Abstract

We examine the question of deposit insurance through the lens of risk management by constructing the loss distribution faced by the Federal Deposit Insurance Corporation (FDIC). We take a novel approach by arguing that the risk management problem faced by the FDIC is similar to that of a bank managing a loan portfolio, only in the FDIC’s case the risk arises from the potential for loss of the individual banks in its portfolio. We explicitly estimate the cumulative loss distribution of FDIC insured banks using two variations of the Merton model and find that reserves are sufficient to cover roughly 99.85% of the loss distribution, corresponding to about a BBB+ rating. However, under different stress scenarios (higher correlations, fat-tailed bank returns, increased loss severity) that level can be much lower: approximately 96% corresponding to about a B+ rating.

Similar content being viewed by others

References

Altman, E.I. “Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy.” Journal of Finance 20 (1968), 589–609.

Altman, E.I., B. Brady, A. Resti, and A. Sironi. “The Link between Default and Recovery Rates: Theory, Empirical Evidence and Implications.” Journal of Business (2003).

Bank for International Settlements, Basel Committee on Banking Supervision. “International Convergence of Capital Measurement and Capital Standards: A Revised Framework.”<http://www.bis.org/publ/bcbs107.htm>, June 2004.

Bater, J. “U.S. Pension Insurer Posts Gap of $3.64 Billion, After Surplus.” Wall Street Journal January 31, 2003, p. B8.

Bennett, R.L. “Evaluating the Adequacy of the Deposit Insurance Fund: A Credit-Risk Modeling Approach.” FDIC Working Paper, 2001–2002.

Benston, G.J., and G.G. Kaufman, “Deposit Insurance Reform in the FDIC Improvement Act: The Experience to Date.” Federal Reserve Bank of Chicago Economic Perspectives, Second Quaxrter 1998, pp. 2–20.

Blinder, A.S., and R.F. Wescott. “Reform of Deposit Insurance: A Report to the FDIC.” http://www.fdic.gov/deposit/insurance/intitiative/reform.html, 2001.

Buser, S.A., A.H. Chen, and E.J. Kane. “Federal Deposit Insurance, Regulatory Policy, and Optimal Bank Capital.” Journal of Finance 35 (1981), 51–60.

Calem, P., and R. Rob “The Impact of Capital-Based Regulation on Bank Risk-Taking.” Journal of Financial Intermediation 8 (1999), 317–352.

Caprio, G. Jr., and D. Klingebiel. “Bank Insolvencies: Cross-country Experience.” World Bank Policy Research Working Paper No. 1620, 1996.

Chava, S., and R.A. Jarrow. “Bankruptcy Prediction with Industry Effects, Market vs. Accounting Variables and Reduced Form Credit Models.” Johnson Graduate School of Management Working Paper, Cornell University, 2001.

Duffie, D., Jarrow, R., A. Purnanandam, and W. Yang “Market Pricing of Deposit Insurance.” Journal of Financial Services Research 24 (2003), 93–119

Embrechts, P., A. McNeil, and D. Straumann. “Correlation and Dependence in Risk Management: Properties and Pitfalls.” In: M. Dempster, ed., Risk Management: Value at Risk and Beyond. Cambridge, UK: Cambridge University Press, 2001, pp. 176–223.

Episcopos, A. “The Implied Reserves of the Bank Insurance Fund.” Journal of Banking and Finance 28 (2004), 1617–1635.

FDIC. “Federal Deposit Insurance Corporation Options Paper.” August 2000, available at http://www.fdic.gov/deposit/insurance/initiative/OptionPaper.html.

FDIC. “Keeping the Promise: Recommendations for Deposit Insurance Reform.” April 2001, available at http://www.fdic.gov/deposit/insurance/initiative/direcommendations.PDF.

Feldman, R. “When Should the FDIC Act Like a Private Insurance Company? When it Comes to Pricing, Not Reserves.” Federal Reserve Bank of Minneapolis The Region 12 (1998), 43–48.

Financial Services Authority. “Individual Capital Adequacy Standards.” Consultation Paper 136, May 2002; available at http://www.fsa.gov.uk/pubs/cp/cp136.pdf.

