Abstract

The COVID-19 pandemic had disastrous effects on health and economic activity worldwide, including in the Euro Area. The application of mandatory lockdowns contributed to a sharp fall in production and a rise in unemployment, inducing an expansionary fiscal and monetary response. Using a uniquely large macro database, this paper examines the effects of the pandemic and the ensuing economic policies on public support for the common currency, the euro, as measured by the Eurobarometer survey. It finds that public support for the euro increased in a majority of the 19 Euro Area member states and reached historically high levels in the midst of the pandemic. This finding suggests that the expansionary fiscal policies initiated at the EU level significantly contributed to this outcome, while the monetary measures taken by the European Central Bank did not have a similar effect.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The coronavirus pandemic that erupted in early 2020 triggered an unprecedented health crisis across the globe, including within the member countries of the Euro Area (EA). In response to the pandemic and in the hope of arresting its spread, governments introduced far-reaching lockdowns in many countries. These policy measures had a strong negative effect on growth, employment and trade,Footnote 1 inducing some observers to talk about the “Great Lockdown Recession”.Footnote 2 The lockdowns had a particularly negative impact on specific sectors of the economy, such as hospitality (Gursoy and Chi 2020). Many industries reacted to the pandemic by implementing short-term work schemes and laying off employees. In sum, the lockdown policies led to a rise in unemployment, a sharp drop in economic activity and a rapid rise in public debt (for an extended analysis of these phenomena, see, for example, Bauer and Weber 2021; Baek et al. 2021; IMF 2020b; Ping Ang and Dong 2022).

COVID-19 became an urgent policy challenge for the EA member states. They were pressed to dampen the spread of the pandemic as well as to reduce the economic damage created by lockdowns. In response to the downturn in economic activity, loss of income in many households, and rising unemployment, national and European Union (EU) policymakers turned to large-scale fiscal and monetary policy initiatives.

How did these economic policy measures influence public support for the euro? This question is a pertinent one to ask, as broad public support for the euro is crucial for the long-term sustainability of the common currency. As long as it prevails, it acts as a shield against attempts to dismantle the euro and grants political legitimacy to the European Central Bank (ECB) “to do whatever it takes” to preserve the EA in times of crisis (Roth and Jonung 2020a).

In addition, given that the economic and unemployment crisis in the EA following the financial and sovereign debt crisis from 2008 to 2013 had a negative impact on public support for the euro (Roth et al. 2016, 2019; Roth and Jonung 2020a, b; Roth 2022), we are interested to examine if the rise in unemployment during the COVID-19 pandemic had a similarly negative effect on public support for the euro.

This paper analyses the evolution and determinants of public support for the euro at the macro-economic level using a Fixed Effect Dynamic Feasible General Least Squares (FE-DFGLS) to derive statistical inferences on the causal impact of our macro-economic variables, adding dummies for fiscal and monetary policy measures. We use a EA19 database running from 3–4/1999 (EB51) to 6–7/2022 (EB97), thus covering the intense phase of the COVID-19 pandemic in 2020–2021 as well. We develop a daily data frequency approach for the matching procedure. By applying the above mentioned tailor-fit estimation approach, data and research design during the pandemic, we observe a striking feature: public support for the euro increased, especially during the winter of 2020–2021, reaching a historical peak at that time despite of an increase in unemployment at the same time.

The results of our paper suggest that the fiscal policy initiatives taken by EU policy makers led to the significant and immediate increase in public support for the euro during the COVID-19 pandemic in the EA19, although unemployment rose at the same time. For the monetary initiative by the ECB, we find only a limited significant positive influence (in the winter of 2020/2021) on public support for the euro. Much suggests that the increased political legitimacy bestowed on the EU institutions during the pandemic can be attributed to the fiscal policy initiatives.

Our study is an explorative one. We had two hypotheses to start with. First, a rise in unemployment would decrease support for the euro judging from our previous work (Roth et al. 2016, 2019; Roth and Jonung 2020a). Second, a rise in the volume of fiscal transfers/expenditures to countries hit by unemployment would increase support for the common currency just as, as an empirical rule, increased public expenditures strengthen the popularity of the government that carries out an expansionary fiscal policy. A priori, there is no theory that can answer which of these two effects would dominate. There is a huge literature on voting functions and popularity functions that suggests that expansionary economic policies do have a significant impact on voter behavior and voter sentiment (for a literature review see Lewis-Beck and Stegmaier 2013).

The aim of this paper is two-fold: first, to analyze how public support for the euro evolved during the COVID-19 pandemic, and second, to investigate the extent to which the fiscal and expansionary monetary responses were driving the increase in public support for the euro. As far as we have seen, the drivers of public support behind the euro during the pandemic have not been studied before. In this sense, our study is unique. Our paper covers the workings of euro area by focusing on the role of monetary and fiscal policies during an economic crisis induced by the corona pandemic. The paper belongs to the field of political economy—using an approach pioneered by economists.

The article is structured in the following manner. The following section summarizes previous studies on public support for the euro and highlights the importance of public support for the euro. The third section elaborates on the various policy initiatives adopted across the EU in response to the COVID-19 pandemic. The fourth section reviews the fiscal and monetary responses by national and EU policymakers during the pandemic. The fifth section presents the model specification used by the authors. The sixth section offers econometric results. The seventh section discusses the fiscal and monetary policy interventions during the COVID-19 crisis and their effects on public support for the euro. The last section offers conclusions.

2 Public support for the Euro: a review of the literature

2.1 The role of public support for the Euro

Public support for the common currency is a crucial prerequisite for the existence and sustainability of a common currency. History contains many cases where the lack of a public support is translated via the political system into a break-up of the common currency area (Bordo and Jonung 2003). During the euro crisis in the early 2010s, some politicians in some EA member states proposed a return to domestic currency units. Public support for the euro among the voters proved, however, strong and sustainable, dampening the requests for a return to a national currency. In France and Italy, for example, populists have muffled their demands for an end of the euro (Roth and Jonung 2020a). Given these events, the determinants behind public support for the common currency is thus a central and current research issue.

We can identify at least five distinct strands of research on the role of public support for the euro. First, economists argue that the European Monetary Union (EMU) benefits from public support for its common currency. If the euro maintains strong public support, policymakers are able to address the challenges arising from political, economic, and financial disturbances and crises by making necessary adjustments (Bordo and Jonung 2003). Second, high levels of public support for the euro, defined by the economics of the optimum currency area (OCA) as a shared sense of a ‘commonality of destiny’, is crucial for a smooth functioning of a monetary union. Baldwin and Wyplosz (2022) assert that the primary reason for the survival of the euro is this political OCA criterion.

Third, public support is identified as a key stabilizer for the process of European integration in the political science literature (Banducci et al. 2003; Verdun 2022). This literature argues that public support for the euro is necessary so that citizens are willing to transfer power from national to European institutions (Kaltenthaler and Anderson 2001). Fourth, a relatively new strand of research links public support for the euro to the fact that Greece and other crisis-prone Mediterranean economies have not exited the EA despite the fact that a majority of citizens oppose austerity measures (Walter et al. 2018; Jurado et al. 2020; Xezonakis and Hartmann 2020).

Fifth, economists conclude that public support for the euro is crucial in times of economic and political distress (Roth et al. 2016, 2019; Roth and Jonung 2020a; Roth 2022). As evidenced by the Italian case, large public support for the euro in the EA19 served as a shield against “populist governments” efforts to dismantle EA cooperation. It also granted political legitimacy to the ECB’s independence against growing criticism of its actions in times of diminished institutional trust.

