Abstract

We study how a capital income tax and a wealth tax affect an investor's valuation of a company's stock in an efficient international capital market. Using a one-period model, a model of infinite horizon where the asset generates a future cash flow that is a martingale, and a finite horizon model where we abandon the martingale assumption, we find that a wealth tax and/or a capital income tax do not lead investors to value an investment differently from untaxed investors. Investors who seek a higher pre-tax rate of return due to capital taxes harm their own wealth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Income and wealth inequality have increased in most OECD countries the last two decades, and the rise in inequality has been particularly pronounced in the USA.Footnote 1 The US debate on the wealth tax has largely been on redistribution and is in stark contrast to the debate in European countries that have a wealth tax in place, such as France, Norway, Liechtenstein and Switzerland. In these countries’ lobby groups driven by business interests argue that foreign investors who do not face the wealth tax, have a greater willingness to pay for a company’s stock than domestic investors who must pay the wealth tax. Furthermore, to cover the wealth tax cost, domestic investors must require a higher rate of return from companies they own compared to tax exempt investors. Therefore, the argument goes, the wealth tax imposes a competitive disadvantage on domestic investors and has stark implications for the ownership structure in an economy. Consequently, it should be replaced by a capital income tax (or if a capital income tax is in place, its rate should be increased).Footnote 2

A wealth tax differs from a capital income tax in that for a given amount of wealth, the tax liability of a wealth tax does not depend on the amount of capital income the wealth actually generates, while in contrast a capital income tax liability is related to that flow. A second difference is the lack of equivalence between a wealth tax and a capital income tax if we assume that they are revenue-equivalent. A wealth tax collects revenue from primarily taxing the principal and effectively imposing the same rate on components of the rate of return. In contrast, the capital income tax falls on the normal rate of return plus any rents and rewards for risk taking.Footnote 3 These differences could potentially affect investors’ willingness to pay for a company’s stocks in different ways.

The purpose of this paper is to investigate how the wealth tax and the capital income tax affect how investors value a company’s stock. We study two investors (foreign and domestic) who have the same investment opportunities, but where only the domestic investor is subject to a tax on capital income and wealth. We could have imposed positive taxes on the foreign investor as well, and even made assumptions on the relative sizes of the taxes facing the domestic and foreign investor without affecting our results.

Capital markets are assumed efficient, transparent and liquid, and all investors are price takers, have access to the same information, and interpret information in the same way.

The Fisher separation theorem states that within this framework, the investment decision can be separated from the risk-taking decision. Moreover, the criterion for the investment decision is to maximize the net present value of investment opportunities. This means that the investor’s risk preference is irrelevant for the investment decision, which is the focus of this article (but it is indeed important for the risk-taking decision).

We first derive the opportunity return on capital for the foreign and the domestic investor, and then, we establish the two investors’ willingness to pay for a company’s stock that is traded freely. We assume that the asset value is determined by its net present value. Our starting point is a one-period model with an uncertain asset return. We then expand the analysis to the case of an infinite horizon where the asset generates a cash flow that is a martingale. Finally, these assumptions are relaxed, and we impose a finite time horizon, and abandon the martingale assumption.

The outcome of all variants of our analysis is the same. Investors who face wealth tax and/or a capital income tax have a lower discount rate, but their willingness to pay for a company’s stock is not affected by either tax. The reason is that the tax liability arising from either tax reduces the cash flow from the asset, but this reduction is exactly matched by the lower discount rate, leaving the valuation of the asset on par with how the market and the foreign investor who is untaxed values the stock. In a next step we show that if a company owner increases her required rate of return from the company because of the wealth tax, say, she will harm the company’s market value and thus her own wealth.Footnote 4

Our results must not be misinterpreted as one where taxes do not matter. All taxes affect disposable income, and investors who are tax exempt or taxed at lower rates, may therefore be able, everything else equal, to hold more stocks than investors who pay taxes. The wealth of tax-exempt or low-taxed investors may therefore grow faster.

There is a small literature focusing on the overall response to wealth taxes using European data. These studies find that taxable wealth is highly responsive to the wealth tax rate.Footnote 5 The effect of the wealth tax has also been studied in relationship with entrepreneurial risk taking (Hall & Woodward, 2010), migration (Organ, 2020), tax evasion (Alstadsæter et al., 2019, Guyton et al., 2020), and tax avoidance (Alvaredo & Saez, 2009; Hemel, 2019). There is a large literature on the effect of taxation on portfolio choice starting with the seminal paper by Sandmo (1977). However, there seems to be no paper that compares the wealth tax to a capital income tax with the aim of studying how these taxes affect the valuation of an asset from an investor’s perspective.

