Abstract

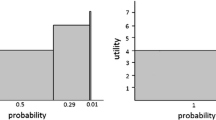

There is substantial evidence that risky decision-making involves a stochastic error process. The literature has adopted different approaches to address this issue, however, risk preferences are not uniquely identified by the most popular methods; decision error is not predicted to monotonically decrease with risk aversion. This paper reports the results of an experiment that elicits risk preferences to identify risk averse individuals and evaluates the frequency the stochastically dominant of two lotteries is chosen. Risk averse subjects exhibit a strong preference for dominant lotteries. More importantly, violations are consistent with stochastic decision error that decreases with risk aversion.

Similar content being viewed by others

Notes

The ‘trembling hand’ approach has rarely been used (Harless and Camerer 1994; Loomes et al. 2002). The Fechner (1860) approach represents a standard homoskedastic latent variable microeconometric model; it is a widely adopted approach to modelling stochastic error (Ballinger and Wilcox 1997; Hey and Orme 1994; Carbone and Hey 1994; Hey 1995; Carbone 1998; Carbone and Hey 2000; Loomes et al. 2002; Wilcox 2011). The Luce (1959) model, made popular by Holt and Laury (2002), represents a special case of white noise error and has been used by Dave et al. (2010), Goeree et al. (2003), and Andersen et al. (2006), to name a few. Random preferences have been used as an alternative to classic microeconometric approaches (Loomes and Sugden 1995, 1998; Carbone 1998; Loomes et al. 2002; Wilcox 2011).

Apesteguia and Ballester (2016) provide a formal proof for both cases.

The low return was also held constant at $0 in the RV format.

Thus, the decision frame is identical to that in which risk preferences are elicited. This minimizes any effect of context dependent risk preferences (Weber et al. 2002).

Bruner (2009) demonstrates there is substantial inconsistency in the degree of risk aversion across the PV and RV formats, assuming CRRA preferences. This is to be expected given stochastic errors in decision-making.

Assume the normalization \(V_i(0) = 0\) throughout the analysis.

A formal proof is provided by Apesteguia and Ballester (2016). Moreover, they demonstrate that random preference models with CRRA and CARA preferences are also ‘monontone’. Loomes and Sugden (1995) proposed random preferences as an alternative to the Fechner white noise approach to modeling stochastic decision error. While the latter assumes an additive noise parameter on a preference function with a fixed risk preference parameter, the former assumes noisiness in the risk preference parameter itself. Hence, as the risk parameter increases, the impact of the noise diminishes, leading to monotonically decreasing errors.

The low return was also held constant at $0 in the RV format.

The previous evidence of order effects Harrison et al. (2005) pertains to varying the magnitude of payoffs, which is constant in our experiment. Thus we have no prior beliefs about the existence, let alone the direction or magnitude of order effects in this experiment.

The selection of the decision that determines their payoff was presented as a compound lottery; the computer first selects the stage of the experiment (each has a \(\frac{1}{3}\) chance of being selected) and then the decision of the stage is selected (each has a \(\frac{1}{10}\) chance of being selected). Thus, we assume that preferences conform to the Independence Axiom (Samuelson 1952). The evidence in the literature suggests that ‘random lottery selection’ is incentive-compatible for simple choice sets (Ballinger and Wilcox 1997; Starmer and Sugden 1991; Wilcox 1993).

We assume the value function is \(EU_k = p_kR_k^{1-r}\) as stated in Sect. 2.3.

According to Holt and Laury (2002), “The overall message is that there is a lot of risk aversion, centered around the 0.3 \(-\) 0.5 range, which is roughly consistent with estimates implied by behavior in games, auctions, and other decision tasks.”

Roughly a third of subjects fall into this category using the average lower bound as a conservative estimate.

Three subjects switched multiple times in the PV format and ten subjects switched multiple times in the RV format. Two subjects switched multiple times in both.

Measurement error in risk preferences implies there is attenuation bias in the subsequent analysis, making it more difficult to detect a significant correlation between risk preferences and decision error.

Seven safe choices was chosen as the cutoff point since it is the midpoint. The graphs are qualitatively similar if 6 or 8 were used as the cutoff point, however, adequate sample sizes become problematic.

The p-values for the Pearson and the Spearman correlation coefficients are 0.0000 and 0.0001, respectively.

The Fechner (1860) approach represents a standard homoskedastic latent variable microeconometric model; it is a widely adopted approach to modelling stochastic error (Ballinger and Wilcox 1997; Hey and Orme 1994; Carbone and Hey 1994; Hey 1995; Carbone 1998; Carbone and Hey 2000; Loomes et al. 2002; Wilcox 2011). The Luce (1959) model, made popular by Holt and Laury (2002), represents a special case of white noise error and has been used by Dave et al. (2010), Goeree et al. (2003), and Andersen et al. (2006), to name a few.

Harrison (2007) generously provides a detailed description of this estimation technique for those that are unfamiliar with the approach.

References

Andersen, S. G., Harrison, G., Lau, M. I., & Rutstrm, E. E. (2006). Elicitation using multiple price list formats. Experimental Economics, 9(4), 383–406.

Apesteguia, J., & Ballester, M. A. (2016). Monotone stochastic choice models: The case of risk and time preferences. Barcelona: Graduate School of Economics.

Ballinger, T. P., & Wilcox, N. T. (1997). Decisions, error and heterogeneity. The Economic Journal, 107, 1090–1105.

Becker, G., DeGroot, M., & Marschak, J. (1963). Stochastic models of choice behavior. Behavioral Science, 8, 41–55.

