Abstract

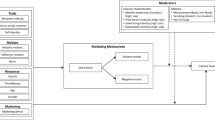

Monetary intelligence asserts: individuals apply their money attitude to frame critical concerns in the context and strategically select certain options to achieve financial goals and ultimate happiness. Bridging the gap between stock volatility and behavioral economics, we collected longitudinal data from multiple sources and at multiple times: First, private investors (N = 229) in Shanghai—the financial capital of China—completed their love of money attitude measure (Rich-affect, Motivator-behavior, and Importance-cognition) and demographic variables in a survey. Second, we recorded daily Shanghai Stock Exchange Composite Index (“the Index”) for 30 consecutive trading days during the financial crisis in 2008—public records. Third, we text-messaged investors, collecting their daily Index Happiness, Stock Percentage (stocks/liquid assets), and Stock Happiness—private information. Here, investors illustrate: high Rich investors fret about low Index happiness, yet high Rich and high Importance investors boast high stock happiness, supporting the endowment effect and investor hubristic smirk. High Motivator investors quickly adjust their stock percentage/portfolio, suffering low Index happiness and low stock happiness. Gender moderates the relationship between the Index and Index happiness. Our panel data of intra-personal changes of stock happiness demonstrate investor monetary wisdom in the boom-and-bust cycles. Behaviorally, investor must become masters (but not slaves) of money and deactivate money as a Motivator. Curbing the desire to become Rich enhances happiness after gains (boom/risk aversion); appreciating money’s Importance bestows happiness after losses (bust/risk seeking). We expand prospect theory and offer implications to investor wealth, health, and happiness during financial crisis in particular as well as individual subjective well-being and happiness in general.

Similar content being viewed by others

Notes

To anyone who has more will be given and he will grow rich; from anyone who has not, even what he has will be take away (Matthew 13: 12).

Those who want to get rich are falling into temptation and a trap and into many foolish and harmful desires, which plunge them into ruin and destruction. For the love of money is the root of all evils (1 Timothy 6: 9–10).

Brady’s two yoked monkey received electric shocks every 20 s that were signaled by a preceding tone. After training, the executive monkey was able to press a level to avoid shocks, whereas the other yoked control monkey could not. These monkeys were in a continuous 6 h on and 6 h off schedule of electric shocks. After 23 days, the executive monkey died from perforated ulcers. No yoked control monkey ever developed an ulcer. It is not the electric shock, but the stress that causes the death of the executive monkey.

We thank an outstanding reviewer for this interesting comment.

We thank another excellent reviewer for this important point.

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50, 179–211.

Ariely, D. (2009). Predictably irrational: The hidden forces that shape our decisions. New York: Harper Collins.

Ariyabuddhiphongs, V., & Hongladarom, C. (2011). Violation of Buddhist five percepts, money consciousness, and the tendency to pay bribes among organizational employees in Bangkok, Thailand. Archive for the Psychology of Religion, 33, 325–344.

Authers, J. (2016, August 19). Is greed good? No, it’s seriously bad for your wealth. https://www.ft.com/content/f16edc12-65d1-11e6-a08a-c7ac04ef00aa.

Bagozzi, R. P., Tybout, A. M., Craig, C. S., & Sternthal, B. (1979). The contrast validity of the tripartite classification of attitudes. Journal of Marketing Research, 16, 88–95.

Baumeister, R. F., Bratslavsky, E., Finkenauer, C., & Vohs, K. D. (2001). Bad is stronger than good. Review of General Psychology, 5(4), 323–370.

Belk, R. W. (1998). Possessions and the extended self. Journal of Consumer Research, 15, 139–168.

Bloomberg.com (2016). http://www.bloomberg.com/news/videos/2016-08-10/investors-love-of-money-can-t-buy-riches-here-s-why.

Brady, J. V. (1958). Ulcers in executive monkeys. Scientific American, 199, 95–98.

Bruner, J. S., & Goodman, C. C. (1947). Value and needs as organizing factors in perception. Journal of Abnormal and Social Psychology, 42, 33–44.

Carnegie, D. (1936/2014). How to win friends and influence people. New York: Harper Collins.