Finger, C. “Conditional Approaches to for CreditMetrics Portfolio Distributions,” CreditMetrics Monitor, April 1999.

Frye, J. “Depressing Recoveries,” Risk 13 (2000) April, 91–94.

Gordy, M.B. “A Comparative Anatomy of Credit Risk Models.” Journal of Banking and Finance 24 (2000), 119–149.

Gordy, M.B. “A Risk Factor Model Foundation for Ratings-Based Capital Rules.” Journal of Financial Intermediation 12 (2003), 199–232.

Gupton, G.M., C.C. Finger and M. Bhatia. CreditMetrics™—Technical Document. New York, NY: J.P. Morgan, This version: April 2, 1997.

James, C. “The Losses Realized by Bank Failures.” Journal of Finance 46 (1991), 1223–1242.

Joint Forum. “Risk Management Practices and Regulatory Capital, Cross-Sectoral Comparison.” November 2001; available at http://www.bis.org/publ/joint03.pdf.

Jorion, P. Value at Risk: The Benchmark for Managing Financial Risk. 2nd Ed., New York: McGraw Hill, 2001.

Koyluoglu, H.U. and A. Hickman. “Credit Risk: Reconcilable Differences.” Risk 11 (1998), 56–62.

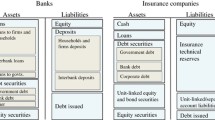

Kuritzkes, A., T. Schuermann and S.M. Weiner. “Risk Measurement, Risk Management and Capital Adequacy of Financial Conglomerates.” in Herring, R. and R. Litan, eds., Brookings-Wharton Papers in Financial Services 2003, 141–194.

Madan, D.B., and H. Ünal. “Risk-neutralizing Statistical Distributions: With an Application to Pricing Reinsurance Contracts on FDIC Losses.” Smith School of Business, University of Maryland; available at http://ssrn.com/abstract=552181, 2004.

Marcus, A.J., and I. Shaked. “The Valuation of FDIC Deposit Insurance Using Option Pricing Estimates.” Journal of Money, Credit and Banking 16 (1984), 446–460.

Merton, R. “On the pricing of corporate debt: The Risk Structure of Interest Rates.” Journal of Finance 29 (1974), 449–470.

Merton, R. “An Analytic Derivation of the Cost of Deposit Insurance and Loan Guarantees.” Journal of Banking and Finance 1 (1977), 3–11.

Mishkin, F.S. “Evaluating FDICIA.” Research in Financial Services: Private and Public Policy 9 (1997), 17–33.

Pennacchi, G.G. “A Reexamination of the Over- (or Under-) Pricing of Deposit Insurance.” Journal of Money, Credit and Banking 19 (1987), 340–360.

Pennacchi, G.G. “The Effects of Setting Deposit Insurance Premiums to Target Insurance Fund Reserves.” Journal of Financial Services Research 17 (2000), 153–180.

Pennacchi, G.G. “Bank Deposit Insurance and Business Cycles: Controlling the Volatility of Risk-Based Premiums.” Mimeo, University of Illinois, 2002.

Ronn, E.I., and A.K. Verma. “Pricing Risk-Adjusted Deposit Insurance: An Option-Based Model.” Journal of Finance 41 (1986), 871–895.

Saunders, A., and L. Allen. Credit Risk Measurement. 2nd Ed., New York, NY: John Wiley and Sons, 2002.

Vasicek, O. “Loan Portfolio Value.” Risk, December 2002, 160–162.

Wilson, T. “Portfolio Credit Risk (Parts I and II).” Risk 10, September and October, 1997.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL classification: G210, G280.

Any views expressed represent those of the author only and not necessarily those of the Federal Reserve Bank of New York or the Federal Reserve System.

Rights and permissions

About this article

Cite this article

Kuritzkes, A., Schuermann, T. & Weiner, S.M. Deposit Insurance and Risk Management of the U.S. Banking System: What is the Loss Distribution Faced by the FDIC?. J Finan Serv Res 27, 217–242 (2005). https://doi.org/10.1007/s10693-005-1802-2

Issue Date:

DOI: https://doi.org/10.1007/s10693-005-1802-2