2.2 The empirical evidence

Research on public support for the euro and EMU neatly follows a timeline. It encompasses studies of public support in the years before the introduction of the common currency (Gärtner 1997; Kaltenthaler and Anderson 2001; Banducci et al. 2003), during the pre-crisis period from 1999 to 2008 (Banducci et al. 2009; Deroose et al. 2007), during the crisis from 2008 to 2013 (Hobolt and Leblond 2014; Hobolt and Wratil 2015; Roth et al. 2016) and during the economic recovery from 2013 to 2018 (Roth et al. 2019; Roth and Jonung 2020a).

A central finding of these studies is that, with a few exceptions, the euro has enjoyed strong support in all EA19 countries since its introduction, including during the crisis from 2008 to 2013 (Roth et al. 2016, 2019). The research on the macroeconomic determinants of public support for the euro is not conclusive. While Hobolt and Leblond (2014) find no significant relationship between unemployment and net support for the euro, Roth et al. (2016, 2019) and Roth and Jonung (2020a) establish a significant and negative relationship during the economic crisis and recovery period from 2008 to 2018. A similarly controversial conclusion applies to the impact of inflation. Banducci et al. (2009) and Hobolt and Leblond (2014) conclude that there is no significant relationship between inflation and public support for the euro, while Roth et al. (2016, 2019) and Roth and Jonung (2020a) find a strong negative coefficient in the pre-crisis period and during the crisis period for an EA-19 country sample.

The above studies form the background for our present study, which deals with the impact on the support for the euro of the economic downturn and of the fiscal and monetary measures taken during the COVID-19 pandemic, starting in early 2020 and lasting through 2022.

3 Covid-19 and public support for the Euro

3.1 The COVID-19 pandemic

In response to the pandemic, EA19 member countries introduced compulsory restrictions on the mobility of the public, commonly referred to as lockdowns.Footnote 3 These measures included non-pharmaceutical interventions such as school closures, workplace closures, and stay-at-home requirements. The commonly stated goal of these mandatory measures was to flatten the epidemiological curve (Baldwin and Wyplosz 2022), thereby reducing the spread of the pandemic and holding down the rise in mortality rates. These measures were the primary tools, as vaccines only reached a minority of EA19 member countries in 2020 and 2021 (Moore et al. 2021; Burki 2021). The actual effect of the lockdowns on mortality is a subject of lively debate. Some argue that lockdowns, that is, increased stringency, decreased the growth of COVID-19 cases and mortality rates (Hale et al. 2020; Violato et al. 2021). Others hold a more skeptical view, such as Herby et al. (2023), concluding that lockdowns had a negligible effect on excess mortality.Footnote 4

Figure 1 displays the 14-day moving average of the stringency index, the common measure of the extent of lockdowns and the mortality rate per million people in the EA19 next to the mean unemployment rate matched according to the respective bi-annual standard Eurobarometer (EBs 92–97) fieldwork periods considered in the analysis.

14-day Moving Average Stringency Index, Mortality Rate per Million People and Mean Unemployment Rate, EA19, 2019–2022. The stringency index is aggregated from 0 to 100 (100 = strictest) and is calculated based on nine response indicators (school closures, workplace closures, cancellations of public events, limits on size of gatherings, public transport closures, stay-at-home requirements, restrictions on internal movement, travel bans, and record presence of public information campaigns). PEPP = Pandemic Emergency Purchase Programme, SURE = Support to mitigate Unemployment Risks in an Emergency, RRF = Recovery and Resilience Facility (RRF), EB = Eurobarometer, Disb. = Disbursement. Values of the left-hand y-scale stringency index are in percent. Values on the right-hand y-scale (showing mean unemployment rates) are in percent. Values on the right-hand y-scale (showing mortality rates) are displayed per million people. X-scale displays 14-day moving averages. Source: Data for the stringency index and confirmed deaths are taken from the Oxford COVID-19 Response Tracker (Hale et al. 2021; Oxford COVID-19 Government Response Tracker 2020), and data for the unemployment rate and population are from Eurostat. *This includes the SURE disbursements on 2 February 2021

During the first two waves of the COVID-19 pandemic,Footnote 5 from March until May 2020 and again from November 2020 until the end of April 2021, the lockdown measures remained at a high level, mostly above 70. Only during the summer of 2020 and after the second wave, at the end of March 2021, was partial control achieved, with a decline in the stringency measures in response to the decreasing infections and death rates. Overall, in 2020 and 2021, the stringency index remained at a high level, mostly above 50. Then in early 2022, the stringency index started to decline and converge toward pre-crisis levels in June 2022. The reason for this decline was the continuous increase in COVID-19 vaccinations in many member countries. The rising frequency of vaccinations, however, led to a decreasing hospitalization rate despite a strong increase in confirmed cases due to the emergence of the Omicron variantFootnote 6 (Ritchie et al. 2020; Ulloa et al. 2021).

The high stringency measures taken in the spring of 2020 and in the winter of 2020–2021 led to a significant decline in economic activity, strongly reflected in the increase in the mean unemployment rate, as shown in Fig. 1 in the winter of 2020–2021 before the standard EB94 fieldwork (2–3/2021). Several studies show that a high stringency index significantly increased the unemployment rate (Bauer and Weber 2021; Baek et al. 2021; Ping Ang and Dong 2022). In parallel with the decreasing stringency index from April 2021 onwards, the mean unemployment rate also fell below the pre-pandemic levels in the summer of 2022.

EU policymakers addressed the economic downturn and the rise in unemployment via rapid large-scale fiscal policy and monetary initiatives. As seen in Fig. 1, the temporary Support to mitigate Unemployment Risks in an Emergency (SURE) was activated by the European Commission (EC) on 22 September 2020. The centerpiece Recovery and Resilience Facility (RRF) of the European recovery plan, NextGenerationEU (NGEU), was approved on 10–12 February 2021 by the European Parliament and the Council of the EU. The ECB activated the Pandemic Emergency Purchase Programme (PEPP) on 24 March 2020. With the decision of the Governing Council, PEPP net purchases were discontinued at the end of March 2022. These three initiatives are described in more detail in Sect. 4.

To sum up: we identify the start of the COVID-19 crisis with a rapid increase in the stringency index at the end of February 2020 and its end with the convergence toward pre-crisis levels in June 2022.

3.2 COVID-19 and public support for the Euro

Let us start by examining the evolution of net public support for the euro and the rate of unemployment in the EA and its 19 individual member countries since the introduction of the euro in 3–4/1999 (EB51) until 6–7/2022 (EB97). A striking feature in Fig. 2a is the increase in public support for the euro of 6.7-percentage points from 57.9 percent before the pandemic in 11/2019 (EB92) compared to 64.6 percent of net support in 2–3/2021 (EB94) (see Table A1 in Appendix A in the online supplementary information). However, whereas the increase from 11/2019 (EB92) to 7–8/2020 (EB93) was only 1-percentage point, the increase from 7–8/2020 (EB93) to 2–3/2021 (EB94) was 5.7-percentage points (see Table A2 in Appendix A in the online supplementary information). This pronounced increase in the winter of 2020/2021 in 2–3/2021 (EB94) established the highest level of support in the history of the euro at that time, although unemployment had risen in the meantime.

a, b Unemployment and Net Public Support for the Euro in the EA19 and in the 19 individual EA19 Countries, 1999–2022. Note: As the figure depicts net support, all values above 0 indicate that a majority of the respondents support the euro. Net support measures are constructed as the number of ‘For’ responses minus ‘Against’ responses, according to the equation: Net support = (For − Against)/(For + Against + Don't know). The vertical dashed lines represent four milestones in the history of the single currency: the physical introduction of the euro in January 2002, the start of the global financial crisis in September 2008, the start of the recovery at the end of 2013, the start of the COVID-19 crisis at the beginning of 2020 and its end in June 2022.