Carter, T. J., & Gilovich, T. (2010). The relative relativity of material and experiential purchases. Journal of Personality and Social Psychology, 98(1), 146–159.

Chang, S., Chen, S., Chou, R., & Lin, Y. (2008). Weather and intraday patterns in stock returns and trading activity. Journal of Banking & Finance, 32, 1754–1766.

Chen, J. Q., Tang, T. L. P., & Tang, N. Y. (2014). Temptation, monetary intelligence (love of money), and environmental context on unethical intentions and cheating. Journal of Business Ethics, 123, 197–219.

Cohn, A., Fehr, E., & Maréchal, M. A. (2014). Business culture and dishonesty in the banking industry. Nature, 516, 86–89.

Coile, C. C., & Levine, P. B. (2011). The market crash and mass layoffs: How the current economic crisis may affect retirement. Journal of Economic Analysis & Policy, 11, 1–42.

Colquitt, J. A., LePine, J. A., & Wesson, M. J. (2011). Organizational behavior: Improving performance and commitment in the workplace. Boston: McGraw-Hill/Irwin.

Corter, J. E., & Chen, Y. J. (2006). Do investment risk tolerance attitudes predict portfolio risk? Journal of Business and Psychology, 20, 369–381.

Csikszentmihalyi, M. (1999). If we are so rich, why aren’t we happy? American Psychologist, 54, 821–827.

De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98(4), 703–738.

Deaton, A. (2012). The financial crisis and the well-being of Americans. Oxford Economic Papers, 64, 1–26.

DeVoe, S. E., Pfeffer, J., & Lee, B. Y. (2013). When does money make money more important? Survey and experimental evidence. ILR Review, 66(5), 1078–1096.

Diener, E., Lucas, R. E., & Scollon, C. N. (2006). Beyond the hedonic treadmill: Revising the adaptation theory of well-being. American Psychologist, 61(4), 3035–3314.

Diener, E., Tay, L., & Oishi, S. (2013). Rising income and the subjective well-being of nations. Journal of Personality and Social Psychology, 104, 267–276.

Dittmar, H., Bond, R., Hurst, M., & Kasser, T. (2014). The relationship between materialism and personal well-being: A meta-analysis. Journal of Personality and Social Psychology, 107(5), 879–924.

Duncan, S. (2016). For the love of money: Why greed isn’t always good. Center for Applied Research, State Street Corporation.

Dunn, E. W., Aknin, L. B., & Norton, M. I. (2008). Spending money on others promotes happiness. Science, 319(5870), 1687–1688.

Easterlin, R. A. (2001). Income and happiness: Towards a unified theory. The Economic Journal, 111, 465–484.

Easterlin, R. A. (2006). Life cycle happiness and its sources: Intersections of psychology, economics, and demography. Journal of Economic Psychology, 27(4), 463–482.

Easterlin, R. A., Morgan, R., Switek, M., & Wang, F. (2012). China’s life satisfaction, 1990–2010. Proceedings of the National Academy of Sciences of the United States of America, 109(25), 9775–9780.

Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial Economics, 101(3), 621–640.

Erdener, C., & Garkavenko, V. (2012). Money attitudes in Kazakhstan. Journal of International Business and Economics, 12(3), 87–94.

Fama, E. F. (1965). The behavior of stock-market prices. Journal of Business, 38, 34–105.

Fiske, S., & Dupree, C. (2014). Gaining trust as well as respect in communicating to motivated audiences about science topics. Proceedings of the National Academy of Sciences of the United States of America, 111(S4), 13593–13597.

Frijters, P., Johnston, D. W., Shields, M. A., & Sinha, K. (2015). A lifecycle perspective of stock market performance and wellbeing. Journal of Economic Behavior & Organization, 112, 237–250.

Furnham, A. (2014). The new psychology of money. London: Routledge.

Gbadamosi, G., & Joubert, P. (2005). Money ethic, moral conduct and work related attitudes: Field study from the public sector in Swaziland. Journal of Management Development, 24(8), 754–763.

Gehring, W. J., & Willoughby, A. R. (2002). The medial frontal cortex and the rapid processing of monetary gains and losses. Science, 296, 2279–2282.

