Abstract

We provide facts showing that in service markets: (i) restrictions on foreign direct investment (FDI) are under reform, (ii) cross-border Mergers & Acquisitions dominate as the entry mode of FDI, and (iii) there is often a high market concentration. Based on these facts, we present a model for analyzing cross-border merger and acquisition policy in liberalized service markets taking into account efficiency and market power effects. Our findings suggest that a merger policy, but not a discriminatory policy towards foreigners, seems warranted. Moreover, policies ensuring competition for domestic target firms seem warranted. In this vein, harmonization of the EU takeover regulations may particularly benefit assets owners in countries with many target firms.

Similar content being viewed by others

Notes

OECD International Direct Investments Statistics. Own calculations.

See World Investment Report (2004, 2006).

The Commission presents an analysis of obstacles to cross-border M&As in the financial sector, Press Release (8.11.2005), http://ec.europa.eu/internal_market/finances/cross-sector/index_en.htm.

This is the case in the telecom, energy and banking industries, for instance.

See World Investment Report (2004, 2006).

For instance, the rumors about a takeover bid of the French dairy producer Danone by the American company PepsiCo provoked an outcry in the French political arena, some politicians swearing to protect this French company from any foreign takeover. A few weeks later, the French government officially proposed to shield ten “strategic” industries, including biotechnologies, secure information systems, casinos and the production of vaccines, from foreign acquisitions.

See, for instance, International Herald Tribune, Business , “Bank chief in Italy off EU hook?”

Saturday, September 17, 2005.

See Barba Navaretti and Venables (2004).

The service share of GDP is today around 70% in developed countries and around 50% in developing countries (World Investment Report 2004, 2006). FDI in services is increasing in importance and the largest share of FDI now takes place in this area.

Proofs available from the authors upon request.

Note that there also exist parameter values where an inefficient acquisition can take place and no entry occurs.

See World Investment Report (2004, 2006).

See Norbäck and Persson (2005) for a more general treatment of this issue.

Proofs available from the authors upon request.

Proofs available from the authors upon request.

References

Barba Navaretti, G. and Venables, A., Multinational Firms in the World Economy. Princeton University Press: Princeton, 2004.

Bjorvatn, K., “Economic integration and the profitability of cross-border mergers and acquisitions,” European Economic Review, vol. 48(6), pp. 1211–1226, 2004.

Campa, J., Donnenfeld, S., and Weber, S., “Market structure and foreign direct investment,” Review of International Economics, vol. 6(3), pp. 361–380, 1998.

Falvey, R., “Mergers in open economies,” The World Economy, vol. 21, pp. 1061–1076, 1998.

Head, K. and Reis, J., “International mergers and welfare under decentralized competition policy,” Canadian Journal of Economics, vol. 30(4), pp. 1104–1123, 1997.

Heyman F., Sjöholm, F., and Tingvall, P.G., “Is there really a foreign ownership wage premium? Evidence from matched employer-employee data,” Journal of International Economics, vol. 73(2), 2007.

Horn, H. and Persson, L., “The equilibrium ownership of an international oligopoly,” Journal of International Economics, vol. 53(2), pp. 307–333, 2001.

Klimenko, M. and Saggi, K., “Technical compatibility and the mode of foreign entry with network externalities,” Canadian Journal of Economics, vol. 40, pp. 176–206, 2007.

Lommerud, K.E., Straume, O.R., and Sorgard, L., “National versus international mergers in unionized oligopoly,” RAND Journal of Economics, vol. 37, pp. 212–233, 2006.

Markusen, J.R., “The boundaries of multinational enterprises and the theory of international trade,” Journal of Economic Perspective, vol. 9, pp. 169–189, 1995.

Mattoo A., Olarrega M., and Saggi K., “Mode of foreign entry, technology transfers, and FDI policy,” Journal of Development Economics, vol. 75, pp. 95–111, 2004.

Neary, J.P., “Cross-border mergers as instruments of comparative advantage,” Review of Economic Studies, vol. 74(4), pp. 1229–1257, 2007.

Nocke, V. and Yeaple, S., “Cross-border mergers and acquisitions versus Greenfield foreign direct investment: the role of firm heterogeneity,” Journal of International Economics, vol. 72(2), pp. 336–365, 2007.

Norbäck, P.-J. and Persson, L., “Privatization and foreign competition,” Journal of International Economics, vol. 62, pp. 409–416, 2004.

Norbäck, P.-J. and Persson, L., “Privatization policy in an international oligopoly,” Economica, vol. 72(288), pp. 635–653, 2005.

Norbäck, P.-J. and Persson, L., “Endogenous asset ownership structures in deregulated markets,” European Economic Review, vol. 50(7), pp. 1729–1752, 2006.