As the pandemic progressed, net support dropped after 2–3/2021 (EB94) but remained higher than before the pandemic. The unemployment rate follows the same pattern as net support, peaking in 2–3/2021 (EB94). With the start of the war in Ukraine we see a “rally-around-the-flag” effect with a renewed increase in public support to 64.7 percent in 6–7/2022 (EB97), representing a new historical high level of support for the euro.

This positive correlation during 2020/2021 between support and unemployment runs counter to the negative correlation during the financial and economic crisis of 2008–2013 (Roth et al. 2016, 2019; Roth and Jonung 2020a). The sharp increase in the unemployment rate at the beginning of the pandemic did not lead to a decline in public support for the euro, as occurred during the period 2008–2013.

Figure 2b, looking at the time series patterns for the 19 individual EA economies, reveals an increase in net public support for the euro in 13 out of the 19 EA countries in 2–3/2021 (EB94), compared to the period before the pandemic in 11/2019 (EB92) (see Table A1 in Appendix A in the online supplementary information). Italy, Greece, and Portugal have seen the largest increase by 20 and 19 percentage points, respectively, followed by Lithuania and Belgium by 15 percentage points and 12 percentage points. In Slovenia and Spain, net support for the euro increased by 10 and 9 percentage points, respectively, whereas in five countries,Footnote 7 a small decline is registered, except in Finland, which experienced a more pronounced decline of 16 percentage points. By looking at the latest data in our sample in 6–7/2022 (EB97), we see an increase in all EA19Footnote 8 member countries, except for Austria, compared to 11/2019 (EB92).

Overall, we conclude that in the midst of the COVID-19 pandemic, public support remained at very high levels and even increased twice to a new all-time high level in 2–3/2021 (EB94) and again in 6–7/2022 (EB97). The question that arises from this pattern is: to what extent did the EU fiscal policy and monetary measures launched in response to the pandemic account for the sharp increase of public support for the euro? Before we answer this question, the following section describes the fiscal and monetary measures taken at the EU level.

4 COVID-19 and fiscal and monetary policy initiatives

The pandemic released an unprecedented fiscal and monetary response from the EU and the ECB. In effect, it transformed the whole approach applied to the framing of stabilization policies in the EU, moving the EU closer toward a fiscal union. We first consider the fiscal policy measures and then deal with the response by the ECB.

4.1 Fiscal policy measures by the EU

Short-term measures SURE is an initiative of the EC to counteract the increase in unemployment and loss of income due to the impact of the pandemic and of lockdowns by providing loans with an overall volume of 100 billion euro to EU member countries for financing national short-time work schemes. In particular, the initiative is intended to cover those costs directly incurred by the introduction or extension of short-time working schemes, as well as similar support for self-employed workers (European Commission 2022a).

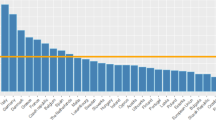

Figure 3 shows the three individual disbursement rates—I. 10/2020–1/2021, II. 3–5/2021 and III. 3/2022—which serve as the base for the dummy construction as utilized within our econometric analysis. It also displays the average disbursed SURE loans of EA19 countries from IV. 10/2020 to 3/2022 in billion euro and measured as a percent of 2020 GDP. After the initiative was activated on 22 September 2020, the Commission disbursed the first financial support of SURE on 27 October 2020 (see Fig. 1). By the end of March 2022, the EC had issued about three-quarters of the overall volume, amounting to loans totaling 74.9 billion euro, to most of the 19 member countries.Footnote 9

SURE Loan Disbursements, EA19, in Billion Euro and Measured as a Ratio of 2020/2021 GDP, 10/2020–3/2022. Note: The dashed line represents the EA19 average in percent of 2020/2021 GDP. The left-hand side of the y-axis shows values measured in billion euro. The right-hand side of the y-axis shows values measured in percent of GDP. Sources: Data extracted from SURE timeline of European Commission (2022a) and 2020, 2021 GDP data taken from Eurostat. *This includes the SURE disbursements on 2 February 2021

All member states that have applied for SURE funding have received part of or the entire requested amount. Italy and Spain figure among the member states that received the largest total sums of 27.4 billion and 21.3 billion euro, respectively. Looking more closely to the distribution of SURE per GDP in the EA19, Fig. 3, lower right part (IV), reveals that Malta received the largest share of 4 percent. Other periphery members of the EA, such as Greece and Portugal, received more than 3 percent of their GDP, while Italy and Spain received around 2 percent of GDP. The core countries Germany and France did not apply for SURE funding. Overall, each of the EA19 country that applied for SURE funding received a distribution per GDP above the EA19 average of 0.7 percent, as seen in the lower right (IV) quadrant of Fig. 3.

Medium to long-term measures The European recovery plan, also called Next Generation EU (NGEU), is the largest stimulus initiative launched by the EU to date. The core of NGEU is the Recovery and Resilience Facility (RRF). The use of the economic stimulus fund is spread over almost seven years until 31 December 2026. With a budget of 723.8 billion euro (338 billion euro in grants), RRF is intended to support the economic recovery to build a “greener, more digital and more resilient Europe” (European Commission 2020). Member states can receive funding up to a pre-allocated amount of grants and loans.

Figure 4 displays the maximum grants pre-allocation of the RRF in billion euro and as a percent of 2020 GDP.Footnote 10 Italy and Spain are each eligible to receive almost 70 billion euro in grants from the RRF initiative, while the other countries, including the core countries France and Germany, are eligible to receive only 39 billion and 26 billion euro, respectively. Looking more closely at the distribution of grants per GDP, Fig. 4 shows that the grants per GDP has been distributed unequally over the 19 member states of the EA. The countries that are eligible to receive the largest grants are those in the periphery of the EA. Greece can receive as much as 10 percent of GDP. Slovakia, Portugal, and Latvia can receive around 8 percent, Spain and Lithuania around 6 percent and Slovenia, Italy, Estonia, Cyprus and Malta all can receive more than 3 percent. On the other hand, the core economies, including Germany and France, all receive less than 2 percent, which is below the EA19 average of 2.7 percent.

Source: Data extracted from Grants Pre-Allocation of European Union (2021), with 2020 GDP data extracted from Eurostat

RRF Grants Pre-Allocation, EA19, in Billion Euro and Measured as a Ratio of 2020 GDP. Note: The dashed line represents the EA19 average in percent of 2020 GDP. The left-hand side of the y-axis shows values measured in billion euro. The right-hand side of the y-axis shows values measured in percent of GDP.

Overall, this pattern suggests a transfer of resources from the core to the periphery economies of the EA (for a detailed discussion, see Dorn and Fuest 2021). Figure 4 is the base for the construction of our dummy variables as utilized within our econometric analysis (see here also Table A7 in Appendix A in the online supplementary information).