Gentina, E., Tang, T. L. P., & Gu, Q. X. (2016). Do parents and peers influence adolescents’ monetary intelligence and consumer ethics? French and Chinese adolescents and behavioral economics. Journal of Business Ethics. doi:10.1007/s10551-016-3206-7.

Gillespie, P. (2016, August 16). Don’t be greedy…it works against you. http://money.cnn.com/2016/08/16/investing/love-of-money-state-street-survey/index.html?

Gino, F., & Pierce, L. (2009). The abundance effect: Unethical behavior in the presence of wealth. Organizational Behavior and Human Decision Processes, 109, 142–155.

Goleman, D. (1995). Emotional intelligence. New York: Bantam Books.

Gomez-Mejia, L. R., & Balkin, D. B. (1992). Determinants of faculty pay: An agency theory perspective. Academy of Management Journal, 35, 921–955.

Graham, C. (2010). Happiness around the world: The paradox of happy peasants and miserable millionaires. New York: Oxford University Press.

Grant, A. M. (2008). Does intrinsic motivation fuel the prosocial fire? Motivational synergy in predicting persistence, performance, and productivity. Journal of Applied Psychology, 93, 48–58.

Gu, Q. X., Tang, T. L. P., & Jiang, W. (2015). Does moral leadership enhance employee creativity? Employee identification with leader and leader-member exchange (LMX) in the Chinese context. Journal of Business Ethics, 126(3), 513–529.

Harpaz, I. (1990). The importance of work goals: An international perspective. Journal of International Business Studies, 21(1), 79–93.

Howard, L. W., Tang, T. L. P., & Austin, M. J. (2015). Teaching critical thinking skills: Ability, motivation, intervention, and the Pygmalion effect. Journal of Business Ethics, 128(1), 133–147.

Hsee, C. K., Hastie, R., & Chen, J. Q. (2008). Hedonomics: Bridging decision research with happiness research. Perspectives of Psychological Science, 3, 224–243.

Hsee, C. K., & Weber, E. U. (1999). Cross-national differences in risk preference and lay predictions. Journal of Behavioral Decision Making, 12, 165–179.

Hsee, C. K., Zhang, J., Cai, C. F., & Zhang, S. (2013). Overearning. Psychological Science, 24, 852–859.

Jenkins, G. D., Mitra, A., Gupta, N., & Shaw, D. (1998). Are financial incentives related to performance? A meta-analytic review of empirical research. Journal of Applied Psychology, 83, 777–787.

Jia, S. W., Zhang, W. X., Li, P., Feng, T. Y., & Li, H. (2013). Attitude toward money modulates outcome processing: An ERP study. Social Neuroscience, 8, 43–51.

Jordan, B. D., & Riley, T. B. (2015). Volatility and mutual fund manager skill. Journal of Financial Economics, 118, 289–298.

Jurgensen, C. E. (1978). Job preferences (What makes a job good or bad). Journal of Applied Psychology, 63(3), 267–276.

Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211, 453–458.

Kahneman, D. (2011). Thinking, fast and slow. New York: Farrar, Strass and Giroux.

Kahneman, D., & Deaton, A. (2010). High income improves evaluation of life but not emotional well-being. Proceedings of the National Academy of Sciences of the United States of America, 107, 16489–16493.

Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase Theorem. Journal of Political Economy, 98(6), 1325–1348.

Kahneman, D., & Tversky, A. (1979). Prospect theory: Analysis of decision under risk. Econometrica, 47, 273–291.

Kasser, T., & Ryan, R. M. (1993). A dark side of the American dream: Correlates of financial success as a central life aspiration. Journal of Personality and Social Psychology, 65, 410–422.

Kish-Gephart, J. J., Harrison, D. A., & Treviño, L. K. (2010). Bad apples, bad cases, and bad barrels: Meta-analytic evidence about sources of unethical decisions at work. Journal of Applied Psychology, 95, 1–31.

Kramer, A. D. I., Guillory, J. E., & Hancock, J. T. (2014). Experimental evidence of massive-scale emotional contagion through social networks. Proceedings of the National Academy of Sciences of the United States of America, 111(24), 8788–8790.

Lea, S. E. G., & Webley, P. (2006). Money as tool, money as drug: The biological psychology of a strong incentive. Behavioral and Brain Sciences, 29, 161–176.