Norbäck, P.-J. and Persson, L., “Investment liberalization—why a restrictive cross-border merger policy can be counterproductive,” Journal of International Economics, vol. 72(2), pp. 366–380, 2007.

OECD, International Investment Perspectives. 2006 Edition. OECD: Paris, 2006.

Saggi, K. and Yildiz, H.M., “On the international linkages between trade and merger policies,” Review of International Economics, vol. 14(2), pp. 212–225, 2006.

Straume, O.R., “International mergers and trade liberalization: implications for unionized labour,” International Journal of Industrial Organization, vol. 21, pp. 717–735, 2003.

World Investment Report, (United Nations Conference on Trade and Development, Geneva) 2004, 2006.

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful for helpful discussions with Mattias Ganslandt, Sten Nyberg and Helder Vasconcelos, and participants in the IFN 2006 Conference on Globalization of the Production of Services. Thanks also to Christina Lönnblad for improving the language. Financial support from Teknikföretagen is gratefully acknowledged.

Appendix: The linear-quadratic Cournot model

Appendix: The linear-quadratic Cournot model

In the Linear-Quadratic Cournot model, we capture that different types of investment have different effects on firms’ production costs, which allows to us derive explicit solutions for the optimal behavior by firms in all stages of the game, and characterize welfare effects. We model the oligopoly interaction in period three as Cournot competition in homogenous services. Investments in new assets in period two reduce the firm’s marginal cost. The profit for firm i can be written:

where R i = (P − c i )q i is the service market profit and we assume costs to be quadratic in new assets, κ i . Firms face the inverse demand \(P=a-\frac{1}{s}\sum_{i=1}^{N}q_{i}\), where a > 0 is a demand parameter, s may be interpreted as the size of the market and N is the total number of firms in the market. Investments in new capital reduce a firm’s marginal cost in a linear fashion \(c_{i}=\bar{c}_{i}-\theta \kappa _{i},\) where θ is a positive constant measuring how effectively investments in new capital κ i in stage two reduce the marginal cost. For simplicity, we assume that all firms share the same investment technology, θ and μ. Asymmetries between firms are captured by the intercept term, \(\bar{c}_{i}\), which measures the impact on firm i’s absolute efficiency level of the possession of all other assets prior to investment in new assets, κ i , in stage 2. Making a distinction between firm types, we have:

Hence, we assume existing assets \(\bar{k}\) and new assets κ i to be imperfect substitutes. The complementarity parameter γ again shows the effect of adding foreign firms’ firm-specific assets to domestic assets k 0. Similarly, we capture other cost asymmetries by including \( \tilde{c}_{A}\) and \(\tilde{c}_{d}\).

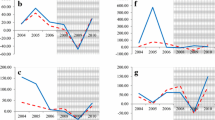

From Eq. 2, \(\frac{\partial R_{i}}{\partial q_{i}}=P-c_{i}-q_{i}=0\) from which optimal quantities q ∗ (κ,l) are derived. In stage two, Eq. 3 implies that \(\frac{d\pi _{i}}{d\kappa _{i}}=\frac{ \partial R_{i}}{\partial \kappa _{i}}+\sum_{j\neq i}^{T}\frac{\partial R_{i} }{\partial q_{j}}\frac{dq_{j}}{d\kappa _{i}}-F_{i}^{\prime }=0\), where optimal investments are given from \(\kappa _{i}^{\ast }(l)=\frac{\theta }{ \mu }q_{i}^{\ast }\tfrac{2N}{N+1}.\) Solving for stage 2 investments κ ∗ (l) and stage 3 sales q ∗ (l), we have the reduced-form profits π i (l). It can be shown that these profits take the form \(\pi _{i}(q,\kappa ,l)-\frac{\mu \kappa _{i}^{2}}{2}=\frac{1}{s}(q_{i}^{\ast }(l))^{2}\left[ 1-\frac{2\eta }{9}\right] -G_{i}\), where \(\eta =s\frac{ \theta ^{2}}{\mu }\). Table 1 gives the explicit expression for the LQC model. Finally, Fig. 8 shows a numerical solution of the model given in Section 3.3.1.

Numerical solution in the Linear-Quadratic Cournot model for the case of low entry barriers in Section 3.3.1. Parameter values at G G = 0.1,G A = G E = 0, \(\bar{k}=1,\Lambda =s=5,M=4\) and \(\tilde{c}_{A}=\tilde{c}_{d}=0\)

Rights and permissions

About this article

Cite this article

Norbäck, PJ., Persson, L. Cross-Border Mergers & Acquisitions Policy in Service Markets. J Ind Compet Trade 8, 269–293 (2008). https://doi.org/10.1007/s10842-008-0038-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-008-0038-x