The remainder of the paper is organized as follows. In the next section, we derive the basic one-period model. Section 3 expands the model into one with an infinite horizon, while Sect. 4 considers a more general setting with a finite horizon, where we abandon the martingale assumption. Section 5 studies the investors’ willingness to bid for a domestic company that is for sale, while Sect. 6 studies the implications of increasing the required rate of return from the company because of capital taxation. The last section offers some conclusions.

2 One-period model and investors’ expected return

We start out with a one-period setting. Capital can be invested in an asset that is traded in the market. The uncertain return is \(\tilde{r}\). In other words, by investing one dollar now (time 0), the investor will receive \(1 + \tilde{r}\) at the end of the period (time 1). The expected payoff is \(1 + r\), where \(r \equiv E\left( {\tilde{r}} \right)\), and \(E\) denotes the expectation operator. Consequently, the expected market return on the asset is \(r\).Footnote 6

We assume that there are two investors: (1) A foreign investor who is not subject to any taxes on capital. (2) A domestic investor who is subject to capital taxes in the form of a capital income tax and a wealth tax. The foreign investor receives \(1 + \tilde{r}\) at the end of the period (time 1) on his one-dollar investment. This means that his expected return is \(r\).

The domestic investor receives \(1 + \tilde{r}\) at the end of the period before tax on her one-dollar investment in the asset. She is subject to tax on both the return and the wealth. We assume that the capital income tax is paid at the end of the period, and that the return tax base is market return, whereas the wealth tax base is the market value of wealth in the beginning of the period. We denote the return tax rate by \(\tau_{\text{r}}\) and the wealth tax rate by \(\tau_{{\text{w}}}\).

After tax, the domestic investor’s one-dollar investment will give the uncertain payoff \(1 + \tilde{r} - \tau_{{\text{r}}} \tilde{r} - \tau_{{\text{w}}}\). We assume full loss offset. The expected payoff is \(1 + r - \tau_{{\text{r}}} r - \tau_{w}\), where we recall that \({\text{r}}\) is the expected market return on the asset. The expected return after-tax for the domestic investor is

If \(r > 0\), it is straightforward to see from Eq. (1) that \(k < r\) when capital tax rates are positive. Consequently, both taxes lower the expected return for the domestic investor compared to that of the foreign investor.

3 Infinite horizon, martingale cash flow

We expand the model above into one with an infinite horizon. We consider an asset that is traded in the market. The asset generates a future cash flow that is a martingale, i.e., \(E_{t} \left( {\tilde{c}_{s} } \right) = c_{t} , 0 \le t \le s \le \infty\), where \(E_{t} \left( {\tilde{c}_{s} } \right)\) denotes the expectation conditional on the information available at time \(t\). In Sect. 4, we consider a finite horizon and abandon the martingale assumption.

The current market price \(p_{0} \) of the asset is

where \(r\) is the implicit expected market return on the asset. The uncertain market price of the asset \(\tilde{p}_{t} \) at the future time \(t\) is

Now, consider the expected total return to the foreign investor from holding the asset from time \(t\) to time \(t + 1\). By using (3), we obtain

Consequently, the foreign investor’s expected return from holding the asset is \(r\).

How much is the foreign investor willing to pay for this asset? The investor’s discount rate follows from his opportunity return, i.e., the return he can expect on an investment in the market with the same relevant risk characteristicsFootnote 7 as the asset. In an efficient market with no trading costs, the opportunity return and the expected return \(r\) from investing in the asset are equal. By using the expected return \(r\) as discount rate, he arrives at the following net present value

By comparing (5) and (2), we observe that the foreign investor has the same valuation of the asset as the market.

What is the expected return to the domestic investor from holding the asset from time \(t\) to time \(t + 1\)? In order to answer this question, we must include taxes when we consider the total return. We assume that the capital income tax is paid at the end of every period, and that the tax bases are market return and values, as described in the previous section. By using Eq. (3), we find the expected return

Consequently, the expected return to the domestic investor from holding the asset is

How much is the domestic investor willing to pay for this asset? The investor’s discount rate follows from her opportunity return, i.e., the return she can expect on an investment in the market with the same relevant risk characteristics as the asset. In an efficient market, her opportunity return and the expected return \(k\) from investing in the asset are equal. By adjusting the cash flow for tax payments and using the expected return after tax \(k\) as discount rate, she arrives at the following net present value

By comparing (8) and (5), we observe that the domestic and the foreign investor agree on the value of the asset, and that this value equals the market price (see Eq. (2)).

