Abstract

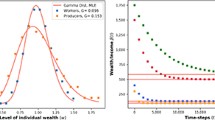

We analyze the large-time behavior of various kinetic models for the redistribution of wealth in simple market economies introduced in the pertinent literature in recent years. As specific examples, we study models with fixed saving propensity introduced by Chakraborti and Chakrabarti (Eur. Phys. J. B 17:167–170, 2000), as well as models involving both exchange between agents and speculative trading as considered by Cordier et al. (J. Stat. Phys. 120:253–277, 2005) We derive a sufficient criterion under which a unique non-trivial stationary state exists, and provide criteria under which these steady states do or do not possess a Pareto tail. In particular, we prove the absence of Pareto tails in pointwise conservative models, like the one in (Eur. Phys. J. B 17:167–170, 2000), while models with speculative trades introduced in (J. Stat. Phys. 120:253–277, 2005) develop fat tails if the market is “risky enough”. The results are derived by a Fourier-based technique first developed for the Maxwell-Boltzmann equation (Gabetta et al. in J. Stat. Phys. 81:901–934, 1995; Bisi et al. in J. Stat. Phys. 118(1–2):301–331, 2005; Pareschi and Toscani in J. Stat. Phys. 124(2–4):747–779, 2006) and from a recursive relation which allows to calculate arbitrary moments of the stationary state.

Similar content being viewed by others

References

Bisi, M., Carrillo, J.A., Toscani, G.: Contractive Metrics for a Boltzmann equation for granular gases: Diffusive equilibria. J. Stat. Phys. 118(1–2), 301–331 (2005)

Bisi, M., Carrillo, J.A., Toscani, G.: Decay rates in probability metrics towards homogeneous cooling states for the inelastic Maxwell model. J. Stat. Phys. 124(2–4), 625–653 (2006)

Bobylev, A.V.: The theory of the spatially Uniform Boltzmann equation for Maxwell molecules. Sov. Sci. Rev. C 7, 112–229 (1988)

Bobylev, A.V., Carrillo, J.A., Gamba, I.: On some properties of kinetic and hydrodynamics equations for inelastic interactions. J. Stat. Phys. 98, 743–773 (2000)

Bobylev, A.V., Cercignani, C.: Self-similar asymptotics for the Boltzmann equation with inelastic and elastic interactions. J. Stat. Phys. 110, 333–375 (2003)

Bouchaud, J.P., Mézard, M.: Wealth condensation in a simple model of economy. Physica A 282, 536–545 (2000)

Carrillo, J.A., Toscani, G.: Contractive probability metrics and asymptotic behavior of dissipative kinetic equations. Riv. Mat. Univ. Parma 6, 75–198 (2007)

Cercignani, C., Illner, R., Pulvirenti, M.: The Mathematical Theory of Dilute Gases. Applied Mathematical Sciences, vol. 106. Springer, New York (1994)

Chakraborti, A.: Distributions of money in models of market economy. Int. J. Mod. Phys. C 13, 1315–1321 (2002)

Chakraborti, A., Chakrabarti, B.K.: Statistical mechanics of money: how saving propensity affects its distributions. Eur. Phys. J. B 17, 167–170 (2000)

Chatterjee, A., Chakrabarti, B.K., Manna, S.S.: Pareto law in a kinetic model of market with random saving propensity. Physica A 335, 155–163 (2004)

Chakraborti, A., Germano, G., Heinsalu, E., Patriarca, M.: Relaxation in statistical many-agent economy models. Eur. Phys. J. B 57, 219–224 (2007)

Cordier, S., Pareschi, L., Toscani, G.: On a kinetic model for a simple market economy. J. Stat. Phys. 120, 253–277 (2005)

Das, A., Yarlagadda, S.: Analytic treatment of a trading market model. Phys. Scr. T 106, 39–40 (2003)

Desvillettes, L., Furioli, G., Terraneo, E.: Propagation of Gevrey regularity for solutions of Boltzmann equation for Maxwellian molecules. Trans. Am. Math. Soc. (in press)

Di Matteo, T., Aste, T., Hyde, S.T.: In: Mallamace, F., Stanley, H.E. (eds.) The Physics of Complex Systems (New Advances and Perspectives). IOS Press, Amsterdam (2004)

Drǎgulescu, A., Yakovenko, V.M.: Statistical mechanics of money. Eur. Phys. J. B 17, 723–729 (2000)