Lemrová, S., Reiterová, E., Fatěnová, R., Lemr, K., & Tang, T. L. P. (2014). Money is power: Monetary intelligence—Love of money and temptation of materialism among Czech university students. Journal of Business Ethics, 125, 329–348.

Lim, V. K. G., & Sng, Q. S. (2006). Does parental job insecurity matter? Money anxiety, money motives, and work motivation. Journal of Applied Psychology, 91, 1078–1087.

Lim, V. K. G., & Teo, T. S. H. (1997). Sex, money and financial hardship: An empirical study of attitudes towards money among undergraduates in Singapore. Journal of Economic Psychology, 18, 369–386.

Lin, H. L., Zhang, Y. H., Xu, Y. J., Liu, T., Xiao, J. P., Luo, Y., et al. (2013). Large daily stock variation is associated with cardiovascular mortality in two cities of Guangdong, China. PLoS ONE, 8(7), e68417.

Locke, E. A., Feren, D. B., McCaleb, V. M., Shaw, K. N., & Denny, A. T. (1980). The relative effectiveness of four methods of motivating employee performance. In K. D. Duncan, M. M. Gruneberg, & D. Wallis (Eds.), Changes in working life (pp. 363–388). New York: Wiley.

Loewenstein, G., Weber, E. U., Hsee, C. K., & Welch, N. (2001). Risk as feelings. Psychological Bulletin, 127, 267–286.

Luna-Arocas, R., & Tang, T. L. P. (2015). Are you satisfied with your pay when you compare? It depends on your love of money, pay comparison standards, and culture. Journal of Business Ethics, 128(2), 279–289.

Lyubomirsky, S., King, L., & Diener, E. (2005a). The benefits of frequent positive affect: Does happiness lead to success? Psychological Bulletin, 131, 803–855.

Lyubomirsky, S., Sheldon, K. M., & Schkade, D. (2005b). Pursuing happiness: The architecture of sustainable change. Review of General Psychology, 9(2), 111–131.

Ma, W. J., Chen, H. L., Jiang, L. L., Song, G. X., & Kan, H. D. (2011). Stock volatility as a risk factor for coronary heart disease death. European Heart Journal, 32, 1006–1011.

Mayer, J. D., Caruso, D. R., & Salovery, P. (1999). Emotional intelligence meets the traditional standards for an intelligence. Intelligence, 27(4), 267–298.

McShane, S. L., & Von Glinow, M. A. (2008). Organizational behavior (4th ed.). Boston: McGraw-Hill Irwin.

Merton, R. C. (1973a). An intertemporal capital asset pricing model. Econometrica, 41(5), 867–887.

Merton, R. C. (1973b). Theory of rational option ricing. Bell Journal of Economics, 4(1), 141–183.

Merton, R. K. (1968). Matthew effect in science. Science, 159(3810), 56–58.

Milkovich, G. T., Newman, J. M., & Gerhart, B. (2014). Compensation (11th ed.). Boston: Irwin/McGraw-Hill.

Mitchell, T. R., & Mickel, A. E. (1999). The meaning of money: An individual difference perspective. Academy of Management Review, 24, 568–578.

Nandi, A., Prescott, M. R., Cerda, M., Vlahov, D., Tardiff, K. J., & Galea, S. (2012). Economic conditions and suicide rates in New York City. American Journal of Epidemiology, 175(6), 527–535.

Newman, J. M., Gerhart, B., & Milkovich, G. T. (2017). Compensation (12th ed.). New York: McGraw-Hill.

Nkundabanyanga, S. K., Omagor, C., Mpamizo, B., & Ntayi, J. M. (2011). The love of money, pressure to perform and unethical marketing behavior in the cosmetic industry in Uganda. International Journal of Marketing Studies, 3(4), 40–49.

OECD. (2012, November). Looking to 2060: Long-term global growth prospects. A going for growth report. OECD Economic Policy Papers. No. 03.

Phillips, J. M., & Gully, S. M. (2013). Organizational behavior: Tools for success (2nd ed.). South-Western: Cengage Learning.

