Abstract

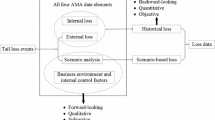

In this paper, I introduce a theoretically justified framework that incorporates scenario analysis into operational risk modeling. The basis for the framework is the idea that only worst-case scenarios contain valuable information about the tail behavior of operational losses. In addition, worst-case scenarios introduce a natural order among scenarios that makes possible a comparison of the ordered scenario losses with the corresponding quantiles of the severity distribution that research derives from historical losses. Worst-case scenarios contain information that enters the quantification process in the form of lower bound constraints on the specific quantiles of the severity distribution. The framework gives rise to several alternative approaches to incorporating scenarios.

Similar content being viewed by others

Notes

E.g., if line of business managers are responsible for generating scenarios, they might avoid generating large scenario losses if doing so will negatively affect their performance. I thank Jose Fillat for pointing out this possibility.

E.g., suppose the modeler samples 20,000 losses from the base model and adds 1000 scenario losses to augment the original sample. The 99.9th percentile loss of the original sample, say X, is the 20th largest loss of that sample, while the 99.9th percentile of the augmented sample with 21,000 losses is the 21th largest loss. This difference means that if all 1000 scenario losses are less than X, then the new 99.9th percentile is less than X as well. This situation can lead to lower, scenario-augmented capital if the severity distribution is a heavy-tail, which the single loss approximation shows (Böcker and Klüppelberg 2005).

Nevertheless, the dependence between scenarios belonging to different units of measure can still be captured through the introduction of a dependence structure between different units of measure, say, by means of copulas (see, among others, El Gamal et al. 2007).

E.g., if the loss amount of the worst-in-a-two-year scenario is L, then the loss amount of, say, the worst-in-a-three-year scenario cannot be less than L.

The approach that Dutta and Babbel (2010) propose works with scenario ranges only. If scenario experts report only point estimates of scenario losses, then one has to create a range around them. The authors recommend a 20% range, which makes their approach sensitive to this number.

References

Basel II (2005) International convergence of capital measurement and capital standards: a revised framework. Basel Committee on Banking Supervision, BIS, Basel, Switzerland

Berkowitz J (2000) A coherent framework for stress testing. J Risk 2(2):1–11

Böcker K, Klüppelberg C (2005) Operational VaR: a closed-form approximation. Risk Mag 12:90–93

Chib S (2001) Markov chain Monte Carlo methods: computation and inference. In: Heckman JJ, Leamer E (eds) Handbook of econometrics, vol 5. North-Holland, Amsterdam, pp 3569–3649

Dutta K, Babbel D (2010) Scenario analysis in the measurement of operational risk capital: a change of measure approach. Working paper, Worton School of Business, University of Pennsylvania

El Gamal M, Inanoglu H, Stengel M (2007) Multivariate estimation for operational risk with judicious use of extreme value theory. J Oper Risk 2(1):21–54

Kahneman D, Slovic P, Tversky A (1982) Judgment under uncertainty: heuristics and biases, 1st edn. Cambridge University Press, New York, 555 pp

Levy H (2006) Stochastic dominance: investent decision making under uncertainty, 2nd edn. Springer, Berlin, 440 pp

Sahay A, Wan Z, Keller B (2007) Operational risk capital: asymptotics in the case of heavy-tailed severity. J Oper Risk 2(2):61–72

The Final Rule (2007) Risk-based capital standards: advanced capital adequacy framework—Basel II, final rule. The Office of the Comptroller of Currency, The Federal Reserve System, The Federal Deposit Insurance Corporation, and The Office of Thrift Supervision

Tversky A, Kahneman D (1974) Judgment under uncertainty: heuristics and biases. Science 185:1124–1131

Acknowledgements

The views in this paper are solely my own responsibility and should not be interpreted as reflecting the views of the Federal Reserve Bank of Richmond or the Board of the Governors of the Federal Reserve System. I would like to thank Evan Sekeris for numerous valuable suggestions and encouragements. I also thank Akhtar Siddique, Jose Fillat, Lindon Fairweather, Robert Stewart, Xiaofei Zhang, and Craig Edwards for helpful discussions. Comments and suggestions by the anonymous referee were useful in improving the quality of the paper. All remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ergashev, B.A. A Theoretical Framework for Incorporating Scenarios into Operational Risk Modeling. J Financ Serv Res 41, 145–161 (2012). https://doi.org/10.1007/s10693-011-0105-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-011-0105-z

Keywords

- Operational risk

- Scenario analysis

- Constrained estimation

- The Markov chain Monte Carlo method (MCMC)

- Stochastic dominance