Abstract

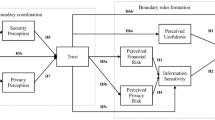

User adoption of mobile payment (m-payment) is low compared to the adoption of traditional forms of payments. Lack of user trust has been identified as the most significant long-term barrier for the success of mobile finances systems. Motivated by this fact, we proposed and tested an initial trust theoretical model for user adoption of m-payment systems. The model not only theorizes the role of initial trust in m-payment adoption, but also identifies the facilitators and inhibitors for a user’s initial trust formation in m-payment systems. The model is empirically validated via a sample of 851 potential m-payment adopters in Australia. Partial least squares structural equation modelling is used to assess the relationships of the research model. The results indicate that perceived information quality, perceived system quality, and perceived service quality as the initial trust facilitators are positively related to initial trust formation, while perceived uncertainty as the initial trust inhibitor exerts a significant negative effect on initial trust. Perceived asset specificity is found to have insignificant effect. In addition, the results show that initial trust positively affects perceived benefit and perceived convenience, and these three factors together predict usage intention. Perceived convenience of m-payment is also found to have a positive effect on perceived benefit. The findings of this study provide several important implications for m-payment adoption research and practice.

Similar content being viewed by others

References

Adam, B. (2014). Mobile payments in Australia: state of the banks. http://www.computerworld.com.au/article/536949/mobile_payments_australia_state_banks/. Accessed 2 Apr 2015.

Ahn, T., Ryu, S., & Han, I. (2007). The impact of Web quality and playfulness on user acceptance of online retailing. Information & Management, 44(3), 263–275.

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

Armstrong, J., & Overton, T. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 14(8), 396–402.

Australian Communications and Media Authority (2013). ACMA Communications Report 2012–13. ACMA.

Bhattacherjee, A. (2002). Individual trust in online firms: scale development and initial test. Journal of Management Information Systems, 19(1), 211–242.

Bock, G.-W., Lee, J., Kuan, H.-H., & Kim, J.-H. (2012). The progression of online trust in the multi-channel retailer context and the role of product uncertainty. Decision Support Systems, 53(1), 97–107.

Central Intelligence Agency (2013). The world factbook. https://www.cia.gov/library/publications/the-world-factbook/fields/2103.html. Accessed 2 Mar 2014.

Chandra, S., Srivastava, S. C., & Theng, Y.-L. (2010). Evaluating the role of trust in consumer adoption of mobile payment systems: an empirical analysis. Communications of the Association for Information Systems, 27(29), 561–588.

Chatterjee, S., Chakraborty, S., Sarker, S., Sarker, S., & Lau, F. Y. (2009). Examining the success factors for mobile work in healthcare: a deductive study. Decision Support Systems, 46(3), 620–633.

Chen, C.-W. D., & Cheng, C.-Y. J. (2009). Understanding consumer intention in online shopping: a respecification and validation of the DeLone and McLean model. Behaviour & Information Technology, 28(4), 335–345.

Chiang, K.-P., & Dholakia, R. R. (2003). Factors driving consumer intention to shop online: an empirical investigation. Journal of Consumer Psychology, 13(1), 177–183.

Chin, W. W. (1998). Commentary: issues and opinion on structural equation modeling. MIS Quarterly, 22(1), 7–16.

Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research, 14(2), 189–217.

Chiou, J.-S., & Shen, C.-C. (2012). The antecedents of online financial service adoption: the impact of physical banking services on Internet banking acceptance. Behaviour & Information Technology, 31(9), 859–871.

Chris, P. (2014). Mobile payments are on the rise in Australia: here’s what you need to know. http://www.businessinsider.com.au/mobile-payments-are-on-the-rise-in-australia-heres-what-you-need-to-know-2014-7. Accessed 3 Apr 2015.

Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 386–405.

Dahlberg, T., Mallat, N., Ondrus, J., & Zmijewska, A. (2008). Past, present and future of mobile payments research: a literature review. Electronic Commerce Research and Applications, 7(2), 165–181.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340.

DeLone, W. H., & McLean, E. R. (1992). Information systems success: the quest for the dependent variable. Information Systems Research, 3(1), 60–95.

Delone, W. H., & Mclean, E. R. (2004). Measuring e-commerce success: applying the DeLone & McLean information systems success model. International Journal of Electronic Commerce, 9(1), 31–47.

Edwards, J. R. (2001). Multidimensional constructs in organizational behavior research: an integrative analytical framework. Organizational Research Methods, 4(2), 144–192.

