Abstract

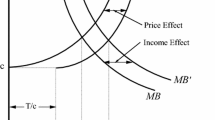

A lump-sum intergovernmental transfer has a “price effect”, as well as an “income effect”, because it allows the recipient government to reduce its tax rate, which lowers its marginal cost of public funds, while still providing the same level of public service. This reduction in the effective price of providing the public service helps to explain the “flypaper effect”—the empirical observation that a lump-sum grant has a much larger effect on spending than an increase in personal income. Contrary to the assertions of Mieszkowski (Modern Public Finance, 1994) and Hines and Thaler (J. Econ. Perspect. 9:217–226, 1995), a model of a benevolent local government financing its expenditures with a distortionary tax predicts flypaper effects from lump-sum grants that are similar to those observed in many econometric studies.

Similar content being viewed by others

References

Bailey, S., & Connolly, S. (1998). The flypaper effect: identifying areas for further research. Public Choice, 95, 335–361.

Baker, M., Payne, M. A., & Smart, M. (1999). An empirical study of matching grants: the ‘cap on cap’. Journal of Public Economics, 72, 269–288.

Becker, G., & Mulligan, C. (2003). Deadweight costs and the size of government. Journal of Law and Economics, 46, 293–340.

Blanco, F. (2006). Os Efeitos das Transferências Intergovernamentais: O Flypaper Effect nas Finanças Municipais Brasileiras. Doctoral dissertation, PUC, Rio de Janeiro. Chap. 3.

Borge, L. (1995). Lump-sum intergovernmental grants have price effects: a note. Public Finance Quarterly, 23, 271–274.

Bradford, D., & Oates, W. (1971). The analysis of revenue sharing in a new approach to collective fiscal decisions. Quarterly Journal of Economics, 85(3), 416–439.

Buettner, T., & Wildasin, D. (2006). The dynamics of municipal fiscal adjustment. Journal of Public Economics, 90, 1115–1132.

Coyte, P., & Landon, S. (1990). Cost-sharing versus block-funding in a federal system: a demand systems approach. Canadian Journal of Economics, 23, 817–838.

Dahlby, B. (2002). The fiscal incentive effects of equalization grants. In Equalization: helping hand or welfare trap. Halifax: Atlantic Institute for Market Studies (Paper #4).

Dahlby, B. (2008a). The marginal cost of public funds: theory and applications. Cambridge: MIT Press.

Dahlby, B. (2008b). The optimal taxation approach to intergovernmental transfers (Working paper). University of Alberta.

Dollery, B., & Worthington, A. (1995). Federal expenditure and fiscal illusion: a test of the flypaper hypothesis in Australia. Publius, 25, 23–34.

Dollery, B., & Worthington, A. (1996). The empirical analysis of fiscal illusion. Journal of Economic Surveys, 10, 261–297.

Gamkhar, S., & Shah, A. (2007). The impact of intergovernmental transfers: a synthesis of the conceptual and empirical literature. In R. Boadway & A. Shah (Eds.), Intergovernmental fiscal transfers: principles and practice. Washington: The World Bank.

Hamilton, J. (1986). The flypaper effect and the deadweight loss from taxation. Journal of Urban Economics, 19, 148–155.

Hammes, D., & Wills, D. (1987). Fiscal illusion and the grantor government in Canada. Economic Inquiry, 25, 707–713.

Haughwout, A., Inman, R., Craig, S., & Luce, T. (2004). Local revenue hills: evidence from four U.S. cities. Review of Economics and Statistics, 86, 570–585.

Hines, J., & Thaler, R. (1995). The flypaper effect. Journal of Economic Perspectives, 9, 217–226.

Logan, R. (1986). Fiscal illusion and the grantor government. Journal of Political Economy, 96, 1304–1318.

Mendes, M., & Boueri Miranda, R. (2008). Transferências Intergovernamentais no Brasil: Diagnóstico e Proposta de Reforma (Working paper). Brazil Country Management Unit, The World Bank Group, Brasília.

Mieszkowski, P. (1994). Comments on Chapter 5. In J.M. Quigley & E. Smolensky (Eds.), Modern public finance (pp. 157–161). Cambridge: Harvard University Press.

Oates, W. (1979). Lump-sum intergovernmental grants have price effects. In P. Mieszkowski & W. Oakland (Eds.), Fiscal federalism and grants in aid. Washington: The Urban Institute.

Oates, W. (1994). Federalism and government finance. In J.M. Quigley & E. Smolensky (Eds.), Modern public finance (pp. 126–151). Cambridge: Harvard University Press.

Oates, W. (1999). An essay on fiscal federalism. Journal of Economic Literature, 37, 1120–1149.

Roemer, J., & Silvestre, J. (2002). The ‘flypaper effect’ is not an anomaly. Journal of Public Economic Theory, 4, 1–17.

Shah, A. (2007). A practitioner’s guide to intergovernmental fiscal transfers. In R. Boadway & A. Shah (Eds.), Intergovernmental fiscal transfers (pp. 1–53). Washington: The World Bank.

Shaw, B. (2005). Canadian flypaper. Department of Economics, University of British Columbia.

Smart, M. (1998). Taxation and deadweight loss in a system of intergovernmental transfers. Canadian Journal of Economics, 31, 189–206.

Smart, M. 2006. Raising taxes through equalization (Working paper). Department of Economics, University of Toronto.

Stewart, M. (1996). Fiscal illusion (the flypaper effect) and government spending in Australia. Australian Economic Papers, 35, 390–396.

Volden, C. (2007). Intergovernmental grants: a formal model of interrelated national and subnational political decisions. Publius, 37, 209–243.

Winer, S. (1983). Some evidence on the effect of the separation of spending and taxing decisions. Journal of Political Economy, 91, 126–140.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper was originally prepared for the World Bank as part of a background report providing a conceptual framework for the reform of intergovernmental transfers in Brazil. I would like to thank Fernando Blanco, Jon Hamilton, Stuart Landon, Enlinson Mattos, Mark Maxson, Mel McMillan, Jay Wilson, Matthias Wrede, and two anonymous referees for their comments. The usual disclaimers apply.

Rights and permissions

About this article

Cite this article

Dahlby, B. The marginal cost of public funds and the flypaper effect. Int Tax Public Finance 18, 304–321 (2011). https://doi.org/10.1007/s10797-010-9160-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-010-9160-x

Keywords

- Flypaper effect

- Intergovernmental grants

- Intergovernmental transfers

- Fiscal federalism

- Marginal cost of public funds