Piff, P. K., Stancato, D. M., Côté, S., Mendoza-Denton, R., & Keltner, D. (2012). Higher social class predicts increased unethical behavior. Proceedings of the National Academy of Sciences of the United States of America, 109, 4086–4091.

Rao, Y., Mei, L., & Zhu, R. (2016). Happiness and stock-market participation: Empirical evidence from China. Journal of Happiness Studies, 17(1), 271–293.

Ratcliffe, A., & Taylor, K. (2015). Who cares about stock market booms and busts? Evidence from data on mental health. Oxford Economic Papers-New Series, 67(3), 826–845.

Richins, M. L., & Dawson, S. (1992). A consumer values orientation for materialism and its measurement: Scale development and validation. Journal of Consumer Research, 19, 303–316.

Rubenstein, C. (1981). Money and self-esteem, relationships, secrecy, envy, satisfaction. Psychology Today, 15(5), 29–44.

Ryan, M. R., & Deci, E. L. (2001). On happiness and human potentials: A review of research on hedonic and eudaimonic well-being. Annual Review of Psychology, 52, 141–166.

Rynes, S. L., & Gerhart, B. (2000). Compensation in organizations: Current research and practice. San Francisco, CA: Jossey-Bass.

Sandra, C., Gladstone, J. J., & Stillwell, D. (2016). Money buys happiness when spending fits our personality. Psychological Science. doi:10.1177/0956797616635200.

Sardžoska, E. G., & Tang, T. L. P. (2009). Testing a model of behavioral intentions in the Republic of Macedonia: Differences between the private and the public sectors. Journal of Business Ethics, 87(4), 495–517.

Sardžoska, E. G., & Tang, T. L. P. (2015). Monetary Intelligence: Money attitudes—Unethical intentions, intrinsic and extrinsic job satisfaction, and coping strategies across public and private sectors in Macedonia. Journal of Business Ethics, 130, 93–115.

Scandura, T. A. (2016). Essentials of organizational behavior: An evidence-based approach. Los Angeles: Sage.

Schwartz, B. G., Pezzullo, J. C., McDonald, S. A., Poole, W. K., & Klone, R. A. (2012). How the 2008 Stock market crash and seasons affect total and cardiac deaths in Los Angeles County. American Journal of Cardiology, 109, 1445–1448.

Seligman, M. (2011). Flourish: A visionary new understanding of happiness and well-being. New York: Free Press.

Shiller, R. J. (2015). Irrational exuberance. Princeton: Princeton University Press.

Siganos, A., Vagenas-Nanos, E., & Verwijmeren, P. (2014). Facebook’s daily sentiment and international stock markets. Journal of Economic Behavior & Organization, 107(SI), 730–743.

Srivastava, A., Locke, E. A., & Bartol, K. M. (2001). Money and subjective well-being: It’s not the money, It’s the motives. Journal of Personality and Social Psychology, 80, 959–971.

Smith, A. (1776/1937). An inquiry into the nature and causes of the wealth of nations. New York: Modern Library (Original work published 1776).

Stress in America: Paying with our health. (2015, February 4). (American Psychological Association). https://www.apa.org/news/press/releases/stress/2014/stress-report.pdf.

Tang, T. L. P. (1992). The meaning of money revisited. Journal of Organizational Behavior, 13, 197–202.

Tang, T. L. P. (1993). The meaning of money: Extension and exploration of the money ethic scale in a sample of university students in Taiwan. Journal of Organizational Behavior, 14, 93–99.

Tang, T. L. P. (1996). Pay differential as a function of rater’s sex, money ethic, and job incumbent’s sex: A test of the Matthew Effect. Journal of Economic Psychology, 17(1), 127–144.

Tang, T. L. P. (2016). Theory of monetary intelligence: Money attitudes—Religious values, making money, making ethical decisions, and making the grade. Journal of Business Ethics, 133(3), 583–603.

Tang, T. L. P., & Baumeister, R. F. (1984). Effects of personal values, perceived surveillance, and task labels on task preference: The ideology of turning play into work. Journal of Applied Psychology, 69, 99–105.

Tang, T. L. P., & Chen, Y. J. (2008). Intelligence vs. wisdom: The love of money, Machiavellianism, and unethical behavior across college major and gender. Journal of Business Ethics, 82, 1–26.