Drǎgulescu, A., Yakovenko, V.M.: Exponential and power law probability distribution of wealth and income in the United Kingdom and the United States. Physica A 299, 213–221 (2001)

Düring, B., Toscani, G.: Hydrodynamics from kinetic models of conservative economies. Physica A 384, 493–506 (2007)

Ernst, M.H., Brito, R.: High energy tails for inelastic Maxwell models. Europhys. Lett. 43, 497–502 (2002)

Ernst, M.H., Brito, R.: Scaling solutions of inelastic Boltzmann equation with over-populated high energy tails. J. Stat. Phys. 109, 407–432 (2002)

Gabetta, E., Toscani, G., Wennberg, B.: Metrics for probability distributions and the trend to equilibrium for solutions of the Boltzmann equation. J. Stat. Phys. 81, 901–934 (1995)

Gamba, I.M., Rjasanow, S., Wagner, W.: Direct simulation of the uniformly heated granular Boltzmann equation. Math. Comput. Model. 42, 683–700 (2005)

Gosse, L., Toscani, G.: Identification of asymptotic decay to self-similarity for one-dimensional filtration equations. SIAM J. Numer. Anal. 43(6), 2590–2606 (2006)

Hayes, B.: Follow the money. Am. Sci. 90(5), 400–405 (2002)

Ispolatov, S., Krapivsky, P.L., Redner, S.: Wealth distributions in asset exchange models. Eur. Phys. J. B 2, 267–276 (1998)

Kac, M.: Probability and Related Topics in the Physical Sciences. Interscience Publishers, New York (1959)

Levy, M., Solomon, S.: New evidence for the power-law distribution of wealth. Physica A 242, 90–94 (1997)

Levy, H., Levy, M., Solomon, S.: Microscopic Simulations of Financial Markets. Academic Press, New York (2000)

Malcai, O., Biham, O., Solomon, S., Richmond, P.: Theoretical analysis and simulations of the generalized Lotka–Volterra model. Phys. Rev. E 66, 031102 (2002)

Mandelbrot, B.: The Pareto–Lévy law and the distribution of income. Int. Econ. Rev. 1, 79–106 (1960)

Matthes, D., Toscani, G.: Analysis of a model for wealth redistribution. Preprint (2007)

Mohanty, P.K.: Generic features of the wealth distribution in an ideal-gas-like market. Phys. Rev. E 74(1), 011117 (2006)

Pareschi, L., Toscani, G.: Self-similarity and power-like tails in nonconservative kinetic models. J. Stat. Phys. 124(2–4), 747–779 (2006)

Pareto, V.: Cours d’Economie Politique. Lausanne and Paris (1897)

Patriarca, M., Chakraborti, A., Kaski, K.: Statistical model with a standard Γ distribution. Phys. Rev. E 70, 016104 (2004)

Pulvirenti, A., Toscani, G.: Asymptotic properties of the inelastic Kac model. J. Stat. Phys. 114, 1453–1480 (2004)

Repetowicz, P., Hutzler, S., Richmond, P.: Dynamics of money and income distributions. Physica A 356(2–4), 641–654 (2005)

Rjasanow, S.: Monte-Carlo methods for the Boltzmann equation. In: Degond, P., Pareschi, L., Russo, G. (eds.) Modeling and Computational Methods for Kinetic Equations, pp. 81–115. Birkhäuser Boston, Cambridge (2004)

Sinha, S.: The Rich Are Different!: Pareto Law from asymmetric interactions in asset exchange models. In: Chatterjee, A., Chakrabarti, B.K., Yarlagadda, S. (eds.) Econophysics of Wealth Distributions, pp. 177–184. Springer, New York (2005)

Slanina, F.: Inelastically scattering particles and wealth distribution in an open economy. Phys. Rev. E 69, 046102 (2004)

Solomon, S.: Stochastic Lotka–Volterra systems of competing auto-catalytic agents lead generically to truncated Pareto power wealth distribution, truncated Levy distribution of market returns, clustered volatility, booms and crashes. In: Refenes, A.P.N., Burgess, A.N., Moody, J.E. (eds.) Computational Finance 97. Kluwer Academic, Dordrecht (1998)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Matthes, D., Toscani, G. On Steady Distributions of Kinetic Models of Conservative Economies. J Stat Phys 130, 1087–1117 (2008). https://doi.org/10.1007/s10955-007-9462-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10955-007-9462-2