4.2 Monetary policy measures by the ECB

The ECB’s Pandemic Emergency Purchase Programme (PEPP), an extension of the Asset Purchase Programme (APP), foresees asset purchases in the secondary government bond market with a total volume of 1850 billion euro. As of the end of March 2022, the ECB had purchased a total of 1520 billion euroFootnote 11 in assets through the program, an impressive number in a historical context.Footnote 12 The ECB’s total assets—including those of the national central banks—have increased by over 3895 billion euro from 4671 billion in 2019 to 8566 billion in 2021, (see Fig. A2 in Appendix A in the online supplementary information). This growth is primarily driven by the securities purchased under PEPP and APP. A comparison of the total assets of the ECB during the pandemic 2020/2021 and during the economic crisis in 2008/2009 shows that the ECB acted much more quickly and comprehensively during the pandemic than during the economic crisis twelve years earlier.Footnote 13

The ECB started asset purchases on 26 March 2020 immediately after its activation on 24 March 2020. Figure 5 shows the aggregated PEPP total net purchases (VI) and the five individual purchase intervals (I–V) from 3/2020 to 3/2022 in billion euro and measured as a ratio of 2020/2021 GDP. The five individual purchase intervals I. 3–6/2020, II. 7/2020–1/2021, III. 2–5/2021, IV. 6–12/2021, and V. 1–3/2022 serve as the basis for the dummy construction as utilized within our econometric analysis. Figure 5, lower right part (VI), shows that total cumulated net purchases in Greece and Portugal approached 22.2 percent and 19.7 percent, respectively, in Spain and Italy, more than 18 percent of GDP and in Slovenia, the PEPP to GDP ratio is 15.7 percent. The net purchases for these five countries are above the EA19 average of 15.1 percent. In Germany and France net purchases were 14.2 percent and 14.6 percent, respectively.

Source: Total assets data extracted from the annual consolidated balance sheet of the European Central Bank (2022b), and PEPP net purchases are taken from the ECB website (European Central Bank 2022a). GDP data extracted from 2020, 2021 data from Eurostat

Pandemic Emergency Purchase Program (PEPP) Net Purchases, EA19, in Billion Euro and Measured as a Ratio of 2020/21 GDP, 3/2020–3/2022. Note: The dashed line displays the EA19 average in percent of 2020/2021 GDP. The left-hand side of the y-axis shows values measured in billion euro. The right-hand side of the y-axis shows values measured in percent of GDP.

In short, the fiscal and monetary policy responses to the pandemic were swift, large, and strongly expansionary. They have sparked a lively debate about the future of the fiscal rules guiding the EU.Footnote 14 During the economic crisis in 2008/2009, European institutions did not react as swiftly or as comprehensively. Moreover, the EU has been described as “not very visible in early crisis management” (Puetter 2012, p. 172). Although the ECB has been viewed as a “shrewd actor” (Menz and Smith 2013, p. 203), its reaction during the economic crisis 2008/2009 was extremely cautious, actually lowering total liabilities from 2008 to 2010 from 2075 billion euro in 2008 to 2002 billion euro in 2010 (see here Fig. A2 in Online Appendix A). In contrast, the ECB reacted promptly to the COVID-19 crisis with PEPP.Footnote 15

5 Model specification, data and research design

5.1 Model specification

To investigate empirically the extent to which public support for the euro was influenced by the fiscal and monetary responses taken during the COVID-19 pandemic from 2020 onwards, we adopt a model specification used by Roth et al. (2016, 2019). Public support for the euro is estimated as a function of unemployment, inflation, growth in real GDP per capita and fiscal and monetary dummies with the addition of COVID-19 control dummies. The baseline model 1 reads:

where \({Support}_{it}\) is the net support for the euro for country i during period t. \({Unemployment}_{it}\), \({Inflation}_{it}\), \({Growth}_{it}\), and \({Z}_{it}\) are unemployment, inflation, growth of GDP per capita and potential macroeconomic control variables deemed to be of potential importance. \({FM}_{it}\) include fiscal and monetary initiative dummies. \({Cov19}_{it}\) represents pandemic-related dummies, including the stringency index—a measure of the degree of lockdowns–, the mortality rate, and confirmed cases per population. The country-specific constant term and the error term are represented by \({\alpha }_{i}\) and \({w}_{it}\).

5.2 Data used

Data for public support for the euro are drawn from the bi-annual Standard Eurobarometer (EB) surveys (European Commission 2022b) from 3–4/1999 (EB51) until 6–7/2022 (EB97). The Standard EB survey data is a unique international data source, as it permits us to compare the period of the financial and sovereign debt crisis 2008/2009 with the period of the COVID-19 crisis 2020/2022. The participants were asked: ‘What is your opinion on each of the following statements? Please tell me for each statement, whether you are for it or against it. A European economic and monetary union with one single currency, the euro’. The response options were ‘For’, ‘Against’ or ‘Don’t Know’ (DK). Net support measures are constructed as described in the notes to Fig. 2a, b.Footnote 16 The other data are from the following sources:

-

Monthly data on inflation (the change in the harmonized index of consumer prices), unemployment rates, GDP per capita and population are taken from Eurostat. Unemployment rates were seasonally adjusted. To retrieve monthly observations, data on GDP and population were interpolated.

-

Fiscal and monetary initiatives data are taken from the SURE loan disbursement, RRF grants pre-allocation and PEPP net purchases, as described in Sect. 4.

-

COVID-19-related data are taken from the Oxford COVID-19 Government Response Tracker (Hale et al. 2021; Oxford COVID-19 Government Response Tracker 2020). These include confirmed COVID-19 cases per population, confirmed COVID-19 deaths per population and the stringency index, representing the degree of lockdowns, in the EA19 member countries from the start of the pandemic in February 2020 until the beginning of June 2022.

Table 1 shows the summary statistics of all variables in our model and their data range, data frequency, construction procedure, and data source.

5.3 Research design

Support for the euro is studied from a macro perspective with a focus on feedback effects between support for the euro and the economic situation during the full sample period from 1999 to 2022. Equation (1) is estimated with an EA12Footnote 17 and EA19Footnote 18 country sample for 1999–2022, with a total number of 549 and 720 observations, respectively.

With t = 46 and n = 12 (n = 19) and thus with a ratio of t/n = 3.8 (t/n = 2.4), Eq. 1 is estimated via a panel time-series estimation. The analysis focuses on the period from 1999 to 2022. We apply a matching procedure between macroeconomic variables, fiscal and monetary initiatives, COVID-19-related variables and standard Eurobarometer (EB) survey data.

For the macroeconomic variables and our monetary initiative (PEPP) dummy, we applied a monthly data frequency approach. Following the previous literature (Roth et al. 2016, 2019), we assume that citizens consider macroeconomic developments and the net purchases under PEPP between two EB surveys. This means that the citizens, in responding to the EB94 (2–3/2021) survey, considered macroeconomic developments and net purchases under PEPP between July 2020 (the first month of the previous EB93 (7–8/2020) survey) up to January 2021 (the month before the standard EB94 (2–3/2021) survey).

For the fiscal initiative dummies (SURE and RRF pre-allocated grants) and COVID-19-related variables, we applied a daily data frequency approach for the matching procedure.Footnote 19,Footnote 20 In examining the pre-allocated RRF grants, we utilize the pre-allocated grants for the bi-annual EB periods from the RRF activation from 10 to 12 February 2021 onwards.Footnote 21 This matching procedure is applied to all bi-annual EB fieldwork up to the latest 6–7/2022 (EB97) survey.Footnote 22 An overview of the matching strategy can be found in Fig. A5 in Appendix A in the online supplementary information.

Figures 3, 4 and 5 illustrate the base for the construction of our dummy variables. Countries that have received SURE loan disbursements, RRF pre-allocated grants and PEPP net purchases per GDP that are above the EA19 average have been marked with 1 (for an overview, see Tables A6–8 in Appendix A in the online supplementary information). COVID-19 control dummies are similarly calculated, with the values for the mean confirmed cases per million people, mean deaths per million people and mean stringency index that lie above the EA19 average indicated by a 1.Footnote 23

6 Estimation approach and econometric results

We utilize a Fixed Effect Dynamic Feasible General Least Squares (FE-DFGLS)Footnote 24 approach, which is represented by Eq. (2)Footnote 25:

with \({\alpha }_{i}\) being the country fixed effect and \(\Delta\) indicating that the variables are in first differences. By applying DFGLS, unemployment, inflation and growth become exogenous and the coefficients \({\beta }_{1}\), \({\upchi }_{1}\), \({\delta }_{1}\) and \({\mathrm{\varphi }}_{1}\) follow a t-distribution. This property permits us to derive statistical inferences on the causal impact of the unemployment, inflation and growth variables. The asterisk (*) indicates that the variables have been transformed and that the error term \({u}_{it}\) fulfils the requirements of the classical linear regression (i.e. no autocorrelation).