Tang, T. L. P., Chen, Y. J., & Sutarso, T. (2008a). Bad apples in bad (business) barrels: The love of money, Machiavellianism, risk tolerance, and unethical behavior. Management Decision, 4, 243–263.

Tang, T. L. P., & Chiu, R. K. (2003). Income, money ethic, pay satisfaction, commitment, and unethical behavior: Is the love of money the root of evil for Hong Kong managers? Journal of Business Ethics, 46, 13–30.

Tang, T. L. P., & Gilbert, P. R. (1995). Attitudes toward money as related to intrinsic and extrinsic job satisfaction, stress and work-related attitudes. Personality and Individual Differences, 19, 327–332.

Tang, T. L. P., & Ibrahim, A. H. S. (1998). Importance of human needs during retrospective peacetime and the Persian Gulf War: Mideastern employees. International Journal of Stress Management, 5(1), 25–37.

Tang, T. L. P., Ibrahim, A. H. S., & West, W. B. (2002). Effects of war-related stress on the satisfaction of human needs: The United States and the Middle East. International Journal of Management Theory and Practices, 3(1), 35–53.

Tang, T. L. P., Kim, J. K., & Tang, D. S. H. (2000). Does attitude toward money moderate the relationship between intrinsic job satisfaction and voluntary turnover? Human Relations, 53, 213–245.

Tang, T. L. P., & Liu, H. (2012). Love of money and unethical behavior intention: Does an authentic supervisor’s personal integrity and character (ASPIRE) make a difference? Journal of Business Ethics, 107(3), 295–312.

Tang, T. L. P., Luna-Arocas, R., Quintanilla Pardo, I., & Tang, T. L. N. (2014). Materialism and the bright and dark sides of the financial dream in Spain: The positive role of money attitudes—The Matthew Effect. Applied Psychology: An International Review, 63(3), 480–508.

Tang, T. L. P., & Sutarso, T. (2013). Falling or not falling into temptation? Multiple faces of temptation, monetary intelligence, and unethical intentions across gender. Journal of Business Ethics, 116(3), 529–552.

Tang, T. L. P., Sutarso, T., Akande, A., Allen, M. W., Alzubaidi, A. S., Ansari, M. A., et al. (2006). The love of money and pay level satisfaction: Measurement and functional equivalence in 29 geographical entities around the world. Management and Organization Review, 2(3), 423–452.

Tang, T. L. P., Sutarso, T., Ansari, M. A., Lim, V. K. G., Teo, T. S. H., Arias-Galicai, F., Garber, I., Vlerick, P., et al. (2011). The love of money is the root of all evil: Pay satisfaction and CPI as moderators. In L. A. Toombs (Ed.), Best paper proceedings of the 2011 annual meeting of the academy of management. doi:10.5465/AMBPP.2011.65869480.

Tang, T. L. P., Sutarso, T., Ansari, M. A., Lim, V. K. G., Teo, T. S. H., Arias-Galicai, F., et al. (2015). Monetary intelligence and behavioral economics across 32 cultures: Good apples enjoy good quality of life in good barrels. Journal of Business Ethics. doi:10.1007/s10551-015-2980-y.

Tang, T. L. P., Sutarso, T., Ansari, M. A., Lim, V. K. G., Teo, T. S. H., Arias-Galicai, F., et al. (2016). Monetary intelligence and behavioral economics: The Enron effect—Love of money, corporate ethical values, Corruption Perceptions Index (CPI), and dishonesty across 31 geopolitical entities. Journal of Business Ethics. doi:10.1007/s10551-015-2942-4.

Tang, T. L. P., Sutarso, T., Davis, G. M. T., Dolinski, D., Ibrahim, A. H. S., & Wagner, S. L. (2008b). To help or not to help? The Good Samaritan Effect and the love of money on helping behavior. Journal of Business Ethics, 82(4), 865–887.

Tang, T. L. P., & West, W. B. (1997). The importance of human needs during peacetime, retrospective peacetime, and the Persian Gulf War. International Journal of Stress Management, 4(1), 47–62.