4 Finite horizon

We now consider a more general setting with a finite horizon where we abandon the martingale assumption. We generalize Eqs. (2) and (3) so that today’s market price of the asset is

whereas the market price of the asset at some future time \(t \) is

As seen from today, the future asset price \(\tilde{p}_{t} \) is uncertain. It follows from (10) that the expected return from holding the asset from time \(t\) to time \(t\) + 1 isFootnote 8

Equation (11) corresponds to the foreign investor’s expected return from holding the asset from time \(t\) to time \(t + 1\).

How much is the foreign investor willing to pay for this asset? The investor’s discount rate follows from his opportunity return, i.e., the return he can expect on an investment in the market with the same relevant risk characteristics as the asset. In an efficient market, the opportunity return and the expected return \(r\) from investing in the asset are equal. By using the expected return \(r\) as discount rate, he arrives at the following net present value

This means that the foreign investor agrees with the market on the value of the asset, as can be seen by comparing Eqs. (12) and (9).

The domestic investor’s expected return from holding the asset from time \(t\) to time \(t + 1\) is

where we have used Eq. (11). Consequently, the expected return to the domestic investor from holding the asset is \(k \equiv r - r\tau_{{\text{r}}} - \tau_{{\text{w}}}\).

How much is the domestic investor willing to pay for this asset? The investor’s discount rate follows from her opportunity return, i.e., the return she can expect on an investment in the market with the same relevant risk characteristics as the asset. In an efficient market, her opportunity return and the expected return \(k\) from investing in the asset are equal. It turns out that the net present value computation is more complicated with a finite horizon and a non-martingale cash flow. It is shown in Appendix 2 that by adjusting the cash flow for the tax payments and using the discount rate \(k\), she arrives at the following net present value

By comparing Eqs. (14) and (12), we see that the domestic and the foreign investor agree on the value of the asset. Moreover, this value coincides with the market price, see Eq. (9).

In Appendices 3 and 4, we show that our results in Sects. 2–4 also hold if the wealth tax base is at the end of the period and if taxes fall on realized gains.

One might ask if results would change in a general equilibrium framework. In our partial equilibrium analysis, we have assumed that the country imposing capital taxes is not large enough to affect the market return. If the country was large enough, capital taxes would reduce the supply of capital and have general equilibrium effects. One such effect would be that investors facing capital taxes would have lower disposable income and thus own a smaller share of assets in the world economy. We would, however, not expect our key result to change; capital taxes do not lead investors to value an investment differently.

5 The investors are bidding for a domestic company

In this section, we assume that a domestic company is for sale and that the two investors agree on the company’s future cash flow as well as on the company’s expected market return. From our results above, we have shown that the two investors have the same willingness to pay to acquire the company, despite the fact that one of the investors is subject to capital taxes, whereas the other is not. In an efficient capital market, the investor’s discount rate corresponds to the investor’s opportunity return. Capital taxes lower the discount rate of the domestic investor compared to the foreign investor. The difference in the discount rates reflects that the domestic investor carries the burden of capital taxes.

Let us now assume that the domestic investor uses the expected market return \(r\) as the discount rate instead of her opportunity return \(k\) when she discounts her expected cash flow. Since \(r > k\), she uses a higher discount rate as compared to Eq. (14), and, as a result, she computes a lower net present value.Footnote 9 Apparently, she is not willing to pay as much as the foreign investor (and the market) for the company’s cash flow because she is taxed. However, this line of reasoning rests on the implicit assumption that her opportunity return after capital taxes is the expected market return \( r\). In other words, the implicit assumption is that the alternative to acquire the cash flow is to earn the market return and pay no taxes. One way to avoid the tax is to channel investments through a tax haven without informing the tax authority, but this is a criminal offence in most countries. Another alternative is to change tax jurisdiction, but she will then have to immigrate to another country. However, these alternatives are not attractive to most investors.

