Abstract

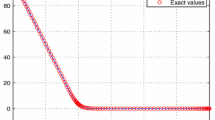

We develop a spectral element method to price single factor European options with and without jump diffusion. The method uses piecewise high order Legendre polynomial expansions to approximate the option price represented pointwise on a Gauss-Lobatto mesh within each element, which allows an exact representation of the non-smooth payoff function. The convolution integral is approximated by high order Gauss-Lobatto quadratures. A second order implicit/explicit (IMEX) approximation is used to integrate in time, with the convolution integral integrated explicitly. The method is spectrally accurate (exponentially convergent) in space for the solution and Greeks, and second-order accurate in time. The spectral element solution to the Black-Scholes equation is ten to one hundred times faster than commonly used second order finite difference methods.

Similar content being viewed by others

References

Achdou, Y., Pironneau, O.: Computational Methods for Option Pricing. SIAM, Philadelphia (2005)

Andersen, L., Andreasen, J.: Jump-diffusion processes: Volatility smile fitting and numerical methods for option pricing. Rev. Deriv. Res. 4, 231–262 (2000)

Briani, M., Natalini, R., Russo, G.: Implicit-explicit numerical schemes for jump-diffusion processes. CALCOLO 44(1), 33–57 (2007)

Broadie, M., Detemple, J.B.: Option pricing: Valuation models and applications. Manag. Sci. 50(9), 1145–1177 (2004)

Bunnin, F.O., Guo, Y., Ren, Y., Darlington, J.: Design of high performance financial modelling environment. Parallel Comput. 26, 601–622 (2000)

Canuto, C., Hussaini, M.Y., Quarteroni, A., Zang, T.A.: Spectral Methods: Fundamentals in Single Domains. Springer, New York (2006)

de Frutos, J.: A spectral method for bonds. Comput. Oper. Res. 35, 64–75 (2008)

Deville, M.O., Fischer, P.F., Mund, E.H.: High Order Methods for Incompressible Fluid Flow. Cambridge University Press, Cambridge (2002)

D’Halluin, Y., Forsyth, P.A., Vetzal, K.R.: Robust numerical methods for contingent claims under jump diffusion processes. IMA J. Numer. Anal. 25, 87–112 (2005)

Greenberg, A.: Chebyshev spectral method for singular moving boundary problems with application to finance. Ph.D. thesis, California Institute of Technology (2003)

Merton, R.C.: Option pricing when underlying stock returns are discontinuous. J. Financ. Econ. 3, 125–144 (1976)

Tavella, D., Randall, C.: Pricing Financial Instruments. Wiley, New York (2000)

Zhu, W.: A spectral element method to price single and multi-asset European options. Ph.D. thesis, The Florida State University (2008)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhu, W., Kopriva, D.A. A Spectral Element Method to Price European Options. I. Single Asset with and without Jump Diffusion. J Sci Comput 39, 222–243 (2009). https://doi.org/10.1007/s10915-008-9267-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10915-008-9267-8