Abstract

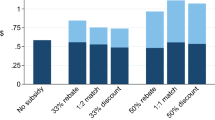

We report the results of a field experiment conducted in conjunction with a mailed fundraising campaign of a nonprofit organization. The experiment is designed to compare the response of donors to subsidies in the form of matching amounts or rebated amounts. Matching subsidies are used by many corporations as an employee benefit; the US federal tax system encourages giving using a rebate subsidy by making donations tax deductible. The design includes a control group and two levels of subsidy of each type. Our main result is that matching subsidies result in larger total donations to charities than rebate subsidies, a result that is qualitatively similar to the lab findings. The estimated price elasticities for the matching subsidy are very similar to (and insignificantly different from) the lab experiments, while rebate subsidies lead to lower contributions in the field than in the lab. Since rebates in the field involve substantial lags and additional complications as compared with the “instant rebates” of the lab, this latter difference is not unexpected. The matching results are an important step in validating lab estimates of responsiveness to subsidies of charitable giving.

Similar content being viewed by others

References

Bénabou, R., & Tirole, J. (2006). Incentives and prosocial behavior. American Economic Review, 96(5), 1652–1678.

Center on Philanthropy. (2007). Patterns of household charitable giving by income group, 2005. Prepared for Google. Available on the Center’s website: http://www.philanthropy.iupui.edu/.

Davis, D. D. (2006). Rebate subsidies, matching subsidies and isolation effects. Judgment and Decision-Making, 1, 13–22.

Davis, D. D., & Millner, E. L. (2005). Rebates and matches and consumer behavior. Southern Economic Journal, 72, 410–421.

Davis, D. D., Millner, E. L., & Reilly, R. J. (2005). Subsidy schemes and charitable contributions: a closer look. Experimental Economics, 8, 85–106.

Dillman, D. A. (2000). Mail and internet surveys: the tailored design method (2nd edn). New York: Wiley.

Eckel, C. C., & Grossman, P. J. (2003). Rebates and matching: does how we subsidize charitable contributions matter? Journal of Public Economics, 87, 681–701.

Eckel, C. C., & Grossman, P. J. (2006a). Do donors care about subsidy type? An experimental study. In D. Davis, & M. Isaac (Eds.), Research in experimental economics, Vol. 11. Experiments investigating fundraising and charitable contributions (pp. 163–182). New York: JAI Press.

Eckel, C. C., & Grossman, P. J. (2006b). Subsidizing charitable giving with rebates or matching: further laboratory evidence. Southern Economic Journal, 72(4), 794–807.

Groves, R. M., & Couper, M. P. (1998). Nonresponse in household interview surveys. New York: Wiley–Interscience

Harrison, G., & List, J. A. (2004). Field experiments. Journal of Economic Literature, 42(4), 1009–1055.

Hoffman, E., McCabe, K., & Smith, V. L. (1996). Social distance and other-regarding behavior in dictator games. American Economic Review, 86(3), 653–660.

Karlan, D., & List, J. A. (2007). Does price matter in charitable giving? Evidence from a large-scale natural field experiment. American Economic Review, 97(5), 1774–1793.

List, J. A. (2006). Field experiments: a bridge between lab and naturally occurring data. Advances in Economic Analysis and Policy 6(2), Article 2.

List, J. A., & Lucking-Reiley, D. (2002). The effects of seed money and refunds on charitable giving: experimental evidence from a university capital campaign. Journal of Political Economy, 110(1), 215–233.

Tourangeau, R., Rips, L. J., & Rasinski, K. (2000). The psychology of survey response. New York: Cambridge University Press.

Author information

Authors and Affiliations

Corresponding author

Electronic Supplementary Material

Rights and permissions

About this article

Cite this article

Eckel, C.C., Grossman, P.J. Subsidizing charitable contributions: a natural field experiment comparing matching and rebate subsidies. Exper Econ 11, 234–252 (2008). https://doi.org/10.1007/s10683-008-9198-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-008-9198-0