Thaler, R. H., & Johnson, E. J. (1990). Gambling with the house money and trying to break even: The effects of prior outcomes on risky choice. Management Science, 36, 643–660.

The Economist. (2015). China’s stockmarket crash: Uncle Xi’s bear market. 426(8946), 63–65.

Veenhoven, R. (1993). Happiness in nations, subjective appreciation of life in 56 nations, 1946–1992. Rotterdam: Erasmus University.

Vohs, K. D., Mead, N. L., & Goode, M. R. (2006). The psychological consequences of money. Science, 314, 1154–1156.

Wang, X. J., & Krumhuber, E. G. (2016). The love of money results in objectification. British Journal of Social Psychology. doi:10.1111/bjso.12158.

Welsh, D. T., & Ordóñez, L. D. (2014). Conscience without cognition: The effects of subconscious priming on ethical behavior. Academy of Management Journal, 57, 723–742.

Wong, H. M. (2008). Religiousness, love of money, and ethical attitudes of Malaysian evangelical Christians in business. Journal of Business Ethics, 81, 169–191.

Zhang, L. Q. (2009). An exchange theory of money and self-esteem in decision making. Review of General Psychology, 13, 66–76.

Zhang, W., Li, X., Shen, D. H., & Teglio, A. (2016). Daily happiness and stock returns: Some international evidence. Physica A: Statistical Mechanics and its Applications, 460, 201–209.

Zhang, Y. H., Wang, X., Xu, X. H., Chen, R. J., & Kan, H. D. (2013). Stock volatility and stroke mortality in a Chinese population. Journal of Cardiovascular Medicine, 14, 617–621.

Acknowledgements

We would like thank Hai Fu Tong Investment Management Co. Ltd. for data collection, Chinese National Science Foundation (Grant Numbers: 71132003 and 71672114 to Ningyu Tang and 71571118 to Jingqiu Chen) and Shanghai Education Science Research Fund (B11006) to Jingqiu Chen for financial support, Christopher K. Hsee for offering his insightful suggestions to this research project, Ping Ou, Yue Zhou, Xiang Luo, Guomei Yu, Wenjing Liu, Qian Li, Bo Zhu, and Qiufeng Huang for data collection; Dan Morrell and Kevin M. Zhao for their comments; Daniel Coleman Mangrum, Joshua D. Pentecost, and Xinyan Ye for their assistance, and late Fr. Wiatt Funk, and late Kuan-Ying and Fang Chen Tang for their inspiration. Brenda and Deacon John D'Amico (God sent an angle and revealed his amazing grace and miracle on June 11, 2017. I would not discover my typo, If Brenda did not check the Bible. Brenda stated: “It never ceases to amaze me who God uses as a vessel for a particular moment. I am humbled by His faith in us... Thanks be to Our Loving Father.” Here were the lessons for the day: “Bless the Lord, all you angels”, Psalm 103: 20; “I will never forsake you or abandon you”, Hebrews 13: 5).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: The Love of Money

Factor Rich

-

1.

I want to be rich.

-

2.

It would be nice to be rich.

-

3.

Having a lot of money (being rich) is good.

Factor Motivator

-

4.

Money reinforces me to work harder.

-

5.

I am motivated to work hard for money.

-

6.

I am highly motivated by money.

Factor Importance

-

7.

Money is important.

-

8.

Money is valuable.

-

9.

Money is good.

Appendix 2

Rights and permissions

About this article

Cite this article

Tang, N., Chen, J., Zhang, K. et al. Monetary Wisdom: How Do Investors Use Love of Money to Frame Stock Volatility and Enhance Stock Happiness?. J Happiness Stud 19, 1831–1862 (2018). https://doi.org/10.1007/s10902-017-9890-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-017-9890-x

Keywords

- Behavioral/financial economics

- Prospect theory

- Volatility

- Framing

- Love of money attitude/value

- Rich/motivator/importance

- Gaines-losses

- Boom-bust cycle

- 2008 Financial crisis

- Intra-personal changes of stock happiness

- Risk aversion/seeking

- Wealth/health/happiness/quality of life

- Portfolio

- Endowment

- Hedonic editing

- Longitudinal/panel

- Hubristic smirk

- Philanthropy

- The Matthew Effect