumar and Savita Patwardhan for providing HadRM3 climate projections under the NATCOM project.

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Aaheim, A., Gopalakrishnan, R., Chaturvedi, R.K. et al. A macroeconomic analysis of adaptation to climate change impacts on forests in India. Mitig Adapt Strateg Glob Change 16, 229–245 (2011). https://doi.org/10.1007/s11027-010-9266-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11027-010-9266-6