Table 2 shows our econometric results within our EA12 and EA19 country samples. Utilizing an FE-DFGLS estimation approach for the EA12 and EA19 over the 23-year period 3–4/1999 to 6–7/2022 with 549 and 720 observations and including the introduced fiscal and monetary stimulus dummies yields the following results.

First, we present the results for our macro-economic variables. Looking at the EA12 and EA19, our long-term variables unemployment and growth of GDP per capita have the usual signs. Whereas an increase in the unemployment rate is associated with a significant decline in net public support for the euro (ranging from − 1.0 to − 1.6), no significant relationship between GDP per capita growth and public support for the euro could be detected. The size of the coefficient can be interpreted as follows: a 1-percentage point increase in unemployment is associated with a 1.0–1.6 percentage point decline in net support for the euro. Overall, these results support previous empirical evidence in Roth et al. (2016, 2019) and Roth and Jonung (2020a). Contrary to these results, inflation has become insignificant. This is due to the inflation dynamics in the Euro Area starting in the winter of 2021/2022 (from EB96 onwards), which has not led to a significant decline, but an actual increase in public support for the euro—a “rally-around-the-flag” effect—in 6–7/2022 (EB97).Footnote 26

More importantly for this paper, we detect that the dummies for the SURE and RRF pre-allocated grants in the EA12 (Regressions 1 and 3) and the EA19 (Regressions 2 and 4) display highly significant and positive coefficients ranging from 5.2 to 7.8 for SURE and from 11.0 to 16.3 for RRF. The size of the coefficient can be interpreted as follows: Member states of the EA12 that benefited from the SURE programFootnote 27 during the COVID-19 pandemic showed on average a 7.8 percentage point increase in net euro support (Regression 1).Footnote 28 In addition, EA12 member states that were net beneficiaries of the RRF grants pre-allocationFootnote 29 experienced on average, an increase in net public support for the euro by 16.3 percentage points (Regression 3).

With a coefficient of 5.2 for SURE (Regression 2) and a coefficient of 11 for RRF pre-allocated grants (Regression 4), these values are nevertheless lower when looking at the complete set of EA19 economies. Our PEPP coefficients in Regressions 5 and 6 are neither significant for the EA12 nor for EA19 when analyzing the full net purchases under PEPP between March 2020 to March 2022.Footnote 30

Regressions 7–12 show our results when focusing on the peak of the COVID-19 crisis in the winter of 2020/2021, particularly in 2–3/2021 (EB94). Regressions 7 and 8 show that the coefficients for SURE increase to 9.5 for EA12 and 6.7 for EA19 member countries when solely analyzing the SURE loan disbursements in 2–3/2021 (EB94) during our full sample period 3–4/1999 to 6–7/2022.Footnote 31 These results indicate that our results for SURE for the overall period are driven by the peak of the COVID-19 crisis in 2–3/2021 (EB94).

We find contrasting results for the RRF pre-allocated grants in Regressions 9 and 10, where coefficients are lower (10.2 for EA12 and 6.6 for EA19) when considering only pre-allocated grants in winter of 2020/2021 (EB94), compared to our sample of pre-allocated grants for the whole COVID-19 period.

More interestingly, the PEPP coefficients are highly significant when solely analyzing the net purchases under PEPP in 2–3/2021 (EB94) within our full sample period in Regressions 11 and 12. Those EA12 and EA19 member countries that benefited from the net purchases under PEPP during the winter of 2020/2021 saw an increase of 10.2 and 7.9 percentage points respectively in net public support for the euro.Footnote 32

In summary, we detect a significant positive influence of the fiscal initiatives on public support for the euro throughout the whole COVID-19 period until 6–7/2022 (EB97), while an overall significantly positive influence of monetary initiatives can be found when solely analyzing net purchases under PEPP in the period 2–3/2021 (EB94). In the case of SURE, the positive effect of the fiscal initiatives is driven by its strong positive impact in the winter 2020/2021 and in 2–3/2021 (EB94) period.

This evidence suggests that the increase during the COVID-19 pandemic of net public support for the euro is significantly connected to the immediate responses of SURE and RRF pre-allocated grants, as well as to the immediate effect of PEPP in winter 2020/2021. This happens despite the simultaneous rise in unemployment—we actually detect positive and significant coefficients of 1.7 and 1.6 for our EA12 and EA19 samples, respectively when analyzing an interaction effect between a COVID-19 dummy and the unemployment rate in Table 3.Footnote 33

7 Discussion

Our results allow us to draw several conclusions about how public support for the euro was affected by the fiscal and monetary initiatives introduced at the beginning of the COVID-19 pandemic.

First, public support for the euro increased amidst a rise in unemployment during the COVID-19 pandemic. This runs counter to previous empirical findings of the negative relationship between unemployment and public support for the euro during the economic crisis recovery period from 2008 to 2018 (Roth et al. 2016, 2019; Roth and Jonung 2020a). This raises the question: Why has public support for the euro increased even though unemployment has also risen?

Coming back to our two theoretical hypotheses as discussed initially, we suggest that the fiscal policy initiatives taken by EU policy makers led to the significant and immediate increase in public support for the euro during the COVID-19 pandemic in the EA19, although unemployment rose at the same time. This might be related, amongst other factors, to the fact that the fiscal policy measures SURE and NGEU, with its centerpiece RRF, were communicated clearly by EU authorities to the public in member states.Footnote 34 In addition, recent research has shown that on average support for European financial solidarity during the pandemic is substantial (Beetsma et al. 2022; Bauhr and Charron 2022). For the monetary initiative, PEPP, we could only find a limited significant positive influence (in the winter of 2020/2021) on public support for the euro. Most likely, the public did not notice in the media the expansionary monetary measures taken by the ECB as much as the expansionary fiscal measures.

The magnitude of these measures is unprecedented in the history of the EU. In the aftermath of the financial crisis in 2008/2009, economic stimuli took mostly the form of intergovernmental initiatives. Additionally, the early crisis management of the EU has been described as slow and indecisive and thus hardly visible (Begg 2012; Puetter 2012; Menz and Smith 2013). In contrast, the fiscal policies SURE and RRF mark an important step towards a common fiscal integration. Moreover, the SURE initiative introduced a step toward a new EU risk-sharing model (Andersson and Jonung 2023). Overall, the early pandemic management of the EU deserves to be described as swift, comprehensive, and decisive.

Much suggests that without these fast and decisive fiscal initiatives, the economic consequences of the increased unemployment associated with the lockdowns would have become even more pronounced. The increased political legitimacy bestowed on the EU institutions during the pandemic can be attributed to the new policy initiatives SURE and RRF, which might have laid the foundation for a new stabilization framework at the supranational level. This implies a move towards fiscal federalism but one that is not universally supported by all of the member states.Footnote 35

Unfortunately, academia and the business/industrial sector in particular, pay little attention to the EB surveys on public support for the euro. Data from these surveys are not fed into the standard macroeconomic forecasts produced by commercial banks, financial institutions, and other institutions supplying and marketing forecasts. One reason is that EB data are of low frequency and only produced biannually. Most forecasters work with high-frequency data like monthly, weekly, and even daily. In addition, data on public support for the euro requires expertise treatment to be consistent over time.