Flood, D., West, T., & Wheadon, D. (2013). Trends in mobile payments in developing and advanced economies. http://www.rba.gov.au/publications/bulletin/2013/mar/8.html. Accessed 2 Apr 2015.

Gao, L., & Bai, X. (2014). An empirical study on continuance intention of mobile social networking services: integrating the IS success model, network externalities and flow theory. Asia Pacific Journal of Marketing and Logistics, 26(2), 168–189.

Gao, S., & Yang, Y. (2014). The role of trust towards the adoption of mobile services in China: an empirical study. In H. Li (Ed.), Digital services and information intelligence (pp. 46–57). Berlin Heidelberg: Springer.

Gao, T. T., Rohm, A. J., Sultan, F., & Pagani, M. (2013). Consumers un-tethered: a three-market empirical study of consumers’ mobile marketing acceptance. Journal of Business Research, 66(1), 2536–2544.

Garrett, J. L., Rodermund, R., Anderson, N., Berkowitz, S., & Robb, C. A. (2014). Adoption of mobile payment technology by consumers. Family and Consumer Sciences Research Journal, 42(4), 358–368.

Gefen, D. (2002). Customer loyalty in e-commerce. Journal of the Association for Information Systems, 3(2), 27–51.

Gefen, D., Karahanna, E., & Straub, D. W. (2003). Trust and TAM in online shopping: an intergrated model. MIS Quarterly, 27(1), 51–90.

Hong, W., & Thong, J. Y. (2013). Internet privacy concerns: an integrated conceptualization and four empirical studies. Management Information Systems Quarterly, 37(1), 275–298.

Hu, X., Wu, G., Wu, Y., & Zhang, H. (2010). The effects of Web assurance seals on consumers’ initial trust in an online vendor: a functional perspective. Decision Support Systems, 48(2), 407–418.

Hwang, Y., & Lee, K. C. (2012). Investigating the moderating role of uncertainty avoidance cultural values on multidimensional online trust. Information & Management, 49(3), 171–176.

Jöreskog, K. G., & Wold, H. O. (1982). Systems under indirect observation: Causality, structure, prediction (Vol. 139). Amsterdam: North Holland.

José Liébana-Cabanillas, F., Sánchez-Fernández, J., & Muñoz-Leiva, F. (2014). Role of gender on acceptance of mobile payment. Industrial Management & Data Systems, 114(2), 220–240.

Jung, Y., Perez-Mira, B., & Wiley-Patton, S. (2009). Consumer adoption of mobile TV: examining psychological flow and media content. Computers in Human Behavior, 25(1), 123–129.

Kapoor, K. K., Dwivedi, Y. K., & Williams, M. D. (2014). Examining the role of three sets of innovation attributes for determining adoption of the interbank mobile payment service. Information Systems Frontiers, 17 1039–1056.

Kassim, N., & Abdullah, N. A. (2010). The effect of perceived service quality dimensions on customer satisfaction, trust, and loyalty in e-commerce settings: a cross cultural analysis. Asia Pacific Journal of Marketing and Logistics, 22(3), 351–371.

Kim, J. B. (2012). An empirical study on consumer first purchase intention in online shopping: integrating initial trust and TAM. Electronic Commerce Research, 12(2), 125–150.

Kim, Y. G., & Li, G. (2009). Customer satisfaction with and loyalty towards online travel products: a transaction cost economics perspective. Tourism Economics, 15(4), 825–846.

Kim, D. J., Ferrin, D. L., & Rao, H. R. (2008). A trust-based consumer decision-making model in electronic commerce: the role of trust, perceived risk, and their antecedents. Decision Support Systems, 44(2), 544–564.

Kim, C., Oh, E., Shin, N., & Chae, M. (2009a). An empirical investigation of factors affecting ubiquitous computing use and U-business value. International Journal of Information Management, 29(6), 436–448.

Kim, D. J., Ferrin, D. L., & Rao, H. R. (2009b). Trust and satisfaction, two stepping stones for successful e-commerce relationships: a longitudinal exploration. Information Systems Research, 20(2), 237–257.

Kim, G., Shin, B., & Lee, H. G. (2009c). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283–311.

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26(3), 310–322.

Lee, M. C. (2009). Factors influencing the adoption of internet banking: an integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8(3), 130–141.