6 One of the investors owns the domestic company

Critics of a wealth tax argue that the tax compels domestic investors, who are subject to a wealth tax, to seek a higher pre-tax rate of return relative to foreign investors, who are not subject to a wealth tax. In this section we investigate this issue. We investigate a situation where one of the investors owns a domestic company. First, we consider the case where the foreign investor is the owner. What is the required rate of return for investing in his own company? It follows from our discussion above that it must be the opportunity return on a similar investment in the market as given by \(r\). Hence, in an efficient capital market, the company’s opportunity cost of capital equals the opportunity return of the foreign investor, which amounts to the expected market return \(r\).

An important question for a domestic investor who owns a domestic company is her required rate of return for investing in her own company. We have shown above that the opportunity return before capital tax is equal for the foreign and the domestic investor. Consequently, the required rate of return for investing is the same for both investors and is equal to the expected market return \(r\). This result is contrary to the claim in the public debate that the capital tax raises the cost of capital of (domestic) companies owned by domestic investors.

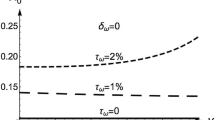

Now, suppose that the domestic investor attempts to shift the capital tax burden to the company. In particular, she fixes the “required rate of return” from the company \(R\) such that her expected return after tax equals that of the foreign investor, i.e., the expected market return \(r\). The rationale for this might be that she feels entitled to the same expected return as the foreign investor. We can find this “required rate of return” \(R\) from

It can be seen from Eq. (15) that the domestic investor’s “required rate of return” \(R\) is higher than the expected market return \(r\), and, consequently, higher than the foreign investor’s required rate of return.

Where does this lead us? Note that our analysis is one where taxes are in existence. If the firm behaves optimally, it has already shifted as much of the burden of taxation onto the product market as it can. Thus, the opportunity cost of capital is still the expected market return \(r\). Suppose that the company follows the strategy that maximizes market value. If the company in this situation must pay the “required rate of return” \(R\) on capital imposed by the owner, the company is given an incentive to deviate from the market maximizing strategy.Footnote 10 For instance, it will reject projects that would otherwise add market value, but do not meet the “required rate of return”. The result is a lower company market value. In other words, in her attempt to shift the burden of taxation onto her company, she reduces the value of her company.

7 Conclusion

We have shown that both the capital income tax and the wealth tax lower the expected return from investing in an asset. In an efficient capital market, the expected return equals the opportunity return (and consequently the discount rate) for each investor. As a result, capital taxes lower the discount rate of an investor who faces capital taxes compared to an investor who is tax exempt. The discount rate is lowered to the point where the domestic (taxed) investor’s net present value of the asset equals that of the (tax exempt) foreign investor, such that both values are equal to the market price. This shows that the law of one price applies in an efficient capital market, even though investors are subject to different tax treatment. To conclude, then, capital taxes do not affect an investor’s willingness to bid for an asset, but they do reduce disposable income. The latter effect is a common feature of all types of taxes and not something that should be held against capital income taxes or the wealth tax in particular.

Taxed investors could potentially fully avoid or reduce the burden of capital taxes through profit shifting. In our model this would amount to a reduction in statutory tax rates. Since the key insight from our study is that capital taxes do not lead investors to value investments differently, profit shifting does not affect our results if it is costless. If there are avoidance costs (the use of lawyers and or accountants to disguise profit shifting), such costs could affect investment valuation.

Our study has implications for tax policy in the sense that it examines one of the most common critiques of the wealth tax, namely, that is, that it compels domestic investors, who are subject to a wealth tax, to seek a higher pre-tax rate of return relative to foreign investors, who are not subject to a wealth tax. The point of this paper has been to evaluate this criticism under several variants of a standard investment model. Each variant points to the same conclusion: neither the wealth tax nor the capital income tax lead investors to value investment differently. However, both types of capital taxes do make investors worse off, but they do not change individual valuations of a company/asset. Our analysis does not offer any guidance into which tax is better. This is a much more complex issue that has been discussed and debated elsewhere (see, e.g., Kopczuk (2019)). Our study has contributed to this literature by showing that one of the most common arguments against the wealth tax is not true.

Notes

The debate in Norway over the wealth tax, for example, is summed up in Edson (2012).

See Kopczuk (2019) for a discussion on the equivalence of the wealth tax and the capital income tax.

This is true irrespective of ownership structure.

