Abstract

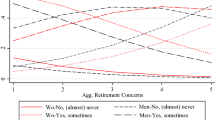

Using data from the Mature Market Survey (MMS) sponsored by the InCharge Education Foundation, this study examined financially distressed consumers’ information search behaviors for retirement plans. Findings showed that financially distressed consumers seek financial information from media and professional services when making a retirement plan. Age was negatively related to the extent of the information search. Income and gender were positively related to the extent of the information search for retirement planning while financial attitude and retirement income sources were not significantly associated with the information search. Results suggest that there is a great need of financial education programs and efficient financial information delivery for older financially stressed consumers.

Similar content being viewed by others

References

Aizcorbe, A. M., Kennickell, A. B., & Moore, K. B. (2003). Recent changes in U.S. family finances: Evidence from the 1998 and 2001 Survey of Consumer Finances. Federal Reserve Bulletin, 89, 1–32.

Andreasen, A. P., & Ratchford, B. T. (1976). Factors affecting consumers’ use of information source. Journal of Business Research, 4, 197–212.

Avery, R. J. (1996). Determinants of search of nondurable goods: An empirical assessment of the economics of information theory. Journal of Consumer Affairs, 30, 390–420.

Bagwell, D. C. (2001). Hierarchical regression analysis of work outcomes with personal financial factors. Writings of the Western Region Home Management Family Economic Educators (pp. 45–54).

Barry, M. J., & Bearden, W. O. (1978). Profiling the shopping behavior of the elderly consumers. The Gerontologist, 18, 454–461.

Bayot, J. (2003, October 14). Not-for-profit credit counselors are targets of an I.R.S. inquiry. Retrieved November 1, 2003, from New York Times website: http://www.nytimes.com.

Bei, L., Chen, E. Y. I., & Widdows, R. (2004). Consumers’ online information search behavior and the phenomenon of search vs. experience product. Journal of Family and Economic Issues, 25, 449–467.

Bi, L., Montalto, C. P., & Fox, J. J. (2002). Household search for and use of financial information. Consumer Interests Annual, 48, 1–9. Retrieved January 15, 2007, from http://www.consumerinterests.org/files/public/HouseholdSearch-02.pdf.

Brucks, M. (1985). The effects of product class knowledge on information search behavior. Journal of Consumer Research, 12(1), 1–16.

Bucy, E. P. (2000). Social access to the Internet. Harvard International Journal of Press/Politics, 5, 50–61.

Carlson, J. A., & Gieseke, R. J. (1983). Rice search in a product market. Journal of Consumer Research, 9, 357–365.

U.S. Census Bureau (2003). Three-year-average median household income by state: 2001–2003. Retrieved December 17, 2004, from http://www.census.gov/hhes/income/income03/statemhi.html.

Chang, Y. R., & Hanna, S. (1992). Consumer credit search behavior. Journal of Consumer Studies and Home Economics, 16, 207–277.

Cole, C. A., & Balasubramanian, S. K. (1993). Age differences in consumers’ search for information: Public policy implications. Journal of Consumer Research, 20, 157–169.

Coleman, W., Warren, W. E., & Huston, R. (1995). Perceived risk and information search process in the selection of a new dentist: An empirical investigation. Health and Marketing Quarterly, 13(2), 27–42.

Copeland, C. (2002). Pension plan participation continued to rise in 2000: What next? EBRI Notes, 23, 4–7.

DeVaney, S. A., & Chien, Y. W. (2001). A model of savings behavior and the amount saved in retirement accounts. Journal of Financial Service Professionals, 5, 72–80.

DeVaney, S. A., Gorham, L., Bechman, J. C., & Haldeman, V. A. (1996). Cash flow management and credit use: Effect of a financial information program. Financial Counseling and Planning, 7, 71–79.

DeVaney, S. A., & Zhang, T. C. (2001). A cohort analysis of the amount in defined contribution and individual retirement accounts. Financial Counseling and Planning, 12, 89–102.

Dowling, G. R., & Staelin, R. (1994). A model of perceived risk and intended risk-handling activity. Journal of Consumer Research, 21, 119–134.

Employee Benefit Research Institute. (2006). Debt of the elderly and near elderly, 1992–2004. EBRI Notes, 27(9), 2–13.

Federal Reserve Statistical Release (2008) Consumer credit. Retrieved February 12, 2008, from http://www.federalreserve.gov/releases/g19/Current/.

Garman, E. T. (2003). 30 million overly indebted and financially distressed adults in the United States. (Press release). Retrieved November 24, 2003, from http://www.ethomasgarman.net.

Hanna, S., & Chen, P. (1997). Subjective and objective risk tolerance: Implications for optimal portfolios. Financial Counseling and Planning, 8, 17–26.

Hatcher, C. B. (2002). Wealth, reservation, wealth, and the decision to retire. Journal of Family and Economic Issues, 23, 167–187.

Hoyt, D. R., Conger, R. D., Valde, J. G., & Weihs, K. (1997). Psychological distress and help seeking in rural America. American Journal of Community Psychology, 25, 449–470.

InCharge Education Foundation. (2003). Mature market survey. Orlando, FL: InCharge Education Foundation.

Johnson, E. J. (2001). Digitizing consumer research. Journal of Consumer Research, 28, 331–336.