Before we turn to our conclusions, we consider the limits to our study. One limitation of our research is that we examine the impact of the pandemic on public support for the euro using only macroeconomic determinants and outcomes. Analyzing the microeconomic determinants using micro data would broaden the results and reveal a more comprehensive picture. We intend to investigate the micro-economic determinants in an additional paper in the future.

8 Conclusions

Using a uniquely large panel dataset and applying a tailor-fit FE-DFGLS estimation approach and a daily-data-frequency research design at the macro-economic level for an EA country sample over the period 1999–2022, our analysis arrives at four major conclusions. First, during the COVID-19 pandemic, net public support for the euro among a majority of the 19 EA economies increased and reached new historically high levels at the peak of the COVID-19 crisis in the winter of 2020/2021. Second, we find a significant positive relationship between the highly expansionary fiscal initiatives taken by the European Commission and the rise in support for the euro in the EA.

Third, the expansionary monetary measures by the European Central Bank are only marginally associated with a positive effect on public support for the euro. We speculate that this modest effect is attributable to the fact that the public was more informed about the expansionary fiscal measures than about the monetary policy of the ECB. Fourth, the increase in unemployment and the downturn in economic activity triggered by the COVID-19 pandemic and the subsequent lockdowns did not negatively affect public support for the euro. This finding contrasts with the pattern observed in the aftermath of the financial and sovereign debt crisis in 2008/2009, when the rise in unemployment was associated with a significant fall in public support for the euro.

Returning to our two theoretical hypotheses as discussed initially, the findings of our paper suggest that the fiscal policy initiatives implemented by EU policy makers led to the significant and immediate increase in public support for the euro during the COVID-19 pandemic in the EA19, although unemployment rose at the same time. In contrast, the impact of the monetary initiatives was limited, with only a slight significant positive influence observed (in the winter of 2020/2021). Much suggests that the increased political legitimacy bestowed on the EU institutions during the pandemic can be attributed to the new fiscal policy initiatives.

Overall, our research results open up two promising avenues for future research, which we have not covered in this paper due to space limitations. The first avenue for future research is a comprehensive analysis of the micro-economic determinants of public support for the euro, focusing on the COVID-19 crisis. The second avenue for future research is an in-depth analysis of the impact of inflation on public support for the euro in times of accelerating inflation and a “rally-around-the-flag” effect as witnessed from late 2021 and early 2022 onward.

Data availability

The data that support the findings of this study are available on request from the corresponding author Felix Roth. The underlying datasets were derived from the following public domain resources: Standard Eurobarometer (51–97) survey: https://www.gesis.org/en/eurobarometer-data-service/survey-series/standard-special-eb and https://europa.eu/eurobarometer/screen/home. Inflation, Unemployment, GDP per capita and population: Eurostat. SURE loan disbursements: https://economy-finance.ec.europa.eu/eu-financial-assistance/sure_en. RRF grants pre-allocation: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32021R0241. PEPP net purchases: https://www.ecb.europa.eu/mopo/implement/pepp/html/index.en.html. COVID-19 variables (stringency index, confirmed cases and confirmed deaths: https://github.com/OxCGRT/covid-policy-tracker/tree/master/data/timeseries.

Material and/or code availability

All supplementary material and codes are supplied in standard file formats.

Notes

A rise in unemployment, business closures, income losses, disruptions in trade and the travel industry are among the pandemic consequences; see for example Barua (2021).

See IMF (2020a) where the COVID-19 recession is compared to the Great Depression of the 1930s.

There is no scientifically agreed definition of a “wave” or a “driving force” (Cacciapaglia et al. 2021). We derive the first two waves based on the daily-confirmed cases as seen in Fig. A1 in Appendix A in the online supplementary information.

The Omicron variant caused a massive increase in the number of confirmed cases since late 2021 as seen in Fig. A1 (arrow) in Appendix A in the supplementary information, although it was not associated with higher mortality, as shown in Fig. 1.

By − 2 percentage points in Estonia and Cyprus and by − 1 percentage point in Austria, France, and Malta.

For Finland, Estonia, and Slovakia net support for the euro in 6–7/2022 (EB97) remained at the same level as before the pandemic in 11/2019 (EB92).

With the latest disbursement provided under SURE on 14 December 2022, the total volume for the loans amounts to 98.4 billion EUR. On 31 December 2022, SURE has been deactivated.

As the first disbursement started as late as 3 August 2021, and thus falls within the fieldwork period as late as EB96 (1–2/2022), and as the funding is spread over the period ending 2026, we take the pre-allocated grant amounts of the RRF for our analysis.

Cumulative net purchases reached a total of 1713 billion euro end of September 2022.

The temporary initiative PEPP is intended to continue to provide favorable financing conditions for companies and households. With PEPP, EA19 member countries were able to carry out expansionary fiscal policies at the national and European levels (Schnabel 2020). With the Governing Council’s decision of 16 December 2021, net purchases were discontinued at the end of March 2022. Reinvestment of the redemption amounts under PEPP is to take place at least until the end of 2024 (European Central Bank 2022a).

However, ECB implemented Outright Monetary Transactions (OMT) in 2012 in order to stabilize the Italian government bond market (European Central Bank 2012).

For a survey of the debate, see for example Andersson and Jonung (2023).

Early accounts argue that the change in reaction stems from the learning process about the implications of the increasing financial fragmentation of the EA on the monetary policy transmission (Morelli and Seghezza 2021).

When studying net support for the euro, we follow a methodological approach developed by Roth et al. (2016), who compare public support for the euro with trust in the ECB. A net measure is utilized in this context given the fact that uncertainty (DK- and “spontaneous refusal”-answers) is much more pronounced for trust in the ECB (mean value of 17.3 percent) than public support for the euro (mean value of 5.3). Table A10 in Appendix A in the online supplementary information shows the results of a probit regression analyzing uncertainty for public support for the euro at the micro level for the EA19 using a model specification developed by Roth et al. (2016). The results indicate that the female population (1.6), the age group of 65 + (0.9), and the unemployed (1.1) show a slightly higher degree of uncertainty, whereas the highly educated 20 + respondents (− 3.3) show a lower probability for uncertainty. Coefficients remain predominantly stable throughout the COVID-19 pandemic. However, uncertainty declined for the female population (from 1.7 to 1.2) and increased for the unemployed (from 1.0 to.1.5).

EA12 includes Austria, Belgium, Finland, France, Germany, Italy, Luxembourg, Netherlands, Greece, Ireland, Portugal and Spain.

EA19 is composed of the EA12 member states plus seven new members: Cyprus, Estonia, Latvia, Lithuania, Malta, Slovakia, and Slovenia.

The EB surveys were conducted during the following periods: 9 July-26 August 2020 (EB93), 12 February-18 March 2021 (EB94), 14 June-15 July 2021 (EB95), 18 January-14 February 2022 (EB96) and 17 June-17 July 2022 (EB97).

Thus, the SURE loan disbursement on 2 February 2021 would have been reflected in the previous EB94 (2–3/21) survey data, since the EB94 fieldwork started on 12 February 2021.

This means that the pre-allocated RRF grants have been considered by citizens when answering EB surveys, starting from 2–3/2021 (EB94).

The latest EB97 (6–7/22) survey was conducted between 17 June and 17 July 2022. Thus, the fiscal initiatives dummy and COVID-19 control variables include the data up to 16 June 2022, one day before the EB97 survey started.

The underlying figures and tables on the dummy construction are available from the authors upon request.

All series are integrated of order 1, i.e. they are I(1) (non-stationary); non-stationary of the variables inflation and GDP per capita growth is due to non-stationarity (non-constancy) of the variance of these series, and they are cointegrated. The Pesaran’s CADF panel unit root tests and Kao’s residual cointegration test are displayed in Tables A4–A5 in Appendix A in the online supplementary information.