Lee, K. C., & Chung, N. (2009). Understanding factors affecting trust in and satisfaction with mobile banking in Korea: a modified DeLone and McLean’s model perspective. Interacting with Computers, 21(5), 385–392.

Lee, J., Lee, J.-N., & Tan, B. C. (2015). Antecedents of cognitive trust and affective distrust and their mediating roles in building customer loyalty. Information Systems Frontiers, 17(1), 159–175.

Li, Y.-M., & Yeh, Y.-S. (2010). Increasing trust in mobile commerce through design aesthetics. Computers in Human Behavior, 26(4), 673–684.

Li, X., Hess, T. J., & Valacich, J. S. (2008). Why do we trust new technology? A study of initial trust formation with organizational information systems. The Journal of Strategic Information Systems, 17(1), 39–71.

Li, J., Liu, J.-L., & Ji, H.-Y. (2014). Empirical study of influence factors of adaption intention of mobile payment based on TAM model in China. International Journal of U & E-Service, Science & Technology, 7(1), 119–132.

Liang, T. P., & Huang, J. S. (1998). An empirical study on consumer acceptance of products in electronic markets: a transaction cost model. Decision Support Systems, 24(1), 29–43.

Liang, H., Saraf, N., Hu, Q., & Xue, Y. (2007). Assimilation of enterprise systems: the effect of institutional pressures and the mediating role of top management. MIS Quarterly, 31(1), 59–87.

Liébana-Cabanillas, F., Sánchez-Fernández, J., & Muñoz-Leiva, F. (2014). The moderating effect of experience in the adoption of mobile payment tools in Virtual Social Networks: The m-Payment Acceptance Model in Virtual Social Networks (MPAM-VSN). International Journal of Information Management, 34(2), 151–166.

Lin, H.-F. (2011). An empirical investigation of mobile banking adoption: the effect of innovation attributes and knowledge-based trust. International Journal of Information Management, 31(3), 252–260.

Lin, K.-Y., & Lu, H.-P. (2011). Why people use social networking sites: an empirical study integrating network externalities and motivation theory. Computers in Human Behavior, 27(3), 1152–1161.

Lin, J., Wang, B., Wang, N., & Lu, Y. (2014). Understanding the evolution of consumer trust in mobile commerce: a longitudinal study. Information Technology and Management, 15(1), 37–49.

Lindell, M. K., & Whitney, D. J. (2001). Accounting for common method variance in cross-sectional research designs. Journal of Applied Psychology, 86(1), 114.

Liu, M. T., Brock, J. L., Shi, G. C., Chu, R., & Tseng, T.-H. (2013). Perceived benefits, perceived risk, and trust: influences on consumers’ group buying behaviour. Asia Pacific Journal of Marketing and Logistics, 25(2), 225–248.

Lohmöller, J.-B. (1989). Latent variable path modeling with partial least squares. Heidelberg: Physica-Verlag.

Lu, Y., Yang, S., Chau, P. Y., & Cao, Y. (2011). Dynamics between the trust transfer process and intention to use mobile payment services: a cross-environment perspective. Information & Management, 48(8), 393–403.

Luo, X., Li, H., Zhang, J., & Shim, J. (2010). Examining multi-dimensional trust and multi-faceted risk in initial acceptance of emerging technologies: an empirical study of mobile banking services. Decision Support Systems, 49(2), 222–234.

Luo, H., Wang, J., & Lin, X. (2014). Empirical research on consumers’ initial trust and gender differences in B2C e-business. In 11th International Conference on Service Systems and Service Management, Beijing, China, (pp. 1–6).

Mallat, N. (2007). Exploring consumer adoption of mobile payments - a qualitative study. The Journal of Strategic Information Systems, 16(4), 413–432.

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. Academy of Management Review, 20(3), 709–734.

McKnight, H. D., Choudhury, V., & Kacmar, C. (2002). The impact of initial consumer trust on intentions to transact with a web site: a trust building model. The Journal of Strategic Information Systems, 11(3), 297–323.

Mostafa, R. (2015). Investigating the role of trust in mobile banking acceptance. In Proceedings of the 2013 Academy of Marketing Science Annual Conference (pp. 834–842). Springer.

Nicolaou, A. I., & McKnight, D. H. (2006). Perceived information quality in data exchanges: effects on risk, trust, and intention to use. Information Systems Research, 17(4), 332–351.

O’Cass, A., & Sok, P. (2012). Examining the role of within functional area resource–capability complementarity in achieving customer and product-based performance outcomes. Journal of Strategic Marketing, 20(4), 345–363.