The capital asset pricing model explains the expected return on the asset by \(r = r_{f} + \beta \left( {r_{{M}} - r_{f} } \right), \)where \({r}_{f}\) is the riskless rate, \({r}_{M}\) is the expected return on the market portfolio, and \(\beta \) is the risk exposure of the asset with respect to the return on the market portfolio (i.e., the exposure with respect to general market movements).

Within the capital asset pricing model, for instance, the relevant risk characteristic is measured by beta.

See Appendix1 for the derivation

We have assumed a positive net present value.

If our analysis had been one where the question was how the introduction of a wealth tax, say, affected the investment decision, the issue of incidence would depend on the characteristics of the product market. The greater the elasticity of demand of the buyers, the smaller the extent to which the tax will be shifted to them. Under reasonable assumptions, taxes would not be fully shifted onto the product market. If the company in this situation in addition must pay the “required rate of return” R on capital, it would not maximize market value.

We use the following result

\(\begin{aligned} & \left( {\tilde{p}_{T} - \left( {1 + i} \right)\tilde{p}_{T - 1} } \right) + \left( {1 + i} \right)\left( {\tilde{p}_{T - 1} - \left( {1 + i} \right)\tilde{p}_{T - 2} } \right) + \left( {1 + i} \right)^{2} \left( {\tilde{p}_{T - 2} - \left( {1 + i} \right)\tilde{p}_{T - 3} } \right) + \cdots \\ & + \left( {1 + i} \right)^{T - 2} \left( {\tilde{p}_{2} - \left( {1 + i} \right)\tilde{p}_{1} } \right) + \left( {1 + i} \right)^{T - 1} \left( {\tilde{p}_{1} - \left( {1 + i} \right)p_{0} } \right) = \tilde{p}_{T} - \left( {1 + i} \right)^{T} p_{0} . \\ \end{aligned}\)

Consider the sum

\(\mathop \sum \limits_{t = 1}^{T} \left( {1 + i} \right)^{T - t} ip_{0} \tau_{{\text{r}}} = \left( {1 + i} \right)^{T} \left( {\mathop \sum \limits_{t = 1}^{T} \frac{1}{{\left( {1 + i} \right)^{t} }}} \right)ip_{0} \tau_{{\text{r}}} = \left( {1 + i} \right)^{T} \frac{1}{i}\left( {1 - \frac{1}{{\left( {1 + i} \right)^{T} }}} \right)ip_{0} \tau_{{\text{r}}} ,\)

where we use the annuity formula. Simplifying leads to the second term of Eq. (26).

References

Advani, A., & Tarrant, H. (2020). Behavioural responses to a wealth tax. Wealth Tax Commission Evidence Paper 5.

Agrawal, D., Foremny, D., & Martínez-Toledano, C. (2020). Paraísos Fiscales, wealth taxation, and mobility. Mimeo.

Alstadsæter, A., Johannesen, N., & Zucman, G. (2019). Tax evasion and Inequality. American Economic Review, 109, 2073–2103.

Alvaredo, F., & Saez, E. (2009). Income and wealth concentration in Spain from a His- torical and fiscal perspective. Journal of the European Economic Association, 7, 1140–1167.

Brülhart, M., Gruber, J., Krapf, M., & Schmidheiny, K. (2019). Behavioral responses to wealth taxes: Evidence from Switzerland. NBER Working Paper 22376.

Duran-Cabré, J., Esteller-Moré, A., & Mas-Montserrat, M. (2019). Behavioural responses to the (Re-)introduction of wealth taxes. Evidence from Spain. IEB Working Paper.

Edson, C. (2012). Constraining the effects of the Norwegian wealth tax. Statistics Norway working paper no. 274.

Guvenen, F., Kambourov, G., Kuruscu, B., Ocampo-Diaz, S., & Chen, D. (2019). Use it or lose it: Efficiency gains from wealth taxation. Working paper 26284, National Bureau of Economic Research, September 2019. https://www.nber.org/papers/w26284.

Guyton, J., Langetieg, P., Reck, D., Risch, M., & Zucman, G. (2020). Tax evasion by the wealthy: Measurement and implications. In R. Chetty, J. Friedman, J. Gornick, B. Johnson, & A. Kennickell (Eds.), Measuring and understanding the distribution and intra/inter-generational mobility of income and wealth. University of Chicago Press. NBER Series.

Hall, R., & Woodward, S. (2010). The burden of the nondiversifiable risk of entrepreneurship. American Economic Review, 100(3), 1163–1194.

Hemel, D. (2019). Taxing wealth in an uncertain world. National Tax Journal, 72(4), 755–776.