See here Table A3 in Appendix A in the online supplementary information, which shows that the negative coefficient for inflation loses significance from 1–2/2022 (EB96) onwards.

As can be seen from Fig. 3 and Table A6 in Appendix A in the online supplementary information, those countries are Belgium, Greece, Ireland, Italy, Portugal, and Spain.

Figure A3 in Appendix A in the online supplementary information shows the variation of the effect of fiscal and monetary policies in the individual EA12 and EA19 countries throughout the COVID-19 pandemic (from 11/2019 to 6–7/2022). Figure A3 suggests that the overall average impact of 7.8 percentage points of the SURE Program in the EA12 as reported in regression 1 in Table 2 is driven by the increases of net public support for the euro in Portugal by 9 percentage points, in Belgium and Spain by 10 percentage points, respectively and in Italy and Greece by 15 percentage points, respectively.

As can be inferred from Fig. 4 and Table A7 in Appendix A in the online supplementary information, those countries are Greece, Portugal, Italy, and Spain.

Our results are robust if we exclude the COVID-19 pandemic-related dummies (stringency index, cases, and mortality) in our analysis.

Figure A4 in Appendix A in the online supplementary information shows the variation of the effect of fiscal and monetary policies in the individual EA12 and EA19 countries at the peak of the COVID-19 crisis in the winter 2020/21 (from 7–8/2020 to 2–3/2021). The figure suggests that the overall average impact of 9.5 percentage points of the SURE Program in the EA12 as reported in regression 7 in Table 2 is driven by the large increases of net public support for the euro in Italy and Portugal by 19 and 18 percentage points, respectively.

These results remain robust if we exclude the COVID-19 pandemic dummies (stringency index, cases and mortality) in our analysis.

This econometric finding supports the visual evidence of a positive relationship between the unemployment rate and net public support for the euro in times of COVID-19 crisis, as highlighted in Fig. 2a, b.

The effectiveness of NGEU is even queried from EB94 (2–3/2021) onwards. As shown in Table A9 in Appendix A in the online supplementary information, a majority of all EA19 countries, with the exceptions being Finland and Latvia, is of the opinion that the NGEU has been effective from 2–3/2021 (EB94) to 6–7/2022 (EB97).

For a detailed review, see Andersson and Jonung (2023).

References

Andersson FNG, Jonung L (2023) European stabilization policy after the Covid-19 pandemic: more flexible integration or more federalism? Chapter 5. In: Bakardjieva Engelbrekt A, Ekman P, Michalski A, Oxelheim L (eds) The EU between federal union and flexible integration. Interdisciplinary European Studies, Palgrave. https://doi.org/10.1007/978-3-031-22397-6_5

Baek C, McCrory PB, Messer T, Mui P (2021) Unemployment effects of stay-at-home orders: evidence from high-frequency claims data. Rev Econ Stat 103(5):979–993. https://doi.org/10.1162/rest_a_00996

Baldwin RE, Wyplosz C (2022) The economics of European integration, 7th edn. McGraw-Hill, London

Banducci SA, Karp JA, Loedel PH (2003) The Euro, economic interests and multi-level governance: Examining support for the common currency. Eur J Polit Res 42(5):685–703. https://doi.org/10.1111/1475-6765.00100

Banducci SA, Karp JA, Loedel PH (2009) Economic interests and public support for the euro. J Eur Publ Policy 16(4):564–581. https://doi.org/10.1080/13501760902872643

Barua S (2021) Understanding coronanomics: the economic implications of the COVID-19 pandemic. J Dev Areas 55(3):435–450. https://doi.org/10.1353/jda.2021.0073

Bauer A, Weber E (2021) COVID-19: how much unemployment was caused by the shutdown in Germany? Appl Econ Lett 28(12):1053–1058. https://doi.org/10.1080/13504851.2020.1789544

Bauhr M, Charron N (2022) ‘All hands on deck’ or separate lifeboats? Public support for European economic solidarity during the Covid-19 pandemic. J Eur Publ Policy 30(6):1092–1118. https://doi.org/10.1080/13501763.2022.2077809

Beetsma R, Burgoon B, Nicoli F, De Ruijter A, Vandenbroucke F (2022) What kind of EU fiscal capacity? Evidence from a randomized survey experiment in five European countries in times of corona. Econ Policy 37(111):411–459. https://doi.org/10.1093/epolic/eiac007

Begg I (2012) The EU’s response to the global financial crisis and sovereign debt crisis. Asia Eur J 9(2):107–124. https://doi.org/10.1007/s10308-012-0304-8

Bordo MD, Jonung L (2003) The future of EMU—what does the history of monetary unions tell us? In: Capie F, Woods G (eds) Monetary unions, theory, history, public choice. Routledge, London, pp 42–69. https://doi.org/10.4324/9780203417911

Burki TK (2021) Challenges in the rollout of COVID-19 vaccines worldwide. Lancet Respir Med 9(4):e42–e43. https://doi.org/10.1016/S2213-2600(21)00129-6

Cacciapaglia G, Cot C, Sannino F (2021) Multiwave pandemic dynamics explained: How to tame the next wave of infectious diseases. Sci Rep 11(1):1–8. https://doi.org/10.1038/s41598-021-85875-2

Deroose S, Hodson D, Kuhlmann J (2007) The legitimation of EMU: lessons from the early years of the euro. Rev Int Polit Econ 14(5):800–819. https://doi.org/10.1080/09692290701642697

Dorn F, Fuest C (2021) Next generation EU: gibt es eine wirtschaftliche Begründung? In: Heinemann F, Schratzenstaller M, Thöne M, Becker P, Waldhoff C, Neumeier C, Barley K, Freund D, Neumeier F (eds) Corona-Aufbauplan: Bewährungsprobe für den Zusammenhalt in der EU. ifo Schnelldienst 74(02), pp 3–8

Ducharme J (2020) World Health Organization declares COVID-19 a pandemic. Here's what that means. https://time.com/5791661/who-coronavirus-pandemic-declaration/

European Central Bank (2012) Technical features of outright monetary transactions. https://www.ecb.europa.eu/press/pr/date/2012/html/pr120906_1.en.html. Accessed 03 Nov 2022

European Central Bank (2022a) Pandemic emergency purchase programme (PEPP). https://www.ecb.europa.eu/mopo/implement/pepp/html/index.en.html. Accessed 03 Nov 2022

European Central Bank (2022b) Annual consolidated balance sheet of the Eurosystem 1999–2020. https://www.ecb.europa.eu/pub/annual/balance/html/index.en.html. Accessed 03 Nov 2022

European Commission (2020) NextGenerationEU. https://ec.europa.eu/info/nextgenerationeu_en. Accessed 03 Nov 2022

European Commission (2022a) SURE The European instrument for temporary Support to mitigate Unemployment Risks in an Emergency (SURE). https://economy-finance.ec.europa.eu/eu-financial-assistance/sure_en. Accessed 04 Nov 2022

European Commission (2022b) Standard Eurobarometer No. 51–97

European Union (2021) Regulation (EU) 2021/241 of the European Parliament and of the Council of 12 February 2021 establishing the Recovery and Resilience Facility. https://eur-lex.europa.eu/eli/reg/2021/241/oj. Accessed 03 Nov 2022

Gärtner M (1997) Who wants the euro—and why? Economic explanations of public attitudes towards a single European currency. Public Choice 93(3/4):487–510. https://doi.org/10.1023/A:1004989519650

Gursoy D, Chi CG (2020) Effects of COVID-19 pandemic on the hospitality industry: review of the current situations and a research agenda. J Hosp Market Manag 29(5):527–529. https://doi.org/10.1080/19368623.2020.1788231