O’Cass, A., & Sok, P. (2014). The role of intellectual resources, product innovation capability, reputational resources and marketing capability combinations in SME growth. International Small Business Journal, 32(8), 996–1018.

Pavlou, P. A., & Sawy, E. O. A. (2006). From IT leveraging competence to competitive advantage in turbulent environments: the case of new product development. Information Systems Research, 17(3), 198–227.

Pearson, A., Tadisina, S., & Griffin, C. (2012). The role of e-service quality and information quality in creating perceived value: antecedents to web site loyalty. Information Systems Management, 29(3), 201–215.

Peter, J. P., & Tarpey, L. X. (1975). A comparative analysis of three consumer decision strategies. Journal of Consumer Research, 2(1), 29–37.

Petter, S., Straub, D., & Rai, A. (2007). Specifying formative constructs in information systems research. MIS Quarterly, 31(4), 623–656.

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903.

Rindfleisch, A., & Heide, J. B. (1997). Transaction cost analysis: past, present, and future applications. Journal of Marketing, 61(4), 30–54.

Schierz, P. G., Schilke, O., & Wirtz, B. W. (2010). Understanding consumer acceptance of mobile payment services: an empirical analysis. Electronic Commerce Research and Applications, 9(3), 209–216.

Schneider, C. O., Bremen, P., Schönsleben, P., & Alard, R. (2013). Transaction cost economics in global sourcing: assessing regional differences and implications for performance. International Journal of Production Economics, 141(1), 243–254.

Shaw, N. (2014). The mediating influence of trust in the adoption of the mobile wallet. Journal of Retailing and Consumer Services, 21(4), 449–459.

Shin, D.-H. (2010). Modeling the interaction of users and mobile payment system: conceptual framework. International Journal of Human-Computer Interaction, 26(10), 917–940.

Sia, C. L., Lim, K. H., Leung, K., Lee, M. K., Huang, W. W., & Benbasat, I. (2009). Web strategies to promote internet shopping: is cultural-customization needed? MIS Quarterly, 33(3), 491–512.

Siau, K., & Shen, Z. (2003). Building customer trust in mobile commerce. Communications of the ACM, 46(4), 91–94.

Slade, E. L., Williams, M. D., & Dwivedi, Y. K. (2013). Mobile payment adoption: classification and review of the extant literature. The Marketing Review, 13(2), 167–190.

Slade, E., Williams, M., Dwivedi, Y., & Piercy, N. (2014). Exploring consumer adoption of proximity mobile payments. Journal of Strategic Marketing, 23(3), 209–223

Smith, A., Anderson, J., & Rainie, L. (2012). The future of money: smartphone swiping in the mobile age. Report, Washington, DC: Pew Research Center’s Internet & American Life Project.

Song, J., & Zahedi, F. (2007). Trust in health infomediaries. Decision Support Systems, 43(2), 390–407.

Susanto, A., Lee, H., Zo, H., & Ciganek, A. P. (2013). User acceptance of Internet banking in Indonesia: initial trust formation. Information Development, 29(4), 309–322.

Teo, T. S. H., & Yu, Y. (2005). Online buying behavior: a transaction cost economics perspective. Omega, 33(5), 451–465.

Teo, T. S. H., Wang, P., & Leong, C. H. (2004). Understanding online shopping behaviour using a transaction cost economics approach. International Journal of Internet Marketing and Advertising, 1(1), 62–84.

Teo, T. S., Srivastava, S. C., & Jiang, L. (2008). Trust and electronic government success: an empirical study. Journal of Management Information Systems, 25(3), 99–132.

Thakur, R. (2013). Customer adoption of mobile payment services by professionals across two cities in India: an empirical study using modified technology acceptance model. Business Perspectives and Research, 15(1), 17–28.

Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Research, 24(3), 369–392.

Vance, A., Elie-Dit-Cosaque, C., & Straub, D. W. (2008). Examining trust in information technology artifacts: the effects of system quality and culture. Journal of Management Information Systems, 24(4), 73–100.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: toward a unified view. MIS Quarterly, 27(3), 425–478.

Verbeke, A., & Kano, L. (2013). The transaction cost economics (TCE) theory of trading favors. Asia Pacific Journal of Management, 30(2), 409–431.

Wang, E. T. (2002). Transaction attributes and software outsourcing success: an empirical investigation of transaction cost theory. Information Systems Journal, 12(2), 153–181.