Joo, S. (1998). Personal financial wellness and worker job productivity. Unpublished doctoral dissertation. Blacksburg: Virginia Polytechnic Institute & State University.

Joo, H., & Grable, J. E. (2001). Factors associated with seeking and using professional retirement-planning help. Family and Consumer Sciences Research Journal, 30, 37–63.

Joo, S., & Grable, J. E. (2005). Employee education and the likelihood of having a retirement saving program. Financial Counseling and Planning, 16(1), 37–49.

Joo, S., & Pauwel, V. W. (2002). Factors affecting workers’ retirement confidence: A gender perspective. Financial Counseling and Planning, 13(2), 1–10.

Kim, H., & DeVaney, S. A. (2005). The selection of partial retirement or full retirement among older workers. Journal of Family and Economic Issues, 26, 371–394.

Kim, J., Garman, E. T., & Sorhaindo, B. (2003). Relationships among credit counseling clients’ financial well-being, financial behaviors, financial stressor events, and health. Financial Counseling and Planning, 14, 75–87.

Kim, J., Kwon, J., & Anderson, E. A. (2005). Factors related to retirement confidence: Retirement preparation and workplace financial education. Journal of Personal Finance, 16(2), 1–20.

Kim, J., Sorhaindo, B., & Garman, E. T. (2006). Relationship between financial stress and workplace absenteeism of credit counseling clients. Journal of Family and Economic Issues, 27(3), 458–478.

Kimball, R. C., Frisch, R., & Gregor, W. T. (1997). Alternative visions of consumer financial services. Journal of Retail Banking Services, 19, 1–10.

Lamdin, D. J. (2008). Does consumer sentiment foretell revolving credit use. Journal of Family and Economic Issues, 29(2), 279–288.

Lee, J., & Cho, J. (2005). Consumers’ use of information intermediaries and the impact on their information search behavior in the financial market. Journal of Consumer Affairs, 39, 95–120.

Lee, J., & Hogarth, J. M. (2000). Relationship among information search activities when shopping for a credit card. Journal of Consumer Affairs, 34, 330–360.

Lee, Y. G., Lown, J., & Sharpe, D. (2007). Predictors of holding consumer and mortgage debt among older Americans. Journal of Family and Economic Issues, 28(2), 305–320.

Lehmann, D. R., & Moore, W. L. (1980). Validity of information display boards: An assessment using longitudinal data. Journal of Marketing Research, 17, 450–459.

Lin, Q., & Lee, J. (2004). Consumer information search when making investment decisions. Financial Services Review, 13, 319–332.

Long, S. (1997). Regression models for categorical and limited dependent variables. Thousand Oaks: Sage.

Lumpkin, J. R., & Festervand, T. A. (1987). Purchasing information sources of the elderly. Journal of Advertising Research, 27, 31–43.

Malroutu, L. Y., & Xiao, J. J. (1995). Perceived adequacy of retirement income. Financial Counseling and Planning, 6, 17–23.

McGhee, H. C., & Draut, T. (2004). Retiring in the red: The growth of debt among older Americans. New York: Demos.

Moorman, D. C., & Garasky, S. (2008). Consumer debt repayment behavior as precursor to bankruptcy. Journal of Family and Economic Issues, 29(2), 219–233.

O’Neill, B., Sorhaindo, B., Xiao, J. J., & Garman, E. T. (2005). Financially distressed consumers: Their financial practices, financial well-being, and health. Financial Counseling and Planning, 16, 75–86.

Porter, N. M., & Garman, E. T. (1993). Testing a conceptual model of financial well-being. Financial Counseling and Planning, 4, 135–164.

Schaninger, C. M., & Sciglimpaglia, D. (1981). The influence of cognitive personality traits and demographics on consumer information acquisition. Journal of Consumer Research, 8, 208–216.

Schmidt, J. B., & Spreng, R. A. (1996). A proposed model of external consumer information search. Journal of the Academy of Marketing Science, 24, 246–256.

Stat Bank. (2005). Journal of Financial Planning, 18(10), 24.

Stigler, G. J. (1961). The economics of information. Journal of Political Economy, 69, 213–255.

Sullivan, T. A., Warren, E., & Westbrook, J. L. (2000). The fragile middle class: Americans in debt. New Haven, CT: Yale University Press.

Ulker, A. (2009). Wealth holdings and portfolio allocation of the elderly: The role of marital history. Journal of Family Economic Issues, 30, 90–108.

U.S. Bureau of Labor Statistics (2006). National Compensation Survey: Employee benefits in private industry in the United States, March 2006. Retrieved January 10, 2008, from http://www.bls.gov/ncs/ebs/sp/ebsm0004.pdf.

Xiao, J. J., Sorhaindo, B., & Garman, E. T. (2006). Financial behaviours of consumers in credit counseling. International Journal of Consumer Studies, 30(2), 108–121.

Xiao, J. J., & Wu, J. (2008). Completing debt management plans in credit counseling: An application of the theory of planned behavior. Financial Counseling and Planning, 19(2), 3–19.

Yuh, Y., & DeVaney, S. A. (1996). Determinants of couple’s defined contribution retirement funds. Financial Counseling and Planning, 7, 31–38.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kim, H., Kim, J. Information Search for Retirement Plans Among Financially Distressed Consumers. J Fam Econ Iss 31, 51–62 (2010). https://doi.org/10.1007/s10834-009-9179-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-009-9179-2