Binswanger, H. (1980). Attitudes toward risk: Experimental measurement in rural India. American Journal of Agricultural Economics, 62, 395–407.

Blavatskyy, P. R. (2007). Stochastic expected utility theory. Journal of Risk and Uncertainty, 34, 259–286.

Bruner, D. M. (2009). Changing the probability versus changing the reward: Evidence from a risk preference elicitation mechanism. Experimental Economics, 12, 367–385.

Buschena, D., & Zilberman, D. (2000). Generalized expected utility, heteroskedastic error, and path dependence in risky choice. Journal of Risk and Uncertainty, 20, 67–88.

Carbone, E. (1998). Investigation of stochastic preference theory using experimental data. Economics Letters, 57(305), 312.

Carbone, E., & Hey, J. D. (1994). Discriminating between preference functionals—A preliminary Monte Carlo study. Journal of Risk and Uncertainty, 8, 223–242.

Carbone, E., & Hey, J. D. (2000). Which error story is best. Journal of Risk and Uncertainty, 20, 161–176.

Dave, C., Eckel, C. C., Johnson, C. A., & Rojas, C. (2010). Eliciting risk preferences: When is simpler better? Journal of Risk and Uncertainty, 41, 219–243.

Fechner, G. (1860/1966). Elements of psychophysics. New York: Holt, Rinehart and Winston.

Fischbacher, U. (2007). Z-Tree: Zurich toolbox for readymade economic experiments—Experimenter’s manual. Experimental Economics, 10, 171–178.

Goeree, J., Holt, C. A., & Palfrey, T. R. (2003). Risk averse behavior in generalized matching pennies games. Games and Economic Behavior, 45, 97–113.

Greiner, B. (2004). The online recruitment system ORSEE 2.0—A guide for the organization of experiments in economics. Working Paper Series in Economics. 10, University of Cologne.

Hadar, J., & Russell, W. R. (1969). Rules for ordering uncertain prospects. The American Economic Review, 59(1), 25–34.

Hanoch, Giora, & Levy, Haim. (1969). The efficiency analysis of choices involving risk. The Review of Economic Studies, 36, 335–346.

Harless, D. W., & Camerer, C. F. (1994). The predictive utility of generalized expected utility theories. Econometrica, 62(6), 1251–1289.

Harrison, G.W. (2007). Maximum likelihood estimation of utility functions using stata. Working Paper 06–12. Department of Economics, College of Business Administration, University of Central Florida.

Harrison, G. W., Johnson, E., McInnes, M. M., & Rutström, E. E. (2005). Risk aversion and incentive effects: Comment. American Economic Review, 95(3), 897–901.

Hey, J. D. (1995). Experimental investigations of errors in decision-making under uncertainty. European Economic Review, 29, 633–640.

Hey, J. D., & Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica, 62(6), 1291–1326.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1657.

Kahneman, D., & Tversky, A. (1979). Prospect theory an analysis of decision under risk. Econometrica, 47, 263–291.

Loomes, G., & Sugden, R. (1995). Incorporating a stochastic element into decision theories. European Economic Review, 39, 641–648.

Loomes, G., & Sugden, R. (1998). Testing alternative stochastic specifications for risky choice. Economica, 65, 581–598.

Loomes, G., Sugden, R., Moffatt, P. G., & Sugden, R. (2002). A microeconometric test of alternative stochastic theories of risky choice. Journal of Risk and Uncertainty, 24(2), 103–130.

Luce, D. (1959). Individual choice behavior. New York: Wiley.

McFadden, D. (1974). Measurement of urban travel demand. Journal of Public Economics, 3, 303–328.

Pratt, J. W. (1964). Risk aversion in the small and large. Econometrica, 32(1/2), 122–136.

Quiggen, J. (1982). A theory of anticipated utility. Journal of Economic Behavior and Organization, 3, 323–343.

Rothschild, M., & Stiglitz, J. (1970). Increasing risk: I. A definition. Journal of Economic Theory, 2, 225–243.

Samuelson, P. A. (1952). Probability, utility, and the indedendence axiom. Econometrica, 20(4), 670–678.

Smith, V. L., & Walker, J. (1993). Monetary rewards and decision cost in experimental economics. Economic Inquiry, 31, 245–261.

Starmer, C., & Sugden, R. (1991). Does the random-lottery incentive system elicit true preferences? An experimental investigation. American Economic Review, 81(4), 971–978.

Thurston, L. L. (1927). A law of comparative judgement. Psychological Review, 34, 273–286.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory—Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Weber, Elke U., Blai, Ann-Ren Te, & Betz, Nancy E. (2002). A domain-specific risk-attitude scale: Measuring risk perceptioons and risk behaviors. Journal of Behavioral Decision Making, 15, 263–290.

Wilcox, N. T. (1993). Lottery choice: Incentives, complexity, and decision time. The Economic Journal, 103, 1397–1470.

Wilcox, N. T. (2011). Stochastically more risk averse: A contextual theory of stochastic discrete choice under risk. Journal of Econometrics, 162, 89–104.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was undertaken at the University of Calgary Behavioural and Experimental Economics Laboratory (CBEEL). I would like to thank Christopher Auld, John Boyce, Michael McKee, William Neilson, Rob Oxoby, and Nathaniel Wilcox for their many helpful comments and suggestions, as well as participants at the 2009 North American Economic Science Association Meetings where preliminary results from this research were presented.

Rights and permissions

About this article

Cite this article

Bruner, D.M. Does decision error decrease with risk aversion?. Exp Econ 20, 259–273 (2017). https://doi.org/10.1007/s10683-016-9484-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-016-9484-1