Jakobsen, K., Jakobsen, K., Kleven, H., & Zucman, G. (2018). Wealth taxation and wealth accumulation: Theory and evidence from Denmark. NBER Working Paper 24371.

Kopczuk, W. (2019). Comments and discussion. Brookings papers on economic activity, 512–526.

Organ, P. (2020). Expatriation and the U.S. tax system. Mimeo, University of Michigan.

Piketty, T., Saez, E., & Zucman, G. (2018). Distributional national accounts: Methods and estimates for the United States. Quarterly Journal of Economics, 133(2), 553–603.

Saez, E., & Zucman, G. (2016). Wealth inequality in the United States since 1913: Evidence from capitalized income tax data. Quarterly Journal of Economics, 131(2), 519–578.

Zoutman, F.T. (2019). The elasticity of taxable wealth: Evidence from the Netherlands. Forthcoming, Journal of Public Economics.

Sandmo, A. (1977). Portfolio theory, asset demand and taxation: Comparative statics with many assets. The Review of Economic Studies, 44(2), 369–379.

Seim, D. (2017). Behavioral responses to an annual wealth tax: Evidence from Sweden. American Economic Journal: Economic Policy, 9(4), 395–421.

Scheuer, F., & Slemrod, J. (2021). Taxing our wealth. Journal of Economic Perspectives, 35(1), 207–230.

Wolf, E.N. (2019). Wealth taxation in the United States. Working paper 26544, National Bureau of Economic Research, December 2019. https://www.nber.org/papers/w26544.pdf.

Acknowledgements

The authors would like to thank David R. Agrawal, Thomas A. Gresik, Mohammed Mardan, Jarle Møen, Maximillian Todtenhaupt, Floris Zoutman and two anonymous referees for insightful comments.

Funding

Open access funding provided by Norwegian School Of Economics.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Derivation of Eq. (11).

In this appendix, we consider the expected market return from holding the asset for one period. Our starting point is Eq. (10), and we proceed as follows:

Equation (11) follows immediately from this expression.

Appendix 2: Derivation of Eq. (14).

First, we consider the special case where wealth tax is the only tax instrument with tax rate \(\tau\). The net present value for the domestic investor who is subject to this wealth tax is

where \(k\) is the discount rate that follows from the investor’s opportunity return on capital. We want to explain this net present value in terms of the expected future cash flow. The first step is to use (9) to substitute the future expected market prices for the future expected cash flow elements. We proceed as follows:

We now rearrange in order to obtain one term for each cash flow element

The finite horizon version of Gordon’s formula, which is known from equity valuation, states that

Simplify the NPV expression by using Gordon’s formula

to obtain

In the special case with only wealth tax with rate \(\tau\), where the investor’s discount rate is \(k = r - \tau\), it follows immediately from equation (17) that

In other words, the domestic investor agrees with the net present value computed by the foreign investor (compare Eqs. (18) and (12)) as well as with the market price (compare Eq. (18) with Eq. (9)).

We now turn to the case with taxes on both return and wealth. The net present value then takes the form

see the mid-term of Eq. (14). By using \(E_{0} \left( {\tilde{p}_{t} + \tilde{c}_{t} - \tilde{p}_{t - 1} } \right) = rE_{0} \left( {\tilde{p}_{t - 1} } \right)\) (that follows immediately from Eq. (11)), and rearranging, the net present value can be expressed as

Observe that the net present value expression in Equation (19) is similar to that in Equation (16). By interpreting \(\tau = \tau_{{\text{r}}} r + \tau_{{\text{w}}}\), it follows that the net present value with two capital tax instruments is

see Equation (17).

The discount rate in this case is \(k = r - \tau_{{\text{r}}} r - \tau_{w} \Leftrightarrow r - k = \tau_{{\text{r}}} r + \tau_{{\text{w}}}\), and by inserting this into (20) it follows immediately that

Appendix 3: Wealth tax base at the end of the period.

Consider Eq. (6). In our analysis, we assume that the wealth tax base is the beginning of the period. Let us now assume that the wealth tax base is at the end of the period before deduction of the capital return tax and let \(\tau_{r}^{{\prime }}\) denote the capital return tax rate. The expected after-tax return for the domestic investor from holding the asset is then.

By interpreting \(\tau_{{\text{r}}}^{{\prime }} + \tau_{{\text{w}}} = \tau_{{\text{r}}}\), the right-hand side of the equation above translates into the second line of Eq. (6).