Wang, L., & Yi, Y. (2012). The impact of use context on mobile payment acceptance: An empirical study in China. In A. Xie & X. Huang (Eds.), Advances in computer science and education (pp. 293–300). Berlin: Springer.

Wang, Y.-S., Wu, S.-C., Lin, H.-H., Wang, Y.-M., & He, T.-R. (2012). Determinants of user adoption of web ‘Automatic Teller Machines’: an integrated model of ‘Transaction Cost Theory’ and ‘Innovation Diffusion Theory’. The Service Industries Journal, 32(9), 1505–1525.

Williamson, O. E. (1975). Markets and hierarchies: analysis and antitrust implications: A study in the economics of internal organization (Vol. 46). New York: Free Press.

Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets (Relational Contracting). New York: Free Press.

Williamson, O., & Ghani, T. (2012). Transaction cost economics and its uses in marketing. Journal of the Academy of Marketing Science, 40(1), 74–85.

Wold, H. (1985). Partial least squares (Encyclopedia of statistical sciences). New York: Wiley.

Wu, C.-C., Huang, Y., & Hsu, C.-L. (2014a). Benevolence trust: a key determinant of user continuance use of online social networks. Information Systems and e-Business Management, 12(2), 189–211.

Wu, L.-Y., Chen, K.-Y., Chen, P.-Y., & Cheng, S.-L. (2014b). Perceived value, transaction cost, and repurchase-intention in online shopping: a relational exchange perspective. Journal of Business Research, 67(1), 2768–2776.

Xin, H., Techatassanasoontorn, A. A., & Tan, F. B. (2013). Exploring the influence of trust on mobile payment adoption. In the 17th Pacific Asia Conference on Information Systems, (pp. 143–161). Jeju Usland: Korea.

Yan, H., & Pan, K. (2014). Examine user adoption of mobile payment using the TAM: a trust transfer perspective. In The Thirteenth Wuhan International Conference on E-Business - Human Behavior and Social Impacts on E-Business, Wuhan, China.

Yan, H., & Yang, Z. (2015). Examining mobile payment user adoption from the perspective of trust. International Journal of u-and e-Service, Science and Technology, 8(1), 117–130.

Yang, S. (2015). Role of transfer-based and performance-based cues on initial trust in mobile shopping services: a cross-environment perspective. Information Systems and e-Business Management. doi:10.1007/s10257-015-0274-7

Yang, S., Lu, Y., Gupta, S., Cao, Y., & Zhang, R. (2012). Mobile payment services adoption across time: an empirical study of the effects of behavioral beliefs, social influences, and personal traits. Computers in Human Behavior, 28(1), 129–142.

Yen, C., Hsu, M.-H., & Chang, C.-M. (2013). Exploring the online bidder’s repurchase intention: a cost and benefit perspective. Information Systems and e-Business Management, 11(2), 211–234.

Yousafzai, S., Pallister, J., & Foxall, G. (2009). Multi-dimensional role of trust in Internet banking adoption. The Service Industries Journal, 29(5), 591–605.

Zahedi, F. M., & Song, J. (2008). Dynamics of trust revision: using health infomediaries. Journal of Management Information Systems, 24(4), 225–248.

Zheng, Y., Zhao, K., & Stylianou, A. (2013). The impacts of information quality and system quality on users’ continuance intention in information-exchange virtual communities: an empirical investigation. Decision Support Systems, 56(4), 513–524.

Zhou, T. (2011a). The effect of initial trust on user adoption of mobile payment. Information Development, 27(4), 290–300.

Zhou, T. (2011b). An empirical examination of initial trust in mobile banking. Internet Research, 21(5), 527–540.

Zhou, T. (2011c). Examining the critical success factors of mobile website adoption. Online Information Review, 35(4), 636–652.

Zhou, T. (2013). An empirical examination of continuance intention of mobile payment services. Decision Support Systems, 54(2), 1085–1091.

Zhou, T. (2014). An empirical examination of initial trust in mobile payment. Wireless Personal Communications, 77(2), 1519–1531.

Zhou, T. (2015). An empirical examination of users’ switch from online payment to mobile payment. International Journal of Technology and Human Interaction, 11(1), 55–66.

Zhou, T., Lu, Y., & Wang, B. (2014). Examining online consumers’ initial trust building from an elaboration likelihood model perspective. Information Systems Frontiers. doi:10.1007/s10796-014-9530-5

Author information

Authors and Affiliations

Corresponding author

Appendix Measurement scales and items

Appendix Measurement scales and items

Perceived system quality (SYQ) (adapted from Kim et al. (2010))

-

SYQ1: Mobile payment quickly loads all the text and graphics.