Hale T, Hale AJ, Kira B, Petherick A, Phillips T, Sridhar D, Thompson RN, Webster S, Angrist N (2020) Global assessment of the relationship between government response measures and COVID-19 deaths. MedRxiv. https://doi.org/10.1101/2020.07.04.20145334

Hale T, Angrist N, Goldszmidt BK, Petherick A, Phillips T, Webster S, Cameron-Blake E, Hallas L, Majumdar S, Tatlow H (2021) A global panel database of pandemic policies (Oxford COVID-19 Government Response Tracker). Nat Hum Behav 5:529–538. https://doi.org/10.1038/s41562-021-01079-8

Herby J, Jonung L, Hanke S (2023) Did lockdowns work? The verdict on Covid restrictions. IEA Perspectives 1, London https://iea.org.uk/publications/did-lockdowns-work-the-verdict-on-covid-restrictions/

Hobolt SB, Leblond P (2014) Economic insecurity and public support for the euro: before and during the financial crisis. In: Bermeo N, Bartels LM (eds) Mass politics in tough times: opinions, votes and protest in the great recession. Oxford University Press, Oxford, pp 128–147. https://doi.org/10.1093/acprof:oso/9780199357505.003.0005

Hobolt SB, Wratil C (2015) Public opinion and the crisis: the dynamics of support for the euro. J Eur Publ Policy 22(2):238–256. https://doi.org/10.1080/13501763.2014.994022

IMF (2020a) World economic outlook, the great lockdown. International Monetary Fund, Washington, DC. https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

IMF (2020b) World economic outlook, a long and difficult ascent. International Monetary Fund Washington, DC. https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020

Jurado I, Walter S, Konstantinidis N, Dinas E (2020) Keeping the euro at any cost? Explaining attitudes toward the euro-austerity trade-off in Greece. Eur Union Polit 21(3):383–405. https://doi.org/10.1177/1465116520928118

Kaltenthaler K, Anderson C (2001) Europeans and their money: explaining public support for the common European currency. Eur J Polit Res 40(2):139–170. https://doi.org/10.1111/1475-6765.00593

Lewis-Beck MS, Stegmaier M (2013) The VP-function revisited: a survey of the literature on vote and popularity functions after over 40 years. Public Choice 157(3–4):367–385. https://doi.org/10.1007/s11127-013-0086-6

Menz G, Smith MP (2013) Kicking the can down the road to more Europe? Salvaging the euro and the future of European economic governance. J Eur Integr 35(3):195–206. https://doi.org/10.1080/07036337.2013.774783

Moore S, Hill EM, Tildesley MJ, Dyson L, Keeling MJ (2021) Vaccination and non-pharmaceutical interventions for COVID-19: a mathematical modeling study. Lancet Infect Dis 21(6):793–802. https://doi.org/10.1016/S1473-3099(21)00143-2

Morelli P, Seghezza E (2021) Why was the ECB’s reaction to Covid-19 crisis faster than after the 2008 financial crash? J Policy Model 43(1):1–14. https://doi.org/10.1016/j.jpolmod.2020.12.002

Oxford COVID-19 Government Response Tracker (2020) https://www.bsg.ox.ac.uk/research/research-projects/coronavirus-government-response-tracker

Pindyck RS, Rubinfeld DL (1991) Econometric models and economic forecasts. McGraw-Hill, New York

Ping Ang J, Dong F (2022) The effects and counter-effects of unemployment and stringency responses to COVID-19: an international analysis using simultaneous equations models. Appl Econ 54(11):1278–1300. https://doi.org/10.1080/00036846.2021.1975634

Puetter U (2012) Europe’s deliberative intergovernmentalism: the role of the Council and European Council in EU economic governance. J Eur Publ Policy 19(2):161–178. https://doi.org/10.1080/13501763.2011.609743

Rigby J, Satija B (2023) WHO declares end to COVID global health emergency. https://www.reuters.com/business/healthcare-pharmaceuticals/covid-is-no-longer-global-health-emergency-who-2023-05-05/.

Ritchie H, Mathieu E, Rodés-Guirao L, Appel C, Giattino C, Ortiz-Ospina E, Hasell J, Macdonald B, Beltekian D, Roser M, Dattani S (2020) Coronavirus pandemic (COVID-19). Our world in data. https://ourworldindata.org/covid-vaccinations. Accessed 26 Oct 2022

Roth F (2022) Public support for the Euro—essays on labor productivity, monetary economics, and political economy, vol 2. Springer, Cham. https://doi.org/10.1007/978-3-030-86024-0

Roth F, Jonung L (2020a) Public support for the Euro and trust in the ECB: the first two decades of the common currency. In: Castenada J, Roselli A, Wood G (eds) The economics of monetary unions. Routledge, New York, pp 141–155. https://doi.org/10.4324/9780429327964

Roth F, Jonung L (2020b) After 25 years as faithful members of the EU: public support for the Euro and trust in the ECB in Austria, Finland and Sweden. In: 47th economics conference 2020 of the OeNB in cooperation with SUERF, Östereichische Nationalbank, pp 64–77

Roth F, Jonung L, Nowak-Lehmann DF (2016) Crisis and public support for the Euro, 1999–2014. J Common Mark Stud 54(4):944–960. https://doi.org/10.1111/jcms.12338

Roth F, Baake E, Jonung L, Nowak-Lehmann DF (2019) Revisiting public support for the Euro, 1999–2017: accounting for the crisis and the recovery. J Common Mark Stud 57(6):1262–1273. https://doi.org/10.1111/jcms.12892

Schnabel I (2020) The shadow of fiscal dominance: misconceptions, perceptions and perspectives. In: Speech at the Centre for European reform and the Eurofi financial form on is the current ECB monetary policy doing more harm than good and what are the alternatives? https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200911~ea32bd8bb3.en.html

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 61(4):783–820. https://doi.org/10.2307/2951763

Ulloa AC, Buchan SA, Daneman N, Brown KA (2021) Early estimates of SARS-CoV-2 Omicron variant severity based on a matched cohort study, Ontario, Canada. MedRxiv. https://doi.org/10.1101/2021.12.24.21268382

Verdun A (2022) Economic and monetary union. In: Cini M, Borragan N (eds) European union politics. Oxford University Press, Oxford, pp 324–338

Violato C, Violato EM, Violato EM (2021) Impact of the stringency of lockdown measures on covid-19: a theoretical model of a pandemic. PLoS ONE 16(10):e0258205. https://doi.org/10.1371/journal.pone.0258205

Walter S, Dinas E, Jurado I, Konstantinidis N (2018) Noncooperation by popular vote: expectations, foreign intervention, and the vote in the 2015 Greek bailout referendum. Int Organ 72(4):969–994. https://doi.org/10.1017/S0020818318000255

Wooldridge JM (2009) Introductory econometrics: modern approach. South-Western Cengage Learning, Mason

Xezonakis G, Hartmann F (2020) Economic downturns and the Greek referendum of 2015: Evidence using night-time light data. Eur Union Polit 21(3):361–382. https://doi.org/10.1177/1465116520924477

Acknowledgements

The authors would like to thank Thomas Straubhaar, Michael Bauer, Ole Wilms and two anonymous reviewers for excellent comments.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by FR and AM. The first draft of the manuscript was written by FR and AM and LJ commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible Editor: Harald Oberhofer.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendix A.

Additional Tables and Figures. Appendix B.Properties and Benefits of the FE-DFGLS Estimation Approach (PDF 1608 KB)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Roth, F., Jonung, L. & Most, A. COVID-19 and public support for the Euro. Empirica 51, 61–86 (2024). https://doi.org/10.1007/s10663-023-09596-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-023-09596-7