Next, consider the case where the base is wealth at the end of the period after deduction of capital return tax and let \(\tau_{{\text{r}}}^{^{\prime\prime}}\) denote the capital return tax rate. The expected after-tax return can then be written as

By interpreting \(\tau_{{\text{r}}}^{{\prime \prime }} + \tau_{{\text{w}}} - \tau_{{\text{r}}}^{{\prime \prime }} \tau_{{\text{w}}} = \tau_{{\text{r}}}\), the right-hand side of the equation above also translates into the second line of Eq. (6).

Hence, we see that the cases discussed above, where the wealth tax base is at the end of the period, can be translated into the setting used in the paper and all our results still hold.

Appendix 4: Capital tax on realized gains

Now, consider a slightly generalized tax system where the return tax base is market return above the rate \(i\). In the following, we refer to \(i\) as the tax shield rate. The return tax rate is \(\tau_{{\text{r}}} \) and the wealth tax rate is \(\tau_{{\text{w}}}^{*}\). The domestic investor’s after-tax return then takes the form:

This means that the opportunity cost of capital (\(k^{*}\)) of the domestic investor is

The net present value of the project to the domestic investor is then found by

By interpreting \(\left( {\tau_{{\text{w}}}^{*} - i\tau_{{\text{r}}} } \right)\) as \(\tau_{\text{w}}\), it follows immediately from (21) and (7) that the opportunity cost of capital is \(k^{*} = k\). Moreover, it follows by comparing (23) and the mid expression of (14) that \({\text{NPV}}_{0}^{*} = {\text{NPV}}_{0}^{D} = {\text{NPV}}_{0}^{F}\). Hence, a tax on market excess return combined with wealth tax is equivalent to a tax on market return combined with a wealth tax.

Let us now investigate a tax on realized gains. Consider the numerator of the mid expression of equation (23), and write the investor’s cash flow at time \(t\) as

Let \(r_{f}\) be the riskless rate. We assume that the riskless return is taxed at rate \(\tau_{\text{r}}\) and that the wealth tax rate is \(\tau_{\text{w}}^{*}\). It follows, then, that the riskless opportunity return of the investor is

In order to attain a tax regime with tax on realized gains, we need to eliminate the last term of Eq. (24).

Now, consider the cash flow in Table

1.

Observe that the first term in this cash flow corresponds to the last term in Equation (24). The forward value of the cash flow, when carried forward to the horizon at the investor’s riskless rate after taxes \(k_{f}^{*}\), is

We may think of this arrangement as a bank account where the cash flows in Table 1 are deposited and withdrawn, and where \({\text{FV}}_{T}\) in Eq. (26) is the balance at the horizon date \(T\).

Assume a tax code where the tax shield rate \(i\) that is used when calculating deductions from taxable share income equals the investor’s riskless opportunity return from Eq. (25), i.e., \(i = k_{f}^{*}\). It then follows from telescoping the first sumFootnote 11 in Eq. (26), and expressing the second sum as the forward value of an annuity,Footnote 12 that the future value of the cash flow in Table 1 is

where we use that \(\tilde{p}_{T} = 0\). Observe that the future value \({\text{FV}}_{T}\) in Eq. (27) is deterministic and zero, i.e., it holds for all price realizations. Clearly, the net present value of the cash flow in Table 1 is zero, i.e.,

Now, combine Eq. (23) and Eq. (28) to obtain

The cash flow from the project with taxes on realized excess gains and wealth, that is derived in Eq. (29), is shown in Table

2.

We observe from Table 2 that the realized excess gain at each time \(t\) is \(\left( {\tilde{c}_{t} - ip_{0} } \right)\), whereas the realized loss at the terminal date \(T\) is \(\left( {0 - p_{0} } \right)\).

To conclude, if the tax shield rate \(i\) that is used when calculating deductions from taxable share income is equal to the riskless opportunity return of the investor \(k_{f}^{*}\) (see Eq. (25)), the net present value of the project to the domestic investor after paying the wealth tax and the tax on excess market return is equal to the net present value under a wealth taxation and a tax on realized excess gains.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bjerksund, P., Schjelderup, G. Investor asset valuation under a wealth tax and a capital income tax. Int Tax Public Finance 29, 873–889 (2022). https://doi.org/10.1007/s10797-021-09691-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-021-09691-0