-

SYQ2: Mobile payment is easy to use.

-

SYQ3: Mobile payment is easy to navigate.

-

SYQ4: Mobile payment is visually attractive.

Perceived information quality (INQ) (adapted from Kim et al. (2010))

-

INQ1: Mobile payment provides me with information relevant to my needs.

-

INQ2: Mobile payment provides me with sufficient information.

-

INQ3: Mobile payment provides me with accurate information.

-

INQ4: Mobile payment provides me with up-to-date information.

Perceived service quality (SEQ) (adapted from Kim et al. (2010))

-

SEQ1: Mobile payment provides on-time services.

-

SEQ2: Mobile payment provides prompt responses.

-

SEQ3: Mobile payment provides professional services.

-

SEQ4: Mobile payment provides personalized services.

Perceived uncertainty (UNC) (adapted from Chiou and Shen (2012) and Wang et al. (2012))

-

UNC1: I would not feel totally safe providing personal privacy information over a mobile payment.

-

UNC2: I am worried about using mobile payment because other people may be able to access my account.

-

UNC3: I would not feel secure sending sensitive information via a mobile payment.

-

UNC4: I fell using mobile payment still has the risk of incomplete transaction.

-

UNC5: I am afraid that my data will be embezzled.

Perceived asset specificity (PSS) (developed based on Liang and Huang (1998) and Teo et al. (2004))

-

PSS1: Mobile payment can be used only in specific websites.

-

PSS2: Using mobile payment requires the installation of specific software that is dedicated to a particular bank.

-

PSS3: Learning the usage of mobile payment takes time.

-

PSS4: It takes time and effort to accumulate mobile payment experience.

Perceived ability (PEA) (adapted from Bhattacherjee (2002), Gefen (2002), and Yousafzai et al. (2009))

-

PEA1: I believe that mobile service providers provide an excellent mobile payment service.

-

PEA2: I believe that mobile payment is processing my transactions accurately and on time.

-

PEA3: I believe that mobile payment provides 24 h access to financial transaction services.

-

PEA4: I think that m-payment services meet my needs.

Perceived integrity (PEI) (adapted from McKnight et al. (2002) and Kim et al. (2009a, Kim et al. 2009b, 2009c)

-

PEI1: I believe that mobile payment is fair with its internet banking customers.

-

PEI2: I believe that mobile payment has consistent online practices and policies.

-

PEI3: Mobile payment always provides reliable financial services.

-

PEI4: Mobile payment always provides safe financial services.

-

PEI5: Mobile payment gives the impression that it keeps promises and commitments.

Perceived benevolence (PEB) (adapted from Gefen (2002), McKnight et al. (2002), and Yousafzai et al. (2009))

-

PEB1: I believe that mobile payment will repay the money if it is taken from myaccount through unauthorized transactions.

-

PEB2: I believe that mobile payment service providers have my best interests in mind.

-

PEB3: I think mobile payment service providers are concerned with the present and future interests of users.

Perceived benefit (BEN) (adapted from Lee (2009) and Kim et al. (2010))

-

BEN1: I think that using mobile payment can save my time in performing payment transaction.

-

BEN2: I think that using mobile payment can save the transaction handling fees in performing payment transaction.

-

BEN3: I think mobile payment enables me to conduct payment quickly.

-

BEN4: Overall, I think that using mobile payment is advantageous.

Perceived convenience (CON) (adapted from Lee (2009) and Kim et al. (2010))

-

CON1: I think that learning to use mobile payment is easy for me.

-

CON2: I think skilfully using mobile payment is easy for me.

-

CON3: I think that interaction with mobile payment does not require a lot of mental effort.

-

CON4: I think that it is easy to use mobile payment to accomplish my payment tasks.

Usage intention (INT) (taken from Kim et al. (2010))

-

INT1: I will use mobile payment.

-

INT2: In the next 6 months, I will use mobile payment.

-

INT3: If I have chances to use mobile payment, I will use it.

Rights and permissions

About this article

Cite this article

Gao, L., Waechter, K.A. Examining the role of initial trust in user adoption of mobile payment services: an empirical investigation. Inf Syst Front 19, 525–548 (2017). https://doi.org/10.1007/s10796-015-9611-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10796-015-9611-0